by Wine Owners

Posted on 2022-10-05

Only a couple of weeks ago the wine market felt like it does quite a lot of the time; a bit of a backwater, no great trends or swings, business as usual. Most things were just floating along calmly on their predicted journey while little pools continued to defy gravity, even though it would appear to make no logical sense; the highly prized Salon 2002 for example, having doubled and tripled in two to three years was in high demand - the joys of rarity are a thing to behold when such demand is in town! (I have sold some of this treasured holding on behalf of clients).

And then along came a newly formed Conservative government who decided they needed to bet the house on the UK economy, cutting taxes in order to promote growth, and wiped 10% off the value of the British pound in the process, and in record quick time. Tax cut reversals have now taken place and sterling has rallied a little although it remains at a much lower level than a year ago:

GBP/USD one year chart

Source: Yahoo Finance

This is unbridled joy for US dollar-based wine traders, which includes the powerful markets of North America, Hong Kong and Singapore, amongst others. Following the latest slide, we have seen some reasonably stale offers of quality stocks suddenly sell and UK traders across the board are reporting increased interest from these areas.

As a result, my personal take on the market has gone from a neutral stance to something more optimistic than that.

I have always held the belief that there is more demand in the US market for the wines of Piedmont and Italy in general given the obvious connections of heritage, and also for Chateauneuf du Pape (or C9P as I saw it written recently!). Mr. Parker had a penchant for handing out incredibly high scores for C9P back in the day which will have helped but it is also felt that America has a higher tolerance for sun kissed, more alcoholic (more than the Europeans are used to at least) juice. Asia does not yet seem to share these particular tastes in these regions but are very happy to continue buying Burgundy and Bordeaux. Everyone continues to buy Champagne, for very good reasons, so that is a large percentage of the market covered already!

I would not be at all surprised to see US wine stocks being exported from the UK back to the USA and feel that back vintages of highly prized Napa wines make strong sense.

Looking ahead, UK buyers in the primary markets for wine will be severely affected by sterling’s weakness in the coming months and their pockets will be stretched, so back vintages of well stored investment grade, quality stocks already in the secondary market also make good sense.

As GBP plummeted and the FTSE faltered, wine investors here in the UK slept well, evidence below. Yet again wine demonstrates its enviable low correlation and low volatility characteristics when all around others were losing their heads. I’ll drink to that!

The WO 150 Index is GBP based, other indices are based in local currency.

Miles Davis, 5th October 2022

by Wine Owners

Posted on 2020-12-09

Miles Davis, Wine Owners December 2020

As we head into the final phase of this extraordinary year, the world of wine investment is a calm and beautiful little side water, gently ebbing and flowing with that serene feeling it knows where it is going.Traditional assets continue to bounce around, no doubt causing palpitations and stress. More than ever, this year has been about timing in the capital markets, and if you got that wrong, the chances are you got it expensively wrong. Not so for vino! Unlike after the global financial crisis, the wine market has held its nerve, merchants did not mark down prices and the market has been stable. Investors are about, and even Bordeaux prices feel like they are firming up. Collectible assets are in vogue and it is easy to see why given these circumstances. You cannot even hold, let alone drink, a bitcoin, a share, a derivative, an option or a future and a bottle feels good, especially in lockdown!

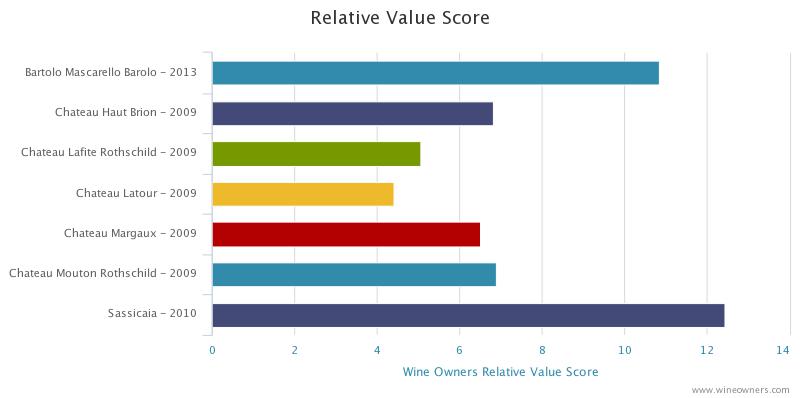

Demand from Asia has increased and merchants trading the big names have been pleased with activity levels in recent weeks. There is almost a feeling there is an element of restocking going on after a quieter than usual period (in Asia) over the preceding months. This has happened in a period when the currency has gone against dollar buyers, although only marginally. Buying is very specific but certain names have moved up considerably since the middle of the year, Mouton ’09 and ’10, for example, are both up c.10%, the controversial ’03 c.14%. There does not appear to be any thematic buying, however, so it is not possible to call a vintage, or a certain Chateau or producer. Keep looking for the relative value is my suggestion and do not forget to make use of the useful tools we provide. See below for an example (if anyone would like a demo on how to use this, please ask):

In Burgundy, especially in the trophy sector, if it is not in its original packaging it is not going anywhere and vice versa. We have seen big ticket items in Leroy and Cathiard sell well recently. Provenance is key and is proving valuable.

Piedmont, Super Tuscans and Champagne remain firm, as does my conviction as areas for further purchasing.

We have had a lot of demand for Penfolds products; whether that continues given the newly slapped Chinese tax on Aussie wine imports will be interesting to observe but, in the meantime, we have plenty of two-way activity.

Personally, I have never been able to compute the prices of some of the ‘Cult Californian’ wines but, in fairness, I have rarely tasted them. Not so for that wonderful producer that is Ridge; the wines are lovely and the prices reasonable, in normal fine wine language, and a total give away compared to some of the ‘cult’ counterparts. We have offers of the flagship, Monte Bello, on the platform of the ’10, ’13 and ’17 that I would happily recommend, to anyone!

