by Wine Owners

Posted on 2022-10-13

Today the wine part of the Wine Owners team, as opposed to the tech team who provide our best-in-class software solutions, tasted wines from one of the great sub-sections of the Union of Grand Crus; it is called the Bordeaux Grands Crus Classés - to avoid confusion!

Wines offered came from 2018-2021 vintages. What was abundantly clear was that 2019 has reconfirmed itself as the best of modern vintages. Also, 2018 is not for the faint hearted, especially Montrose, and also that second wines offer a lot of drinking pleasure at a diddly squat fraction of grand vin prices. La Dame de Montrose excelled, as did La Croix de Canon. The unpronounceable Chateau d’Aiguilhe from the Cotes de Castillon performed well, as usual (apart from the ’21), and at £150 per 12 in bond for the 2019 is remarkable value. Chateau Canon reinforced its ‘polished’ status and was probably the most consistent.

There were some volatile samples of ‘21s, which we imagine not to be representative.

To my mind, the question is not what to buy but when to buy, if you haven’t already - 2019 should be in everybody’s cellars.

Chateaux represented:

Smith Haut Lafitte

Gazin

Vignobles Comtes Von Niepperg - d’Aiguilhe, Clos de l’Oratoire, Canon La Gaffeliere, La Mondotte

Canon

Rauzan Segla

Branaire Ducru

Pontet Canet

Montrose

Guiraud

For enormous pleasure and for a twist on sweet wines, readers should definitely embrace the current trend of lighter wines from the region. Fresher and less sweet wines from Sauternes were particularly well represented by the second wines of Chateau Guiraud and these will make a very stylish aperitif. The dry whites of Smith Haut Lafitte were superb, and are so often overlooked for more obvious alternatives, Burgundy normally, as are most dry white Bordeaux wines - in the U.K. at least.

Miles Davis October 11th 2022

by Wine Owners

Posted on 2022-10-05

Only a couple of weeks ago the wine market felt like it does quite a lot of the time; a bit of a backwater, no great trends or swings, business as usual. Most things were just floating along calmly on their predicted journey while little pools continued to defy gravity, even though it would appear to make no logical sense; the highly prized Salon 2002 for example, having doubled and tripled in two to three years was in high demand - the joys of rarity are a thing to behold when such demand is in town! (I have sold some of this treasured holding on behalf of clients).

And then along came a newly formed Conservative government who decided they needed to bet the house on the UK economy, cutting taxes in order to promote growth, and wiped 10% off the value of the British pound in the process, and in record quick time. Tax cut reversals have now taken place and sterling has rallied a little although it remains at a much lower level than a year ago:

GBP/USD one year chart

Source: Yahoo Finance

This is unbridled joy for US dollar-based wine traders, which includes the powerful markets of North America, Hong Kong and Singapore, amongst others. Following the latest slide, we have seen some reasonably stale offers of quality stocks suddenly sell and UK traders across the board are reporting increased interest from these areas.

As a result, my personal take on the market has gone from a neutral stance to something more optimistic than that.

I have always held the belief that there is more demand in the US market for the wines of Piedmont and Italy in general given the obvious connections of heritage, and also for Chateauneuf du Pape (or C9P as I saw it written recently!). Mr. Parker had a penchant for handing out incredibly high scores for C9P back in the day which will have helped but it is also felt that America has a higher tolerance for sun kissed, more alcoholic (more than the Europeans are used to at least) juice. Asia does not yet seem to share these particular tastes in these regions but are very happy to continue buying Burgundy and Bordeaux. Everyone continues to buy Champagne, for very good reasons, so that is a large percentage of the market covered already!

I would not be at all surprised to see US wine stocks being exported from the UK back to the USA and feel that back vintages of highly prized Napa wines make strong sense.

Looking ahead, UK buyers in the primary markets for wine will be severely affected by sterling’s weakness in the coming months and their pockets will be stretched, so back vintages of well stored investment grade, quality stocks already in the secondary market also make good sense.

As GBP plummeted and the FTSE faltered, wine investors here in the UK slept well, evidence below. Yet again wine demonstrates its enviable low correlation and low volatility characteristics when all around others were losing their heads. I’ll drink to that!

The WO 150 Index is GBP based, other indices are based in local currency.

Miles Davis, 5th October 2022

by Wine Owners

Posted on 2022-05-20

Just back from the USA where I spent two weeks speaking widely to wine business owners. There are signs of a cooling off in the fine wine market. Even given the buying power a strong dollar confers.

The backdrop is a correcting stock market that’s seen its biggest sell-off since 2020. Unlike 2020, the drivers behind the correction are inflation and the threat of recession. In other words, it’s not driven by a market discontinuity, however persistent Covid proved to be. It’s driven by a fear of market fundamentals turning sour.

