by Wine Owners

Posted on 2016-05-09

As we jump into the 2015 En Primeur campaign with analysis and our recommendations of those wines that could be worth buying early on, let’s have a look at how last year’s 2014 En Primeur ‘picks’ have performed.

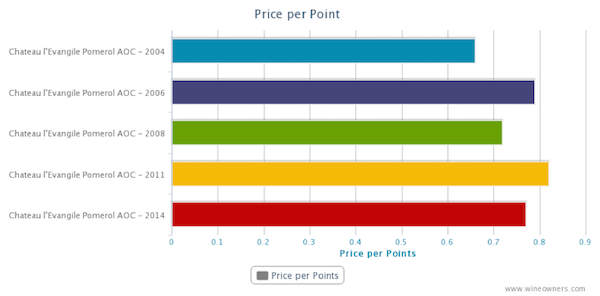

We used our price per points analysis to identify relative value of the 2014 releases vs comparable back vintages vintages

It's worth noting that wines that we felt could have been worth buying early were a little more than a handful, out of the swathe of en primeur releases. But then, there are only about 60 wines potentially worth bothering with these days. Buying the equivalent of cru bourgeois releases as a future is surely a mug's game these days. Of the 60 or so top producers who released in 2014, we thought there were about 8 wines worth buying as a future.

Here's how they performed...

Chateau Lafite Rothschild 2014

Last year you could have bought a 12x75cl case of Château Lafite Rothschild 2014 for £ 2,700. Since then, it's increased to £3,300 (12x75cl) which represents a growth of 18% from it’s initial released price.

It was a tough one to taste at the property in April 2015, but we took a punt on it as proper wine - at least there was no lipstick applied to the barrel samples.

Chateau Calon Ségur 2014

Released at £410-£420 (12x75cl) retail, Calon has increased in price by 23.2% and stands at a market price of £505. It's worth noting volume of wine released En Primeur was much reduced last year and négociant channels were heavily rationalised. Having been earlier acquired by new owners for €200M, expect further 'management' of En Primeur releases in an attempt to drive the secondary market price.

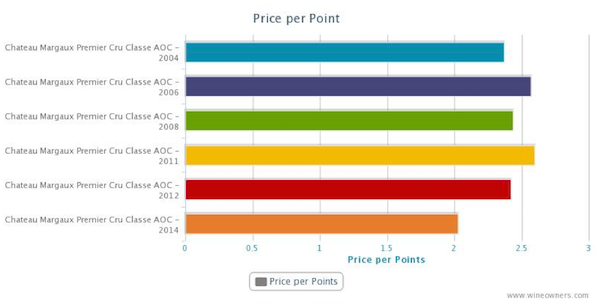

Chateau Margaux 2014

The release price of Chateau Margaux 2014 was £ 2,340 (12x75cl).

Market price has risen to £ 2,850 for a case of 12 in one year, and increase of 21,8%.

Robert Parker Score : 93-95

Petit Mouton 2014

Le Petit Mouton’s release price was £ 750 per case of 12 bottles, the closest thing to a ‘one way bet’ we found last year, and I filled my personal boots. Given how well this atypically predominant cabernet Sauvignon Petit Mouton has performed in the last 12 months, we hope you did too! It was also the most delicious and impressive wine, and felt to me a little under-rated by Neal.

The price of Le Petit Mouton has increased by 30% going from £ 750 to £ 1,080 for 12x75cl.

Robert Parker Score : 90-92

Chateau Mouton Rothschild 2014

Along with Petit Mouton, we loved Mouton last year, with its merlot so successful on gravel that a large slug of it made it into the Grand Vin. The trade was baying for release prices close to 2008 (£1750-£1800), but we thought £2,300 was a fair price for the quality, especially in the light of how much market momentum there has been behind Mouton of late.

Mouton 2014 has increased from it’s release price to £ 2,700, an increase of 13%.

Robert Parker Score : 96/100

Chateau Lynch-Bages 2014

Chateau Lynch-Bages 2014 was universally declared good value by the wine trade last year, and released at £580.

Over the past year it rose from £ 580 to £ 650 (12x75cl) representing an increase of 12%.

