by Wine Owners

Posted on 2021-07-11

Will Cheval Blanc and Ausone no longer be Grand Cru Classé ‘A’ as from the 2021 vintage?

If so, it won’t be because of the Commission de Classement. The closing of the Saint-Emilion classification applications took place on June 30 and neither Cheval Blanc nor Ausone returned their copies.

Unlike the left bank classification system of 1855 that is pretty much immutable (with the exception of Mouton’s promotion to Premier Cru in 1973), the St Emilion classification is reviewed approximately once every 10 years, permitting a periodic revaluation of quality and performance. It’s not all been plain sailing; the 2006 reclassification was plagued by accusations of impropriety and was eventually annulled. Consequently, tastings conducted for the 2012 reclassification were outsourced to independent groups from across France to rehabilitate the process.

Cheval Blanc and Ausone, the first St Emilion producers to be awarded Classé A classification in 1954 when it was created, are effectively leaving the classification system.

The Classé A incumbents evidently concluded that the system is no longer sufficiently discriminating to reflect the ranking of their respective properties compared to their peers.

This bombshell threatens to undermine the kudos and financial benefits of promotion to Classé A, and in turn the market pricing potential of those that are elevated. Not to mention it raises questions of the credibility of the St Emilion classification system more broadly.

So what does the two colossus’s departure say about the process of decennial review? How does this reflect on the composition and process of the Commission de Classement?

Is Grand Cru Classé A about to lose its lustre; devalued by ambitious properties busy erecting glitzy edifices? Concrete and stone, some say, matter more than they ought to compared to the brilliance of the wines and their track record.

Or, is Classé A promotion a reflection of the qualitative transformation we see taking place in St Emilion - given the strongly weighted preconditions of a sustained track record of exceptional results and market recognition - and therefore are not elevations thoroughly deserved?

Let’s see what happens over the coming weeks. Can Cheval Blanc and Ausone be courted back into the fold, or is their departure (by omission of submission) a fait accompli? Assuming the latter, perhaps we'll see more promotions next year than we might have otherwise. What effect this all has economically on those producers who attain Classé A classification is now more uncertain than ever.

by Wine Owners

Posted on 2021-06-30

As mentioned in our recent and well received offer of the incredibly well priced Montepeloso Eneo 2010 (there are a few left), we promised a closer look into the relative value of Italian wines. I know I have been banging on about Italy for quite a while now but there is every reason for it – there is some terrific value to be had, and so on will I bang!

The facts are that there are only a handful of Italian wines that trade at, what we are going to call here, ‘silly money’ compared to vast swathes of wines from their rather posher neighbour - namely La Belle France. It is true that the same can be said for Spain, and for most of the New World. The U.S. is an exception, as like France, it has many an offering at ‘silly money’. But for my pound, I say sweepingly, these regions do not offer such a vast variety of quality wines that appeal in quite the same way (I should qualify at this point I am really talking about top quality red wines).

What Italy offers, unlike everywhere else, is a multitude of wines at relatively affordable prices with absolutely massive ratings. There are two variables here, the prices and the ratings; the simplest explanation for the comparatively lower pricing is that Italian wines have not yet been recognised, and accordingly priced, as truly international brands. Put another way, Asia has not got to grips with it yet. Other than a few ‘Super Tuscans’ and the top labels from the likes of Giacomo Conterno, Bruno Giacosa and Gaja from Piedmont, very little starts life close to £100 a bottle. There have been half a dozen EP releases every day last week from Bordeaux that qualify for that prize! In Burgundy a hefty percentage of premier crus start there and for some more sought-after growers, your £100 only buys you a taste of a lowly village wine.

The ratings are, rather obviously, dished out by the critics. It is worth remembering that each region is scored on its merits in a peer group fashion. The wines, as are the vintages, are reviewed in the context of that individual region or vintage. What has happened, however, is that tones have been set for different areas which do seem to vary from each other. Burgundy, for example, tends to harbour rather conservative scoring where anything over 95 is a massive achievement. Prices for these trophies are also massive. It is different in Italy. There are countless Brunelli with huge scores and even people in the trade ask, ‘how come there are so many 100 pointers we’ve never heard of’?

A possible explanation is that the bar has been set so high, and for so long, by the likes of DRC and Rousseau that a mere premier cru from someone like Dujac or Roumier is only worthy of 90/91 points. So, perhaps a cleaner canvas for the critics to assess has led to some more generous brushstrokes? Or perhaps it is a more generational thing; France has long been understood, consumed, and pontificated upon by the old guard, who might not quite understand the Italian way? An old friend of mine, an experienced wine merchant recently said to me “I don’t really get Italian wine” (Burgundy and Sauternes are more his bag!) and then confused me further by saying “except I couldn’t possibly eat Italian food without Italian wine”. I understand exactly what he means with the latter statement (but not the first), and this goes from pizza level all the way to Piazza Duomo, a three star Michelin in Alba – quite good by the way! Either way, some of the scores in recent times and particularly for the amazing ’16 vintage, in all of Italy, and the ’15 vintage in Tuscany, have drawn truly flamboyant landscapes from the young masters – and for not many Lira either!

The other thing to remember is that the critics live and die by their reputations, so if they are going to award high nineties or even the magical triple digits, you know the wines are going to be very good indeed – within the context of their peer group.

Obviously, we would love to hear from you to discuss the opportunities further and there will be offers to follow based on this theme. In the meantime, you may want to engage with the ‘Advanced Search’ button or take in some of these names which spring to mind:

Piedmont: Alessandria, Cavallotto, Grasso, Sandrone, Scavino, Vajra

Tuscany: Fontodi, Fuligni, Grattamacco, Il Poggione, Isole e Olena, Pertimali, Montepeloso

Ciao for now! Miles 07798 732 543

by Wine Owners

Posted on 2021-06-17

Luke MacWilliam, June 2021

It is well documented that Piedmont is attracting more attention than ever before and activity in the secondary market has become increasingly frequent.

Comparisons can be drawn between Burgundy and Piedmont in terms of quality and scale (no politically motivated 1855 classification here). Your regional Nebbiolo or Barbera (Langhe, d’Alba etc) equate to a Bourgogne rouge, your straight Barolo to a village cru and then your single vineyards to Premier Cru Burgundy. The most lauded single vineyards from the best producers can mix it with the Grand Cru big boys! Pay particular attention to Cannubi, Bussia, Brunate and Rocche dell’Annunziata and Monvigliero.