As far as blue chip Bordeaux is concerned - as far as collectible fine wine in general is concerned - we don’t yet know the impact of these macro economic factors, nor the impact of a shock to global food security.

But I’d wager there are a fair few highly leveraged buyers, and a lot more feeling considerably poorer than a month or so ago. However immune much of that market may be to cost of living increases, it is not unaffected by sentiment.

The similarities between Spring 2020 and now are striking, albeit the outlook as of early summer 2022 is less positive because it’s harder to look beyond the events that are driving market concerns. Lockdowns drove outsized wine sales. A recession will not have the same effect. A well priced 2019 campaign lit up demand. An overpriced 2021 campaign could douse it.

Meantime arbitrage opportunities in back vintages abound, which is why négoces are busy buying UK stocks and why US fine wine businesses are buyers: but with what intensity and for how long?

by Wine Owners

Posted on 2022-02-03

As eagerly anticipated as the Sue Gray report, here it is, the annual WO round up and look ahead.

So, what happened?

2021 turned out to be a very good year for the wine market, the owners of wine and therefore for Wine Owners Ltd. also. Turnover on the exchange ramped up by 77% in 2021, producing more buying and selling opportunities than ever before! Our tenth year of trading is set to be an exciting one and has started well.

The broad based WO150 Index returned +15% with the stars of the show being Champagne and Burgundy, posting respectively +30% and +27%. Bordeaux returned a more modest 10% while Italy, having led the charge in 2020 came in with more modest numbers, yielding 6.5%. Tuscany performed better than Piedmont which was flat on the year. The Rhone did well, notching low double figures and the Rest of the World was twice as good as that, all thanks to California.

The reasons for the strength in the market were various; probably the biggest two were continued liquidity being pumped into the system in a low interest environment pushing more buyers into real assets, and the very real fear of inflation. Savings derived from staying at home more seems to have pushed up the spend on what people have been consuming at home – a quality driven drowning of sorrows in yet another lockdown!? The lifting of U.S. tariffs on some European wines brought a weight of new buying activity from across the pond, as did a lot of ‘new wave’ investment dollars - this should not be underestimated.

The market pre Covid had been largely stifled by various different factors but once demand started to outstrip supply, the market started to motor. Hong Kong and China were not responsible (for once) and collectively have been less of a force in recent times. Stringent lockdowns and border controls have meant very few visitors, especially of Mainland Chinese to Hong Kong, and an exodus of wealthy residents seeking a more liberated culture – some of the demand is moving elsewhere. Current thinking is that will last for some time (not just until after the Winter Olympics!), so be warned. I would expect Singapore to take up some of the slack and become a more prominent player.

