by Wine Owners

Posted on 2015-02-16

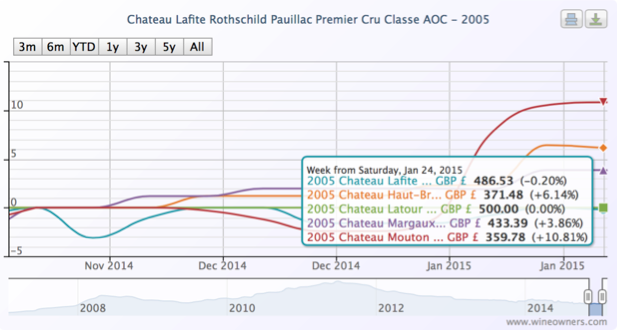

The turning point for fine Bordeaux was August of last year. By early October it was unclear whether the tick-up was yet another of those blips we’d seen several of during the previous 24 months.

Today it is clearer: the trend is up, most wines are well off their lows, and the Bordeaux Index overall is 2.17% up on 6 months ago.

The exception is the Libournais index covering Pomerol and St Emilion, which has slipped 0.48%, a reversing the gains of 1.24% between early October and the end of November last year.

The Medoc Classed Growths are collectively up 2.77% form their August 9th 2014 lows.

Whereas the First Growths only managed 1.51% during the same period. Not entirely surprising since top vintages are still highly priced, they have had further to fall, making it hard to call bottom, and started picking up momentum in January 2015. What is clearer is that wines such as Haut Brion 2008 appear to be interesting propositions.

Elsewhere the Blue Chip Burgundy Index continues to power ahead, though within that there are notable, and expensive, fallers (last 12 months):

| Domaine de la Romanee-Conti Le Montrachet Grand Cru AOC |

2010 |

-7.16 |

| Domaine Ponsot Charmes Chambertin Cuvee des Merles Grand Cru AOP |

2010 |

-7.69 |

| Domaine Armand Rousseau Mazis-Chambertin Grand Cru AOC |

2010 |

-7.89 |

| Domaine Jean Grivot Richebourg Grand Cru AOC |

2007 |

-9.43 |

| Domaine de la Romanee-Conti Romanee Saint Vivant Grand Cru AOC |

2010 |

-10.71 |

| Domaine Jean Grivot Echezeaux Grand Cru AOC |

2002 |

-11.2 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2006 |

-13.15 |

| Sylvain Cathiard Vosne Romanee En Orveaux Premier Cru AOC |

2010 |

-13.69 |

| Domaine Comte Georges de Vogue Chambolle Musigny Les Amoureuses Premier Cru AOC |

2002 |

-13.7 |

| Domaine de la Romanee-Conti La Tache Monopole Grand Cru AOC |

2010 |

-15.38 |

| Domaine Armand Rousseau Clos de la Roche Grand Cru AOC |

2010 |

-16.08 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2005 |

-16.18 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2006 |

-16.35 |

| Domaine Leflaive Chevalier-Montrachet Grand Cru AOC |

2005 |

-16.67 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2008 |

-20 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2006 |

-20.16 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2005 |

-21.94 |

Northern Italy is up 1.42%, with Giacomo Conterno one again heading the leaderboard

Champagne has defied our predictions in gaining a whopping 7.42% over the last 6 months, the top risers comprising exclusively older vintages in the range 1996-2002. This makes a lot of sense. Millions of bottles of top cuvees such as Dom Perignon (up to 8M bottles per annum) means that values kick up only when supply and demand becomes more balanced.

We also thought Californian wines would moderate their growth this year. Comparative to Bordeaux prices, they seem expensive. Since January they have indeed dipped -0.65%, off the back of six month growth of 6.65% up until that point. It’s too early to say whether they are simply pausing for breath, or have reached a natural plateau. The trend line favours the first scenario.

by Wine Owners

Posted on 2015-02-13

It was February 2007, and Denis was particularly excited. He’d just had a call from the American Ambassador in Paris, who was driving down to Gevrey Chambertin to taste his exceptional 2005s. If ever there was a defining moment in his gradual, understated rise to superstardom could this have been it?

