by Wine Owners

Posted on 2019-04-29

MONDAY 17th JUNE

Some huge scores for Vieux Chateau Certan 2018 this year, including an impressive 18.5 from Julia Harding of JancisRobinson.com. VCC is on a massive roll and there is no disputing the quality - the scores from recent vintages are level pegging with their very much more expensive neighbours, Petrus and Le Pin. Released at £219 per bottle, a 20% premium to our proto-price, the 2018 is 10% cheaper than 2016 but more expensive than the ‘09 (12%) and the same price as the ’10.

We prefer the 2011, mis-judged by Robert Parker in many people’s opinion, and similarly loaded as the ’18 with Cabernet Franc. Julia scores it 18 and Neal Martin 96-8 and at less than £100 a bottle is less than half the price of the ’18 – go figure! See full note here.

99-100 Points - James Suckling

98-100 Points - Wine Enthusiast

97-100 Points - Wine Advocate

98-100 Points - Wine Cellar Insider / Jeff Leve

94-97 Points - Antonio Galloni, Vinous

98-100 Points - Decanter

FRIDAY 14th JUNE

Figeac has been released this morning at £181 per bottle, 46% clear of our proto-price of £124.22. There seems to be no doubt among critics that Figeac has produced one of the best wines in their history. The 2017, which is still languishing at release price, just takes the lead in absolute relative value (see chart), but isn’t really in the same league as the 2018, a vintage which may prove a qualitative milestone for Figeac.

Worth noting too that the relative value score is high at 20, and compares extremely favourably to similar quality wines from other St Emilion properties. Pavie, for example released at £292 per bottle, which makes the better scoring Figeac look quite exciting.

97-99 Points - Wine Advocate

18 Points - Julia Harding

96-99 Points - Antonio Galloni, Vinous

98-99 Points - James Suckling

97-99 Points - Jeb Dunnuck

Conseillante has also been released this morning at £168 per bottle, so 60% up on our proto-price of £105. This is 35% above last year’s release price, but there’s a palpable increase in quality, and still looks well-priced in comparison to top-flight Pomerol peers.

96-98+ Points - Wine Advocate

95-98 Points - Antonio Galloni, Vinous

97-98 Points - James Suckling

97-100 Points - Jeb Dunnuck

97 Points - Decanter

Cheval Blanc is also off and running this morning at £549 per bottle, a relatively modest 12% above our proto-price of £490.33.

Given the potential for a top score, it’s arguable that there’s value here, but many buyers would be forgiven for wondering whether back vintages may be the answer, with the 100 point 2005 readily available at around £560 per bottle.

97-99 Points - Wine Advocate

18.5 Points - Julia Harding

97-100 Points - Antonio Galloni, Vinous

98-99 Points - James Suckling

97-100 Points - Jeb Dunnuck

THURSDAY 13th JUNE

Ausone is the first of the big Right Bank releases, coming out this morning at £556 in London, so almost spot on our proto-price of £545. 2017 is still the winner on relative value at the moment, but even though well priced for Ausone it’s unlikely to achieve a perfect score. 2018 might just do that, and if it can be expected to follow the path of the 09s,(£725) 2010’s (£932) and ultimately 2005 (£900) in terms of price, it makes sense to buy on release.

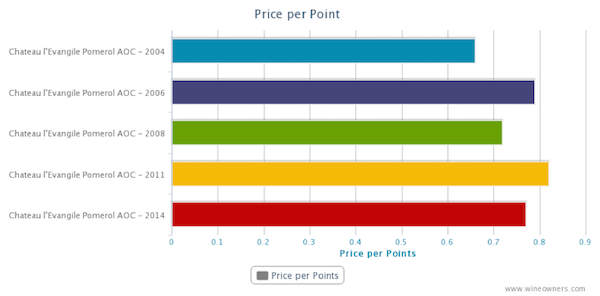

Evangile is the second out of the stalls this morning at £180 per bottle against our proto-price of £151.48. 19% north of our proto-price, but one of the few chateaux not to increase prices from their 2017 release.

On relative value, given the high score and relatively reasonable pricing, we think this looks like one to buy if offered.

Lafite is one of the most hotly anticipated releases of the vintage, with near-universal praise from critics. If this wine doesn’t get Bordeaux lovers hearts' racing, nothing will, says the Wine Advocate’s Lisa Perotti-Brown. The question is, does the price engender palpitations of excitement or terror?

£428.32 was the proto price, so the release at £500 from UK merchants is 17% up on that ideal - not too ungenerous in a vintage that’s often been 20-30% over.

Relative value analysis suggests that the 2018 works pretty well. The contender in comparable vintages in 2017, which pushes ahead on absolute value, but probably doesn’t have the potential to be a top scorer, which the 2018 does.

