by Wine Owners

Posted on 2019-01-25

Sassicaia 2006, 94 points £2,050 per 12

Sassicaia 2009, 96 points £1,590 per 12

Sassicaia 2010, 94 WO points £1,430 per 12

Sassicaia 2015, 97 points £1,750 per 12

When we began researching Sassicaia for this post we began by thinking it would turn out be a good and solid egg. We were right. Other than the stratospheric and legendary 100 point ’85, now c.£30,000 per 12, up from £12,000 three long years ago, Sassicaia is a really steady holding. It’s a wine that gets drunk readily, is approachable at a younger age than most investment grade wines and doesn’t tend to get dumped in a downturn.

The 2015 is another exception to this generalisation, not least because last November it claimed the coveted Wine Spectator’s ‘Wine of the Year’ 2018, causing the price to do this:

It is interesting to note that the Wine Advocate’s upgrade from 91-93 to 97 points in February 2018 had no lasting impact on price – do they not influence this corner of the market, we wonder?

In an efficient market, there’s a great short to mid-term switch play here, selling '15 and buying the cheaper and older ’09 or ’10 vintage where supply is shrinking faster. This is the wine market though, and trades like these not always play out. Judging from the price of the ’06, there is sufficient upside to these two vintages to suggest a purchase, especially if conservative is your thing!

The younger 2013 also looks cheap (but much more plentiful):

Buy: 2009, 2010, 2013

Trading sell: 2015

by Wine Owners

Posted on 2017-09-13

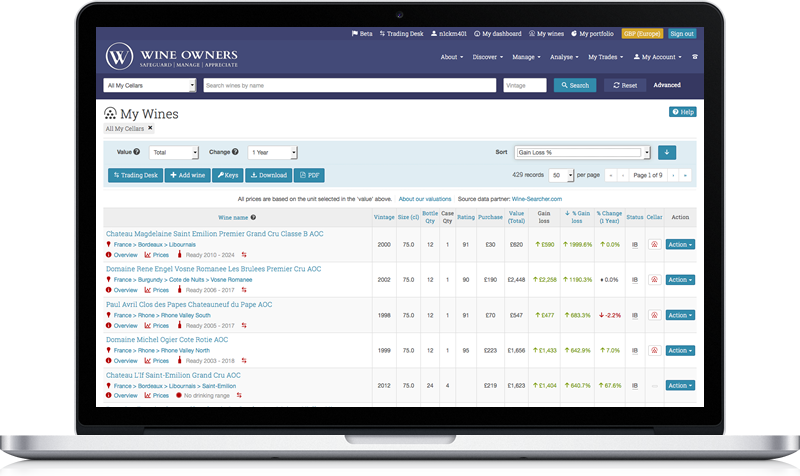

After a busy summer including in August our most productive trading month to date, we thought it would be instructive to run some analysis of trading trends and movements, compared to the same quarter in 2016.

Market share between regions remains relatively stable despite a large increase in trading value overall, with Bordeaux holding first place with a 75.14% share of market compared to 78.15% in the same quarter of 2016. That there is a drop is interesting in its own right, perhaps pointing to greater diversity in wines offered for sale, as well as to diversifying demand in export markets.

Burgundy is the major winner in market share, extending from 11.78% in summer 2016 to 17.10% over the same period in 2017, and we’ve certainly seen an increase in Burgundy purchases from Far East markets, showing a 17% increase on 2016 numbers by value.

Other regions remain very much minority sports, with Rhone up to 2.03% from 1.8% and Italy, surprisingly, down from 4.85% to 2.5%.

Within Bordeaux, the share of the market taken up by First Growths has grown from 28.26% in 2016 to 44.05%, perhaps reflecting heightened interest in the top wines, though the real interest is in how the First Growths compare within their own category.

Haut Brion is the major winner amongst the Firsts, increasing its share of the Bordeaux market to 13.35% from 3.2%. As a proportion of the First Growth market, the share increased from11.31% to 30.3%, putting Haut Brion at the head of the market alongside Lafite.

Lafite moved up to a 13.34% share of the Bordeaux market from 11.62%, but lost ground against the other First Growths, slipping to 30.29% from 41.12%, exchanging a clear lead in the class for an almost dead heat with the progressive Haut Brion.

