by Wine Owners

Posted on 2019-11-15

This article is a republished version of one that appeared earlier in the year. Why? Because there’s another reason to sing about the virtues of Italian wines; the Trump administration have recently introduced a 25% tariff on all wines from France, Germany and Spain below a 14.1% alcohol level (Champagne is exempt). This has caused a loss in confidence in the French heavyweights and Bordeaux and Burgundy prices are on the slide. Italy’s cheese industry was the one selected to take the hit in this particular trade war, leaving their wine sector sitting pretty. We’ve been bullish on Italy all year, this adds further grist to the mill.

The Italians are not only the largest wine producing country in the world, they have been making wine for over four thousand years and cultivate over two thousand grape varieties on a multitude of different soils in twenty different regions! They are not bad at food either. Their climate seems to suit most of the finer things in life.

Italian wine being recommended is nothing new, but having it recommended as a collectable asset bearing an investment case is another matter. Ten years or so ago, a few canny collectors realised some of the ‘Super Tuscans’ (red wines typically made of a Bordeaux blend in Tuscany) such as Masseto, Ornellaia, Sassicaia (recent blog) and Solaia were ripe for decent returns. Traditionalists were a bit put out by these glossy new pretenders turning up on the Italian wine scene with their fancy French grape varieties and lots of marketing but it is fair to say they have helped the overall attention given to Italy and, as a result, the ‘Bs’ are blossoming – namely, Barolo, Barbaresco and, to a lesser extent, Brunello.

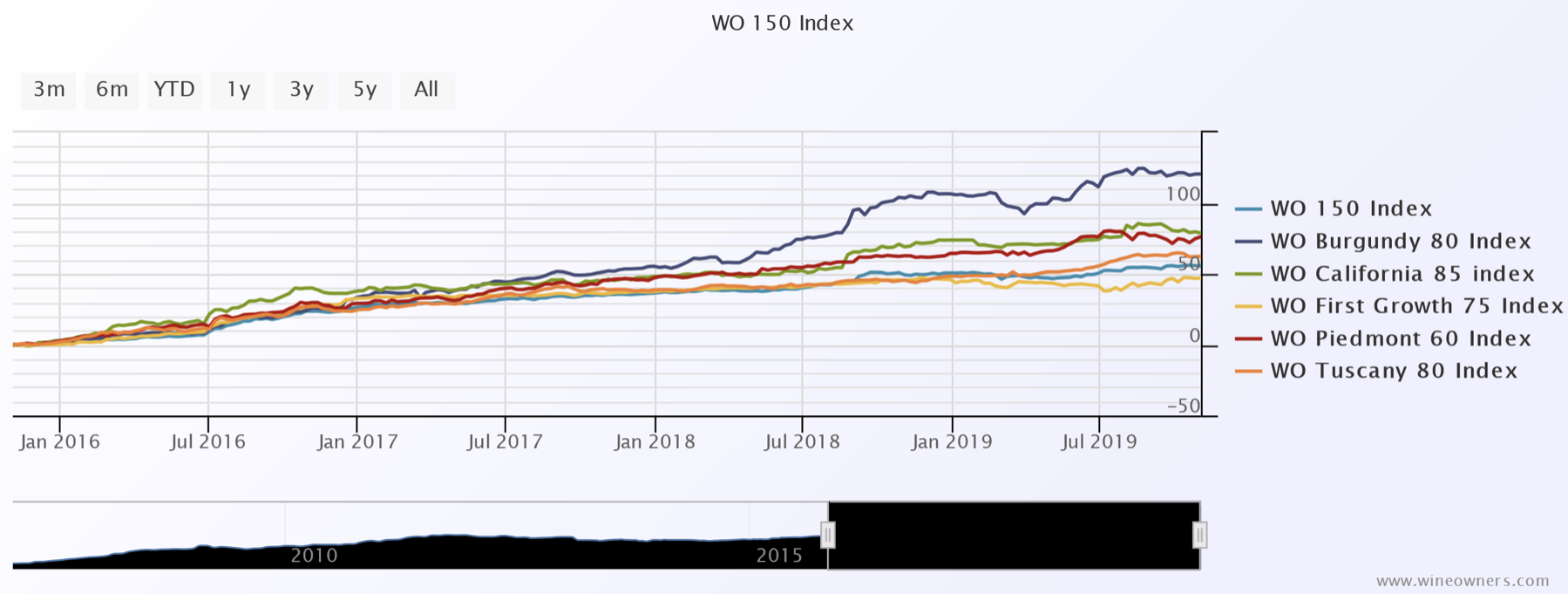

Wines from the best producers of Italy’s most venerable regions have been collected by the cognoscenti for years but now their appeal is becoming more widespread. The problems of Bordeaux, following an explosive China-driven period, have been well documented in the last decade and in its place, the smaller top-quality regions have been profiting. The indices for the last five years show Burgundy +120%, California +79%, Piedmont +76%, Tuscany +62% and First Growth Bordeaux +47%, the broad base WO 150 is +55% (all nice numbers!).

The reason for Burgundy’s performance is that old tried and tested wine world fundamental of genuine demand outstripping supply - who knew!? I think it is fair to say prices in Burgundy have been coming off the top for nearly a year now. Californian prices were a little more ‘forced’ and are in retreat now, but both these regions produce tiny quantities in comparison to the number of people looking to access these markets and gain exposure. Very widely held Bordeaux has been steady but is beginning to slide in this difficult environment. Piedmont and Tuscany are holding firm to gently positive.

