by Wine Owners

Posted on 2020-01-27

By Miles Davis, 27th January 2020

Summary

Piedmont is on the up, the area and the wine. The region is extremely picturesque, and the food and wine scene is superb. Winemaking is better than ever with younger generations bursting through full of energy and enthusiasm and the wines are getting better and better. In my experience, they are becoming more approachable too. The natural acidities of the grapes and the soils can handle, if not benefit, from the warmer climate and there have been some very fine vintages in the recent past. In global terms, Piedmont is relatively undiscovered and comparative values to other great regions make for a compelling story – read on!

Background

I have just returned from three glorious days in Piedmont. The weather was fine, the food was finer, and the wines were finer still! As readers will know, I have been singing the virtues of Piemontese wines, and the value they offer, for many months now. I was not expecting to have my enthusiasm heightened, just confirmed really, but this trip exceeded all expectations. I have been a few times before but the combination of seeing some top-notch producers, having a local courtier (David Berry Green, DBG Italia) as a guide, and in the company of both an experienced wine journalist (Victoria Moore, Daily Telegraph) and a wine merchant (Mark Roberts, Decorum Vintners), the stars aligned and we hit some celestial heights.

Compared to Bordeaux and Burgundy, Piedmont has not been making wine for very long, certainly not commercially. Producers have been operating for decades rather than centuries. The Nebbiolo grape that provides us with Barolo and Barbaresco was not even the top variety in the region 30 years ago, that was Dolcetto. Back in the eighties, Conterno Fantino encouraged larger orders by giving away six bottles of Barolo for every sixty bottles Dolcetto ordered! Now Dolcetto vines are being grubbed up and replaced by Nebbiolo - oh how trends change! This one will not be reversed, however. Producers are defensive on Dolcetto, arguing it makes wine for everyday drinking and whilst I really wouldn’t mind drinking Bartolo Mascarello Dolcetto most days, it doesn’t compare to the joys produced by Nebbiolo.

Victoria Moore & David Berry Green - © Miles Davis, Wine Owners

Notes

The striking and salient points derived from the trip were all positive. The region has never generated so much international interest, both generally and in the wine department, but largely thanks to the wine department. In 2014 ‘First floor Landscape of Piedmont: Langhe-Roero and Monferrato’ became the official name of a UNESCO World Heritage Site and this has brought tourism flooding in, although some of it is now becoming a problem. The village of Barolo itself and its 700-800 residents now plays host to international rock concerts; Bob Dylan and Eddie Vedder of Pearl Jam have played to 7,000 (presumably ageing and wine loving) rockers in the last couple of years. Basta! scream the residents, producers are less concerned. The U.S., Germany and England are already major markets for the wines, but others are growing. Australia, Japan, Malaysia, South Korea, Singapore were all mentioned, as was Scandinavia. There was one noticeable absentee – China. ‘Not yet’, the producers said.

© Miles Davis, Wine Owners

The Wines

The wines we tasted were largely brilliant and we all agreed what a good reminder it was when we had our first poor tasting - it offered reassurance that we hadn’t become so inured to the place that we had become complacent! To be fair the Baroli we were tasting were mainly from the fabulous 2016 vintage and we were tasting at very good growers, some famous, some less so, but more on them later.

I was surprised by the approachability of most of the wines, a marked difference to previous experiences. The wines were pale, supple and elegant and with a weightlessness (something that perhaps Nebbiolo can deliver more than any other variety) yet packed with fruit, power and nuance at the same time.

Times have been a-changing in Barolo country and where they haven’t changed too much, the results have improved dramatically. The ‘Barolo wars’ are well documented, indeed there has even been a film made about them and concern the traditionalist approach versus the modern. Briefly, this translates into long maceration periods and ageing in large oak barrels (botti), the traditional approach, versus shorter maceration, temperature controlled fermentation and small oak barrels, the modern. It was interesting to note that the two wineries employing the highest percentage of small oak barrels produced the least good wines. The better wines were made in the traditional way but are harvesting better fruit, implying improved work in First floor.

As with other regions, alcohol levels in Piedmont have been rising, largely due to climate change. Most of the wines tasted were at 14.5%, but such are the natural acidity of Nebbiolo and the soils you really don’t notice, at least not until you’ve had the whole bottle yourself! It is a very different experience compared to drinking Bordeaux wines at the same level. Another local variety, Pelaverga, produces an even paler juice which is amazingly light and fruity. I had just started dreaming of summer barbecues when I noticed G.B. Burlotto’s offering weighed in at 15% - keep it away from the kids!

