by Wine Owners

Posted on 2014-08-14

Unsurprisingly, given the continuing market morosité over classed growth Bordeaux, the index plumbed fresh 2014 lows last week, down -3.83% since January, and -6.8% from this time a year ago. The right bank fared marginally better with the Libournais Index year to date (-2.68%) whilst year to date it was down -4.61%.

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOC |

2000 |

-16.15% |

£475.00 |

| Chateau Beausejour Becot Saint Emilion Premier Grand Cru Classe B AOC |

2000 |

-16.19% |

£41.31 |

| Chateau Belair-Monange Saint Emilion Premier Grand Cru Classe B AOC |

2010 |

-16.55% |

£81.66 |

| Chateau La Fleur Petrus Pomerol AOC |

2001 |

-16.78% |

£93.70 |

| Chateau Latour a Pomerol Pomerol AOC |

2005 |

-17.02% |

£48.71 |

| Chateau Le Tertre Roteboeuf Saint Emilion Grand Cru AOC |

2001 |

-17.63% |

£100.72 |

| Chateau Beausejour Duffau-Lagarrosse Saint Emilion Premier Grand Cru Classe B AOC |

2005 |

-17.90% |

£48.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOC |

2005 |

-18.70% |

£325.00 |

| Chateau Figeac Saint Emilion Grand Cru AOC |

2009 |

-18.99% |

£120.83 |

| Chateau Clos L'Eglise Pomerol AOC |

2001 |

-19.55% |

£71.46 |

| Chateau Beausejour Becot Saint Emilion Premier Grand Cru Classe B AOC |

1998 |

-19.82% |

£32.89 |

| Chateau Latour a Pomerol Pomerol AOC |

2001 |

-20.04% |

£32.36 |

| Chateau Ausone Saint Emilion Premier Grand Cru Classe A AOC |

2005 |

-21.21% |

£802.05 |

| Chateau Moulin Saint-Georges Saint Emilion Grand Cru AOC |

2000 |

-21.74% |

£34.45 |

| Chateau Hosanna Pomerol AOC |

2000 |

-21.79% |

£111.60 |

| Chateau Clos L'Eglise Pomerol AOC |

2009 |

-24.12% |

£98.24 |

| Chateau Ausone Saint Emilion Premier Grand Cru Classe A AOC |

2000 |

-25.02% |

£750.00 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOC |

2000 |

-26.15% |

£26.77 |

| Le Dome Saint Emilion Grand Cru AOC |

2000 |

-40.75% |

£76.41 |

The First Growth Index is down -10% year to date and -27.9% since summer 2011 highs. However, there are some surprisingly low prices on back vintages being seen on the fine wine exchange. How about Latour 2004 at £3,050 IB per 12x75cl excluding buyer’s commission? Or Margaux 1996 at £3,500 IB per 12x75cl - one of their great vintages, drinking beautifully now. Frankly, with pretty good to excellent back vintages fetching these kind of prices, no wonder there are no takers for the recent string of Bordeaux off-vintages. The risk to discount ratio is simply not compelling enough. No doubt the market will sort that out over the next couple of years. Contrarily, good to great vintages with 6-10+ years under their belts are starting to look very attractive in places, at least in our eyes, and there’s a trend towards restocking within the fine wine trade - a positive sign.

Looking at constituents of the Wine Owners 150 (which comprises 150 Investment Grade Wines across the top 40 performers of the last 10 years), the leaderboard is topped by Monfortino 2002, up 39% in the last 12 months. This is a romantic, if not heroic performance, from one of the greatest wines in the world defying the miserable conditions of the vintage with its superlative microclimate and the producer’s belief in the intrinsic quality of the wine.

