by Wine Owners

Posted on 2019-01-18

WO Score: 96

Price: £6,900 per 12

Margaux ’96 has always received rave reviews from the Wine Advocate, whether is was big Bob himself or Neal Martin who awarded it the full 100 in October ’16. Neal does not hand out the perfect score lightly – in fact, barely ever. Our own Nick Martin gave it the full three figures at the Wine Owner’s Margaux dinner last summer although his clout is not quite as heavy!

Left bank 96s deserve a decent allocation in any investment portfolio given their quality, liquidity and age profiles. You could argue the stars here are aligned. Margaux ’90, the only other confirmed 100-point Margaux from vintages still possible to source, enjoyed a chart break out starting last summer (see chart below). The ’96 is trading at a very attractive 47% discount to the ’90 suggesting a strong recommendation. The chart break out may not be around the corner but I’d want to be long when it does.

Recommendation: Buy as a core holding.

by Wine Owners

Posted on 2019-01-15

Chateau Margaux - ©Wine Owners Ltd.

WO Score: 95

Price: £4,675 per 12

Margaux ’89 has never received great scores from Robert Parker, with five tasting notes at either 89 or 90 points. His last post on the subject, however, was recorded in 2003. Neal Martin has always been more generous, rating the wine between 92 and 95, the last note dated 2010 – so, again, some time ago. In 2008 Jancis Robinson rewarded the wine with a generous 19 points which, as we know, is a high score from her.

The relatively low (and now aged) scores from Parker have probably always depressed the price performance of Margaux ’89. A more recent note from another critic a bit closer to home, from a dinner only a few months ago, yielded this review: “The generosity of the vintage is evident on the nose, yet the accomplishments of this wine are still hidden, and there’s a sense of more to come. That grainy texture and gorgeous spiced finish are surely harbingers of great things in store for future drinking. As a result, a decent investment to boot for a 10-year view: 94+.”

Margaux ‘89 has always been dwarfed by its much acclaimed sister from the ’90 vintage which currently trades at £13,000 per 12. 1989 and 1990 are often coupled for comparative purposes and have thrown up some intriguing pairs, both for tasting and trading purposes, Haut Brion and Petrus being the most fabled.

As the chart below demonstrates, the prices of Margaux ’89 and ’90 started diverging six months ago and the differential has never been wider. This, coupled with our own notes above, gives us good reason to recommend a purchase.

___ 1989

___ 1990

Recommendation: Buy.

by Wine Owners

Posted on 2018-10-16

We had the pleasure to share a wonderful Chateau Margaux dinner with our members and the estate's ambassador Thibault Pontallier at La Trompette last week. The line up encompassed Chateau Margaux 1983, 1986, 1989, 1990, 1996, 1999, 2004, and a surprise magnum of 2000, preceded by Pavillon Blanc 2015 and Pavillon Rouge 2000 and 2009.

Pavillon Blanc 2015

Mineral nose, chalky, white currants, and saline. In other words a lot going on! Bright attack, palate follows the profile of the nose with addition of seville oranges and attractively bitter pith, green guava, and a fruit bush leafiness before ending on a firm finish.

2022-2030

94

Wine Owners view

A great investment in future drinking - one of the most complex of white Bordeaux, with refinement and structure for the long haul, and will be impossible to find in the future.

Pavillon Rouge 2009

A controlled, spicy nose, intense cassis, fresh blackcurrant leaf. Surprisingly cool from such a warm vintage, great grain to the wine’s texture, full of future promise, with depth and focus.

2023-2035

93+

Wine Owners view

Hitting the level of a second growth, Pavillon rouge is a grand wine in 2009, more expressive than the Grand Vin at this stage, yet with the same sense of balance and poise. Chip off the old block.

Pavillon Rouge 2000

Complex pine infused nose. Dry aromatic attack, gorgeous definition and a fine persistence. A touch of gaminess, roses, and spruce tips on the mid palate, the fruit evolving into a broad savoury finish enlivened with sappy, uplifting acidity.

Now to 2025

95

Wine Owners view

Mature and exciting with lots of complexity within which it’s easy to pick out individual flavours. So plenty of wine to make a special occasion a bit more special.

Margaux 1983

Aromatically expressive, a spiced attack preludes a charming medium-weight classic claret of supreme elegance and harmony. A gentle finish that nevertheless remains very elegant and delightfully complete.

Now to 2023

93

Wine Owners view

A great drink for right now, majoring on Margaux’s famed subtlety. Still possible to find in the secondary market around £350-£400 per bottle, which given its age and refinement is something of a steal. Hard to think of better First Growth value for money.