-G.B. Burlotto © Miles Davis, Wine Owners

The Market

As previously commented on here, the market in Piedmont wines is firm. Without the geopolitical issues currently hanging over the wider market, it would be a fair chunk firmer. The very loudly heralded 2016 will be released this year and buyers are waiting to pounce. If 2010, another great vintage, is anything to go by they most certainly will, and probably in far greater numbers than back then. In the grand scheme of things, Piedmont is an adolescent and will continue to grow. Wine making will continue to improve and prices will rise.

The Producers (in brief) (and not all)

Punset (Nieve) – previously unheard of (by me). Bio-dynamic and very in touch with climate and nature. Only releases when the wines are ready. Marina Marcarino’s Barbaresco Basarin 2013 (a year very similar in weather to the brilliant 1982, her first vintage) is available now. Delicious and only 13% alcohol. So desperate to make wine, she lied to her parents about the course she was taking at University. They wanted her to join their family widget making business – we were all glad she didn’t! Her range is just great, elegant and refined. She may even save the planet too.

G.B. Burlotto (Verduno) – Premier League status and I now know why! Verduno, at the northern tip of Barolo country, is the village of the moment and its best vineyard, Monvigliero, known for its elegance, is the piece of dirt everyone wants a piece of right now. Fabio Alessandria makes c. 8,000 bottles of Monvigliero - Investment Grade ‘A’. His whole range is superb.

Fratelli Alessandria (Verduno) – Cousins of Fabio and not to be confused with the Glaswegian band. Rising up into the Premiership. Traditional methods, improvements in the winery and focusing on improving quality, not expansion. Their Langhe Nebbiolo ‘Prinsiot’ 2016 is already in my cellar for drinking and I’ve been buying ’13 Monvigliero for investment.

Trediberri (La Morra) – Nicola Oberto and his parents bought a 5 hectare site in La Morra in 2008 and have 2 prime hectares of Rocche dell’Annunziata. Definitely one to watch, this guy is on the move and has been studying Bruno Giacosa’s methods. Refreshingly honest, he was genuinely most excited about his recently made Annunziata 2019 - at three months of age! The Langhe Nebbiolo ’19 might be one to sample. Moving from on the radar to gentle accumulation…

Trediberri (La Morra) – Nicola Oberto © Miles Davis, Wine Owners

Roagna (Castiglione Falletto and Barbaresco) – Now in the hands of Luca Roagna, they are one of the few growers making really serious wines in both Barolo and Barbaresco. The star has been rising for some time. Organic with old vines. We tasted wines from the poorly reviewed 2014 vintage (he releases later) at 10 degrees in the cellars. Although the wines were also cold, they sang their heads off. Both from Barbaresco, the Albesani (2,000 bottles) with the most amazing nose and the Montefico (1,000 bottles) stood out for me. Invest with confidence!

Crissante, La Morra – not on my radar before, Alberto has been running this family affair (we met Nonna (his nan), 88 and still dancing) since 2008. The family owns 6 hectares of vines, 5 of hazelnuts and a lovely holiday house they rent out. The Barolo Classico ’16 will ticks a lot of boxes when released. Thier Capalot ’15 will also give immense pleasure. The ’13 is currently available. Firmly on the radar now.

Bartolo Mascarello, Barolo – Investmnent Grade A. Brilliantly understated and traditional with a touch of jazz, but only in the artwork on display. Maria Theresa’s 2018 Dolcetto was superb, the ’16 Barolo sublime. A blend of 4 vineyards with production at 15-20,000 bottles. Genius. Interesting to spot an empty Trediberri box by the back door!

Giovanni Rosso (sounds so much better than Red John!), Serralunga – Proprietor Davide turned up as we were leaving, completely unphased by his tardiness. How someone so laid back has managed to create such a bustling business is amazing; two tasting rooms, one with a full restaurant style kitchen, a helipad, a contract to make BBR house Barolo and sales all over the world. Our impromptu host excelled in showing us the famous Vigna Rhionda vineyard. Once our feet were double caked in clay he informed us the terroir was nearly all limestone! A rushed tasting followed which was a bit inconclusive but with their top cuvée selling at £500+ a bottle, something is working. Another visit required!

