by Wine Owners

Posted on 2020-11-23

Krug is, surely, a Champagne that needs no introduction.

In all likelihood it is the first name to enter one’s head when considering the top names in the prestige Champagne bracket. It was the first thing I sought out on receipt of my first proper bonus! There are others obviously but Krug has carved itself a special niche of its own.

Krug, founded in 1843 produce a range of different cuvées ranging from the Grande Cuvée for everyday drinking (!) to the Clos d’Ambonnay for that very, very special occasion (at £2k+ per bottle it should be at least a very good excuse!). Here we are looking at Krug’s Vintage Champagne over some of the best vintages of the last two decades.

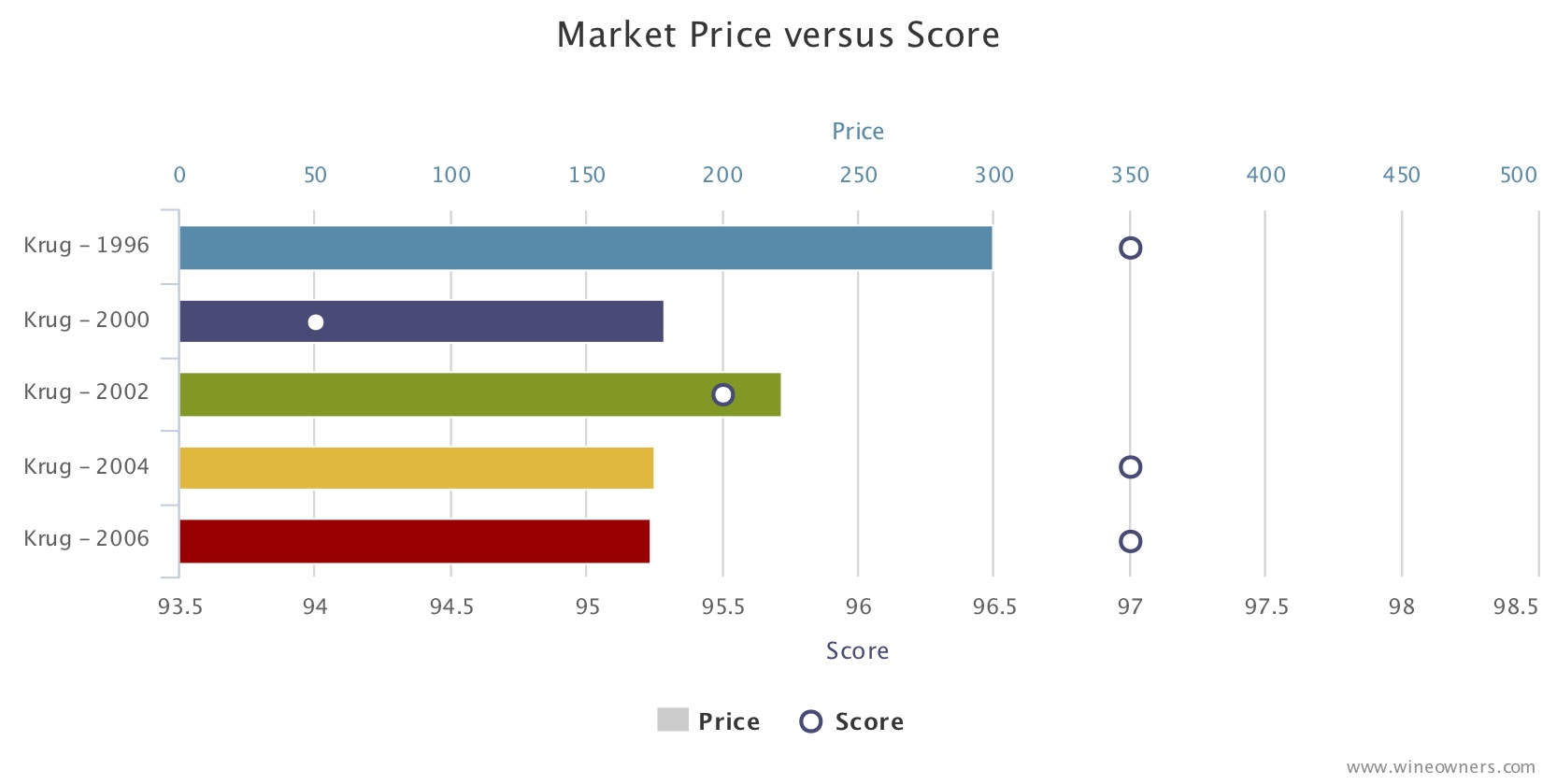

First, the market prices and scores:

