by Wine Owners

Posted on 2022-02-03

As eagerly anticipated as the Sue Gray report, here it is, the annual WO round up and look ahead.

So, what happened?

2021 turned out to be a very good year for the wine market, the owners of wine and therefore for Wine Owners Ltd. also. Turnover on the exchange ramped up by 77% in 2021, producing more buying and selling opportunities than ever before! Our tenth year of trading is set to be an exciting one and has started well.

The broad based WO150 Index returned +15% with the stars of the show being Champagne and Burgundy, posting respectively +30% and +27%. Bordeaux returned a more modest 10% while Italy, having led the charge in 2020 came in with more modest numbers, yielding 6.5%. Tuscany performed better than Piedmont which was flat on the year. The Rhone did well, notching low double figures and the Rest of the World was twice as good as that, all thanks to California.

The reasons for the strength in the market were various; probably the biggest two were continued liquidity being pumped into the system in a low interest environment pushing more buyers into real assets, and the very real fear of inflation. Savings derived from staying at home more seems to have pushed up the spend on what people have been consuming at home – a quality driven drowning of sorrows in yet another lockdown!? The lifting of U.S. tariffs on some European wines brought a weight of new buying activity from across the pond, as did a lot of ‘new wave’ investment dollars - this should not be underestimated.

The market pre Covid had been largely stifled by various different factors but once demand started to outstrip supply, the market started to motor. Hong Kong and China were not responsible (for once) and collectively have been less of a force in recent times. Stringent lockdowns and border controls have meant very few visitors, especially of Mainland Chinese to Hong Kong, and an exodus of wealthy residents seeking a more liberated culture – some of the demand is moving elsewhere. Current thinking is that will last for some time (not just until after the Winter Olympics!), so be warned. I would expect Singapore to take up some of the slack and become a more prominent player.

Champagne

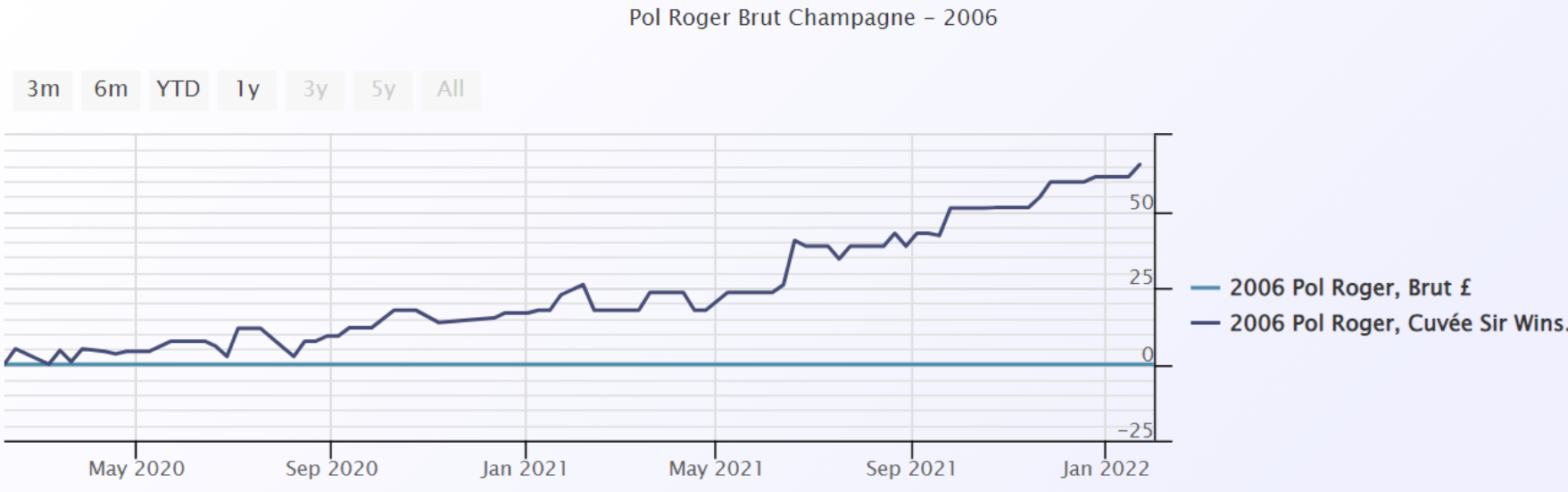

I cannot remember Champagne ever being the star turn in the wine market before but given the cyclical nature of the market and the fact that the different regions are much more equal than they used to be, it is not surprising. It has also consistently delivered steady returns, see my report from last July, just before the market really accelerated. Reports of supply shortages coming out of the region and a slew of really good quality releases added further weight to the concept of Champagne as an investment proposition which led to some voracious buying activity. The Champagne Index is dominated by the biggest names and/or the tête de cuvée of noble producers. As ever, fine wine collectors and investors focus in on the most prized assets driving the gap between the seriously good and the seriously a little bit better than that ever wider. Here’s a good example, vintage Pol Roger ’06 versus the Sir Winston Churchill cuvée from the same year:

The ‘simple’ vintage Champagnes from good producers offer extremely good value to drinkers and is a segment of the market that has been left behind.

