by Wine Owners

Posted on 2016-09-12

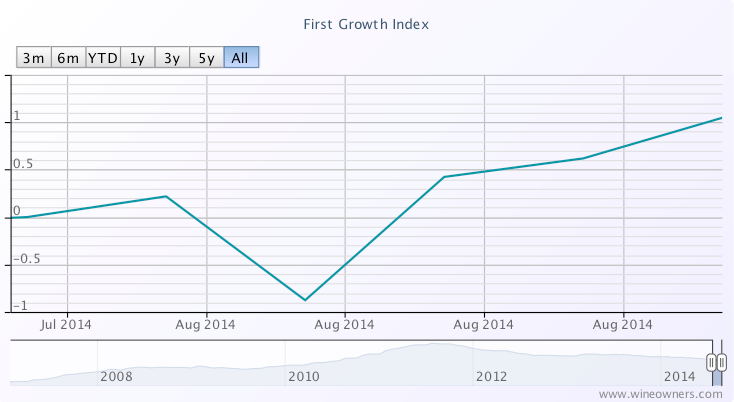

The WO First Growth Index showed price appreciation over the last 12 months pushed through the 20% threshold last week.

Haut Brion’s emergence as a wine that can now rivals its peers in the secondary market is clear, with 4 vintages in the top 10 movers, namely 2000, 2003, 2006 and 2008. Will we see Haut Brion close the gap where historically it would have sold at a discount to the other Firsts? The data seems to support the likelihood of this happening.

The top 10 movers have risen 23%-32% in the last year. Furthermore there has been just one faller out of the 75 constituents of the WO First Growth Index, namely Latour 2005.

Top 10 movers over the last 12 months

For the first time in years, we see a wine from the twin peaks of 2009 and 2010 in the top 10 movers, in the shape of the exceptional Margaux 2010. Scores from Robert Parker, Neal Martin and Stephen Tanzer oscillate in the 96-99 range, but the market is indicating it thinks that this could be a perfect wine. It’s now caught up with Haut Brion and Lafite at circa £540 per bottle.

Latour’s withdrawal from the en primeur business looks like paying dividends. Although the 2010’s value is far out in front of the field at £845 a bottle, it’s still not broken through it’s retail en primeur opening offer price of £950. Nevertheless it has performed well through the worst of the Bordeaux market’s 3-4 year slide, losing just 26% of its value by November 2015 before recovering, quite a decent performance compared with Lafite considering their similarly high release prices.

Can the Firsts continue this powerful recovery? Can they recapture the heights of their 2009 and 2010 release prices? If, so which will be the first ‘First’ to do so?

Least likely is Lafite, whose 2010 release price of £983 per bottle reflects a moment in time when Lafite was practically a Chinese barter currency, not to mention the 2009’s vertiginous release of £1,000. In each case there is a loss per per bottle of £440 versus en primeur retail.

Most likely to get back to even terms, in order of proximity of current market price vs opening retail offer price, is:

Latour 2010

Latour 2009

Margaux 2010

Haut Brion 2010

Confidence has returned and momentum is driving the market forward. If and when the current price of the above 4 wines exceeds their opening prices, and buyers of 2009 and 2010 First Growths no longer see a sea of red loss/gain percentages in their portfolios, confidence will be given a further boost.

by Wine Owners

Posted on 2014-09-12

With market sentiment for fine red Bordeaux brightening, we ask, what do the latest market numbers actually suggest?

Let's start with the market as a whole.

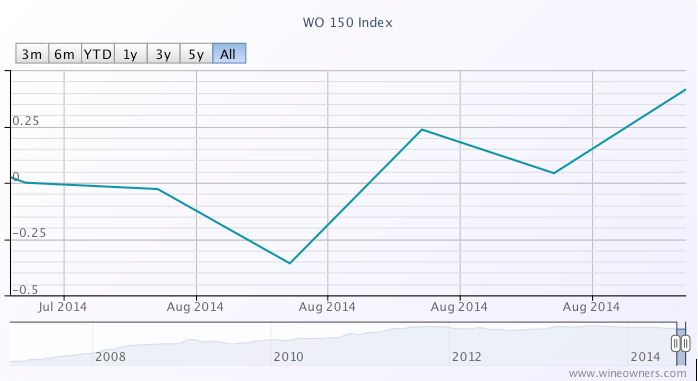

The Wine Owners 150 (WO 150) comprises investment grade wines across the top 40 performers of the last 20 years from all key regions of production. This index rose 0.4% in the last month compared with a fall of -4.45% over the course of the last 12 months. Of the most recent bottom 40 fallers, all were red Bordeaux. More positively there were 22 Bordeaux in the top 40 gainers.

