by Wine Owners

Posted on 2023-03-22

by Luke MacWilliam

Download the full report here

2022 was a year of “permacrisis” according to Knight Frank's annual “Wealth Report”, with Ultra High Net Worth Individuals' overall wealth decreasing by 10%. Energy, Economics and Geopolitical shockwaves all had an impact on wealth.

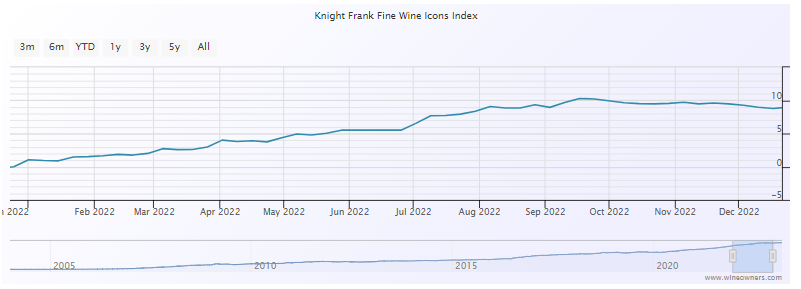

Fine Wine grew 10% as a whole in 2022, a slight dip compared to the 16% seen in 2021 but double-digit growth in such a turbulent year can’t be sniffed at.

The Wine Owners/Knight Frank Fine Wine Icons Index shows the tale of the tape. This index follows 150 blue chip collectables including First Growth Bordeaux, Cult Californians, Burgundy, Champagne, Super Tuscans and more. It shows a year of two halves. Steady growth in Q’s 1 & 2 followed by a slow down/flat line in Q’s 3 & 4.

We attribute this pattern to a combination of factors, including the “permacrisis” factors stated in Knight Frank's report. One key observation is the behaviour at the top of the Burgundy market which has entered into a slight decline of -2% so far in 2023.Has the market topped out or is it pausing whilst global economics work themselves out? We’ve seen a rise in the number of Burgundy offers, and those pricing ambitiously are not seeing much interest.

What is encouraging is that throughout the global economic turmoil, interest in the fine wine market remains strong, and once again fine wine has proven to be a steady ship in a very unpredictable world.

As part of Knight Frank's report they conduct an attitudes survey, compiling responses from over 500 private bankers, wealth advisors and family offices who combined represent over $2.5 Trillion worth of assets. In the passion investments segment, Wine has again performed strongly as an area for future investment. 39% of respondents indicated that their clients are likely to purchase Wine as a passion investment in 2023, placing it behind only Art and Watches and ahead of Classic Cars and Jewellery in the passion sector.

2022 was a remarkable year on so many fronts; war in Ukraine, multiple PM’s, energy crisis, interest rates, countries trying to recover from the after-effects of pandemic - who can be sure what curveballs 2023 will throw us, but wine has a proven track record of sailing serenely thought turbulent waters and 2022 was no exception.

by Wine Owners

Posted on 2022-12-15

The latest Liv-ex Power 100 performance saw Burgundy sweep the top 5 spots, pushing fellow blue-chip region Bordeaux out for the first time – ever. The index ranks the best performing brands in the fine wine secondary market based on criteria including price performance and trade performance of wines across a brands portfolio.

In a nutshell, Domaine Leroy claimed the top spot for the second year in a row, while Arnoux-Lachaux, Leflaive and Prieure Roch jumped over 30 places to nestle within the top 5. Spurred by a fall in wine supply (enter difficult harvests over the last decade) and a rise in demand (cue a resettling of the fine wine market post Brexit, a lifting of Trump’s US tariffs on French wines and pandemic recovery), Burgundian wine prices have been steadily rising.

We speculate on why and whether this is sustainable:

Accessibility

What is profound about the strong performance of Burgundian wines is the inclusion of Maison (négociant) labels in the data pool. Burgundy is a unique region in that producers can also sell wines as négociants. Wines made under these labels are made from outsourced grape, grape juice and/or fermented wines made or grown by other farmers. The prize in this is that collectors that miss out on rarer and higher priced Domaine wines can now access excellent wines of these esteemed brands at lower prices.

Ironically, the consideration of négociant labels for a specific brand in the Power 100 index calculations has now contributed to massive price jumps for these wines.