Champagne

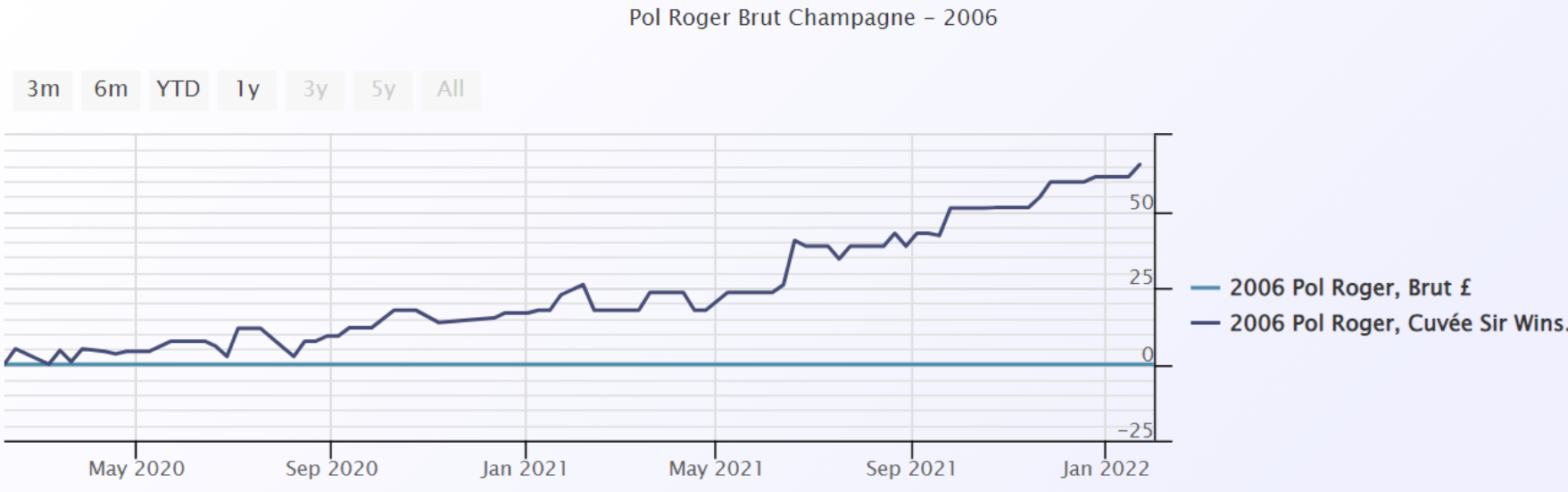

I cannot remember Champagne ever being the star turn in the wine market before but given the cyclical nature of the market and the fact that the different regions are much more equal than they used to be, it is not surprising. It has also consistently delivered steady returns, see my report from last July, just before the market really accelerated. Reports of supply shortages coming out of the region and a slew of really good quality releases added further weight to the concept of Champagne as an investment proposition which led to some voracious buying activity. The Champagne Index is dominated by the biggest names and/or the tête de cuvée of noble producers. As ever, fine wine collectors and investors focus in on the most prized assets driving the gap between the seriously good and the seriously a little bit better than that ever wider. Here’s a good example, vintage Pol Roger ’06 versus the Sir Winston Churchill cuvée from the same year:

The ‘simple’ vintage Champagnes from good producers offer extremely good value to drinkers and is a segment of the market that has been left behind.

Where Champagne goes from here is one of the big questions as some of the recent returns have been enormous. Various vintages of Krug, Dom Perignon, Taittinger’s Comtes de Champagne, Pol Roger’s Winston Churchill have added more 50-100% in the last year and rosé Champagne has been bought in a way not seen before. I am tempted to take some profit from some of the biggest risers and look for some laggards.

Burgundy

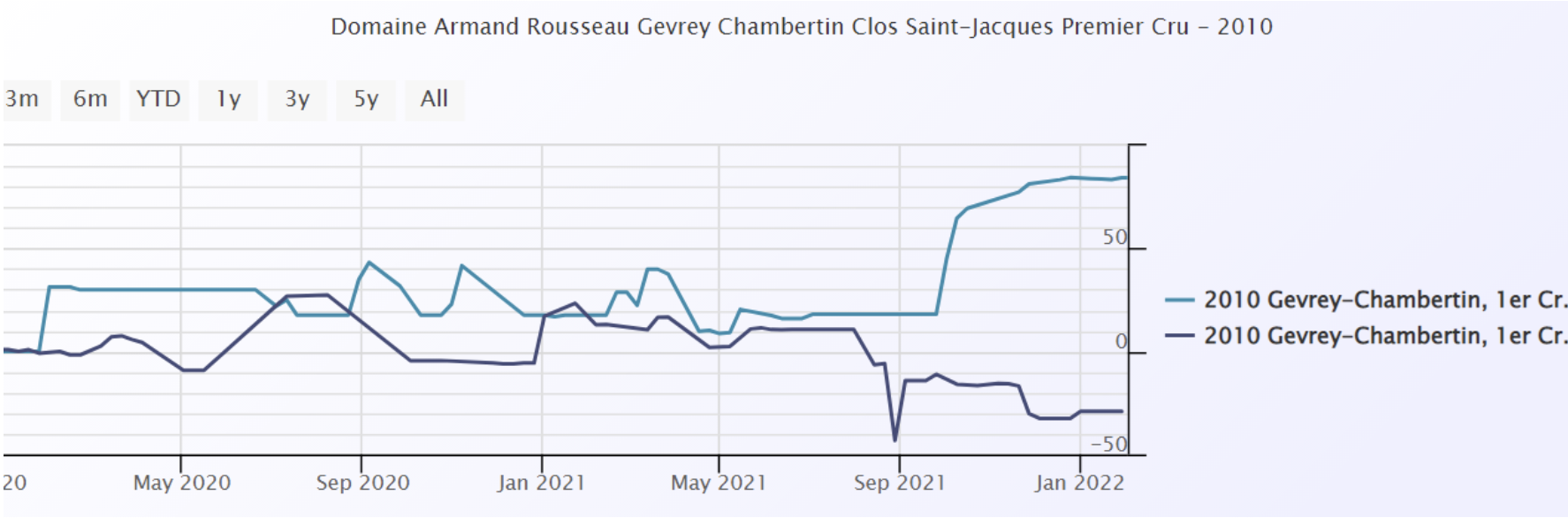

The polarisation of the wine market and the premiums attached to the most desirable names have continued to grow and probably make less sense than ever before. Names such as Leroy, DRC and Rousseau in Burgundy have outperformed their neighbours and as highlighted in some of our recent offers, often trade at multiples of equally high scoring wines from the same vineyards but from less famous producers. Obviously, this creates opportunity and I feel more comfortable making bets at the prices that are a fraction of the big guys. Here is a comparison between Armand Rousseau’s Clos St. Jacques (light blue) versus Bruno Clair’s. This sort of chart can be repeated numerous times - premiums have become too large for my liking, but if Rousseau is your man and you have the cash….

