by Wine Owners

Posted on 2019-03-25

The basic premise for investing in fine wine is a very simple one; you buy a truly great wine that is produced in a finite quantity and store it, carefully. So, whilst others are enjoying/drinking theirs, thereby reducing the supply of that wine, you enjoy the price appreciation that naturally results from the increased rarity value. The growth in global wealth and newly discovered riches help fuel the desire for these wines for added benefit. For example, Chateau Latour 1982 was released in 1983 at c. £400 per case of 12 bottles. That case could today be sold for £16,000, implying an annual growth rate of a little over 12% per annum over the course of its life (and it will continue to be enjoyable for another 50+ years).

So, it is easy then?

First a bit of background.

The investment market is dominated by the red wines of Bordeaux where production levels of top-quality wine far exceeds any other area of note. Other areas which spark interest include the finest wines of Burgundy, Champagne, Tuscany and Piedmont and to a lesser extent some of the trophy wines from the new world.

For decades, centuries even, ‘gentlemen’ have been investing in wine, maybe unintentionally, but certainly filling their cellars with good Bordeaux and Burgundy, Port and Madeira and the like. Auction houses commenced wine sales in England in the middle of the last century and now there are all manner of brokers, merchants, exchanges and on-line auctions in existence. The internet has lent transparency to what was an opaque market, brought an endless flow of information and with it various offerings from a wide range of ‘investment specialists’. Investing in wine has become a more commonplace activity. Very few of these specialists, however, are authorised by the FCA or an equivalent and, thanks to the great bull market of 2005-2011 a proliferation of new companies designed to take advantage of this phenomenon were formed.

Like all markets the wine market continues to evolve although the last decade has proved to be probably the most turbulent period in its history. Previously, wine price performance was generally very steady with long term returns going back to the seventies averaging just over double figures. Once a decade or so, a global crisis would cause a healthy reality check (the oil crisis of ’73, the stock market crash of ’87, the Asian currency crisis of ’97 and the Lehman debacle of ’08, although the latter turned out to be very short lived) and then things would revert to normal.

The great bull run that begun in 2005 was created by exceedingly high and new demand emanating from mainland China. The fast expanding Chinese economy created easy money that flowed through the hands of the relatively experienced Hong Kong based merchants all the way to London, the global centre of secondary market wine trading (the primary markets being located at the point of production). Prices were pushed higher and higher, no one wanted to sell as the value kept on going up, until one day it all stopped.

What had not been appreciated at the time, by either the market or its participants was that this money was not just coming from the newly wealthy and aspirational individual but mainly from officials and employees of state owned enterprises.

Their ostentatious extravagance was legendary – lavish dining in top class restaurants and hotels accompanied by lashings of fine first growth wines, the corporate gifting of wine that oiled the wheels of business and the need to be seen only drinking the very best.

The government had lost control – and that was not going to wash with the incoming new President, Xi Jinping. In mid-2011 all luxury items and their markets were knocked back as the new environment of anti-graft measures were introduced and these measures remain firmly in place today. Having risen c. 260% from ’05 to mid-2011, the Liv-ex 100 index, the leading market indicator, then fell by 36% between mid-2011 and mid-2014. Since then the market has stabilised and in recent weeks has started to appreciate once again. The natural order is returning, and the madness of this extraordinary period has receded, the river of cash from China has dried up and a lot of the new, often dubious, players have been washed up on that river’s banks.

Another major factor that came into play during this period of flux was the stratospheric pricing of two Bordeaux vintages of outstanding quality, 2009 and 2010. Not wishing to miss the party the Bordelais lost their heads; 2009 sold but the market just couldn’t stomach the prices from 2010. Subsequent vintages were not reduced to commercial levels and have also failed to sell.

