by Wine Owners

Posted on 2018-05-17

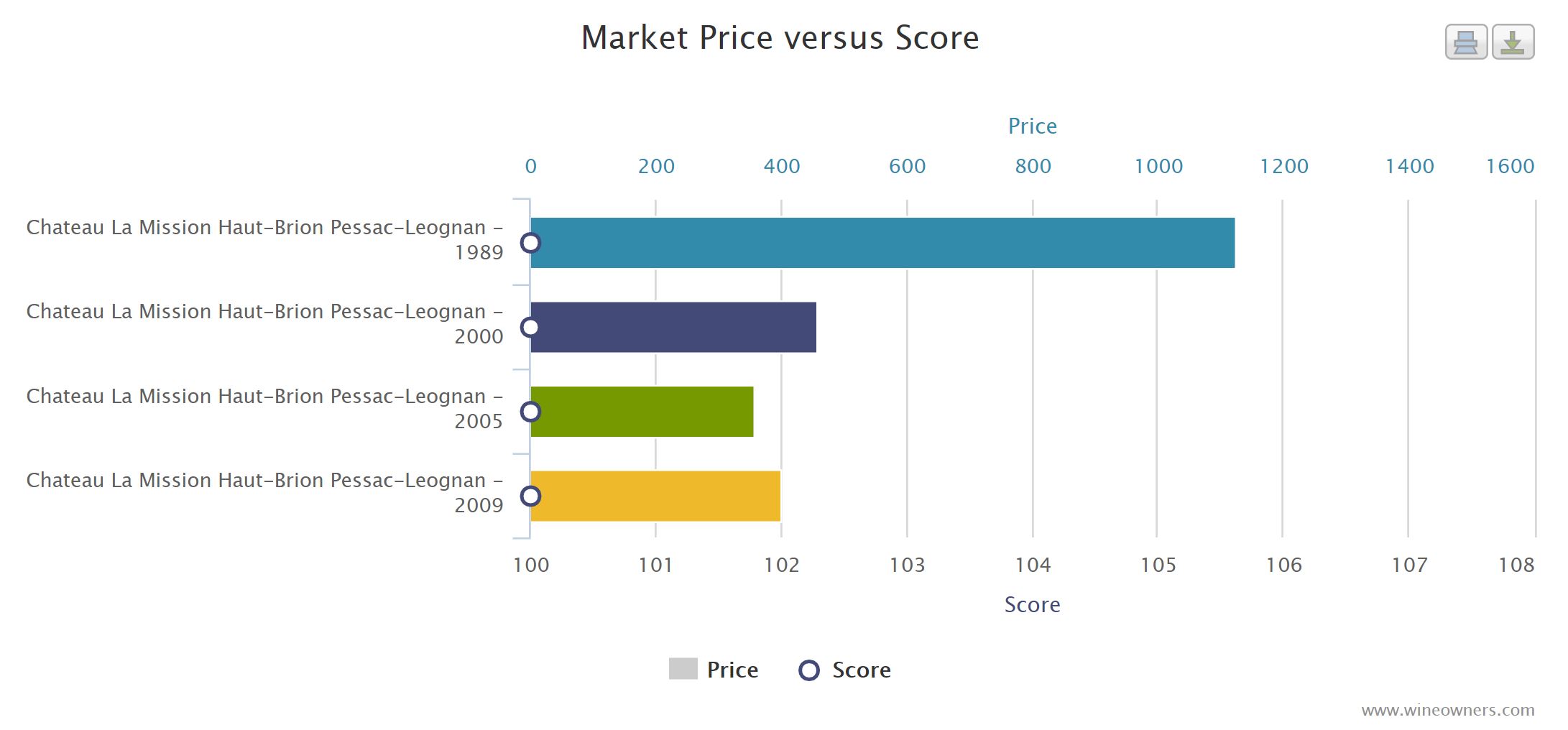

An overlooked example of value for money here from the 100 point La Mission 2005. Compared to Domaine Clarence Dillon stablemate Haut-Brion, and the rest of the 2005 First Growths, 2005 La Mission is a clear winner in terms of value as is eminently clear from relative value analysis. The only other 100 point wine on the whole left bank is Haut-Brion, which trades at around £6,500. The other Mouton will cost £5,250, Latour £6,600, and Margaux £6,100, all on 98 points, while Lafite lags behind them all in relative terms, commanding £7,700 for 96 points.