1 month

1 year

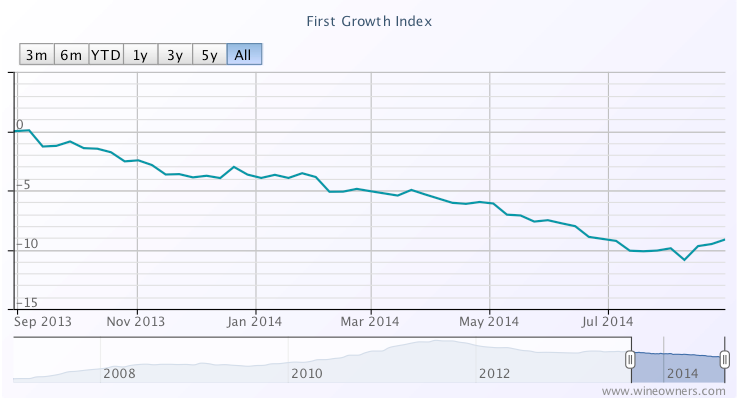

The First Growths Index rose 0.98% over the last month, and is now down -9.14% over the last 12 months, off its early August lows of -10.87%

Haut Brion appears to be leading the charge, 1989 and 2006 showing strong double digit growth, with Mouton (1986, 1989, 1996, 1998 and 2010) showing 5%-8.5% growth along with Haut Brion 2003, Margaux 1986 and Lafite 1990. The predominance of older, scarcer vintages among the top movers is notable. Older vintages can show some of the sharpest short-term moves given there is much less of them in the market, so market movements in 25 year old vintages are not convincing bellwethers.

1 month

1 year

The Medoc classed growth index rose 0.23% over the month and was up 0.72% from its August lows, and is now down -4.8% over the last 12 months.

Palmer saw double digit growth in respect of vintages 2009 and 1998, along with Pontet Canet 1996, Leoville Barton 2006 and Gruaud Larose 2005. Risers however were largely offset by fallers across a broad range of vintages including 1996, 2000, 2005, 2006 and 2009. Although there is increasingly positive support for hard-hit wines from vintages such as 2005, the data does not yet substantiate an upturn.

1 month

1 year

The right bank also saw a rise comparable with the First Growths, with the Libournais Index up 1.09% over the last month, and up 2.5% from its August lows. It is now down just -0.98% over the course of the last year.

Top movers include Petrus 2010, Beausejour Duffau (1998 and 2010), VCC (2001 and 2010), Tertre Roteboeuf (2005, 2009, 2010), Belair [Monange] (2000, 2010), Latour a Pomerol 2005 and Pavie Macquin 2005.

1 Month

1 year

Green shoots?

It’s noticeable that merchants have been talking about restocking since July which can only be positive, but there are opposing views on where the latest data may lead the market.

With the exception of a 0.94 rise in the First Growths Index in December 2013, price declines have been inexorable since then – until now. The trade is split however on how much further First Growths have to fall, especially amongst the previously most inflated wines. With the First Growths down -27% since the peak in July 2011, a small rise of 0.98% may be positive but the inevitable continuing focus on value on the part of buyers favours the possibility of as many - or more - fallers vs risers over the remainder of 2014.

The Medoc classed growths saw a 0.7% uptick in March 2014 in addition to a rise last December in line with the First Growths. Taking all the data into account, it’s hard on that basis to read anything into the recent comparable bounce back from August lows.

The Libournais Index has performed the strongest over the last year with a 2.3% rise between mid January and mid February 2014, comparable with the performance over the last month after a summer of declines. Relative scarcity and a positive 3-year performance (+8%) suggest that the conditions for a broader based recovery are more firmly established for right bank fine wines.

Perhaps of significance, the 22 Bordeaux constituents showing price growth in the WO 150 index since the end of July compares with just 10 Bordeaux wines that have traded in positive territory on a 12 month view.