Some readers will be familiar with en primeur, meaning the first release, which is the first opportunity to purchase wine from the new vintage. In the good old days this was the opportunity to get in on the ground floor and the majority of investors and consumers benefitted. That game is long gone and arguably the market has split between the recent vintages where the release price still influences and the older vintages where the secondary market controls pricing. The market for older wines is, in any case, more compelling as pricing is more logical, there is greater assurance of quality and the dwindling of supply has begun.

Opportunities abound, especially now we are ‘ex-China’. Pricing has never been more competitive and the information available have never been so sophisticated. So, yes, it is easy – if you know what you are doing!

Miles Davis, February 2015

by Wine Owners

Posted on 2017-05-24

With the 2015 Burgundies arriving in the market these days and with more to come over the next period the market is showing mixed signals - some of continued excessive demand and some spell disaster for lesser producers trying to claim high prices.

The prices of the 2015 vintage

The price development for the 2015s shows a rather mixed picture at the primary level - some producers have showed great restraint and have in some cases kept the prices at 2014 level, whereas moderate increases have been seen even amongst the top producers in very high demand.

A lot of Burgundy producers are aware of the dangers of high prices even on village level, as these wines are now becoming very expensive in restaurants. If they want to maintain a good representation in restaurants the prices for a village level wine are near the limit - aside from the producers in extremely high demand.

Other producers seem not very aware of these dangers and have increased the 2015 prices by more than 20% - and while this may be viable in the very short run - I have talked to several wine bars and restaurants that have cut allocations already, and many will do so after the 2015 vintage. This will perhaps not have a huge effect on the 2016 vintage as the quantities are very small in some cases .. but in the long run some producers have priced themselves out of the market so to speak.

The 2016 vintage - what to expect

I have tasted some 2016s already and there are plenty of reasons to be optimistic, as quality looks very fine indeed. The wines are cooler than the 2015s, and in that way more classic. It's still too early to be very firm on the quality - but potentially a quite outstanding vintage - very well balanced and enjoyable for both the reds and the whites.

The quantities are very low due to the April frost, but also very uneven across the producers and appellations. My expectation would be that the low quantity will ensure a continued upward pressure on prices for the wines in demand, but the tendency could be trouble ahead for increases in prices for the wines with no real demand in the secondary market.

Francois Millet, Domaine Comte Georges de Vogüé - Picture: http://winehog.org/

The long-term effect of prices

In my view, we will see continued increases in prices on the wines in very high demand - i.e. wines getting high prices in the secondary market thus ensuring a margin for those who buy the wines in the primary market.

These wines will still be in demand, as many people will keep allocations as it's a good investment, but larger share will eventually end up in the secondary market. Some of these wines are now priced beyond the limits of the average quite well off consumer, and will be traded accordingly. Restaurants will do the same, and as it becomes more difficult to sell the wines at the tables - they will also cash-in offering wines on the secondary market.

The wines not in demand in the secondary market will eventually have problems, as consumers will cut allocations and move on to other products.

This is where Bordeaux was 15 - 20 years ago, and while the top Bordeaux wines have managed to increase prices the lesser wines from Bordeaux are struggling with low demand and low prices even though quality and the value of these wines often can be tremendous these days.

Take a look at the wine lists of today and note how limited the Bordeaux offerings often are these days - compared to 20 years ago.

Burgundy will prevail but demand will be more volatile

With the small quantities produced in Burgundy the risk of a full meltdown is not imminent even with the latest increases in prices. Some producers will struggle as they will be caught between the need or urge to increase prices and the restrain shown by some of the top estates regarding the prices on the low-level wines.

A good negociant will be facing the fact that their Vosne village will cost the same as the wines from a top end producer in the primary market. That is not sustainable in the long run - and these producers could well see a collapsing demand within a few years.

As prices go up I expect demand to be more volatile, as the focus on the great vintages will increase. This has happened in Bordeaux and with the globalisation and available price information around the clock this will also be the case with Burgundy.

So, I expect increasing and more volatile prices for the wines in demand, and a sluggish market for the producers with high prices without a good demand from the secondary market.