**************************

We have been busy at Wine Owners, with a lot more trades going through, spread amongst an ever-increasing group of followers. We are at record levels of new subscribers and have £300k of fresh offers in the last week alone. Notwithstanding the difficulties of some warehouse operations presented, our back office is working well, and our post trade analytics improve all the time.

On that bullish note, the team and I would like to thank everyone for their ongoing support. For those who have not yet fully engaged, we look forward to welcoming you soon.

Have a very happy Christmas, a wonderful new year, and drink as well as you can!

Miles Davis, 8th December 2020

by Wine Owners

Posted on 2020-11-12

Miles Davis, Wine Owners November 2020

There is not much to report on for October. The market continues to be very steady, gently rising in fact, and lacking in volatility – we are leaving that for the traditional asset classes and for those with a strong constitution!

The Covid related news had been sending shivers down the spines of stock markets as we here in the UK were heading into our second full lockdown of the year, only for that to turn around swiftly on the good news on vaccines.

The platform was busy in October, however, with good demand from Asia. Bordeaux indices have even been positive although overall market share remains weak. Sterling had been a little weaker during the month and this normally speedily converts into demand for Bordeaux blue chips from Asia. We have seen continued demand for Italian wines and Champagne with red Burgundy more mixed. Top end white Burgundy priced sensibly soon disappears from the platform and liquidity in this sector is perhaps stronger than it has ever been.

Champagne is the focus of the month and there could even be unprecedented Christmas demand this year if lockdowns ease and families and friends are once again allowed to socialise!

The recent release of Taittinger’s Comtes de Champagne 2008, which receives a fabulous write up from William Kelley of the Wine Advocate and 98 points, was met with great interest. There’s plenty of supply right now but given time there is plenty of room for price upside given the level of the ’02 now. Here is the relative value chart:

Obviously ’06 is the cheapest here but that, nor the ’04 vintage, quite carries the same stature of the fabulous ’02 and ’08 vintages. Having said that and given the quality of the juice we are talking about, Relative Value Scores at 30 or above look good in any book!

Generally speaking, I like the lower production levels of Pol Roger’s Winston Churchill Cuvée. In fine wine terms, Dom Perignon and Cristal produce vast quantities but are truly international brands and therefore trade at premiums to other names. Comtes falls somewhere in between.

Here are some price and point comparisons of the names discussed here, from really good to excellent vintages.

Overall, I would not put anybody off buying these wonderful wines for the medium to long term, they have years of life ahead and plenty of upside potential as they become rarer and rarer – and more golden!

|

| | Vintage | Price | WA Score | Price/Point (WA) | VINOUS Score | Price/Point (VINOUS) |

| Dom Perignon Champagne | 2002 | £127 | 96 | 1.32 | 97 | 1.31 |

| Dom Perignon Champagne | 2004 | £107 | 92 | 1.16 | 95 | 1.13 |

| Dom Perignon Champagne | 2006 | £108 | 96 | 1.13 | 95 | 1.14 |

| Dom Perignon Champagne | 2008 | £110 | 95.5 | 1.15 | 98 | 1.12 |

| | | | | | | |

| Louis Roederer Cristal Brut | 2002 | £213 | 98 | 2.17 | 94 | 2.27 |

| Louis Roederer Cristal Brut | 2004 | £160 | 97 | 1.65 | 96 | 1.67 |

| Louis Roederer Cristal Brut | 2006 | £130 | 95 | 1.37 | 95 | 1.37 |

| Louis Roederer Cristal Brut | 2008 | £158 | 97 | 1.63 | 98 | 1.61 |

| | | | | | | |

| Pol Roger Cuvee Sir Winston Churchill | 2002 | £167 | 96 | 1.74 | 96 | 1.74 |

| Pol Roger Cuvee Sir Winston Churchill | 2004 | £127 | 95.5 | 1.33 | 93 | 1.37 |

| Pol Roger Cuvee Sir Winston Churchill | 2006 | £117 | 95 | 1.23 | 96 | 1.22 |

| Pol Roger Cuvee Sir Winston Churchill | 2008 | £140 | 97 | 1.44 | 95.5 | 1.47 |

| | | | | | | |

| Taittinger Comtes Champagne Blanc de Blancs | 2002 | £166 | 98 | 1.7 | 97 | 1.71 |

| Taittinger Comtes Champagne Blanc de Blancs | 2004 | £96 | 96 | 1 | 96 | 1 |

| Taittinger Comtes Champagne Blanc de Blancs | 2006 | £73 | 96 | 0.76 | 95 | 0.77 |

| Taittinger Comtes Champagne Blanc de Blancs | 2008 | £117 | 98 | 1.19 | 96 | 1.22 |

by Wine Owners

Posted on 2020-10-06

Miles Davis, October 2020.

7min read.

Given the lack of relatively significant news in the wine market, this is the first report since early in the second quarter of the year.

In fact, it is fair to say that the world of fine wine has been relatively boring, and in this world, boring is good! The lack of volatility has been impressive. The WO 150 index has (rather surprisingly) posted a gain of c.%5 this year but that should come with the caveat that the constituents are older vintages and not the most liquid.

In the aftermath of the 2008 financial crisis, the major wine indices (predominantly Bordeaux led) fell sharply (c.25%) as market players and stockholders marked down prices, desperately trying to reduce inventory. The relative newcomer, China, was busy buying all the Bordeaux it could at the time and was presumably a little surprised by this sudden easing of prices – after all, what did wine have to do with the financial markets??