Where Champagne goes from here is one of the big questions as some of the recent returns have been enormous. Various vintages of Krug, Dom Perignon, Taittinger’s Comtes de Champagne, Pol Roger’s Winston Churchill have added more 50-100% in the last year and rosé Champagne has been bought in a way not seen before. I am tempted to take some profit from some of the biggest risers and look for some laggards.

Burgundy

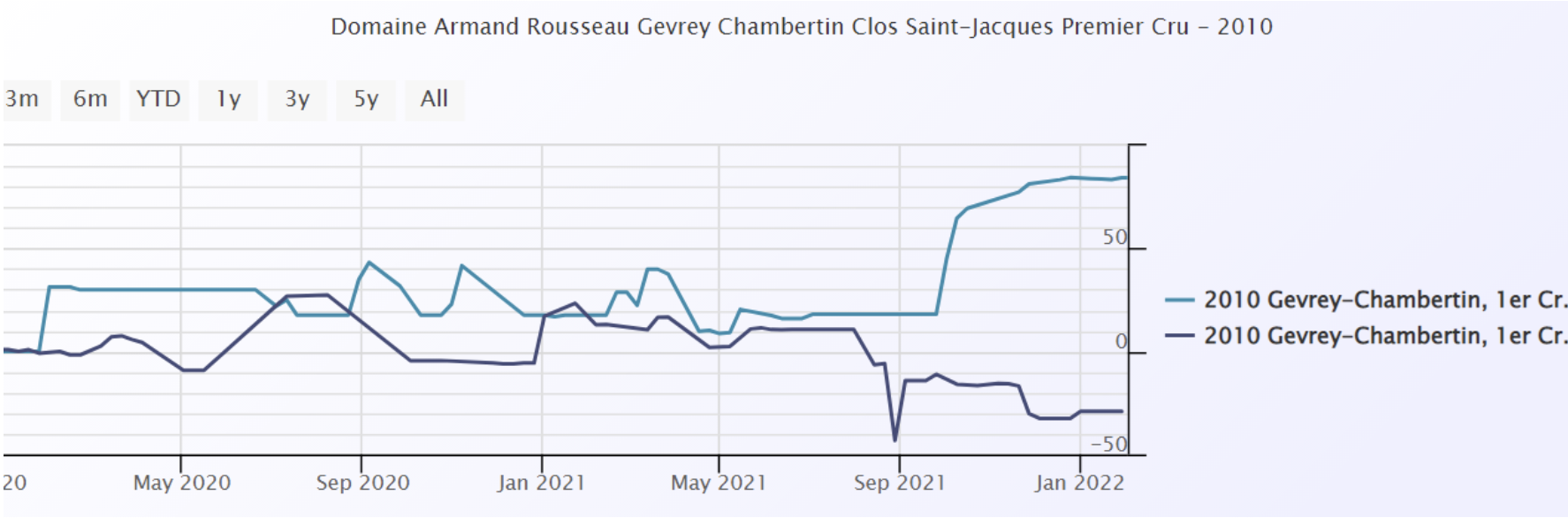

The polarisation of the wine market and the premiums attached to the most desirable names have continued to grow and probably make less sense than ever before. Names such as Leroy, DRC and Rousseau in Burgundy have outperformed their neighbours and as highlighted in some of our recent offers, often trade at multiples of equally high scoring wines from the same vineyards but from less famous producers. Obviously, this creates opportunity and I feel more comfortable making bets at the prices that are a fraction of the big guys. Here is a comparison between Armand Rousseau’s Clos St. Jacques (light blue) versus Bruno Clair’s. This sort of chart can be repeated numerous times - premiums have become too large for my liking, but if Rousseau is your man and you have the cash….

The current shortage of 2020 red Burgundy and the general short supply frost hit ’21 vintage, see report from last November, will push prices and demand ever higher and whilst some price performances seem overly vertiginous, I anticipate they will continue their path – for now at least. High rollers love spending big on Burgundy and the small production levels really adds the glitter dust to this famous region. And there are always the producers that are beginning to make a name for themselves.

Bordeaux

Bordeaux had a decent year, posting +10%. Apart from a brief flirtation with the 2019 en primeur release, Bordeaux has not been sexy for a very long time now. Market share continues to fall as other regions eat into the Bordelais’ gateau. It is still, and always will be, the largest slice of the market and those who buy into the general wine argument and need liquidity are best allocating here. It has become the steady Eddie. As a massive generalisation you know what you’re getting in your glass with a Bordeaux; a lot of that infuriating yet bewitching and beguiling wonder of what to expect from your wine just doesn’t exist in the same way that it does with Burgundian Pinot or Piedmont’s Nebbiolo and passionate collectors are just not quite so aroused by its charms (as I said, a generalisation!). I expect it to remain firm however.

Italy

Italy has had a mixed year. Super Tuscany has done well, the massive names of Sassicaia, Tignanello and Masseto have continued to shine posting average gains in the region of 25%, 35% and 25% respectively, and Solaia and Ornellaia also, but not so brightly. Lots of smaller Brunelli have fared quite well and this sector continues to build – hardly surprising given the price to quality ratio. Piedmont has had a mixed time, Monfortino in general is up a little in most vintages but lots of big names across the region have remained unchanged. I would not be surprised to see interest return to this area once Burgundy’s current run has blown through. There are still numerous 2016s looking very interesting for the longer term.