The calculative consumer

As the prices increase the consumers will be more calculative and look at the historic prices and the development in the prices and availability of back vintages. Is it the right time to buy, can the same wine in an equally good back-vintage be found on the market at a lower cost.

The conscious consumer will check these things, and will search for information, to ensure a good price and ensure a good investment, even though the wine is bought for pure pleasure. Importantly consistency in the prices seen in relation to back vintages will be needed at least for wines produced in relatively large quantities.

This will increase the focus on services that offer historic data on prices and the possibility to validate and research the “true” market price.

The rising stars will emerge and shine brightly

Furthermore, we will see new talented producers pop up - and become in fashion within a very short time - and achieve high demand for these wines in the secondary market very rapidly as the producers get the acclaim from the wine press. So, exciting times where buyers and investors must be on their toes to follow the trends in Burgundy.

As a wine writer, it's exciting times in Burgundy as new talents emerge all the time, and old somewhat lacklustre estates are transformed to a new star within a few years with the arrival of a new generation.

So, stay on your toes, stay tuned in and informed on winehog.org - a yearly subscription is only 29€ - sign up here

Steen Öhman

Chief Tasting Officer

Winehog.org

NB:

The team at Wine Owners love Steen’s Burgundy reviews. Just like us, he was an impassioned collector, until he decided to pack in his day job and apply his palate to Burgundy for the good of mankind (and perhaps to gain a little personal enlightenment along the way).

An annual subscription with https://Winehog.org is a bit of a bargain; plus the reviews are accessible, and when we taste the wines that Steen’s tasted, we ‘get it’. Furthermore he’s a real discoverer, so if you're the sort of collector who loves the idea of buying into the next young Burgundy buck before the rest of the world catches on and spoils the price, you really should subscribe!

by Wine Owners

Posted on 2016-12-14

Two pieces of news caught my attention in December.

The first was Martin Brown, CEO of Wine-Searcher, speaking at a conference in California, noting that increased pricing transparency had not caused market prices of wine to fall.

He wasn’t referring to just fine wine or collectible wine, but rather the effect of his price comparison site on retail prices and the wine market as a whole. I’m paraphrasing, and you can read the whole of the discussion on their blog.

The second was the news that Stanley Gibbons, the stamp specialist and now owner of a group encompassing antiques specialist Malletts and auctioneer Drewetts, has seen it share price tank over the last year (see chart).

Let’s begin with Stanley Gibbons and the stamp market.

STANLEY GIBBONS GROUP PLC ORD 1P

The share price tanked in part because of how it reported revenues from the sale of ‘plans’ in investment grade stamps.

Like fine wine, stamps are a collectible. Unlike fine wine, there is a great deal less price transparency in the stamp market.

As a consequence, Stanley Gibbons used to offer collectible stamp buyers a buy back scheme, whereby the company itself guaranteed the purchaser 75% of their original investment back if the value of the stamps purchased through their Capital Protected Growth Plan fell over a 5-10 year period.

Since the repurchase scheme booked stamps onto their balance sheet at a discounted rate to their own retail catalogue rather than at cost, its auditor has estimated the potential balance sheet liability (and asset write-downs) to be £64M.

Collectible markets are relatively illiquid, in large part because the things that people collect are rarely fungible*.

But just because a market isn’t fungible or liquid doesn’t mean it can’t benefit from price and market transparency. Not to mention direct market access.

The nature of a trading collectible market, as the Stanley Gibbons example highlights, is that very rare examples are quite hard to estimate, whilst more liquid collectibles will tend to sell within or just below the lowest cluster of available market offers for sale.

Onto Martin Brown’s speech on price transparency

Wine-Searcher has done a great job of price comparison and substantially improving price transparency, so that no matter where in the world you are, it’s easy to get a price for and find the wine you want.

The key point is that price transparency has not driven down retail wine pricing, contrary to economic theory, but it has substantially reduced price outliers, both high and low.