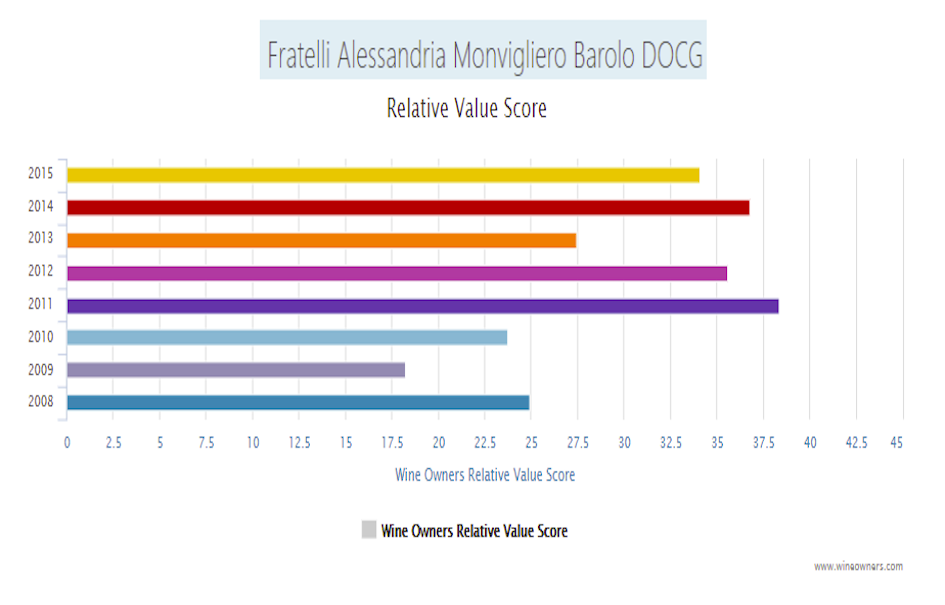

One producer I’d like to place under our spotlight is Fratelli Alessandria. A 150 year old estate, Fratellis Alessandria has 30 acres to its name, and produce a portfolio of wines from “simple” Langhe Nebbiolo right up the Premier and Grand cru equivalents in San Lorenzo, Gramolere and Monvigliero.

Last January - following a trip to Piedmont our very own Miles Davis noted the following:

The same week, I attended a Monvigliero focused Barolo tasting at 67 Pall Mall and was blown away by the ethereal elegance, approachability and precision of Fratelli Alessandra’s wines (Diego Morra, Roset and Sordi also shone, but I’ll leave those for another day). Don't mistake “youthful approachability” as “lack of ageability” - it’s still Nebbiolo we are talking about - the structure is there to go 20-30 years. The killer combination of approachability, ageability and affordability is exactly why any self-respecting wine lover should buy into them, you can enjoy the evolution for years to come without getting involved in bonkers Burgundy money (yet).

The same week, I attended a Monvigliero focused Barolo tasting at 67 Pall Mall and was blown away by the ethereal elegance, approachability and precision of Fratelli Alessandra’s wines (Diego Morra, Roset and Sordi also shone, but I’ll leave those for another day). Don't mistake “youthful approachability” as “lack of ageability” - it’s still Nebbiolo we are talking about - the structure is there to go 20-30 years. The killer combination of approachability, ageability and affordability is exactly why any self-respecting wine lover should buy into them, you can enjoy the evolution for years to come without getting involved in bonkers Burgundy money (yet).

Fratelli Alessandria are moving forwards, and as demand increases for quality Barolo so are prices of the top crus and top vintages (investment anyone?) but on relative value terms they are still an absolute steal.

Take their regular Barolo 2016. £175 + comms IB per 6 and earning a whopping 96pts from Monica Larner. Could you imagine such a write up for a village burgundy?

'The 2016 Barolo opens to tight elegance and a nervous quality that pits red fruit energy over lean fruit weight. The results are graceful, lithe, fragile and lasting. The wine's aromas unfolded slowly and seductively, revealing wild berry, cassis, bitter cherry, toasted almond and blue flower. This is a dreamy wine that promises more beauty as it continues its bottle evolution. An ample 20,000 bottles were produced. This is one of the very best values found anywhere in Barolo.' 96pts, Monica Larner, Wine Advocate

It doesn’t stop there, moving up to Gramolere 2013 (premier cru equivalent) at £215 + comms IB per 6.

'This is a wine of beauty and intensity. The Gramolere cru in Monforte d'Alba is distinguished by the focused and sharp nature of its aromas. The 2013 Barolo Gramolere is a textbook expression of the cru, with deeply delineated aromas of wild berry, rose hip, rosemary sprig and licorice. The mouthfeel is silky and smooth with good structure and firmness to add to that sense of purity and sharpness. The wine's profound depth is what stands out most.' 94pts, Monica Larner, Wine Advocate.

And finally to Monvigliero:

'The 2010 Barolo Monvigliero shows a pretty degree of color salutation with brilliant garnet and ruby highlights. The bouquet is broad and wide-sweeping with a healthy succession of red berry, sweet almond, stone fruit, medicinal herb and crushed mineral. Fruit thrives from 220 to 280 meters above sea level with full southern exposures facing La Morra. They own 1.5 hectares of the 20-hectare single vineyard. Fratelli Alessandria keeps its Barolo in oak casks for three years, instead of two. The wine shows light spice notes with distant touches of dark fruit. The tannins are silky and long. The wine is amazingly expressive now, but promises great aging potential. Drink: 2017-2033.' 95pts, Monica Larner, Wine Advocate.

From a relative value perspective, scores are high across the board. 2010 and 13 are the vintages that have begun to move upwards in price, 2016 has rocketed too. Value can be found in 11, 12, 14 and 15 where quality remains consistent.

P.S For the adventurous out there - seek out their Pelaverga Speziale for something utterly different. Pelaverga is a local variety made almost exclusively around Verduno. My notes start with “Wow. Weird. So floral….not like anything I’ve tasted before” and my attention was grabbed immediately.

P.S For the adventurous out there - seek out their Pelaverga Speziale for something utterly different. Pelaverga is a local variety made almost exclusively around Verduno. My notes start with “Wow. Weird. So floral….not like anything I’ve tasted before” and my attention was grabbed immediately.

A historic producer who embraces tradition and local identity, but also strives to improve and improve in a changing world ticks all the boxes for me.

by Wine Owners

Posted on 2021-06-01

There has been a lot written about 2005 and most people know it’s right up there up there with some of the very best vintages in current collector’s lifetimes.

For the record, the truly great years of the last sixty years, as measured by using a vintage score of 96 or above on Vinous Media, are: 1961, 1982, 1986, 1990, 2005, 2009, 2010 and 2016 (I have chosen to ignore the 2018 and 2019 vintages). The only three vintages to score 98 points are 1961, 2005 and 2016. Arguments will continue forevermore about which vintage is the best and there will be the obvious comparisons between left and right banks, and which is better, but does it really matter when you are in the presence of greatness? Everyone at least agrees 2005 is right up there and on balance it is less contentious than both 2009 and 2010, but for different reasons. I remember the great Robert Parker commenting the quality of the vintage went deep into the layers of the wider Bordeaux region and across the breadth of all the appellations.