On balance, a buy, if you can get some.

98-100 Points - Wine Advocate

19 Points - Julia Harding

99-100 Points - James Suckling

98-100 Points - Decanter

TUESDAY 11th JUNE

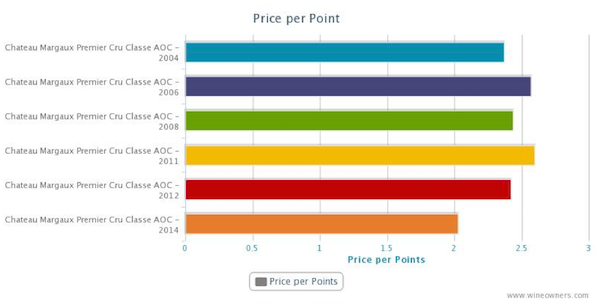

Margaux has been released this morning at £426, around 10% up from our proto-price of £386.41, so less ambitious than many so far.

Relative value analysis makes this look reasonably good, although in absolute terms behind the 2017. The gamble is this being re-scored in the upper limit of the ranges (i.e., 99-100), at which point it would clearly outstrip its rivals on value.

94-97 Points - Antonio Galloni, Vinous

97-99 Points - Wine Advocate

96-98+ Points - Jeb Dunnuck

18 Points - Julia Harding

100 points - James Suckling

Pavillon Rouge is released at £149 per bottle, bang on our proto-pricing - at last the Chateaux are listening! It works therefore and the Relative Value Score is attractive too.

94-97 Points - Antonio Galloni, Vinous

97-100 Points - Lisa Perrotti-Brown, Wine Advocate

98-100 Points - Jeb Dunnuck

17 Points - Julia Harding

98 - 99 points - James Suckling

Haut Brion joins the advance this morning too, releasing at £426 from London merchants, and like Mouton comes in 12% above our proto-price of £380.15.

Solid scores here, though Antoni Galloni, as for the La Mission, is a dissenter with a (relatively) meagre 93-96.

If we consider this a 99 point average, it pushes ahead of the pack on relative value, but only marginally. Again, a fairly fully priced offering that seems sensibly, if not compellingly, priced.

93-96 Points - Antonio Galloni, Vinous

97-99+ Points - Wine Advocate

97-99 Points - Jeb Dunnuck

18 Points - Julia Harding

98-99 points - James Suckling

WEDNESDAY 5th JUNE

Chateau Montrose just out at £130 per bottle, so about 25% above our proto price of £102.63.

It’s a good score, but Montrose has been consistently performing well recently, and the price seems too high here to make it truly compelling. The 96 point 2014 looks like incredible value if you can get a case under £90 per bottle which is easily achievable!

This morning sees a release from one of the most consistently outstanding wineries in the world - Chateau La Mission Haut Brion is out at £1,475 per 6 bottles.

There is no doubt one of the most historic sites in Bordeaux is basking in a true renaissance period, producing wines of incredible concentration and richness in recent years.

98-100 Points - Lisa Perrotti-Brown, Wine Advocate

97-99 Points - Jeb Dunnuck

97-99 Points - Jeff Leve, Wine Cellar Insider

97 Points - Jane Anson, Decanter

TUESDAY 4th JUNE

This afternoon’s first highlight is Haut Bailly, which was universally loved by member of the WO team when tasted over the last few months.

In a rare occurrence for this year, this has been released below our predicted proto price, at £87 per bottle v a proto price of £88.95.

The very high score puts this in a league with the 2009 and 2010, both of which it far outstrips on relative value, and makes it one of the most sure buys of the vintage so far.

Also released this morning is Pichon Baron 2018, at £117 per bottle, so a good 20% north of our proto-price at £98. Clearly a special wine, and receiving much critical acclaim, and the relative value score is good, though not 2015 and 2014 are ahead and 2017 not far away. On the other hand, the consensus seems to be that this is about the highest scoring Baron since the legendary 1990, which will clinch the deal for many buyers.

Cos d’Estournel out this morning at £148 per bottle. Although at a premium of c.22% to the 2016 release it is offered at a significant discount to the ’09 and ’10 vintages – unlike many others!

Cos 2016 is now trading in the secondary market at £150 per bottle, meaning that however great the 2018 is, it shows no discount to the current market of one of the greatest ever wines from Cos d’Estournel. This will be a hot issue however, the relatively understated Galloni stating:

A regal, soaring Saint-Estèphe, the 2018 Cos d'Estournel is also clearly one of the wines of the vintage. On the palate, the 2018 is dark and sumptuous, with striking aromatic presence and silky tannins that wrap around a rich core of exotic fruit. Black cherry, savory herbs, leather, spice and menthol build in the glass in a wine that is both aromatically intense and richly textured. The 2018 has been nothing short of breathtaking on the two occasions I have tasted it so far. Don't miss it.