Actionable data

Wine Owners works with Wine-Searcher, receiving tens of millions of price point as the building blocks of our Market Level price – the price at which it’s likely a wine will find ready buyers (or the approximate point of market liquidity). That data is combined with traded wine prices and for the rarest wines in the world we’ll be cross-referencing with auction data from the biggest Houses.

Blue chip fine wine behaves like collectible markets, not like CPG markets. Production and therefore supply is limited. Where there is no demand prices fall or stagnate, but where there is a ready market of buyers, prices rise. Just as you’d expect.

In fact, price discovery is the underpinning of all successful and proper-functioning trading markets.

Reliable, actionable pricing data supports buy and sell decisions. It informs counter parties. It breeds confidence, and confidence boosts sentiment.

Direct market access

Combine market transparency based on realistic selling prices with direct market access that allows all market participants to buy and sell on a peer-to-peer basis, and the effect is entirely beneficial. Consumers get the opportunity to sell through their wines across the entire spectrum from interesting drinking bottles to desirable blue chips. Buyers can buy the wines they love to drink or to accumulate as a store of value from fellow wine lovers and collectors with little added market friction due to modest commissions. Counter parties’ confidence to trade is assisted by price transparency and all the settlement and logistics support we offer through the platform.

- - - - - - - - -

* The word fungible is used in relation to a category of asset that is indivisible from each other. Pure gold and shocks and shares are indivisible. One of each is the exactly the same as the next. Collectibles are not fungible. In wine the things that make a difference are storage, fill levels, the condition of labels, capsules, and where the wine has been (wine that’s made the journey from Bordeaux to London to Hong Kong and back again doesn’t give buyers the same quality of juice as Bordeaux to Octavian for example).

by Wine Owners

Posted on 2016-03-16

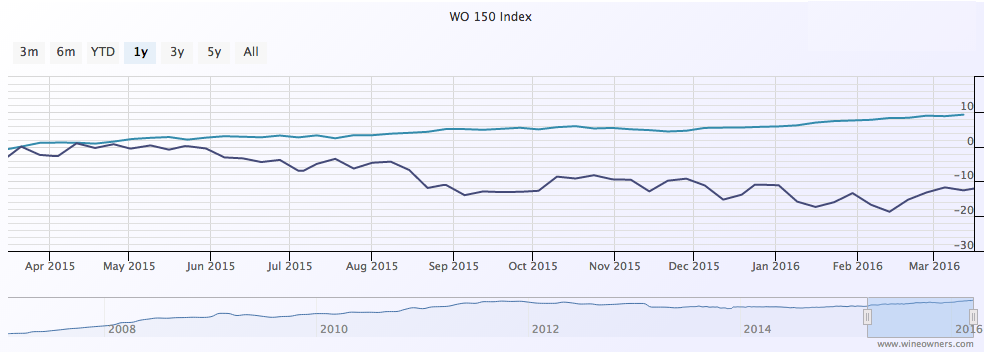

As of March 12, 2016, the WO 150 Index recorded gains of 9.18% in comparison to the FTSE100 index which made a loss of -12.57% (Base price comparison March 12, 2015)

The graph below illustrates how Wine Owners Index has consistently produced higher returns in comparison to the FTSE100. Could such a trend be explained through the huge uncertainty surrounding the global economy in recent months as seen through the crash in stock prices on 'Black Monday' in China or the increasing popularity of wine as a whole as an alternative investment asset? Regardless, the case has once again been made on the role wine plays as a 'safe haven' asset in our volatile financial climate, a wonderful addition to any portfolio.

What does 2016 hold for the collector?

GET YOUR FREE REPORT TODAY

by Wine Owners

Posted on 2014-10-20

Why is there apparently so little wine in Bordeaux when so little of more recent vintages has been selling through? Why buy young wines at release? Will negociants’ balance sheets cope with more vintages that stick? Why would that happen?

