by Wine Owners

Posted on 2018-09-14

Rioja was Spain’s answer to Bordeaux - incredibly high quality AND quantity produced from noble grape varieties (in Rioja’s case Tempranillo).

Back in the 1950s and 1960s the large Rioja houses were making wine of extraordinary quality to rival their Bordeaux neighbours to the north. By the 1980s and 1990s many Bodegas had let standards slip (with a few notable exceptions) and the outside world turned away from Rioja, creating a self fulfilling downward qualitative spiral. Since the early 2000s the region has turned itself around, make serious investments, and more recent vintages have attained (or perhaps even bettered?) the heights achieved of their great post-war vintages.

Rioja prices are still great value but the world is catching on, the positive cycle is established an the region’s future as a blue chip wine producing region is more or less assured.

The following shows the jump in the last 12 months of Rioja prices compared to the general Spanish Index (in which there is a hefty Rioja set of constituents as well).

For the budding collector, without access to unlimited funds, Rioja is the obvious region to buy into on a 10-year view.

by Wine Owners

Posted on 2018-04-04

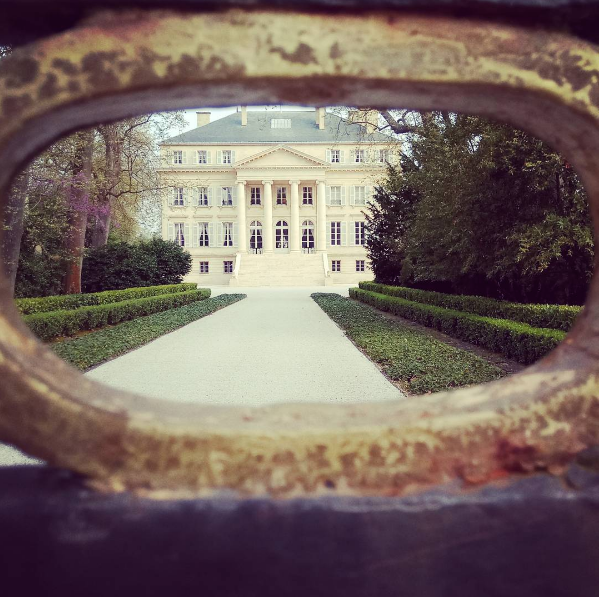

Follow us on Twitter and Instagram next week as our team will be sharing their first impression and analysis on the new vintage live from le Bordelais.

Here's a taste of our week:

Monday

|

Tuesday

|

Wednesday

|

Thursday

|

Lafite

Mouton

Cos d’Estournel

Pontet Canet

Calon Segur

Montrose

Margaux

|

Nenin

VCC

Cheval Blanc

Château de Ferrand

Gazin

La Couspaude

Canon

Pavie

|

Haut Brion

Pape Clément

Malartic Lagravière

Smith Haut Laffite

Haut Bailly

Lafon-Rochet

Beychevelle

Siran

Lagrange

|

Le Pin

La Conseillante

Figeac

Eglise Clinet

Angelus

Latour

Palmer

Ulysse Cazabonne

Leoville Barton

|

by Wine Owners

Posted on 2017-09-13

After a busy summer including in August our most productive trading month to date, we thought it would be instructive to run some analysis of trading trends and movements, compared to the same quarter in 2016.

Market share between regions remains relatively stable despite a large increase in trading value overall, with Bordeaux holding first place with a 75.14% share of market compared to 78.15% in the same quarter of 2016. That there is a drop is interesting in its own right, perhaps pointing to greater diversity in wines offered for sale, as well as to diversifying demand in export markets.

Burgundy is the major winner in market share, extending from 11.78% in summer 2016 to 17.10% over the same period in 2017, and we’ve certainly seen an increase in Burgundy purchases from Far East markets, showing a 17% increase on 2016 numbers by value.

Other regions remain very much minority sports, with Rhone up to 2.03% from 1.8% and Italy, surprisingly, down from 4.85% to 2.5%.

Within Bordeaux, the share of the market taken up by First Growths has grown from 28.26% in 2016 to 44.05%, perhaps reflecting heightened interest in the top wines, though the real interest is in how the First Growths compare within their own category.