Robert Parker Score : 92 -94

Chateau Canon 2014

This stood out as proper wine last year as well, and tasted alongside some heavyweights held it's own. Re-tasted this year, it's shutting down and wasn't the most exciting wine on earth. The price hasn't budged either way from its release price of £375. One that in retrospect we should not have recommended to buy early.

by Wine Owners

Posted on 2015-05-27

So goes the good luck saying, advising what a bride might wear at her wedding to bring good fortune.

In reviewing Bordeaux 2014 releases to date what could be more appropriate? After all, this has been a campaign where a few enlightened producers got their winemaking and pricing aligned, whilst others (the majority?) have simply ignored the current compelling pricing of many of their back vintages of comparable quality.

In the light of that, what mixture of old and new vintages might the wine lover or collector consider?

SOMETHING OLD

Something old is symbolic of continuity.

When comparing the 2014s to broadly comparable back vintages, it reaffirms the value there is in wines around the 7-12 year old mark. In the majority of cases these are wines just hitting their stride, and in some cases with enormous drinking windows ahead of them.

Here are some examples but today Bordeaux unquestionably is generally favouring back vintages over new releases.

L’Eglise Clinet 2006

I just love L’Eglise Clinet, so I’m delighted to give it my first mention. Only, why buy 2014 when 2004, 2006 and 2008 are all cheaper? Personally I’d probably pay the market premium for the 2006, simply because that vintage is proving to be such a fine year in Pomerol. There is so much definition to the fruit, and such balance to the best wines. L’Eglise Clinet is an obvious choice due to winemaking of the highest order over the last decade.

Haut Brion 2008

At around £2,400 per case, the 2008 makes a profoundly compelling case for itself, as does the 2012 in the light of its recent Parker rerating, reinforced by other reviewers such as Jeff Leve. Throw 2006 into the mix as a wine of exceptional purity, and there’s an embarasse de richesses for grown up lovers of Graves.

Palmer 2004

Leaving aside the fact that the beautiful 2014 is Palmer’s first vintage made entirely biodynamically, 2004 still stands out as a wine value that warrants the wine lover’s attention. According to Parker it’s a modern day version of Palmer’s brilliant 1966, majoring on elegance and precision, freshness and depth of flavor.

SOMETHING NEW

Represents good luck, success and hopes for a bright future.

Let’s start with a handful of winners. Using the soon to be released price per points analysis feature on Wine Owners highlights value in the context of broadly comparable quality. The teetering Euro helped, creating a rare opportunity for Châteaux to please the market and satisfy their accountants. A handful grasped the opportunity.

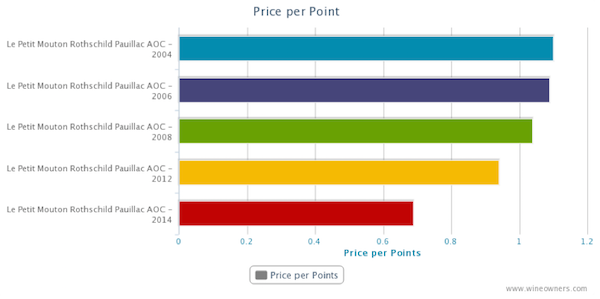

Le Petit Mouton 2014

Growing positive sentiment in respect of the quality of the last decade’s vintages has given those years a recent helping hand. This is the cheapest vintage in the market at £375, and a 40% discount to its possible qualitative equal – 2006. Different too. The success of Merlot on gravel relegated a big slug of Cabernet to the second wine, so atypically cabernet-dominated and correspondingly serious.

Mouton Rothschild 2014

Outstanding in a vintage in which Pauillac starred. There’s a breezy balance whilst its Merlot genes and dash of Cabernet Franc complete a raspberry-driven, fresh, complex palate with plenty of fine-grained tannins. They got the price right as the charts show.

Lynch Bages 2014

Poised, with classic Pauillac character; loaded with griottes fruit and flowing Saville Row lines. It was priced to within a hairs-breadth of 2011 and 2012 current market value but the value difference over 2008 and 2006 must have convinced loyal buyers to part with their money early as merchants reported healthy demand.