Mouton showed a similar fall-off in share, dropping from an 8.63% share of Bordeaux to 7%, and a 30.54% share of the First Growth market dropping to a 15.89% share. Market and trading values for Lafite and Mouton remain robust however, so this feels more like a positive story about Haut Brion than a negative for the two Rothschild properties.

Latour has benefited too here, growing a very small share of Bordeaux (1.18%) to 5.07%, and increasing its share of the First Growth market from 4.18% to 11.05%.

Margaux has the least movement to comment on, increasing its share of the Bordeaux market marginally to 5.29% from 3.6%, and falling from 12.84% to 12.01% in its share of the First Growths.

by Wine Owners

Posted on 2017-04-24

by Wine Owners

Posted on 2017-04-11

Here's what François-Xavier Maroteaux has to say about yields and quality as demonstrated by Bordeaux 2016 primeurs. A 'hard' and uniform fruit set in resulted in large-sized bunches but of small berries, so whilst volume is up 10% above a 'normal' harvest, don't think it was because berries were big, quite the reverse was the case. Phenolics levels were high too, reflecting lots of tannins and colorants. Tannins are rich and refined, with rich fruit coating the big structure.

by Wine Owners

Posted on 2017-03-22

Few producers ever achieve the magical 100 point rating from the Wine Advocate. Parker’s ratings have been the most influential in the world, so to achieve the magic century is quite some accolade; to achieve it more than once is the stuff of dreams; to achieve it 28 times as have Guigal’s famed Cote Rotie triumvirate of La Landonne, La Turque and La Mouline (collectively nicknamed ‘the La Las’) is unprecedented. No other producer from a single appellation comes close.

You might have thought that these three wine with a claim to be among the finest in the world should cost the earth, shouldn’t they? Well, in fact they don’t – at least not in comparison with the finest wines of Bordeaux, Burgundy and California.

For the purposes of this analysis we’re going to look at the 2009 vintage, which paints a fairly typical picture for these wines. Historically there is very little variation in the values of the three wines, with prices often within a 3% range. So, this chart for La Mouline ’09 is mirrored closely by the other two. What is immediately noticeable is that prices have, until midway through last year, fallen consistently. This despite two 100 point scores in November 2013 and September 2014!

The fall in price is on a par with the falls in value of Bordeaux wines in the same period, but importantly the La Las did not have a huge price rise immediately prior to the falls that insulated many buyers from the slump. It seems, on the face of it that Guigal’s amazing wines were simply the victim of a lack of global interest in Rhone wines at the top end.

This seems to be changing however, as over the last 6 to 9 months the relatively attractive pricing has found favour, and sentiment seems to have turned positive. All good vintages across all three wines are moving upwards, and demand is out-stripping supply for the first time in many years.

La Mouline 09 is 15% up since July, and is on its way back to the £4000 a case level last seen in early 2013. In our view there is reason* to be confident that this recovery is a fundamental re-evaluation of the value of the wine, rather than simply the beneficial effect of weak Sterling, and there is definitely reason* to add this to a cellar, for both investment and drinking purposes.

So, what is this reason you may well ask?

Sadly, the La La’s were among the chosen wines of various boiler room, sales led operations who decided that they were ideal wines to sell as investments to unsuspecting investors at way over fair market prices. This created skewed pricing and led to reputational damage to the wines that caused prices to drop. Thankfully most of these operations have now closed down, and their negative impact on the market has dissipated. The secondary market is now a healthier place for these great wines, and prices are once again reflecting the supreme quality and longevity of Rhone’s finest.

by Wine Owners

Posted on 2017-01-06

With the highly touted 2015 Burgundy campaign upon us, we can be sure of two things: it is a superb vintage, and prices will rise.

Let’s be honest, Burgundy is for wine lovers. Although we may have more Bordeaux in our cellars - steady, consistent, blended excellence - it is fickle, flirtatious Burgundy which steals our hearts. And the whole world is now falling in love with Burgundy, courting the tiny quantities and ready to take our place in the queue.

The pure, ripe fruit of the 2015s will tempt early drinking, but if we want to experience the extraordinary range of flavours, textures and sensations that fine burgundy can produce, we must be prepared to wait. Or to seek out mature wines from great producers in other vintages. Remember, in Burgundy more than anywhere, it is the producer who matters more than First floor or the year.

So rather than bet the whole house on the latest vintage, now might be the time to review the Burgundies that your fellow collectors have offered for sale on the fine wine exchange.