Anyway, Bordeaux prices rebounded quickly and from early 2009 to mid- 2011 witnessed one of the biggest rises in prices this market has ever seen, followed by a sustained bull run for, the recently discovered by China, red Burgundy. Unlike 2008, the Covid-19 infested world of 2020 is yet to lead to a global banking crisis, but the economic effects will surely be felt for some time and some easing of prices would not be surprising; yet in the world of fine wine prices are not being marked down, and the indices are largely flat. There is no panic and this is good. As you would expect, liquidity isn’t great, spreads are wider, and there aren’t many merchants buying for stock. Overall, the volume of wine (number of bottles) traded has increased although there are widespread reports of the value being lower – hardly surprising.

Here’s the WO 150 vs. the FTSE in the last ten years:

Other than a reasonably successful 2019 en primeur campaign, of which more later, Bordeaux has maintained its trend of recent years - its market share continues to slide. In August it hit a new all-time low of 35%, according to our friends at Liv-ex. Ten years ago that number was 95%! It is still easily the most liquid market, however, and that should not be forgotten in times of stress. Lafite and Mouton Rothschild still dominate Asian demand but long gone are the days when the prices just kept on rising; they are flat.

The 2019 Bordeaux en primeur campaign was highly unusual, in many respects. Not only did it happen in lockdown, it happened, apart from the locals, without any but the top wine journalists tasting any of the wines – unheard of! We decided to listen more to Jane Anson (Decanter) and James Lawther (jancisrobinson.com), both based locally, than other international critics after reports of samples being abandoned on melting driveways and being flown around the world in a rush; it just seemed more prudent. The consensus, however, or whatever, was that it was another fabulous vintage and even came out with the highest average scores in fifteen years – no mean feat. The other strange thing that happened was that some Chateaux priced the wine attractively. Prices needed to be 20-30% below 2018 prices to sell through and some were. The leading names for relative value and quality were the Lafite (including L’Evangile) and Mouton stables, Pontet Canet, Palmer, Canon and Rauzan Segla. The campaign came as a much-needed boost to Bordeaux’s flailing reputation, but it took some extreme circumstances to bring it about. In terms of wine, Bordeaux is doing nothing wrong, it is the pricing that is the issue.

The super-fabulous-amazing 2016 Piedmont vintage has been dribbling into the market, some via the grey market European trade and some from agent releases. Given the general mood, these have been easier to accumulate than in a non-virus savaged world and without an organised primeur release. Who knows how well these wines would sell if you had all the merchants shouting their virtues from the rooftops at the same time? Three wines, all with 98 points from Monica Larner that make sense and that I have bought are: Cavallotto Bricco Boschis (£260 per 6), Elio Grasso Gavarini Chiniera (£375) and G.D. Vajra Bricco delle Viole (£360). Luciano Sandrone’s Le Vigne 2016 was awarded the magical three-digit score (ML also) which sent the price from c. £550 to £1,250 before settling at around £1,100 now. From the same estate, Aleste (formerly Cannubi Boschis), with a mere 98 points, makes sense at £650. The official U.K. release from Roberto Conterno will be in October and although they are not yet scored, I have been accumulating in the grey market. They have decided not to make Monfortino in ’16 as it’s not the right style (!!??), which can only leave Cascina Francia as one of the buys of the decade, but what do I know?

As readers know, I am a keen fan of Italian wines for the portfolio, particularly Piedmont and Tuscany and wines from here can easily take greater supporting roles. The lead roles of Bordeaux and Burgundy have never felt more questioned. Super Tuscans are well developed in terms of the market and continue to do well, other Tuscan wines to a lesser degree. 2015 and 2016 were epic years in Tuscany, as we already know, but the ‘16 releases of Brunello are still to come and there will be opportunities ahead.

This interplays with the theme of new areas becoming more accessible and more interesting. The rise of the new world continues gradually as the depth of this market grows. Wine knowledge is on the up, price transparency and trading channels are ever more abundant, so competition from other areas is bound to increase. Quality from everywhere is on the up and the international market is flourishing.

The Champagne market deserves more on the limelight too. Here is the ten-year chart of the WO Champagne 60 index, a smooth 9% annualised, with barely a bump in the road:

Burgundy is in a funny place right now. The froth has definitely been blown off the top end of the market, even before the pandemic struck and the usual suspects do not just fly out of the door anymore. There is still demand for DRC, but it needs to be in OWC. Buying is to order, not for stock, and prices need to be sharp to attain a sale. The performance of collectable white Burgundies has been greater than their red counterparts recently and this is a very interesting area. Buy top quality producers at an early stage and do not hold on too long – the fear of premox has not disappeared entirely!

Keep an eye out for South African wines, mainly for the drinking cellar at the moment, but quality and media coverage are on the rise.

Any questions, please let me know.

Good drinking!

Miles

by Wine Owners

Posted on 2020-05-19

Miles Davis, 18th May 2020.

Activity in the wine market in April was, pretty much, a repeat of what we saw in March. Numbers of alcohol and wine sales have been higher across the board since the pandemic struck, with people apparently drinking more, just less publicly! Closer examination would suggest quantity is winning out over quality, as volumes are up but values are lower. This comes as little surprise and this trend has been replicated on the Wine Owners platform. Plenty of gluggers being bought with little activity in the investment grade.

One interesting area of note amongst London’s fine wine traders, who have generally been quieter than in more normal times, has been a few very high value trades purchased by drinkers not investors. High value cases of DRC, Le Pin and other very top end names have been changing hands in piece meal fashion. Otherwise trade stumbles along with consumers rather than investors calling the shots.

