by Wine Owners

Posted on 2014-09-12

With market sentiment for fine red Bordeaux brightening, we ask, what do the latest market numbers actually suggest?

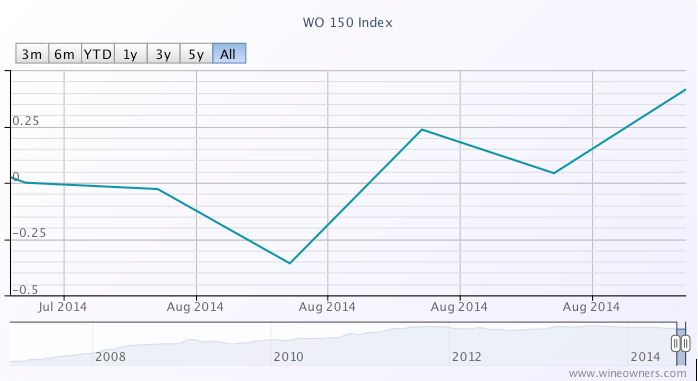

Let's start with the market as a whole.

The Wine Owners 150 (WO 150) comprises investment grade wines across the top 40 performers of the last 20 years from all key regions of production. This index rose 0.4% in the last month compared with a fall of -4.45% over the course of the last 12 months. Of the most recent bottom 40 fallers, all were red Bordeaux. More positively there were 22 Bordeaux in the top 40 gainers.

1 month

1 year

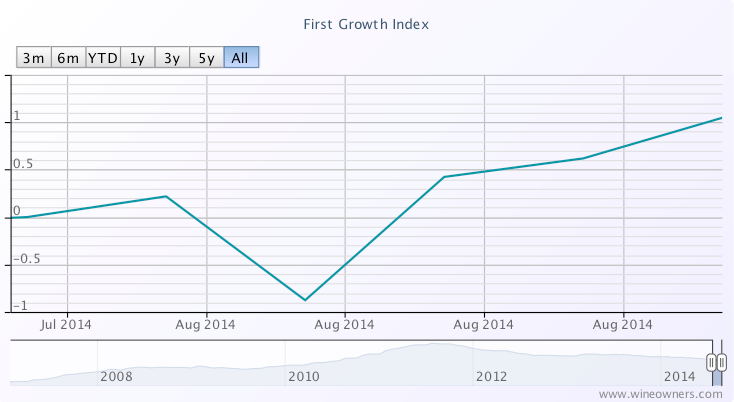

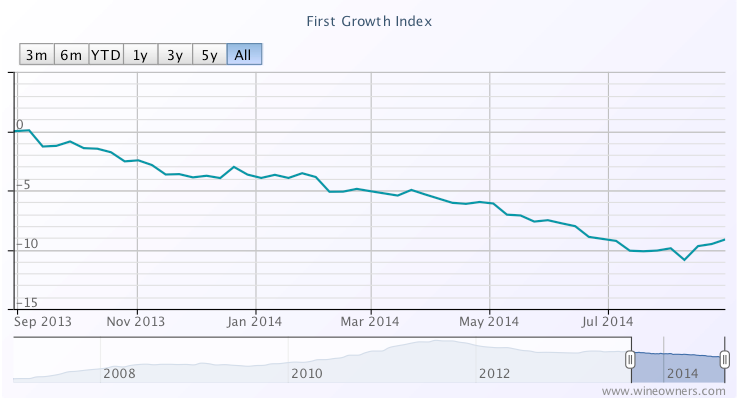

The First Growths Index rose 0.98% over the last month, and is now down -9.14% over the last 12 months, off its early August lows of -10.87%

Haut Brion appears to be leading the charge, 1989 and 2006 showing strong double digit growth, with Mouton (1986, 1989, 1996, 1998 and 2010) showing 5%-8.5% growth along with Haut Brion 2003, Margaux 1986 and Lafite 1990. The predominance of older, scarcer vintages among the top movers is notable. Older vintages can show some of the sharpest short-term moves given there is much less of them in the market, so market movements in 25 year old vintages are not convincing bellwethers.

1 month

1 year

The Medoc classed growth index rose 0.23% over the month and was up 0.72% from its August lows, and is now down -4.8% over the last 12 months.