97-100 Points, Antonio Galloni, Vinous

MONDAY 3rd JUNE

Ducru Beaucaillou 2018 is out at £144 per bottle versus a proto-price of £114. Another set of top-notch reviews from the critics and a very good relative value score to boot (see attached).

"This is so layered and beautiful with incredible tannin quality. Full-bodied with a caressing texture that reminds me of the finest cashmere. So layered. You want to swallow this. Brings a smile to the face. Wow. So well crafted." 98-99 Points, James Suckling

Pichon Lalande 2018 is released at £138 per bottle, our proto-price is £97.27, so a chunky premium but this is a Chateau on the up, with scores to match (see chart). James Suckling says “A deep and intense young red with blackberries and blueberries, as well as green olives and hints of fresh tobacco. But really black fruit. Full-bodied, tight and integrated with a refreshing and harmonious finish. Just floating on the palate. Great tannin backbone to this. A classic. Another flying carpet." 98-99 Points

Leoville Las Cases 2018 is released today at £179 per bottle. It is loved by the critics, a potential 100 pointer according to Perrotti-Brown, Suckling and Dunnuck, but a more conservative 95-8 from Galloni. It’s a fully charged, expansive wine with plenty of power (14.5%), expression and charm. It is, however, marginally more expensive than either ’09 and ’10 but a bit less than ’16….

WEDNESDAY 29th MAY

This morning also sees the releases from the von Neipperg stable, including Mondotte, and Canon la Gaffeliere, both well scored, but reasonably fully priced.

Canon la Gaffeliere comes out at £64 per bottle against a proto price of £54, so slightly closer, and much similar to recent vintages in terms of relative value.

Neverthless, the high score makes it relatively good value in comparison to other recent vintages and a definite improvement on the ‘16, with more consistent reviews. On balance, it’s a yes, if you can get a case...

Julia Harding: 16.5

James Suckling: 94 - 95

Wine Advocate: 94 - 96

Mondotte is £171 v. a proto price of £154.13, so not far off the mark. We’re calling this 96 points on average, although no Wine Advocate review available for this wine. At this price, relative value analysis prefers the 2017…

Julia Harding: 16.5

James Suckling: 97 - 98

Lynch Bages 2018 is this morning’s major release, one of the more hotly anticipated wines of the vintage. Pricing looks well above the proto-price threshold of £79.62, with a London merchant price at £92 per bottle.

Neverthless, the high score makes it relatively good value in comparison to other recent vintages and a definite improvement on the ‘16, with more consistent reviews. On balance, it’s a yes, if you can get a case...

Julia Harding: 17

Decanter: 97

James Suckling: 97 - 98

Jeb Dunnuck: 96 - 98

Wine Advocate: 96 - 98

Wine Spectator: 96 - 99

TUESDAY 28th MAY

A little closer to our predicted proto-price of £83.81 for Clos Fourtet. the offer from London traders is out at £504 per 6, so pretty much spot on. The property has gone from strength to strength in the last 10 years without pricing itself out of the market.

Relative value indicates we’re doing better than back vintages as the score is considerably better (another 96 average), even though the release is more expensive.

Score: 95-97, Jeb Dunnuck

Score: 94-97, Antonio Galloni, Vinous

Score: 95-97, Wine Advocate

Our proto-price calculation came in at £61.61 for Leoville Poyferre, so a price from London merchants at £408 is a little north of where we had hoped, but on the other hand the scores are high, averaging to a Wine Owners 96 points, better than anything in our comparable vintage list. In terms of relative value, it’s fine, lagging a little behind 2015, but probably nothing to write home about.

Score: 96-99, Jeb Dunnuck

Score: 94-97, Antonio Galloni, Vinous

Score: 94-96, Wine Advocate

Our proto-price calculation came in at £82.03, and the ex-Negociant price this morning is around EUR 86.80, so we’re well within the bounds of reasonable pricing. Coupled with some very high scores, and clear desire from the Chateau to reposition themselves as a top player we think, on balance, that it’s a buy.

Score: 94-96, Jeb Dunnuck

Score: 94-97, Antonio Galloni, Vinous

Score: 93-95+, Wine Advocate

FRIDAY 24th MAY

Pontet Canet ’18 is released today at £86.50 per bottle. It is a HUGE wine. With a proto price of £84.39 and with a 2/3 reduction in crop thanks to mildew, Pontet Canet could be accused of being generous – not something we’re accustomed to! The relative value score is also strong and the critics are mad about it. Monsieur Tesseron opened conversation when we were there with “clearly this is the best modern day vintage of Pontet Canet”. Buy some if you can.