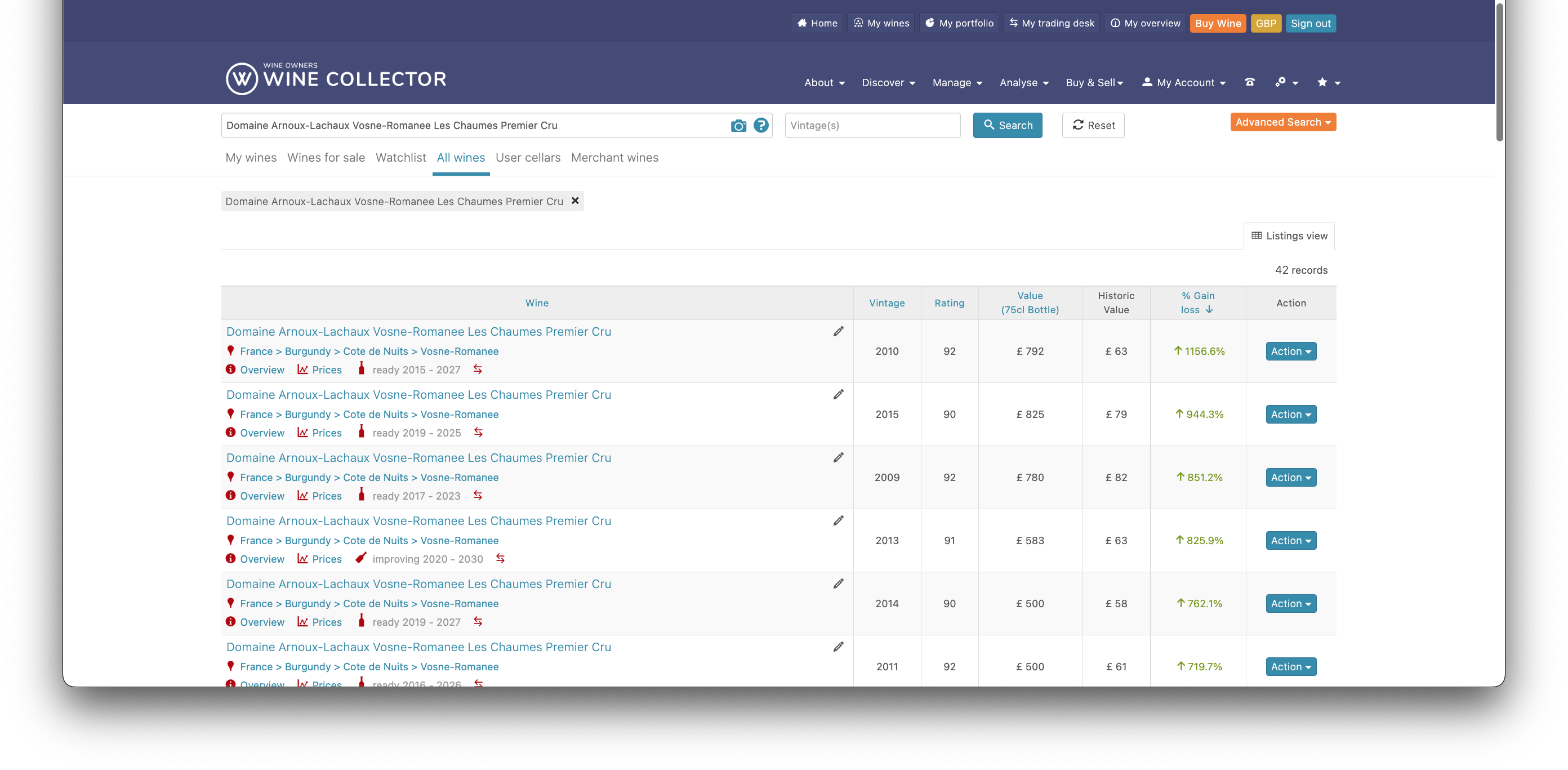

For example, for 60 place jumper on the Index Domaine Arnoux-Lachaux, the inclusion of micro-négoce label Charles Lachaux, amplified the trade volume and value of the brand. It now sits pretty at second place right after Domaine Leroy, which also trades Maison labels. On the other hand, these initially relatively accessible wines (Charles Lachaux) had a price jump of over 1,000%. Though including Maison labels is expected to dilute the price of the stronger Domaine labels and therefore the average price of the brand, the price performance of Domaine wines has been impressive. A random search on Wine Owners of any of the Domaine’s wines will show this as true.