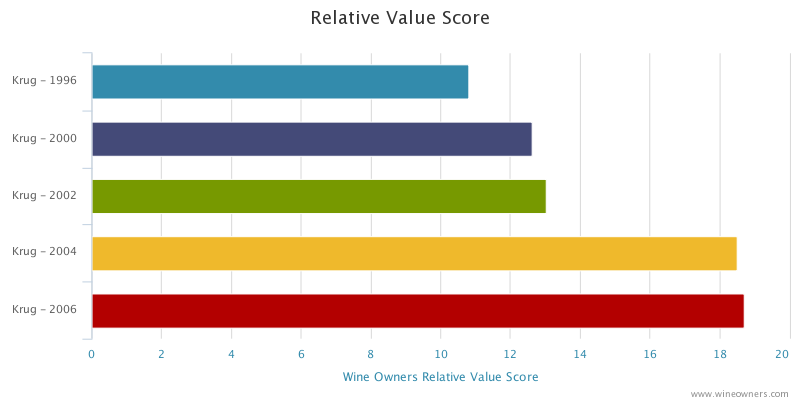

And now the relative value score:

The mega vintage that is 2008 has not yet been released, so in the meantime I have no hesitation in recommending both the ’04 and the ’06 as very solid buys for the long term.

Banner Image: www.krug.com/the-house-krug

by Wine Owners

Posted on 2019-04-30

Research does not come any easier than looking at Krug 2004. Vintage Krug is an investment stalwart and the long-term numbers tell us it is a consistent performer. So, you key in the various available vintages into Wine Owners ‘Relative Value Analysis’ and ’04 comes out as THE pick of the bunch:

Then you read the tasting note from Antoni Galloni:

Krug's 2004 Vintage is absolutely mesmerizing. Layers of bright, chiseled fruit open up effortlessly as the wine fleshes out with time in the glass. Persistent and beautifully focused, with a translucent sense of energy, the 2004 captures all the best qualities of the year. Moreover, the 2004 is clearly superior to the consistently underwhelming 2002 and the best Krug Vintage since 1996. Readers who can find it should not hesitate, as it is a magical bottle. 97+

Simples! But, as ever, it is not quite as simple as that; if we compare the returns over the last twelve months, performance across the vintages is far from consistent:

| 1996 |

7.50% |

| 1998 |

-0.90% |

| 2000 |

19.80% |

| 2002 |

2.30% |

| 2003 |

12.50% |

| 2004 |

-6.00% |

It is difficult to explain the variances, especially the ‘98 but I take heart that the 2004 is yet to perform positively. It was a decent size crop and clearly there are plenty of merchants still holding their allocation but this means there is still time to accumulate before it starts appreciating – and it most certainly will! This is a buy on a long term basis.

by Wine Owners

Posted on 2019-01-11

In a year, and particularly the last quarter, of great uncertainty the wine market has proved to be a place of great refuge - the WO 150 increased by 10.3%. The wine market performance during the fourth quarter of 2018 was flat, having been gently on the rise until December when indices, including the red-hot WO Burgundy Index, came off a little, in line with a noticeable drop off in turnover throughout the market. In the context of all asset classes, this is another demonstration of the low correlation with more conventional investments the wine market enjoys. Ongoing trade wars between China and the U.S. continued to damage confidence across the board, hitting stock markets, both developed and emerging and depreciating the Yuan – a significant factor as we estimate 40% of fine wine by value lands there. As global markets faltered the wine traders of London, the epicentre of the fine wine trading world, were and still are, gripped in the throes of Mrs. May’s desperate attempts to pass her Brexit bill.

The main story of 2018, like 2017, was Burgundy, the index posting a gain of 33%. A combination of Asian-led demand and real scarcity is a powerful dynamic. The biggest names amongst the producers and the grandest crus still dominate; the usual suspects of DRC and Rousseau are still out in front and may always stay that way but Coche-Dury, Dujac, Leroy, Mugnier, Roumier, and Rouget, are some of the names that are hot on their heels and we suspect there are plenty more sitting in behind. Prices of some wines have skyrocketed and are, some may argue, fast becoming the preserve of the insane (or very brave) as they rush headlong into unknown territory! A lot of serious collectors we know have been taking profit in these sorts of examples and are looking for value elsewhere.