Score: 96-98, Jeb Dunnuck

Score: 97-99, Antonio Galloni, Vinous

Score: 94-96+, Lisa Perrotti-Brown MW, Wine Advocate

The 2018 vintage has probably produced Phelan Segur’s highest ever scores; LP-B 93-5, JS 95-6 and AG 91-4. There is no doubt this is a Chateau on the up, with a new owner and under the beautiful directorship of Veronique Dausse this is one to watch. The Relative Value Score is good, the price is a not too taxing £35.41.

THURSDAY 23rd MAY

If you believe in the gospel according to Suckling, one must buy Domaine de Chevalier (rouge) at £65: "Wow. I can’t get over the pureness of fruit in this wine with so much currant, tar and wet-earth character. Flowers, too. So aromatic. Full body, yet pureness and brightness of fruit. Layered. Incredible depth and beauty. 65 per cent cabernet sauvignon, 30 per cent merlot and 5 per cent petit verdot. Greatest ever?" Score: 99-100

Scores from other critics are also very high and it was certainly one of the best wines this taster tasted in the primeur tastings. Is this a break out moment for this famous Domaine? Like the man from Del Monte, the price and the scores say YES!

Score: 94-96+, Lisa Perrotti-Brown MW, Wine Advocate

Score: 94-97, Antonio Galloni

Score: 96-98, Jeb Dunnuck

It’s the big blast – the Canon! One of the most fashionable Chateaux of Bordeaux have released at £87 a bottle, representing a 11.5% premium to our proto price of £78.04. It looks like relative value to recent vintages at current market levels and people will be fighting for allocation. Will it power up from here like the 2015 and ’16? Maybe not that much but it looks good nonetheless. BUY.

Huge points from the major critics:

97-99 Points, Lisa Perrotti-Brown, The Wine Advocate

94-97 Points, Antonio Galloni, Vinous

96-98+ Points, Jeb Dunnuck

98-99 Points, James Suckling

Another jewel in the Chanel crown and today as equally as fashionable as Canon, Rauzan Segla is out at £75. There will be equally as much bun fight over allocations for this one as well. The proto price is £63.80, so a premium of 17%, but one which will easily be achieved. Good relative value and with a slightly higher average score than Canon, it is a BUY.

Gruaud Larose has been released at £55.83 today. Our proto price is £45.31, nearly 19% lower. The wine split the critics with exuberance from Perrotti-Brown (95-7) and Suckling (95-6) and reservation from Julia Harding (JR.com) (16) and 89-92 from Galloni “For my taste, Gruaud is on the edge of being too much”. All vintages since 2010 are available today at less than this release price and 2014-2017 inclusive all have higher relative value scores.

WEDNESDAY 22nd MAY

Leoville Barton is released today at £66.16 per bottle. There is no question the wine is of a very high quality and the Chateau, quite rightly, has a devoted following based on its strong rapport qualité/prix. Our proto price is £58.51. Here is the relative value analysis.

Julia Harding (Jancisrobinson.com): 16.5

Lisa Perrotti-Brown (Wine Advocate): 94-96

Antonio Galloni (Vinous): 93-96

Also known for its excellent rapport qualité/prix, the popular Grand Puy Lacoste released today at £56 a bottle, a tiny premium to our proto price of £54.15. It is also a tiny premium to today’s market price of their ’09 vintage.

Julia Harding (Jancisrobinson.com): 17.5

Lisa Perrotti-Brown (Wine Advocate): 92-94+

Antonio Galloni (Vinous): 93-96

It’s rapport qualité/prix day from Bordeaux! Chateau Talbot is always commercial and is priced to sell well at en primeur when the vast majority of their wine is released. At £43.16 it looks decent value, especially looking at the Relative Value Score.

TUESDAY 21st MAY

At £35 per bottle Lagrange is a little over our proto price of £31.76 but follows a completely barren ’17 - most Chateaux would have been far more demanding price wise. We continue to recommend Lagrange as a good value wine for consumers.

Julia Harding (Jancisrobinson.com): 16.5

Lisa Perrotti-Brown (Wine Advocate): 93-95+

Antonio Galloni (Vinous): 92-95

Buy Lagrange 2018

FRIDAY 10th MAY

Duhart Milon has released at £54.66 per bottle, a very modest 11% premium to our proto-price of £48.46. The Wine Owners team were very impressed by it and many of the critics have asked the question of it being the best Duhart ever. Certainly the Rothschild family have been investing here and it’s bearing good fruit! A ‘modest’ 14% alcohol too! 17.5 (95) from Julia Harding and a lovely note. This is a Chateau on the up.

Lafite’s Technical Director, Eric Kohler commented, 'The Merlot performed very well—Duhart-Milon might just have better terroir for Merlot than Lafite'.