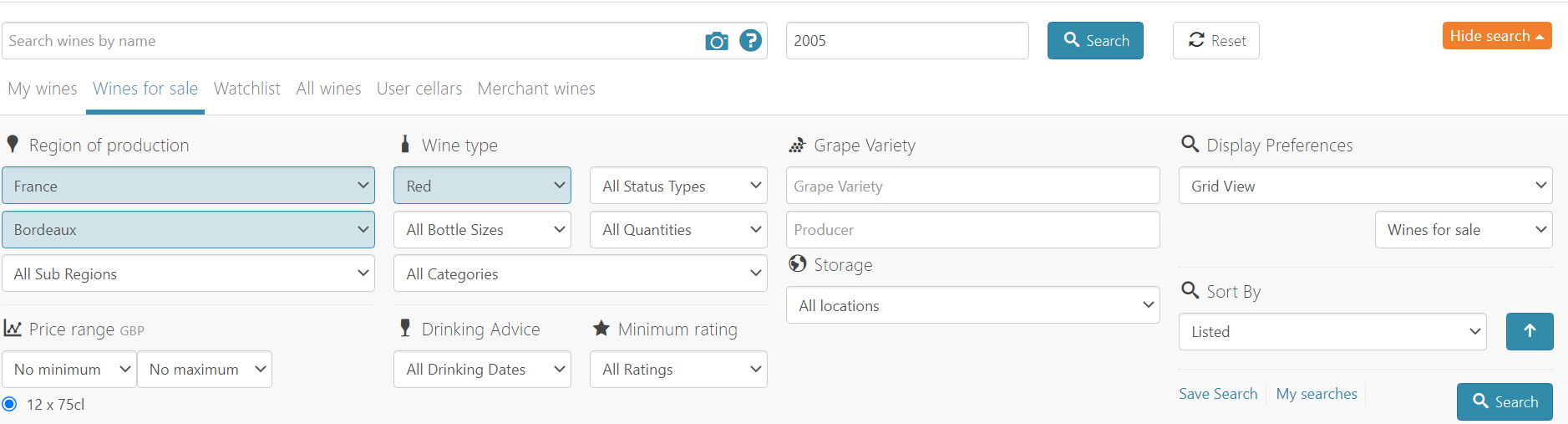

Given the 1961 has all but disappeared and the 2016 vintage is a touch on the adolescent side, the 2005 vintage would appear to be a vintage to stock up on, if you haven’t already. A quick ‘Advanced search’ (see picture depiction below) on our platform shows me there are 44 different offers on the Wine Owners for the 2005 vintage, from Chateau Sainte Colombe Cotes de Castillon (£162 per 12), all the way to Petrus (£17,400 per 6). Someone else has been looking after these treasures (and paying a fair whack of storage on them) but is now ready to exchange them for hard currency.

Miles 07798 732 543

N.B. In my opinion really good Bordeaux takes a lot longer than the commonly held perception (and many suggested drinking dates) to really shine through and for nuance to really develop. Even serious commentators have been overheard saying ‘it all tastes the same!’ and when the wine is not fully developed, I can see why it could be easy to share that point of view.

I have only just begun to approach my best 2000s (and will be leaving them a while longer yet) and have barely touched my ’05s outside of some second wines (Sarget de Gruaud Larose I particularly enjoy and there’s still plenty of life left in it). The best wines may take thirty years or so to show their true potential. The second wines of lauded estates in really good vintages is normally a very reliable way to go.

by Wine Owners

Posted on 2021-03-17

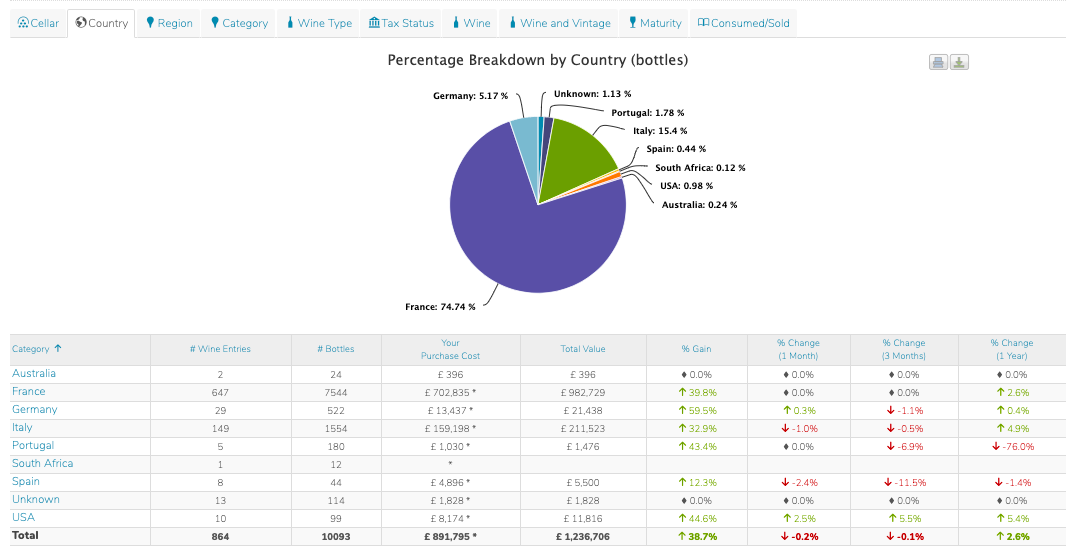

For just a moment, imagine no longer having to depend on a tedious cellar spreadsheet and instead being able to view your entire wine collection all in one place in an interactive way, bringing your portfolio to life?

Spreadsheets can be dull and relentless at the best of times. By consolidating piles of paper, spreadsheets, emails and invoices all into a well organised online portfolio, you can pull other valuable pieces of information together that lend a new dimension of enjoyment to organising your collection. Contrary to what you may think, managing your collection end to end, ensuring that all your wine acquisitions are accounted for, can be a fun process!

Cellar management software enables you to achieve this in 3 steps:

Step 1) Getting your collection organised.

Figuring out what wine you have may sound simple but it often isn’t. Wines are sourced from multiple merchants and stored in numerous locations. Although the majority of merchants are organised, not all can be relied on to remind you of your purchases.

An online cellar management platform enables you to track your entire wine collection in one place, both your professionally stored wines and those at home. Wine Owners’ home cellar functionality enables you to track the exact location of each bottle down to hole in a bottle rack, so that no bottle will be forgotten and ensures wines will be consumed within their drinking window (a window that you can edit according to taste).

Having been built by a fellow wine enthusiast, all functionality has been developed taking every part of the wine journey into consideration. All important information can be recorded: the wine name, vintage, format, where it was bought, purchase price, condition, quantity or a shipment date if it is incoming stock.

When you join, you have instant access to a pool of valuable information including drinking dates, critic stores, producer profiles and up to date pricing information and more, enough to keep any wine collector happy. Optimised for mobile and tablet access, you can access your collection wherever you are, whether on public transport, at work or abroad.

2) Rediscovering your collection.

Now that you have catalogued your portfolio and you know what you have and where it is, Wine Owners can help you make well-informed decisions around a) which wines to drink next and b) what you have too much of thanks to overzealous purchasing or a very good relationship with your account manager!

Lots of fun is to be had exploring the integrated analytical tools which include sophisticated pricing graphs and relative value score analysis. You can also review your portfolio by a range of filters, view values per category, total value and category performance over different periods of time.

Latest perspectives of the critics are also helpful to appreciate the quality of the wines you have bought, and you can add your own tasting notes as well.

3) Shaping your collection.

Once you’re clear on your inventory, it’s time to take key decisions around your collection.

