by Wine Owners

Posted on 2019-08-20

A brief and holiday interrupted report for activity in July

The wine market continues to hold its breath. Boris fulfils (what somehow now feels like) his destiny and moves into Number 10 and the pound plummets. It has since recovered a bit but even so, the wine market didn't flinch. As we know, a weaker pound generally leads to increased demand in the sterling denominated secondary fine wine market, especially from U.S.$ based buyers, but maybe not during the hot days of summer? Certainly not when the U.S./China trade wars rumble on, the rhetoric becoming ever stronger, and most definitely not when Hong Kong explodes into the most violent scenes of pro-democracy protest in its modern history. The Brexit backdrop adds to the confusion, so no wonder little happens.

The largest market within wine will always be Bordeaux and it is business in the wines of Bordeaux that is suffering the most from this continued malaise. Many of the other top wine regions are less affected by these global events and market conditions as the wines are more scarce, with the supply and demand ratio is in a different place. Bordeaux has been looking cheap versus its peers for some time now, but the stars need to start aligning. This can and will happen, but when is the big question!

Despite these almost stagnant overtones, trade has never been brisker with July setting a record level of turnover. Numbers of users, bids and offers forever grow. Collectors looking to trim positions have been well accommodated by others adding and reorganising their cellars, something we are seeing a lot more of.

Burgundy continues to look for its feet, Champagne and Super Tuscans gently hum along nicely, and we’ve seen a little demand for some of the new world too.

Here at Wine Owners, Barolo dominated trading in July. Many vintages of Bartolo Mascarello changed hands, also many Bruno Giacosas, Riservas and otherwise. Fratelli Alessandria becomes ever more popular, as does Luciano Sandrone. And there were some big-ticket trades in Monfortino and Ca d’Morissio.

Miles Davis, 20th August 2019

miles.davis@wineowners.com

by Wine Owners

Posted on 2017-09-13

After a busy summer including in August our most productive trading month to date, we thought it would be instructive to run some analysis of trading trends and movements, compared to the same quarter in 2016.

Market share between regions remains relatively stable despite a large increase in trading value overall, with Bordeaux holding first place with a 75.14% share of market compared to 78.15% in the same quarter of 2016. That there is a drop is interesting in its own right, perhaps pointing to greater diversity in wines offered for sale, as well as to diversifying demand in export markets.

Burgundy is the major winner in market share, extending from 11.78% in summer 2016 to 17.10% over the same period in 2017, and we’ve certainly seen an increase in Burgundy purchases from Far East markets, showing a 17% increase on 2016 numbers by value.

Other regions remain very much minority sports, with Rhone up to 2.03% from 1.8% and Italy, surprisingly, down from 4.85% to 2.5%.

Within Bordeaux, the share of the market taken up by First Growths has grown from 28.26% in 2016 to 44.05%, perhaps reflecting heightened interest in the top wines, though the real interest is in how the First Growths compare within their own category.

Haut Brion is the major winner amongst the Firsts, increasing its share of the Bordeaux market to 13.35% from 3.2%. As a proportion of the First Growth market, the share increased from11.31% to 30.3%, putting Haut Brion at the head of the market alongside Lafite.

Lafite moved up to a 13.34% share of the Bordeaux market from 11.62%, but lost ground against the other First Growths, slipping to 30.29% from 41.12%, exchanging a clear lead in the class for an almost dead heat with the progressive Haut Brion.

Mouton showed a similar fall-off in share, dropping from an 8.63% share of Bordeaux to 7%, and a 30.54% share of the First Growth market dropping to a 15.89% share. Market and trading values for Lafite and Mouton remain robust however, so this feels more like a positive story about Haut Brion than a negative for the two Rothschild properties.

Latour has benefited too here, growing a very small share of Bordeaux (1.18%) to 5.07%, and increasing its share of the First Growth market from 4.18% to 11.05%.

Margaux has the least movement to comment on, increasing its share of the Bordeaux market marginally to 5.29% from 3.6%, and falling from 12.84% to 12.01% in its share of the First Growths.

by Wine Owners

Posted on 2016-03-24

Sales of Bordeaux through the

exchange saw a significant increase on the preceding month, rising from a 75%

share of the market to 88%, the highest market share since the launch of the

exchange in 2013. Bids overall in Bordeaux have increased in value by 2

percentage points, perhaps reflecting a slight upturn in confidence in the

market.

