by Wine Owners

Posted on 2019-04-24

Sotheby’s had announced it would auction 75 limited edition Versailles Celebration Cases which house 5 vintages of Chateau Mouton Rothschild to be given towards the restoration of the Palace of Versailles. Each beautifully crafted case honours the rich cultural history of the domain and the Palace of Versailles.

However, as a result of the terrible fire at Notre Dame on 15 April, 2019, yesterday Château Mouton Rothschild and the Palace of Versailles jointly announced that the sale proceeds of the 25 cases sold in London for in excess of £750,000 would be donated to efforts to rebuild Notre-Dame cathedral.

The cases offered in London realised £752,620 / US$983,148 / HK$7.7 million, bringing the combined total for the 50 cases sold in London and Hong Kong to £1.4 million / US$1.9 million / HK$14.8 million.

Proceeds from the final tranche of 25 cases to be offered by Sotheby’s in New York on 4 May will still go towards funding restoration projects at Versailles, as will funds raised from the first tranche of 25 cases sold by Sotheby’s in Hong Kong on 1 April.

Each case presents five Château Mouton Rothschild vintages with labels by outstanding contemporary artists who have also exhibited at the Palace of Versailles:

-

Château Mouton Rothschild 2005 - Giuseppe Penone: Palace of Versailles, 2013

-

Château Mouton Rothschild 2007 - Bernar Venet: Palace of Versailles, 2011

-

Château Mouton Rothschild 2009 - Anish Kapoor : Palace of Versailles, 2015

-

Château Mouton Rothschild 2010 - Jeff Koons: Palace of Versailles, 2008-9

-

Château Mouton Rothschild 2013 - Lee Ufan: Palace of Versailles, 2014

The cases offered across a trio of international auctions at Sotheby’s throughout the Spring 2019, begun in Hong Kong on 1 April, followed by London on 17 April and concluding in New York on 4 May. Successful bidders will also receive an invitation for them and a guest to attend a private visit and tasting at Château Mouton Rothschild and an exclusive event, the Versailles Celebration Gala Dinner, at the Palace of Versailles on 21 September 2019, during which historic ex-cellar vintages will be served including Château Mouton Rothschild 1945 - one of the great vintages of the last century.

For a full list of the artists and labels visit: https://www.chateau-mouton-rothschild.com/label-art/discover- the-artwork

www.chateau-mouton-rothschild.com | Instagram: @moutonnechange

www.chateauversailles.fr | Instagram: @chateauversailles

by Wine Owners

Posted on 2019-01-21

Latour ’82, Mouton Rothschild ’82, Mouton Rothschild ’82, ’86, Haut Brion ’89, La Mission Haut Brion ’89, Margaux ’90, Cheval Blanc ’90 and Pichon Baron ‘90

When managing two wine investment funds (2006-2016) we referred to this subsection of the portfolio as ‘the legends‘. They all received cast iron reviews from all the major critics and rock solid and multiple 100s from Big Bob. Cheval Blanc ’90 “unequivocally a brilliant wine” (Neal Martin) has slipped a little to a 98+, but otherwise these wines are confirmed as truly great – legendary in fact! As such, they don’t come cheap (prices in GBP per bottle in graphic below).

Latour and Mouton ’82, +46% and 38% in 2018 respectively, Haut Brion and La Mission ’89 +35% and +52% respectively and Margaux ’90 +35% have all broken out and have massively outperformed the index in the last few months. I believe they can continue to yield positive returns.

Scarcity has been the big driver of price rises in the last couple of years as demonstrated most ably by Burgundy (WO Burgundy Index +33% for 2018, +16% in 2017). This is a prime example of how the principle of good demand versus limited supply in the wine market can work. As a region Burgundy has thrashed others as production is so much smaller, especially with Bordeaux in comparison. Where Bordeaux has been able to compete is in these older vintages of legendary wines, where consumption has driven a scarcity of supply. Each case that is now opened will have a direct impact on that side of the equation.