The WO Champagne index rose by 8.8% on a feeling of increased interest from investors. Italy and the Rhone both performed respectably. More for reference, as it is so difficulty to source efficiently in the U.K., but the California index was more than respectable with +17.2%

Wine Owners Indices

by Wine Owners

Posted on 2017-02-13

Romance and wine are irrevocably linked for the simple reason that alcohol reduces our inhibitions and allows the true poetry in our souls to bubble to the surface. And if we're not quite as lyrical as we'd hoped, it gives us a very good excuse the next day. So here are 10 tips to help you navigate the wine pitfalls of Valentine's Day. (But that is all. We can't guarantee love).

1. Order a couple of glasses of champagne whilst you're looking at the menu. And let your date have one of them. Champagne shows you have class and you care.

2. Try Italian. Any Italian wine will enable chaps to pretend they're Casanova, whilst ladies can dream they're in Venice or Florence.

3. Women like pinot noir. Yes, it's expensive, but is she not worth it? Try one from Russian River or Oregan or go wild with a Nuits St Georges or Chambolle from Burgundy. Speak like Louis Garrel and she'll have shivers down her spine.

4. The Spanish are arguably more passionate than the French or Italians. Lively whites from Verdejo, Godello and Albarino and intense reds from the Rioja and Ribera del Duero. You can get all emotional and wear a cape and tight trousers, but girls, avoid the moustache.

5. Look into your dates' eyes as you sip red wine. It will light your face with a rosy tint and make you even more attractive. Yates wrote "Wine enters through the mouth, Love (through) the eyes." Make sure you get it the right way round.

6. Spice up your relationship with a peppery little shiraz or grenache. Try wines from the untamed landscapes of the Southern Rhone and Languedoc. Think Wuthering Heights with grapes. Adding pepper to a glass of house red may not have the same effect.

7. If you're nervous and tongue-tied, splash out on some proper claret. You will feel like a Scottish Laird and talk like Sean Connery.

8. Sweeten the mood. Try dessert wine. Perhaps have it instead of dessert, if you're watching the waistline. Sauternes, Coteaux du Layon or great German Riesling will inspire all manner of affectionate language like honey and sweetie, but we suggest you avoid calling anyone pudding.

9. Beware the rugby club humour of buying wines with names that talk for you. "Flowers" and "Fairytale" are just cheesy. "Flirt", "Menage a Trois" and "Fourplay" (an Italian red) may leave you facing an empty seat.

10. Finally, however well it goes, bear in mind Rosalind's words in As You Like it. " I pray you do not fall in love with me, for I am falser than vows made in wine."

by Wine Owners

Posted on 2016-08-09

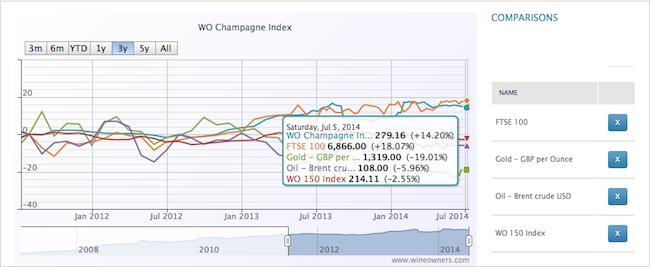

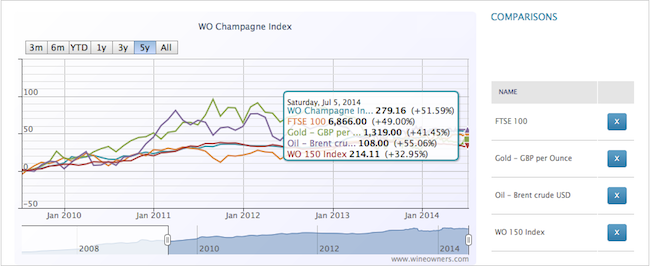

From an investment perspective champagne has delivered solid if unspectacular gains year on year, as the chart below shows. Since the start of 2011, the WO Champagne Index (pale blue line) has steadily moved up, displaying little of the volatility of the wine market at large, as represented by the WO 150 Index (purple). A 5 year increase of 55% is pretty impressive by anyone’s reckoning in this day and age.

