by Wine Owners

Posted on 2021-07-11

Will Cheval Blanc and Ausone no longer be Grand Cru Classé ‘A’ as from the 2021 vintage?

If so, it won’t be because of the Commission de Classement. The closing of the Saint-Emilion classification applications took place on June 30 and neither Cheval Blanc nor Ausone returned their copies.

Unlike the left bank classification system of 1855 that is pretty much immutable (with the exception of Mouton’s promotion to Premier Cru in 1973), the St Emilion classification is reviewed approximately once every 10 years, permitting a periodic revaluation of quality and performance. It’s not all been plain sailing; the 2006 reclassification was plagued by accusations of impropriety and was eventually annulled. Consequently, tastings conducted for the 2012 reclassification were outsourced to independent groups from across France to rehabilitate the process.

Cheval Blanc and Ausone, the first St Emilion producers to be awarded Classé A classification in 1954 when it was created, are effectively leaving the classification system.

The Classé A incumbents evidently concluded that the system is no longer sufficiently discriminating to reflect the ranking of their respective properties compared to their peers.

This bombshell threatens to undermine the kudos and financial benefits of promotion to Classé A, and in turn the market pricing potential of those that are elevated. Not to mention it raises questions of the credibility of the St Emilion classification system more broadly.

So what does the two colossus’s departure say about the process of decennial review? How does this reflect on the composition and process of the Commission de Classement?

Is Grand Cru Classé A about to lose its lustre; devalued by ambitious properties busy erecting glitzy edifices? Concrete and stone, some say, matter more than they ought to compared to the brilliance of the wines and their track record.

Or, is Classé A promotion a reflection of the qualitative transformation we see taking place in St Emilion - given the strongly weighted preconditions of a sustained track record of exceptional results and market recognition - and therefore are not elevations thoroughly deserved?

Let’s see what happens over the coming weeks. Can Cheval Blanc and Ausone be courted back into the fold, or is their departure (by omission of submission) a fait accompli? Assuming the latter, perhaps we'll see more promotions next year than we might have otherwise. What effect this all has economically on those producers who attain Classé A classification is now more uncertain than ever.

by Wine Owners

Posted on 2017-08-09

Caroline and Ludovic Decoster from Chateau Fleur Cardinale

Wine Owners: What is your greatest moment/regret as a winemaker?

Caroline Decoster: It’s a little bit sad to start this interview by a regret, but I have to say that we lost 95% of our vineyard in one night last April. It was heartbreaking. We’ve already invested in new machines, called Frostguards, for the end of the year, that will prevent us for this kind of catastrophe, but our main regret is not to have had them before.

WO: In what ways have your wine making changed over the last 10 years.

CD: The global warming has affected our wine making. We are located in the coolest part of the appellation of Saint-Emilion, which means that we have a late ripening terroir. Ripening the berries over the past decades could had been difficult in this part of Saint-Emilion, because of the lower temperatures during October - which is the moment of the year when we usually harvest. But nowadays, due to this global warming, we can benefit from Indian summers year after year, to reach the optimal ripeness effortlessly.

WO: What vintage are you proudest of?

CD: It’s very easy to be proud of a successful vintage. Like in 2010 and 2015, the wine growers were most of all very lucky, thanks to good conditions all year long. But in difficult vintages, all the right decisions that we took in tough moments were decisive to make a good wine in the end. Like in 2014 and 2016 : after months of rain and cold temperatures, the sun came back at the end of the summer, and everybody was so excited to finally have good conditions of ripening, that some vineyards completely de-leafe the bunches, which could be a mistake in some cases: the weeks after that we’d had the hottest temperatures for September since 50 years. We did not de-leafe completely, because we were sure that everything could still happen, and it was the right decision to take.

WO: If you had to define your wines/domaine in one sentence?

CD: Lots of wine owners will say how passionate they are about their wines : but we believe that passion can isolate you and make you blind. That’s why we rather prefer to talk about the « enthusiasm » that we have for our life, a positive and dynamic way of life that we want to share in each glass of Fleur Cardinale, with a lively fruit, and wine with a great energy.

WO: Tell us about your terroir & microclimate, and your approach to winemaking.