The steep rise in Bordeaux’s market

share overshadows other regions, pushing Burgundy right back to 5%, though the

figure reflects less a decline for Burgundy than the strengthening of the

market in Bordeaux. Volume and value traded were in fact similar to the

preceding period. Rhone had a poor showing overall, dropping market share to

1.3%. Again, the figure is skewed by Bordeaux, but in any case volumes were

down, mitigated only by a flurry of interest in Henri Bonneau triggered by the

announcement of his death on Wednesday. The remainder of the market was shared

almost equally between Champagne and Italy, where trading in top level Barolo

oustripped Supertuscans two to one.

As usual, the First Growths accounted

for the lion’s share of the Bordeaux market, 72% of the value of Bordeaux

trades were made up of 1ers crus and their right bank equivalents. Several

large trades in Haut Brion saw that wine take 61% of the value of 1st

growth trades, though Mouton continued to hold its own at 11.7%, down by

percentage on the preceding period, but up in overall value and volume. Lafite

remained strong at 5.8%, with Latour and Margaux lagging behind. Petrus showed

strongly too, picking up a share of 11% among the 1st growths,

though the high value of these wines always has a tendency to distort market

share by value.

Access the Trading Desk to view recent trades, bids & offers.

by Wine Owners

Posted on 2016-02-15

As expected, Bordeaux continues to dominate trading on the exchange both by value and volume. Reported figures much the same as the previous quarter, with Bordeaux accounting for 75% of trades, and 75% of trading value. The latter is a 5% fall from the previous quarter, which reflects an increased number of trades overall, and in increase in bulk trades of slightly lower value wines in the runup to Chinese New Year.

Burgundy has increased market share on last quarter, now accounting for 15.75% of trade by value, and 11.55% by volume. Both figures are big steps up from the previous quarter, and serve to demonstrate that the marketplace is still small enough to be affected by parcels from individual collectors providing a sudden elevation in liquidity, especially outside Bordeaux.

The First Growths accounted for the largest shares of the market in terms of value trades, and within that number Mouton Rothschild had the best of it, with a 31.8% share of the First growth market by value. Lafite trailed slightly at 26.1%. Haut Brion showed higher than expected at 16.67% and Margaux held its ground at 11.9%.

The surprise in this quarter has been Latour, which has trailed at 7.14%. Hard to determine whether that’s just slightly lower availability of Latour in the market over that period, but either way it seems like the two Rothschild properties are on top at the moment.

The increased focus on Burgundy came at the expense of Italy, which seems to be slightly off the boil compared to the previous quarter’s promising outlook. In fact, Italy was clearly overtaken on volume by the Rhone, which ran at 5.89% of volume traded v Italy’s 1.54, although on value traded the figures are rather closer.

Access the Trading Desk to view recent trades, bids & offers.

by Wine Owners

Posted on 2015-10-29

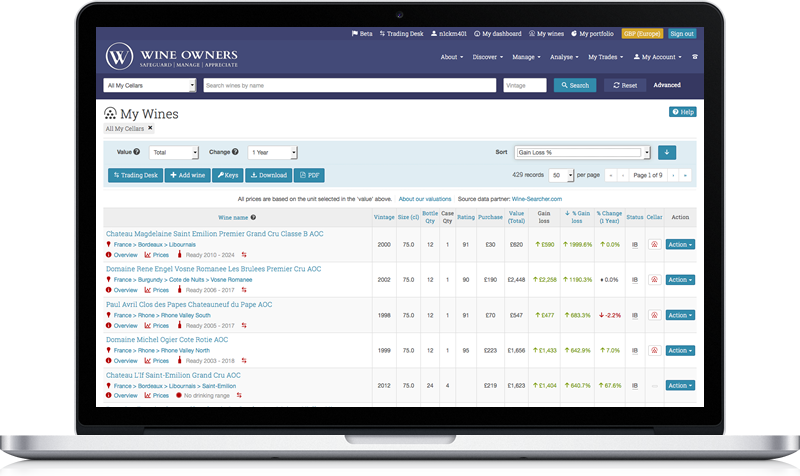

Our goal? Simply to be the best platform in the world where wine lovers and collectors can do absolutely everything they want to do. We are the go-to address for your personal wine management. Whatever you need to help you do that we'll build!