Ask most champagne lovers to name the three most important champagne marques, and the vast majority would plump for Dom Perignon, Krug and Cristal – let’s call them the Three Musketeers. These are by far the most likely to be found in collections, and have international standing as the benchmark for top quality, premium fizz. My question is that if we assume most collectors will hold at least one, if not all three, of these in their cellars if they are champagne followers, which champagne is best placed to play the role of d’Artagnan to their Porthos, Aramis and Athos?

There are several pretenders to the throne. Bollinger RD, Perrier Jouet Belle Epoque, Pol Roger Winston Churchill, Armand de Brignac Ace of Spades – these and a host of others are a match for the quality and cachet of the Three Musketeers, but there is one name that I think stands out, and one whose financial performance and quality cannot easily be overlooked.

That wine is Salon ‘Cuvee S’ Le Mesnil. Despite its relative anonymity – there are many better known marques – this champagne is viewed as the apogee of champagne making by those in the know. Ruthlessly (almost self-defeatingly!) small production quantities and a quality control regime that makes North Korea look like a hippy commune have enabled Salon ‘Cuvee S’ to reach prices that are eye-wateringly expensive across the board. Despite this its prices have moved up more dramatically that most champagnes for vintages from the 1990s, and even more recent vintages from the 2000s have shown growth despite much higher release prices.

So, if you can find it at the right price, Salon ‘Cuvee S’ is perfectly placed to play the role of the Fourth Musketeer. All for one, and one for all…

by Wine Owners

Posted on 2016-03-22

OWNER

OWNER

Dom Perignon Champagne

APPELLATION

France

BLEND

Chardonnay, Pinot Noir

AVERAGE SCORE

95/100

REVIEW:

The 2002 Dom Perignon is at first intensely floral, with perfumed jasmine that dominates the bouquet. With time in the glass the wine gains richness as the flavors turn decidedly riper and almost tropical. Apricots, passion fruit and peaches emerge from this flashy, opulent Dom Perignon.

(Robert Parker, 2010)

by Wine Owners

Posted on 2015-02-16

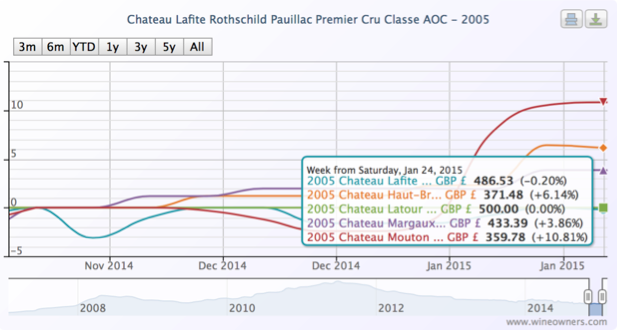

The turning point for fine Bordeaux was August of last year. By early October it was unclear whether the tick-up was yet another of those blips we’d seen several of during the previous 24 months.

Today it is clearer: the trend is up, most wines are well off their lows, and the Bordeaux Index overall is 2.17% up on 6 months ago.

The exception is the Libournais index covering Pomerol and St Emilion, which has slipped 0.48%, a reversing the gains of 1.24% between early October and the end of November last year.

The Medoc Classed Growths are collectively up 2.77% form their August 9th 2014 lows.

Whereas the First Growths only managed 1.51% during the same period. Not entirely surprising since top vintages are still highly priced, they have had further to fall, making it hard to call bottom, and started picking up momentum in January 2015. What is clearer is that wines such as Haut Brion 2008 appear to be interesting propositions.

Elsewhere the Blue Chip Burgundy Index continues to power ahead, though within that there are notable, and expensive, fallers (last 12 months):

| Domaine de la Romanee-Conti Le Montrachet Grand Cru AOC |

2010 |

-7.16 |

| Domaine Ponsot Charmes Chambertin Cuvee des Merles Grand Cru AOP |

2010 |

-7.69 |

| Domaine Armand Rousseau Mazis-Chambertin Grand Cru AOC |

2010 |

-7.89 |

| Domaine Jean Grivot Richebourg Grand Cru AOC |

2007 |

-9.43 |

| Domaine de la Romanee-Conti Romanee Saint Vivant Grand Cru AOC |

2010 |

-10.71 |

| Domaine Jean Grivot Echezeaux Grand Cru AOC |

2002 |

-11.2 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2006 |

-13.15 |

| Sylvain Cathiard Vosne Romanee En Orveaux Premier Cru AOC |

2010 |

-13.69 |

| Domaine Comte Georges de Vogue Chambolle Musigny Les Amoureuses Premier Cru AOC |

