by Wine Owners

Posted on 2019-02-28

Following recent ’10 years on’ tastings, one held at Bordeaux Index whilst the ‘Southwold group’ met at Farr Vintners, there have been various write ups, reports and blogs appearing. Jane Anson’s write up in Decanter can be found here, Farr Vintner’s Chairman Stephen Browett’s blog here and the mighty Joss Fowler on Vinolent here.

The initial reaction from the time, which can so often can be over-hyped, has now been confirmed (which is nice) – this really is ‘a vintage of the century’! Most people view it alongside the famous 2005 vintage in terms of overall quality although the ’05 is regarded as a rather more grown up vintage with the ’09 being a more confident and flamboyant younger sibling. In due course and following years of maturation, they will both have to overcome 2010 and 2016 for the absolute title and neither of these two are going to be pushed over lightly. As well as being exceptional, 2009 was a consistent vintage and did well on the left and right although it has now showed a tad disappointingly in Sauternes, certainly when compared to earlier indications.

The following wines have been mentioned in more than one dispatch from respected commentators so have made it into this condensed list of really top picks, with market price scores (MPS) and relative value scores (RVS) to follow:

St. Emilion: Ausone, Canon, Cheval Blanc and Pavie

Pomerol: Le Pin, Petrus, Le Gay

Pessac-Leognan: Haut Brion, La Mission Haut Brion, Fieuzal, Smith Haut Lafitte and Pape Clement

Margaux: Margaux, Palmer, Rauzan Segla (and 2nd wine Segla), Issan

St. Julien: Ducru Beaucaillou, Leoville Poyferré, St. Pierre (big surprise)

Pauillac: Latour (strong claims for WotV), Lafite, Mouton, Grand Puy Lacoste, The Pichons and Pontet Canet

St. Estephe: Montrose, Lafon Rochet, Les Ormes de Pez

Medoc: Cantemerle, Bernadotte

Broken into comparable peer groups, starting with the stratospheric right bank set:

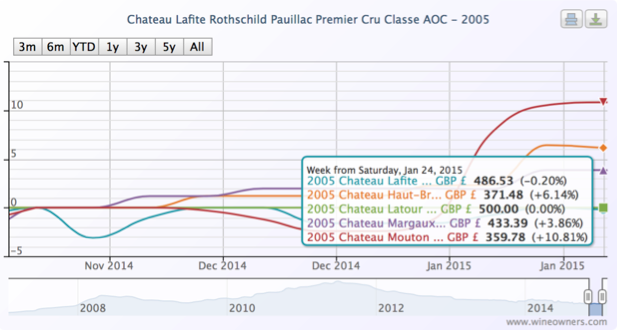

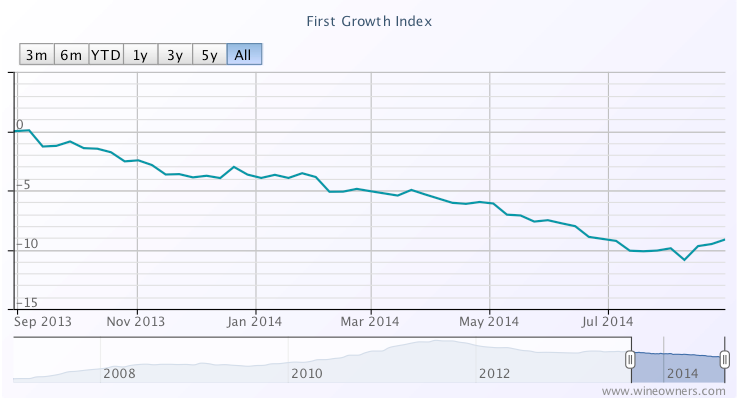

The first growths are still below their release prices and continue to underperform both the WO150 index (not surprisingly, given Burgundy’s ascent) and the WO Bordeaux Index. They will outperform at some stage, but we don’t think it is yet judging by the supply side of the equation.

Generally speaking, a relative value score (RVS) in double figures for a first growth signals a buy, so nothing doing here.

And now on to the arguably more interesting second liners. It is interesting to note that they have not suffered from the over-priced releases (compounded by some crazy speculation shortly after) in the same way as the first growths and have performed much better in the secondary market as a result, many generating decent returns.

A lot of these wines have pleased the critics and are punching way above their £££ weight. Look how the relative value scores reach double figures and soar. A score of over 20 for this group should cause a loud bark of approval.

And now on to the real cheapies, which will make for exceptionally lovely wines at really attractive prices, mainly for the drinker but with some likely upside on the prices of the posher names to be enjoyed too!

A special mention should go to Grand Puy Lacoste (RVS 37.6), a Grand Vin from grand appellation (Pauillac) from a lovely branch of grand Bordeaux family. The wine came in first equal with Pichon Baron (21.3) and not that far behind Latour (4.3)! it even looks cheap in this ‘lowly group’ here!

We have covered the ‘marmite’ wine that is Cos d’Estournel ’09 here and have come down on the side of the  .

.

You can argue the case to buy any of the wines listed in this post, given the quality of the vintage, but here is the Strong Buy list:

For drinkers:

Alter Ego

Bernadotte

Cantermerle

Croix de Beaucaillou

Fieuzal

St. Pierre

Segla

For drinkers and investors alike:

Canon

Grand Puy Lacoste

Rauzan Segla

Pichon Baron

Pichon Lalande

Pontet Canet

And if money is no object:

Ausone, Cheval Blanc, Le Pin and Petrus

Latour, Haut Brion and Margaux

by Wine Owners

Posted on 2017-05-15

The release of 2016 of £775 (12x75cl) is a substantial jump up on the simply marvellous 2015. The previous (in our view better) vintage released at £615 (12x75cl).

So we are looking at a 21% increase YoY. Meanwhile the gap between the two vintages has since closed, with the best offer price of Pape Clément 2015 now trading at £720 (12x75cl).

Not only was 2015 a sound buy for those who jumped in this time last year, it remains an attractive hold, since the release price of 2016 and a rumoured reduction in release quantities attributed to the April 2017 frosts, will lend its price support and push it up to £800+ (2x75cl).