Margaux 1986

Heady, spiced, with a touch of iodine creating an intoxicating blend. Resolved on the palate, very good intensity allied to racy acidity. Fine scale with oranges and cloves on the long finish.

Now to 2025

95

Wine Owners view

1986 was a happy surprise due to the energy and resonance of the vintage. We wouldn’t keep it much longer but another strong buy for drinking around £400 per bottle.

Margaux 1989

Gorgeous overt nose, great length and grain, sappy with rising aromatics, a twist of liquorice and a cloved finish.

2020-2035

94+

Wine Owners view

The generosity of the vintage is evident on the nose, yet the accomplishments of this wine are still hidden, and there’s a sense of more to come. That grainy texture and gorgeous spiced finish are surely harbingers of great things in store for future drinking. As a result, a decent investment to boot for a 10 year view.

Margaux 1990

Saline, gamey nose and an energetic and velvet-textured attack, counter-balanced and infused with blood orange. Great resonance and breadth, visceral, spiced finish, and a whiff of very attractive sweet chloroform right at the finish. Very, very long. A great wine.

Now to 2030

98+

Wine Owners view

The velour and silky density of this wine makes it a beauty for enjoyment right now, and sure enough it was wine of the night for the majority of attendees. There’s more to go but will it ever be as lovely as it is now? Expect to pay £720+ per bottle so one for the collector who is looking for the very best vintages of Margaux.

Margaux 1996

Svelte Nose, and then at the outset, so young and fresh. Tannins still present. A large scaled, monumental wine of extraordinary length yet extremely primary. An absolute baby in other words! With time in the glass the aromatics really open up. There is great intensity and a wonderful centre to this wine. Tonight 1990 gives more pleasure, but the sense of energy and drive in this wine along with all the other elements suggest a great, great Margaux in the making for 2025 onwards.

2025-2050

Wine Owners view

This is going to be mind-bendingly good. Though it lacks the resolution and some of the warmth of the 1990, it makes up for that in sheer energy, focus and intensity in its core. This elemental wine is still good value at around £500+ per bottle and would be an obvious choice as an investment, or buy now and wait 15 years to for a thrilling vinous experience as close as any gets to a concept of the perfect wine.

100

Margaux 2000 (Magnum)

A wine that is already resolved but at the beginning of its plateau. Spiced, cloves, sweet chloroform. Great energy, definition and depth on the finish, enlivened by a fine thread of acidity that uplifts the fruit. Very long and all the while gaining in energy through the impressive finish.

2018-2033

97

Wine Owners view

The overriding sense one has here is of harmony. Balanced and complete, spiced and heady with the signs of further maturity a short few years away. For many palates this is completely ready but an interesting addition to any Bordeaux lover’s cellar for its immediacy and near term potential.

by Wine Owners

Posted on 2018-05-04

by Wine Owners

Posted on 2018-04-10

Starting early, we hit the Monday-morning Bordeaux commuter congestion armed with laptops, phones and an excellent pain au chocolat. Day one launched us headlong into the Medoc grand crus, starting at Lafite, then moving through Mouton, Cos d'Estournel, Pontet-Canet, Calon-Segur, Montrose, finishing at Chateau Margaux.

©Jonathan Reeve / Wine Owners

Tongues still tingling from untamed tannins, we are now reviewing the day from the wine-free environs of our rented loft- conversion apartment. There is blue sky peeping through the skylights.

Three main themes emerged from today's en primeur 2017 tastings:

Cabernet Cornucopia

The most obvious pattern is that 2017 was clearly a Cabernet vintage in Pauillac and Saint-Estephe. Almost all of the wines we tried have a higher proportion of Cabernet Sauvignon in their blends than in 2016. The particular weather patterns of the 2017 growing season meant that Merlot was tricker in 2017, and Cabernet performed well. Lafite, Montrose and Calon-Segur particularly exemplified this - their wines glowing from the healthy Cabernet. The Calon tasting demonstrated this most clearly; comparing side-by-side the Marquis de Calon and the Calon-Segur (Cabernet was particularly higher in the latter) it became clear how a higher percentage of Cabernet has worked wonders in 2017. The Calon is fresher, brighter and more defined than the Marquis, has more-focused acidity, and will be by far the longer-lived wine.

A noteworthy exception to this pattern is the grand vin at Chateau Margaux, where the team are obviously very happy with their Merlot this year. In fact, their Merlot was apparently so good that it was used worthy of a greater dose in the grand vin this year - a move which brought production levels of the grand vin up to almost 2015 levels (impressive from the smaller 2017 vintage). This is an unusual moment of glory for Merlot, which is typically the ‘insurance policy' grape.