2002 |

-13.7 |

| Domaine de la Romanee-Conti La Tache Monopole Grand Cru AOC |

2010 |

-15.38 |

| Domaine Armand Rousseau Clos de la Roche Grand Cru AOC |

2010 |

-16.08 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2005 |

-16.18 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2006 |

-16.35 |

| Domaine Leflaive Chevalier-Montrachet Grand Cru AOC |

2005 |

-16.67 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2008 |

-20 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2006 |

-20.16 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2005 |

-21.94 |

Northern Italy is up 1.42%, with Giacomo Conterno one again heading the leaderboard

Champagne has defied our predictions in gaining a whopping 7.42% over the last 6 months, the top risers comprising exclusively older vintages in the range 1996-2002. This makes a lot of sense. Millions of bottles of top cuvees such as Dom Perignon (up to 8M bottles per annum) means that values kick up only when supply and demand becomes more balanced.

We also thought Californian wines would moderate their growth this year. Comparative to Bordeaux prices, they seem expensive. Since January they have indeed dipped -0.65%, off the back of six month growth of 6.65% up until that point. It’s too early to say whether they are simply pausing for breath, or have reached a natural plateau. The trend line favours the first scenario.

by Wine Owners

Posted on 2014-10-17

Treasure assets are uncorrelated. That’s part of the attraction to high net worth individuals (HNWIs) looking for suitable stores of value.

I use the phrase store of value purposefully. Wealth preservation and enjoyment of the fruits of success are arguably far more important to HNWIs than specific targeted annual returns.

Wine has appeared deeply uncorrelated since the financial crisis of 2008. The facts bear that out. Yet we mustn’t forget the power of externalities to distort underlying tendencies; such as insatiable demand from China up until mid-2011, or the flight from traditional financial instruments during periods of extreme market stress into all things tangible. It’s easy to forget that the wine market did suffer during previous economic recessions or shocks, whether the recession of the early 1990s or the Asian financial crisis of 1997.

Yes, of course we’re talking principally about Bordeaux, that behemoth of a region that produces unrivalled oodles of fine red wine. Paradoxically other regions of production may indeed be uncorrelated with Classed Growth Bordeaux as hot wine money searches for relative value, or where scarcity creates a rather different drumbeat.

With the current financial market turmoil; the sudden reawakening to the woes of Europe; the economic and political uncertainty of its recession-hit member states - what better moment to analyse the question of market correlation?

The wine market became quite excited by a small upturn that started in late July, continued during August and through much of September. A month on, and things aren’t quite so clear-cut, but in spite of plummeting stock markets, wine prices are not following suit.

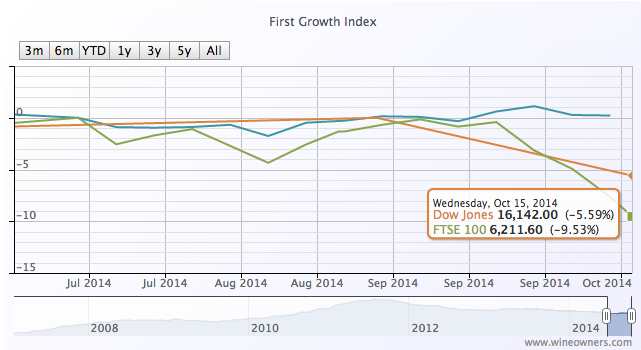

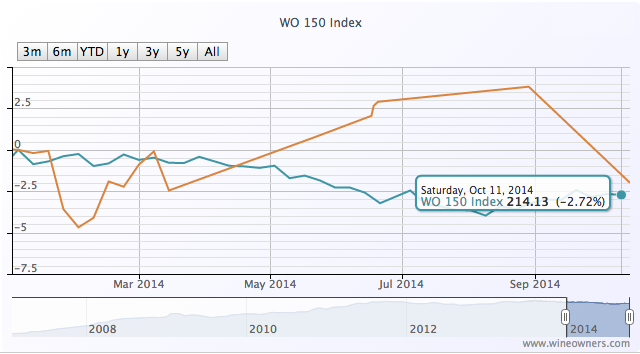

The First Growth Index is up by 1.2% over the last 3 months whilst the FTSE has dived almost 8% - that’s roughly the same amount of value destruction as the First Growths experienced over the previous 12 months. The Bordeaux Index has followed the same positive (if tentative) trajectory (comprising Medoc and Graves Classed Growths and the top Libournais benchmarks). So has Northern Italy, only a whisker off its all-time highs, along with blue chip Burgundy and the effervescent Champagne market.