For whom do the frosts toll? Us, the consumer, wine lover, collector…those who buy. The reduction in production volumes now likely for 2017 are difficult for producers, especially in those areas most severely affected, parts of Pessac included. By far the worst affected were those in the lesser appellations on the right bank, St Emilion and Pomerol off the plateaux, and inland in the Medoc. For many of those producers the frosts really were a catastrophe.

As we described here the great estates alongside the Gironde were the least touched by the frost due to the warming effects of the river; those parts of their vineyards affected were on the whole those producing grapes destined for their second wines.

We need to bear in mind too that 2016 production volumes are up 10%-20%, in many instances offsetting the potential losses (subject to a faint possibility of second budding) relating to 2017.

So as consumers, we should sympathise and feel bad for estates such as Pape Clément for their loss of production. We should feel even sadder for producers’ losses in places like Fronsac, Lalande de Pomerol and Castillon, where there will be economic casualties. But it doesn’t mean we will consequently want to buy much more expensive wine.

by Wine Owners

Posted on 2016-04-07

Back from Bordeaux and having tasted widely across all the

major communes, for a good proportion of the wines at least twice, we can

report that 2015 will be a very good to excellent overall vintage.

The wines have nice density accompanied by varying degrees

of power. But it’s best to avoid sweeping generalisations in this vintage, as

this overview explains. Read on...

Those who say the heights were achieved on the right bank

are overlooking a number of exceptional wines from across many other appellations. St. Emilion has been proposed as the top-performing commune

of the vintage, but there are plenty of examples that are too big and powerful.

Those Chateaux really do need to wake up to the changing market that is

thankfully favouring balance once more.

Pomerol has seen some great successes, yet different styles

of vinification between producers have resulted in wines with very different

characters. On the one hand are those that are pure with a brightly illuminated

core of fruit, ripe elegant tannins and a taut finale. On the other are styles

that are evidently riper, with imperceptible tannins and an extremely smooth,

even edgeless, finish. Whilst these are extremely attractive and very easy to drink after just a few months in cask we wonder if they will stay the

long-term course and evolve into compelling wines worthy of their glossy and alluring first

showing.

Many state that the higher up the Medoc peninsular you go,

the less good are the wines due to higher mid-season rainfall than the right

bank, Margaux and Pessac-Leognan. That isn’t necessarily evident, perhaps with

the exception of Haut Médoc and Listrac.

Much-touted Margaux is indeed extremely consistent across

the board, to a degree we’ve not seen for many years. Yet in our view the most

impressive individual wines from the Medoc come from Pauillac and St. Julien,

perhaps with the exception of Chateaux Margaux itself and the broodingly structured Chateau Palmer.

St. Julien is a very consistent appellation once again.

Graves (Pessac Leognan) is excellent, and some historically big styled wines

have reined it in with exceptional results,making for a very impressive showing for the appellation overall.

Soil composition would appear to have as much to do with

variation between properties as levels of rainfall. It’s possible that this

variable will have been accentuated by a scorching July when drought conditions

had set in, with the vines showing heat stress by starting to drop leaves.

Relief came in early August with some heavy downpours and temperate August weather

accompanied by comparatively high hours of sunshine.

The dry, hot July conditions were compared to 2003. Yet

unlike that vintage when night time temperatures were steamy, 2015 experienced

cooler hours of darkness, and many of the wines do have a pleasant acidity in

the mid palate, whilst the best have a crystalline fruit quality and are salivant - mouth-watering.

Notwithstanding the very high July temperatures, picking

took place from around the middle of September through to October 7th,

with lovely late-season weather giving the fruit plenty of hang time to fully

ripen, and producers were able to pick selectively at their leisure ahead of

the forecasted rains at the start of the second week in October.

It’s been said Merlot is the standout grape of the vintage

and the best since 2010. That’s true of

the right bank overall, but not in the Medoc, where the best wines contain

85%-92% Cabernet Sauvignon.

Also, some of the greatest expressions of the vintage are

wines that contain significant proportions of Cabernet Franc in their blends.

Vieux Chateau Certan, Cheval Blanc, Figeac and Carmes Haut Brion are all gorgeous

benchmarks.

Finally the big question: is 2015 in the same league as

2009/ 2010? Or perhaps 2005, a vintage which in our opinion may well prove the

equal of 2010.It doesn’t look

like it at this stage, and many Negociants

and producers we spoke to didn’t look to equate 2015 with the monumental 2010s.

This is undoubtedly an excellent vintage. We do not think it is a legendary one.

What’s next?

We'll be sharing our tasting notes of the vintage over the

next few days.

You’ll be able to view a number of videos we shot of

producer, Negociant and merchant opinion of the vintage and their favourite

wines.

We’ll review our recommendations and wines we cautioned

against buying early from the 2014 vintage release based on the best wines of

the vintage, which we subjected to a rigorous price per points analysis. You’ll

be able to judge for yourself how well our ‘buys’ and ‘do not buy early’ guidance has performed in the last year - notwithstanding they are still pre-arrivals.

As prices of Bordeaux 2015s release (which we are told will be a long and drawn out affair this year) we shall publish our

price per points analysis, highlighting the buys of the vintage; pinpointing

comparable back vintages that look like good value against a range of other

vintages; and highlighting the wines that are too highly priced at first

release to warrant buying early.

by Wine Owners

Posted on 2015-07-24

Could 2008 be the one to go for in the secondary market if you’re in the market for Petrus?

Considered the most concentrated wine of the vintage by Parker, cropped at low yields (for Bordeaux) and a vast, future drinking window. You’ll be paying a small premium over the 2014 release, whilst market prices may have suffered a little due to very slight critic downgrades 3-4 years ago (when the wine is likely to have been at its most closed and ungiving). At £14,500 its market that will one day appreciate it in glass will be necessarily limited to the world’s multi-millionaires and above; but it’s the cheapest it’s been since just after release and only a smidgen above its 2009 mid-year market price.