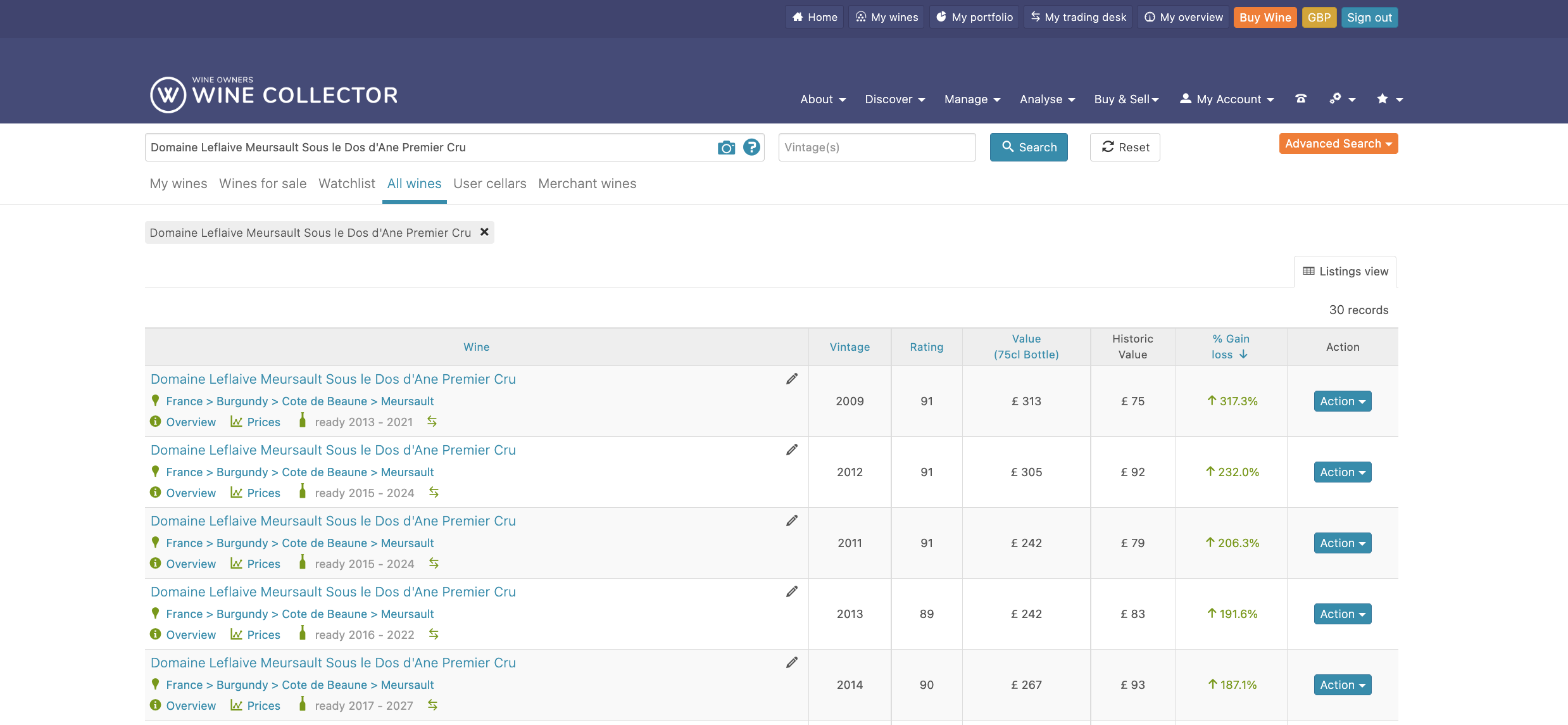

Similarly, 4th placed Domaine Leflaive, whose wine range now include négociant partnerships under the labels Esprit Leflaive and Leflaive et Associés, showed its strength this year by ranking fourth and laudable average price performance of nearly 100% since last year.

While we do not claim to undermine other market forces such as dwindling Burgundy supply and the general revere of one of the best wind regions in the world, it is an interesting explanatory to consider while examining Burgundy’s continuous price rise.

Could this signal that the “accessibility” offerings that are unique to Burgundy are helpful in their brand power? Maybe. As there is only so much fine Burgundy wine to go around, the desire for collectors to get as close to the cru wines, négociant driven wines are clearly wanted in the market.

The sustainability of this trend is yet to be seen but Burgundy is still a force. Though the Wine Owners (WO) 80 Burgundy index dipped slightly last month, prices look like they will keep staying up. Strong brand name and reputation, strict supply, and the irreplaceability of Burgundy should maintain the index, which has significantly outperformed the WO 150, Dow Jones, Bordeaux 750 and Italy 150 for the latter part of this year.