After a disappointing year so far for the wine market overall (represented by the WO 150 Index), the previously run-away Dow is within single-digit, fingertip distance of fine wine’s -2.7% fall.

by Wine Owners

Posted on 2014-07-14

The performance of the Wine Owners Champagne Index has been nothing short of stellar - outperforming most other assets over the last 3, 5 and 7 years.

Over the last 12 months, however, the index has stagnated, registering a measly 0.5% growth.

Much was said of Champagne as an investment during the course of 2013. In sharp contrast to other fine wine regions, production quantities tend to be vast, but so is consumption. Analysing the performance of the Champagne market shows that appreciation is entirely driven by the very top vintages. With no stellar vintage such as 1996 or 2002 due for imminent release, we said in the first quarter of 2014 that the vintage Champagne market may drift over the next 1-2 years, though very top back-vintages may well benefit as supply dries up, and Champagne styles suited for long ageing such as Salon may continue to firm.

6 months on, this has indeed proved to be the case, with the top performers over the last 12 months to July 2014 being Jacques Selosse Blanc de Blancs Millésimé 1996 (+40%), Krug Clos de Mesnil Blac de Blancs 1996 (+28%) and Salon Cuveé ’S’ Le Mesmil Blanc de Blancs 1996 (+16.5%). This shows the value of relative scarcity, age and a top vintage - the perfect combination for future returns in a market otherwise dominated by exceptionally high volume production.

The poorest performers over 12 months have been Taittinger Contes de Champagne Blanc de Blancs 1996 (-9%) and 1998 (-28%), along with Dom Perignon 1998 (-11%).

by Wine Owners

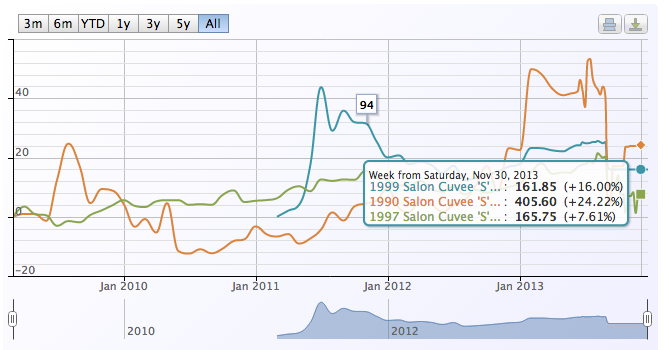

Posted on 2013-12-20

First commercially produced in 1921, and made in only 37 vintages since then, Salon is the archetypal ‘boutique’ champagne. The original 1 ha single vineyard plot is now supplemented by carefully selected grapes from other growers in Le Mesnil, taking the production up to around 500 cases per vintage. With supply low, and little available on the secondary market as a consequence, it’s best for collectors who want this wine to pick it up on or close to release, before prices start their inevitable rise.

- - -

“The Salon 1999 Brut Le Mesnil – disgorged already in 2011 and dosed with a pretty typical six grams of residual sugar – displays faintly fusil and quarry dust notes as well as hickory nut, almond, walnut and toasted wheat piquancy on the nose. Polished and subtly creamy in texture yet brightly juicy with apple and lemon, this displays an uncanny sense of lift and refinement, perfectly complementing the honeysuckle and heliotrope perfume that waft inner-mouth. You could lose yourself in the ineffability of this wine’s floral diversity and in its resonantly nut and grain low tones. Hints of apple pip lend subtle additional piquancy on a long and at once soothing as well as stimulating finish, with suggestions of oyster liquor becoming prominent as the bottle stands open for a few minutes, and serving to milk the salivary glands for all that they are worth. Follow this for at least a decade.”

95 points, David Schildknecht, Wine Advocate

- - -

1999 Salon is the latest release, with a market value of £1,942, which compares reasonably favourably with a market level of £3,042 for the 1996 vintage. Recent trades on the Wine Owners Exchange, which may also be useful for price discovery purposes, show a selling level of £2550.

The 1997 remains reasonable value where available, with a market level of £1,989 based on a European low. That said, the lowest current UK price for the 1997 is £2,040 and the best price for complete cases is around £2,200.

Prices for back vintages quickly become prohibitive: the 1995 sits at a market level of £3416 while the 1990 is being sold for £4,867, making it seem relative good sense to mop up the remaining 1997s and 1999s while the hunting is still good.