Time to top slice your Apple or Google profits and buy a case?

by Wine Owners

Posted on 2015-03-03

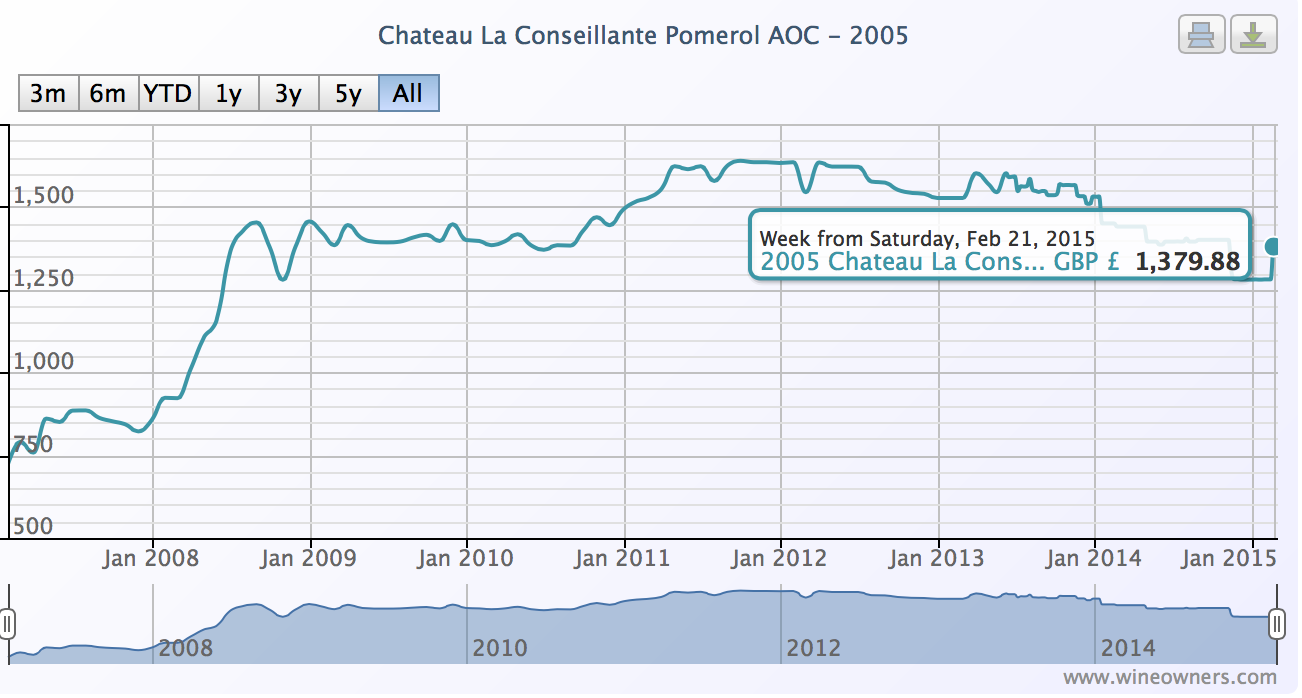

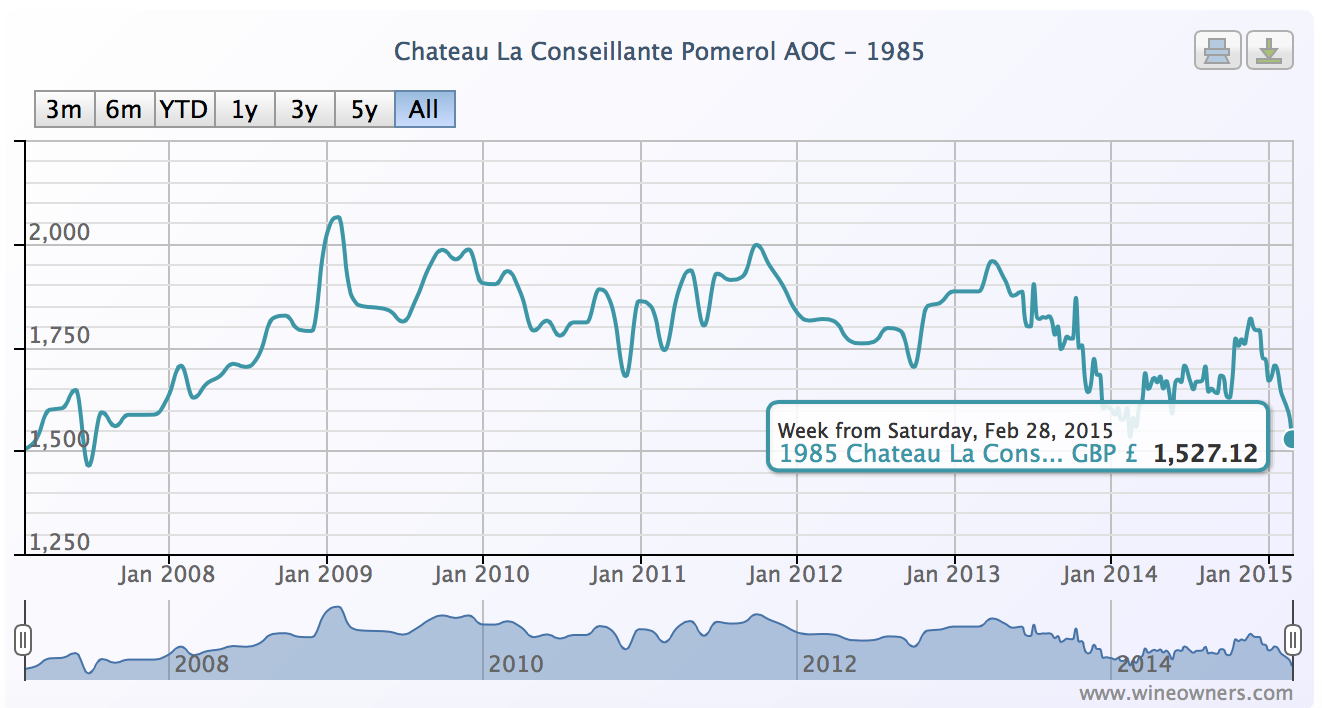

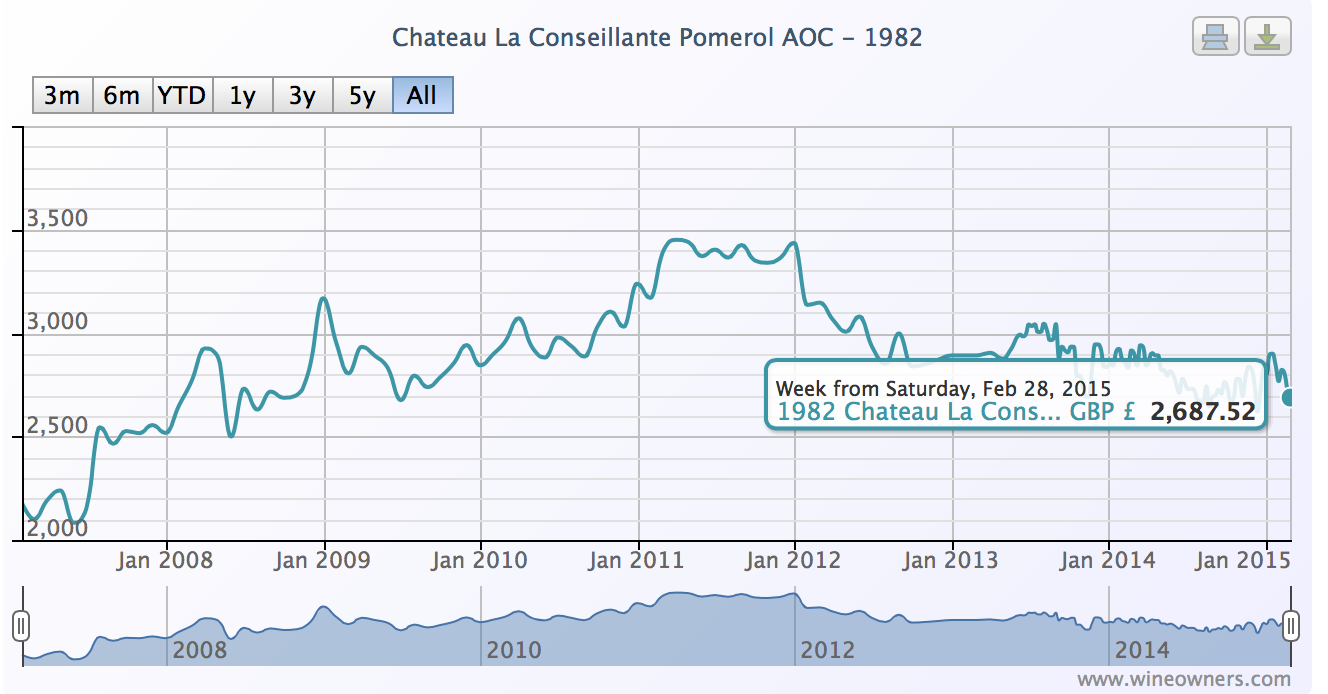

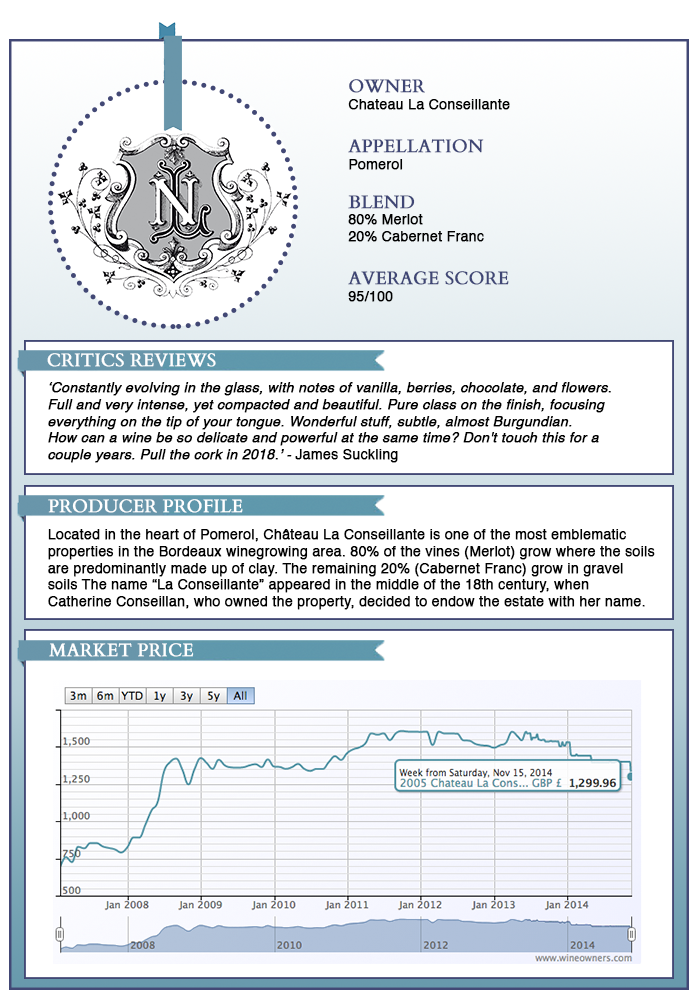

As if to make Jean-Michel Laporte, estate manager of Chateau La Conseillante, feel at home, the walls of auction room G2 at Bonhams on New Bond Street are covered in deep purple fabric. Not only were those walls a perfect match for the violette which so strikingly makes La Conseillante's capsules instantly recognisable, but also recalled Jean-Michel's city of origin, Toulouse, which made it's medieval fortune on the back of the highly prized dye it extracted from violets. Life has a certain symmetry to it, just like the wines of La Conseillante.

Jean-Michel comes across as proud though modest - "we just make wine" - eschews recent trends for biodynamics in a humid, Atlantic weather system, yet recognises that there are some things that past generations practised which have significance today, such as following the lunar cycles.

The tasting kicked off with the great duo of 2010 and 2009; the 2011 that was to have been served being misdirected en route to the auction room. Champagne in hand to slate our thirst, this hardly seemed like a great loss, yet by the end of the tasting presumptions of greater and lesser vintages had been challenged. 2010

Licorice and floral notes on the nose, with hints of pepper. Poised fruit, of a vivid, floral character washes over the palate, at once grippy and sweet. Impeccable balance, somehow belying it's 14.5 degrees of alcohol with a remarkable finesse and purity. This really is great wine for the very long term. 2009 Darker fruited nose announcing a warmer style. A deep well of fruit, in the cassis and blackberry spectrum. A powerful entry and confit fruited mid-palate. The heat of the year lends it a modern dimension.

2008 Explosive nose of macerated fruit, aromatic and playful. On the palate, elegant and cool, grippy. Balanced, symmetrical wine with substance to the cleansing fruit, salivant then hints of earthiness on the finish. Classically dry at the end.