House Styles

One obvious pattern showing in day one's tastings was house styles. These are very much in evidence in 2017, and most obvious at the Mouton stable, where d'Armailhac, Petit Mouton, Mouton and Aile d'Argent all shared the house's exuberent, borderline-exotic richesse. This continues right down to the house's entry-level Baronarques brand from Limoux, which we were also warmly invited to taste. The four Cos d'Estournel wines also had a family feel about them, being clean, bright and focused, without being overly ‘new world'. The pattern was most pleasing, perhaps, at Montrose, where both the Dame de Montrose and the grand vin showed brilliantly, and shared a distinctive style; cool, fresh wines (yes, high Cabernet content) with lots of tightly wound potential, and a whiff of something herbal (along the lies of nettles and lavender) marking them out from the crowd.

©Jonathan Reeve / Wine Owners

Past and present

References to the past, as a means of promoting the present, were frequent in the presentations today.

Lafite's new director, Jean-Guillaume Prats (previously of Cos d'Estournel), pointed to technology as being significant in the quality of this 2017 vintage. Thirty years ago, he said, given the same vintage conditions, it would have been 'very tricky' to make a wine of such high quality as they have managed this vintage with both the Carruades and grand vin. Of course, his job is to say such things, but his demeanour was very real, honest and open. And the wines spoke for themselves; the Lafite was its usual elegant, impressive self even at this early stage in its life.

Also illustrating progress by pointing to the past was Thibault Pontalier of Chateau Margaux, who highlighted that the blend of Pavillon Rouge today is exactly the blend of the grand vin thirty years ago. A strong part of his reasoning for this was the ever- increasing quality of Cabernet Sauvignon that Margaux is able to produce, thanks to investment in technique and technology. This was in evidence for more than just the reds, however; Margaux's stunning Pavillon Blanc 2017 ended today with a refreshing flourish of beautifully concentrated, linear Sauvignon.

©Jonathan Reeve / Wine Owners

Comparing 2017 with 2016, the majority of wines from day one appear to be a notch less intense and refined than 2016. We're interested to see if this continues on the right bank.

Tomorrow we visit Nenin, Vieux Chateau Certan, Cheval Blanc, Gazin, La Couspade, Canon and Pavie. Watch this space tomorrow, for reflections on the right bank.

by Wine Owners

Posted on 2015-10-29

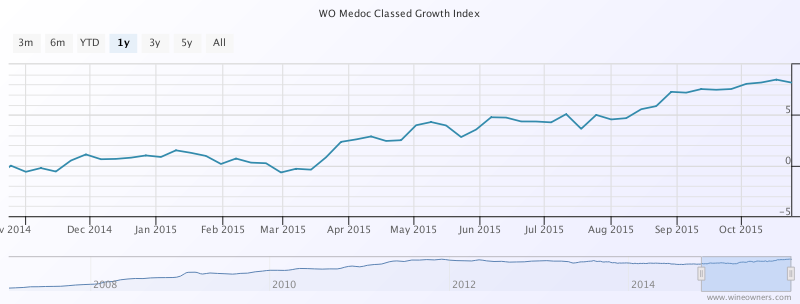

Quite a lot of members we speak to these days assume that the market prices of Bordeaux are still stagnating or falling. The morosité that had descended on the region's finest wines in by 2012 does not appear to have lifted.

Wine traders will point to volumes that are much reduced since the giddy heyday of 2009-2011, and that is of course true.

However, it does not mean that in aggregate, prices of Bordeaux have begun an upward trend. In the last year, the Wine Owners Medoc Classed Growth Index is up 8.2%.

Whereas the Wine Owners First Growth Index has only managed half of that in the last year, up 4.1%.

That's still better than the performance of the FTSE100, which is fractionally underwater over the last year, and exactly where the S&P500 has clawed it's way back to after the summer's wobbles.

Wine Owners 150 = Turquoise

FTSE100 = Navy

S&P500 - Green

However, when looking at First Growth performance over the last 12 months, it is far from broad-based. 'The further they rise, the longer they fall' seems to hold true, with Lafite 1986 and 1989 performing the worst at -8% and -9% respectively.

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1999 | -5.45% | £ 216.68 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2006 | -5.75% | £ 286.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2009 | -5.82% | £ 441.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1982 | -5.92% | £ 436.68 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1982 | -6.29% | £ 1,810.14 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1998 | -7.15% | £ 270.83 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2006 | -7.26% | £ 212.50 |

| Chateau Margaux Premier Cru Classe AOP | 1989 | -7.59% | £ 250.10 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1986 | -8.13% | £ 651.48 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1989 | -9.11% | £ 395.92 |

Among the vintages populating negative territory, 1986 has suffered with the exception of the very great Mouton. The exceptional 1989s and 1990s have fallen, along with with the dull 1999s.