The Rhone

The Rhone valley is more appreciated than ever before. There are numerous cult producers all over Cote Rotie, Hermitage, Cornas with St. Joseph coming to the party nowadays. Prices of Rayas product from down south have travelled to the far north as collectors chase these rare treasures. White Rhone is still very much a speciality interest but one to keep an eye on. I have bought a lot of red Rhone for drinking from the WO platform in the last year or so as the combination of maturity, quality and price is virtually impossible to beat. There are plenty of names delivering superior returns too.

The Rest of the World

California has dominated the remaining regions with some ease, posting over 20%. Screaming Eagle has led the pack, followed by Ridge and Dominus. Australia has suffered at the hands of China’s tariffs.

Conclusion

I am confident the market will continue to perform well this year. Sentiment is strong, and supply in some key areas is shorter than usual, especially Burgundy. The inflation fear mentioned earlier is real and wine has been seen as a good hedge against this for a long time now. Interest rates are likely to rise but remain historically low and the real asset argument holds sway but will lessen as QE reverses – something to keep an eye on. Access to the fine wine market is greater than ever before, particularly in the U.S., and continues to grow.

As ever, I would be delighted to hear from you to discuss any of this, or anything else wine related. I am happy to help and advise on your portfolio or cellar, for investment or drinking purposes. And now we can go out again I would be delighted to share a bottle!

Miles Davis 02/02/2022

by Wine Owners

Posted on 2021-07-11

Will Cheval Blanc and Ausone no longer be Grand Cru Classé ‘A’ as from the 2021 vintage?

If so, it won’t be because of the Commission de Classement. The closing of the Saint-Emilion classification applications took place on June 30 and neither Cheval Blanc nor Ausone returned their copies.

Unlike the left bank classification system of 1855 that is pretty much immutable (with the exception of Mouton’s promotion to Premier Cru in 1973), the St Emilion classification is reviewed approximately once every 10 years, permitting a periodic revaluation of quality and performance. It’s not all been plain sailing; the 2006 reclassification was plagued by accusations of impropriety and was eventually annulled. Consequently, tastings conducted for the 2012 reclassification were outsourced to independent groups from across France to rehabilitate the process.

Cheval Blanc and Ausone, the first St Emilion producers to be awarded Classé A classification in 1954 when it was created, are effectively leaving the classification system.

The Classé A incumbents evidently concluded that the system is no longer sufficiently discriminating to reflect the ranking of their respective properties compared to their peers.

This bombshell threatens to undermine the kudos and financial benefits of promotion to Classé A, and in turn the market pricing potential of those that are elevated. Not to mention it raises questions of the credibility of the St Emilion classification system more broadly.

So what does the two colossus’s departure say about the process of decennial review? How does this reflect on the composition and process of the Commission de Classement?

Is Grand Cru Classé A about to lose its lustre; devalued by ambitious properties busy erecting glitzy edifices? Concrete and stone, some say, matter more than they ought to compared to the brilliance of the wines and their track record.

Or, is Classé A promotion a reflection of the qualitative transformation we see taking place in St Emilion - given the strongly weighted preconditions of a sustained track record of exceptional results and market recognition - and therefore are not elevations thoroughly deserved?

Let’s see what happens over the coming weeks. Can Cheval Blanc and Ausone be courted back into the fold, or is their departure (by omission of submission) a fait accompli? Assuming the latter, perhaps we'll see more promotions next year than we might have otherwise. What effect this all has economically on those producers who attain Classé A classification is now more uncertain than ever.

by Wine Owners

Posted on 2021-06-30

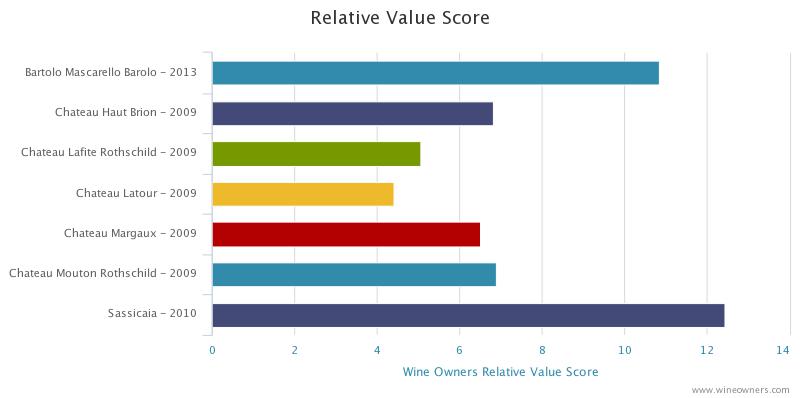

As mentioned in our recent and well received offer of the incredibly well priced Montepeloso Eneo 2010 (there are a few left), we promised a closer look into the relative value of Italian wines. I know I have been banging on about Italy for quite a while now but there is every reason for it – there is some terrific value to be had, and so on will I bang!