The trends that existed pre the virus seem to be continuing and there is no question Italy continues to steal the limelight away from France. There is no doubt the lack of U.S. tariffs on Italian wines will be assisting here but Italy is on fire anyway. Some superb vintages from their finest wine regions, namely Piedmont (2016) and Tuscany (2015 and 2016) are proving popular amongst wine lovers who are accustomed to paying far more for their French equivalents. These wines are coming to the market now as the Italians release their wines much later than the French. The extra ageing that occurs helps enormously as the reputation of the vintage is not speculative; the wines will have been tasted and re-tasted, so that significant element of risk is eliminated. They don’t ‘do’ en primeur like the French either, so there is far less hype and less FOMO (fear of missing out), so all in all it’s better for the purchaser (the two countries really could learn quite a lot from each other!). Chateau Angludet released their 2019 yesterday, even though only a handful of people have tasted it, as the whole Bordeaux en primeur system challenges itself yet further. June is the current plan for the pricing up of Bordeaux primeurs and unless there are substantial price reductions, we must surely be looking more at a case of double amputation rather than simply shooting one’s own foot off!

Whatever happens with Bordeaux en primeur I strongly believe Italy and the rest of the world will continue to eat into the French gateau. The fine wine market continues to broaden, there has never been so much good wine coming out of other regions and other countries, with journalist’s coverage to match, and with points awarded to even outstrip that! The economic effects of Covid-19 are going to be felt far and wide and the quest for relative vinous value will be evermore sought after.

miles.davis@wineowners.com

by Wine Owners

Posted on 2020-04-08

Miles Davis, 2nd April 2020.

If we look at the performance of the wine market relative to the major asset classes, wine has, once again, demonstrated some fine defensive qualities. The wider wine market has traded in a narrow range in the last couple of years, but the WO 150 is still up 57% over a five-year period. So far this year the WO150 is -1.3%. The WO First Growth 75 Index is down 6.6% - not bad compared to the FTSE slide of over 26% (peaking at -34%). There is a correlation in that the Covid 19 crisis has brought both classes down but the difference in magnitude and the speed in which it happens is significant:

Perhaps there will be a time lag response to the wine market as liquidity is so relatively small and because professional investors will not even stop to think about wine in times such as these (a good thing!). Following the Global Financial Crisis in 2008, The Fine Wine Fund, which I was co-managing and invested entirely in blue chip Bordeaux, lost an average 5.5% a month between September and December.

| Wine |

Current Value |

MTD |

YTD |

1 Year |

5 Year |

10 Year |

| WO 150 Index |

306.56 |

2.00% |

-1.52% |

-0.26% |

54.19% |

83.43% |

| WO Champagne 60 Index |

488.78 |

2.24% |

1.73% |

6.53% |

62.87% |

151.71% |

| WO Burgundy 80 Index |

786 |

5.20% |

7.57% |

17.87% |

155.27% |

256.58% |

| WO First Growth 75 Index |

251.92 |

-0.29% |

-7.14% |

-9.68% |

34.15% |

46.01% |

| WO Bordeaux 750 Index |

365.35 |

2.71% |

0.08% |

8.06% |

68.39% |

105.06% |

| WO California 85 index |

685.88 |

1.42% |

0.04% |

2.46% |

94.94% |

292.25% |

| WO Piedmont 60 Index |

312.96 |

2.44% |

-5.89% |

-2.24% |

68.28% |

101.01% |

| WO Tuscany 80 Index |

339.75 |

2.33% |

5.82% |

15.45% |

77.51% |

96.32% |

So far, the current market does not feel like it is going to react in quite the same way as either back then or like the major asset classes. To start with Hong Kong (and therefore China) has been inactive for the last nine months, first with the political troubles and now the virus and inventory must have reduced but, more importantly, the strength of the US dollar versus sterling is in play. At the start of the year GBP/USD was 1.33, falling to 1.15 on the 20th March and now at c. 1.24. The depreciation of GBP has protected sterling holders of wine and encouraged dollar buyers back into the market – indeed, we have seen this as a noticeable trading pattern, one which will probably continue.

Our own experience is that we have seen buyers of first growth Bordeaux, village and premier cru Burgundy, 2016 Piedmont and some of the super Tuscans. Most of the sub-indices are in good shape but there are two points to note here; one is that merchants rarely mark stock down unless they have to and the other is that these are calculated using the only readily available price – the offer price. Bids may well tell a different story.

Overall, the wine market is going to struggle this year and I would predict mainline prices, i.e. liquid Bordeaux and expensive Burgundy will be up against it. There will be lots of opportunities however and I do not expect a sudden crash, as we would have seen that by now. In a normal market 2016 Piedmont would have been extremely difficult to buy but, as it is, it is proving a joy. This will not be the case when the dust settles and as there’s very little to go around, I repeat my buy recommendation.

N.B. Our Burgundy index needs reworking as it has too many older, illiquid vintages contained within it.

by Wine Owners

Posted on 2020-03-17

We live in extraordinary times and what we thought was the perfect storm for the wine market just became a lot more perfect! Since I last wrote, major asset classes have tumbled in value as fear and uncertainty grips the globe. Wine prices look like they have barely moved in comparison to equity indices and the like but the reality of achieved selling prices would tell a different story. This is the nature of illiquid markets.

We have all lived through market crashes before and experience tells us that the aftermath makes for a very good buying opportunity. Admittedly we haven’t had an economic downturn brought about by a pandemic before. We don’t know how long the pandemic will last and how deep the economic hit will be.

We haven’t seen panic in the wine markets, not yet at least, and it’s fair to say that it feels like Hong Kong is waking up a little, in an almost post hibernation sort of way. Comment from friends in Hong Kong gives the impression of calm and that the worst is over. Although social distancing is still in full force people are getting on with the rest of their lives. Given how inactive, wine-wise, that area has been since last July, it’s possible that inventory needs restocking. Political unrest has also been dampened by the virus, so maybe there’s some cause for some springtime optimism in the orient.