There is a dazzling range of beautiful wines available, from the most humble appellations to the greatest of Grand Crus. Some are for drinking now, others for keeping for the future, whatever that may bring. Some are in bond and some are duty paid, but DP prices are never more than their In Bond case equivalents and there is no VAT for exchange buyers. All were bought when the pound was much stronger and prices were lower. Prices of Burgundy’s back vintages may never be this low again.

So where would you start?

Chardonnay is arguably easier to enjoy across the board in youth than Pinot Noir. 2014 whites have greater precision and zest than their 2015 counterparts and it is probably the best vintage since 2001. 2014s are only just starting to appear as offers for sale on the secondary market and they are unquestionably worth having in any cellar.

As long as yields of this naturally exuberant varietal are constrained, there is plenty to pick from: 2013, 2012, 2010, 2007 were all very good, whilst there are some terrific 2006s with nerve and energy, in contrast to lush and giving 2008s. Very late malolactic fermentations in 2001 lent plenty of substance to the best wines; they had longer to feed off their nourishing lees. When looking at 2005 and earlier fears of premature oxidation (premox) have really hurt the market. But there are still old bones that are simply thrilling.

Looking to red Burgundy, consider 2005 - considered one of the great vintages and should make fine old bones, but there's tannins aplenty, some more puckering than others depending on extraction, that suggests another 10-20 years will be required. Indeed they may be drinking in the same window as 2015 or later!

Consider 2010, a vintage with the nerve and intensity of 2008 married to the flesh of a vintage like 1995.

If you want to buy into a vintage that was overlooked when released but that has evolved into one of the most exciting we’ve tasted look to 2002, a lesson if ever there was one in how pinot noir loves luminosity more than heat. These are wines with fine intensity and great purity.

Talking of which, if you’re a classicist and enjoy form over flattery, 2001 is starting to climb the upward slope of maturity with wines that are sappy and crystalline but may have yet to reach their peaks.

The truly great 1999s are lusciously fleshy, sweetly spiced and dense, but at the same time so coiled, that most Grand Crus will surely need another 5-10 years. Many premier crus and village wine are gorgeous now.

2012 is a successful recent vintage that had really low yields (a very good thing for Pinot Noir) but will be cheaper than 2015. Producers love 2012 thanks to their fabulous balance and flattering ripe fruit, which nonetheless blankets an underlying structure for mid term appreciation.

The top tips for 2015s (whatever we say, we know you’ll want to buy some!) are that the lesser appellations, cooler climates and colder soils will excel. You don't need to stretch to the top of the tree to find great Pinot Noir in 2015 to drink over the next 15 years, which is great news for Burgundy lovers and something to be thankful for in a very expensive vintage.

Buying back vintages vs new releases

Other than exceptionally hard to find Grand Crus and Holy Grail producers’ best wines – that you’re either allocated or you’re not – it’s worth looking to premier crus from producers with good reputations for quality and value-hunting.

Take Beaune Grèves L’Enfant Jésus from Bouchard Père et Fils. Whilst back vintages were much cheaper at release than they are today, there isn’t much between the release price of 2015 or any number of superb back vintages.

As the chart below shows, the superb 1999 vintage is still cheaper today than the release price of 2015, the equally acclaimed 2010 is the same price, but you can drink it in 10 years instead of having to wait until the 2030s for the 2015; and only the 2005 and 2002 are a little more expensive – but not hideously so.

by Wine Owners

Posted on 2016-08-02

Will it be Bordeaux or Burgundy where the smart money goes in 2017?

It is well known that over the last few years the wines of Burgundy have substantially out-performed their Bordeaux cousins. The chart below vividly represents this:

Since the start of 2012 the Blue Chip wines of Burgundy (purple) have risen consistently year on year to now sit around 50% up in 4.5 years, whilst First Growth Bordeaux (green) has fallen nearly 20% in the same period . An astonishing disparity accounted for by the Bordeaux bubble of 2009-2012 caused by the market discontinuity of early Chinese demand and trade speculation that accompanied it. Even the Bordeaux Medoc Classed Growths (light blue), that withstood the crash in Bordeaux prices far better in general than First Growth royalty, only managed an increase in value of 15% since the start 2012, but this is entirely down to the last 15 months.

So, what do we think of the potential of these three vital segments of the market in terms of future performance? Will Burgundy continue to rise regardless, or will Bordeaux be resuscitated?