You may wish to sell surplus stock back to the merchant who initially sold you the wine or, if they refuse, you’re only a few clicks from being able to offer your wine for sale in a vibrant secondary market, with trading desk experts available to help.

An easy to navigate, comprehensive digital overview makes it a lot easier to make decisions around which wines in your collection you’ll want to keep and the ones that are ballast. You’ll also be less likely to miss a drinking window. As a wine collector, the satisfaction of enjoying that glass of wine that has appreciated 10-fold since the date of purchase cannot be understated!

For those members who want to buy and sell, it’s super simple.

As it is integrated with a peer-to-peer trading exchange, you are joining a vibrant ecosystem of like-minded collectors as soon as you upload your collection.

In addition, by making purchases through the platform, every part of the settlement process is looked after by our logistics team.

If you are ready to upgrade your cellar management experience, we’re here to help. You can start by creating a free account HERE to organise, value and monitor price changes on up to 30 wines. If you have over 30 wines, our premium plans offer all the tools you will ever need to easily and successfully manage your collection.

by Wine Owners

Posted on 2021-03-04

Miles Davis, March 2021

In early December I wrote the following:

‘Traditional assets continue to bounce around, no doubt causing palpitations and stress. More than ever, this year has been about timing in the capital markets, and if you got that wrong, the chances are you got it expensively wrong. Not so for vino! Unlike after the global financial crisis, the wine market has held its nerve, merchants did not mark down prices and the market has been stable. Investors are about, and even Bordeaux prices feel like they are firming up. Collectible assets are in vogue and it is easy to see why given these circumstances.’

Not too much has changed since then although there has been plenty more talk about inflation, with the UK’s November numbers coming through much higher than anticipated. This can be viewed as a positive. There has also been the small matter of a new American President. This, in itself, should not have a direct influence on the wine market (!?) but a $1.9 trillion stimulus package and a clear signal that money is going to keep being pumped into the system might be!

So, the macro factors are looking stable and the index performances from last year are also looking sensible. There is no massive ‘feel good factor’ about, which often brings about a more boom-and-bust style dynamic, so this is beginning to feel like an old-fashioned wine market, steady as she goes, nice little earner, thanks very much.

Bordeaux First Growths continue to be the fly in the ointment, underperforming all the other regions with +2.8%, save California with -2%, and generally Bordeaux’s market share continues to slide and is now less than 40% (95% ten years ago!). Pricing from a few of the Chateaux meant the 2019 en primeur campaign awoke the old beast for a moment but otherwise, the top end wine market of Bordeaux continues to struggle. Interestingly, the much broader Bordeaux 750 fared far better with a nearly 10% rise.

Italy was the star of the wine market show in 2020, with Tuscany posting nearly 20% gains and Piedmont 6.4%, followed by Champagne with 12.7%. It is more than coincidence that these markets have been exempt from US tariffs in recent times. Italy has long lived in the shadows of France in terms of reputation and price in the fine wine world, but the gap is still vast, certainly pricewise. The super recognizable names of the Super Tuscans, which have recently benefited from the mega vintages of ’15 and ’16, consistently receive incredibly high scores.

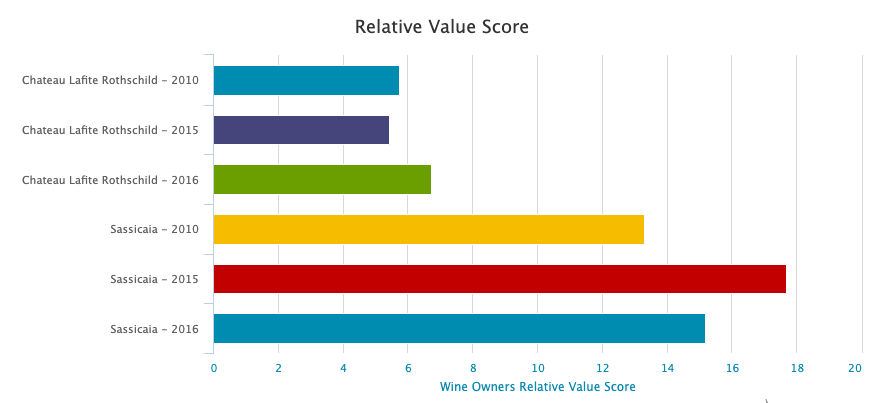

The 2016 Sassicaia (100 points WA, 97 VM), one of the most expensive Sassicaias of all time, is £230 a bottle, Lafite Rothschild 2016 (99 WA, 97 VM) is £530 a bottle, and production levels are roughly twice as much at Lafite. Maybe this is not a fair comparison but given the price differential and the tariffs in place, I know which one I would be backing:

This is a short excerpt from Miles Davis' 'Wine Owners 2020 Wine Investment Report and a look ahead at 2021'. CLICK HERE to read the full report.

by Wine Owners

Posted on 2020-11-23

Krug is, surely, a Champagne that needs no introduction.

In all likelihood it is the first name to enter one’s head when considering the top names in the prestige Champagne bracket. It was the first thing I sought out on receipt of my first proper bonus! There are others obviously but Krug has carved itself a special niche of its own.

Krug, founded in 1843 produce a range of different cuvées ranging from the Grande Cuvée for everyday drinking (!) to the Clos d’Ambonnay for that very, very special occasion (at £2k+ per bottle it should be at least a very good excuse!). Here we are looking at Krug’s Vintage Champagne over some of the best vintages of the last two decades.