Here's what’s active in our fine wine exchange from the top 5 Liv-ex Power Burgundy brands:

| Wine Name | Vintage | Pack Size | Qty | Tax Status | Market Value | Offer | Discount to Market |

| Charles Lachaux Bourgogne Aligote Les Champs d'Argent | 2018 | 6x75 | 3 | IB | £5099 | £4975 | 2.4% |

| Domaine Armand Rousseau Chambertin Clos de Beze Grand Cru | 2008 | 6x75 | 1 | IB | £18809 | £18350 | 2.5% |

| Domaine Armand Rousseau Gevrey Chambertin Lavaux Saint-Jacques Premier Cru | 2011 | 1x75 | 2 | DP | £750 | £650 | 13% |

| Domaine Arnoux-Lachaux Echezaux Grand Cru | 2016 | 1x75 | 1 | IB | £2092 | £1675 | 20% |

| Domaine Arnoux-Lachaux Vosne-Romanee Les Suchots | 2017 | 6x75 | 1 | IB | £12790 | £11000 | 14% |

Domaine Leflaive Puligny-Montrachet Clavoillon Premier Cru | 2019 | 1x75 | 1 | DP | £333 | £300 | 10% |

Domaine Leflaive Puligny-Montrachet Clavoillon Premier Cru | 2019 | 3x75 | 1 | IB | £1000 | £995 | 0.5% |

| Domaine Leroy Latricieres-Chambertin Grand Cru | 2009 | 2x75 | 1 | IB | £20297 | £16000 | 21% |

| Domaine Leroy Nuits-Saint-Georges | 2015 | 3x75 | 1 | IB | £11987 | £10500 | 12% |

| Domaine Leroy Romanee Saint Vivant Grand Cru | 2017 | 1x75 | 1 | IB | £8695 | £8695 | 8% |

Domaine Prieure Roch Nuits-Saint-Georges Clos des Corvées Premier Cru | 2017 | 6x75 | 1 | IB | £4000 | £3900 | 2.5% |

by Wine Owners

Posted on 2022-11-17

Last week the great and the good of the UK fine wine trade congregated in Lindley Hall, Westminster for the annual tasting of the latest Bordeaux vintage to be bottled - this year the turn of 2020.

Overall impression was of an above average vintage, but without the consistency of 2019. The best wines were very very good but there were some uninspiring wines too. We’ll focus on the positives as at this stage it would be unfair to write off some of the less impressive/obvious wines where factors such as bottle shock are quite possibly at fault.