Cheval ’90 has been volatile but is generally on the up and is well worth considering. I have included Pichon Baron ’90, only a 98+ according to Neal Martin but a Steven Spurrier legend, as it is so relatively cheap and has not broken out at all, so watch this space. The really obvious choice, however, is Mouton ’86. This wine at 32+ years is still a baby in terms of maturity but has an exciting life ahead. Its backwardness has had an impact on the wine’s supply but that will change. As ever good provenance is extremely important and as this is a wine that has been traded more than most so beware - we have seen many examples of poor condition. If this can be found in good nick, do not hesitate in acquiring it - it’s a legend!

Recommendation

Buy: Mouton ’86, Cheval Blanc ’90, Pichon Baron ‘90

Hold: if it’s a legend, continue to hold, for now at least…

N.B. Petrus ’89 and ’90 fall into the ‘legend’ definition but they are so expensive (c.£45,000 per 12) and rare, they have been excluded here.

Miles Davis - professional wine consultant working in the fine wine market. He has been a wine collector for thirty years and managed wine investment funds between 2006-17 for Wine Asset Managers LLP.

by Wine Owners

Posted on 2017-09-13

After a busy summer including in August our most productive trading month to date, we thought it would be instructive to run some analysis of trading trends and movements, compared to the same quarter in 2016.

Market share between regions remains relatively stable despite a large increase in trading value overall, with Bordeaux holding first place with a 75.14% share of market compared to 78.15% in the same quarter of 2016. That there is a drop is interesting in its own right, perhaps pointing to greater diversity in wines offered for sale, as well as to diversifying demand in export markets.

Burgundy is the major winner in market share, extending from 11.78% in summer 2016 to 17.10% over the same period in 2017, and we’ve certainly seen an increase in Burgundy purchases from Far East markets, showing a 17% increase on 2016 numbers by value.

Other regions remain very much minority sports, with Rhone up to 2.03% from 1.8% and Italy, surprisingly, down from 4.85% to 2.5%.

Within Bordeaux, the share of the market taken up by First Growths has grown from 28.26% in 2016 to 44.05%, perhaps reflecting heightened interest in the top wines, though the real interest is in how the First Growths compare within their own category.

Haut Brion is the major winner amongst the Firsts, increasing its share of the Bordeaux market to 13.35% from 3.2%. As a proportion of the First Growth market, the share increased from11.31% to 30.3%, putting Haut Brion at the head of the market alongside Lafite.

Lafite moved up to a 13.34% share of the Bordeaux market from 11.62%, but lost ground against the other First Growths, slipping to 30.29% from 41.12%, exchanging a clear lead in the class for an almost dead heat with the progressive Haut Brion.

Mouton showed a similar fall-off in share, dropping from an 8.63% share of Bordeaux to 7%, and a 30.54% share of the First Growth market dropping to a 15.89% share. Market and trading values for Lafite and Mouton remain robust however, so this feels more like a positive story about Haut Brion than a negative for the two Rothschild properties.

Latour has benefited too here, growing a very small share of Bordeaux (1.18%) to 5.07%, and increasing its share of the First Growth market from 4.18% to 11.05%.

Margaux has the least movement to comment on, increasing its share of the Bordeaux market marginally to 5.29% from 3.6%, and falling from 12.84% to 12.01% in its share of the First Growths.