Palmer saw double digit growth in respect of vintages 2009 and 1998, along with Pontet Canet 1996, Leoville Barton 2006 and Gruaud Larose 2005. Risers however were largely offset by fallers across a broad range of vintages including 1996, 2000, 2005, 2006 and 2009. Although there is increasingly positive support for hard-hit wines from vintages such as 2005, the data does not yet substantiate an upturn.

1 month

1 year

The right bank also saw a rise comparable with the First Growths, with the Libournais Index up 1.09% over the last month, and up 2.5% from its August lows. It is now down just -0.98% over the course of the last year.

Top movers include Petrus 2010, Beausejour Duffau (1998 and 2010), VCC (2001 and 2010), Tertre Roteboeuf (2005, 2009, 2010), Belair [Monange] (2000, 2010), Latour a Pomerol 2005 and Pavie Macquin 2005.

1 Month

1 year

Green shoots?

It’s noticeable that merchants have been talking about restocking since July which can only be positive, but there are opposing views on where the latest data may lead the market.

With the exception of a 0.94 rise in the First Growths Index in December 2013, price declines have been inexorable since then – until now. The trade is split however on how much further First Growths have to fall, especially amongst the previously most inflated wines. With the First Growths down -27% since the peak in July 2011, a small rise of 0.98% may be positive but the inevitable continuing focus on value on the part of buyers favours the possibility of as many - or more - fallers vs risers over the remainder of 2014.

The Medoc classed growths saw a 0.7% uptick in March 2014 in addition to a rise last December in line with the First Growths. Taking all the data into account, it’s hard on that basis to read anything into the recent comparable bounce back from August lows.

The Libournais Index has performed the strongest over the last year with a 2.3% rise between mid January and mid February 2014, comparable with the performance over the last month after a summer of declines. Relative scarcity and a positive 3-year performance (+8%) suggest that the conditions for a broader based recovery are more firmly established for right bank fine wines.

Perhaps of significance, the 22 Bordeaux constituents showing price growth in the WO 150 index since the end of July compares with just 10 Bordeaux wines that have traded in positive territory on a 12 month view.

by Wine Owners

Posted on 2014-07-08

If a wine is from a first class vintage (serially dubbed ‘the vintage of the century’) and has scored a perfect or near perfect score, surely that wine is likely to give the greatest thrill; after all it’s considered the best that there is.

Or is it? If pleasure is what you're after, pulling a cork on highly–rated wine may be the most disappointing choice, especially if it’s from a relatively recent vintage.

Take the example of 1996 classed growth Medocs. Pontet Canet 1996 has impressive depth and purity that is currently held in check by a slowly receding tannic frame and enduringly fresh acidity. But one day it will surely be a very great wine.

Wines from so-called ‘off vintages’ (also known as restaurant vintages, shoulder vintages, an overshadowed by …. vintage) may give far superior current pleasure than its more illustrious, fêted siblings. Sticking with the Pontet Canet example, take your pick from 2002, 2004 or 2006 for wines which today deliver greater visceral pleasure; whether you favour Asian spiced, sweetly grained or delineated and pure fruit.

Switching to burgundy, surely great pinot noir doesn’t require the long wait of the finest red Bordeaux? Not so. Anyone who’s tasted the very best that 1999 has to offer will know how un-evolved, fruity and dense those wines still are. Sure, they impress with their texture and depth, but at the dinner table can disappoint with their primary-ness.

That peacock’s tail array of scent and flavour will one day burst out of the glass, seducing and beguiling the drinker. But today these wines merely provide waypoints to their future destination.

By contrast, the under-appreciated burgundy vintages of 1997, 1998 and 2000 provide some incredibly succulent current drinking, including Engel’s Vosne-Romanée Brûlées 1997, Ghislaine Barthod’s Chambolle-Musigny Les Cras 1998 and Denis Mortet’s Gevrey-Chambertin Champeaux 2000. There are countless others to pick from.

Thinking of arguably the greatest modern-era Italian, Roberto Conterno’s Monfortino, how can one compare the delicate 2002 with the blockbusting 1999? 2002 was a year in which most of sodden Piedmont suffered badly. Yet here is a sweet, perfectly poised wine showing soft red fruits and noble length. In contrast the 1999 is stunningly defined and intense, and a future monument for 10-20 years hence. But I’ll drink the 2002 now in preference.