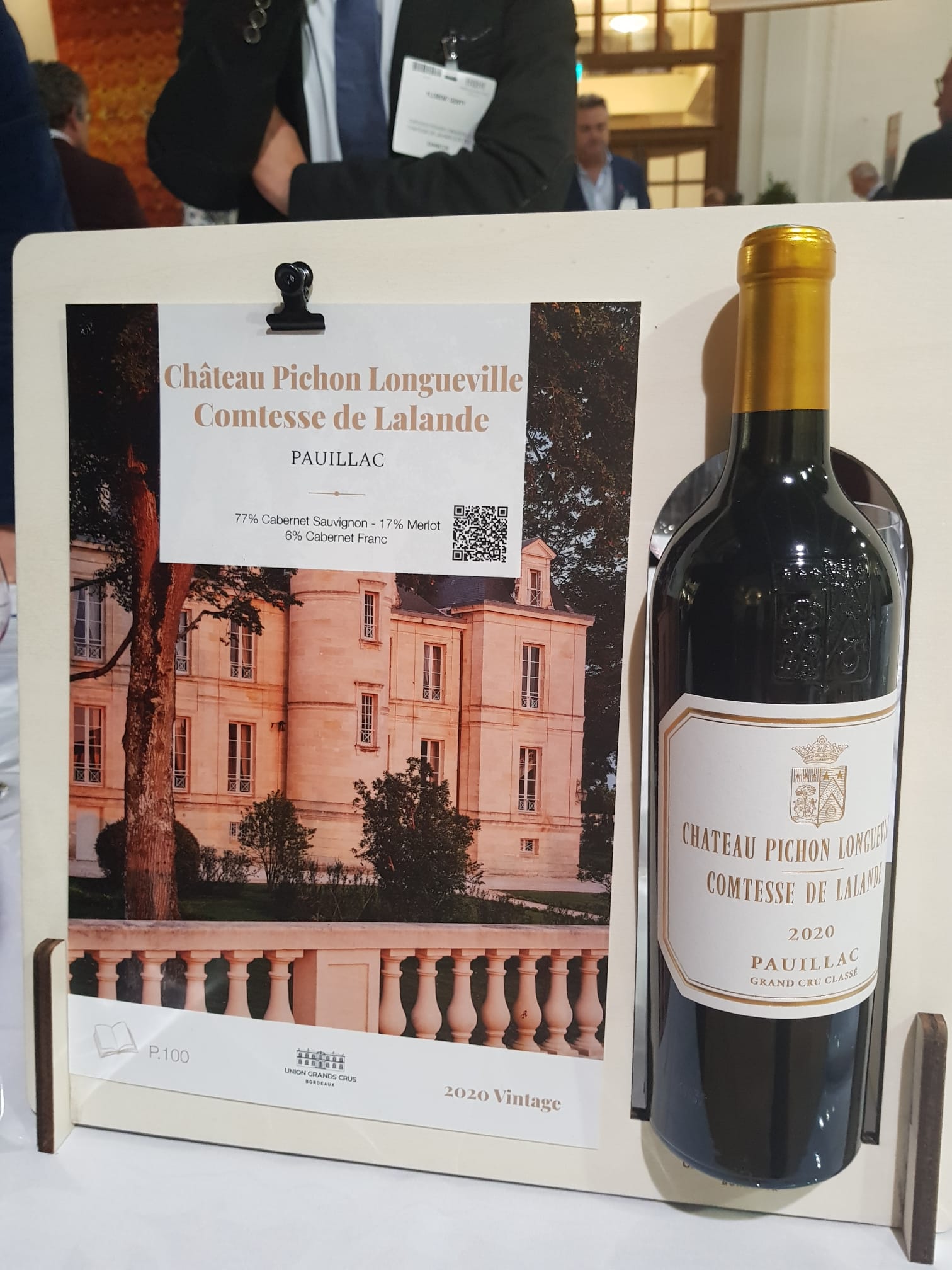

Pauillac offered the most consistency, Pichon Lalande laid down an early marker for wine of the day helped in part by its soft approachable style and purity of fruit but backed up by impressive structure and acidity. Neighbouring Pichon Baron is unmistakably more powerful but this year as with 2019 has retained elegance and precision, a good sign for the future.

On to St Julien and a clearer demonstration of the variability on show, the best (Léoville Barton and Léoville Poyferre) shone bright with searing acidity, bold fruits and tannic structure. For others, this is the section in my notes where the words “flat”, “thin” and “fine if not exactly exciting” start appearing.

Léoville Poyferre was shown off in their special bottle celebrating 100 vintages, clearly inspired by Mouton’s Gold on Black sheep from 2000 but detailing a map of the estate. I think it’s effective, looks great and I’m pleased to report the wine being put into it is fitting for such an anniversary. Bravo.

Margaux followed suit from St Julien in seeming a bit disjointed, Brane Cantenac and Rauzun Segla offering typical Margaux opulence and Lascombes and Château du Tertre showing potential once the oak becomes more integrated.

Pessac was more consistent, Smith Haut Lafite can’t miss these days and there were good showings from Haut Bailly and Pape Clement. There wasn’t much from St Estephe on display, but what was offered showed promise. Phélan Ségur stood out but good efforts from Lafon-Rochet and Château du Pez showed typicité of the region.

I didn’t get round the right bank as much as I would have liked but Canon was sensational and fully deserving of the excitement surrounding it. Clinet also showed huge potential receiving a “wow” in my notes and praise for power, elegance and intensity. I felt sorry for the wine (that shall not be named) that I tasted immediately afterwards.

Altogether, 2020 is evidently an excellent vintage with some superb wines but perhaps not the overall consistency or excitement as 2019 or 2016. That being said, I'd be very interested to re-taste some of my lower scorers in a year or two as I’m sure that on the day some of them underperformed or got lost amongst the more “showy” wines.

Luke MacWilliam - luke.macwilliam@wineowners.com

November 2022

by Wine Owners

Posted on 2022-10-13

Today the wine part of the Wine Owners team, as opposed to the tech team who provide our best-in-class software solutions, tasted wines from one of the great sub-sections of the Union of Grand Crus; it is called the Bordeaux Grands Crus Classés - to avoid confusion!

Wines offered came from 2018-2021 vintages. What was abundantly clear was that 2019 has reconfirmed itself as the best of modern vintages. Also, 2018 is not for the faint hearted, especially Montrose, and also that second wines offer a lot of drinking pleasure at a diddly squat fraction of grand vin prices. La Dame de Montrose excelled, as did La Croix de Canon. The unpronounceable Chateau d’Aiguilhe from the Cotes de Castillon performed well, as usual (apart from the ’21), and at £150 per 12 in bond for the 2019 is remarkable value. Chateau Canon reinforced its ‘polished’ status and was probably the most consistent.

There were some volatile samples of ‘21s, which we imagine not to be representative.

To my mind, the question is not what to buy but when to buy, if you haven’t already - 2019 should be in everybody’s cellars.

Chateaux represented:

Smith Haut Lafitte

Gazin

Vignobles Comtes Von Niepperg - d’Aiguilhe, Clos de l’Oratoire, Canon La Gaffeliere, La Mondotte

Canon

Rauzan Segla

Branaire Ducru

Pontet Canet

Montrose

Guiraud

For enormous pleasure and for a twist on sweet wines, readers should definitely embrace the current trend of lighter wines from the region. Fresher and less sweet wines from Sauternes were particularly well represented by the second wines of Chateau Guiraud and these will make a very stylish aperitif. The dry whites of Smith Haut Lafitte were superb, and are so often overlooked for more obvious alternatives, Burgundy normally, as are most dry white Bordeaux wines - in the U.K. at least.