by Wine Owners

Posted on 2017-03-28

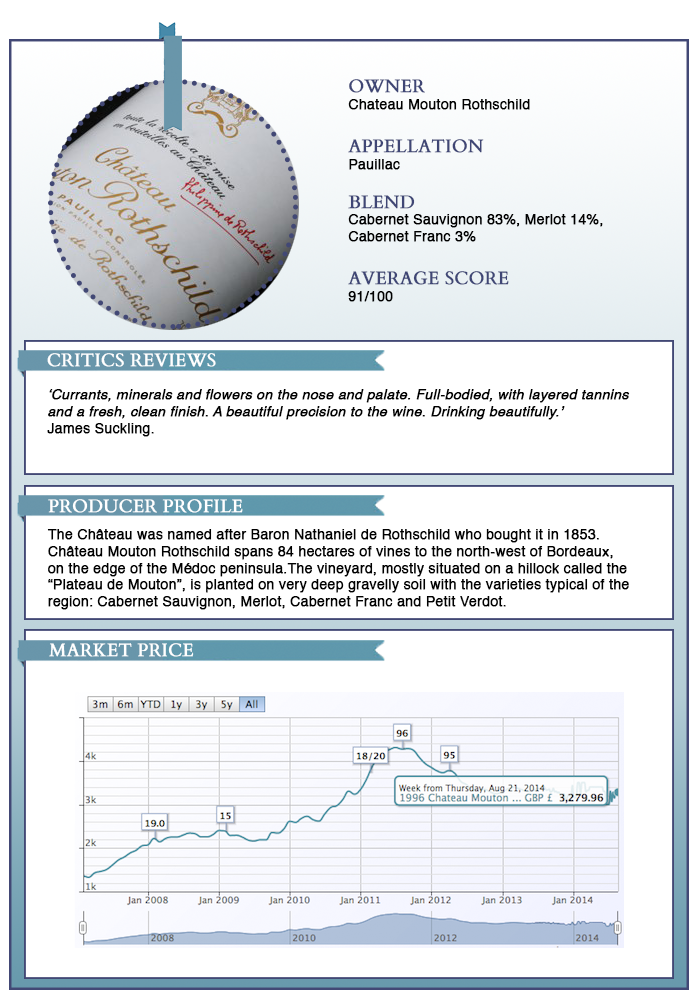

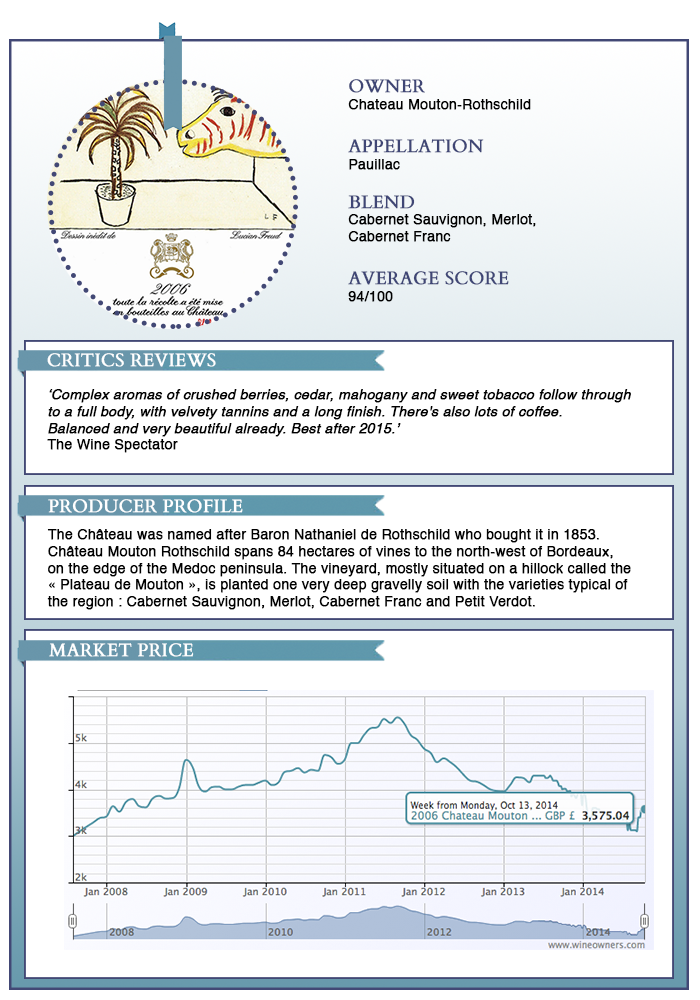

Keen followers of Bordeaux can’t have missed the striking price revivals that have been in progress over roughly the last 12 months, and Mouton Rothschild 2006 makes for in interesting case study.

We’re looking here at what is effectively an over-performing wine in an under-appreciated vintage. 2006 Mouton has consistently been rated highly by both Robert Parker (last scored at 96 in 2014) and Neal Martin (scored at 97 points in May 2016), and compares very favourably to the other First Growths in 2006. Latour consistently scores around 94-95; Lafite at 95 from Neal Martin, 97 from Parker; Margaux at 94 and Haut Brion at 96.

Not only that, it outscores or equals itself in what ought to be better vintages. The 2005 is likewise rated 97 by both Parker and Martin, and 2006 is only outscored in recent vintages by 2009 and 2010. No doubt then that winemaker Philippe Dhalluin did exceptional work in the vintage, and those buying at the nadir of the market in and around January 2015 were picking up a serious bargain at around £3000, the same price as the far less interesting 2007, and rather cheaper than the less well-rated 2008.