And the Relative Value Analysis screams BUY:

Clerc Milon was released at £61.65 per bottle, awarded 93-95 points by Lisa Perrotti-Brown (WA).

The bio-dynamic, certified organic estate that is Chateau Palmer released their 2018 wine today at £241. Our proto-price was £221.67. Following a heavy dose of mildew and the long hot summer the yield was a miserly 11 hectolitres per hectare, translating into 6,000 cases and no Alter Ego was made at all. This could turn out to be a unicorn wine it’s so rare and deserves to be treated as a special case. It receives amazing and interesting reviews, 18.5 (97) from Julia Harding, 98-100 from Jane Anson, 97-100 from James Molesworth (notoriously tight!) but, by his standards, a paltry 94-5 from James Suckling – I was expecting something in four figures! Like most 2018s, it comes with the usual 2018 caveat that it is strong in alcohol – 14.3%.

Market Price versus Score here:

Relative Value Analysis here:

Other releases include:

Chateau Gloria at £29

Chateau Lafon-Rochet at £32

Chateau Saint Pierre at £42

THURSDAY 9th MAY

Today sees an attractive release price from Bernard Magrez’s Pape Clement (red) at £66.16 ex London merchant. Our ‘proto-price’ is £75.13, so very nearly a 12% discount to that.

There are a wide range of scores for Pape Clement with Julia Harding of Jancis.Robinson.com scoring it 16.5 (converting to 91 on the 100 point scale), whilst Lisa Perotti-Brown of the Wine Advocate awards a much more optimistic 96-98, James Suckiling 98-99 but a more modest 93-96 from Antonio Galloni.

Using a generous 97 points, it’s looks like very good value:

But at 91 points, it’s a different story:

Our very own Fabian Cobb really liked the wine and gave it 95 but he’s notoriously mean with his scores. Elegance was his take, so clearly a different experience to that of Julia Harding who wrote a bit “a bit monolithic”.

Pape Clément Blanc was released at £98.66 (London price) - 16.5 from Julia Harding.

TUESDAY 7th MAY

Today's releases included:

Calon Ségur released at £72 per bottle.

A record release price for Calon Ségur at £864 per 12 in the London market. Significantly above our proto-price of £63.57 but the wine was very well received by most critics. The WO house view was a bit too full and sweet to be a masterpiece but undeniably impressive. Its high scores relative to previous vintages leads to an attractive Relative Value Score.

Pavie Macquin released at £52.7 (£632 per 12), the same as last year. Our proto price is £47.36, so 11% below the release. The RVS below uses a Julia Harding's score of 16.5 (equivalent to 91), significantly lower than some of the other critics, one of which went as high as 97-99. The jury is out.

Beychevelle released at £60 per bottle and Cantemerle out at £20.50.

Carmes Haut Brion was released at £69 per bottle.

THURSDAY 2nd MAY

Lafleur 2018 released at £483 per bottle, 10% above our proto price but it will sell out with Julia Harding’s big score and is still only half the price of the secondary market average of 09, 10, 15 16. The closest thing to a dead cert a wealthy collector can buy this year.

Fair price from Clinet - £64 per bottle. They are pricing 12.5% below current market for 2016 (£73). Just £2 per bottle above our suggested proto price. Are they listening?!

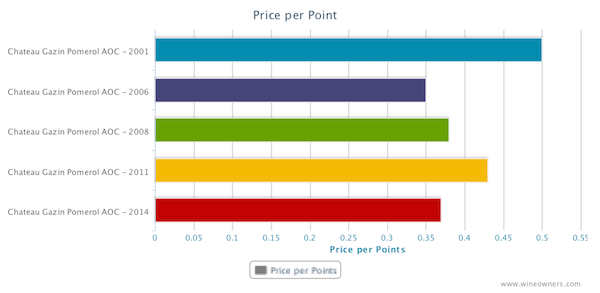

Gazin out - £62 per bottle EST (with negociants as we speak). No price advantage over the chasing pack of back vintages.

They are very pleased with it this year they say, but it doesn’t make sense as an EP buy on this basis, and it didn’t wow us.

TUESDAY 30th APRIL

Batailley 2018 released at £408 per 12 (London Merchant Price).

Relative Value Score, using a WO aggregated score of 93:

MONDAY 29th APRIL

Today saw the release of Branaire Ducru 2018 at £462 per 12 (London merchant price).

A higher release price than the last three vintages and 12.4% higher than last year. Our proto-price was £44.48 per bottle, so at £38.50 it looks interesting. Relative Value Analysis, however, indicates the 2016 being better value, a trend that we think is likely to continue.

by Wine Owners

Posted on 2015-05-27

So goes the good luck saying, advising what a bride might wear at her wedding to bring good fortune.