This next chart might help put things in context. It is of the same three indices above, but within a timeframe of the last 9 months only:

All indices are over 10% up over this 9 month period. Excellent news. You should also notice the similarities in their trajectories, showing growth in both regions. Again, good news. You should then discern that it is the two Bordeaux indices that are leading the way. To be precise, The Bordeaux Medoc Classed Growth index is up 16.6%, First Growths are up 13.5% and Blue Chip Burgundies are up 11.3%.

Now, of course, these time-frames are arbitrarily chosen, and it could be possible to draw other conclusions by choosing different representations of the same data. But that misses the point. We do believe that the improvement in fortunes of Bordeaux is likely to be a major theme of the next 18 months, and it is reasonable to suggest that increased interest, and resurgent sentiment, in this pre-eminent region may mean Bordeaux prices rising more steeply than Burgundy prices.

The Burgundy market is unlikely to fall prey to the same rapid boom and bust cycles that affected Bordeaux between 1991 and 2014, but we think it is a fair and proportionate response when looking at the prices and bid/offer spreads available to think that the very top of the Blue Chip Burgundy market may have run its course for now, and that to risk increased exposure to Burgundy might not be the best idea if short-term return on investment is your primary motivator.

Yet it's notoriously difficult to call the top of any market, and this viewpoint needs to be set against the severely reduced yields in 2016 in certain parts of the Cote D'Or that will push up 2016 release prices in 18 months' time, and may inflate the very good 2015 releases next January. What effect this has on back vintages remains to be seen.

by Wine Owners

Posted on 2016-06-10

There’s a clear division between 2015 En Primeur releases before Vinexpo Hong Hong and those that have been announced since. It begs the question, why?

It's not just that the bigger Chateaux are the ones releasing later. After all, many important names had released well beforehand.

The answer is what happened whilst the producers were in Hong Kong.

We understand that producers were taken aback by the demand they experienced this year at Vinexpo, and they boarded the flight home with bulging order books.

For every producer who wants to sell the new wines through En Primeur and recognises the importance of providing a future upside for buyers of non-physical stock, there are others who see a new opportunity within the changing global fine wine market.

Bernard Magrez was full of the joys of spring at Vinexpo Hong Kong, confirming he had sold out of his impressive Chateau Pape Clement in 40 minutes.

He was refreshing in his analysis, saying that he knew he’d left money on the table for the merchant and En Primeur buyer, which he saw as a positive for the property’s burgeoning reputation. Surely if you’re going to be part of En Primeur that’s the way to do it: body and soul.

Many others however have been eyeing life after En Primeur for some time, but have held back from backing one horse or another by the generally morose market conditions. With green shoots appearing over the last 12 months, few were in the mood to risk seeing them wither.

But what they experienced at Vinexpo may have shifted the balance further away from genuine, tangible broad-based support for En Primeur.

The Chateaux owners were surprised by the jump in orders experienced for their back vintages. There was a realisation that the wine market in China was coming back after 4 years of austerity and Party approbation.

The politics seem to be loosening up a touch, the consumer is spending again and contributing strongly to GDP growth, imports of luxury goods are steady (and proportionately performing better than exports).

Not that the Chinese buy En Primeur, there’s still almost no market there for it there, but with physical stocks in Bordeaux being soaked up by a sharp uptick in demand, it’s hardly surprising many producers are choosing to hold onto significantly more of the new vintage, so that they can serve the Asian market further down the line.

What a relief it must be to see all those accumulated bottles sell.

If it’s all heading towards producers being the stockholders and focusing on selling back vintages at premium prices, the one thing I’d say to them is, don't confuse the issue by using the En Primeur system as purely a promotional opportunity in the marketing calendar to get press and attention, if you don't care so much if any actually sells. It creates mixed messages.

I am super-impressed by what Palmer are doing in terms of developing sales channels worldwide, focusing on selling physical stock, staging stunning auctions through their negociant shareholder, creating a brand to rival the Firsts - but the En Primeur thing just muddies the water and undermines the brilliance of everything else.

If the recent Sotheby’s auction of Chateau Palmer in Hong Kong points the way to selling En Primeur by the barrel to high rollers with privileged access thrown in, I would surely go down that route as a producer too. The equivalent of £10,800 per 9 litres (12x75cl) before seller commission is simply amazing if you can get it.

