by Wine Owners

Posted on 2016-07-25

It is fair to say that in the recent improvement of fortunes in Bordeaux prices, most focus is given to the classed growths of the Medoc on the Left Bank, and the top wines of Pomerol and St Emilion on the Right Bank. The recovery over the last 12 months has been significant, as seen below, with the Medoc Classed Growth Index (the turquoise line) rising by over 23% and the Libournais Index (purple line) up over 18%. Great news for all those people who have experienced the huge price correction of 2011 to 2014.

But, when looking at Bordeaux as a whole the focus should perhaps swing further south. See what happens when I add the Graves Classed Growth Index (the purple line in the chart, below) into the mix. Over the same time frame the wines of Graves, headlined by Haut Brion and la Mission Haut-Brion, have leapt up by over 30%, outstripping their neighbouring appelations.

Even when you take into account the Brexit effect, which has seen a weak pound in the past month provide a boost from sterling denominated stock as HK and US buyers pile in, this still represents a huge return to form. The lesson here is to realise that the 1855 classification (which ignores Graves, with the notable exception of Haut-Brion) and finest wines north of the Garonne are not the be all and end all. Look south, towards Graves, and you will find a raft of excellent wines that have improved dramatically in the last few years in many instances (think Smith Haut Lafitte, Haut-Bailly, Pape Clement), and which represent both great quality and great value. It is perhaps important that the gravelly, smoky, pencil lead and pencil shaving notes which characterise the best wines of Graves have few, if any, imitations around the world. Bordeaux blends from other continents tend to mimic the Medoc or the Libourne, and so the terroir-specific nature of Graves wines perhaps gives them a uniqueness that collectors ascribe value to in the same way as they do in Burgundy.

Sometimes it pays to take the path less travelled….

by Wine Owners

Posted on 2015-10-29

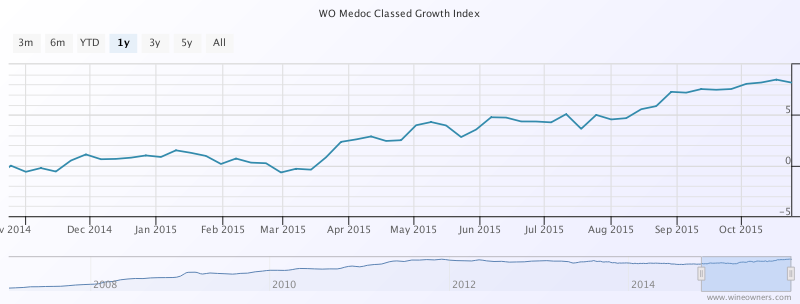

Quite a lot of members we speak to these days assume that the market prices of Bordeaux are still stagnating or falling. The morosité that had descended on the region's finest wines in by 2012 does not appear to have lifted.

Wine traders will point to volumes that are much reduced since the giddy heyday of 2009-2011, and that is of course true.

However, it does not mean that in aggregate, prices of Bordeaux have begun an upward trend. In the last year, the Wine Owners Medoc Classed Growth Index is up 8.2%.

Whereas the Wine Owners First Growth Index has only managed half of that in the last year, up 4.1%.

That's still better than the performance of the FTSE100, which is fractionally underwater over the last year, and exactly where the S&P500 has clawed it's way back to after the summer's wobbles.

Wine Owners 150 = Turquoise

FTSE100 = Navy

S&P500 - Green

However, when looking at First Growth performance over the last 12 months, it is far from broad-based. 'The further they rise, the longer they fall' seems to hold true, with Lafite 1986 and 1989 performing the worst at -8% and -9% respectively.