In reviewing Bordeaux 2014 releases to date what could be more appropriate? After all, this has been a campaign where a few enlightened producers got their winemaking and pricing aligned, whilst others (the majority?) have simply ignored the current compelling pricing of many of their back vintages of comparable quality.

In the light of that, what mixture of old and new vintages might the wine lover or collector consider?

SOMETHING OLD

Something old is symbolic of continuity.

When comparing the 2014s to broadly comparable back vintages, it reaffirms the value there is in wines around the 7-12 year old mark. In the majority of cases these are wines just hitting their stride, and in some cases with enormous drinking windows ahead of them.

Here are some examples but today Bordeaux unquestionably is generally favouring back vintages over new releases.

L’Eglise Clinet 2006

I just love L’Eglise Clinet, so I’m delighted to give it my first mention. Only, why buy 2014 when 2004, 2006 and 2008 are all cheaper? Personally I’d probably pay the market premium for the 2006, simply because that vintage is proving to be such a fine year in Pomerol. There is so much definition to the fruit, and such balance to the best wines. L’Eglise Clinet is an obvious choice due to winemaking of the highest order over the last decade.

Haut Brion 2008

At around £2,400 per case, the 2008 makes a profoundly compelling case for itself, as does the 2012 in the light of its recent Parker rerating, reinforced by other reviewers such as Jeff Leve. Throw 2006 into the mix as a wine of exceptional purity, and there’s an embarasse de richesses for grown up lovers of Graves.

Palmer 2004

Leaving aside the fact that the beautiful 2014 is Palmer’s first vintage made entirely biodynamically, 2004 still stands out as a wine value that warrants the wine lover’s attention. According to Parker it’s a modern day version of Palmer’s brilliant 1966, majoring on elegance and precision, freshness and depth of flavor.

SOMETHING NEW

Represents good luck, success and hopes for a bright future.

Let’s start with a handful of winners. Using the soon to be released price per points analysis feature on Wine Owners highlights value in the context of broadly comparable quality. The teetering Euro helped, creating a rare opportunity for Châteaux to please the market and satisfy their accountants. A handful grasped the opportunity.

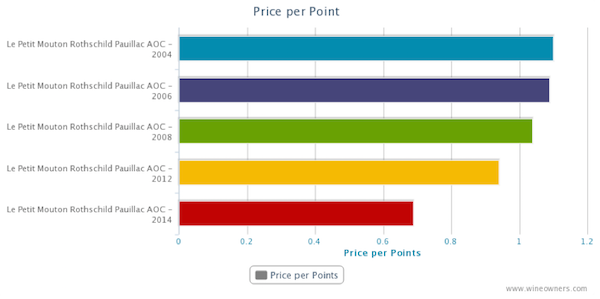

Le Petit Mouton 2014

Growing positive sentiment in respect of the quality of the last decade’s vintages has given those years a recent helping hand. This is the cheapest vintage in the market at £375, and a 40% discount to its possible qualitative equal – 2006. Different too. The success of Merlot on gravel relegated a big slug of Cabernet to the second wine, so atypically cabernet-dominated and correspondingly serious.

Mouton Rothschild 2014

Outstanding in a vintage in which Pauillac starred. There’s a breezy balance whilst its Merlot genes and dash of Cabernet Franc complete a raspberry-driven, fresh, complex palate with plenty of fine-grained tannins. They got the price right as the charts show.

Lynch Bages 2014

Poised, with classic Pauillac character; loaded with griottes fruit and flowing Saville Row lines. It was priced to within a hairs-breadth of 2011 and 2012 current market value but the value difference over 2008 and 2006 must have convinced loyal buyers to part with their money early as merchants reported healthy demand.

Lafite 2014

We didn’t think Lafite was the most immediately impressive First Growth in 2014. In fact it seemed to be the most obdurate. Yet the critics lapped it up, and we’re more than happy to defer to their better judgement. In the meantime one thing is very, very obvious looking at the price per points analysis. It’s priced as a come-on to consumers to open their pocket books and buy early.

SOMETHING BORROWED

Anything can be borrowed but it must be returned afterwards.

A couple of worrying features of the 2014 campaign have emerged.

The first is linkage. Back in 2010 Bordeaux chose to tie certain wines with others. The most interesting example was a pack of Rieussec linked to a pack of Carruades. Interesting because of the distorting factor it had on the market for Rieussec. Back then, merchants simply added a couple of hundred pounds to the price of their Carruades allocation before dumping Rieussec onto Livex and selling through at £210-£220 per 12; roughly half the retail release price offered to consumers. To this day those Livex members who jumped in and hoovered up stock are sitting on the best returns that the 2010 vintage had to offer. Not great for the consumer who bought Carruades but a creative market response to price manipulation.