Compared to other 100 point La Missions over the year, the 2005 wins out on relative value as well. Whether any of the 2009, 2005 and 2000 will hit the price highs of the legendary 1989 is a subject on which the verdict is very much out, and will depend on how reputation of the vintages develops. Nevertheless, all three look like relatively sound buys, and the 2005 at the offer price just beats the rest (assuming they can be bought at market level).

“The 2005 La Mission Haut-Brion is pure perfection. It has an absolutely extraordinary nose of sweet blackberries, cassis and spring flowers with some underlying minerality, a full-bodied mouthfeel, gorgeously velvety tannins (which is unusual in this vintage) and a long, textured, multi-layered finish that must last 50+ seconds. This is a fabulous wine and a great effort from this hallowed terroir. Drink this modern-day legend over the next 30+ years. Only 5,500 cases were produced of this blend of 69% Merlot, 30% Cabernet Sauvignon and 1% Cabernet Franc.”

100 points, Robert Parker

La Mission Haut-Brion 2005 is offered £4,300 on the Wine Owners Exchange (£4,435 including fees)

by Wine Owners

Posted on 2014-10-17

Treasure assets are uncorrelated. That’s part of the attraction to high net worth individuals (HNWIs) looking for suitable stores of value.

I use the phrase store of value purposefully. Wealth preservation and enjoyment of the fruits of success are arguably far more important to HNWIs than specific targeted annual returns.

Wine has appeared deeply uncorrelated since the financial crisis of 2008. The facts bear that out. Yet we mustn’t forget the power of externalities to distort underlying tendencies; such as insatiable demand from China up until mid-2011, or the flight from traditional financial instruments during periods of extreme market stress into all things tangible. It’s easy to forget that the wine market did suffer during previous economic recessions or shocks, whether the recession of the early 1990s or the Asian financial crisis of 1997.

Yes, of course we’re talking principally about Bordeaux, that behemoth of a region that produces unrivalled oodles of fine red wine. Paradoxically other regions of production may indeed be uncorrelated with Classed Growth Bordeaux as hot wine money searches for relative value, or where scarcity creates a rather different drumbeat.

With the current financial market turmoil; the sudden reawakening to the woes of Europe; the economic and political uncertainty of its recession-hit member states - what better moment to analyse the question of market correlation?

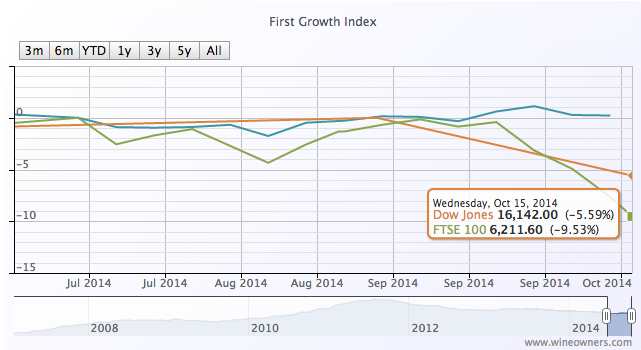

The wine market became quite excited by a small upturn that started in late July, continued during August and through much of September. A month on, and things aren’t quite so clear-cut, but in spite of plummeting stock markets, wine prices are not following suit.

The First Growth Index is up by 1.2% over the last 3 months whilst the FTSE has dived almost 8% - that’s roughly the same amount of value destruction as the First Growths experienced over the previous 12 months. The Bordeaux Index has followed the same positive (if tentative) trajectory (comprising Medoc and Graves Classed Growths and the top Libournais benchmarks). So has Northern Italy, only a whisker off its all-time highs, along with blue chip Burgundy and the effervescent Champagne market.

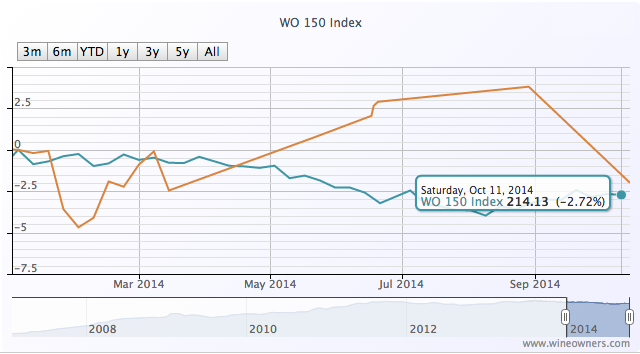

After a disappointing year so far for the wine market overall (represented by the WO 150 Index), the previously run-away Dow is within single-digit, fingertip distance of fine wine’s -2.7% fall.