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1999 | -5.45% | £ 216.68 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2006 | -5.75% | £ 286.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2009 | -5.82% | £ 441.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1982 | -5.92% | £ 436.68 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1982 | -6.29% | £ 1,810.14 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1998 | -7.15% | £ 270.83 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2006 | -7.26% | £ 212.50 |

| Chateau Margaux Premier Cru Classe AOP | 1989 | -7.59% | £ 250.10 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1986 | -8.13% | £ 651.48 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1989 | -9.11% | £ 395.92 |

Among the vintages populating negative territory, 1986 has suffered with the exception of the very great Mouton. The exceptional 1989s and 1990s have fallen, along with with the dull 1999s.

The risers are headed by Mouton, Haut Brion and Latour. The top 10 performers registering double digit growth are entirely accounted for by these three Châteaux.

| Wine | Vintage | Change 1 year | Price |

|---|

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2005 | 22.39% | £ 366.67 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2008 | 21.13% | £ 262.54 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2005 | 20.95% | £ 437.50 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 1996 | 16.87% | £ 282.74 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1990 | 14.30% | £ 429.12 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2005 | 13.36% | £ 566.79 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2000 | 13.32% | £ 1,038.81 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2008 | 11.00% | £ 226.64 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1989 | 9.08% | £ 1,000.03 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1995 | 8.49% | £ 316.67 |

Crossing over to the right bank, predominant top performers over the last 12 months are St EmillMedoc Classed Growth Indexon 2005s and the 2001 Class A relative newcomers. Since March 2015 The Wine Owners Libournais Index is up 7%, coming off it's 3 year lows at that point.

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 53.85% | £ 300.00 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 48.07% | £ 176.57 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 45.67% | £ 183.46 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2000 | 37.16% | £ 301.79 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 1998 | 34.59% | £ 161.84 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOP | 2005 | 27.82% | £ 110.96 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 26.84% | £ 232.57 |

| Chateau La Violette Pomerol AOP | 2009 | 26.67% | £ 208.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOP | 2005 | 24.71% | £ 433.34 |

What can we conclude from this? Some commentators are suggesting that value is returning to older back vintages on the back of 4 year declines. Relative value vs quality is likely to be a key driver of future value, for which we recommend you check out the new price per points builder on Wine Owners to which you'll need to subscribe.

Liv-ex have recently seen a predominance of trades of the 2010 vintage, and whilst there seems to be value returning selectively to the Classed Growths, one wonders if it's a little early yet the First Growths, whose starting release prices were in nose-bleed territory. Since 'the further they rise, the longer they fall' it may yet be a bit early to call.

by Wine Owners

Posted on 2014-08-14

Unsurprisingly, given the continuing market morosité over classed growth Bordeaux, the index plumbed fresh 2014 lows last week, down -3.83% since January, and -6.8% from this time a year ago. The right bank fared marginally better with the Libournais Index year to date (-2.68%) whilst year to date it was down -4.61%.

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOC |

2000 |

-16.15% |

£475.00 |

| Chateau Beausejour Becot Saint Emilion Premier Grand Cru Classe B AOC |

2000 |

-16.19% |

£41.31 |

| Chateau Belair-Monange Saint Emilion Premier Grand Cru Classe B AOC |

2010 |

-16.55% |

£81.66 |

| Chateau La Fleur Petrus Pomerol AOC |

2001 |

-16.78% |

£93.70 |

| Chateau Latour a Pomerol Pomerol AOC |

2005 |

-17.02% |

£48.71 |

| Chateau Le Tertre Roteboeuf Saint Emilion Grand Cru AOC |

2001 |

-17.63% |

£100.72 |

| Chateau Beausejour Duffau-Lagarrosse Saint Emilion Premier Grand Cru Classe B AOC |