“Chapeau”. I raise my hat to the Chateaux who go the full-on brand-building route and do it this well - but why risk the negative sentiment and comments that a perceptually very high En Primeur release price creates? There are simply too many foreseeable consequences: negative comments (mea culpa); anxious merchant emails to clients warning them off; negociants dropping prices during the course of the same day the release happens in a mildly desperate attempt not to be left with expensive stock that might/ will have to be written down; and static or lower secondary market prices that will make consumer buyers feel negative about the brand due to being under water ‘x’ years down the line.

With Asian appetite for Bordeaux on the rise once again, the moment may have arrived when more and more producers will respond to the shift in demand for primary market releases of back vintages by backing the new horse. It’s a complicated decision with a brew of old allegiances, dependent market structures, local friends, brand building, rising land values and a changing global market. Watch this space.

by Wine Owners

Posted on 2016-03-24

OWNER

OWNER

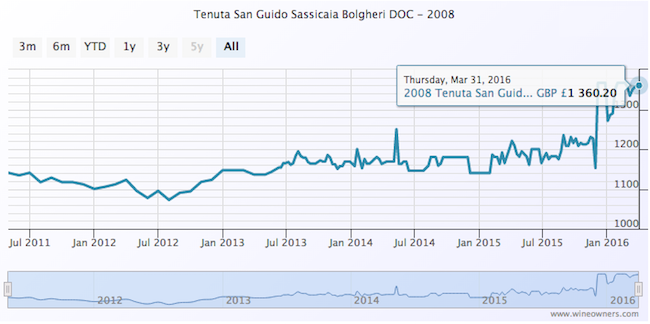

Tenuta San Guido

APPELLATION

Bolgheri

BLEND

85% Cabernet Sauvignon, 15% Cabernet Franc

AVERAGE SCORE

94/100

REVIEW

The 2008 Sassicaia is a rich, deep wine imbued with notable class in its black cherries, plums, grilled herbs, minerals and smoke. The 2008 is a decidedly buttoned-up, firm Sassicaia that is currently holding back much of its potential, unlike the 2006 and 2007, both of which were far more obvious wines. Readers who can afford to wait will be treated to a sublime wine once this settles down in bottle. Muscular, firm tannins frame the exquisite finish in this dark, implosive Sassicaia. The 2008 Sassicaia is 85% Cabernet Sauvignon and 15% Cabernet Franc. The wine spent 24 months in French oak barrels. Anticipated maturity: 2018-2038. Tenuta San Guido is on a roll these days. Over the last few years, the estate has released a number of hugely delicious wines. These new releases are nicely aligned with their respective vintages. The entry-level Le Difese and Guidalberto both capture the essence of a sunny year that made wines well suited to near-term drinking, while the 2008 Sassicaia captures the potential of a powerful vintage characterized by low yields and a late harvest. (Robert Parker, 2011).

by Wine Owners

Posted on 2016-03-24

Sales of Bordeaux through the

exchange saw a significant increase on the preceding month, rising from a 75%

share of the market to 88%, the highest market share since the launch of the

exchange in 2013. Bids overall in Bordeaux have increased in value by 2

percentage points, perhaps reflecting a slight upturn in confidence in the

market.

The steep rise in Bordeaux’s market

share overshadows other regions, pushing Burgundy right back to 5%, though the

figure reflects less a decline for Burgundy than the strengthening of the

market in Bordeaux. Volume and value traded were in fact similar to the

preceding period. Rhone had a poor showing overall, dropping market share to

1.3%. Again, the figure is skewed by Bordeaux, but in any case volumes were

down, mitigated only by a flurry of interest in Henri Bonneau triggered by the

announcement of his death on Wednesday. The remainder of the market was shared

almost equally between Champagne and Italy, where trading in top level Barolo

oustripped Supertuscans two to one.

As usual, the First Growths accounted

for the lion’s share of the Bordeaux market, 72% of the value of Bordeaux

trades were made up of 1ers crus and their right bank equivalents. Several

large trades in Haut Brion saw that wine take 61% of the value of 1st

growth trades, though Mouton continued to hold its own at 11.7%, down by

percentage on the preceding period, but up in overall value and volume. Lafite

remained strong at 5.8%, with Latour and Margaux lagging behind. Petrus showed

strongly too, picking up a share of 11% among the 1st growths,

though the high value of these wines always has a tendency to distort market

share by value.

Access the Trading Desk to view recent trades, bids & offers.