Sadly, events in Europe and the west are only likely to deteriorate before they improve. The UGC finally called off Bordeaux en primeur tastings last week. My personal view is that this is a fantastic opportunity to reorganise tastings later in the calendar, giving the infantile wines a chance to develop and settle. The volatility of the major markets should have settled by then as well, inspiring better judged pricing.

Keep well, don’t panic and for those with cash, there will be some lovely opportunities. The Warren Buffets of the wine world will be rubbing their hands in glee!

| Index | Value | MTD | YTD | 1 Year | 5 Year | 10 Year |

| WO Burgundy 80 Index | 747.18 | 1.42% | 2.26% | 6.44% | 142.30% | 238.96% |

| WO Bordeaux 750 Index | 355.72 | -2.99% | -2.55% | 5.97% | 68.01% | 99.65% |

| WO Piedmont 60 Index | 305.5 | -8.39% | -8.13% | -5.73% | 64.89% | 96.22% |

| WO Tuscany 80 Index | 332.03 | 1.75% | 3.42% | 12.73% | 71.79% | 91.86% |

| WO First Growth 75 Index | 252.65 | -6.02% | -6.87% | -7.45% | 36.40% | 46.43% |

| WO California 85 index | 676.29 | -4.38% | -1.36% | 2.15% | 94.66% | 286.76% |

| WO Champagne 60 Index | 478.07 | -0.04% | -0.50% | 3.85% | 60.56% | 146.20% |

| WO 150 Index | 300.54 | -3.60% | -3.45% | -2.42% | 54.98% | 79.82% |

Miles Davis, Wine Owners March 2020

by Wine Owners

Posted on 2020-02-13

Miles Davis, 11th February 2020.

January in the wine world is always dominated by the latest Burgundy en primeur campaign. All the major Burgundy traders host tastings and the great and the good of the Burgundy buying world descend on them, hoping to make the latest ‘discovery’. Tastings this year were from the bumper 2018 crop. It was a very warm and sunny vintage with sunlight hours breaking new records. There were a lot of higher than average alcohol levels around and full, fat and juicy wines! There was plenty of merchant hype with generous descriptors in full flow. I found that seasoned pros were less impressed. The single most interesting fact surrounding the campaign, to my mind, was that one of the biggest merchants was only buying to order and would not be taking any wine for stock. Is this a sign of the times (i.e. the market) or the vintage? I think it’s a bit of both.

As previously described here, the wine market has been under the influence of a fare few geopolitical factors of late. That theme continued in January with the outbreak of the coronavirus in China. Given the proximity of Hong Kong to the outbreak, this is a further blow to the territory and the wine trading scene. Residents are working from home; confidence is low, and demand is thin.

Demand from the U.S. continues to be muted as we expect a further announcement from their administration regarding the Airbus related European tariffs on February 18th. Monsieur Macron has agreed a truce with Mr. Trump, for now, on his digital tax, but although that has gone away no one is placing any bets right now - the merest whiff of a tariff is enough to keep importers at bay. Here is a fascinating (and alarming) table of numbers from the American Association of Wine Economists, clearly showing the impact of U.S. tariffs:

I cannot explain the significant increase in New Zealand and South Africa versus the equally surprising declines for Argentina, Australia and Chile but researching the potential in South Africa is very much on my list of things to do!

Back in old London town merchants are discounting in increased margins to move stubborn stock and the traffic of e-mail offers has been on the rise. The market is desperately short of good news (the ‘Boris bounce’ lasted a full five minutes) and the signs are beginning to tell.

We have now seen releases of Giacosa and Sassicaia 2017. The Giacosa releases included the Barolo Classico, Falletto and the Barbaresco Rabaja from the mega 2016 vintage but the big one, Falletto Vigna Le Rocche Riserva, was from the 2014 vintage. Monica Larner of the Wine Advocate awarded 97 points and wrote “This estate is known for taking its biggest chances in the so-called off vintages. Betting on 2014 has turned out to be a brilliantly contemplated move”. I bought the lot, in all formats, in a brilliantly contemplated move!

I also bought some Elio Grasso 2016s (c. £350 per 6) and magnums of the Runcot Riserva 2013s. This is full blown 100 pointer from the Wine Advocate and only c. 5,000 bottles are made in only the very best years. This grower is becoming more popular and now he holds a perfect score is likely to become more so. One for the notebook.

I wrote very recently that if I had to pick one brand for 2020 it would be Sassicaia – the commentator’s curse! Following superb reviews and having won various awards for the ’15 and ’16 vintages, with price performances in the secondary market to match, Sassicaia has gone and done ‘a Bordeaux’! At £850 per six, this is a 22% increase on the 2016 release price, for an inferior vintage with an inferior score in a troubled market. Priced more modestly this could have sold out in seconds and left the crowd baying for more. As it is, it is very easy to buy at £850 – I prefer back vintages.

More generally, the WO platform has seen a lot of really good quality offers recently. There is a lack of confidence in the short term, collectors are trimming but there are buyers about; they just tend to be playing a bit more hardball than before. Spreads have widened in reflection of this and sellers need to be realistic (not over ambitious) if they want to sell.

Miles Davis, Wine Owners February 2020

by Wine Owners

Posted on 2020-01-27

By Miles Davis, 27th January 2020

Summary

Piedmont is on the up, the area and the wine. The region is extremely picturesque, and the food and wine scene is superb. Winemaking is better than ever with younger generations bursting through full of energy and enthusiasm and the wines are getting better and better. In my experience, they are becoming more approachable too. The natural acidities of the grapes and the soils can handle, if not benefit, from the warmer climate and there have been some very fine vintages in the recent past. In global terms, Piedmont is relatively undiscovered and comparative values to other great regions make for a compelling story – read on!