The facts are that there are only a handful of Italian wines that trade at, what we are going to call here, ‘silly money’ compared to vast swathes of wines from their rather posher neighbour - namely La Belle France. It is true that the same can be said for Spain, and for most of the New World. The U.S. is an exception, as like France, it has many an offering at ‘silly money’. But for my pound, I say sweepingly, these regions do not offer such a vast variety of quality wines that appeal in quite the same way (I should qualify at this point I am really talking about top quality red wines).

What Italy offers, unlike everywhere else, is a multitude of wines at relatively affordable prices with absolutely massive ratings. There are two variables here, the prices and the ratings; the simplest explanation for the comparatively lower pricing is that Italian wines have not yet been recognised, and accordingly priced, as truly international brands. Put another way, Asia has not got to grips with it yet. Other than a few ‘Super Tuscans’ and the top labels from the likes of Giacomo Conterno, Bruno Giacosa and Gaja from Piedmont, very little starts life close to £100 a bottle. There have been half a dozen EP releases every day last week from Bordeaux that qualify for that prize! In Burgundy a hefty percentage of premier crus start there and for some more sought-after growers, your £100 only buys you a taste of a lowly village wine.

The ratings are, rather obviously, dished out by the critics. It is worth remembering that each region is scored on its merits in a peer group fashion. The wines, as are the vintages, are reviewed in the context of that individual region or vintage. What has happened, however, is that tones have been set for different areas which do seem to vary from each other. Burgundy, for example, tends to harbour rather conservative scoring where anything over 95 is a massive achievement. Prices for these trophies are also massive. It is different in Italy. There are countless Brunelli with huge scores and even people in the trade ask, ‘how come there are so many 100 pointers we’ve never heard of’?

A possible explanation is that the bar has been set so high, and for so long, by the likes of DRC and Rousseau that a mere premier cru from someone like Dujac or Roumier is only worthy of 90/91 points. So, perhaps a cleaner canvas for the critics to assess has led to some more generous brushstrokes? Or perhaps it is a more generational thing; France has long been understood, consumed, and pontificated upon by the old guard, who might not quite understand the Italian way? An old friend of mine, an experienced wine merchant recently said to me “I don’t really get Italian wine” (Burgundy and Sauternes are more his bag!) and then confused me further by saying “except I couldn’t possibly eat Italian food without Italian wine”. I understand exactly what he means with the latter statement (but not the first), and this goes from pizza level all the way to Piazza Duomo, a three star Michelin in Alba – quite good by the way! Either way, some of the scores in recent times and particularly for the amazing ’16 vintage, in all of Italy, and the ’15 vintage in Tuscany, have drawn truly flamboyant landscapes from the young masters – and for not many Lira either!

The other thing to remember is that the critics live and die by their reputations, so if they are going to award high nineties or even the magical triple digits, you know the wines are going to be very good indeed – within the context of their peer group.

Obviously, we would love to hear from you to discuss the opportunities further and there will be offers to follow based on this theme. In the meantime, you may want to engage with the ‘Advanced Search’ button or take in some of these names which spring to mind:

Piedmont: Alessandria, Cavallotto, Grasso, Sandrone, Scavino, Vajra

Tuscany: Fontodi, Fuligni, Grattamacco, Il Poggione, Isole e Olena, Pertimali, Montepeloso

Ciao for now! Miles 07798 732 543

by Wine Owners

Posted on 2020-12-09

Miles Davis, Wine Owners December 2020

As we head into the final phase of this extraordinary year, the world of wine investment is a calm and beautiful little side water, gently ebbing and flowing with that serene feeling it knows where it is going.Traditional assets continue to bounce around, no doubt causing palpitations and stress. More than ever, this year has been about timing in the capital markets, and if you got that wrong, the chances are you got it expensively wrong. Not so for vino! Unlike after the global financial crisis, the wine market has held its nerve, merchants did not mark down prices and the market has been stable. Investors are about, and even Bordeaux prices feel like they are firming up. Collectible assets are in vogue and it is easy to see why given these circumstances. You cannot even hold, let alone drink, a bitcoin, a share, a derivative, an option or a future and a bottle feels good, especially in lockdown!

Demand from Asia has increased and merchants trading the big names have been pleased with activity levels in recent weeks. There is almost a feeling there is an element of restocking going on after a quieter than usual period (in Asia) over the preceding months. This has happened in a period when the currency has gone against dollar buyers, although only marginally. Buying is very specific but certain names have moved up considerably since the middle of the year, Mouton ’09 and ’10, for example, are both up c.10%, the controversial ’03 c.14%. There does not appear to be any thematic buying, however, so it is not possible to call a vintage, or a certain Chateau or producer. Keep looking for the relative value is my suggestion and do not forget to make use of the useful tools we provide. See below for an example (if anyone would like a demo on how to use this, please ask):

In Burgundy, especially in the trophy sector, if it is not in its original packaging it is not going anywhere and vice versa. We have seen big ticket items in Leroy and Cathiard sell well recently. Provenance is key and is proving valuable.

Piedmont, Super Tuscans and Champagne remain firm, as does my conviction as areas for further purchasing.