New www.wineowners.com is a responsive website, which means it automatically adjusts according to the screen size and resolution of the device you are using.

More and more we use multiple devices that come in diverse shapes and sizes. The new Wine Owners mobile website allows you to access Wine Owners from almost any device, wherever you are. The screen including the menus adapt to the screen size you are using. On a smart phone for example, the top navigation looks like and behaves similarly to an App.

Also available on mobiles and tablets is Label recognition, allowing you to take a picture of label with your device's inbuilt camera, and choose whether to research, add or consume wine using this cutting edge method.

The advantages of a responsive website over a downloadable App are that you have access to all the functionality of the entire site without compromising any features or activities; there’s no need to download periodic updates, and your site preferences persist across any devices you may use to access our website.

There's a raft of new functions and improvements which we've included, answering many of your requests for more...

New functionality

As well as the new interface designed for mobile use, we have also added a number of new functions in this release:

Portfolio Management

Trading exchange

My Market Position panel, showing all your offers, bids, pending trades and order history with links to the detail lists

User experience

by Wine Owners

Posted on 2014-12-17

Anticipating buying opportunities

The subdued state of the Bordeaux market offers buying opportunities, such as First Growths from 1996 and right bank wines from 1998 – superb vintages that are coming into an early stage of their long maturity phase. Because of this demand ought to pick up. 1996 in particular looks fair value following declines of 40%, with the exception of Lafite which still commands a premium.

Volatility creates buying opportunities in any market, and wine is no different. When sentiment is negative, markets will tend to overshoot as they readjust. In wine, the very greatest vintages, comprising wines that are most susceptible to high prices at release, are often those that are sold off the hardest.

One such vintage that has been sold down over the last 3 years and yet which is one of the ‘greats’ is 2005. Whether the market has yet hit bottom is hard to judge. What is sure is that 2005 is the next great vintage following 1996 and 2000 that has a huge drinking window.

2005 may have been under-rated by key critics relative to 2009/2010. The likelihood of this vintage seeing improved ratings is greater than a downside, and any broad-based re-rating of them as they start to show their true class will spur price rises. Spring 2015 could well be the turning point for this vintage.

Back vintages of right bank Bordeaux have started to pick up, with the top of the market leading the way. This may have a positive effect on the peer group of right bank, merlot-dominated top wines. Typically production volumes are much lower than the big Medoc (left bank) estates, and scarcity exerts a greater influence on market pricing of older vintages.

This is an extract of our report 2015 FINE WINE PREDICTIONS

by Wine Owners

Posted on 2014-12-15

Bordeaux re-evaluated

Bordeaux’s steady decline from its broad-based peak in the summer of 2011 has led investors to reappraise the role of red Bordeaux, and especially the First Growths within their portfolio.

Whereas before 2010/11 top red Bordeaux might have accounted for 90-95%+ of all wine investments, these days diversification is seen by many as much more important as a hedge against volatility.

Market watchers now see buying opportunities on the back of 4-5 year lows and expect the Bordeaux market to move up in the next year. This is a likely scenario in respect of Classed Growth Bordeaux from the best years and First Growths from the lesser years, barring near-term risks posed by economic and geo-political externalities.

Sentiment towards Bordeaux will improve as prices bottom out. From 2008 onwards many new participants entered a frothy market. Several have now exited (e.g. Wine Networks owned by a Korean Telco) and many of the cold-calling wine investment companies that profited from a fast-rising market have gone bust – all of which have caused price falls to accelerate as stock was dumped. This unwinding has been necessary and essential for the market to resume normal functioning.

Looking ahead, prices of back vintages will start to firm up as channel inventories need to be refilled and as consumer confidence slowly rebuilds. Calling the bottom of a market is notoriously problematic, but back vintages are looking more interesting, right now, than at any time in the last 5 years.