However, having risen in value throughout 2016 from £3200 to £4400, the market price has stagnated since October 2016, and now stands at £4500, with bids standing around £4130, which is still the highest this wine has traded at since 2011, but starts to look like the top of the market. For drinkers, this seems to continue to represent good value, but for those interested in wine as a store of value, quite possibly one to swap out.

Click here to see live trading information on Mouton 2006.

Did you know...? British artist Lucian Freud was commissioned to create the label for the 2006 vintage of Château Mouton-Rothschild. "Far from the tormented portraits and nudes for which he is renowned, [he] chose a joyously exotic transposition of the pleasure of drinking, in which the vinestock is transformed into a springing palm tree and the wine lover into a happily anticipatory zebra." Source: Chateau Mouton Rothschild.

INTERESTED IN BORDEAUX? We will be in the Bordelais covering the en primeur campaign, so don't forget to follow us: - on Twitter - on Instagram - on Facebook |

by Wine Owners

Posted on 2016-02-18

Looking ahead to the forthcoming Bordeaux En Primeur release, it seems like there’ll be plenty to be excited about, at least from a quality perspective, and there’s already a good deal of speculation about release strategies.

It’s fascinating that Chateau Mouton Rothschild has come out with a similar announcement to Chateau Latour’s 2013 En Primeur campaign withdrawal. It amounts to essentially the same thing, nuanced differently.

“Sales of our wines in bottle are growing a lot and we’ve got to the point where we don’t have enough bottles left in our cellar."

“We won’t be buying our wine back but we will be releasing less of it en primeur as we have to rebuild our inventory.”

“We haven’t lost faith in the en primeur system but you have to be reasonable with your pricing as there are so many reference points for consumers now.”

This roughly translates, into words that you and I will understand, as: "in an increasingly transparent world where discerning consumers can analyse and evaluate young wines by their relative value to past vintages, the only way we can get an en primeur campaign away is by pricing at a discount to comparable previous vintages, that recognises the end-user buyer needs a reason to buy early. That doesn’t seem to make a great deal of sense if we wish to capitalise on growing worldwide demand. Going forward, we would rather not give that discount away to more than a tiny number of en primeur buyers who will help us establish (hopefully higher) future secondary market pricing. That will create the preconditions for us to capture a much bigger slice of the downstream value of our wines, satisfying shareholder requirements for income growth and capital (land) appreciation.”

With Latour and Mouton effectively ‘out’, how will the remaining Firsts respond next year?

Last year there were only a small handful of wines worth buying early. That’s not to say there were not plenty of lovely wines made in 2014, but very few were sufficiently well priced to justify tying up cash. Given the overall superior quality of 2015, producers will hike up their prices, possibly quite a bit. Given that, it’s quite likely that savvy wine buyers will do well to continue to focus on relative values from comparable back vintages and revisit 2015 in a few years’ time. Meanwhile the impending campaign is bound to throw a spotlight on 2000, 2005 and even the better values within 2009 and 2010.

by Wine Owners

Posted on 2015-10-29

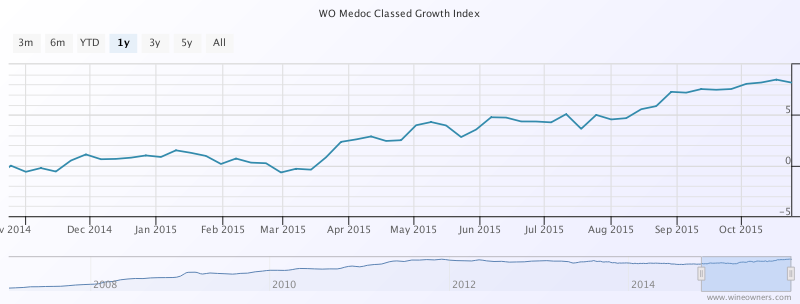

Quite a lot of members we speak to these days assume that the market prices of Bordeaux are still stagnating or falling. The morosité that had descended on the region's finest wines in by 2012 does not appear to have lifted.

Wine traders will point to volumes that are much reduced since the giddy heyday of 2009-2011, and that is of course true.