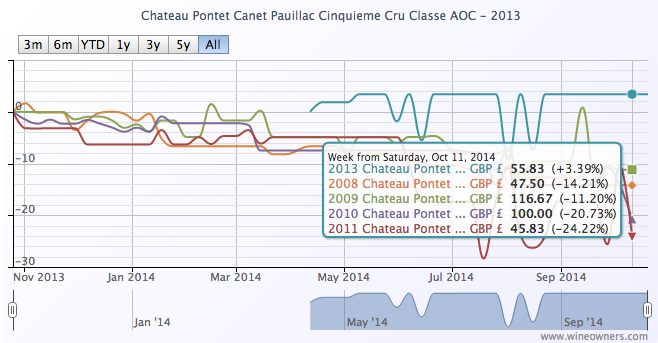

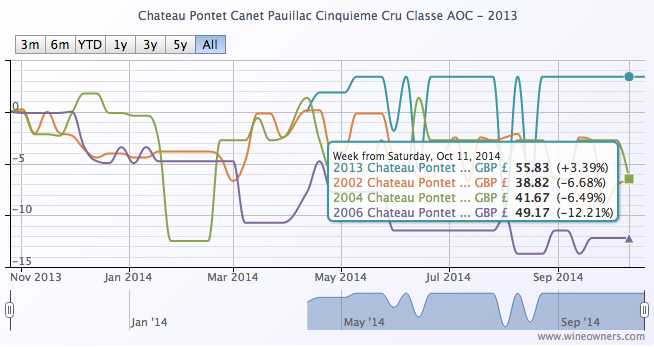

Pontet Canet 2013 famously ‘sold out’ within an hour or two of being offered on the Bordeaux Place. Negociants sucked it up and took their allocations. That’s their historical role after all. Merchants generally weren’t having any of it. More relevantly, nor were their private clients. It was a lousy deal for the consumer: 2002, 2004 and 2006 are all cheaper vintages.

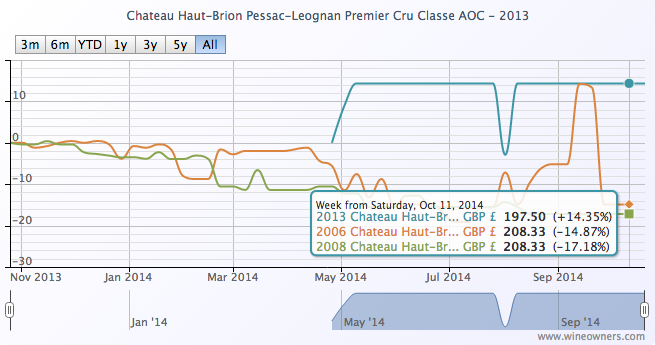

Now we’re on the cusp of a rather good vintage, the first in a small handful of years. Haut Brion 2008 has been trading at £2,400: a fair price for a lovely wine. To be a good buy, what will Haut Brion 2014 need to be offered to consumers for? £2,000? £1,900? £1,800? If instead it’s offered for £2,500, for example, what would be the point of buying it?

Loyalty? Surely not. Would consumers really want to play the stockholder for Chateaux that made extravagant profits out of 2005, 2006, 2009 and 2010 vintages? Some of who pillaged the European Union’s agricultural support fund during the bloody aftermath of Lehmann to construct a new chai or two? Buy into wines that might not drink for 15-20 years and might not be materially more expensive in 2 or 3 or more years’ time? Wines that are made in such benevolent quantities that finding them won't take more than a couple of minutes online? When there are so many back vintages that are coming back down to earth and are challenging our perceptions of value over the last few years?