Futures market in the balance

The new Bordeaux release of the 2013 vintage was the damp squib that everyone predicted and confirmed that the en primeur (futures) market is moribund.

Looking forward, 2014 is promised as a good to excellent vintage that would normally see prices rise. This time around it will need to be different: a moment of truth for the en primeur system.

As long as top wines are favourably priced at a discount to 2013 releases, en primeur may spring back into life, and the rest of the secondary market will be given further impetus. To this end a strong dollar will help.

The question is whether Chateaux still value the role the consumer plays as stockholder or whether that role is being taken for granted. There are only two reasons to buy young wine before it is bottled: either because it will be difficult to find in the future or because it’s better value to buy early. For Medocs and Graves, scarcity isn’t an issue, so it has to be much cheaper than when it is available in bottle for consumers to buy en primeur.

This is an extract of our report 2015 FINE WINE PREDICTIONS

by Wine Owners

Posted on 2014-07-02

You might also like our first infographic: The 9 Commandments to Wine Collecting

by Wine Owners

Posted on 2013-11-21

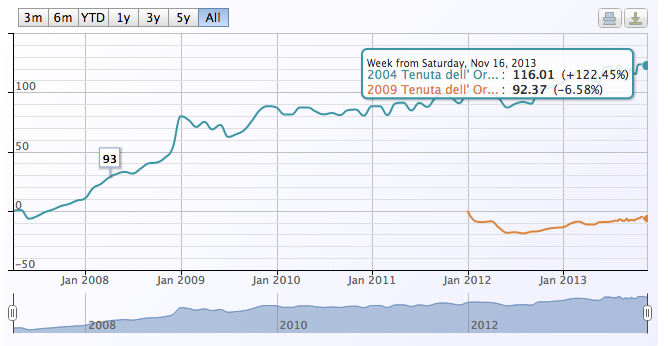

Among all wines that were bought and sold this week on the Exchange, let's take a look at Tenuta dell' Ornellaia Ornellaia Bolgheri 2004.

Bolgheri is one of Italy’s most prestigious vineyard areas, with a reputation based around terroir-driven Bordeaux style blends from iconic estates such as Sassicaia and Ornellaia. The main focus of the Bolgheri DOC is the importance of terroir and for this reason, the Bolgheri Rosso and Bolgheri Superiore wines are labeled without the mention of grapes, as terroir is considered more significant than grape varieties. It is also why Bolgheri wines are reputed for their true expressions of terroir.

Tenuta dell' Ornellaia Ornellaia Bolgheri 2004 reached a market price peak of £1403.76 at the beginning of November and is now hovering around £1,380, with the most recent trade on the Exchange at a level of £1244.

'The 2004 Ornellaia (magnum) has always been a beautiful wine, but stylistically it stands out quite a bit from other vintages of this era, something that is particularly evident in this tasting. The 2004 is perhaps the most delicate, feminine Ornellaia ever made. Silky tannins frame a perfumed core of ripe fruit all the way through to the sublime finish. The wine's inner fragrance, sweetness and balance are all impeccable. The 2004 remains one of my all-time favorite Ornellaias, and it is firing on all cylinders on this night. In 2004 the growing season was long and even, with a cool early summer and warmer late summer. Yields were on the high side, as the vines released the stored energy they had held in reserve from the previous year, which required the estate to aggressively green harvest in order to keep the plants in balance. The 2004 Ornellaia is 60% Cabernet Sauvignon, 25% Merlot, 12% Cabernet Franc and 3% Petit Verdot. The relatively high percentage of Cabernet Franc may explain the 2004's gorgeous, vivid bouquet. The wine spent a total of 18 months in oak (70% new) prior to being bottled. Anticipated maturity: 2012-2024.' 95 points, Antonio Galloni

Interestingly, the younger 2009 vintage, rated 97 points by Robert Parker, gravitates around a market price of £1,108. It slightly dropped from its release price of £1186. This raises two questions. First, can the 2004 stand as a benchmark against which younger vintages are compared? In which case will the 2009 follow the same trajectory over the next few years?