Background

I have just returned from three glorious days in Piedmont. The weather was fine, the food was finer, and the wines were finer still! As readers will know, I have been singing the virtues of Piemontese wines, and the value they offer, for many months now. I was not expecting to have my enthusiasm heightened, just confirmed really, but this trip exceeded all expectations. I have been a few times before but the combination of seeing some top-notch producers, having a local courtier (David Berry Green, DBG Italia) as a guide, and in the company of both an experienced wine journalist (Victoria Moore, Daily Telegraph) and a wine merchant (Mark Roberts, Decorum Vintners), the stars aligned and we hit some celestial heights.

Compared to Bordeaux and Burgundy, Piedmont has not been making wine for very long, certainly not commercially. Producers have been operating for decades rather than centuries. The Nebbiolo grape that provides us with Barolo and Barbaresco was not even the top variety in the region 30 years ago, that was Dolcetto. Back in the eighties, Conterno Fantino encouraged larger orders by giving away six bottles of Barolo for every sixty bottles Dolcetto ordered! Now Dolcetto vines are being grubbed up and replaced by Nebbiolo - oh how trends change! This one will not be reversed, however. Producers are defensive on Dolcetto, arguing it makes wine for everyday drinking and whilst I really wouldn’t mind drinking Bartolo Mascarello Dolcetto most days, it doesn’t compare to the joys produced by Nebbiolo.

Victoria Moore & David Berry Green - © Miles Davis, Wine Owners

Notes

The striking and salient points derived from the trip were all positive. The region has never generated so much international interest, both generally and in the wine department, but largely thanks to the wine department. In 2014 ‘First floor Landscape of Piedmont: Langhe-Roero and Monferrato’ became the official name of a UNESCO World Heritage Site and this has brought tourism flooding in, although some of it is now becoming a problem. The village of Barolo itself and its 700-800 residents now plays host to international rock concerts; Bob Dylan and Eddie Vedder of Pearl Jam have played to 7,000 (presumably ageing and wine loving) rockers in the last couple of years. Basta! scream the residents, producers are less concerned. The U.S., Germany and England are already major markets for the wines, but others are growing. Australia, Japan, Malaysia, South Korea, Singapore were all mentioned, as was Scandinavia. There was one noticeable absentee – China. ‘Not yet’, the producers said.

© Miles Davis, Wine Owners

The Wines

The wines we tasted were largely brilliant and we all agreed what a good reminder it was when we had our first poor tasting - it offered reassurance that we hadn’t become so inured to the place that we had become complacent! To be fair the Baroli we were tasting were mainly from the fabulous 2016 vintage and we were tasting at very good growers, some famous, some less so, but more on them later.

I was surprised by the approachability of most of the wines, a marked difference to previous experiences. The wines were pale, supple and elegant and with a weightlessness (something that perhaps Nebbiolo can deliver more than any other variety) yet packed with fruit, power and nuance at the same time.

Times have been a-changing in Barolo country and where they haven’t changed too much, the results have improved dramatically. The ‘Barolo wars’ are well documented, indeed there has even been a film made about them and concern the traditionalist approach versus the modern. Briefly, this translates into long maceration periods and ageing in large oak barrels (botti), the traditional approach, versus shorter maceration, temperature controlled fermentation and small oak barrels, the modern. It was interesting to note that the two wineries employing the highest percentage of small oak barrels produced the least good wines. The better wines were made in the traditional way but are harvesting better fruit, implying improved work in First floor.

As with other regions, alcohol levels in Piedmont have been rising, largely due to climate change. Most of the wines tasted were at 14.5%, but such are the natural acidity of Nebbiolo and the soils you really don’t notice, at least not until you’ve had the whole bottle yourself! It is a very different experience compared to drinking Bordeaux wines at the same level. Another local variety, Pelaverga, produces an even paler juice which is amazingly light and fruity. I had just started dreaming of summer barbecues when I noticed G.B. Burlotto’s offering weighed in at 15% - keep it away from the kids!

-G.B. Burlotto © Miles Davis, Wine Owners

The Market

As previously commented on here, the market in Piedmont wines is firm. Without the geopolitical issues currently hanging over the wider market, it would be a fair chunk firmer. The very loudly heralded 2016 will be released this year and buyers are waiting to pounce. If 2010, another great vintage, is anything to go by they most certainly will, and probably in far greater numbers than back then. In the grand scheme of things, Piedmont is an adolescent and will continue to grow. Wine making will continue to improve and prices will rise.

The Producers (in brief) (and not all)

Punset (Nieve) – previously unheard of (by me). Bio-dynamic and very in touch with climate and nature. Only releases when the wines are ready. Marina Marcarino’s Barbaresco Basarin 2013 (a year very similar in weather to the brilliant 1982, her first vintage) is available now. Delicious and only 13% alcohol. So desperate to make wine, she lied to her parents about the course she was taking at University. They wanted her to join their family widget making business – we were all glad she didn’t! Her range is just great, elegant and refined. She may even save the planet too.

G.B. Burlotto (Verduno) – Premier League status and I now know why! Verduno, at the northern tip of Barolo country, is the village of the moment and its best vineyard, Monvigliero, known for its elegance, is the piece of dirt everyone wants a piece of right now. Fabio Alessandria makes c. 8,000 bottles of Monvigliero - Investment Grade ‘A’. His whole range is superb.

Fratelli Alessandria (Verduno) – Cousins of Fabio and not to be confused with the Glaswegian band. Rising up into the Premiership. Traditional methods, improvements in the winery and focusing on improving quality, not expansion. Their Langhe Nebbiolo ‘Prinsiot’ 2016 is already in my cellar for drinking and I’ve been buying ’13 Monvigliero for investment.