So let’s imagine that the 2014 vintage proves a tricky sell. Not as thankless a job as the unloved 2013 vintage of course. The really big merchants who have an economic interest in en primeur to succeed and will sell the vintage: the weather, the brilliant Indian summer, the inevitable comparisons with the weather of 1996. Those cool nights, dewy mornings and balmy days under clear skies. But imagine it’s not what you might call a ‘successful’ campaign…

What happens then? How many of the negociants will be able to stomach another huge influx of stock without a corresponding outflux? With credit harder or impossible to come by; stalling European growth; a currency still fairly strong but with a significant downside, undermined by Europe’s recession-states, impatient creditors and a faltering Germany? With banks increasingly wary of lending support?

Of course some negociants will seize the moment to consolidate their position, increasing their market share as they gobble up distressed owners and their stocks. But others?

No one is yet disputing the efficiency of the negociant distribution system via the Bordeaux Place. After all, the huge Tuscan estates were sufficiently impressed by the system to want in. (And if you want your Libournais estate to be Classé, woe betide you if you try to circumnavigate the system.)

But it doesn't automatically follow that you have to believe in en primeur as long as it undervalues the consumer’s stockholding role to adhere to the established Bordeaux distribution model.

Passion-driven many of us may be, but perennially stupid we are not.

by Wine Owners

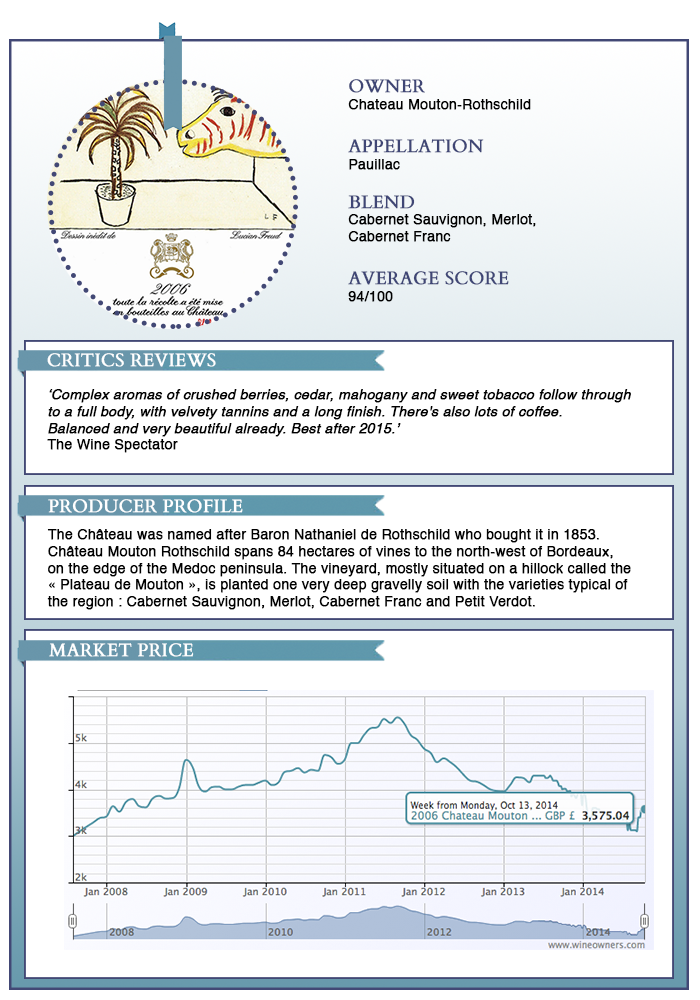

Posted on 2014-10-13

by Wine Owners

Posted on 2012-03-05

Check out Jim Budd's excellent blog and site, who has been leading the good fight against disreputable and financially risky traders for many years.

The message is loud and clear when looking to invest in wine:

- Stick to established sources, especially when buying futures

- Use pricing tools such as Wine Searcher to establish fair market value based on a known range of selling prices if in any doubt

- Report suspicious cold calls and hard selling to Jim.

I've met intelligent people who have invested in wine futures and lost considerable amounts of money. Basic checks and following Jim's advice is as good a way as any to ensure many, many years of happy drinking and fine wine appreciation.