However, it does not mean that in aggregate, prices of Bordeaux have begun an upward trend. In the last year, the Wine Owners Medoc Classed Growth Index is up 8.2%.

Whereas the Wine Owners First Growth Index has only managed half of that in the last year, up 4.1%.

That's still better than the performance of the FTSE100, which is fractionally underwater over the last year, and exactly where the S&P500 has clawed it's way back to after the summer's wobbles.

Wine Owners 150 = Turquoise

FTSE100 = Navy

S&P500 - Green

However, when looking at First Growth performance over the last 12 months, it is far from broad-based. 'The further they rise, the longer they fall' seems to hold true, with Lafite 1986 and 1989 performing the worst at -8% and -9% respectively.

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1999 | -5.45% | £ 216.68 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2006 | -5.75% | £ 286.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2009 | -5.82% | £ 441.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1982 | -5.92% | £ 436.68 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1982 | -6.29% | £ 1,810.14 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1998 | -7.15% | £ 270.83 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2006 | -7.26% | £ 212.50 |

| Chateau Margaux Premier Cru Classe AOP | 1989 | -7.59% | £ 250.10 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1986 | -8.13% | £ 651.48 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1989 | -9.11% | £ 395.92 |

Among the vintages populating negative territory, 1986 has suffered with the exception of the very great Mouton. The exceptional 1989s and 1990s have fallen, along with with the dull 1999s.

The risers are headed by Mouton, Haut Brion and Latour. The top 10 performers registering double digit growth are entirely accounted for by these three Châteaux.

| Wine | Vintage | Change 1 year | Price |

|---|

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2005 | 22.39% | £ 366.67 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2008 | 21.13% | £ 262.54 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2005 | 20.95% | £ 437.50 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 1996 | 16.87% | £ 282.74 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1990 | 14.30% | £ 429.12 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2005 | 13.36% | £ 566.79 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2000 | 13.32% | £ 1,038.81 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2008 | 11.00% | £ 226.64 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1989 | 9.08% | £ 1,000.03 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1995 | 8.49% | £ 316.67 |

Crossing over to the right bank, predominant top performers over the last 12 months are St EmillMedoc Classed Growth Indexon 2005s and the 2001 Class A relative newcomers. Since March 2015 The Wine Owners Libournais Index is up 7%, coming off it's 3 year lows at that point.

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 53.85% | £ 300.00 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 48.07% | £ 176.57 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 45.67% | £ 183.46 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2000 | 37.16% | £ 301.79 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 1998 | 34.59% | £ 161.84 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOP | 2005 | 27.82% | £ 110.96 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 26.84% | £ 232.57 |

| Chateau La Violette Pomerol AOP | 2009 | 26.67% | £ 208.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOP | 2005 | 24.71% | £ 433.34 |

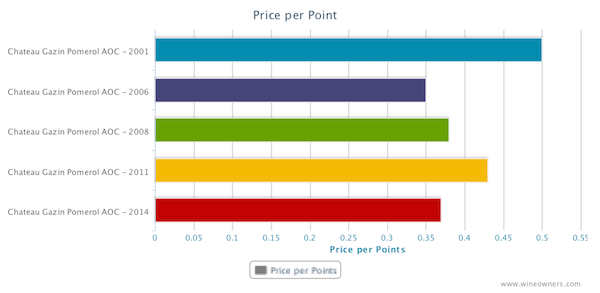

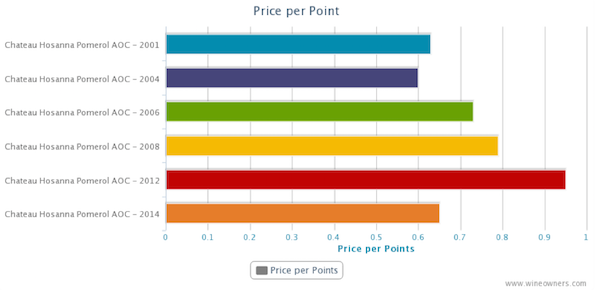

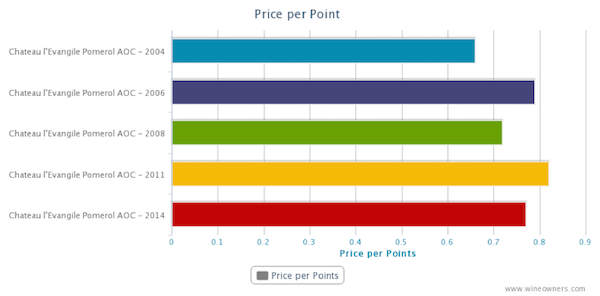

What can we conclude from this? Some commentators are suggesting that value is returning to older back vintages on the back of 4 year declines. Relative value vs quality is likely to be a key driver of future value, for which we recommend you check out the new price per points builder on Wine Owners to which you'll need to subscribe.