Miles Davis October 11th 2022

by Wine Owners

Posted on 2022-10-05

Only a couple of weeks ago the wine market felt like it does quite a lot of the time; a bit of a backwater, no great trends or swings, business as usual. Most things were just floating along calmly on their predicted journey while little pools continued to defy gravity, even though it would appear to make no logical sense; the highly prized Salon 2002 for example, having doubled and tripled in two to three years was in high demand - the joys of rarity are a thing to behold when such demand is in town! (I have sold some of this treasured holding on behalf of clients).

And then along came a newly formed Conservative government who decided they needed to bet the house on the UK economy, cutting taxes in order to promote growth, and wiped 10% off the value of the British pound in the process, and in record quick time. Tax cut reversals have now taken place and sterling has rallied a little although it remains at a much lower level than a year ago:

GBP/USD one year chart

Source: Yahoo Finance

This is unbridled joy for US dollar-based wine traders, which includes the powerful markets of North America, Hong Kong and Singapore, amongst others. Following the latest slide, we have seen some reasonably stale offers of quality stocks suddenly sell and UK traders across the board are reporting increased interest from these areas.

As a result, my personal take on the market has gone from a neutral stance to something more optimistic than that.

I have always held the belief that there is more demand in the US market for the wines of Piedmont and Italy in general given the obvious connections of heritage, and also for Chateauneuf du Pape (or C9P as I saw it written recently!). Mr. Parker had a penchant for handing out incredibly high scores for C9P back in the day which will have helped but it is also felt that America has a higher tolerance for sun kissed, more alcoholic (more than the Europeans are used to at least) juice. Asia does not yet seem to share these particular tastes in these regions but are very happy to continue buying Burgundy and Bordeaux. Everyone continues to buy Champagne, for very good reasons, so that is a large percentage of the market covered already!

I would not be at all surprised to see US wine stocks being exported from the UK back to the USA and feel that back vintages of highly prized Napa wines make strong sense.

Looking ahead, UK buyers in the primary markets for wine will be severely affected by sterling’s weakness in the coming months and their pockets will be stretched, so back vintages of well stored investment grade, quality stocks already in the secondary market also make good sense.

As GBP plummeted and the FTSE faltered, wine investors here in the UK slept well, evidence below. Yet again wine demonstrates its enviable low correlation and low volatility characteristics when all around others were losing their heads. I’ll drink to that!

The WO 150 Index is GBP based, other indices are based in local currency.

Miles Davis, 5th October 2022

by Wine Owners

Posted on 2022-05-20

Just back from the USA where I spent two weeks speaking widely to wine business owners. There are signs of a cooling off in the fine wine market. Even given the buying power a strong dollar confers.

The backdrop is a correcting stock market that’s seen its biggest sell-off since 2020. Unlike 2020, the drivers behind the correction are inflation and the threat of recession. In other words, it’s not driven by a market discontinuity, however persistent Covid proved to be. It’s driven by a fear of market fundamentals turning sour.

As far as blue chip Bordeaux is concerned - as far as collectible fine wine in general is concerned - we don’t yet know the impact of these macro economic factors, nor the impact of a shock to global food security.

But I’d wager there are a fair few highly leveraged buyers, and a lot more feeling considerably poorer than a month or so ago. However immune much of that market may be to cost of living increases, it is not unaffected by sentiment.

The similarities between Spring 2020 and now are striking, albeit the outlook as of early summer 2022 is less positive because it’s harder to look beyond the events that are driving market concerns. Lockdowns drove outsized wine sales. A recession will not have the same effect. A well priced 2019 campaign lit up demand. An overpriced 2021 campaign could douse it.

Meantime arbitrage opportunities in back vintages abound, which is why négoces are busy buying UK stocks and why US fine wine businesses are buyers: but with what intensity and for how long?

by Wine Owners

Posted on 2022-05-18

A long time ago there was a common response to the question "a glass of white wine?

What type or style would you like?" That response was "ABC" - anything BUT Chardonnay! Please.

Frequently the affronted sommelier (or smart Alec host) would respond with "how

about a nice little Chablis?"

"Oooh, yes please, we love Chablis!"

Oh, how we all laughed!!

The ‘ABC movement’ was brought about by mass market winemakers (and dare I say it, but a hefty percentage from the

New World) rather over oaking the pudding. The combination of clumsily used oak, sometimes in floating chip form, a

buttery malolactic character and with more residual sugar left in the bottle these heavy, almost sweet, (and

obviously oaky) Chardonnays gained mass market popularity. The cognoscenti were appalled and, like anything that

becomes over popular, and perhaps regarded as ‘common’, there was an almighty backlash. After all, well made, top

class Chardonnays have always been treated to some expensive oak treatment, and when used judiciously, this produces

wonderful depth, nuance and flavour.

