by Wine Owners

Posted on 2020-05-27

So Latour 2012 is out today at £350 a bottle. What’s that got to do with 2019 EP I hear you ask? Well coming as it does just before the releases of the 2019 big boys, and because it’s the first release from Latour that wasn’t previously released EP, it’s seen as a test of the market and what the consumer’s appetite is for laying out hard earned spondoolies in The Time of Covid.

I’ve seen emails from merchants this morning gushing that this is the cheapest Latour in the market today, and how they’ve got the pricing right.

The retail channel needs to see the 2019 releases come out minus 30% v 2018. That would put Lafite et al at around £2,000/ 6 and at that price it would sell. Plus it might just re-energise the Bordeaux secondary market with a dollop of positive sentiment.

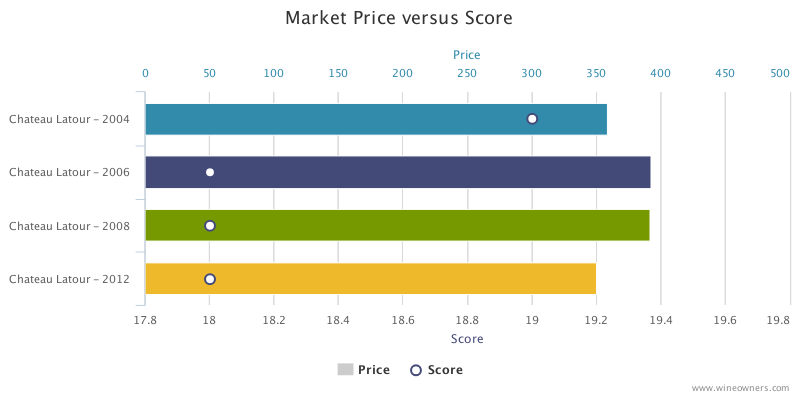

However If we compare 2012 Latour to other comparable vintages of Latour, so say 2008, 2006 and 2004, which I think is rather realistic, we see a very different picture.

Here’s the market price and JR points plotted for 2012 and those benchmark vintages selected:

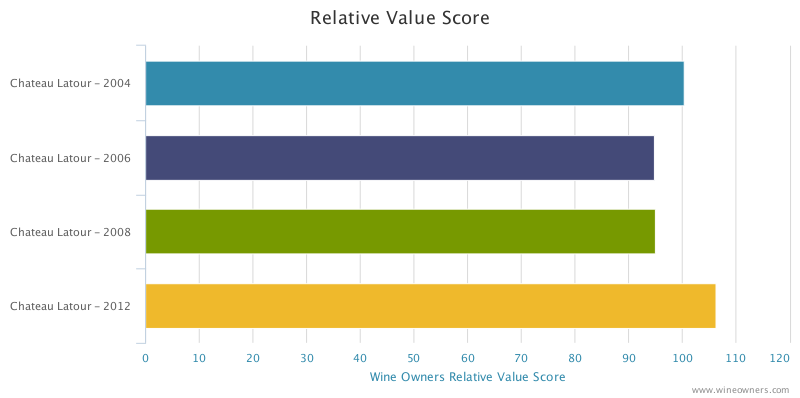

And here’s the weighted effect of that taking into account scores:

The longer the bar the better the value, the bigger the gap between the longest and the next, the more compelling the buy. Not much in it is there? Which says that Ch. Latour, far from doing their 2019 EP peers a massive favour, have given absolutely nothing away. There’s no Covid discount baked into this price. The best you can say is that there’s no guff about ex Chateau premium.

So, as a curtain raiser, it's a damp squib. But that’s their release model now and who’s to say they are wrong? At least we know what we’re drinking. The reply to this question, answerable only by Lafite et al, will come soon enough.

by Wine Owners

Posted on 2020-05-20

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.” Charles Dickens.

18th May 2020 kicks off the Bordeaux 2019 en primeur campaign with the release of Chateau Angludet. They’ve partially gone down the amphora route to gain purity. It’s a great success, a very great Angludet, according to a number of merchant emails received today. Those same emails belie one small issue - that the wine has yet to be tasted. A reminder of the impact of Covid-19, the anxieties and emotions over this year’s releases dominated by hope and despair. So we have to take the Bordelais at their word that it’s a great vintage, fresher than 2018, in the same mould as 2016 or 2010. I’m sure producers are excited by what they have in cask or tank or whatever receptacle the juice is in these days. But it’s not unjustified to say that local opinion isn’t always entirely objective. So bring on those Chronopost and UPS samples and let us all taste...