Whilst every wine that Denis makes is exceptional in its classification, it is his Charmes that encapsulates the magic of his low-intervention winemaking from extremely old vines. To our taste, it is the finest of all Charmes Chambertins.

With top vintages, such as 2005 in £4,000-5,000 territory (if you can find any), 2007 looks remarkably good value at £1,575.

2007 is an earlier drinking vintage – but with a velvety density that delivers a sensation of lusciousness over the underlying soft tannins. Think of 2000 but with greater density and finesse. The fruit is still primary and will take a year or so yet for the secondary elements to show and express themselves. It should be at its peak around 2016-2020.

His wines are at complete ease in their metaphorical skins. Perfectly weighted, allied to a fine intensity and directness. There are no disappointing vintages here, just wines to drink a little earlier than others.

In a recent comparative tasting of 1999 and 2001 vintages alongside Armand Rousseau’s Charmes, Denis’s simply blew them away. 2002 Charmes also showed its class more recently in the same company as grand crus of the same vintage from Roumier, Rousseau and Ponsot.

Last year, a few of us attended a Charmes dinner, attended and written up by arguably the finest burgundy critic of his generation, Neal Martin, in The Hedonist’s Gazette.

Here are his summary scores:

by Wine Owners

Posted on 2015-02-13

The Traackr social media influence platform that we used for creating the wine writers and bloggers index elicited a fantastic range of comments, appropriately via social media on Twitter and Facebook.

Measuring writers personally based on their social media engagement across all platforms through which they engage their audience is a fresh way of looking at the world, which is precisely what makes it interesting.

So let’s dig a little deeper into how writer-centric, social media online measurement actually works:

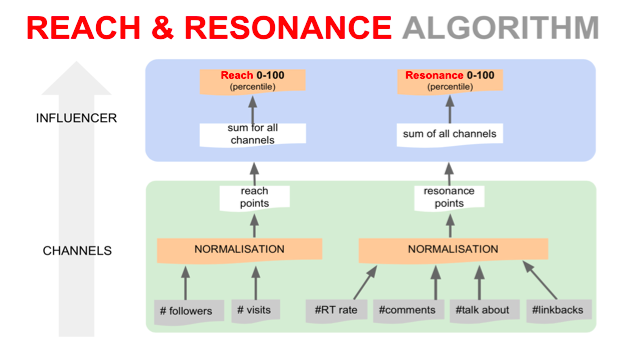

As previously explained, Traackr’s algorithm is based on 3 parameters: Relevance, Reach and Resonance.

In the case of the wine writer and bloggers index, Relevance – the measure of expertise within the subject –scored highly across the board, as one might expect and the keywords used to determine this were necessarily quite broad.

The distribution of scores that reflect relevance were in fact tighter than Reach or Resonance, so this proved rather less of a discriminating factor than it otherwise might have done.

Subscription sites that put most content behind a firewall can’t be measured of course, since web crawlers and searchers cannot access them, so some of the most influential wine writers in the world end up with low overall scores.

Although their Twitter and social media accounts may well score well, blog posts and articles posted across online properties (which can be measured as long as sufficient article or blog text copy is available via RSS feeds) are heavily weighted by Traackr, so these influencers don’t show up as being key influencers through social media as they don't disseminate their content through it.

They may have significant influence over wine trade and consumer buying decisions, and consequently wine prices and the market, due to their experienced palates and authoritative wine evaluation and writing skills, but this is not what’s being measured when ranking by social media influence.

Reach measures the size of audience, based on numbers of followers and visits across all reach points. This measure focuses on the writer as an individual, and their free-to-air content whichever online properties they write for (as long as they can be personally identified).

That brings us to Resonance. This describes how much endorsement and engagement is being generated by a piece of content; every comment against blog entries or articles that are accessible free-to-air and available via RSS feeds, every talk about, tweet and retweet.

Those wine writers who outperformed their peers in the resulting list engaged powerfully with their audience, generated disproportionately high numbers of comments and talk abouts, along with tweets and retweets.