Liv-ex have recently seen a predominance of trades of the 2010 vintage, and whilst there seems to be value returning selectively to the Classed Growths, one wonders if it's a little early yet the First Growths, whose starting release prices were in nose-bleed territory. Since 'the further they rise, the longer they fall' it may yet be a bit early to call.

by Wine Owners

Posted on 2015-05-27

So goes the good luck saying, advising what a bride might wear at her wedding to bring good fortune.

In reviewing Bordeaux 2014 releases to date what could be more appropriate? After all, this has been a campaign where a few enlightened producers got their winemaking and pricing aligned, whilst others (the majority?) have simply ignored the current compelling pricing of many of their back vintages of comparable quality.

In the light of that, what mixture of old and new vintages might the wine lover or collector consider?

SOMETHING OLD

Something old is symbolic of continuity.

When comparing the 2014s to broadly comparable back vintages, it reaffirms the value there is in wines around the 7-12 year old mark. In the majority of cases these are wines just hitting their stride, and in some cases with enormous drinking windows ahead of them.

Here are some examples but today Bordeaux unquestionably is generally favouring back vintages over new releases.

L’Eglise Clinet 2006

I just love L’Eglise Clinet, so I’m delighted to give it my first mention. Only, why buy 2014 when 2004, 2006 and 2008 are all cheaper? Personally I’d probably pay the market premium for the 2006, simply because that vintage is proving to be such a fine year in Pomerol. There is so much definition to the fruit, and such balance to the best wines. L’Eglise Clinet is an obvious choice due to winemaking of the highest order over the last decade.

Haut Brion 2008

At around £2,400 per case, the 2008 makes a profoundly compelling case for itself, as does the 2012 in the light of its recent Parker rerating, reinforced by other reviewers such as Jeff Leve. Throw 2006 into the mix as a wine of exceptional purity, and there’s an embarasse de richesses for grown up lovers of Graves.

Palmer 2004

Leaving aside the fact that the beautiful 2014 is Palmer’s first vintage made entirely biodynamically, 2004 still stands out as a wine value that warrants the wine lover’s attention. According to Parker it’s a modern day version of Palmer’s brilliant 1966, majoring on elegance and precision, freshness and depth of flavor.

SOMETHING NEW

Represents good luck, success and hopes for a bright future.

Let’s start with a handful of winners. Using the soon to be released price per points analysis feature on Wine Owners highlights value in the context of broadly comparable quality. The teetering Euro helped, creating a rare opportunity for Châteaux to please the market and satisfy their accountants. A handful grasped the opportunity.

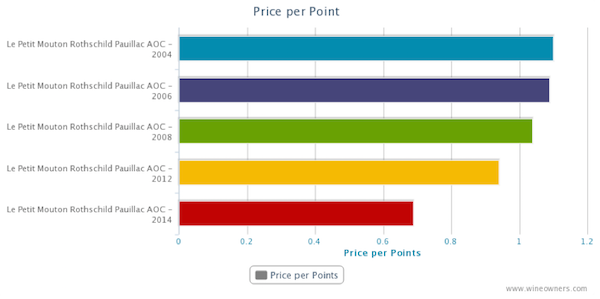

Le Petit Mouton 2014

Growing positive sentiment in respect of the quality of the last decade’s vintages has given those years a recent helping hand. This is the cheapest vintage in the market at £375, and a 40% discount to its possible qualitative equal – 2006. Different too. The success of Merlot on gravel relegated a big slug of Cabernet to the second wine, so atypically cabernet-dominated and correspondingly serious.