The current shortage of 2020 red Burgundy and the general short supply frost hit ’21 vintage, see report from last November, will push prices and demand ever higher and whilst some price performances seem overly vertiginous, I anticipate they will continue their path – for now at least. High rollers love spending big on Burgundy and the small production levels really adds the glitter dust to this famous region. And there are always the producers that are beginning to make a name for themselves.

Bordeaux

Bordeaux had a decent year, posting +10%. Apart from a brief flirtation with the 2019 en primeur release, Bordeaux has not been sexy for a very long time now. Market share continues to fall as other regions eat into the Bordelais’ gateau. It is still, and always will be, the largest slice of the market and those who buy into the general wine argument and need liquidity are best allocating here. It has become the steady Eddie. As a massive generalisation you know what you’re getting in your glass with a Bordeaux; a lot of that infuriating yet bewitching and beguiling wonder of what to expect from your wine just doesn’t exist in the same way that it does with Burgundian Pinot or Piedmont’s Nebbiolo and passionate collectors are just not quite so aroused by its charms (as I said, a generalisation!). I expect it to remain firm however.

Italy

Italy has had a mixed year. Super Tuscany has done well, the massive names of Sassicaia, Tignanello and Masseto have continued to shine posting average gains in the region of 25%, 35% and 25% respectively, and Solaia and Ornellaia also, but not so brightly. Lots of smaller Brunelli have fared quite well and this sector continues to build – hardly surprising given the price to quality ratio. Piedmont has had a mixed time, Monfortino in general is up a little in most vintages but lots of big names across the region have remained unchanged. I would not be surprised to see interest return to this area once Burgundy’s current run has blown through. There are still numerous 2016s looking very interesting for the longer term.

The Rhone

The Rhone valley is more appreciated than ever before. There are numerous cult producers all over Cote Rotie, Hermitage, Cornas with St. Joseph coming to the party nowadays. Prices of Rayas product from down south have travelled to the far north as collectors chase these rare treasures. White Rhone is still very much a speciality interest but one to keep an eye on. I have bought a lot of red Rhone for drinking from the WO platform in the last year or so as the combination of maturity, quality and price is virtually impossible to beat. There are plenty of names delivering superior returns too.

The Rest of the World

California has dominated the remaining regions with some ease, posting over 20%. Screaming Eagle has led the pack, followed by Ridge and Dominus. Australia has suffered at the hands of China’s tariffs.

Conclusion

I am confident the market will continue to perform well this year. Sentiment is strong, and supply in some key areas is shorter than usual, especially Burgundy. The inflation fear mentioned earlier is real and wine has been seen as a good hedge against this for a long time now. Interest rates are likely to rise but remain historically low and the real asset argument holds sway but will lessen as QE reverses – something to keep an eye on. Access to the fine wine market is greater than ever before, particularly in the U.S., and continues to grow.

As ever, I would be delighted to hear from you to discuss any of this, or anything else wine related. I am happy to help and advise on your portfolio or cellar, for investment or drinking purposes. And now we can go out again I would be delighted to share a bottle!

Miles Davis 02/02/2022

by Wine Owners

Posted on 2021-11-22

For a couple of days at least the world felt normal again as the English wine trade returned en masse to Burgundy for the first time in two years. How wonderful it was to be back was the most prevalent sentiment and ‘ooh, aren’t the wines good’ the most repeated phrase. The Burgundians are a little more patient than their counterparts from Bordeaux and wait for a little over a year, as opposed to a few months, after harvest to show their wines to the world, making en primeur tastings that much more informative, and pleasant, so here’s a quick review of Burgundy 2020.

2020 was another very warm and dry year but the range in temperatures between night and day and the ongoing improvement and knowledge of how to handle the heat meant the vintage is a good one, a very good one. The whole winemaking process is more scientific and exacting than ever before and the attention to detail demonstrated by some winemakers is incredible. Whether it is more work in the vineyard, including the lighting of candles in the vineyards at four o’clock in the morning to stave off potential frost (or not as it turned out for Cyprien Arlaud of the eponymous domain in spring this year), harvesting earlier, new technology and/or machinery including a million-euro bottle washer machine (at Domaine Lorenzon in Mercurey), or organic or even bio dynamic farming these guys are giving themselves every chance of making great wine whatever mother nature throws their way. It was noticeable that bio dynamic farmers reported less loss of crop due to frost than others as their plants are healthier – at least that is what they say! Another technique favoured by some to avoid frost damage is to prune closer to springtime whereas traditionally pruning of the vines took place in November. This means they can control budding more closely and not leave the new buds exposed for longer. This has helped some growers enormously.