2005 |

-17.90% |

£48.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOC |

2005 |

-18.70% |

£325.00 |

| Chateau Figeac Saint Emilion Grand Cru AOC |

2009 |

-18.99% |

£120.83 |

| Chateau Clos L'Eglise Pomerol AOC |

2001 |

-19.55% |

£71.46 |

| Chateau Beausejour Becot Saint Emilion Premier Grand Cru Classe B AOC |

1998 |

-19.82% |

£32.89 |

| Chateau Latour a Pomerol Pomerol AOC |

2001 |

-20.04% |

£32.36 |

| Chateau Ausone Saint Emilion Premier Grand Cru Classe A AOC |

2005 |

-21.21% |

£802.05 |

| Chateau Moulin Saint-Georges Saint Emilion Grand Cru AOC |

2000 |

-21.74% |

£34.45 |

| Chateau Hosanna Pomerol AOC |

2000 |

-21.79% |

£111.60 |

| Chateau Clos L'Eglise Pomerol AOC |

2009 |

-24.12% |

£98.24 |

| Chateau Ausone Saint Emilion Premier Grand Cru Classe A AOC |

2000 |

-25.02% |

£750.00 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOC |

2000 |

-26.15% |

£26.77 |

| Le Dome Saint Emilion Grand Cru AOC |

2000 |

-40.75% |

£76.41 |

The First Growth Index is down -10% year to date and -27.9% since summer 2011 highs. However, there are some surprisingly low prices on back vintages being seen on the fine wine exchange. How about Latour 2004 at £3,050 IB per 12x75cl excluding buyer’s commission? Or Margaux 1996 at £3,500 IB per 12x75cl - one of their great vintages, drinking beautifully now. Frankly, with pretty good to excellent back vintages fetching these kind of prices, no wonder there are no takers for the recent string of Bordeaux off-vintages. The risk to discount ratio is simply not compelling enough. No doubt the market will sort that out over the next couple of years. Contrarily, good to great vintages with 6-10+ years under their belts are starting to look very attractive in places, at least in our eyes, and there’s a trend towards restocking within the fine wine trade - a positive sign.

Looking at constituents of the Wine Owners 150 (which comprises 150 Investment Grade Wines across the top 40 performers of the last 10 years), the leaderboard is topped by Monfortino 2002, up 39% in the last 12 months. This is a romantic, if not heroic performance, from one of the greatest wines in the world defying the miserable conditions of the vintage with its superlative microclimate and the producer’s belief in the intrinsic quality of the wine.

Year on year top performers (Wine Owners 150):

| Giacomo Conterno Monfortino Barolo Riserva DOCG |

2002 |

39.06% |

£338.62 |

| Screaming Eagle Winery Cabernet Sauvignon Napa Valley AVA |

1995 |

28.99% |

£3,135.00 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2005 |

28.50% |

£2,015.74 |

| Tenuta dell' Ornellaia Masseto Toscana IGT |

1998 |

20.66% |

£454.00 |

| Petrus Pomerol AOC |

2001 |

18.28% |

£1,400.00 |

| Tenuta dell' Ornellaia Ornellaia Bolgheri DOC |

2004 |

16.53% |

£133.33 |

| Tenuta dell' Ornellaia Masseto Toscana IGT |

1997 |

15.94% |

£516.67 |

| Chateau Le Pin Pomerol AOC |

2009 |

14.92% |

£2,291.67 |

| Domaine de la Romanee-Conti Richebourg Grand Cru AOC |

2002 |

12.08% |

£1,130.35 |

| Dominus Estate Bordeaux Red Blend Napa Valley AVA |

1997 |

10.66% |

£107.27 |

| Domaine de la Romanee-Conti Romanee Conti Monopole Grand Cru AOC |

2001 |

9.62% |

£7,353.97 |

| Tenuta San Guido Sassicaia Bolgheri DOC |

2006 |

9.36% |

£137.50 |

| Joseph Phelps Winery Insignia |

1997 |

9.19% |

£163.90 |

By the way, not one Medoc classed growth made it into the top 20 of the Wine Owners 150, with the best performing representative of the region being Pichon Baron 2000.

| Chateau Pichon Baron Pauillac Deuxieme Cru Classe AOC |

2000 |

2.47% |

£125.00 |