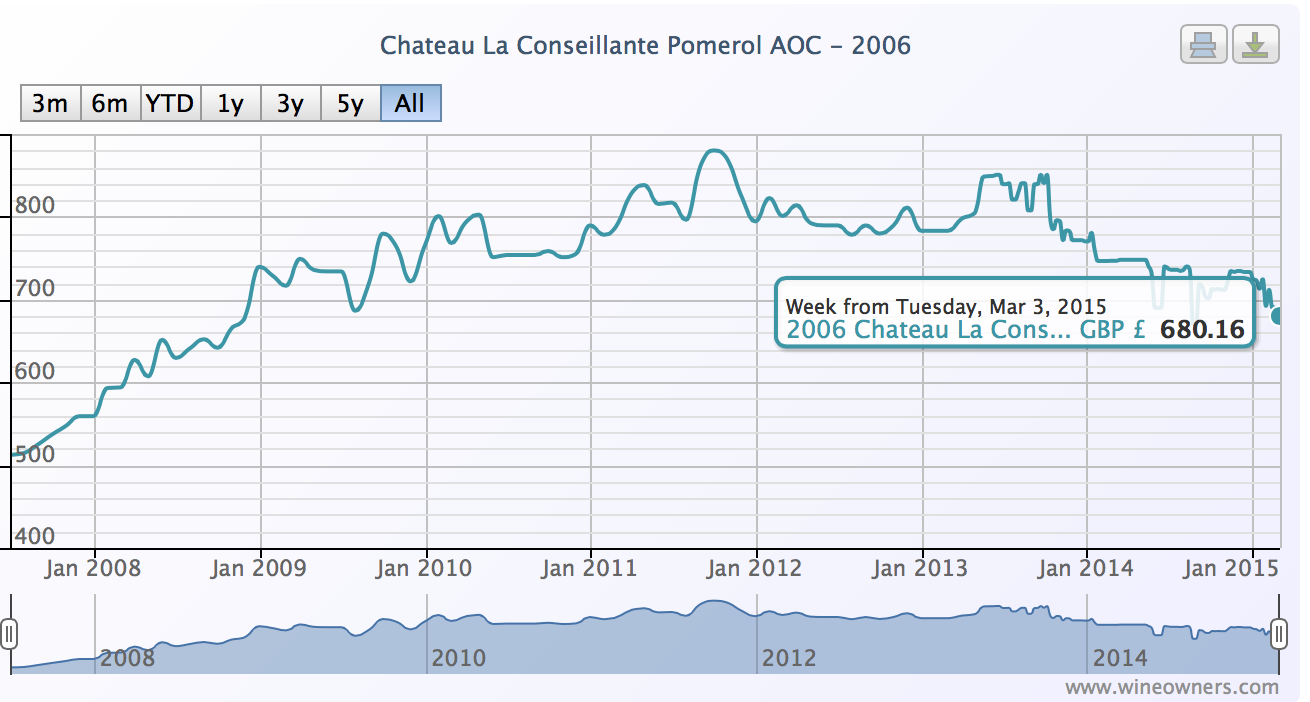

2006 Refined, liquory nose with dusting of pepper. Textural wine, with a meaty, gamey mid palate and iodine notes. 30 minutes later, a revelation, with purer fruit, sappy and intense with great tension and length. Wow. Exciting already, but some way short of early maturity.

2005 Finely chiselled nose, cool, peppery. The palate shows a velvety smooth entry, aromatic and gamey flavours, with super intensity of grainy fruit. Mouthwatering and lifted mid palate, very progressive, and a very, very long finish.

2001 Earthy nose, aromatic fruit and a touch of pepper. More evolved, with iodine on the mid palate ahead of intense lifted fruit. Firm and decidedly mineral. 2000 Elegant, sweet nose rather like a maturing Barolo or Cote de Nuits Cru. Followed by a red-fruited, warm Burgundian palate. Very pretty, a predictably ripe and satisfying mid-palate, leading to a sappy insistent finish.

1985 Perfumed nose of sandalwood. Soft-fruited and scented wood notes on the palate, truffled, autumnal and with a subtle smoked character. Utterly alluring and delicious.

1982 Deeper perfumed nose and camphor. A similarly velvety, coating sensation of fruit like the 2005, then gamey notes, tobacco notes and a more pronounced smokiness. Crystalline finish, again sappy and very, very persistent.

by Wine Owners

Posted on 2015-03-01

Today's excellent Matter of Taste event at the Saatchi gallery put on by the Robert Parker organisation highlighted to me that wines from so-called vintages overshadowed by great vintages may give far superior early to medium term pleasure than those more illustrious, fêted siblings.

Thinking back a year or so to previous tastings, Pontet Canet comes to mind. Take your pick from 2002, 2004 or 2006 for wines which today deliver great visceral pleasure (although the latter vintages are youthful) - whether you favour asian-spiced, sweetly grained and plump or delineated and pure fruit the choice (and preference) is yours. The dual powerhouses of 2009 and 2010 are incredibly dense wines, but today seem brutalistic and impregnable. Impressive as hell, they remain ébauches that Time, the master craftsman, is yet to shape.

A wonderful Masterclass led by Neal Martin and Alexandre Thienpont, winemaker and proprietor of Vieux Chateau Certan, further illustrated the point.

The surprise of the tasting was Vieux Chateau Certan 2006, which preceded the 2005.

A composed, peppery and dark-scented nose announced a medium weight, finely-woven, textured wine. Beautifully integrated, showing a firm core coated with a fine, sweet gloss, and a medium-long, insistent finish.

A delight to drink now, whilst giving the warmer, controlled, classically sauvage (iodine/ meaty) character of the 2005 another 5-10 years to achieve its unquestionable potential. In contrast the 2006 has an elegance and purity all of its own, and at a 20% discount to the 2005.