CD: First floor is located at the east of Saint-Emilion, on one of the highest points of the appellation, and is planted on clay-limestone soil in the middle of the hillsides. The planting is 75% Merlot with 20% Cabernet Franc and 5% Cabernet Sauvignon. Our aim, vintage after vintage, is to preserve the freshness of the fruit in the glass.

In terms of viticulture, it means for instance that we want each vine to be very healthy, and to express the full potential from its terroir. This year, we’ve been certified High Environmental Value (HEV). This certification is the highest level of a generalised scheme for the environmental certification of farms. It guarantees that the presence of factors of biodiversity (hedges, grass strips, trees, flowers, insects, etc.) is very widespread on our vineyard and that the pressure applied to the environment by our practices (on air, water, soil, climate, biodiversity and landscape) is kept to a minimum.

In terms of vinification, it means that the ageing time in barrels is perfectly well-managed : The wine is aged for 12-14 month maximum, in new French oak barrels. Our coopers provide us with barrels produced exclusively from wood of the 3 most qualitative French forests. A Burgundy toast has been adopted for all our barrels: this kind of toast is realized at a moderate high heat and for an extended period of time, so as to preserve the purity of the fruit and the silky touch of the tannins.

Thank you so much to Caroline for taking the time to answer our questions. All our best wishes to the entire team at Fleur Cardinale!

You can visit the domaine's website here and follow their dedicated work on Instagram, Facebook and Twitter.

by Wine Owners

Posted on 2017-05-15

The release of 2016 of £775 (12x75cl) is a substantial jump up on the simply marvellous 2015. The previous (in our view better) vintage released at £615 (12x75cl).

So we are looking at a 21% increase YoY. Meanwhile the gap between the two vintages has since closed, with the best offer price of Pape Clément 2015 now trading at £720 (12x75cl).

Not only was 2015 a sound buy for those who jumped in this time last year, it remains an attractive hold, since the release price of 2016 and a rumoured reduction in release quantities attributed to the April 2017 frosts, will lend its price support and push it up to £800+ (2x75cl).

For whom do the frosts toll? Us, the consumer, wine lover, collector…those who buy. The reduction in production volumes now likely for 2017 are difficult for producers, especially in those areas most severely affected, parts of Pessac included. By far the worst affected were those in the lesser appellations on the right bank, St Emilion and Pomerol off the plateaux, and inland in the Medoc. For many of those producers the frosts really were a catastrophe.

As we described here the great estates alongside the Gironde were the least touched by the frost due to the warming effects of the river; those parts of their vineyards affected were on the whole those producing grapes destined for their second wines.

We need to bear in mind too that 2016 production volumes are up 10%-20%, in many instances offsetting the potential losses (subject to a faint possibility of second budding) relating to 2017.

So as consumers, we should sympathise and feel bad for estates such as Pape Clément for their loss of production. We should feel even sadder for producers’ losses in places like Fronsac, Lalande de Pomerol and Castillon, where there will be economic casualties. But it doesn’t mean we will consequently want to buy much more expensive wine.

by Wine Owners

Posted on 2015-02-16

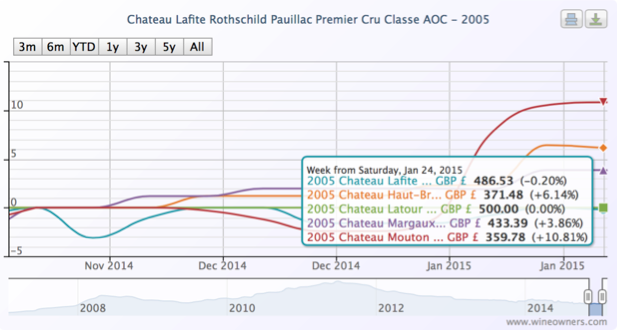

The turning point for fine Bordeaux was August of last year. By early October it was unclear whether the tick-up was yet another of those blips we’d seen several of during the previous 24 months.

Today it is clearer: the trend is up, most wines are well off their lows, and the Bordeaux Index overall is 2.17% up on 6 months ago.