Lafite 2014

We didn’t think Lafite was the most immediately impressive First Growth in 2014. In fact it seemed to be the most obdurate. Yet the critics lapped it up, and we’re more than happy to defer to their better judgement. In the meantime one thing is very, very obvious looking at the price per points analysis. It’s priced as a come-on to consumers to open their pocket books and buy early.

SOMETHING BORROWED

Anything can be borrowed but it must be returned afterwards.

A couple of worrying features of the 2014 campaign have emerged.

The first is linkage. Back in 2010 Bordeaux chose to tie certain wines with others. The most interesting example was a pack of Rieussec linked to a pack of Carruades. Interesting because of the distorting factor it had on the market for Rieussec. Back then, merchants simply added a couple of hundred pounds to the price of their Carruades allocation before dumping Rieussec onto Livex and selling through at £210-£220 per 12; roughly half the retail release price offered to consumers. To this day those Livex members who jumped in and hoovered up stock are sitting on the best returns that the 2010 vintage had to offer. Not great for the consumer who bought Carruades but a creative market response to price manipulation.

Linkage is seemingly back, with Rieussec once again tied to Carruades, according to one or two merchants we talked to. Who’s doing the tying is a question to which I have no answer, and this time the merchants can’t just transfer pricing from one wine (relatively difficult to sell at first release) to another (for which there was unquenchable demand back in 2010).

The second feature is limited quantities released by some Châteaux. Who’d have thought the Bordelais would have de facto discouraged early purchases in 2014 – maybe they don’t believe in the en primeur system after all? Like a boyfriend who isn’t in love anymore, but is too insecure to let his partner go.

Calon-Ségur is a wine I thought showed delightfully in 2014. The vibe among négociants in Bordeaux was positive, lending emotional support to the wine even before release.

Recently acquired by Suravenir Assurance, an insurance company for whom no doubt a higher average release price per bottle will help to sûr-value their estate on a forward-looking basis, chose to release up but at a realistic price point for the fine quality. But then the real game plan became apparent. There was no wine: merchants who had assumed they were in line for a reasonable allocation (and had promised private clients allocations on that basis) found that they were empty handed. Merchants were left scurrying around for whatever they could pick up. Consumers were left feeling that however big Calon’s heart, maybe it was losing its soul.

This is the sort of attempt at market influence that Bordeaux EP does not need. Frankly, if Châteaux would prefer to achieve a higher price than the market can bear, then why not exit EP as Latour did, and release when the wine is considered ready? It’s dishonest to play it both ways and the market will not necessarily reward throttled supply with higher prices: demand is often chocked off too in the process.

SOMETHING BLUE

The symbol of faithfulness, purity and loyalty.

There are so many Châteaux that we could have used to exemplify the question of whether we would have chosen to buy early, or wait a few years until the young wines are fully formed, or go back to earlier vintages where there’s so much value to be had. In most (but by no means all) cases we’d go back to earlier vintages and wait to buy the new releases in bottle. But buying young wine isn’t an entirely rational decision as we all know.

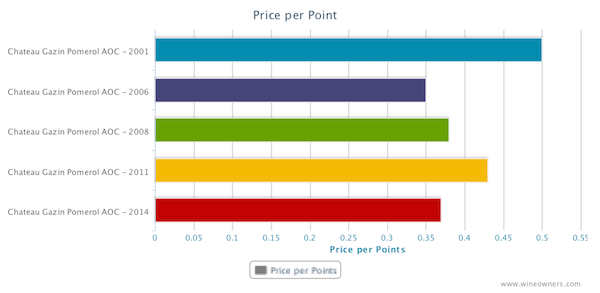

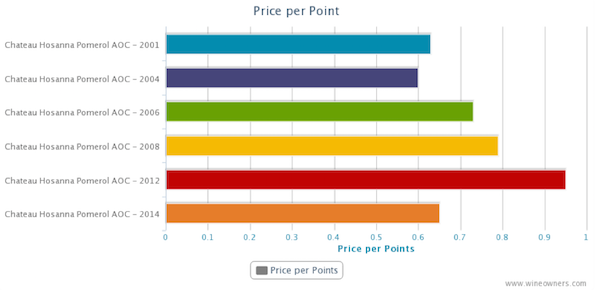

Which vintages would you buy on the basis of the following charts? You decide!