Year on year top performers (Wine Owners 150):

| Giacomo Conterno Monfortino Barolo Riserva DOCG |

2002 |

39.06% |

£338.62 |

| Screaming Eagle Winery Cabernet Sauvignon Napa Valley AVA |

1995 |

28.99% |

£3,135.00 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2005 |

28.50% |

£2,015.74 |

| Tenuta dell' Ornellaia Masseto Toscana IGT |

1998 |

20.66% |

£454.00 |

| Petrus Pomerol AOC |

2001 |

18.28% |

£1,400.00 |

| Tenuta dell' Ornellaia Ornellaia Bolgheri DOC |

2004 |

16.53% |

£133.33 |

| Tenuta dell' Ornellaia Masseto Toscana IGT |

1997 |

15.94% |

£516.67 |

| Chateau Le Pin Pomerol AOC |

2009 |

14.92% |

£2,291.67 |

| Domaine de la Romanee-Conti Richebourg Grand Cru AOC |

2002 |

12.08% |

£1,130.35 |

| Dominus Estate Bordeaux Red Blend Napa Valley AVA |

1997 |

10.66% |

£107.27 |

| Domaine de la Romanee-Conti Romanee Conti Monopole Grand Cru AOC |

2001 |

9.62% |

£7,353.97 |

| Tenuta San Guido Sassicaia Bolgheri DOC |

2006 |

9.36% |

£137.50 |

| Joseph Phelps Winery Insignia |

1997 |

9.19% |

£163.90 |

By the way, not one Medoc classed growth made it into the top 20 of the Wine Owners 150, with the best performing representative of the region being Pichon Baron 2000.

| Chateau Pichon Baron Pauillac Deuxieme Cru Classe AOC |

2000 |

2.47% |

£125.00 |

by Wine Owners

Posted on 2014-07-14

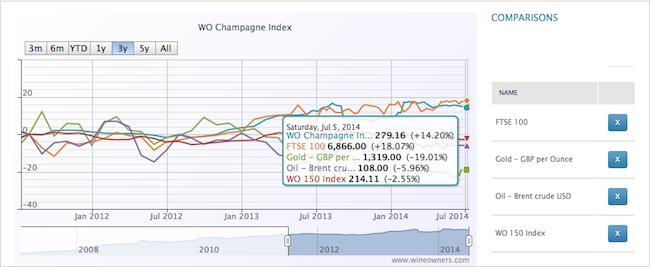

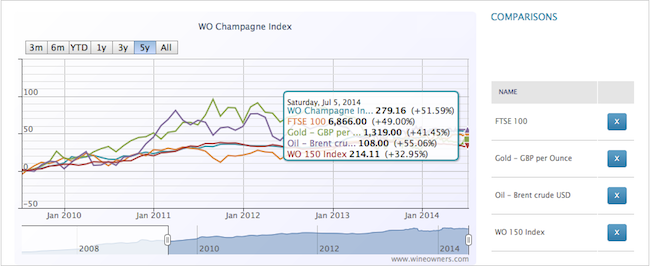

The performance of the Wine Owners Champagne Index has been nothing short of stellar - outperforming most other assets over the last 3, 5 and 7 years.

Over the last 12 months, however, the index has stagnated, registering a measly 0.5% growth.

Much was said of Champagne as an investment during the course of 2013. In sharp contrast to other fine wine regions, production quantities tend to be vast, but so is consumption. Analysing the performance of the Champagne market shows that appreciation is entirely driven by the very top vintages. With no stellar vintage such as 1996 or 2002 due for imminent release, we said in the first quarter of 2014 that the vintage Champagne market may drift over the next 1-2 years, though very top back-vintages may well benefit as supply dries up, and Champagne styles suited for long ageing such as Salon may continue to firm.

6 months on, this has indeed proved to be the case, with the top performers over the last 12 months to July 2014 being Jacques Selosse Blanc de Blancs Millésimé 1996 (+40%), Krug Clos de Mesnil Blac de Blancs 1996 (+28%) and Salon Cuveé ’S’ Le Mesmil Blanc de Blancs 1996 (+16.5%). This shows the value of relative scarcity, age and a top vintage - the perfect combination for future returns in a market otherwise dominated by exceptionally high volume production.

The poorest performers over 12 months have been Taittinger Contes de Champagne Blanc de Blancs 1996 (-9%) and 1998 (-28%), along with Dom Perignon 1998 (-11%).