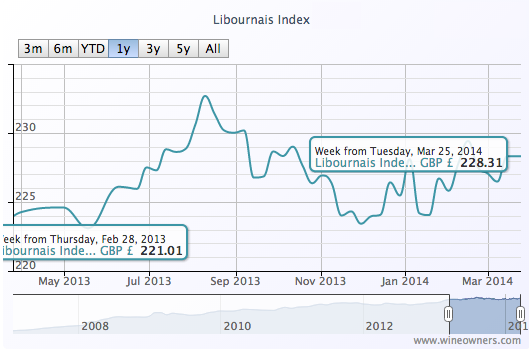

The exception is the Libournais index covering Pomerol and St Emilion, which has slipped 0.48%, a reversing the gains of 1.24% between early October and the end of November last year.

The Medoc Classed Growths are collectively up 2.77% form their August 9th 2014 lows.

Whereas the First Growths only managed 1.51% during the same period. Not entirely surprising since top vintages are still highly priced, they have had further to fall, making it hard to call bottom, and started picking up momentum in January 2015. What is clearer is that wines such as Haut Brion 2008 appear to be interesting propositions.

Elsewhere the Blue Chip Burgundy Index continues to power ahead, though within that there are notable, and expensive, fallers (last 12 months):

| Domaine de la Romanee-Conti Le Montrachet Grand Cru AOC |

2010 |

-7.16 |

| Domaine Ponsot Charmes Chambertin Cuvee des Merles Grand Cru AOP |

2010 |

-7.69 |

| Domaine Armand Rousseau Mazis-Chambertin Grand Cru AOC |

2010 |

-7.89 |

| Domaine Jean Grivot Richebourg Grand Cru AOC |

2007 |

-9.43 |

| Domaine de la Romanee-Conti Romanee Saint Vivant Grand Cru AOC |

2010 |

-10.71 |

| Domaine Jean Grivot Echezeaux Grand Cru AOC |

2002 |

-11.2 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2006 |

-13.15 |

| Sylvain Cathiard Vosne Romanee En Orveaux Premier Cru AOC |

2010 |

-13.69 |

| Domaine Comte Georges de Vogue Chambolle Musigny Les Amoureuses Premier Cru AOC |

2002 |

-13.7 |

| Domaine de la Romanee-Conti La Tache Monopole Grand Cru AOC |

2010 |

-15.38 |

| Domaine Armand Rousseau Clos de la Roche Grand Cru AOC |

2010 |

-16.08 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2005 |

-16.18 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2006 |

-16.35 |

| Domaine Leflaive Chevalier-Montrachet Grand Cru AOC |

2005 |

-16.67 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2008 |

-20 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2006 |

-20.16 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2005 |

-21.94 |

Northern Italy is up 1.42%, with Giacomo Conterno one again heading the leaderboard

Champagne has defied our predictions in gaining a whopping 7.42% over the last 6 months, the top risers comprising exclusively older vintages in the range 1996-2002. This makes a lot of sense. Millions of bottles of top cuvees such as Dom Perignon (up to 8M bottles per annum) means that values kick up only when supply and demand becomes more balanced.

We also thought Californian wines would moderate their growth this year. Comparative to Bordeaux prices, they seem expensive. Since January they have indeed dipped -0.65%, off the back of six month growth of 6.65% up until that point. It’s too early to say whether they are simply pausing for breath, or have reached a natural plateau. The trend line favours the first scenario.

by Wine Owners

Posted on 2014-03-25

With a level of 221 at the end of February 2013 (baseline January 31st 2007), the Libournais Index shows a relatively flat performance, with a change of only 1.8% over a 1-year period to 228.31.

While the top movers of the Medoc Classed Growth Index were relatively affordable vintages, the Libournais Index top gainers feature higher value wines, as do the biggest fallers, perhaps indicating a rather higher level of market interest than on the left bank.

Individual high-scoring wines, however, buck the trend, with the 100 pointers La Violette 2010 and Petrus 2009 showing that a perfect Parker score can still be a market driver and suggesting that scarcity may increasingly be a market driver within the Bordeaux market, either due to tiny production or due to age.

It's arguably even more interesting to see the price of Vieux Chateau Certan 2010 fall quite significantly since the turn of the year (possibly as stockholders finally throw their hands up and start to write-down the value of their holdings?). Will Vieux Chateau Certan 2010 fall further carried by the momentum of price gravity? At some point this could be extremely tempting, for an utterly sublime wine that was considered by many (including us) to be perfect.

TOP GAINERS

BIGGEST FALLERS

Create an account on www.wineowners.com to receive our analyses by email.