by Wine Owners

Posted on 2016-08-09

From an investment perspective champagne has delivered solid if unspectacular gains year on year, as the chart below shows. Since the start of 2011, the WO Champagne Index (pale blue line) has steadily moved up, displaying little of the volatility of the wine market at large, as represented by the WO 150 Index (purple). A 5 year increase of 55% is pretty impressive by anyone’s reckoning in this day and age.

Ask most champagne lovers to name the three most important champagne marques, and the vast majority would plump for Dom Perignon, Krug and Cristal – let’s call them the Three Musketeers. These are by far the most likely to be found in collections, and have international standing as the benchmark for top quality, premium fizz. My question is that if we assume most collectors will hold at least one, if not all three, of these in their cellars if they are champagne followers, which champagne is best placed to play the role of d’Artagnan to their Porthos, Aramis and Athos?

There are several pretenders to the throne. Bollinger RD, Perrier Jouet Belle Epoque, Pol Roger Winston Churchill, Armand de Brignac Ace of Spades – these and a host of others are a match for the quality and cachet of the Three Musketeers, but there is one name that I think stands out, and one whose financial performance and quality cannot easily be overlooked.

That wine is Salon ‘Cuvee S’ Le Mesnil. Despite its relative anonymity – there are many better known marques – this champagne is viewed as the apogee of champagne making by those in the know. Ruthlessly (almost self-defeatingly!) small production quantities and a quality control regime that makes North Korea look like a hippy commune have enabled Salon ‘Cuvee S’ to reach prices that are eye-wateringly expensive across the board. Despite this its prices have moved up more dramatically that most champagnes for vintages from the 1990s, and even more recent vintages from the 2000s have shown growth despite much higher release prices.

So, if you can find it at the right price, Salon ‘Cuvee S’ is perfectly placed to play the role of the Fourth Musketeer. All for one, and one for all…

by Wine Owners

Posted on 2016-03-22

OWNER

OWNER

Dom Perignon Champagne

APPELLATION

France

BLEND

Chardonnay, Pinot Noir

AVERAGE SCORE

95/100

REVIEW:

The 2002 Dom Perignon is at first intensely floral, with perfumed jasmine that dominates the bouquet. With time in the glass the wine gains richness as the flavors turn decidedly riper and almost tropical. Apricots, passion fruit and peaches emerge from this flashy, opulent Dom Perignon.

(Robert Parker, 2010)

by Wine Owners

Posted on 2015-02-16

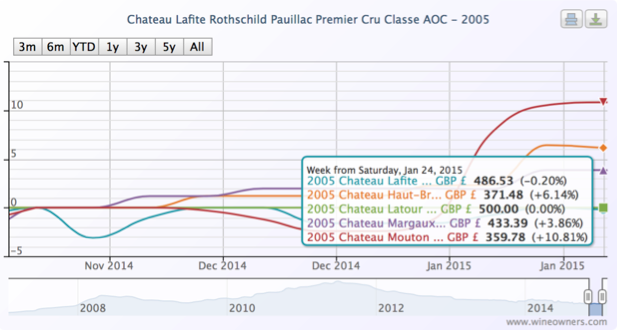

The turning point for fine Bordeaux was August of last year. By early October it was unclear whether the tick-up was yet another of those blips we’d seen several of during the previous 24 months.

Today it is clearer: the trend is up, most wines are well off their lows, and the Bordeaux Index overall is 2.17% up on 6 months ago.

The exception is the Libournais index covering Pomerol and St Emilion, which has slipped 0.48%, a reversing the gains of 1.24% between early October and the end of November last year.

The Medoc Classed Growths are collectively up 2.77% form their August 9th 2014 lows.

Whereas the First Growths only managed 1.51% during the same period. Not entirely surprising since top vintages are still highly priced, they have had further to fall, making it hard to call bottom, and started picking up momentum in January 2015. What is clearer is that wines such as Haut Brion 2008 appear to be interesting propositions.

Elsewhere the Blue Chip Burgundy Index continues to power ahead, though within that there are notable, and expensive, fallers (last 12 months):

| Domaine de la Romanee-Conti Le Montrachet Grand Cru AOC |

2010 |

-7.16 |

| Domaine Ponsot Charmes Chambertin Cuvee des Merles Grand Cru AOP |

2010 |

-7.69 |

| Domaine Armand Rousseau Mazis-Chambertin Grand Cru AOC |

2010 |

-7.89 |

| Domaine Jean Grivot Richebourg Grand Cru AOC |

2007 |

-9.43 |

| Domaine de la Romanee-Conti Romanee Saint Vivant Grand Cru AOC |

2010 |

-10.71 |

| Domaine Jean Grivot Echezeaux Grand Cru AOC |

2002 |

-11.2 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2006 |

-13.15 |

| Sylvain Cathiard Vosne Romanee En Orveaux Premier Cru AOC |

2010 |

-13.69 |

| Domaine Comte Georges de Vogue Chambolle Musigny Les Amoureuses Premier Cru AOC |

2002 |

-13.7 |

| Domaine de la Romanee-Conti La Tache Monopole Grand Cru AOC |

2010 |

-15.38 |

| Domaine Armand Rousseau Clos de la Roche Grand Cru AOC |

2010 |

-16.08 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2005 |

-16.18 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2006 |

-16.35 |

| Domaine Leflaive Chevalier-Montrachet Grand Cru AOC |

2005 |

-16.67 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2008 |

-20 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2006 |

-20.16 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2005 |

-21.94 |

Northern Italy is up 1.42%, with Giacomo Conterno one again heading the leaderboard

Champagne has defied our predictions in gaining a whopping 7.42% over the last 6 months, the top risers comprising exclusively older vintages in the range 1996-2002. This makes a lot of sense. Millions of bottles of top cuvees such as Dom Perignon (up to 8M bottles per annum) means that values kick up only when supply and demand becomes more balanced.

We also thought Californian wines would moderate their growth this year. Comparative to Bordeaux prices, they seem expensive. Since January they have indeed dipped -0.65%, off the back of six month growth of 6.65% up until that point. It’s too early to say whether they are simply pausing for breath, or have reached a natural plateau. The trend line favours the first scenario.