Haut Brion is the major winner amongst the Firsts, increasing its share of the Bordeaux market to 13.35% from 3.2%. As a proportion of the First Growth market, the share increased from11.31% to 30.3%, putting Haut Brion at the head of the market alongside Lafite.

Lafite moved up to a 13.34% share of the Bordeaux market from 11.62%, but lost ground against the other First Growths, slipping to 30.29% from 41.12%, exchanging a clear lead in the class for an almost dead heat with the progressive Haut Brion.

Mouton showed a similar fall-off in share, dropping from an 8.63% share of Bordeaux to 7%, and a 30.54% share of the First Growth market dropping to a 15.89% share. Market and trading values for Lafite and Mouton remain robust however, so this feels more like a positive story about Haut Brion than a negative for the two Rothschild properties.

Latour has benefited too here, growing a very small share of Bordeaux (1.18%) to 5.07%, and increasing its share of the First Growth market from 4.18% to 11.05%.

Margaux has the least movement to comment on, increasing its share of the Bordeaux market marginally to 5.29% from 3.6%, and falling from 12.84% to 12.01% in its share of the First Growths.

by Wine Owners

Posted on 2017-08-08

Early afternoon 22 May 2017 word spread that Lafite was out. A few calls were made. But where was the wine? Allocations were down 50% but with the promise of another tranche in a couple of weeks’ time. Négociants waited, not wishing to be stuck with more highly priced second tranche releases.

In tandem the Chateau also attempted to revive its 2010 vintage strategy of tying other wines in the stable to allocations of Carruades and le Grand Vin. Either Rieussec and Carmes de Rieussec were being tied to Carruades, or Carruades was being tied with Duhart, or Duhart was being tied with Lafite.

As an aside, there was nothing subpar with Duhart this year, a properly serious wine in fact. But using it in a bait-and-switch move is unlikely to enhance the bait’s secondary market reputation.

Then, without waiting for the second tranche, more than one of the smaller négociants broke ranks on releasing the first tranche to customers, but estimating the cost of the second tranche and pricing at the intersect of the two. With lack of market transparency buyers were uncertain what fair value might look like.

In fact the majority of estimated intersect prices turned out to be the level of the second release price, handing merchants a handy profit of 20%, and suggesting Lafite were less aggressive with their second release pricing than they had previously signposted.

Thankfully, Lafite 2016 represents a big step up on the previous vintage, so the price increase will likely be justified in the medium term, if as expected, the secondary market adds 25% to its release price over the next few years. In fact Lafite 2016 is simply glorious: an absolute pinnacle of classicism in this great left bank vintage.

Notwithstanding, the Lafite release ‘strategy’ represents everything that is most unattractive about Bordeaux en primeur at its opaque worst.

None of which would matter, if it weren’t for the consumer. It wasn’t so long ago that the Bordeaux market was moribund: the market killed off by aggressive pricing of 2009 and 2010 vintages and a subsequent market collapse. As long as consumers end up nursing persistent losses, there is a high risk of a collapse in market confidence. Commodity-like collectible markets that wine epitomises are particularly sensitive to the maintenance of positive sentiment.

We’re certainly not back in territory as yet. Lafite 2016 released at almost 50% below that of 2010, whilst for UK buyers the collapse of Sterling has magnified price increases, whereas the strength of the US Dollar provides a tailwind for Bordeaux sales into the USA.

But the Bordelais need to be mindful of what happened following the mis-priced 2010 release. Lest we forget, it was barely 3 years ago that the Bordeaux secondary market was still in the doldrums. The remarkable market resurgence that started in late 2014 should not be taken for granted. The Chateaux have a profound responsibility to avoid the Dory Syndrome, named after the forgetful fish in the Disney film animation.

by Wine Owners

Posted on 2017-05-15

The release of 2016 of £775 (12x75cl) is a substantial jump up on the simply marvellous 2015. The previous (in our view better) vintage released at £615 (12x75cl).