Mouton Rothschild 2014

Outstanding in a vintage in which Pauillac starred. There’s a breezy balance whilst its Merlot genes and dash of Cabernet Franc complete a raspberry-driven, fresh, complex palate with plenty of fine-grained tannins. They got the price right as the charts show.

Lynch Bages 2014

Poised, with classic Pauillac character; loaded with griottes fruit and flowing Saville Row lines. It was priced to within a hairs-breadth of 2011 and 2012 current market value but the value difference over 2008 and 2006 must have convinced loyal buyers to part with their money early as merchants reported healthy demand.

Lafite 2014

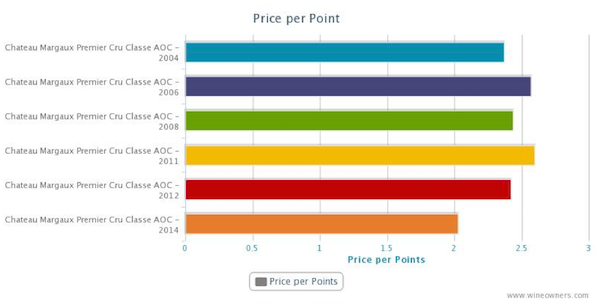

We didn’t think Lafite was the most immediately impressive First Growth in 2014. In fact it seemed to be the most obdurate. Yet the critics lapped it up, and we’re more than happy to defer to their better judgement. In the meantime one thing is very, very obvious looking at the price per points analysis. It’s priced as a come-on to consumers to open their pocket books and buy early.

SOMETHING BORROWED

Anything can be borrowed but it must be returned afterwards.

A couple of worrying features of the 2014 campaign have emerged.

The first is linkage. Back in 2010 Bordeaux chose to tie certain wines with others. The most interesting example was a pack of Rieussec linked to a pack of Carruades. Interesting because of the distorting factor it had on the market for Rieussec. Back then, merchants simply added a couple of hundred pounds to the price of their Carruades allocation before dumping Rieussec onto Livex and selling through at £210-£220 per 12; roughly half the retail release price offered to consumers. To this day those Livex members who jumped in and hoovered up stock are sitting on the best returns that the 2010 vintage had to offer. Not great for the consumer who bought Carruades but a creative market response to price manipulation.

Linkage is seemingly back, with Rieussec once again tied to Carruades, according to one or two merchants we talked to. Who’s doing the tying is a question to which I have no answer, and this time the merchants can’t just transfer pricing from one wine (relatively difficult to sell at first release) to another (for which there was unquenchable demand back in 2010).

The second feature is limited quantities released by some Châteaux. Who’d have thought the Bordelais would have de facto discouraged early purchases in 2014 – maybe they don’t believe in the en primeur system after all? Like a boyfriend who isn’t in love anymore, but is too insecure to let his partner go.

Calon-Ségur is a wine I thought showed delightfully in 2014. The vibe among négociants in Bordeaux was positive, lending emotional support to the wine even before release.

Recently acquired by Suravenir Assurance, an insurance company for whom no doubt a higher average release price per bottle will help to sûr-value their estate on a forward-looking basis, chose to release up but at a realistic price point for the fine quality. But then the real game plan became apparent. There was no wine: merchants who had assumed they were in line for a reasonable allocation (and had promised private clients allocations on that basis) found that they were empty handed. Merchants were left scurrying around for whatever they could pick up. Consumers were left feeling that however big Calon’s heart, maybe it was losing its soul.

This is the sort of attempt at market influence that Bordeaux EP does not need. Frankly, if Châteaux would prefer to achieve a higher price than the market can bear, then why not exit EP as Latour did, and release when the wine is considered ready? It’s dishonest to play it both ways and the market will not necessarily reward throttled supply with higher prices: demand is often chocked off too in the process.

SOMETHING BLUE

The symbol of faithfulness, purity and loyalty.

There are so many Châteaux that we could have used to exemplify the question of whether we would have chosen to buy early, or wait a few years until the young wines are fully formed, or go back to earlier vintages where there’s so much value to be had. In most (but by no means all) cases we’d go back to earlier vintages and wait to buy the new releases in bottle. But buying young wine isn’t an entirely rational decision as we all know.

Which vintages would you buy on the basis of the following charts? You decide!

by Wine Owners

Posted on 2014-10-13

by Wine Owners

Posted on 2014-08-21