The devastating frosts of earlier this year (2021), particularly for Chardonnay, will be discussed repeatedly during the impending 2020 campaign in January, as growers will be factoring their lack of supply for next year into prices for this. Apart from the odd pause for breath Burgundy prices have been on the rise significantly for well over a decade now and there is no reason to suggest this will cease anytime soon.

There is just something very special about Burgundy; it appears there are just more aficionados plugged into this region than any other. Perhaps it is because it offers so many world class wines in both red and white, from two of the world’s favourite grape varieties, that no other region can compete with it in quite the same way. Release prices are going up and wines in the secondary market will continue to rise. Demand for all top end Burgundy is insane but the supply shortages of white coming up are going to impact prices heavily.

In brief, the whites from 2020 were picked early and characterised by mineral driven intensity and focus, not quite as fleshy as ‘17s, but fresh and zippy and generous too. Red berries were smaller than usual, with thick skins producing wines of good concentration and structure, bursting with fruit flavour and with early picking acidity was maintained.

Producers visited: Domaine Sauzet, Domaine Lorenzon, Domaine Chavy-Chouet, Domaine Ballot-Millot, Domaine Launay-Horiot, Domaine Duroché, Domaine Henri Magnien, Domaine Georges Noellat, Domaine Thibault Liger-Belair, Domaine Arlaud Pere et Fils, Domaine Marchand Tawse

For me the standouts were Sauzet, Duroché and Arlaud.

Bottle of the trip: Chambolle Musigny, Domaine G. Roumier 2017

Take aways from the trip: The quality of Thibault Ligier-Belair’s Morgon and how few people in the wine trade have ever been to Beaujolais!

The epic combination of Epoisses and red Burgundy (apparently, it’s ‘a thing’ but we didn’t know).

Many thanks to Flint Wines for organising the itinerary and to Cuchet and Co. for driving. Nice to see Albany Vintners, Brunswick, Decorum Vintners, FMV, IG Wines and Uncorked.

by Wine Owners

Posted on 2021-07-11

Will Cheval Blanc and Ausone no longer be Grand Cru Classé ‘A’ as from the 2021 vintage?

If so, it won’t be because of the Commission de Classement. The closing of the Saint-Emilion classification applications took place on June 30 and neither Cheval Blanc nor Ausone returned their copies.

Unlike the left bank classification system of 1855 that is pretty much immutable (with the exception of Mouton’s promotion to Premier Cru in 1973), the St Emilion classification is reviewed approximately once every 10 years, permitting a periodic revaluation of quality and performance. It’s not all been plain sailing; the 2006 reclassification was plagued by accusations of impropriety and was eventually annulled. Consequently, tastings conducted for the 2012 reclassification were outsourced to independent groups from across France to rehabilitate the process.

Cheval Blanc and Ausone, the first St Emilion producers to be awarded Classé A classification in 1954 when it was created, are effectively leaving the classification system.

The Classé A incumbents evidently concluded that the system is no longer sufficiently discriminating to reflect the ranking of their respective properties compared to their peers.

This bombshell threatens to undermine the kudos and financial benefits of promotion to Classé A, and in turn the market pricing potential of those that are elevated. Not to mention it raises questions of the credibility of the St Emilion classification system more broadly.

So what does the two colossus’s departure say about the process of decennial review? How does this reflect on the composition and process of the Commission de Classement?

Is Grand Cru Classé A about to lose its lustre; devalued by ambitious properties busy erecting glitzy edifices? Concrete and stone, some say, matter more than they ought to compared to the brilliance of the wines and their track record.

Or, is Classé A promotion a reflection of the qualitative transformation we see taking place in St Emilion - given the strongly weighted preconditions of a sustained track record of exceptional results and market recognition - and therefore are not elevations thoroughly deserved?

Let’s see what happens over the coming weeks. Can Cheval Blanc and Ausone be courted back into the fold, or is their departure (by omission of submission) a fait accompli? Assuming the latter, perhaps we'll see more promotions next year than we might have otherwise. What effect this all has economically on those producers who attain Classé A classification is now more uncertain than ever.