The risers are headed by Mouton, Haut Brion and Latour. The top 10 performers registering double digit growth are entirely accounted for by these three Châteaux.

| Wine | Vintage | Change 1 year | Price |

|---|

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2005 | 22.39% | £ 366.67 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2008 | 21.13% | £ 262.54 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2005 | 20.95% | £ 437.50 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 1996 | 16.87% | £ 282.74 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1990 | 14.30% | £ 429.12 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2005 | 13.36% | £ 566.79 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2000 | 13.32% | £ 1,038.81 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2008 | 11.00% | £ 226.64 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1989 | 9.08% | £ 1,000.03 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1995 | 8.49% | £ 316.67 |

Crossing over to the right bank, predominant top performers over the last 12 months are St EmillMedoc Classed Growth Indexon 2005s and the 2001 Class A relative newcomers. Since March 2015 The Wine Owners Libournais Index is up 7%, coming off it's 3 year lows at that point.

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 53.85% | £ 300.00 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 48.07% | £ 176.57 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 45.67% | £ 183.46 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2000 | 37.16% | £ 301.79 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 1998 | 34.59% | £ 161.84 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOP | 2005 | 27.82% | £ 110.96 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 26.84% | £ 232.57 |

| Chateau La Violette Pomerol AOP | 2009 | 26.67% | £ 208.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOP | 2005 | 24.71% | £ 433.34 |

What can we conclude from this? Some commentators are suggesting that value is returning to older back vintages on the back of 4 year declines. Relative value vs quality is likely to be a key driver of future value, for which we recommend you check out the new price per points builder on Wine Owners to which you'll need to subscribe.

Liv-ex have recently seen a predominance of trades of the 2010 vintage, and whilst there seems to be value returning selectively to the Classed Growths, one wonders if it's a little early yet the First Growths, whose starting release prices were in nose-bleed territory. Since 'the further they rise, the longer they fall' it may yet be a bit early to call.

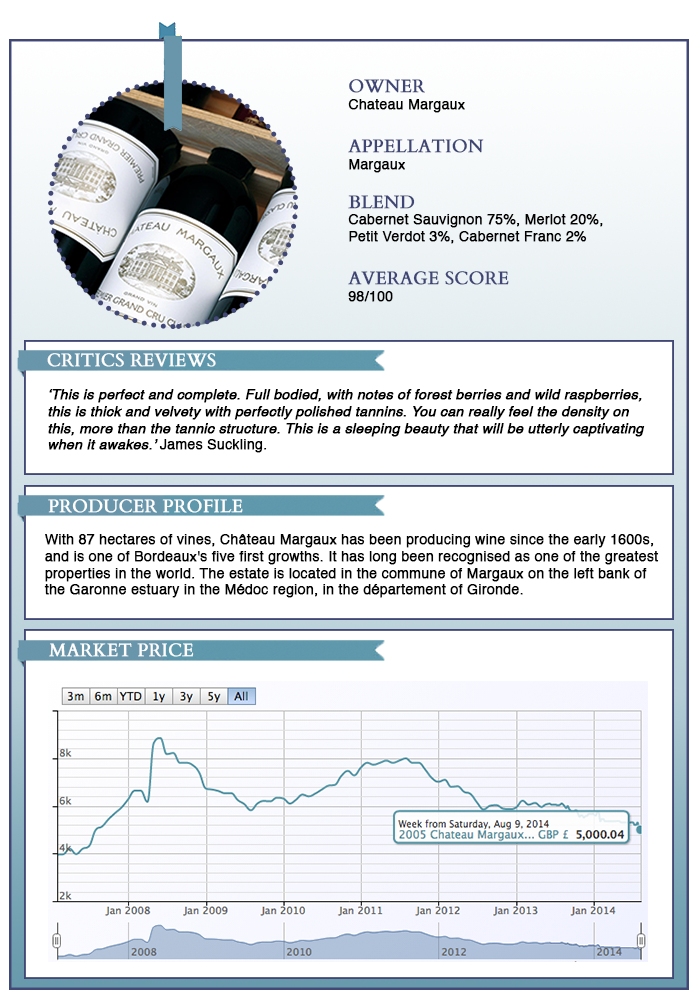

by Wine Owners

Posted on 2014-08-14

In line with recent interest in 2005 Bordeaux, Chateau Margaux 2005 (98RP) makes interesting reading. Down from a 2011 high of £7991 to a market value of £5000, and offered at £2500 per 6, it’s an almost affordable case of near-perfect First Growth claret, with a perfect rating from James Suckling to rely on.