All of this is very hard to imagine these days and as my colleague Luke argues, ABC should stand for ABSOLUTELY

BANGING CHARDONNAY!

I dined with an award winning Australian winemaker last week who makes Chardonnays at every level, represented in,

and all the way from, Aldi to Zafferano’s (probably not but I needed a good ‘Z’!). He tells me he simply cannot make

enough of the stuff, at every level. Demand is massive. On top of that he runs a wine bar and restaurant in Western

Australia for which he bought three pallets of white Burgundy from a local merchant. The same merchant begged him to

sell him back some of the Burgundy at a higher price within weeks.

Climate change has led to some well documented problems for Burgundy producers, from frosts to extreme heat,

particularly in the most highly prized Cote de Beaune. Winemakers are adapting their skills admirably both in the

vines and in the cellars, but there is currently a shortage of fruit and quality wines from this area and obviously

prices are rising fast. This is where Chablis comes in! Situated in the north of Burgundy, the slightly cooler

climate and without quite the same gamut of superstar names being pursued, other than Dauvissat and Raveneau, wines

from here can often be easier to find and possibly represent better value.

by Wine Owners

Posted on 2022-04-28

Chateau Bellegrave, Pauillac

I have just returned from a short three days in Bordeaux, tasting the recently crafted 2021 vintage. My tastings were not extensive, tasting mainly at negociants and the communal tastings with only a few Chateau visits, so this report is not comprehensive, but I aim to give a well balanced impression of my findings.

The weather last year was challenging, in some cases in the extreme. Frosts in the springtime, rains in May and June that led to mildew in July, but then a good late summer into harvest time. Vignerons had to hold their nerve to see if phenolic and alcoholic maturity could be achieved - would the grapes fully ripen? Some did, others did not and in this vintage, it boils down to the microclimates, what the winemaker did, and what luck they had, either good or bad. There are some very nice wines out there but too often we found wines without enough fruit, leading to little joy or charm.

Chateau d’Yquem, Sauternes

As is always the case, wines tasted at the Chateau showed more favourably than at the communal tastings. The wines are prepared more carefully and this year, as one representative admitted, the serving temperature was warmer than in recent years. Wines from the trio of ‘hot’ vintages preceding this one were generally presented at a cooler temperature to promote the idea of freshness as much as possible, but this year they were presenting at a slightly warmer temperature to promote the aromatics and give the fruit a chance to show. Some tasting conditions were just too cold and when they were, the wines did not show well.

2021s will offer something quite different from these recent, warmer vintages. Winemakers had to be careful with extraction to avoid bitterness from underripe pips and skins, and many wines will be approachable early. Tannin levels are lower, alcohol levels are down which is great, and acidity levels are higher, some too high. The key question to bear in mind is: will the bottle you open in a few years down the line have enough fruit and concentration? If it has you should be on to a winner.

For me St. Julien was the most consistent commune, and both the Barton sisters did a star turn. I will happily buy Langoa, very sleek, juicy, and moreish with Leoville a bit more serious. I heard Poyferré made a stunner, Las Cases less so. Beychevelle and Branaire Ducru were good and Lagrange and Talbot were both very decent, you could say reliable.

Chateau Giscours, Margaux

Margaux, Pomerol and St. Emilion were all over the shop, except for Canon and Rauzan Segla, surprise surprise, which were both exemplary!

Chateau Canon, St. Emilion

In Margaux, Labegorce Zede, and D’Isaan ran well. In Pomerol, La Conseillante, Certain de May, Hosanna, La Fleur Petrus all performed well and in St. Emilion, Belair Monange, Le Dome and Gaffeliere did a good job.

The powerhouses of Pauillac, I’m thinking the Pichons and Lynch Bages, not the first growths, demonstrated relatively good concentration but there were surprising disappointments too.

I didn’t taste at the very top of the St. Estephe tree, but the Calon stable showed well, as did Ormes de Pez.

Most communes were so varied that it is hard to say one is better than the other. Also difficult are vintage comparisons. There were bits of ‘14 in the good wines, touches of ’17, and I was reminded of ’04 in parts, the greener parts, and the parts that included the dry white wines of Bordeaux. Malartic-Lagravière was a delicious glass of tropical fruit salad and Domaine de Chevalier Blanc just pure class. As is often the case with weaker red vintages, the whites have done well.

The early developing Merlot was the weakest performing grape variety, in quality and quantity terms. More Merlot was lost to frost than the Cabernets, so naturally lower percentages than normal found their way into the final blends.