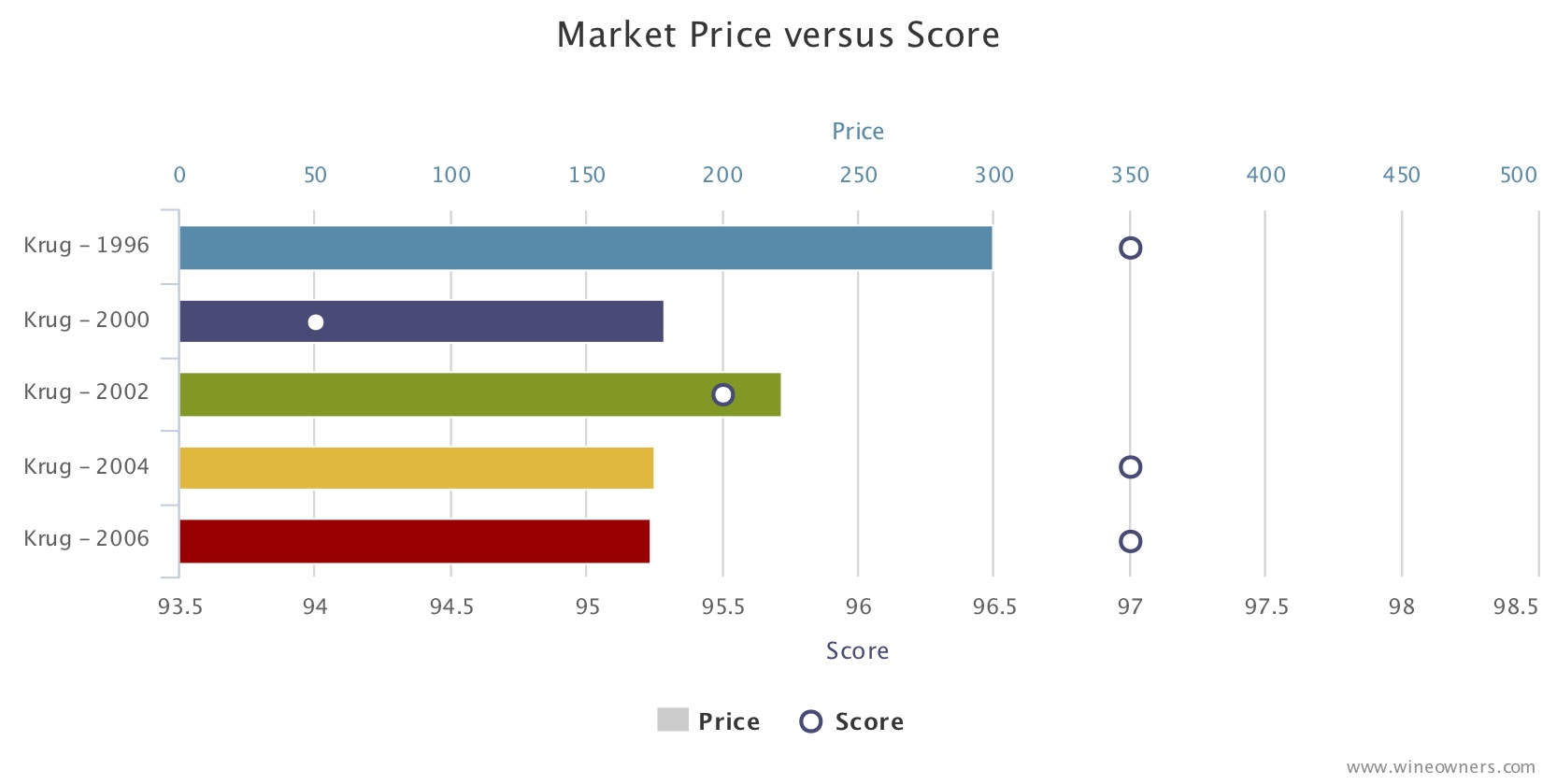

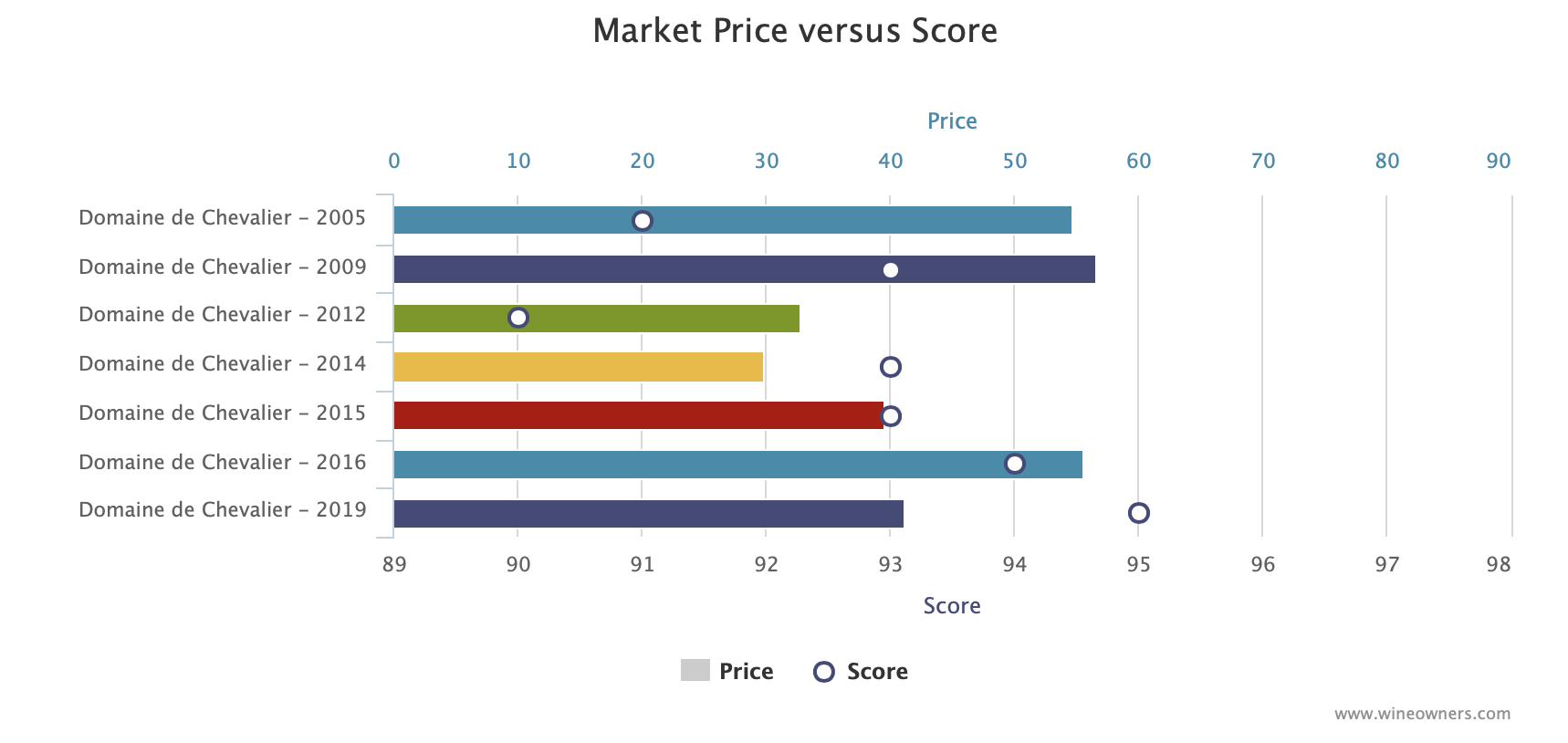

First, the market prices and scores:

And now the relative value score:

The mega vintage that is 2008 has not yet been released, so in the meantime I have no hesitation in recommending both the ’04 and the ’06 as very solid buys for the long term.