Luciano Sandrone, Barolo – impeccable presentation. Famous for their Barolo labels Cannubi Boschis (Aleste since 2013) and Le Vigne, and now the uber rare Vite Talin, that they vinify themselves, they not only sell a lot of grapes from their Roero sites, they also sell finished wine to others. A mixture of traditional and modern. Barbara works with her Uncle Luca, only 3 years apart in age and Luciano (Barbara’s father and Luca’s brother) is still on site having begun his wine life with Giacomo Borgogno, bang next door and right under the slopes of the Cannubi Bioschis vineyard. Great 16s, the 15s also very attractive. Lovely wines, I have been buying and will continue.

Sandrone © Miles Davis, Wine Owners

General comment

It was an inspiring trip and easily surpassed expectation, particularly in the wine department. Growers tend to be family run businesses, are friendly, engaging and genuinely passionate. The bigger businesses are the antithesis of this and, dare I say it, more reminiscent of Bordeaux producers. These personalities are clearly reflected in the wines and different styles are very apparent.

On my return to my desk I found the tail end of the Burgundy 2018 en primeur offerings. The relative prices just do not make sense. On every level, there is no comparison; there are dozens of Grand Cru Burgundies from a host of producers releasing wines at more than c. £150 a bottle, in Piedmont a tiny handful. From a recent release of Giacomo Conterno’s 2015 wines, only the legendary Monfortino (the most expensive wine in all Piedmont) was above this price level. Many Burgundy premier crus cost more than exceptional Barolo cru, village wines more than ‘classico’ blends etc., etc.

For drinkers and those wishing to dip their toe, all of the producers make an entry level wine, be it a Langhe Nebbiolo, a Langhe Rosso or a Nebbiolo d’Alba. These are released earlier than the aged Barolos and offer an inexpensive way of treating yourself and opening the door.

As ever, please fire away with questions.

© Miles Davis, Wine Owners

by Wine Owners

Posted on 2019-09-09

August was much like July with summer holidays being the prime concern for most people. The wider market has felt quiet, maybe because the Bordeaux market is still largely flat, but there are definitely pockets of excitement about and the broad-based Wine Owners Index was up 0.9%. Trade was brisk with Piedmont, Tuscany and Champagne dominating turnover at Wine Owners.

The solid, relative value investment case for the wines of Piedmont has created demand which, in turn, has led to us step up our sourcing efforts. Liquidity is tight, obviously one of the plus points in the investment case, but we have managed to unearth some lovely parcels, particularly some legendary Bartolo Mascarello vintages.

Sterling has remained weak due to the Brexit shenanigans, and this has finally translated into some positive moves for various wine indices. As we know, a weaker pound generally leads to increased demand in the sterling denominated secondary fine wine market, especially from U.S.$ based buyers. Little has come out of Asia, however, as continuing rhetoric surrounding the U.S./China trade wars rumble on and Hong Kong is still suffering from the most vocal political protests in its modern history. They (the people of Honk Kong) have even appealed to Mr. Trump to help!

The largest region within the wine market will always be Bordeaux and it is business in the wines of Bordeaux that is suffering the most from these continuing issues. Many of the other top wine regions are less affected by these global events and market conditions as the wines are less traded, and the supply and demand ratio in a different place. Bordeaux has been looking cheap versus its peers for some time now, and there’s a lot of bad news in the price but the stars need to start aligning. This can and will happen, but when is the big question!

