by Wine Owners

Posted on 2019-11-15

This article is a republished version of one that appeared earlier in the year. Why? Because there’s another reason to sing about the virtues of Italian wines; the Trump administration have recently introduced a 25% tariff on all wines from France, Germany and Spain below a 14.1% alcohol level (Champagne is exempt). This has caused a loss in confidence in the French heavyweights and Bordeaux and Burgundy prices are on the slide. Italy’s cheese industry was the one selected to take the hit in this particular trade war, leaving their wine sector sitting pretty. We’ve been bullish on Italy all year, this adds further grist to the mill.

The Italians are not only the largest wine producing country in the world, they have been making wine for over four thousand years and cultivate over two thousand grape varieties on a multitude of different soils in twenty different regions! They are not bad at food either. Their climate seems to suit most of the finer things in life.

Italian wine being recommended is nothing new, but having it recommended as a collectable asset bearing an investment case is another matter. Ten years or so ago, a few canny collectors realised some of the ‘Super Tuscans’ (red wines typically made of a Bordeaux blend in Tuscany) such as Masseto, Ornellaia, Sassicaia (recent blog) and Solaia were ripe for decent returns. Traditionalists were a bit put out by these glossy new pretenders turning up on the Italian wine scene with their fancy French grape varieties and lots of marketing but it is fair to say they have helped the overall attention given to Italy and, as a result, the ‘Bs’ are blossoming – namely, Barolo, Barbaresco and, to a lesser extent, Brunello.