by Wine Owners

Posted on 2021-06-30

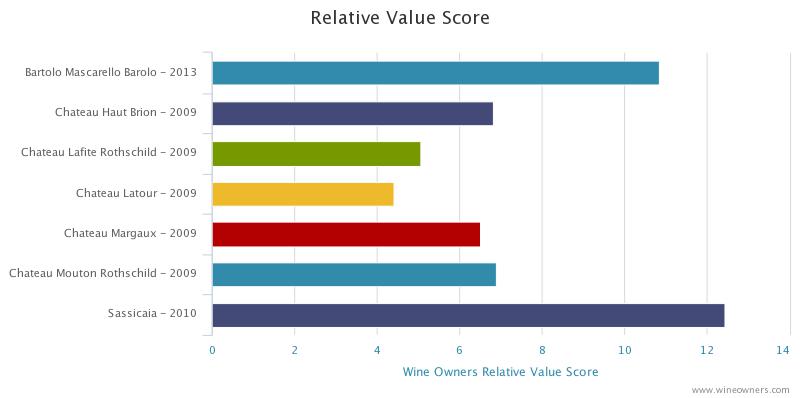

As mentioned in our recent and well received offer of the incredibly well priced Montepeloso Eneo 2010 (there are a few left), we promised a closer look into the relative value of Italian wines. I know I have been banging on about Italy for quite a while now but there is every reason for it – there is some terrific value to be had, and so on will I bang!

The facts are that there are only a handful of Italian wines that trade at, what we are going to call here, ‘silly money’ compared to vast swathes of wines from their rather posher neighbour - namely La Belle France. It is true that the same can be said for Spain, and for most of the New World. The U.S. is an exception, as like France, it has many an offering at ‘silly money’. But for my pound, I say sweepingly, these regions do not offer such a vast variety of quality wines that appeal in quite the same way (I should qualify at this point I am really talking about top quality red wines).

What Italy offers, unlike everywhere else, is a multitude of wines at relatively affordable prices with absolutely massive ratings. There are two variables here, the prices and the ratings; the simplest explanation for the comparatively lower pricing is that Italian wines have not yet been recognised, and accordingly priced, as truly international brands. Put another way, Asia has not got to grips with it yet. Other than a few ‘Super Tuscans’ and the top labels from the likes of Giacomo Conterno, Bruno Giacosa and Gaja from Piedmont, very little starts life close to £100 a bottle. There have been half a dozen EP releases every day last week from Bordeaux that qualify for that prize! In Burgundy a hefty percentage of premier crus start there and for some more sought-after growers, your £100 only buys you a taste of a lowly village wine.

The ratings are, rather obviously, dished out by the critics. It is worth remembering that each region is scored on its merits in a peer group fashion. The wines, as are the vintages, are reviewed in the context of that individual region or vintage. What has happened, however, is that tones have been set for different areas which do seem to vary from each other. Burgundy, for example, tends to harbour rather conservative scoring where anything over 95 is a massive achievement. Prices for these trophies are also massive. It is different in Italy. There are countless Brunelli with huge scores and even people in the trade ask, ‘how come there are so many 100 pointers we’ve never heard of’?

A possible explanation is that the bar has been set so high, and for so long, by the likes of DRC and Rousseau that a mere premier cru from someone like Dujac or Roumier is only worthy of 90/91 points. So, perhaps a cleaner canvas for the critics to assess has led to some more generous brushstrokes? Or perhaps it is a more generational thing; France has long been understood, consumed, and pontificated upon by the old guard, who might not quite understand the Italian way? An old friend of mine, an experienced wine merchant recently said to me “I don’t really get Italian wine” (Burgundy and Sauternes are more his bag!) and then confused me further by saying “except I couldn’t possibly eat Italian food without Italian wine”. I understand exactly what he means with the latter statement (but not the first), and this goes from pizza level all the way to Piazza Duomo, a three star Michelin in Alba – quite good by the way! Either way, some of the scores in recent times and particularly for the amazing ’16 vintage, in all of Italy, and the ’15 vintage in Tuscany, have drawn truly flamboyant landscapes from the young masters – and for not many Lira either!

The other thing to remember is that the critics live and die by their reputations, so if they are going to award high nineties or even the magical triple digits, you know the wines are going to be very good indeed – within the context of their peer group.

Obviously, we would love to hear from you to discuss the opportunities further and there will be offers to follow based on this theme. In the meantime, you may want to engage with the ‘Advanced Search’ button or take in some of these names which spring to mind:

Piedmont: Alessandria, Cavallotto, Grasso, Sandrone, Scavino, Vajra

Tuscany: Fontodi, Fuligni, Grattamacco, Il Poggione, Isole e Olena, Pertimali, Montepeloso