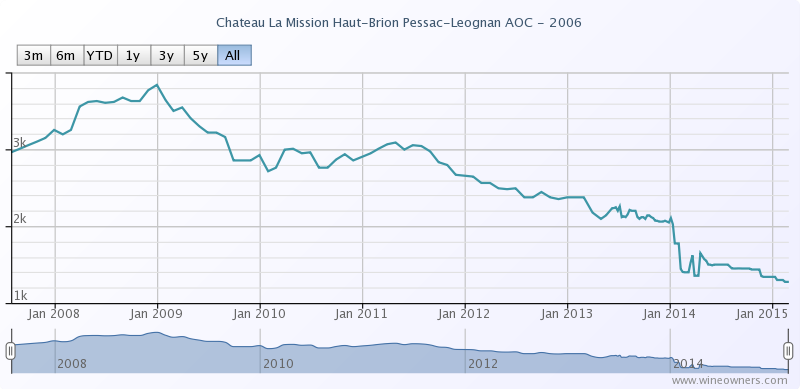

It's worth looking out for 'VCC' 2006 on the back of this showing. It's equally tempting to seek out more 2006s more generally, a vintage that had garnered some good reviews at first release, but which suffered in comparison to the more successful 2005 vintage across the Bordeaux region and due to release prices that were far too close to those of the previous year. Now almost a decade on, the fine, compelling character of the year is clear, and the pricing looks very fair.

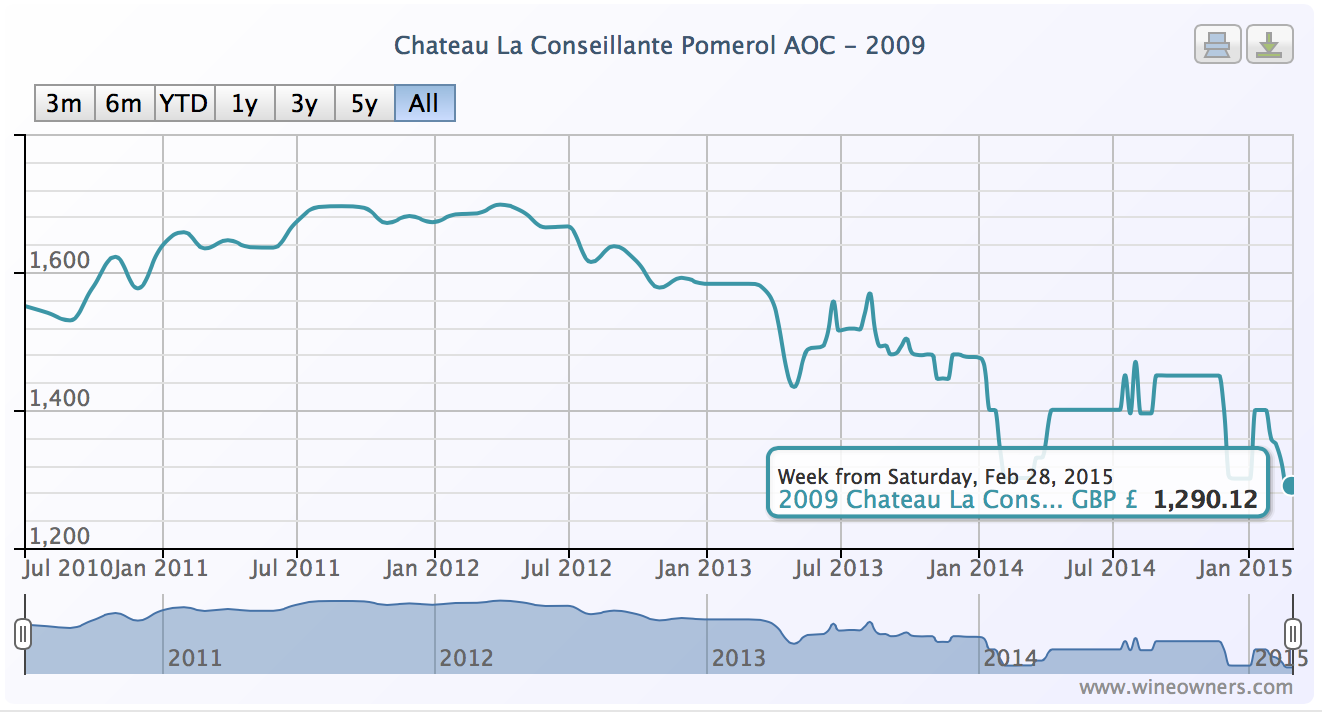

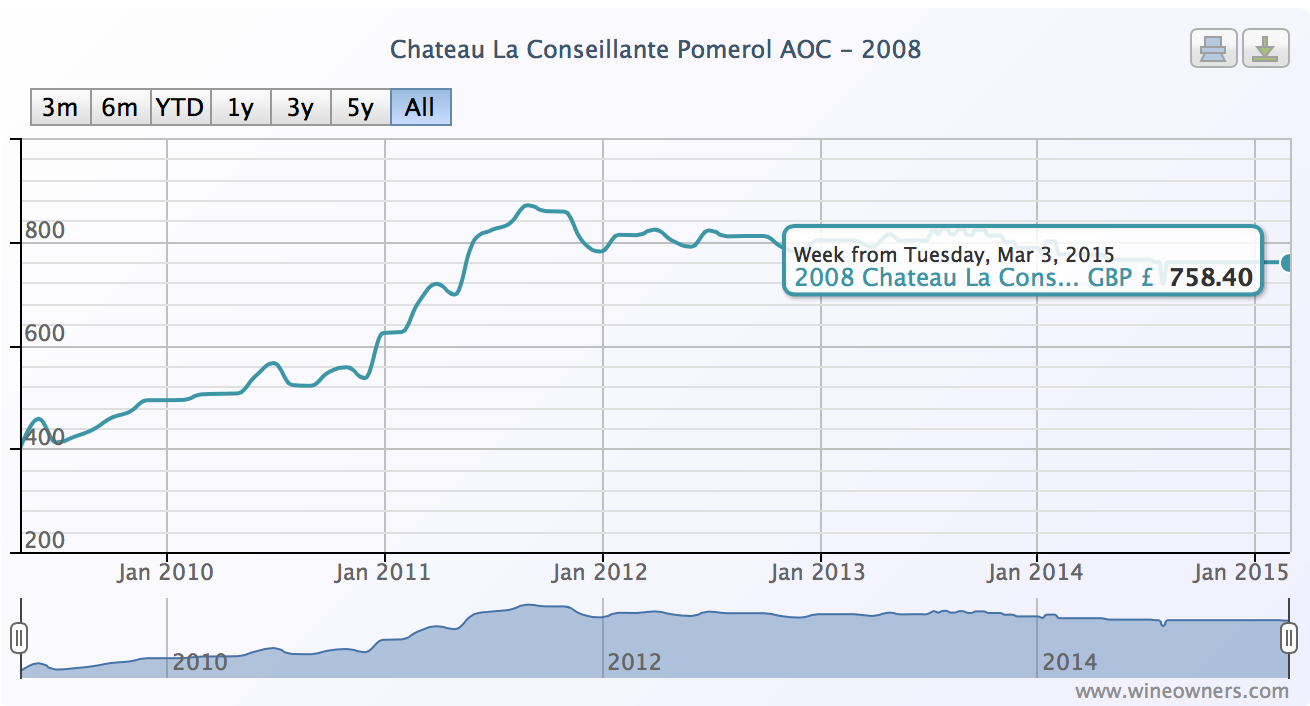

Martin highlighted that Pomerol and St Emilion had enjoyed a particularly successful vintage in 2006. With that in mind, you may wish to check out the fine wine exchange for the following:

