by Wine Owners

Posted on 2018-04-12

A late return tonight (past midnight) and a long day, waking at 05:00. But there's still gas left in the tank, so to speak. Over the course of the day we gathered thoughts in advance for the below.

Saint-Julien Delivers

JR has been looking for patterns all week - some form of shape around which to build recommendations for wise en primeur purchases. Until this afternoon we failed to find anything solid, but then...Saint-Julien delivered. At the UGC (Union des Grands Crus) Saint-Julien tasting hosted by Chateau Beychevelle at its modern-looking new winery, we noticed a clear consistency in the wines; there wasn't a dud among them. Well, maybe there was one, but we don't need to talk about that as it wasn't really that bad. Either way, this was the first appellation we'd seen where quality was reliably high in these en primeur tastings. Everywhere else had required dedicated tasting to work out what was hot and what was not. So thank you Saint-Julien, and bravo!

Bright Whites

Of course, as soon as this pattern had been spotted, we remembered another that we wanted to talk about yesterday(but ran out of time). It's the incredible purity to the whites this year, all around Bordeaux - not just in Graves where we were today (starting with Haut-Brion, Pape Clement and Smith Haut-Lafitte) but everywhere. Lovely balanced wines great concentration and acidity, and pithy, chalky tannins. Our tasting notes are full of descriptors like kaffir lime leaves, sweet sage, gooseberry, sherbet and candied lemon. Even lemon verbena made it in there. 2017 looks like a really great year for Bordeaux whites.

©Nick Martin / Wine Owners

The Cold Shoulder

Frost - the running theme of conversations all around Bordeaux this week - was as much as issue in Graves as it was in the right bank. The frost pattern here in the Graves seems to have been much more black and white than over in Saint-Emilion and Pomerol. For some producers, there is a glittering silver lining to this rather painful situation, in that they adapted to it by significantly changing their blend and have come out smiling. Larrivet Haut-Brion is a gleaming example of this; the team there turned their blend around to use three times the usual amount of Cabernet Franc, and one third the amount of Merlot (which got severely hit by the frost). Les Carmes de Haut Brion is a similar story, and a similar success.

We have been focusing a lot on the frost topic (both here in the blog, and in our conversations with producers), but in fact a key point we'd like to make is that the frost is not something that consumers and investors should really focus on. What really matters, ultimately, is what each of the producers has managed to create. There are no strong patterns that consumers can reliably follow with regard to the frost.

Softly Softly Catchy Monkey

After a morning on the right bank, we returned to the Medoc, to the UGC tasting at Lafon Rochet. There, Basil Tesseron told us that 2017 was a vintage where it was extremely important not to over-extract, not being a super-ripe or sunny vintage. Over-extraction would just lead to mean, green bitter compounds leaching into the wine. This echoed a sentiment raised earlier in the day at Smith Haut-Lafitte, where the team did 4 pigeages per day, but no pumperovers, in order to keep the winemaking relatively gentle. 2017 was a year to be patient for picking and gentle in the winery.

©Jonathan Reeve / Wine Owners

Less (Wine) Does Not Necessarily Mean More (Money)

Despite indications given by some chateaux that smaller harvests will mean higher release prices, we see no justification for this. Traditionally, in vintages which are not 'stellar' -particularly those which followed relatively good vintages (as 2016 was) vintages, prices have tended to drop or remain roughly stable. Even in 2006 prices didn't significantly rise; they stayed roughly the same as 2005 even though the vintage clearly wasn't quite as impressive.

Tomorrow is a final look at the top producers we've not yet visited, all around the region. Lots of driving, between Le Pin, Angelus, La Conseillante, Eglise-Clinet and then back over the river to Latour, Leoville Barton and Palmer. Here's hoping for good driving conditions!

by Wine Owners

Posted on 2015-10-29

Quite a lot of members we speak to these days assume that the market prices of Bordeaux are still stagnating or falling. The morosité that had descended on the region's finest wines in by 2012 does not appear to have lifted.

Wine traders will point to volumes that are much reduced since the giddy heyday of 2009-2011, and that is of course true.