So we are looking at a 21% increase YoY. Meanwhile the gap between the two vintages has since closed, with the best offer price of Pape Clément 2015 now trading at £720 (12x75cl).

Not only was 2015 a sound buy for those who jumped in this time last year, it remains an attractive hold, since the release price of 2016 and a rumoured reduction in release quantities attributed to the April 2017 frosts, will lend its price support and push it up to £800+ (2x75cl).

For whom do the frosts toll? Us, the consumer, wine lover, collector…those who buy. The reduction in production volumes now likely for 2017 are difficult for producers, especially in those areas most severely affected, parts of Pessac included. By far the worst affected were those in the lesser appellations on the right bank, St Emilion and Pomerol off the plateaux, and inland in the Medoc. For many of those producers the frosts really were a catastrophe.

As we described here the great estates alongside the Gironde were the least touched by the frost due to the warming effects of the river; those parts of their vineyards affected were on the whole those producing grapes destined for their second wines.

We need to bear in mind too that 2016 production volumes are up 10%-20%, in many instances offsetting the potential losses (subject to a faint possibility of second budding) relating to 2017.

So as consumers, we should sympathise and feel bad for estates such as Pape Clément for their loss of production. We should feel even sadder for producers’ losses in places like Fronsac, Lalande de Pomerol and Castillon, where there will be economic casualties. But it doesn’t mean we will consequently want to buy much more expensive wine.

by Wine Owners

Posted on 2017-04-25

Cos d’Estournel was truly fabulous in 2016 and shows a decisive shift of style away from over-extracted to an elegant, dare we say, powerful aristocratic style – the archetypal iron hand in velvet glove.

The great news is that the release price is the same as 2015, with a small increase due to currency exchange.

The price per points analysis shows 2016 to be a rather sensible buy in the context of comparison with the best vintages of the last 17 years.

Comparison with 2010 suggests a modest 10% upside, or a 75% upside versus the 100 point 2009. But, what price per points doesn’t show is the move to elegance, something that’s been applauded by the critics. But in our view, it’s a better wine than both those vintages and arguably at least the equal of Chateau Montrose.

"This is one of the best Cos d'Estournels that I can remember trying at this early stage, it really does have every hair standing up on end. Powerful and deep, with a clear intensity but such delicacy; this is fresh, beautiful and succulent. It moves effortlessly through the palate without ever letting you forget that it's there. Deep black cherries, touches of dark chocolate and graphite are driven forward by a pulse of energy. From a blend of 76% Cabernet Sauvignon, 23% Merlot and 1% Cabernet Franc aged in 60% new oak"

Jane Anson, Decanter Magazine

"Energy and raciness on the nose. Gentle and lifted. And then lots of tannins underneath. Fresh almost sandy tannins. Good energy and tea-leaf sensation. Excellent freshness. Long. Restrained. Elegant."

Jancis Robinson

by Wine Owners

Posted on 2017-04-24

by Wine Owners

Posted on 2017-04-24

by Wine Owners

Posted on 2017-04-11

Here's what François-Xavier Maroteaux has to say about yields and quality as demonstrated by Bordeaux 2016 primeurs. A 'hard' and uniform fruit set in resulted in large-sized bunches but of small berries, so whilst volume is up 10% above a 'normal' harvest, don't think it was because berries were big, quite the reverse was the case. Phenolics levels were high too, reflecting lots of tannins and colorants. Tannins are rich and refined, with rich fruit coating the big structure.

by Wine Owners

Posted on 2017-04-10

Nicolas Gluimineau recounts the growing season in 2016; the twists and turns of a difficult drought summer following an enormous amount of rain in the first 6 months' of the year. Thankfully the rains finally stopped in June, followed by an almost completely arid July and August. Drought conditions caused winemakers to fear dry, tough tannins, because when a vine can't take on the water it needs in order to ripen the fruit, the berries produce tannin in lieu. Think 1975. Yet that fear was not realised, and whilst we found a few wines with awkward tannins (at this early stage) on the right bank, in the Medoc and Graves tannins were uniformly rich. For Nicholas the end result is "just incredible" and "a miracle". #PichonLalande is one of our picks for wine of the vintage.