We have had a lot of demand for Penfolds products; whether that continues given the newly slapped Chinese tax on Aussie wine imports will be interesting to observe but, in the meantime, we have plenty of two-way activity.

Personally, I have never been able to compute the prices of some of the ‘Cult Californian’ wines but, in fairness, I have rarely tasted them. Not so for that wonderful producer that is Ridge; the wines are lovely and the prices reasonable, in normal fine wine language, and a total give away compared to some of the ‘cult’ counterparts. We have offers of the flagship, Monte Bello, on the platform of the ’10, ’13 and ’17 that I would happily recommend, to anyone!

**************************

We have been busy at Wine Owners, with a lot more trades going through, spread amongst an ever-increasing group of followers. We are at record levels of new subscribers and have £300k of fresh offers in the last week alone. Notwithstanding the difficulties of some warehouse operations presented, our back office is working well, and our post trade analytics improve all the time.

On that bullish note, the team and I would like to thank everyone for their ongoing support. For those who have not yet fully engaged, we look forward to welcoming you soon.

Have a very happy Christmas, a wonderful new year, and drink as well as you can!

Miles Davis, 8th December 2020

by Wine Owners

Posted on 2020-12-04

Wine Owners is the market-leading collection management platform that provides instant valuations and connects you with a peer to peer trading exchange.

Today, we're very pleased to announce that our collection management platform just got even better - and now includes a fabulous new home cellar management capability.

Imagine knowing exactly where each bottle is stored down to a hole in a rack, and being able to effortlessly move cases from a stack in the corner into bins or racks. Home cellars constantly change and this new release helps make organising them a joy.

Easily catalogue and organise wines at home.

Create new racks, bins and mixed cases

Move or add wines easily to your home cellar.

Save time by copying wines.

And create and update cellar references.

All this while getting the same high quality pricing data from our referential database.

If you want to start managing your home cellar, sign in to your account or create an account if you're not yet a member of Wine Owners.

by Wine Owners

Posted on 2020-11-12

Miles Davis, Wine Owners November 2020

There is not much to report on for October. The market continues to be very steady, gently rising in fact, and lacking in volatility – we are leaving that for the traditional asset classes and for those with a strong constitution!

The Covid related news had been sending shivers down the spines of stock markets as we here in the UK were heading into our second full lockdown of the year, only for that to turn around swiftly on the good news on vaccines.

The platform was busy in October, however, with good demand from Asia. Bordeaux indices have even been positive although overall market share remains weak. Sterling had been a little weaker during the month and this normally speedily converts into demand for Bordeaux blue chips from Asia. We have seen continued demand for Italian wines and Champagne with red Burgundy more mixed. Top end white Burgundy priced sensibly soon disappears from the platform and liquidity in this sector is perhaps stronger than it has ever been.

Champagne is the focus of the month and there could even be unprecedented Christmas demand this year if lockdowns ease and families and friends are once again allowed to socialise!

The recent release of Taittinger’s Comtes de Champagne 2008, which receives a fabulous write up from William Kelley of the Wine Advocate and 98 points, was met with great interest. There’s plenty of supply right now but given time there is plenty of room for price upside given the level of the ’02 now. Here is the relative value chart:

Obviously ’06 is the cheapest here but that, nor the ’04 vintage, quite carries the same stature of the fabulous ’02 and ’08 vintages. Having said that and given the quality of the juice we are talking about, Relative Value Scores at 30 or above look good in any book!

Generally speaking, I like the lower production levels of Pol Roger’s Winston Churchill Cuvée. In fine wine terms, Dom Perignon and Cristal produce vast quantities but are truly international brands and therefore trade at premiums to other names. Comtes falls somewhere in between.

Here are some price and point comparisons of the names discussed here, from really good to excellent vintages.

Overall, I would not put anybody off buying these wonderful wines for the medium to long term, they have years of life ahead and plenty of upside potential as they become rarer and rarer – and more golden!

|

| | Vintage | Price | WA Score | Price/Point (WA) | VINOUS Score | Price/Point (VINOUS) |

| Dom Perignon Champagne | 2002 | £127 | 96 | 1.32 | 97 | 1.31 |

| Dom Perignon Champagne | 2004 | £107 | 92 | 1.16 | 95 | 1.13 |

| Dom Perignon Champagne | 2006 | £108 | 96 | 1.13 | 95 | 1.14 |

| Dom Perignon Champagne | 2008 | £110 | 95.5 | 1.15 | 98 | 1.12 |

| | | | | | | |

| Louis Roederer Cristal Brut | 2002 | £213 | 98 | 2.17 | 94 | 2.27 |

| Louis Roederer Cristal Brut | 2004 | £160 | 97 | 1.65 | 96 | 1.67 |

| Louis Roederer Cristal Brut | 2006 | £130 | 95 | 1.37 | 95 | 1.37 |

| Louis Roederer Cristal Brut | 2008 | £158 | 97 | 1.63 | 98 | 1.61 |

| | | | | | | |

| Pol Roger Cuvee Sir Winston Churchill | 2002 | £167 | 96 | 1.74 | 96 | 1.74 |

| Pol Roger Cuvee Sir Winston Churchill | 2004 | £127 | 95.5 | 1.33 | 93 | 1.37 |