by Wine Owners

Posted on 2019-07-09

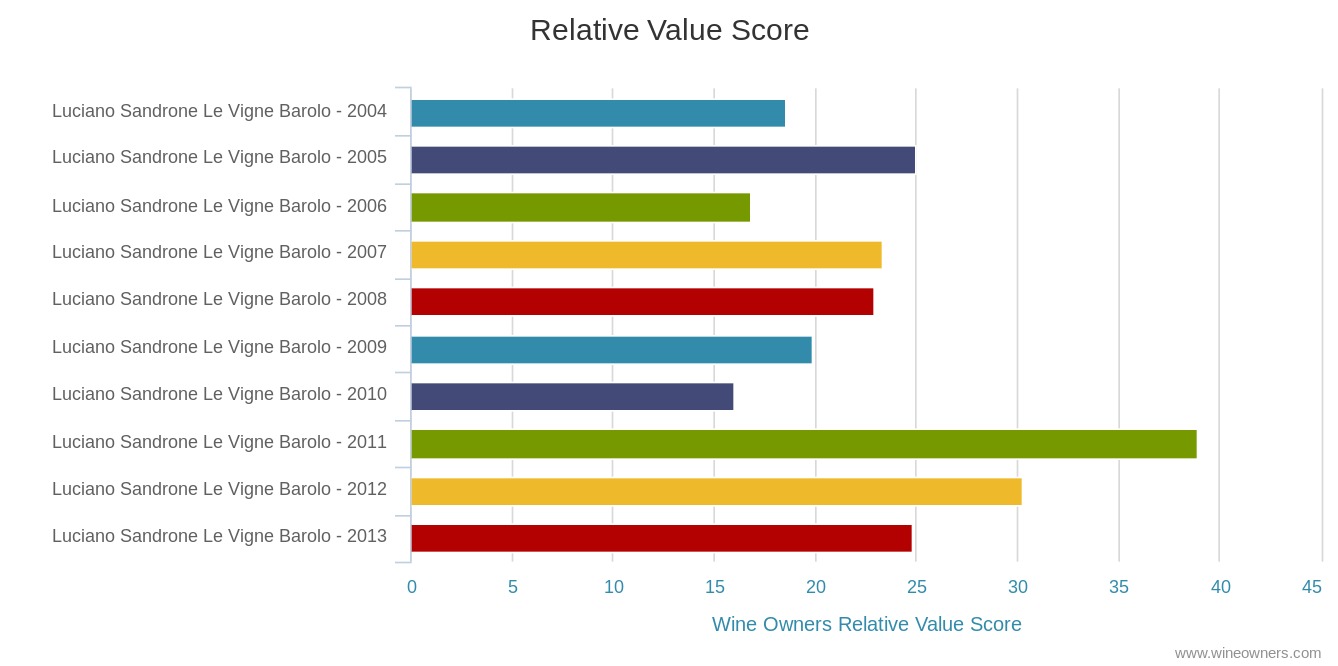

The reputation of Luciano Sandrone continues to grow and grow, in keeping with the popularity of Barolo. Not as famous as the very top tier of Bruno Giacosa, Giacomo Conterno or Giuseppe Rinaldi but nestling just in behind, at a far more attractive price point.

Here we consider Le Vigne cru although the story is much the same for the slightly more expensive Cannubi Boschis (renamed Aleste in 2013 – in classic, designed to confuse, Piemonte style!).The consistency of the scores is incredible - through a mixture of very varied vintages from ’06-’15 the average is 95.3 points (Wine Advocate). Very significantly, the estate releases a small amount of the exact wines (under the labels Le Vigne Sibi et Paucis and Cannubi Boschis Sibi et Paucis) after ten years of age and they consistently achieve greater acclaim at that point, the ’07 going from 96 to 99 points (WA) for example. The range of points scored would indicate these are very fine wines indeed and given the rarity, must be only affordable to only the mega rich. Not so, prices start at c. £60 a bottle, rising to c. £170 for the stonking 2010 vintage.

For comparison sake I looked at some other fine wines from Burgundy and Bordeaux over the same ten year time period. Obviously these comparisons will never be exactly like for like but the differentials are not that great either; brilliant producers from the top tier of their respective regions, producing internationally acclaimed wines from the best local grape varieties designed to take advantage of their particular terroirs and climates to the full. We have a decent premier cru Burgundy, Domaine Dujac Aux Combottes, a sensational Pomerol on top of its game, Vieux Chateau Certan, and the king, Chateau Petrus (just for fun):

Comparisons between ‘06-‘15 vintages: |

Av. points

|

Av. Price

|

Highest price

|

Luciano Sandrone Le Vigne Barolo DOCG |

95.3

|

£98

|

£170

|

Domaine Dujac Gevrey Chambertin Aux Combottes Premier Cru |

91.6

|

£170

|

£234

|

Vieux Chateau Certan |

94.1

|

£134

|

£220

|

Petrus |

96.1

|

£2,200

|

£3,250

|

I suggest there is room for significant upside for this Barolo. And I am going to start selling the Combottes I own, the differential is absurd and further illuminates how crazy Burgundy prices have become. Production of fine wine in Barolo (and Barbaresco) is tiny compared to even Burgundy and completely miniscule in what we could consider the ‘investable’ candidates.

Please see charts for Market Price and Relative Value Scores for available vintage comparison.

Miles Davis

9th July 2019

by Wine Owners

Posted on 2019-04-16

Italia! From the the country that has given us espresso and cappuccino, ciabatta and focaccia, minestrone and spaghetti, Maldini and Rossi, Pavarotti and Verdi, Canaletto and Leonardo da Vinci, Ferraris and Maseratis, Bunga Bunga, the Mafia and the Pope, we now have… un'opportunità di investimento – nel mondo del vino!!

The Italians are not only the largest wine producing country in the world, they have been making wine for over four thousand years and cultivate over two thousand grape varieties on a multitude of different soils in twenty different regions! They are not bad at food either. Their climate seems to suit most of the finer things in life.

Italian wine being recommended is nothing new, but having it recommended as a collectable asset bearing an investment case is another matter. Ten years or so ago, a few canny collectors realised some of the ‘Super Tuscans’ (red wines typically made of a Bordeaux blend in Tuscany) such as Masseto, Ornellaia, Sassicaia (see recent blog post) and Solaia were ripe for decent returns. Traditionalists were a bit put out by these glossy new pretenders turning up on the Italian wine scene with their fancy French grape varieties and lots of marketing but it is fair to say they have helped the overall attention given to Italy and, as a result, the ‘Bs’ are blossoming – namely, Barolo, Barbaresco and, to a lesser extent, Brunello.

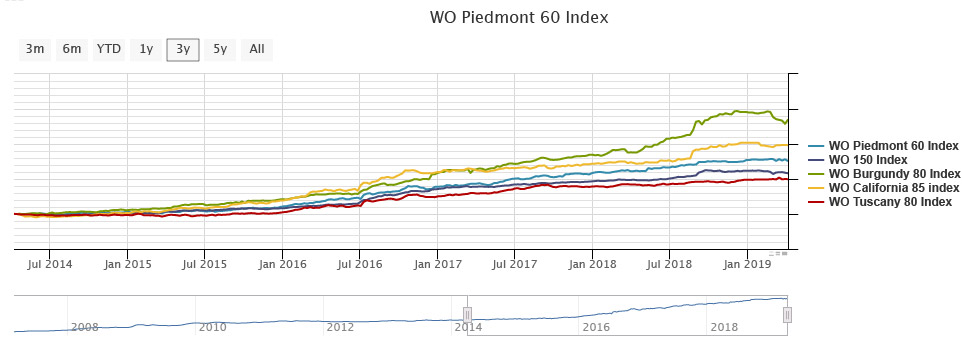

Wines from the best producers of Italy’s most venerable regions have been collected by the cognoscenti for years but now their appeal is becoming more widespread. The problems of Bordeaux, following an explosive China-driven period, have been well documented in the last decade and although we are quietly confident on a comeback from the sleeping giant, the smaller top-quality regions have been profiting. The indices for cult Californian (+98%) and beautiful Burgundy (+135%) have both gone berserk in the last five years, whilst Piedmont has gained a more modest 78%, with Tuscany posting +50%.

The reason for Burgundy and California’s performance is that old tried and tested wine world fundamental of demand outstripping supply - who knew!?? Both these regions produce tiny quantities in comparison to the number of people looking to access these markets and gain exposure. The complex nature of these regions with tiny vineyards, often co-owned by different families and winemakers, has added to the gloss and mystery, spurring on newcomers to learn more and invest time and money accordingly. More of the written word is more easily accessible to interested folk, and with platforms such as Wine Owners to trade on, the visibility of the product and the liquidity of the commodity has increased.

Grand Nebbiolo from Piedmont is yet to hit the big time, apart from a few, but there are more than rumblings in other names; dedicated collectors and the inquisitive are homing in. It is a Burgundian-like network of vineyards, producers, families and reputations and you need to know what you are doing. Famous names like Conterno, for example, have six listings in my favourite reference book: Aldo, Diego, Fantino, Franco, Giacomo (the big one) and Paolo.

Some of the bigger names like Giacomo Conterno famed for his Montfortino vineyard, Giuseppe Rinaldi, famed for Brunate and Tre Tine, Bartolo Mascarello and Gaja are already highly sought after superstars with prices to match but there are a host of others with reputations and demand beginning to swell; Brovia, Cappellano, Fratelli Alessandria, Sandrone, Voerzio and Vietti to name a few.