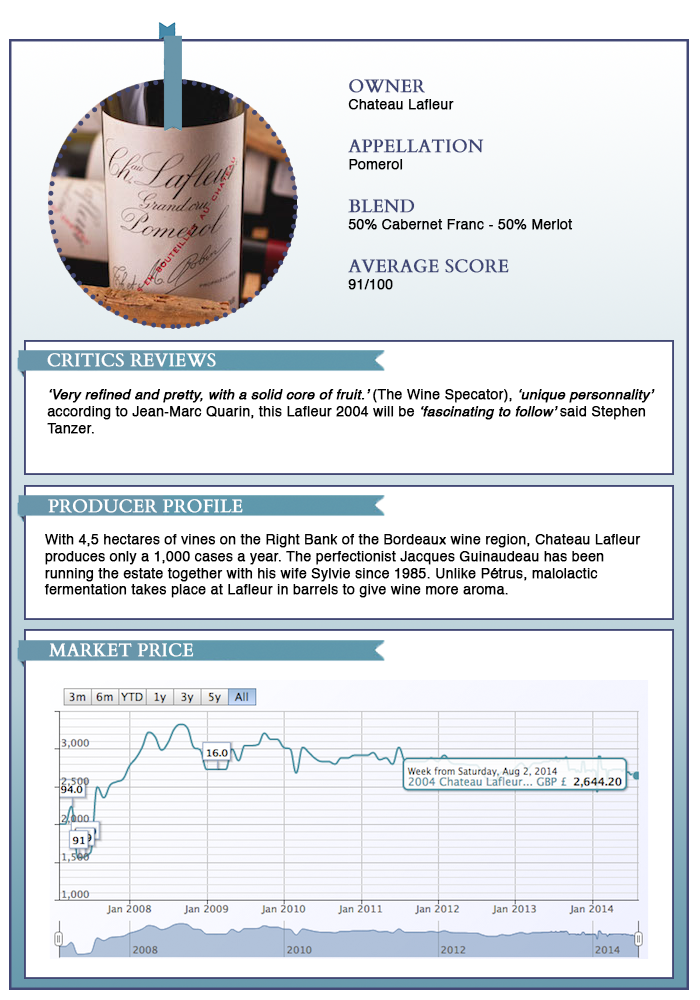

Lafleur Petrus

La Conseillante

Hosanna

Ausone

Marzelle

The wine of the 2006 vintage, Robert Parker and Jancis Robinson both proposed (in a rare show of unanimity), was Mission Haut Brion. Surely the price will never be as realistic as it is today, at around £1,250-1,350? (55%+ down from it's idiotic opening price that proved to be damaging to its secondary market performance). At least now this great wine is within reach of more wine lovers.

Mission Haut Brion

A somewhat under-the-radar La Mission, the 2006 was generally overlooked following the brilliance of the 2005. A young, dense purple-hued wine that is developing beautifully, it exhibits notes of Asian plum sauce, charcoal, barbecue smoke, roasted meats, graphite and background oak. Full-bodied with good acidity, moderate tannin and a vigorous, powerful youthfulness, the 2006 will age more quickly than the 2005, but it still requires another 5-8 years of cellaring. Anticipated Maturity: 2014-2035. (RP 2012)

Nick Martin

by Wine Owners

Posted on 2015-02-16

The turning point for fine Bordeaux was August of last year. By early October it was unclear whether the tick-up was yet another of those blips we’d seen several of during the previous 24 months.

Today it is clearer: the trend is up, most wines are well off their lows, and the Bordeaux Index overall is 2.17% up on 6 months ago.

The exception is the Libournais index covering Pomerol and St Emilion, which has slipped 0.48%, a reversing the gains of 1.24% between early October and the end of November last year.

The Medoc Classed Growths are collectively up 2.77% form their August 9th 2014 lows.

Whereas the First Growths only managed 1.51% during the same period. Not entirely surprising since top vintages are still highly priced, they have had further to fall, making it hard to call bottom, and started picking up momentum in January 2015. What is clearer is that wines such as Haut Brion 2008 appear to be interesting propositions.

Elsewhere the Blue Chip Burgundy Index continues to power ahead, though within that there are notable, and expensive, fallers (last 12 months):

| Domaine de la Romanee-Conti Le Montrachet Grand Cru AOC |

2010 |

-7.16 |

| Domaine Ponsot Charmes Chambertin Cuvee des Merles Grand Cru AOP |

2010 |

-7.69 |

| Domaine Armand Rousseau Mazis-Chambertin Grand Cru AOC |

2010 |

-7.89 |

| Domaine Jean Grivot Richebourg Grand Cru AOC |

2007 |

-9.43 |

| Domaine de la Romanee-Conti Romanee Saint Vivant Grand Cru AOC |

2010 |

-10.71 |

| Domaine Jean Grivot Echezeaux Grand Cru AOC |

2002 |

-11.2 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2006 |

-13.15 |

| Sylvain Cathiard Vosne Romanee En Orveaux Premier Cru AOC |

2010 |

-13.69 |

| Domaine Comte Georges de Vogue Chambolle Musigny Les Amoureuses Premier Cru AOC |

2002 |

-13.7 |

| Domaine de la Romanee-Conti La Tache Monopole Grand Cru AOC |

2010 |

-15.38 |

| Domaine Armand Rousseau Clos de la Roche Grand Cru AOC |

2010 |

-16.08 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2005 |

-16.18 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2006 |

-16.35 |

| Domaine Leflaive Chevalier-Montrachet Grand Cru AOC |

2005 |

-16.67 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2008 |

-20 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2006 |

-20.16 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2005 |

-21.94 |

Northern Italy is up 1.42%, with Giacomo Conterno one again heading the leaderboard

Champagne has defied our predictions in gaining a whopping 7.42% over the last 6 months, the top risers comprising exclusively older vintages in the range 1996-2002. This makes a lot of sense. Millions of bottles of top cuvees such as Dom Perignon (up to 8M bottles per annum) means that values kick up only when supply and demand becomes more balanced.