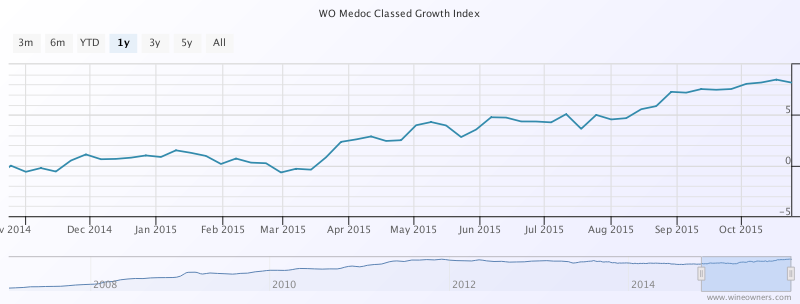

However, it does not mean that in aggregate, prices of Bordeaux have begun an upward trend. In the last year, the Wine Owners Medoc Classed Growth Index is up 8.2%.

Whereas the Wine Owners First Growth Index has only managed half of that in the last year, up 4.1%.

That's still better than the performance of the FTSE100, which is fractionally underwater over the last year, and exactly where the S&P500 has clawed it's way back to after the summer's wobbles.

Wine Owners 150 = Turquoise

FTSE100 = Navy

S&P500 - Green

However, when looking at First Growth performance over the last 12 months, it is far from broad-based. 'The further they rise, the longer they fall' seems to hold true, with Lafite 1986 and 1989 performing the worst at -8% and -9% respectively.

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1999 | -5.45% | £ 216.68 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2006 | -5.75% | £ 286.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2009 | -5.82% | £ 441.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1982 | -5.92% | £ 436.68 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1982 | -6.29% | £ 1,810.14 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1998 | -7.15% | £ 270.83 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2006 | -7.26% | £ 212.50 |

| Chateau Margaux Premier Cru Classe AOP | 1989 | -7.59% | £ 250.10 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1986 | -8.13% | £ 651.48 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1989 | -9.11% | £ 395.92 |

Among the vintages populating negative territory, 1986 has suffered with the exception of the very great Mouton. The exceptional 1989s and 1990s have fallen, along with with the dull 1999s.

The risers are headed by Mouton, Haut Brion and Latour. The top 10 performers registering double digit growth are entirely accounted for by these three Châteaux.

| Wine | Vintage | Change 1 year | Price |

|---|

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2005 | 22.39% | £ 366.67 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2008 | 21.13% | £ 262.54 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2005 | 20.95% | £ 437.50 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 1996 | 16.87% | £ 282.74 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1990 | 14.30% | £ 429.12 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2005 | 13.36% | £ 566.79 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2000 | 13.32% | £ 1,038.81 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2008 | 11.00% | £ 226.64 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1989 | 9.08% | £ 1,000.03 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1995 | 8.49% | £ 316.67 |

Crossing over to the right bank, predominant top performers over the last 12 months are St EmillMedoc Classed Growth Indexon 2005s and the 2001 Class A relative newcomers. Since March 2015 The Wine Owners Libournais Index is up 7%, coming off it's 3 year lows at that point.

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 53.85% | £ 300.00 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 48.07% | £ 176.57 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 45.67% | £ 183.46 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2000 | 37.16% | £ 301.79 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 1998 | 34.59% | £ 161.84 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOP | 2005 | 27.82% | £ 110.96 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 26.84% | £ 232.57 |

| Chateau La Violette Pomerol AOP | 2009 | 26.67% | £ 208.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOP | 2005 | 24.71% | £ 433.34 |

What can we conclude from this? Some commentators are suggesting that value is returning to older back vintages on the back of 4 year declines. Relative value vs quality is likely to be a key driver of future value, for which we recommend you check out the new price per points builder on Wine Owners to which you'll need to subscribe.

Liv-ex have recently seen a predominance of trades of the 2010 vintage, and whilst there seems to be value returning selectively to the Classed Growths, one wonders if it's a little early yet the First Growths, whose starting release prices were in nose-bleed territory. Since 'the further they rise, the longer they fall' it may yet be a bit early to call.