| Pol Roger Cuvee Sir Winston Churchill | 2006 | £117 | 95 | 1.23 | 96 | 1.22 |

| Pol Roger Cuvee Sir Winston Churchill | 2008 | £140 | 97 | 1.44 | 95.5 | 1.47 |

| | | | | | | |

| Taittinger Comtes Champagne Blanc de Blancs | 2002 | £166 | 98 | 1.7 | 97 | 1.71 |

| Taittinger Comtes Champagne Blanc de Blancs | 2004 | £96 | 96 | 1 | 96 | 1 |

| Taittinger Comtes Champagne Blanc de Blancs | 2006 | £73 | 96 | 0.76 | 95 | 0.77 |

| Taittinger Comtes Champagne Blanc de Blancs | 2008 | £117 | 98 | 1.19 | 96 | 1.22 |

by Wine Owners

Posted on 2020-10-06

Miles Davis, October 2020.

7min read.

Given the lack of relatively significant news in the wine market, this is the first report since early in the second quarter of the year.

In fact, it is fair to say that the world of fine wine has been relatively boring, and in this world, boring is good! The lack of volatility has been impressive. The WO 150 index has (rather surprisingly) posted a gain of c.%5 this year but that should come with the caveat that the constituents are older vintages and not the most liquid.

In the aftermath of the 2008 financial crisis, the major wine indices (predominantly Bordeaux led) fell sharply (c.25%) as market players and stockholders marked down prices, desperately trying to reduce inventory. The relative newcomer, China, was busy buying all the Bordeaux it could at the time and was presumably a little surprised by this sudden easing of prices – after all, what did wine have to do with the financial markets??

Anyway, Bordeaux prices rebounded quickly and from early 2009 to mid- 2011 witnessed one of the biggest rises in prices this market has ever seen, followed by a sustained bull run for, the recently discovered by China, red Burgundy. Unlike 2008, the Covid-19 infested world of 2020 is yet to lead to a global banking crisis, but the economic effects will surely be felt for some time and some easing of prices would not be surprising; yet in the world of fine wine prices are not being marked down, and the indices are largely flat. There is no panic and this is good. As you would expect, liquidity isn’t great, spreads are wider, and there aren’t many merchants buying for stock. Overall, the volume of wine (number of bottles) traded has increased although there are widespread reports of the value being lower – hardly surprising.

Here’s the WO 150 vs. the FTSE in the last ten years:

Other than a reasonably successful 2019 en primeur campaign, of which more later, Bordeaux has maintained its trend of recent years - its market share continues to slide. In August it hit a new all-time low of 35%, according to our friends at Liv-ex. Ten years ago that number was 95%! It is still easily the most liquid market, however, and that should not be forgotten in times of stress. Lafite and Mouton Rothschild still dominate Asian demand but long gone are the days when the prices just kept on rising; they are flat.

The 2019 Bordeaux en primeur campaign was highly unusual, in many respects. Not only did it happen in lockdown, it happened, apart from the locals, without any but the top wine journalists tasting any of the wines – unheard of! We decided to listen more to Jane Anson (Decanter) and James Lawther (jancisrobinson.com), both based locally, than other international critics after reports of samples being abandoned on melting driveways and being flown around the world in a rush; it just seemed more prudent. The consensus, however, or whatever, was that it was another fabulous vintage and even came out with the highest average scores in fifteen years – no mean feat. The other strange thing that happened was that some Chateaux priced the wine attractively. Prices needed to be 20-30% below 2018 prices to sell through and some were. The leading names for relative value and quality were the Lafite (including L’Evangile) and Mouton stables, Pontet Canet, Palmer, Canon and Rauzan Segla. The campaign came as a much-needed boost to Bordeaux’s flailing reputation, but it took some extreme circumstances to bring it about. In terms of wine, Bordeaux is doing nothing wrong, it is the pricing that is the issue.

The super-fabulous-amazing 2016 Piedmont vintage has been dribbling into the market, some via the grey market European trade and some from agent releases. Given the general mood, these have been easier to accumulate than in a non-virus savaged world and without an organised primeur release. Who knows how well these wines would sell if you had all the merchants shouting their virtues from the rooftops at the same time? Three wines, all with 98 points from Monica Larner that make sense and that I have bought are: Cavallotto Bricco Boschis (£260 per 6), Elio Grasso Gavarini Chiniera (£375) and G.D. Vajra Bricco delle Viole (£360). Luciano Sandrone’s Le Vigne 2016 was awarded the magical three-digit score (ML also) which sent the price from c. £550 to £1,250 before settling at around £1,100 now. From the same estate, Aleste (formerly Cannubi Boschis), with a mere 98 points, makes sense at £650. The official U.K. release from Roberto Conterno will be in October and although they are not yet scored, I have been accumulating in the grey market. They have decided not to make Monfortino in ’16 as it’s not the right style (!!??), which can only leave Cascina Francia as one of the buys of the decade, but what do I know?