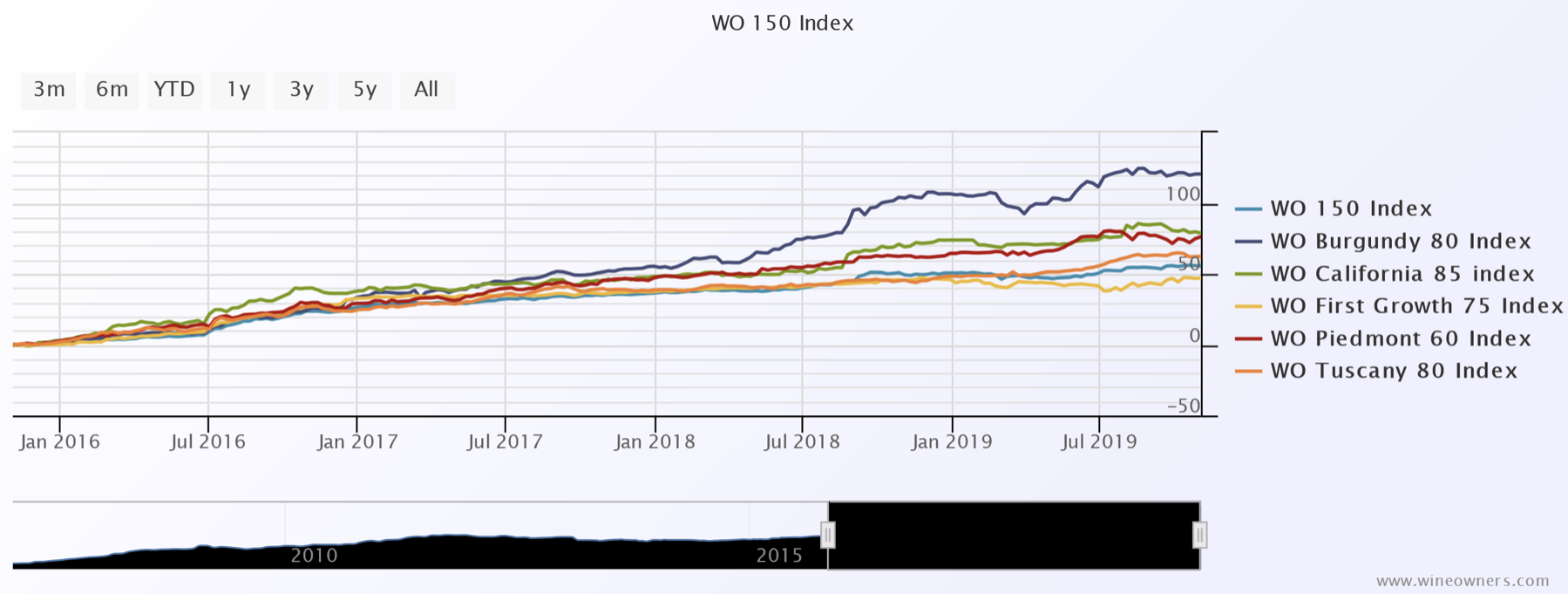

Wines from the best producers of Italy’s most venerable regions have been collected by the cognoscenti for years but now their appeal is becoming more widespread. The problems of Bordeaux, following an explosive China-driven period, have been well documented in the last decade and in its place, the smaller top-quality regions have been profiting. The indices for the last five years show Burgundy +120%, California +79%, Piedmont +76%, Tuscany +62% and First Growth Bordeaux +47%, the broad base WO 150 is +55% (all nice numbers!).

The reason for Burgundy’s performance is that old tried and tested wine world fundamental of genuine demand outstripping supply - who knew!? I think it is fair to say prices in Burgundy have been coming off the top for nearly a year now. Californian prices were a little more ‘forced’ and are in retreat now, but both these regions produce tiny quantities in comparison to the number of people looking to access these markets and gain exposure. Very widely held Bordeaux has been steady but is beginning to slide in this difficult environment. Piedmont and Tuscany are holding firm to gently positive.

The complex nature of Burgundy, California and Piedmont with their tiny (compared to Bordeaux) vineyards is attractive. This adds to the aesthetics, spurring on both the well-seasoned and newcomers alike, keen to learn more and invest time and money accordingly. More of the written word is more easily accessible to interested folk, and with platforms such as Wine Owners to trade on, the visibility of the product and the liquidity of the commodity has increased.

Grand Nebbiolo from Piedmont is yet to hit the big time, apart from a special few producers, but the word is spreading and there are ‘new’ names coming through; dedicated collectors and the inquisitive are homing in. It is a Burgundian-like network of vineyards, producers, families and reputations and you need to know what you are doing. Famous names like Conterno, for example, have six listings in my favourite reference book: Aldo, Diego, Fantino, Franco, Giacomo (the big one) and Paolo.

Some of the bigger names like Giacomo Conterno famed for his Montfortino vineyard, Giuseppe Rinaldi, Bartolo Mascarello, Bruno Giacosa and Gaja are already highly sought after superstars, with prices to match, but there are a host of others with reputations and demand beginning to swell; Brovia, Cappellano, Fratelli Alessandria, Sandrone, Voerzio and Vietti to name a few.

The ‘Super Tuscans’ of Bolgheri are much simpler to understand, like Bordeaux versus Burgundy, and are produced in larger numbers. The names mentioned earlier are virtually household names (in wine terms!), are less exciting right now overall but tend to deliver very steady returns.

Brunello di Montalcino, made from Sangiovese, is also comparatively easy to piece together in relation to Piedmont. Biondi Santi, Poggio di Sotto, Salvioni and Soldera are the big names with the fancy price tags. The secondary market for Brunello has not yet developed so, for now at least, it is a case of keeping a watchful eye although Soldera has been added to several portfolios already. There are many other less well-known names that have been attracting huge plaudits from the top critics that remain under the radar. This group haven’t matured into the darlings of the market, so far, and back vintages are cheap and well worth consideration.

There have been some excellent vintages in Italy in the last decade or so, attracting fantastic media coverage and now the battle-weary Bordeaux buyers and profit takers of Burgundy are moving in. Another reason for favouring Italian wines in the current climate is that the U.S. and Germany are the biggest export markets, so the market unlikely to be affected by any potential fallout from Brexit.

Most of all, however, these wines are barely scratching the Asian surface as yet and we all know what happens when that changes!

Miles Davis 15th November 2019

by Wine Owners

Posted on 2019-11-07

I wrote at the end of September that the market mood is sombre, it is a bit darker now. It is too early to be reflected in the monthly indices, but blue-chip Bordeaux prices are beginning to slide a little. The ongoing factors that have been keeping a lid on any sort of optimism, namely International trade wars, the Hong Kong political situation and Brexit have now been compounded by upcoming UK elections, in December, and therefore huge concerns over sterling, and US trade tariffs imposed by Donald Trump’s administration in retaliation on behalf of the airline industry (for Pete’s sake!). These tariffs are to the tune of 25%, added to the value of French, German and Spanish wines at 14.1% alcohol or below. Champagne is exempt - god knows why! One could argue that thanks to global warming there’s barely an investible wine made under that alcohol level these days but news like this tends to affect the market as a whole; people will not seek to differentiate one wine from another.

| Current Value | MTD | YTD | 1 Year | 5 Year | 10 Year |

| WO 150 Index | 321.96 | 0.02% | 3.46% | 3.67% | 67.21% | 101.28% |

| WO Champagne 60 Index | 489.4 | 0.07% | 4.60% | 6.22% | 70.83% | 170.94% |

| WO Burgundy 80 Index | 748.85 | 0.20% | 6.73% | 9.37% | 152.68% | 254.40% |

| WO First Growth 75 Index | 283.32 | 0.02% | 0.41% | 0.80% | 54.59% | 76.29% |

| WO Bordeaux 750 Index | 374.87 | 0.10% | 10.68% | 12.29% | 74.33% | 123.98% |

| WO California 85 index | 703.15 | -0.55% | 3.39% | 6.44% | 108.22% | 326.72% |

London based merchants have had little reason to be properly confident in the last few months and these latest two factors are enough to have toppled the balance. The same applies to private clients, be they drinkers or investors, but all players need the feel-good factor to make the wine market tick up. That is simply not around - UK consumer confidence is at its lowest point for six years, according to a recent YouGov poll. So, with the core of the market, in the form of London based merchants, cowering under their desks, the good folk of Hong Kong donning tear gas masks and fighting in the streets and with Uncle Sam’s citizens being asked for a further 25% in tax, there aren’t any hot spots of demand right now. These are all conditions that can, and will, change but for now it is tin hat time.

I have been arguing for a while that recent vintage (anything since 2005), highly expensive (albeit highly rated) wines from Bordeaux are still in huge supply. No one is drinking them as they are either far too young or just too expensive, fit only for the ‘money no object brigade’. Also, with the glut of ‘investment companies’ that existed during the glory days of the Bordeaux market, there are warehouses stuffed full of overpriced claret all over the land. Even the good guys of the wine investment world largely focus on very highly rated claret from good years, quite often without stopping to consider the price.

2009 and 10 First Growths have been my biggest sell recommendations so far this year, but I have expanded those thoughts and now, I would suggest that Bordeaux First Growths and equivalents since and including 2000 are a SELL; also, a lot of next tier down, Montrose and Pontet Canet ‘09 and ’10 for example, notwithstanding their incredible ratings. I would keep anything from 1990 and beyond due to rarity and would sit on the fence for anything in between, although I am sure that prices there will ease a little too.

I do not think the rest of the wine market will suffer to the same extent as Bordeaux, mainly because it’s not nearly so tradeable and doesn’t suffer from the over supply problem; Bordeaux is unique in this and with another great vintage around the corner (early reports suggest 2019 is going to be very good, but isn’t it always thus!) there’s another wall of stock on its way, probably much of it at the wrong price again.

Don’t get me wrong, I love Bordeaux and am very happy to accumulate and drink older vintages. For investing, I just prefer other regions right now, particularly Piedmont, Tuscany and vintage Champagne. Even in these tough trading conditions it’s actually quite difficult accumulating really good stocks of Piedmont at decent prices at the moment.

Below is a quick comparison between some great vintages of Mouton Rothschild versus Bartolo Mascarello, one of the best Barolo producers. Mascarello is not the household name that Mouton is but it is the qualitative equivalent, is produced in tiny quantities (easily less than a tenth of Mouton) and is held almost entirely by the cognoscenti who are likely to drink it themselves. Mouton, on the other hand, can be found in cellars from the cognoscenti to the cretini! The message is clear, and the relative bet to my mind is absolutely nailed on (as they say on the racetrack).

Even taking into account trading spreads and expenses I would happily recommend selling Bordeaux blue chips and reinvesting in other areas. The difference between the per bottle prices of equivalents elsewhere suggest there’s plenty of upside in the trade.

Miles Davis 7th November 2019