What good is a cellar full of great vintages if you end up broaching so many of them in their infancy? Raise a glass for under-appreciated vintages. So often they will surprise and delight you, and may even win your best wines of the year awards!

Looking for ideas?

Leoville Barton 2002 - £450 (12x75cl) including duty and VAT

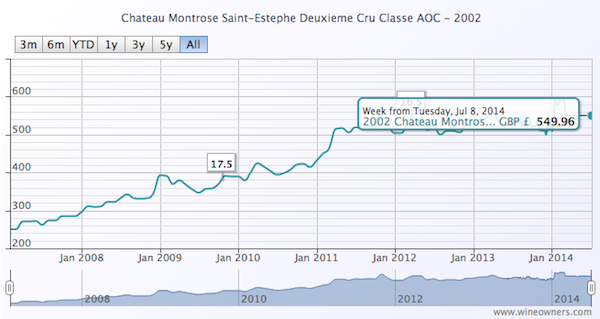

Montrose 2002 - £550 (12x75cl) ) including duty and VAT

Malescot St. Exupery 2004 - £350 (12x75cl) In Bond

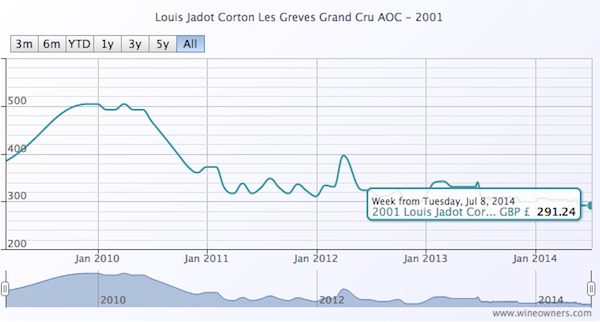

Louis Jadot Corton Les Greves Grand Cru 2001 - £150 (6x75cl) In Bond.

by Wine Owners

Posted on 2014-06-26

We were guided through this fascinating tasting by Anthony Barton’s grandson, who had kindly offered to guide us through the vintages and offered insights into his family history.

The origin of the Barton family’s involvement in wine stems from the peculiarities of the English taxation system in the 1700s. The family business had been selling sheepskins from Ireland where they had previously settled from England. But Irish products were subject to high import duties at the time. In contrast Aquitaine enjoyed a favorable trading status with England and so the business was relocated to this favorable tax jurisdiction.

However, pressure was exerted by local interests who were perhaps not keen to be party to a European tax carousel, and so the Bartons developed wine interests, first as a merchant, and in the early 19th century as a producer through the acquisitions of Langoa Barton and then part of the Leoville estate that became Leoville Barton.

We tried the vintages in three flights, beginning with 2006 and 2000, two powerful and structured vintages that demonstrate excellent potential; followed by 2007 and 1999 as examples of overlooked vintages that are well priced and offering great current drinking pleasure. We rounded up the evening with two high profile vintages, 1989 and 1990, illustrative of great, maturing vintages on their plateau of drinkability.

Notes

Future promise

2006 – Pronounced pepper and graphite nose, , elegant fruit but still on its reserve. Full of future promise.

2000 – A classic pencil-shaving nose, and displaying effortless balance. Delicately poised, a fine of finesse, yet still quite elemental. Greatness around the corner.

Early drinking crowd-pleasers

2007 – Lush, velvety nose, spiced warm palate, lovely food wine.

1999 – Fresh mint nose, expressive palate of angelica, puerh tea, licorice. Lip smacking and massively satisfying.

Mature classics

1989 – Super-structured and painfully intense licorice. Huge length of flavor. Impressive but not entirely integrated. An adolescent - needing several more years to fully resolve.

1990 – Incredible nose of anis and macerated cherries. Lifted black cherry and hedgerow fruits, with a weight and svelte palate that reflected greatness.

Conclusions

A quick straw poll revealed the 1990 (perhaps unsurprisingly) as the favourite wine of the evening, narrowly trailed by 2000, with 1999 and 2006 tying for bronze.

A big thank you again to Damien for joining us, to our friends from Asset Wines who organised this event with us, and to Aurelien and Morgane for welcoming us at Pall Mall Fine Wine!

by Wine Owners

Posted on 2014-06-09