Ciao for now! Miles 07798 732 543

by Wine Owners

Posted on 2020-12-16

Luke Macwilliam, December 2020

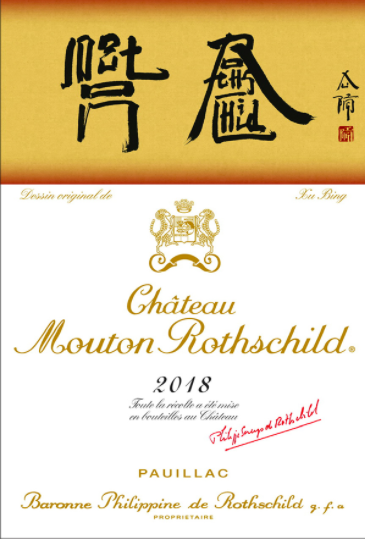

At the beginning of December, Mouton Rothschild announced that Chinese artist Xu Bing had been chosen to design the latest installment in their famous long running series. The label itself features the words Mouton Rothschild styled to resemble Chinese characters. Visually it’s attractive enough, it’s certainly quite clever and effective in the way you are compelled to look beyond the characters and see the recognisable letters hidden in the design.

Predictably the price jumped around 12% after the announcement, Mouton Rothschild, Chinese artist, good vintage, it's a banker! Isn’t it?

The last time Mouton entrusted the honour of designing their label to a Chinese artist was a decade ago in 2010, on the release of the 2008 Vintage. Now the market was very different back then, and the Chinese market was the main driver of the wine market as it grew and grew despite the financial crisis of 2008. Upon announcing the label design, prices skyrocketed.

The excitement was short lived, however. The Chinese bubble burst in the summer of 2011 and prices came tumbling down.

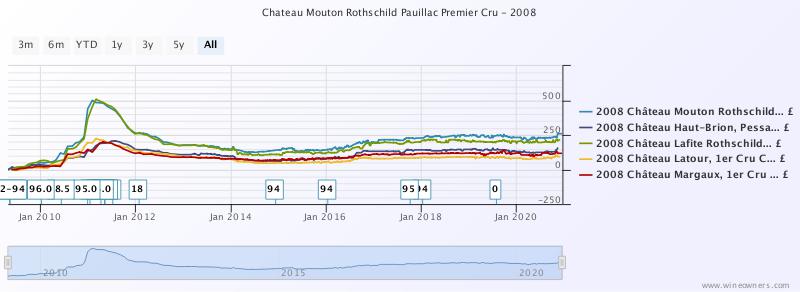

If we compare the big five from 2008 (nb. Lafite also included a Chinese Symbol on their 2008 label), you can clearly see the over inflation the hype caused compared to the other 1st growths. Those who bought Mouton and Lafite 2008 between Nov 2010 and June 2012 will have been licking their wounds for some time, destined to never recoup their losses.

If you bought in 2014 however, you will have seen Mouton 2008 perform in a much more sensible manner.

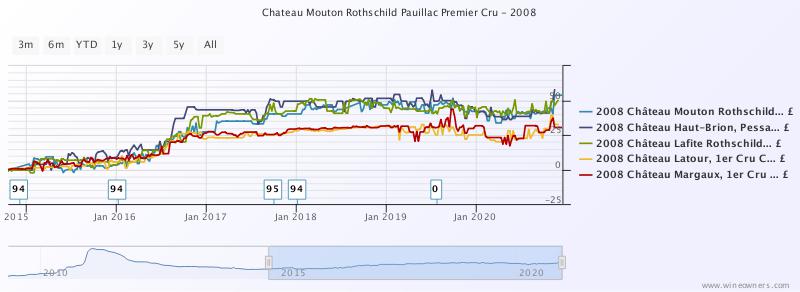

The last 5 years performance is a much healthier representation of the Bordeaux market in general, steady growth between 2015-2018, a flat 2018-19 (read THIS market report from Sept 2019 for the explanation) and finally strong resilience in a really difficult 2020 for markets of any kind. Has Mouton 2008 performed in this way because of it’s label or because it’s a top wine?

All of the 1st growths have tracked steadily, but more recently, Mouton and Lafite 2008 have begun to diverge in price once more showing that continued demand for these special labels does still exist.

In 20 years time when supplies of these vintages become more scarce, will Chinese demand for a label outrun the global demand for the greatest vintages (2010, 2016 etc)? That is the million dollar question.

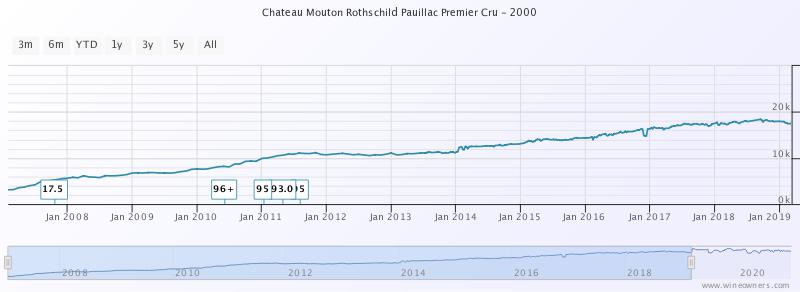

Let’s look at the example of Mouton 2000, we have a golden combination of a special wine from a special vintage in a special bottle (not just for the Chinese Market, but for the world). The result? Steady increase in value over time as demand remains high and stocks steadily run down. The troubles of 2011 did not affect Mouton 2000 in the way they did affect Lafite and Mouton 2008.