As ever, pricing will be important and given the economic headwinds this isn’t just about the wine. The secondary wine market is still travelling well, is in good health, but the primary market is a very different beast and it’s not a great vintage. Other than the much reduced 2019s there has been little point in tying up capital by buying en primeur across the board since the 2005 and 2008 vintages. There have been many specific wines that have worked well from other vintages, particularly ’15 and ’16 but en primeur has become a much more selective game and probably none more so than this tricky vintage but there are still some lovely wines out there.

Please look out for our analytics and comment on en primeur releases as they happen on the Jancis Robinson forum.

Miles Davis

April 2022

07798 732543

by Wine Owners

Posted on 2022-03-14

Nebbiolo Day returned to London on 3rd March, showcasing Piedmontese passion and prowess in all things Nebbiolo.

I used it as an opportunity to taste taste taste, side by side a variety of producers, crus and vintages and delve right down into why Nebbiolo is deservedly enjoying more and more attention from collectors. There was not enough time or oral capacity to taste everything on offer, so I focused on Barolo and Barbaresco producers and may have missed some gems from Alto Piemonte and Valtellina.

My main 3 takeaways were as follows:-

1) Langhe Nebbiolo should feature in everyone's home cellar for immediate consumption. Pretty much universally under £20 per bottle and in some cases difficult to separate from regular Barolo. GD Vajra, Diego Morra, Domenic Clerico and of course GB Burlotto 2020’s all stood out as high class efforts, as did Vietti 2019 (possibly because the grapes are all declassified Barolo….)

2) 2016 was something special. The vast majority of wines on show were from 2018, and the quality for the most part was high (exceptional in many cases) but 2016 has that something extra. The 2016’s on show simply just shone! .... do not miss and showed Nebbiolo at its absolute pinnacle. Giovanni Sordo Rocche di Castiglione, Brezza Bricco Sarmassa, Diego Morra Monvigliero were the highlights and still very much in their juvenile state. They are still cheap for what they offer!

3) Flagship wines generally lived up to the hype. It may sound obvious, but when you taste through a range it is always reassuring when the top name (and most expensive) delivers the goods, and in 2018 Piedmont, they do. Tasting notes like “Jackpot” appear in my notes by Paolo Scavnio’s Bric del Fiasc 2018, Brovia Ca Mia and pretty much everything on show by Pio Cesare (increasingly excited with more exclamation marks as you move up the range).

Finally, a special mention to for ArnaldoRivera, the largest cooperative of growers who have been producing consistently high quality wines in recent years, and whose “Undicicomuni” now boasts a selected blend of 21 plots (up from 16 when I last tasted pre pandemic). I like to think of it as NV champagne and a delight to drink. The single vineyard expressions on show were also stunning, both Rocche dell’Annunziata and Villero 2018’s..very exciting times for the group.

Thank you to Hunt and Speller for organising a well attended and vibrant event, I can’t wait for next year.

And Miles would like to add: there are still many 16s available at initial offer price, this vintage was EPIC and should be in everyone's cellar. Covid helped keep prices down… please load up, you will not be disappointed…. promise!

Luke MacWilliam

March 2022

07375 594 196

by Wine Owners

Posted on 2022-03-09

Like traditional asset classes, the appalling events in Eastern Europe have cast a (tiny) bit of a shadow over the wine market. Unlike traditional asset classes this does not mean prices sharply falling, then rallying, and then yo-yoing up and down, repeating again if necessary, but a much more sedate and sanguine sitting back and taking stock approach. There is no wall of stock flooding the market and buyers have not just suddenly disappeared, they may just be exercising a touch more caution than before the outbreak.

The wine market has been enjoying a really good run for eighteen months or so but the exuberance witnessed in the run up to Christmas has calmed. Indices were still positive in February but trading has slowed a little and the gains are not so pronounced.

Major indices over a one year period:

My feeling is that the wine market has developed so much breadth in the last decade or so that it is less affected by global events than previously. Merchants and market makers are slower to mark down prices than before; they have survived Asian currency crises, the bursting of dot com bubbles and global financial disasters etcetera, etcetera and are better capitalised and have a wider audience. The volume and the diversity of the client base continues to grow which at this point in the wine market’s history is bringing more stability to underlying prices. As an asset class it offers probably better diversification than ever before and may even start to challenge Gold as a safe haven trade. The Kremlin’s gold reserves are well documented, and may be up for sale soon - luckily the same cannot be said about their fine wine holdings!

Factor that in with some supply issues (thinking drought affected Burgundy), supply chain issues (thinking Brexit amongst others), and rising inflation and I think wine is still a good place to be. We would definitely recommend looking out for cut priced opportunities if they arise and there’s certainly no reason to panic. Not yet at least!

And here's a look at the major indices over the last fifteen years: