by Wine Owners

Posted on 2020-06-02

Palmer was released this morning at £999 per 6, a 31% reduction from the (pumped-up) pricing levels of 2016 and 2018. We are back into rational release pricing territory.

Does it work? Absolutely. Note we have put in a placeholder of 18 points but it works at 17 points too.

At this rate, if the whole of Bordeaux rallies around the reduction level of -30% to -35% set by Pontet Canet and now Palmer (and rumoured to be the level of reduction that Lafite will apply), this’ll be the first en primeur campaign since 2014 where it would make sense to buy more broadly than the very specific, narrow range that we’ve suggested makes any sense at all in the last 3 campaigns.

Here’s the analysis of Palmer.

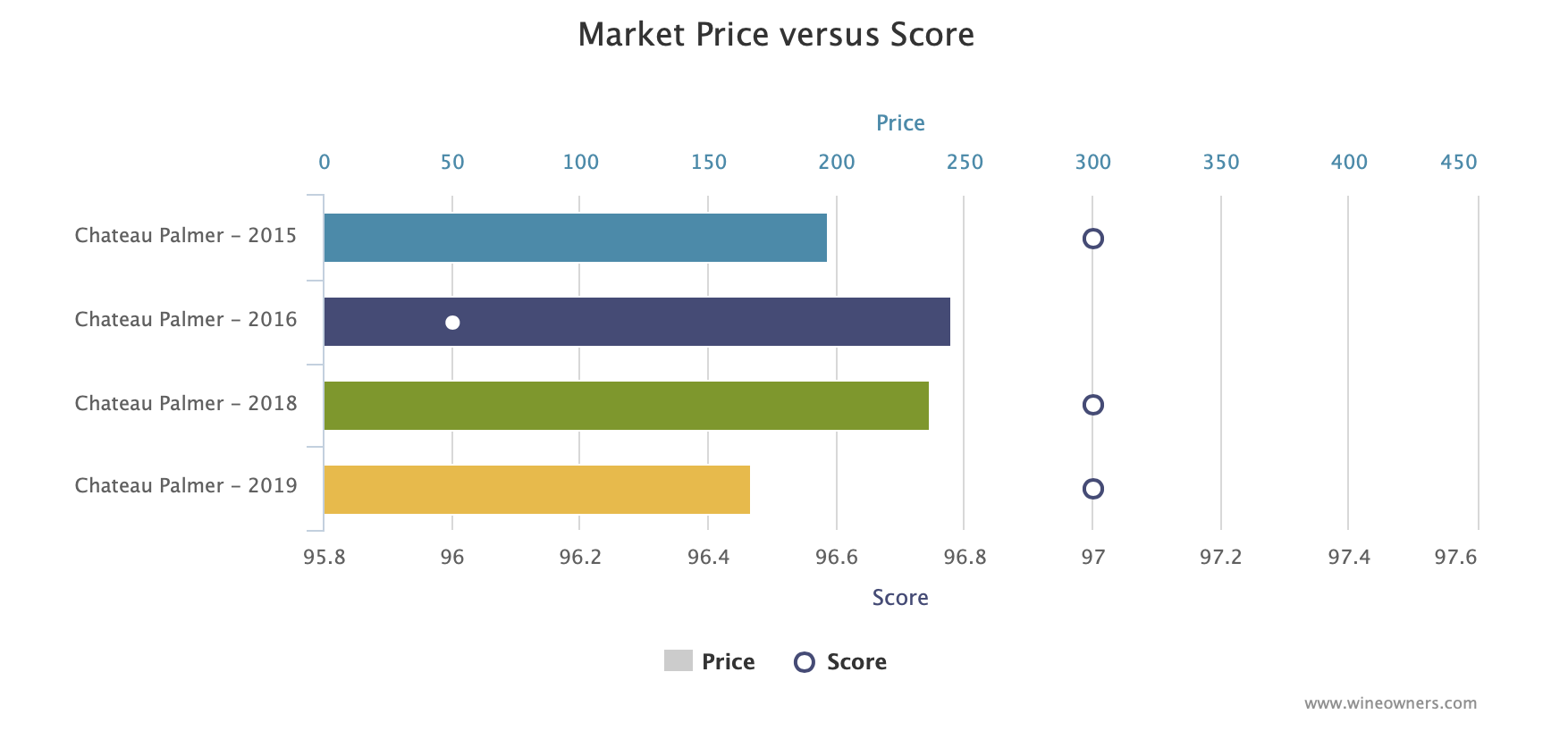

First pricing and scores:

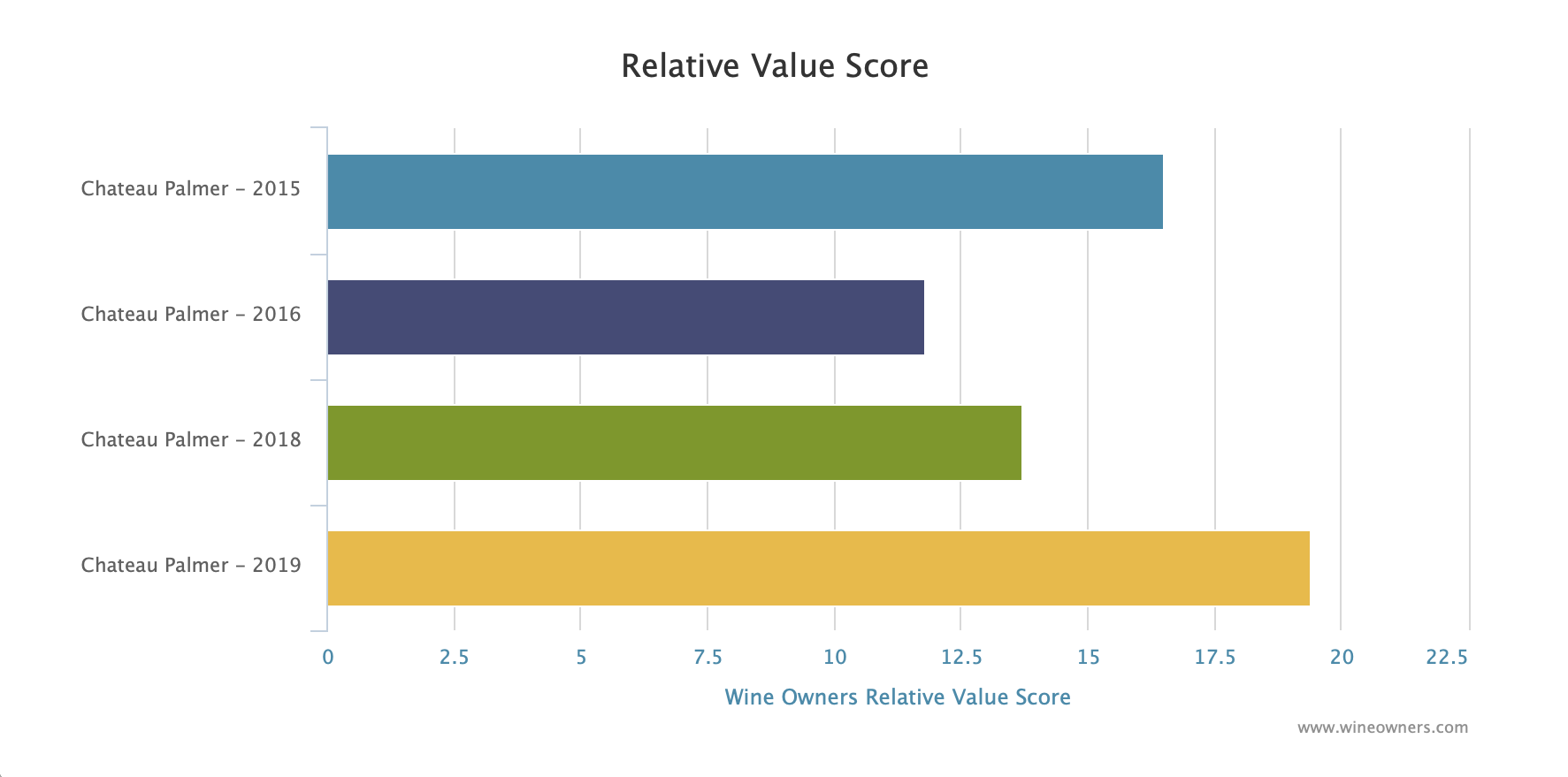

And the relative value calculation. Note how much longer, and therefore better value, the 2019 bar is than any of the comparative vintages used for the analysis:

Banner Image: www.chateau-palmer.com

by Wine Owners

Posted on 2020-05-27

So Latour 2012 is out today at £350 a bottle. What’s that got to do with 2019 EP I hear you ask? Well coming as it does just before the releases of the 2019 big boys, and because it’s the first release from Latour that wasn’t previously released EP, it’s seen as a test of the market and what the consumer’s appetite is for laying out hard earned spondoolies in The Time of Covid.

I’ve seen emails from merchants this morning gushing that this is the cheapest Latour in the market today, and how they’ve got the pricing right.

The retail channel needs to see the 2019 releases come out minus 30% v 2018. That would put Lafite et al at around £2,000/ 6 and at that price it would sell. Plus it might just re-energise the Bordeaux secondary market with a dollop of positive sentiment.

However If we compare 2012 Latour to other comparable vintages of Latour, so say 2008, 2006 and 2004, which I think is rather realistic, we see a very different picture.

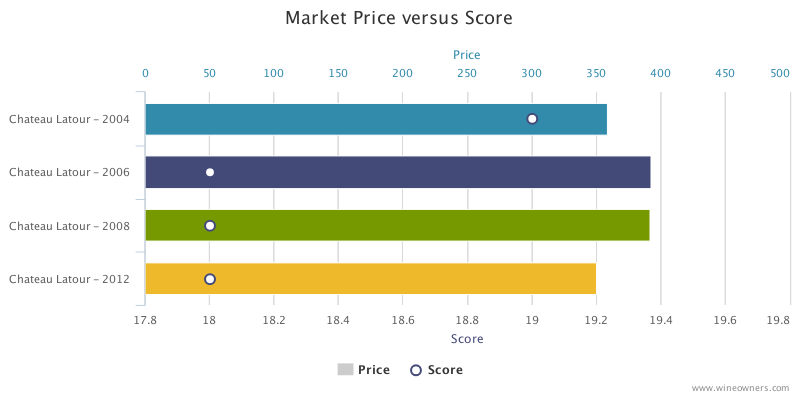

Here’s the market price and JR points plotted for 2012 and those benchmark vintages selected:

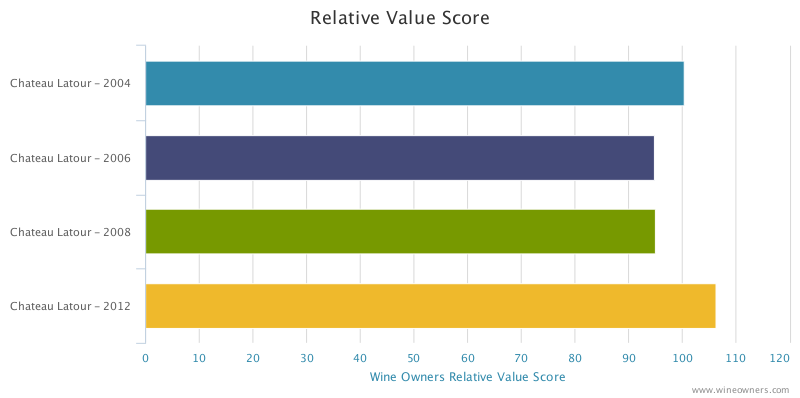

And here’s the weighted effect of that taking into account scores:

The longer the bar the better the value, the bigger the gap between the longest and the next, the more compelling the buy. Not much in it is there? Which says that Ch. Latour, far from doing their 2019 EP peers a massive favour, have given absolutely nothing away. There’s no Covid discount baked into this price. The best you can say is that there’s no guff about ex Chateau premium.

So, as a curtain raiser, it's a damp squib. But that’s their release model now and who’s to say they are wrong? At least we know what we’re drinking. The reply to this question, answerable only by Lafite et al, will come soon enough.