The ‘Super Tuscans’ of Bolgheri are much simpler to understand, like Bordeaux versus Burgundy, and are produced in larger numbers. The names mentioned earlier are virtually household names (in wine terms!) and are less exciting right now overall. Brunello di Montalcino, made from Sangiovese, is also comparatively easy to piece together in relation to Piedmont. Biondi Santi, Poggio di Sotto, Salvioni and Soldera are the big names with the fancy price tags. The secondary market for Brunello has not yet developed so, for now at least, it is a case of keeping a watchful eye.

There have been some excellent vintages in the last decade or so, attracting fantastic media coverage and battle-weary Bordeaux buyers. Another reason for favouring Italian wines in the current climate is that the U.S. and Germany are the biggest export markets, so unlikely to be affected by any potential fallout from Brexit. Most of all, however, these wines are barely scratching the Asian surface as yet and we all know what happens when that changes!

by Wine Owners

Posted on 2019-03-14

2007 £1,300 per 6 WO Score 96

2010 £2,100 per 6 WO Score 100

Bartolo Mascarello is one of the true legends of Barolo, think Rousseau or Roumier in Burgundy terms, in case you’re not familiar with the ‘Knights of Nebbiolo’. And if that’s still confusing, think Liverpool (Football Club), but I would say that, wouldn’t I? In fact, to be drawn against Juve tomorrow morning could easily inspire a trip to Piedmont, with a bit more than hazelnuts to look forward to! I digress…

Maria-Teresa Mascarello took over from Bartolo, her father, in 1993, the estate having been founded in 1918. Beautifully simple in its creation, the wine is a blend of four of the top crus, or vineyards and has been consistently and spectacularly successful for decades.

In the charts above and below we have compared various well-regarded vintages of a similar era. These vintages are very good and very scarce, two of the most important factors for investors as they are squirreled away by the canniest collectors and prices have been rising. They are still a fraction of their Burgundian cousins however and we have no issue with recommending a buy, particularly the ’07 and the ’10, the cheapest relative value bets here:

Tasting notes, courtesy of Vinous Media:

2007: Mascarello’s 2007 Barolo shows just how compelling this vintage can be, even now. Sensual, layered and totally voluptuous in the glass, the 2007 shows the more flamboyant side of Barolo. I find the wine’s voluptuous, engaging personality impossible to resist. Sure, 2007 is not a classic vintage, but when a wine is this good, I say: Who cares?

2010: The 2010 Barolo is one of the most striking, hauntingly beautiful wines I have ever tasted here. Mysterious and slow to show its cards, the 2010 impresses for its inner perfume, sweetness and exceptional overall balance. Today the striking fruit and classic, austere elements of the vintage take turns in dominating the wine's balance. The 2010 was always magnificent in barrel. It is equally spectacular from bottle. Readers who can find the 2010 should not hesitate. Ideally I wouldn't dream of touching a bottle until age 15 or so, although I doubt I will personally have the discipline to follow my own advice!

The 2007 is the cheaper option from a classic vintage and the 2010 is the turbo charge version from the all-conquering 2010 vintage. Both are recommended.

by Wine Owners

Posted on 2019-02-11

Sassicaia 2006, 94 points £2,050 per 12

Sassicaia 2009, 96 points £1,590 per 12

Sassicaia 2010, 94 WO points £1,430 per 12

Sassicaia 2015, 97 points £1,750 per 12

Sassicaia 2016, 100 points (WA) £2,700 now, released yesterday at £1,270!

I am now editing this blog originally written on the 25th January as yesterday saw the release of

Sassicaia ’16. Monica Larner of the

Wine Advocate heaped the magical three digit score and a boat load of praise meaning it sold out in seconds (she does hold sway!). I would have enjoyed being a fly on the wall of Armit’s office yesterday as the phones must have been red (pun intended) hot! If, like she says it will, the ’16 turns out to be just as good and valuable as the ’85 vintage, 31 years from now, that would yield a most respectable 8%

CAGR (compound average growth rate). One should take note, however, that the price of the ’85 more than doubled in the last three years so buyer’s beware! I repeat my recommendations from before.

Original post:

When we began researching Sassicaia for this post we began by thinking it would turn out be a good and solid egg. We were right. Other than the stratospheric and legendary 100 point ’85, now c.£30,000 per 12, up from £12,000 three long years ago, Sassicaia is a really steady holding. It’s a wine that gets drunk readily, is approachable at a younger age than most investment grade wines and doesn’t tend to get dumped in a downturn.

The 2015 is another exception to this generalisation, not least because last November it claimed the coveted Wine Spectator’s ‘Wine of the Year’ 2018, causing the price to do this:

It is interesting to note that the Wine Advocate’s upgrade from 91-93 to 97 points in February 2018 had no lasting impact on price – do they not influence this corner of the market, we wonder?

In an efficient market, there’s a great short to mid-term switch play here, selling '15 and buying the cheaper and older ’09 or ’10 vintage where supply is shrinking faster. This is the wine market though, and trades like these not always play out. Judging from the price of the ’06, there is sufficient upside to these two vintages to suggest a purchase, especially if conservative is your thing!

The younger 2013 also looks cheap (but much more plentiful):

Buy: 2009, 2010, 2013

Trading sell: 2015

by Wine Owners

Posted on 2019-02-07

The broad-based WO 150 Index was flat for the month, as were nearly all the indices. The only real note of interest was the Burgundy Index, dropping by 0.7%. As you can see from the graph below it has been the stellar performer amongst the great wine producing regions of the world. It’s far too early to start calling a general cooling off period but as I have been arguing here it feels right to top slice some of the better performing names and start looking for some laggards.

The numbers in the box below are performance numbers over a five-year period, so all very respectable but nothing comes close to Burgundy. The consistency and lack of volatility must surely be a thing of beauty to the investor and connoisseur alike?

January is a busy month in the wine world when the latest Burgundy vintage is sold ‘en primeur’. 2017 was a decent vintage (See WO Blog) and has sold through pretty well given another year of testing prices.

The ‘Southwold group’ met in January to review the now in bottle Bordeaux 2015 vintage and there are two excellent reports on the three day session to be found on Vinolent.net and FarrVintners.com. In brief summary, ’15 is maybe not quite the excellent vintage that was first pronounced, certainly when judged by ‘English’ palates but still pretty damn good with some show stoppers therein. At the end of the Farr report there is an interesting table of recent vintages in order of perceived quality.

Here at Wine Owners we are betting more heavily on the ’16 vintage (not yet included in the Farr report) which we believe will move very close to the top of the leader board. Messrs Martin and Galloni of Vinous Media have recently reviewed the 16s in bottle and are waxing lyrical. Our very own meteorology and Bordeaux expert called the ’16 vintage some time back - pre the en primeur tastings even! All subsequent tastings and encounters of the vintage have confirmed our views and we are confident enough to shout BUY. What and when is a much more interesting question - so please get in touch to hear our thoughts.

by Wine Owners

Posted on 2019-02-05

Pichon Lalande 2010

WO Score: 94

Price: £1,300 per 12

Probably our most popular and current investment theme, derived from the outperformance generated by Burgundy in the last few years, is scarcity. This recommendation has not been generated as a result of scarcity, it comes from the old-fashioned premise that good old-fashioned merchants used to be famed for – this is bloody good stuff, it’s under-priced and it’s going up - trust us!

Looking at the chart below the relative value doesn’t appear out of kilter relative to its peer group but that is using a WO generated averaged score (of current ratings) of 94 points. Based on various tastings since the Wine Advocate et al rated this wine, members of the team here have consistently and with conviction rated this wine above its peer group and above its current critic scores. To be fair Mr. Parker, back in February ’13, allowed himself some room for improvement with a 95+. The WO team would apply the plus sign very happily.

For the sake of argument if we were to award the Pichon Lalande a score of 97 and run that number through the relative value equation, the score would be a far more enticing 30, almost as cheap as Leoville Barton – and Pichon Lalande is never as cheap as Leoville Barton!

On top of this, 2010 is becoming widely accepted as the greatest vintage of the modern era. The five first growths from 2010 currently average £7,500 per 12 and Pichon Lalande ‘82, possibly the greatest vintage the estate has produced until this one, is £7,800 per 12, so there seems plenty of room for upside!

by Wine Owners

Posted on 2019-01-25

Sassicaia 2006, 94 points £2,050 per 12

Sassicaia 2009, 96 points £1,590 per 12

Sassicaia 2010, 94 WO points £1,430 per 12

Sassicaia 2015, 97 points £1,750 per 12

When we began researching Sassicaia for this post we began by thinking it would turn out be a good and solid egg. We were right. Other than the stratospheric and legendary 100 point ’85, now c.£30,000 per 12, up from £12,000 three long years ago, Sassicaia is a really steady holding. It’s a wine that gets drunk readily, is approachable at a younger age than most investment grade wines and doesn’t tend to get dumped in a downturn.

The 2015 is another exception to this generalisation, not least because last November it claimed the coveted Wine Spectator’s ‘Wine of the Year’ 2018, causing the price to do this:

It is interesting to note that the Wine Advocate’s upgrade from 91-93 to 97 points in February 2018 had no lasting impact on price – do they not influence this corner of the market, we wonder?

In an efficient market, there’s a great short to mid-term switch play here, selling '15 and buying the cheaper and older ’09 or ’10 vintage where supply is shrinking faster. This is the wine market though, and trades like these not always play out. Judging from the price of the ’06, there is sufficient upside to these two vintages to suggest a purchase, especially if conservative is your thing!

The younger 2013 also looks cheap (but much more plentiful):

Buy: 2009, 2010, 2013

Trading sell: 2015

by Wine Owners

Posted on 2017-05-11

The tasting event in Westminster for the trade in early May provided an opportunity to re-taste a number of 2016 Bordeaux comparatively with their 2015 and 2014 equivalents.

The conclusions reinforce to a large extent the general impressions we formed in Bordeaux at the start of April, but the comparison also showed it’s not one size fits all.

Canon

Starting with the one wine tasted from the right bank, Canon 2016 is showing more aromatics than 2015, very silky, integrated tannins and is thicker-styled, with riper fruit. Canon 2015 showed greater intensity, with a stunningly pure mid-palate of ripe, sticky fruit, and a prolonged finish. Canon 2014 is more classically styled, with a cedar nose and liqueur-like mouth feel, this is lovely now and looks like much earlier drinking.

No doubt there are glorious wines from the Libournais in 2016, but both St Emillion and Pomerol do not conform to a vintage stereotype in these two vintages, and you will have preferences for individual wines from one or other year.

Smith Haut Lafitte

Jumping down to Pessac-Léognan, Smith Haut Lafitte (SML) 2016 is firm and properly dry, with crystalline fruit. Very intense and just on the right side of focus, with a very grippy, licorice finish. SML 2015 has a very energetic attack, sweet, refined tannins, a warm, fruity mid-palate and an aromatically spiced finish. SML 2014 was delicious but not in the same league as the other two vintages.

2015 was a stellar vintage in Pessac and Graves across the board. The same is not true of 2016 but SML showed (along with Haut Bailly, Chevalier and Carmes Haut Brion) that the best 16s are superlative and brilliantly architected for the long-term.

Rauzan Ségla

Rauzan Ségla 2016 is refined, with a liqueur-like mouth feel, and a hint of prunes. It’s less pure than Rauzan-Ségla 2015, with its fine nose, superbly energetic attack, refined mid palate and liquorice infused, fruit-driven finish. Rauzan-Ségla 2014 is dry, mid-weight, unforced and classic, with appealing grip, and a great, insistent finish.

Margaux was a star appellation of 2015, and this wine confirms how relatively disappointing the commune'’s wines are in 2016. They remain fine claret from a good vintage, but they miss out on the excitement of the ‘15s.

Pontet Canet

Our Pauillac representative of the comparative tasting stood out for its increasingly aromatic character, a factor that Justine Tesseron attributes to the growing influence that biodynamic farming is having on the fruit.

Pontet Canet 2015 was one of the most refined and silky examples of the appellation, yet today it just didn't cut it in the company of the glorious 2014 and deeply serious 2016. Pontet Canet 2016 displayed a fine nose, wonderfully textured fruit, a really firm mid-palate with bitter-edged fruit before sweetening into the long finish. Serious, long-haul stuff – and I suspect might become a legend 50 years hence. Pontet Canet 2014 is extremely aromatic, sweetly imbued with angelica flavouring, and with proper, grainy tannins on the finish.

Montrose

Montrose 2015 is delicious and aromatic: a fine showing for the vintage, yet seemed to lack a bit of structure. St Estephe in particular produced some of the best wines in a generation in 2016, and Montrose shows up that difference as does almost every wine from the appellation. Montrose 2016 is equally as expressive as 2015, but feels like a wine for the longer term, with more serious structure and vital freshness. What impresses here is the focus and elegance, which make this one of the stars of the vintage.

Picture: Wine Owners Ltd.