The complex nature of Burgundy, California and Piedmont with their tiny (compared to Bordeaux) vineyards is attractive. This adds to the aesthetics, spurring on both the well-seasoned and newcomers alike, keen to learn more and invest time and money accordingly. More of the written word is more easily accessible to interested folk, and with platforms such as Wine Owners to trade on, the visibility of the product and the liquidity of the commodity has increased.

Grand Nebbiolo from Piedmont is yet to hit the big time, apart from a special few producers, but the word is spreading and there are ‘new’ names coming through; dedicated collectors and the inquisitive are homing in. It is a Burgundian-like network of vineyards, producers, families and reputations and you need to know what you are doing. Famous names like Conterno, for example, have six listings in my favourite reference book: Aldo, Diego, Fantino, Franco, Giacomo (the big one) and Paolo.

Some of the bigger names like Giacomo Conterno famed for his Montfortino vineyard, Giuseppe Rinaldi, Bartolo Mascarello, Bruno Giacosa and Gaja are already highly sought after superstars, with prices to match, but there are a host of others with reputations and demand beginning to swell; Brovia, Cappellano, Fratelli Alessandria, Sandrone, Voerzio and Vietti to name a few.

The ‘Super Tuscans’ of Bolgheri are much simpler to understand, like Bordeaux versus Burgundy, and are produced in larger numbers. The names mentioned earlier are virtually household names (in wine terms!), are less exciting right now overall but tend to deliver very steady returns.

Brunello di Montalcino, made from Sangiovese, is also comparatively easy to piece together in relation to Piedmont. Biondi Santi, Poggio di Sotto, Salvioni and Soldera are the big names with the fancy price tags. The secondary market for Brunello has not yet developed so, for now at least, it is a case of keeping a watchful eye although Soldera has been added to several portfolios already. There are many other less well-known names that have been attracting huge plaudits from the top critics that remain under the radar. This group haven’t matured into the darlings of the market, so far, and back vintages are cheap and well worth consideration.

There have been some excellent vintages in Italy in the last decade or so, attracting fantastic media coverage and now the battle-weary Bordeaux buyers and profit takers of Burgundy are moving in. Another reason for favouring Italian wines in the current climate is that the U.S. and Germany are the biggest export markets, so the market unlikely to be affected by any potential fallout from Brexit.

Most of all, however, these wines are barely scratching the Asian surface as yet and we all know what happens when that changes!

Miles Davis 15th November 2019

by Wine Owners

Posted on 2018-09-19

This is an extract of Wine Owners' Collecting and Investing in Fine Wine guide. You can download if for free here.

Short-term? Long-term?

Generally speaking, wine investments perform best over a minimum period of around 5 years.

There is no single ‘right answer’ of course. Some very active collectors sell and reinvest as soon as they see a fixed return, following speculative market momentum. Other collectors tend to hold for long periods of time— and although they may go through periods of flat or negative growth, typically they benefit from shifts in supply and demand; when demand pulls significantly ahead of supply, prices tend to move sharply reflecting that imbalance. Longer-term strategies may also benefit from partial realisation of profits to mitigate the risks of re-ratings.

Wine has periods of both high and low performance, just like any other investment class. Medium- and long-term holds tend to perform more consistently as a result. They also give investors the option to enjoy matured wines (i.e drink rather than sell), if their financial circumstances improve such that personal enjoyment of the wine becomes more significant than the financial value of selling it.

Vintage follower vs. perennial buyer

A common refrain among some investors is “the best wines from the best vintages”. It’s practically a matter of pride having exclusively the best wines in their portfolios.

However, this approach does not fit with the reality of how buyers are allocated wine at first release by merchants. Nor is it necessarily a good idea.

With Bordeaux, this ‘best-vintages-only’ policy is relatively easy to maintain. There is no particular need to buy off-vintages because the wines are produced in volume, and are widely distributed.

But things are different for scarcity-led markets such as top Burgundy, Barolo and cult Californians. Here, supply is low, demand is high and distribution channels are narrow. The net result is that suppliers can apply pressure on consumers to buy a particular wine every vintage, or else lose their right to an allocation next year. With so many customers vying for these wines, merchants can choose to give their best allocations to their best (most consistent) customers. Maintaining an allocation of these wines, therefore, requires consistent buying every vintage, irrespective of quality.

Cherry-picking vintages doesn’t always work, either. Vintages which are heavily touted initially are not always those considered the best in the fullness of time. Piedmont 1997 was considered a stellar vintage early on, but today the favour falls with less-hot vintages such as 1998, 1999 and 2001. And this works both ways; Burgundy 2002 was largely unloved at release, but has now evolved into one of the all-time greats.

Relative value picking

Identifying value is vital for both short- and long-term performance. How do you select which new releases to pick, or determine which vintages of a wine represent the best value?

Picking the best prospects is now simple. Use relative value analysis to find sweet spots between market pricing and (carefully weighted) critic ratings.

To determine whether Le Pin 2017 is a sensible en primeur purchase, the analysis below compares it with four earlier vintages. The Relative Value Score shows that 2017 is a more attractive buy than the higher-rated 2015 and 2016 vintages. It also confirms that 2012 offers better value (at current market prices, factoring in current critic ratings) than any of the other four vintages.

This is an extract of Wine Owners' Collecting and Investing in Fine Wine guide. You can download if for free here.