We also thought Californian wines would moderate their growth this year. Comparative to Bordeaux prices, they seem expensive. Since January they have indeed dipped -0.65%, off the back of six month growth of 6.65% up until that point. It’s too early to say whether they are simply pausing for breath, or have reached a natural plateau. The trend line favours the first scenario.

by Wine Owners

Posted on 2014-11-19

by Wine Owners

Posted on 2014-09-12

With market sentiment for fine red Bordeaux brightening, we ask, what do the latest market numbers actually suggest?

Let's start with the market as a whole.

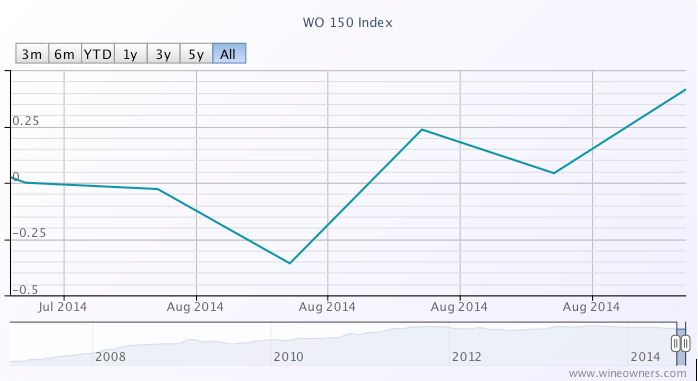

The Wine Owners 150 (WO 150) comprises investment grade wines across the top 40 performers of the last 20 years from all key regions of production. This index rose 0.4% in the last month compared with a fall of -4.45% over the course of the last 12 months. Of the most recent bottom 40 fallers, all were red Bordeaux. More positively there were 22 Bordeaux in the top 40 gainers.

1 month

1 year

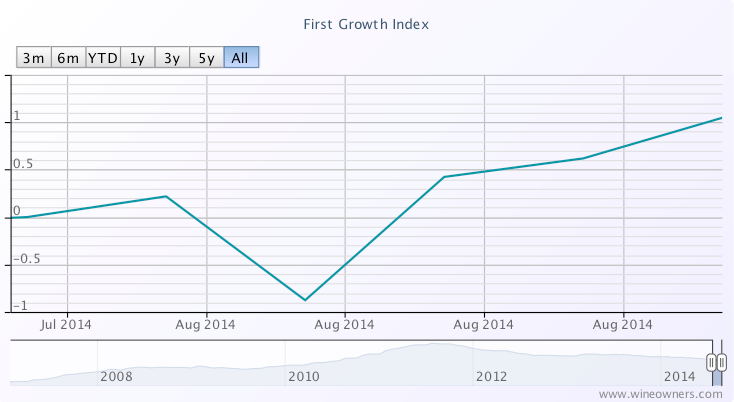

The First Growths Index rose 0.98% over the last month, and is now down -9.14% over the last 12 months, off its early August lows of -10.87%

Haut Brion appears to be leading the charge, 1989 and 2006 showing strong double digit growth, with Mouton (1986, 1989, 1996, 1998 and 2010) showing 5%-8.5% growth along with Haut Brion 2003, Margaux 1986 and Lafite 1990. The predominance of older, scarcer vintages among the top movers is notable. Older vintages can show some of the sharpest short-term moves given there is much less of them in the market, so market movements in 25 year old vintages are not convincing bellwethers.

1 month

1 year

The Medoc classed growth index rose 0.23% over the month and was up 0.72% from its August lows, and is now down -4.8% over the last 12 months.

Palmer saw double digit growth in respect of vintages 2009 and 1998, along with Pontet Canet 1996, Leoville Barton 2006 and Gruaud Larose 2005. Risers however were largely offset by fallers across a broad range of vintages including 1996, 2000, 2005, 2006 and 2009. Although there is increasingly positive support for hard-hit wines from vintages such as 2005, the data does not yet substantiate an upturn.

1 month

1 year

The right bank also saw a rise comparable with the First Growths, with the Libournais Index up 1.09% over the last month, and up 2.5% from its August lows. It is now down just -0.98% over the course of the last year.

Top movers include Petrus 2010, Beausejour Duffau (1998 and 2010), VCC (2001 and 2010), Tertre Roteboeuf (2005, 2009, 2010), Belair [Monange] (2000, 2010), Latour a Pomerol 2005 and Pavie Macquin 2005.

1 Month

1 year

Green shoots?

It’s noticeable that merchants have been talking about restocking since July which can only be positive, but there are opposing views on where the latest data may lead the market.

With the exception of a 0.94 rise in the First Growths Index in December 2013, price declines have been inexorable since then – until now. The trade is split however on how much further First Growths have to fall, especially amongst the previously most inflated wines. With the First Growths down -27% since the peak in July 2011, a small rise of 0.98% may be positive but the inevitable continuing focus on value on the part of buyers favours the possibility of as many - or more - fallers vs risers over the remainder of 2014.

The Medoc classed growths saw a 0.7% uptick in March 2014 in addition to a rise last December in line with the First Growths. Taking all the data into account, it’s hard on that basis to read anything into the recent comparable bounce back from August lows.

The Libournais Index has performed the strongest over the last year with a 2.3% rise between mid January and mid February 2014, comparable with the performance over the last month after a summer of declines. Relative scarcity and a positive 3-year performance (+8%) suggest that the conditions for a broader based recovery are more firmly established for right bank fine wines.

Perhaps of significance, the 22 Bordeaux constituents showing price growth in the WO 150 index since the end of July compares with just 10 Bordeaux wines that have traded in positive territory on a 12 month view.

by Wine Owners

Posted on 2014-07-14