Linkage is seemingly back, with Rieussec once again tied to Carruades, according to one or two merchants we talked to. Who’s doing the tying is a question to which I have no answer, and this time the merchants can’t just transfer pricing from one wine (relatively difficult to sell at first release) to another (for which there was unquenchable demand back in 2010).

The second feature is limited quantities released by some Châteaux. Who’d have thought the Bordelais would have de facto discouraged early purchases in 2014 – maybe they don’t believe in the en primeur system after all? Like a boyfriend who isn’t in love anymore, but is too insecure to let his partner go.

Calon-Ségur is a wine I thought showed delightfully in 2014. The vibe among négociants in Bordeaux was positive, lending emotional support to the wine even before release.

Recently acquired by Suravenir Assurance, an insurance company for whom no doubt a higher average release price per bottle will help to sûr-value their estate on a forward-looking basis, chose to release up but at a realistic price point for the fine quality. But then the real game plan became apparent. There was no wine: merchants who had assumed they were in line for a reasonable allocation (and had promised private clients allocations on that basis) found that they were empty handed. Merchants were left scurrying around for whatever they could pick up. Consumers were left feeling that however big Calon’s heart, maybe it was losing its soul.

This is the sort of attempt at market influence that Bordeaux EP does not need. Frankly, if Châteaux would prefer to achieve a higher price than the market can bear, then why not exit EP as Latour did, and release when the wine is considered ready? It’s dishonest to play it both ways and the market will not necessarily reward throttled supply with higher prices: demand is often chocked off too in the process.

SOMETHING BLUE

The symbol of faithfulness, purity and loyalty.

There are so many Châteaux that we could have used to exemplify the question of whether we would have chosen to buy early, or wait a few years until the young wines are fully formed, or go back to earlier vintages where there’s so much value to be had. In most (but by no means all) cases we’d go back to earlier vintages and wait to buy the new releases in bottle. But buying young wine isn’t an entirely rational decision as we all know.

Which vintages would you buy on the basis of the following charts? You decide!

by Wine Owners

Posted on 2014-03-25

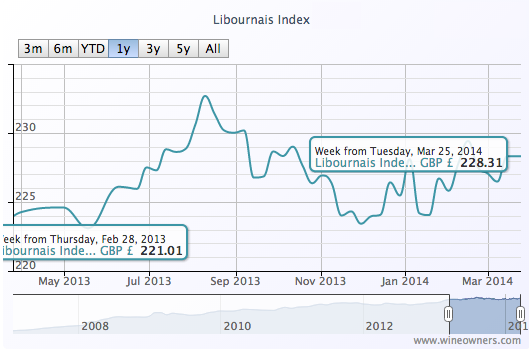

With a level of 221 at the end of February 2013 (baseline January 31st 2007), the Libournais Index shows a relatively flat performance, with a change of only 1.8% over a 1-year period to 228.31.

While the top movers of the Medoc Classed Growth Index were relatively affordable vintages, the Libournais Index top gainers feature higher value wines, as do the biggest fallers, perhaps indicating a rather higher level of market interest than on the left bank.

Individual high-scoring wines, however, buck the trend, with the 100 pointers La Violette 2010 and Petrus 2009 showing that a perfect Parker score can still be a market driver and suggesting that scarcity may increasingly be a market driver within the Bordeaux market, either due to tiny production or due to age.

It's arguably even more interesting to see the price of Vieux Chateau Certan 2010 fall quite significantly since the turn of the year (possibly as stockholders finally throw their hands up and start to write-down the value of their holdings?). Will Vieux Chateau Certan 2010 fall further carried by the momentum of price gravity? At some point this could be extremely tempting, for an utterly sublime wine that was considered by many (including us) to be perfect.

TOP GAINERS

BIGGEST FALLERS

Create an account on www.wineowners.com to receive our analyses by email.

by Wine Owners

Posted on 2013-11-15

The 2009 Annual Bordeaux Tasting organised by The Institute of the Masters of Wine recently highlighted the high standard and homogeneity of Bordeaux 2009.

The best Medocs were beautifully perfumed, notably throughout the Graves, Margaux, and St. Julien. Where freshness was retained, the very ripe fruit lifted by fresh acidity, the wines were both easy to taste and delineated.

Examples that stood out were:

Pontet Canet with a refined, liqueur texture, fabulous confit yet crystalline, vivid fruit, and a velvety finish.

Leoville Barton was extremely pretty for a property that typically makes very structured long-term wines, exciting and fresh with wonderful aromatics.

Montrose was immense, and so confidently poised within its powerful structure.

Mission Haut Brion was truly fine; beautifully perfumed, noble fruit, dusty tannins in no way inhibiting a very long finish.