If you buy into a Chinese label, you are buying into the notion that China is, and will continue to be the main driver of the top end of the fine wine market. If you buy into a wine, then the whole world will potentially be after what you have.

Wine is a long game, and snap reactionary decisions based on hype come with great risk. If you are looking to make a quick buck then you are likely to come unstuck. Call me boring, but I find trends more compelling than one-off anomalies. There is a place for special editions in your portfolio, they do tend perform well over time, so long as the wine is up to the task as well.

Oh, and if you fancy picking up a case of Mouton 2008 BID or BUY here.

Luke MacWilliam, December 2020

Banner Image: http://www.domainedechevalier.com

by Wine Owners

Posted on 2020-12-09

Miles Davis, Wine Owners December 2020

As we head into the final phase of this extraordinary year, the world of wine investment is a calm and beautiful little side water, gently ebbing and flowing with that serene feeling it knows where it is going.Traditional assets continue to bounce around, no doubt causing palpitations and stress. More than ever, this year has been about timing in the capital markets, and if you got that wrong, the chances are you got it expensively wrong. Not so for vino! Unlike after the global financial crisis, the wine market has held its nerve, merchants did not mark down prices and the market has been stable. Investors are about, and even Bordeaux prices feel like they are firming up. Collectible assets are in vogue and it is easy to see why given these circumstances. You cannot even hold, let alone drink, a bitcoin, a share, a derivative, an option or a future and a bottle feels good, especially in lockdown!

Demand from Asia has increased and merchants trading the big names have been pleased with activity levels in recent weeks. There is almost a feeling there is an element of restocking going on after a quieter than usual period (in Asia) over the preceding months. This has happened in a period when the currency has gone against dollar buyers, although only marginally. Buying is very specific but certain names have moved up considerably since the middle of the year, Mouton ’09 and ’10, for example, are both up c.10%, the controversial ’03 c.14%. There does not appear to be any thematic buying, however, so it is not possible to call a vintage, or a certain Chateau or producer. Keep looking for the relative value is my suggestion and do not forget to make use of the useful tools we provide. See below for an example (if anyone would like a demo on how to use this, please ask):

In Burgundy, especially in the trophy sector, if it is not in its original packaging it is not going anywhere and vice versa. We have seen big ticket items in Leroy and Cathiard sell well recently. Provenance is key and is proving valuable.

Piedmont, Super Tuscans and Champagne remain firm, as does my conviction as areas for further purchasing.

We have had a lot of demand for Penfolds products; whether that continues given the newly slapped Chinese tax on Aussie wine imports will be interesting to observe but, in the meantime, we have plenty of two-way activity.

Personally, I have never been able to compute the prices of some of the ‘Cult Californian’ wines but, in fairness, I have rarely tasted them. Not so for that wonderful producer that is Ridge; the wines are lovely and the prices reasonable, in normal fine wine language, and a total give away compared to some of the ‘cult’ counterparts. We have offers of the flagship, Monte Bello, on the platform of the ’10, ’13 and ’17 that I would happily recommend, to anyone!

**************************

We have been busy at Wine Owners, with a lot more trades going through, spread amongst an ever-increasing group of followers. We are at record levels of new subscribers and have £300k of fresh offers in the last week alone. Notwithstanding the difficulties of some warehouse operations presented, our back office is working well, and our post trade analytics improve all the time.

On that bullish note, the team and I would like to thank everyone for their ongoing support. For those who have not yet fully engaged, we look forward to welcoming you soon.

Have a very happy Christmas, a wonderful new year, and drink as well as you can!

Miles Davis, 8th December 2020

by Wine Owners

Posted on 2020-12-04

Wine Owners is the market-leading collection management platform that provides instant valuations and connects you with a peer to peer trading exchange.

Today, we're very pleased to announce that our collection management platform just got even better - and now includes a fabulous new home cellar management capability.

Imagine knowing exactly where each bottle is stored down to a hole in a rack, and being able to effortlessly move cases from a stack in the corner into bins or racks. Home cellars constantly change and this new release helps make organising them a joy.

Easily catalogue and organise wines at home.

Create new racks, bins and mixed cases

Move or add wines easily to your home cellar.

Save time by copying wines.

And create and update cellar references.

All this while getting the same high quality pricing data from our referential database.

If you want to start managing your home cellar, sign in to your account or create an account if you're not yet a member of Wine Owners.