Trediberri (La Morra) – Nicola Oberto and his parents bought a 5 hectare site in La Morra in 2008 and have 2 prime hectares of Rocche dell’Annunziata. Definitely one to watch, this guy is on the move and has been studying Bruno Giacosa’s methods. Refreshingly honest, he was genuinely most excited about his recently made Annunziata 2019 - at three months of age! The Langhe Nebbiolo ’19 might be one to sample. Moving from on the radar to gentle accumulation…

Trediberri (La Morra) – Nicola Oberto © Miles Davis, Wine Owners

Roagna (Castiglione Falletto and Barbaresco) – Now in the hands of Luca Roagna, they are one of the few growers making really serious wines in both Barolo and Barbaresco. The star has been rising for some time. Organic with old vines. We tasted wines from the poorly reviewed 2014 vintage (he releases later) at 10 degrees in the cellars. Although the wines were also cold, they sang their heads off. Both from Barbaresco, the Albesani (2,000 bottles) with the most amazing nose and the Montefico (1,000 bottles) stood out for me. Invest with confidence!

Crissante, La Morra – not on my radar before, Alberto has been running this family affair (we met Nonna (his nan), 88 and still dancing) since 2008. The family owns 6 hectares of vines, 5 of hazelnuts and a lovely holiday house they rent out. The Barolo Classico ’16 will ticks a lot of boxes when released. Thier Capalot ’15 will also give immense pleasure. The ’13 is currently available. Firmly on the radar now.

Bartolo Mascarello, Barolo – Investmnent Grade A. Brilliantly understated and traditional with a touch of jazz, but only in the artwork on display. Maria Theresa’s 2018 Dolcetto was superb, the ’16 Barolo sublime. A blend of 4 vineyards with production at 15-20,000 bottles. Genius. Interesting to spot an empty Trediberri box by the back door!

Giovanni Rosso (sounds so much better than Red John!), Serralunga – Proprietor Davide turned up as we were leaving, completely unphased by his tardiness. How someone so laid back has managed to create such a bustling business is amazing; two tasting rooms, one with a full restaurant style kitchen, a helipad, a contract to make BBR house Barolo and sales all over the world. Our impromptu host excelled in showing us the famous Vigna Rhionda vineyard. Once our feet were double caked in clay he informed us the terroir was nearly all limestone! A rushed tasting followed which was a bit inconclusive but with their top cuvée selling at £500+ a bottle, something is working. Another visit required!

Luciano Sandrone, Barolo – impeccable presentation. Famous for their Barolo labels Cannubi Boschis (Aleste since 2013) and Le Vigne, and now the uber rare Vite Talin, that they vinify themselves, they not only sell a lot of grapes from their Roero sites, they also sell finished wine to others. A mixture of traditional and modern. Barbara works with her Uncle Luca, only 3 years apart in age and Luciano (Barbara’s father and Luca’s brother) is still on site having begun his wine life with Giacomo Borgogno, bang next door and right under the slopes of the Cannubi Bioschis vineyard. Great 16s, the 15s also very attractive. Lovely wines, I have been buying and will continue.

Sandrone © Miles Davis, Wine Owners

General comment

It was an inspiring trip and easily surpassed expectation, particularly in the wine department. Growers tend to be family run businesses, are friendly, engaging and genuinely passionate. The bigger businesses are the antithesis of this and, dare I say it, more reminiscent of Bordeaux producers. These personalities are clearly reflected in the wines and different styles are very apparent.

On my return to my desk I found the tail end of the Burgundy 2018 en primeur offerings. The relative prices just do not make sense. On every level, there is no comparison; there are dozens of Grand Cru Burgundies from a host of producers releasing wines at more than c. £150 a bottle, in Piedmont a tiny handful. From a recent release of Giacomo Conterno’s 2015 wines, only the legendary Monfortino (the most expensive wine in all Piedmont) was above this price level. Many Burgundy premier crus cost more than exceptional Barolo cru, village wines more than ‘classico’ blends etc., etc.

For drinkers and those wishing to dip their toe, all of the producers make an entry level wine, be it a Langhe Nebbiolo, a Langhe Rosso or a Nebbiolo d’Alba. These are released earlier than the aged Barolos and offer an inexpensive way of treating yourself and opening the door.

As ever, please fire away with questions.

© Miles Davis, Wine Owners

by Wine Owners

Posted on 2020-01-16

This article is a follow up to our 2019 year end round-up by Miles Davis, published on the 10th January 2020.

The outlook for 2020

The geopolitical climate will continue to dominate the fine wine market in 2020. Uncertainty continues to hamper confidence amongst wine traders and although our view that the robust long-term fundamentals of wine will play out, there are some short-term issues (more on these below) that need to settle. If these issues, some of which are very specific to the wine market, can settle, we will look back on 2020 as the year of opportunity. Physical assets are doing well, gold is at a seven-year high, and we live in a climate of negative real interest rates. Stock markets are trading at all time highs and there is liquidity in the system, it’s just not finding its way into wine right now. Wine has been underperforming these other assets recently (one-year performances), see here:

The fine wine market continues to develop and change, and is becoming more interesting, with different fundamentals developing for individual markets, making them more autonomous all the time.

A whole new and significant factor is the U.S. and its trade tariffs, not only treating wines from different countries differently, but Champagne differently to still French wines, and wines above or below 14.1% alcohol from the countries on their hit list. Tariffs will influence the underlying markets, so until we have further clarification it is difficult to predict what may happen next.

As a result, I expect the wider market to start the year a little unsure of itself. There are and will always be opportunities within the wine market, however, but perhaps portfolio allocation has never been more important, producer too. And maybe more important than both of those considerations, are prices and relative value. Buying on the bid side of the market will be the key and good buying will be richly rewarded.