Banner Image: www.krug.com/the-house-krug

by Wine Owners

Posted on 2020-06-04

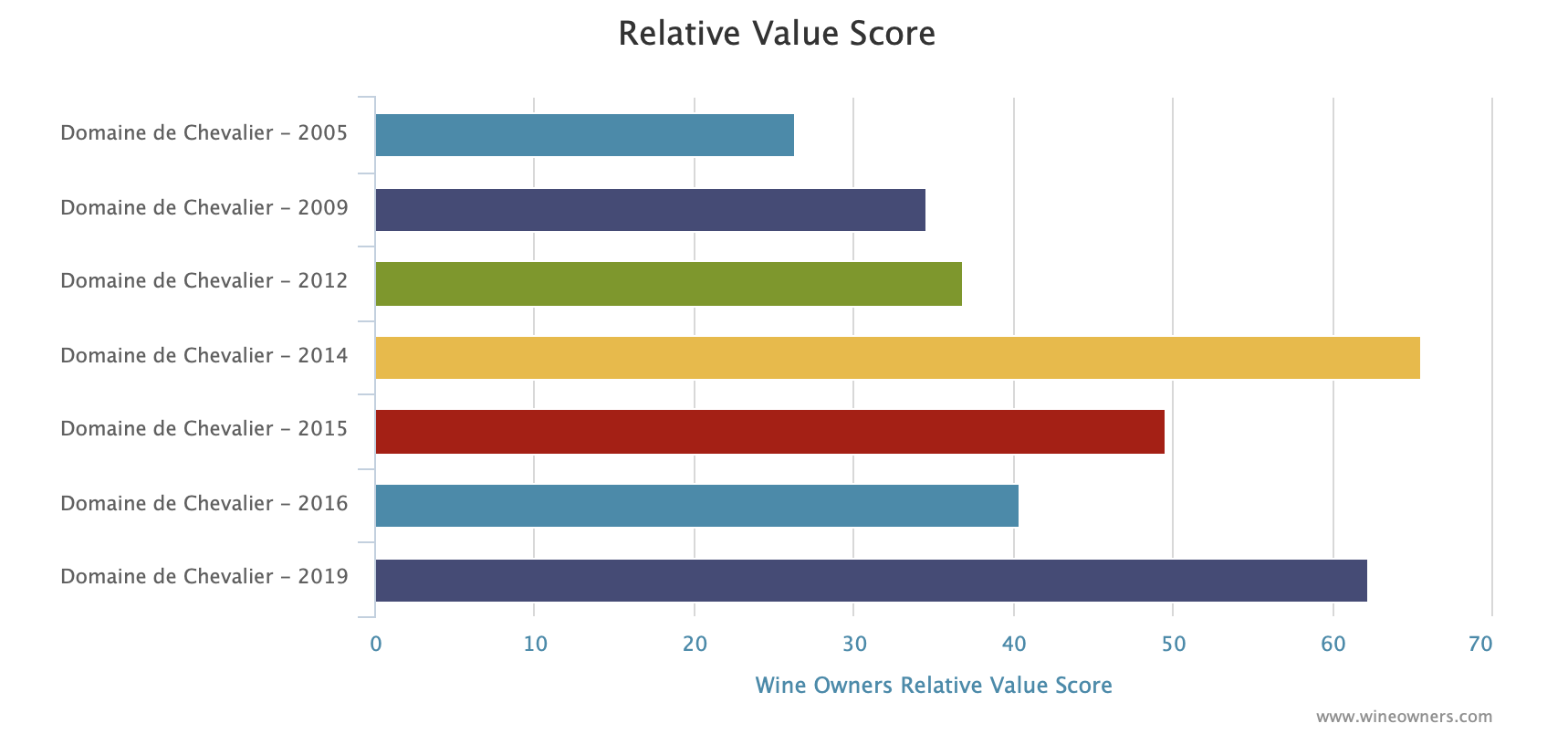

Chevalier is out this morning at £247 per 6, a perennial favourite and on the back of a seemingly great success in 2018. Hopefully in 2019 they’ll have tamed the merlot alcohols which hit 15 degrees in 2018. Bordeaux being blends saved the day and early pickings of Cabernet brought the assemblage down to under 14 degrees. Still, that kind of inherent excessiveness does make you wonder. Chevalier does age with unusually consistent grace no matter the kind of vintage.

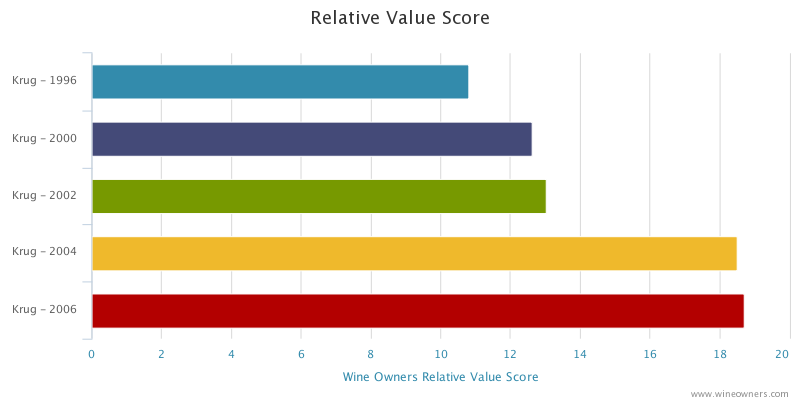

Relative value analysis points to 2014 as being a rather decent pick of an excellent run of recent vintages. 2019 is fairly priced for collectors of this lovely estate but not to attract the short term profiteers.

Banner Image: http://www.domainedechevalier.com

by Wine Owners

Posted on 2020-06-03

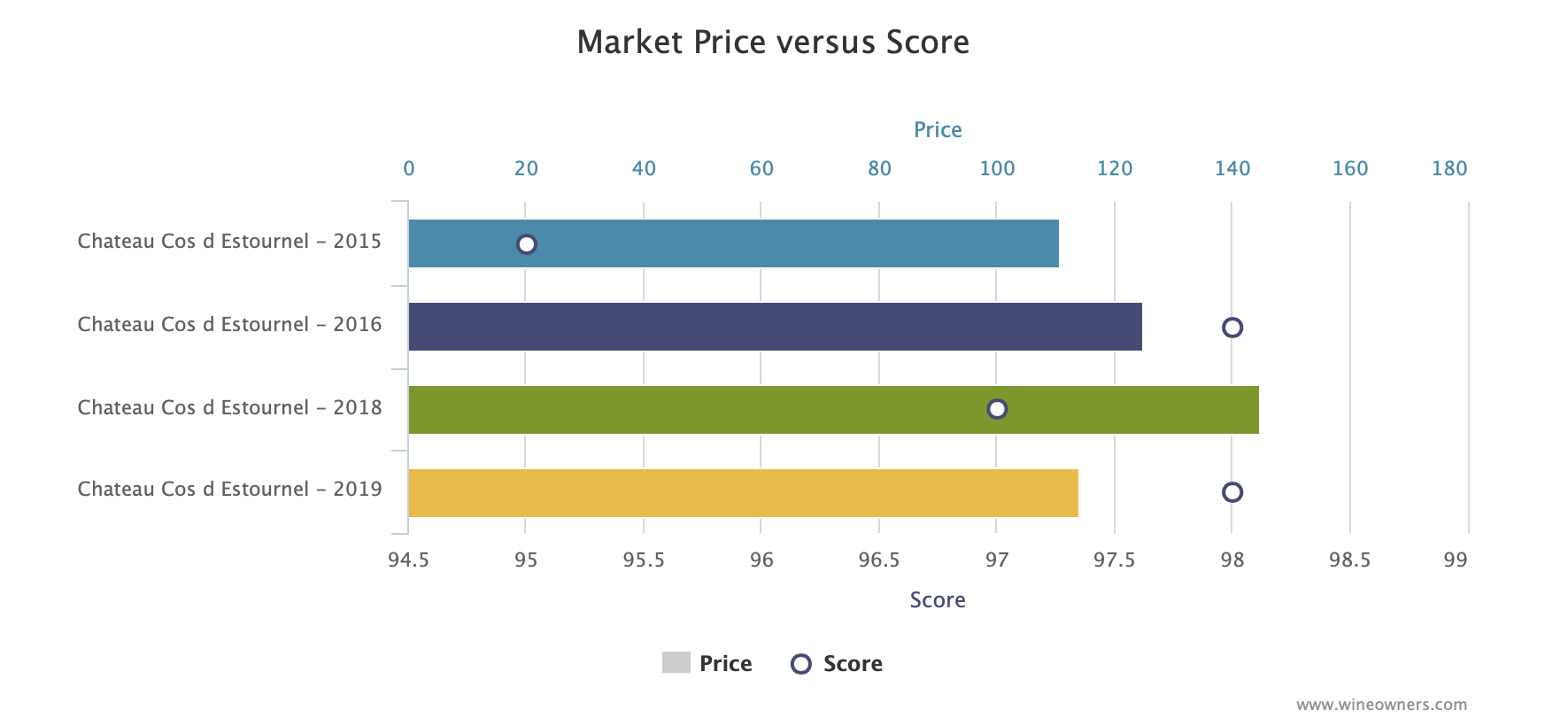

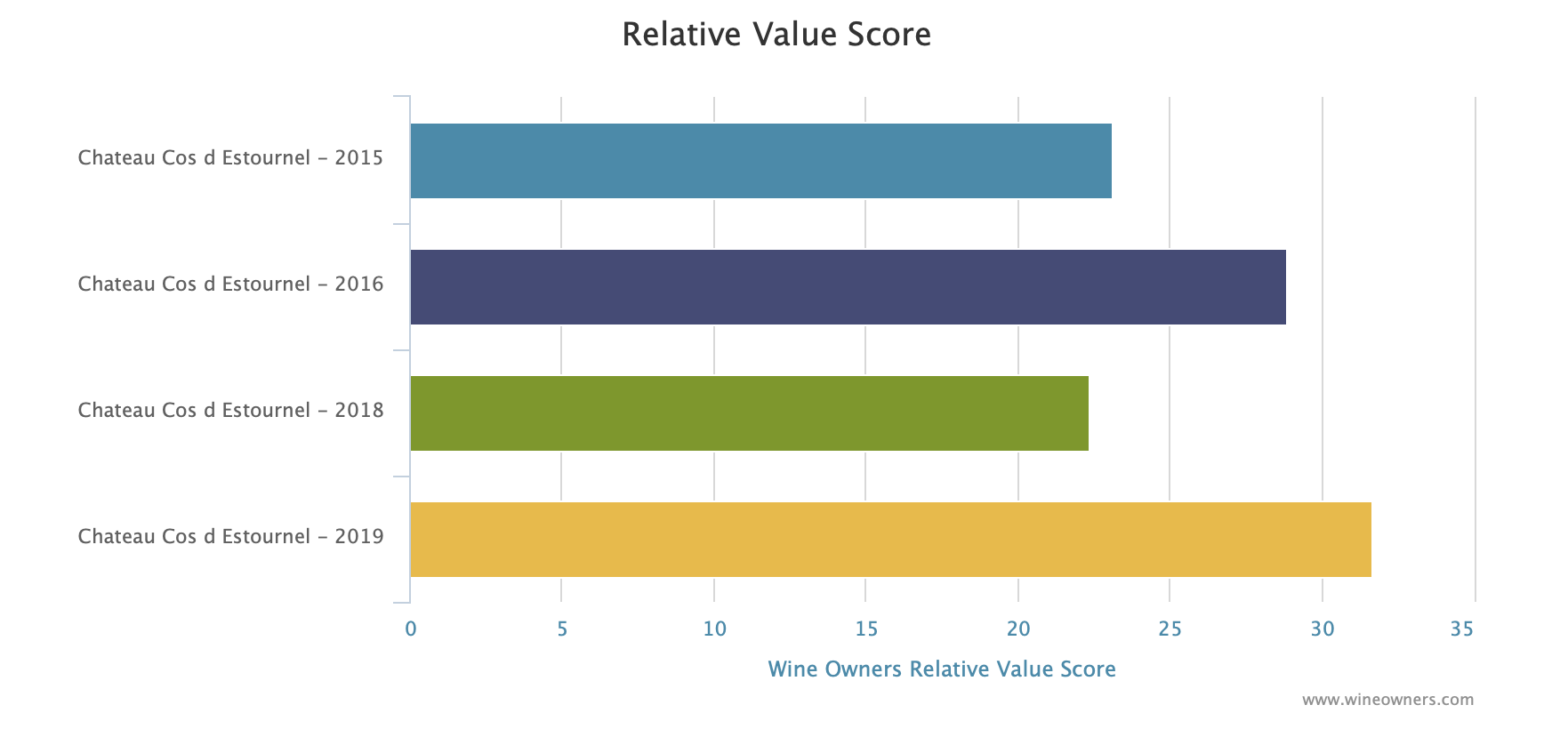

Cos d’Estournel is out £684 per 6. -23% down on 2018. Great wine they say but is the price reduction enough?

The magisterial 2016 is hovering 10% above this release price, which is among the greatest young Bordeaux Lisa Perotti-Brown has ever tasted, it’s in bottle and widely available, so we think they needed to do a little more to make this really attractive. However good the 2019 proves to be, it does not prompt the same compulsion to buy this year as Pontet Canet and Palmer.

Prices and points (we have allocated 98 points)

Banner Image: www.estournel.com

by Wine Owners

Posted on 2020-06-02

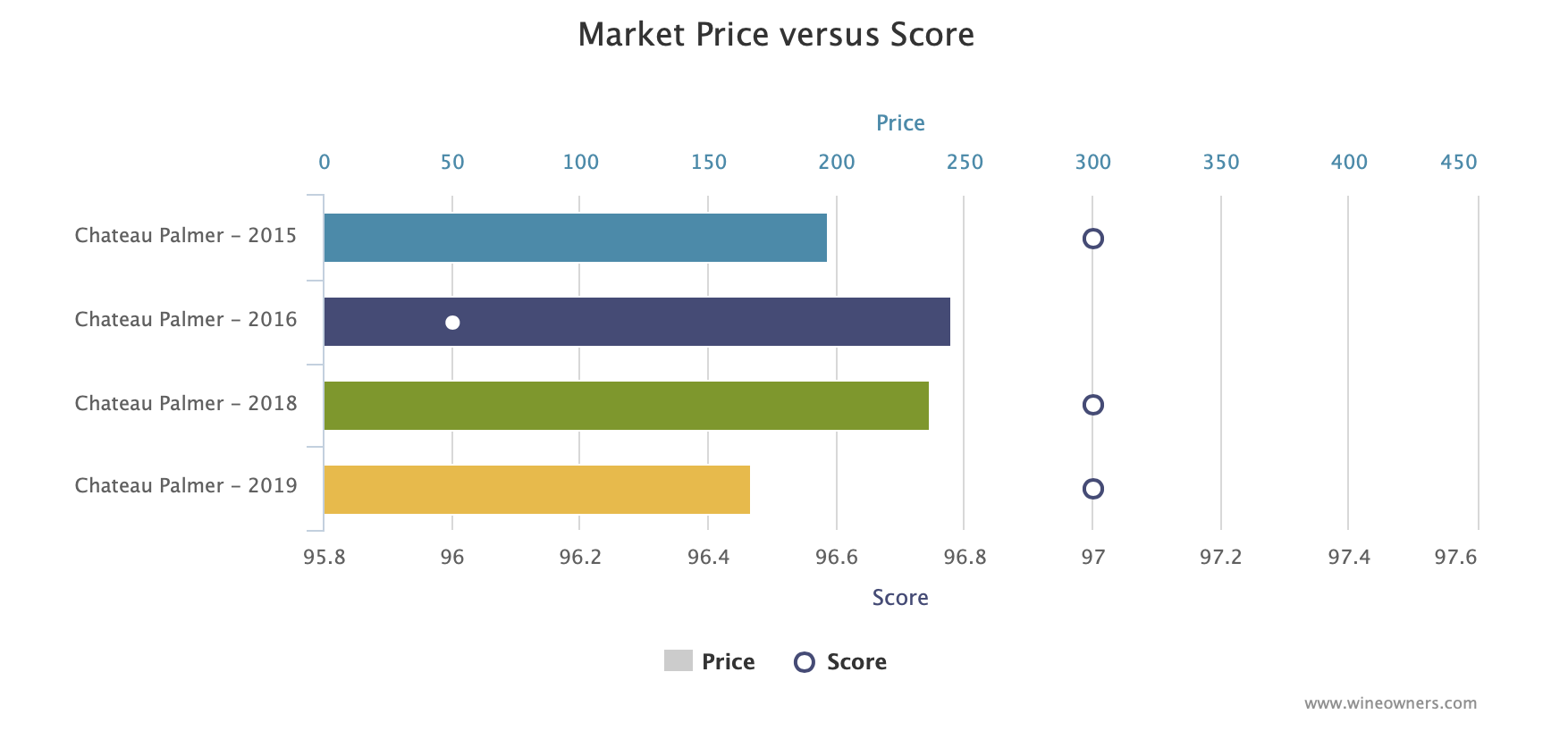

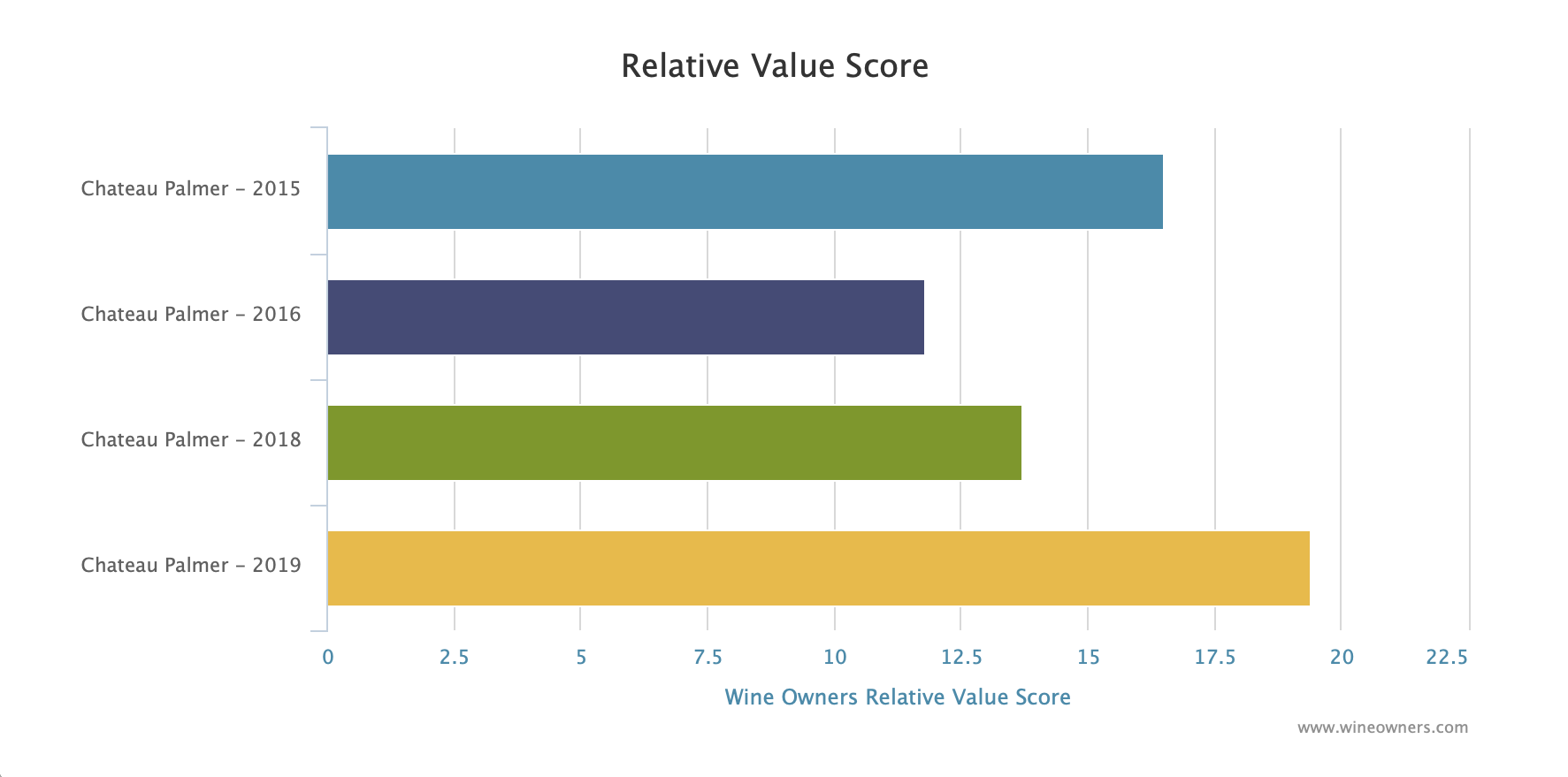

Palmer was released this morning at £999 per 6, a 31% reduction from the (pumped-up) pricing levels of 2016 and 2018. We are back into rational release pricing territory.

Does it work? Absolutely. Note we have put in a placeholder of 18 points but it works at 17 points too.

At this rate, if the whole of Bordeaux rallies around the reduction level of -30% to -35% set by Pontet Canet and now Palmer (and rumoured to be the level of reduction that Lafite will apply), this’ll be the first en primeur campaign since 2014 where it would make sense to buy more broadly than the very specific, narrow range that we’ve suggested makes any sense at all in the last 3 campaigns.

Here’s the analysis of Palmer.

First pricing and scores:

And the relative value calculation. Note how much longer, and therefore better value, the 2019 bar is than any of the comparative vintages used for the analysis:

Banner Image: www.chateau-palmer.com