Sister property Haut Brion showed in a more structured vein, bright fruits, yeast and cedar on the nose, uplifting with a real sense of energy underlying the progression of flavours. Haut Brion was a beacon of how great 2009 can be when ripe fruit, acidity, structure and energy come together to create a unique, visceral experience. It also served to highlight how unctuous and relatively soft so many of the other wines in 2009 really are. And this isn't necessarily a good thing for the long term.

At a recent dinner tutored by Edouard Moueix where he showed La Fleur Petrus 2009 and 2010 side by side, the 2009 was unctuous and richly textured. The 2010 had more clearly delineated elements, showed as being far more complex, with wave after wave of nuanced flavours through an almost interminable finish.

Back in 2011, in the heat-wave of that Bordeaux spring, 2010 also showed brilliantly. Where wines were compared side by side, the 2010 vintage got my vote almost every time, including beauties from:

Calon Segur

Cheval Blanc

Haut Brion

Haut-Bailly

La Conseillante

L’Eglise-Clinet

La Mission Haut-Brion

Latour

Le Pin

Margaux

Montrose

Pichon Longueville Comtesse de Lalande

Rauzan Segla

Vieux Chateau Certan

So for me whilst the two vintages are both extraordinary; I prefer the definition, balance, complexity and enduring length of flavour so commonly found in the best 2010 red Bordeaux, which gets my vintage vote bar a few exceptions like Leoville Barton.

by Wine Owners

Posted on 2012-03-04

Around 9am on Friday 2nd March 2012 my inbox lit up with wave after wave of 2009 Bordeaux offers from wine merchants. (Congratulations to Flint Wines for refreshingly focusing on an up-and-coming Burgundian grower.) In the weeks leading up to last Friday, merchants had taken the opportunity to inform private customers that RP's new scores were imminent, and that now was a good time to pick over market prices, many of which had fallen from their release price and 2011 highs.

I'd already done all my 2009 'business' during 2010/11 so stood by and watched. Parker duly came out with his new 2009 scores and a glowing recommendation - like 1982 (on which he made his reputation) but better thanks to advances in wine making, a return to traditional vineyard husbandry, and greater de-classification of parcels into second and third wines (in fairness common arguments trotted out regularly by the regisseurs and chateau owners in Bordeaux). What surprised everyone was how many high points he awarded his favourite wines - 18 wines getting 100 points; in comparison to just 6 wines in each of the two great vintages of 2000 and 1982.

Here are the final 100 pointers thanks to Ditton Wine Traders

| wine |

bottle |

barrel |

| Beausejour Duffau Lagarosse |

100 |

96-98 |

| Bellevue Mondot |

100 |

95-100 |

| Clinet |

100 |

97-100 |

| Clos Fourtet |

100 |

95-98 |

| Cos d'Estournel |

100 |

98-100 |

| Ducru Beaucaillou |

100 |

96-98 |

| L'Evangile |

100 |

96-100 |

| Haut Brion |

100 |

96-100 |

| La Mission Haut Brion |

100 |

98-100 |

| La Mondotte |

100 |

95-98 |

| Latour |

100 |

98-100 |

| Le Pin |

100 |

95-98 |

| Leoville Poyferre |

100 |

97-100 |

| Montrose |

100 |

96-100 |

| Pavie |

100 |

96-100 |

| Petrus |

100 |

96-100 |

| Pontet Canet |

100 |

97-100 |

| Smith Haut Lafitte |

100 |

96-98 |

And Friday's price increases vs the previous day's prices ranked from high to low

| Wine |

prior |

after |

% change |

| Beausejour Duffau Lagarosse |

£1,000 |

£2,400 |

140% |

| Clos Fourtet |

£750 |

£1,800 |

140% |

| Smith Haut Lafitte |

£680 |

£1,600 |

135% |

| Clinet |

£1,500 |

£2,200 |

47% |

| Le Pin |

£18,000 |

£25,000 |

39% |

| Montrose |

£1,900 |

£2,550 |

34% |

| Leoville Poyferre |

£1,350 |

£1,800 |

33% |

| Pontet Canet |

£1,350 |

£1,800 |

33% |

| L'Evangile |

£2,300 |

£2,750 |

20% |

| La Mondotte |

£2,550 |

£3,000 |

18% |

| Petrus |

£25,000 |

£29,000 |

16% |

| Cos d'Estournel |

£2,800 |

£3,200 |

14% |

| Pavie |

£2,200 |

£2,500 |

14% |

| Ducru Beaucaillou |

£2,000 |

£2,200 |

10% |

| Haut Brion |

£7,400 |

£8,000 |

8% |

| Bellevue Mondotte |

£2,550 |

£2,750 |

8% |

| La Mission Haut Brion |

£5,600 |

£6,000 |

7% |

| Latour |

£11,700 |

£11,800 |

1% |