As readers know, I am a keen fan of Italian wines for the portfolio, particularly Piedmont and Tuscany and wines from here can easily take greater supporting roles. The lead roles of Bordeaux and Burgundy have never felt more questioned. Super Tuscans are well developed in terms of the market and continue to do well, other Tuscan wines to a lesser degree. 2015 and 2016 were epic years in Tuscany, as we already know, but the ‘16 releases of Brunello are still to come and there will be opportunities ahead.

This interplays with the theme of new areas becoming more accessible and more interesting. The rise of the new world continues gradually as the depth of this market grows. Wine knowledge is on the up, price transparency and trading channels are ever more abundant, so competition from other areas is bound to increase. Quality from everywhere is on the up and the international market is flourishing.

The Champagne market deserves more on the limelight too. Here is the ten-year chart of the WO Champagne 60 index, a smooth 9% annualised, with barely a bump in the road:

Burgundy is in a funny place right now. The froth has definitely been blown off the top end of the market, even before the pandemic struck and the usual suspects do not just fly out of the door anymore. There is still demand for DRC, but it needs to be in OWC. Buying is to order, not for stock, and prices need to be sharp to attain a sale. The performance of collectable white Burgundies has been greater than their red counterparts recently and this is a very interesting area. Buy top quality producers at an early stage and do not hold on too long – the fear of premox has not disappeared entirely!

Keep an eye out for South African wines, mainly for the drinking cellar at the moment, but quality and media coverage are on the rise.

Any questions, please let me know.

Good drinking!

Miles

by Wine Owners

Posted on 2020-05-20

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.” Charles Dickens.

18th May 2020 kicks off the Bordeaux 2019 en primeur campaign with the release of Chateau Angludet. They’ve partially gone down the amphora route to gain purity. It’s a great success, a very great Angludet, according to a number of merchant emails received today. Those same emails belie one small issue - that the wine has yet to be tasted. A reminder of the impact of Covid-19, the anxieties and emotions over this year’s releases dominated by hope and despair. So we have to take the Bordelais at their word that it’s a great vintage, fresher than 2018, in the same mould as 2016 or 2010. I’m sure producers are excited by what they have in cask or tank or whatever receptacle the juice is in these days. But it’s not unjustified to say that local opinion isn’t always entirely objective. So bring on those Chronopost and UPS samples and let us all taste...

We have to be honest, we’d have much preferred a deferral of the campaign to October after the harvest. We don’t agree that would have caused any issues with other regions’ releases. There is something very strange about releasing a futures campaign whilst so much of our economy is in deep purdah. But the die has been cast and June it is (for the 60-odd releases that the market chooses to focus on).

The choice of timing of the releases is significant. It is quite obvious that, just like the 2008 vintage release, there will have to be a very significant reduction in release prices for 2019 to find a market. Those properties who have tended to use en primeur more as a marketing opportunity than a selling one will have to think about what it means to them: the prospect of a marketing campaign has more or less evaporated. For those properties who expect or need to sell a sizeable percentage of the harvest, only one one of the four marketing ‘P’s matter. It can be the best vintage in the world, it can garner (in the fullness of time) more 100 pointers than any of the last 40 years, but success will boil down to one thing and one thing only: price.

That decision will have ramifications on the whole of the Bordeaux global secondary market. A significant reduction of 30%-40% can ignite interest in the region’s great wines. It can draw in a new generation that has largely ignored the region, or doesn’t see the point of purchasing new releases two years before shipping. It can reward buyers of the last vintages who are under water and likely to remain so. A compromise that shows intent but brings us back to the levels of 2015 will consign Bordeaux to another year in the shallow quicksands of a secondary market lacking direction, fearful of the future, unwilling to commit cash, failing to see the point anymore.

Ah, I hear you say, but the world is awash with cash desperately looking for a home, just as it was post-Lehmann - when the fine wine market benefitted royally. I disagree. We are entering uncharted waters and cash in the bank trumps FOMO, the fear of missing out. Warren Buffet can be wrong sometimes, but not all the time, and moving to an underinvested position does not seem completely crazy.

So let’s say that 2019 is the equal of 2016, increasingly recognised as the greatest classic Bordeaux vintage in a generation. 2019 is likely not its older sibling’s equal (probably, but who knows) but let’s pretend it is for a second. Even on this most optimistic reading of the new vintage, would you rather buy into a vintage that has been tasted, re-tasted, evaluated ad infinitum and has withstood the scrutiny of the entire market, or roll the dice with a vintage that will be narrowly evaluated based on posted samples? Add to that 2016 prices that have barely moved or drifted down, and the comparative case for 2016 is about as strong as it gets.

Bring on June, and a prediction: either the most successful en primeur campaign since 2016 (notwithstanding Covid-19) or a non-event, determined purely by one variable - price.

Nick Martin

20th May 2020

by Wine Owners

Posted on 2019-12-09

I have just finished reading the latest threats relating to U.S. trade tariffs. In response to France’s application of a 3% digital services tax on heavyweight U.S. tech companies (you know the ones), DT and his representatives are considering recouping $2.4 billion from France’s premium markets; namely handbags, make up, certain cheeses and sparkling wines made from grapes. These tariffs will not be introduced until the new year if at all, so Christmas is saved at least. These products are possibly facing a 100% tax penalty so it’s out with Vuitton, Chanel, Roquefort and Krug and in with Coach, Maybelline, Monterey Jack and Napa Mumm – maybe Brexit isn’t looking quite so bad for us Brits after all!