We have to be honest, we’d have much preferred a deferral of the campaign to October after the harvest. We don’t agree that would have caused any issues with other regions’ releases. There is something very strange about releasing a futures campaign whilst so much of our economy is in deep purdah. But the die has been cast and June it is (for the 60-odd releases that the market chooses to focus on).

The choice of timing of the releases is significant. It is quite obvious that, just like the 2008 vintage release, there will have to be a very significant reduction in release prices for 2019 to find a market. Those properties who have tended to use en primeur more as a marketing opportunity than a selling one will have to think about what it means to them: the prospect of a marketing campaign has more or less evaporated. For those properties who expect or need to sell a sizeable percentage of the harvest, only one one of the four marketing ‘P’s matter. It can be the best vintage in the world, it can garner (in the fullness of time) more 100 pointers than any of the last 40 years, but success will boil down to one thing and one thing only: price.

That decision will have ramifications on the whole of the Bordeaux global secondary market. A significant reduction of 30%-40% can ignite interest in the region’s great wines. It can draw in a new generation that has largely ignored the region, or doesn’t see the point of purchasing new releases two years before shipping. It can reward buyers of the last vintages who are under water and likely to remain so. A compromise that shows intent but brings us back to the levels of 2015 will consign Bordeaux to another year in the shallow quicksands of a secondary market lacking direction, fearful of the future, unwilling to commit cash, failing to see the point anymore.

Ah, I hear you say, but the world is awash with cash desperately looking for a home, just as it was post-Lehmann - when the fine wine market benefitted royally. I disagree. We are entering uncharted waters and cash in the bank trumps FOMO, the fear of missing out. Warren Buffet can be wrong sometimes, but not all the time, and moving to an underinvested position does not seem completely crazy.

So let’s say that 2019 is the equal of 2016, increasingly recognised as the greatest classic Bordeaux vintage in a generation. 2019 is likely not its older sibling’s equal (probably, but who knows) but let’s pretend it is for a second. Even on this most optimistic reading of the new vintage, would you rather buy into a vintage that has been tasted, re-tasted, evaluated ad infinitum and has withstood the scrutiny of the entire market, or roll the dice with a vintage that will be narrowly evaluated based on posted samples? Add to that 2016 prices that have barely moved or drifted down, and the comparative case for 2016 is about as strong as it gets.

Bring on June, and a prediction: either the most successful en primeur campaign since 2016 (notwithstanding Covid-19) or a non-event, determined purely by one variable - price.

Nick Martin

20th May 2020

by Wine Owners

Posted on 2020-05-19

Miles Davis, 18th May 2020.

Activity in the wine market in April was, pretty much, a repeat of what we saw in March. Numbers of alcohol and wine sales have been higher across the board since the pandemic struck, with people apparently drinking more, just less publicly! Closer examination would suggest quantity is winning out over quality, as volumes are up but values are lower. This comes as little surprise and this trend has been replicated on the Wine Owners platform. Plenty of gluggers being bought with little activity in the investment grade.

One interesting area of note amongst London’s fine wine traders, who have generally been quieter than in more normal times, has been a few very high value trades purchased by drinkers not investors. High value cases of DRC, Le Pin and other very top end names have been changing hands in piece meal fashion. Otherwise trade stumbles along with consumers rather than investors calling the shots.

The trends that existed pre the virus seem to be continuing and there is no question Italy continues to steal the limelight away from France. There is no doubt the lack of U.S. tariffs on Italian wines will be assisting here but Italy is on fire anyway. Some superb vintages from their finest wine regions, namely Piedmont (2016) and Tuscany (2015 and 2016) are proving popular amongst wine lovers who are accustomed to paying far more for their French equivalents. These wines are coming to the market now as the Italians release their wines much later than the French. The extra ageing that occurs helps enormously as the reputation of the vintage is not speculative; the wines will have been tasted and re-tasted, so that significant element of risk is eliminated. They don’t ‘do’ en primeur like the French either, so there is far less hype and less FOMO (fear of missing out), so all in all it’s better for the purchaser (the two countries really could learn quite a lot from each other!). Chateau Angludet released their 2019 yesterday, even though only a handful of people have tasted it, as the whole Bordeaux en primeur system challenges itself yet further. June is the current plan for the pricing up of Bordeaux primeurs and unless there are substantial price reductions, we must surely be looking more at a case of double amputation rather than simply shooting one’s own foot off!

Whatever happens with Bordeaux en primeur I strongly believe Italy and the rest of the world will continue to eat into the French gateau. The fine wine market continues to broaden, there has never been so much good wine coming out of other regions and other countries, with journalist’s coverage to match, and with points awarded to even outstrip that! The economic effects of Covid-19 are going to be felt far and wide and the quest for relative vinous value will be evermore sought after.

miles.davis@wineowners.com