A reminder of performance over a five-year period:

I continue to favour Italy, particularly Piedmont and some of the super Tuscans and vintage Champagne. 2016 was an amazing vintage for Piedmont and new releases of Barolo should be considered. Of the major markets, I am generally lukewarm on Burgundy, but keener on Bordeaux where some fantastic older vintages, particularly ’89, ’90 and ‘96, are more available on the market than for some time. I think there will be some amazing opportunities this year in this area. I maintain my view that younger Bordeaux is fully priced, especially block buster vintages of ‘05, ‘09 and ’10 where supply is still plentiful and prices are high. I would be highly selective and very price sensitive in California and other ‘lesser’ investment markets, and always on the look out for lower levels of alcohol.

If I had to name one brand to buy this year it would be Sassicaia.

The issues in 2020

Brexit

The election result in the UK cleared the UK air after a period of uncertainty and it appears that producers and importers are relaxed, for now, about any Brexit impact.

Tariffs

The possibility of further U.S. tariffs has taken the place of the Brexit uncertainty but the situation there will become much clearer in mid-February, but I cannot believe anyone is going to be brave before then. If the tariffs remain as they are, I think the market will react in a positive way, negatively if they are any more punitive. The fact that the tariffs are only levied on wines under 14.1% alcohol, and thus wines stronger than that are exempt, is largely ignored by the market as an overriding sentiment takes over and the damage is done. Only wines from England, France, Germany and Spain are currently subject to these measures, making the rest of the world, particularly Italy in my view, look more interesting in the short term. France has particularly annoyed the U.S. with its digital tax aimed at the big tech companies and Champagne, given exemption last time round, may be in the firing line. But who knows what is going to happen next on this issue – the uncertainty is somewhat paralysing.

Hong Kong

The situation in Hong Kong is also creating uncertainty. The people are scared about the future and feel strongly enough to risk life and limb in protest, and China is not happy. The protests have calmed down from their most violent but there were heavily populated demonstrations at the turn of the year. Last week Beijing replaced their H.K. liaison officer with a senior and trusted aid of President Xi, hardliner Luo Huining, who ominously says that “everyone eagerly hopes Hong Kong can return to the right path." He comes with a reputation for fixing tough problems for Beijing!

The situation is complex, and it is likely the impasse will run and run. China can afford to be patient; it is sitting with the stronger hand and can probably slowly strangle the territory into submission without using undue force. Hong Kong has a long history of migration (especially post Tiananmen Square) and the numbers from now on will make interesting reading. Mainlanders are currently arriving at the rate of 50 a day but how many are leaving? Ultimately, I expect a huge number of democracy loving, wealthy locals will be leaving before 2047 but that this is the dawning of a new era for Hong Kong.

As well as being a lively wine hub itself, Hong Kong has been and is the gateway to China for fine wine and houses a lot of the experience and expertise in the region. More than ever, personnel and the location of businesses are transferable, and Hong Kong may lose market share in the longer term. This does not affect the long-term demand for wine, just where and how it is traded. If China was to open Shenzhen as a free port, for example, the impact would be immediate, and Hong Kong would be shunted sideways.

Other themes and points of interest

Bordeaux

The overall share of trade in the wines of Bordeaux has continued to decrease and the 2018 en primeur campaign was another damp squib. 2019 is another good, possibly great, vintage but the Bordelais need to respond accordingly if they want to stop the rot (how many times have we heard that!??). Young Bordeaux wine is still in a state of over supply with warehouses packed; a new lease of life is urgently required and if the Bordelais, by lowering prices, can take advantage of the huge media machine of en primeur to capitalise, they have a chance to turn the worm. I believe they have severely undervalued the power of the en primeur message over the years – we live in hope!

Climate change

Apart from the devastating fires we have seen in the U.S. in recent years, and Australia very recently, what does climate change mean for fine wine? Although winemakers are learning new techniques to deal with warmer weather the obvious and irrefutable consequence will be higher alcohol levels. Bordeaux 2018 demonstrated this in spades, with most wines well above 14%, and some around 15%. Although a lot of these wines can be well balanced, where the riper, more generous fruit copes with the higher alcohol levels, it does not take away from the fact there is a higher level of alcohol, and that’s not good. Most people, but especially connoisseurs, would prefer their wine to be around 13%. Other than the obvious benefits of scarcity, this is another good reason to favour older wines, they tend to be less alcoholic. I remember 2010 recording higher alcohol levels than we were accustomed to and causing quite a stir at the time - they seem perfectly natural now.

General (more for drinking)

South Africa has been receiving some very good press in recent times and quality is improving. It maybe not yet offering wines for investment, but it is certainly worth dipping a toe. I recently bought Meerlust’s Rubicon 2015 following some massive reviews, for not much money, for example.

Piedmont has had a string of good vintages, and there’s a lot of great quality Langhe Nebbiolo and Barbaresci on the market. Produttori del Barbaresco 2016s are both excellent and good value. Prices for these types of wines are the equivalent of generic Bourgogne.

Climate change is good for Beaujolais. The Gamay grape is a tough little number that needs plenty of sun and warmth. There has been plenty of investment in the region and quality and the number of wines providing pleasure is on the up. Do not overlook the versatile Chardonnay from the area either, a leaner style in general compared to the Maconnais and further north.

2018 Burgundy will provide plenty of easy pleasure but don’t believe all the hype from the merchants. Check alcohol levels, there are some that are too warm but in the main they, especially the reds, are generous.

Try and understand the critics and their scoring. At the Judgement of Paris in 1976, the range of scores, out of twenty, came in between two and seventeen. Some of today’s critics don’t really start at anything below ninety three (out of one hundred) and famous producers in half decent vintages are all north of ninety five. Big scores sell wines and are commercially attractive for nearly all involved – they just don’t necessarily reflect the truth! It has all gone way too far and this observer, for one, has had enough of it.

Wishing you well for 2020!

As ever, if you have any questions or would like to discuss anything wine related, do let me know.