How these lists are drawn up I do not know; the cheeses include Edam, Gouda and Parmesan which, as we all know, are not known for their Gallic qualities. Unlike still French wines below 14.1% alcohol, Champagne dodged the tariff bullet in October but may now be hit four times harder. These tariffs are messing up our market and we don’t like it! Tit for tat exchanges cannot be the way forward, and we look and hope for more stable trade agreements globally, but we must live with them for now. We have heard of several ‘swerves’ so far; U.S. buyers storing in Europe in the short term, importers identifying the highest alcohol level of any of a producer’s wine and employing that number universally across the producer’s range and even producers being asked to mark 14.1% on the label!

| Index | Current Value | MTD | YTD | 1 Year | 5 Year | 10 Year |

| WO 150 Index | 315.67 | -1.95% | 1.44% | 2.03% | 62.62% | 91.05% |

| WO Champagne 60 Index | 493.15 | 0.77% | 5.40% | 7.02% | 73.96% | 166.01% |

| WO Burgundy 80 Index | 744.26 | -0.61% | 6.08% | 7.35% | 147.25% | 239.18% |

| WO First Growth 75 Index | 274.38 | -3.16% | -2.76% | -2.65% | 48.45% | 64.45% |

| WO Bordeaux 750 Index | 366.5 | -2.23% | 8.20% | 8.98% | 69.82% | 111.68% |

| WO California 85 index | 679.17 | -3.41% | -0.14% | 0.83% | 98.95% | 296.39% |

| WO Piedmont 60 Index | 335.87 | -1.70% | 5.64% | 6.32% | 81.94% | 125.17% |

| WO Tuscany 80 Index | 312.88 | -2.43% | 6.86% | 10.01% | 61.16% | 86.68% |

As predicted last month, the indices are beginning to tell the story of recent headwinds. It is interesting to note that Champagne was bucking the trend - that will not continue now. All the other main indices drifted down; the Italian numbers surprise me as the wines we are currently seeking to accumulate have shown no weakness in price. Italy remains free of any U.S. tariffs although further scrutiny can be expected.

I expect there to be some continued easiness in the market in the short term, but I would not recommend selling now as I think it unlikely the market will retreat by 10% or more. Spreads have widened a little and bids are currently around 10% (or more) below the cheapest market price. There will indubitably be some very interesting buying opportunities in the coming months for those brave (and clever) enough and it is interesting to note rarer stocks already becoming available. Great 1990 Bordeaux is a perfect example; normally very scarce and difficult to buy, there is some volume available and it is a buyer’s market.

If some of the current headwinds, namely Hong Kong politics, U.S. tariffs and uncertainty surrounding GBP stemming from UK elections, and no deal Brexit fears, died down activity would increase, and the wine market would soon shore up. In the world we live in, with low (or negative) interest rates and where investors buy bonds for capital appreciation and equities for income, wine will make a lot of sense again soon. There needs to be a certain amount of unravelling of these issues first, however.

Please contact miles.davis@wineowners.com with any questions.

by Wine Owners

Posted on 2019-10-08

Is it time to hit the bottle?

At the risk of sounding like a stuck record, the market mood is sombre. It does, however, remain reasonably steady amidst a turbulent sea of macro factors.

Hong Kong is an important market for wine and the ongoing protests are a concern. The original cause of complaint, an extradition agreement between the territory and the Chinese mainland, has long since been retracted but the protests continue, becoming ever more violent. This is about democracy and freedom and the eyes of the world are watching. It is an uncomfortable position for China who cannot afford to handle the situation as perhaps it might in its own provinces but in the long term, remains a very powerful parent. Already the economic effects are being felt; officially occupancy rates in Hong Kong hotels are currently running at about 20%, unofficially they are in single digits. A quick internet search found a room in the territory for US$9 a night, including breakfast!

As we know, Hong Kong, apart from having its own burgeoning wine scene, is currently the gateway to the wine market of China, legally or otherwise. We expect China will open new free ports in time, but the current troubles may just accelerate that process. We think this is a short term problem but in the meantime, trade form that corner of the world is quiet.

U.S./China trade negotiations and Brexit shenanigans continue, and emerging markets are threatened by contagion emanating from Argentina. Thrown in the unrest in various parts of the Middle East and various other more localised scenarios, it’s a right old mess. And what does well in right old messes – physical assets! Here is the Gold price performance so far this year against the WO 150 index.

We’re not saying there is any correlation, delayed or otherwise, between wine and gold but recent financial history (since the last global financial crisis) has made physical and alternative assets increasingly popular.

We live in an era of negative real interest rates, where buyers of roughly a third of the world’s outstanding bonds will lose money if held to maturity and where even high yielding equities with strong balance sheets are not performing – all very sobering! With all this going on, is it time to hit the bottle?

Within the wine world, my investment themes remain the same; focus on regional allocation, combined with scarcity and relative value is the game.

Please contact miles.davis@wineowners.com with any questions.