by Wine Owners

Posted on 2015-05-27

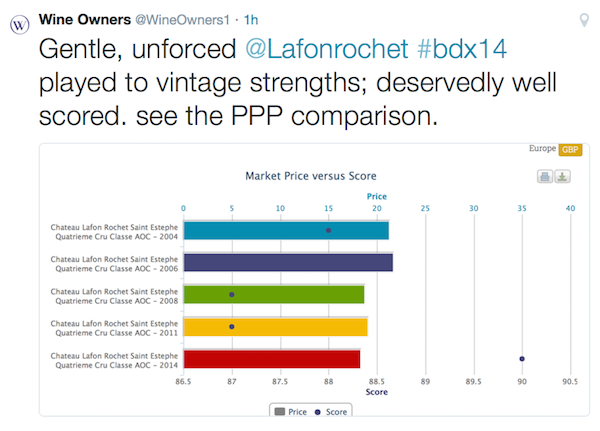

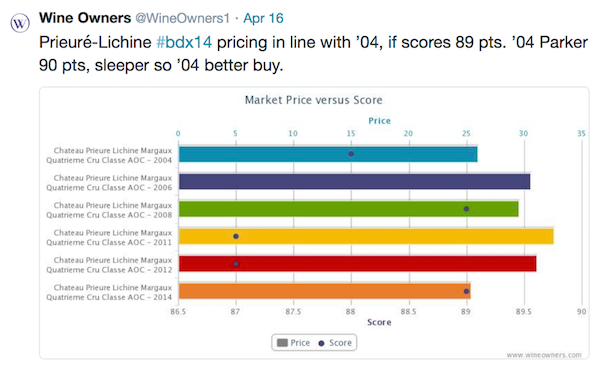

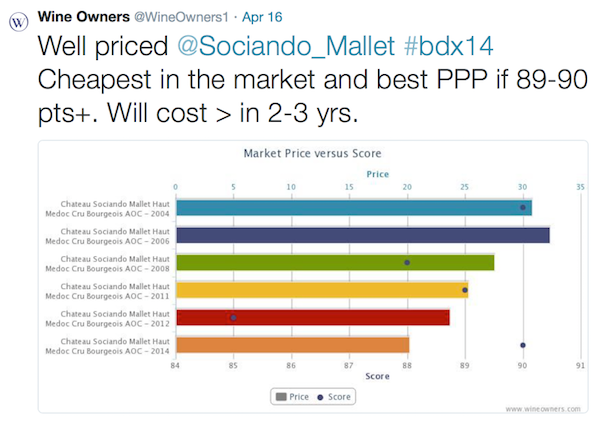

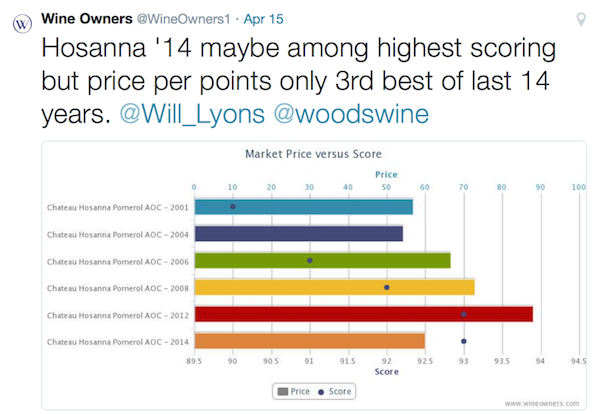

We’re busy road testing the new price per points analysis (PPP) function on Wine Owners, designed to highlight comparative value. Together with comparative charting, the two functions are arguably the most powerful combination of analytical tools available to the fine wine buyer and collector. We thought it would be interesting to use PPP to evaluate the new releases from Bordeaux. Here are copies of some of our tweets that tell their own story.

Not following us on Twitter yet? You should! It’s the perfect way to receive just-in-time information to inform your fine wine decisions.

We’re @WineOwners1.