There’s something special to a consumer about having a dialogue with people who are expert in their subject area, or otherwise connecting with them online, and it’s to be celebrated. Of course it’s a different measure of influence when compared to the dissemination of paid for, advisory content through traditional media (whether online or not). Today, however, we proudly recognise the wine writing stars of social media and the social web across its many forms and the significant contribution they make, passing on their knowledge, guidance and passion to the many millions of people interested in wine.

by Wine Owners

Posted on 2015-02-10

It’s become apparent over the last few weeks and months that consumers who’ve already been taken advantage of by companies like European Fine Wines (EFW) are being targeted yet again with advance fee frauds and ‘White Knight’ scams.

What’s more, the cold-callers approaching those people who had previously bought from EFW seem to know an awful lot about their prior purchases. We can only presume that the EFW customer base was filched and passed around the London and Bromley wine underworld?

One of our members was approached recently by Rothstein Capital & Partners, who purported to be working in partnership with the receivers of EFW to assist former clients in recovering losses.

On that basis they offered to find buyers for her stock. The prices quoted were well ahead of market levels, for example £14k for her case of 2003 Latour (actual market price £6,500).

They then advised that the case of Latour 2003 she had received in 2013 had been misallocated, and that 'her' case was still held at the Chateau. She was told that she could not sell the case of Latour in her possession, as it did not bear her ‘log number’. She was told that her case needed to be exchanged for the correct case before they could proceed to sell it, and offered to arrange shipping of the 'correct' case from Bordeaux, provided she cover the insurance costs associated with shipping, which would cost £1,000 up front.

As reported in Jim Budd’s excellent resource on wine fraud, Investdrinks Blog, The liquidator, Nedim Ailyan of Abbott Fielding Limited, was understandably scathing of this advance fee fraud and according to Jim Budd of Investdrinks has reported Rothstein Capital to the police.

This isn't an isolated instance reported to us: another member was approached with a similar proposal, requesting that she pay for shipping fees plus a commission fee of £1,500 to get her wine to Hong Kong where it would sell at a premium.

EFW ex-customers are not alone in being targeted.

An elderly gentleman who had bought from Bordeaux Fine Wines previously, was contacted before Christmas with an offer to place wines for sale at auction in Hong Kong, again on the proviso that he pay £2,000 for shipping (and insurance). He was informed by the cold-caller – going by the name of Jay Kingsley - that his case of Montrose 2009 for which he’d paid £3K (at a time when it was worth no more than £1,500) would fetch £7,000 in Hong Kong due to heightened demand ahead of the Chinese New Year.

If you’ve bought from EFW or other cold callers from so-called wine investment companies, watch out for these scams, demand to know how the cold-caller got your information, and do not be taken in. Collect as much information as you can about the caller and their contact details, and report them to Jim Budd. Check the value of your wines on the Wine Owners website, and do let us know.

The bottom line is: if it sounds too good to be true, it will almost certainly be a scam.

by Wine Owners

Posted on 2015-02-09

The morning after the night before, following a DRC dinner led by Aubert de Villaine in the wonderful setting of the Cutty Sark in Greenwich. The two stars of the evening had been a mind-blowing Batard-Montrachet 2000 that kept expanding with time in the glass, and La Tache 1991.

The 2012s presented a contrast to the more delicate, ethereal 2011s. These were firmer wines with iron-infused finishes. Darker-veined, rooted in a firm mineral character in contrast to 2011's brighter, airienne nature.

The Echezeaux was a great deal more open than the Grands Echezeaux, with less grip but enticing acidity. A dark streak of fruit, developing freshness and lift, carried forward. Lovely progression and really salivant.

Grands Echezeaux showed a darker character and a creamy trim. Firm and savoury, a licorice mid-palate, grainy and grippy with a similarly firm, iron finish.

Whereas RSV 2011 seemed more complex and coiled than Richebourg of the same vintage, in 2012 the reverse seemed true:

Richebourg exhibited a heady nose, deep and figgy, with great intensity on the palate. A big core of fruit and a firm, closed, iron finish.

RSV's nose was rather far less visceral, but sweet as fruit-gums, direct and joyful. On the palate the wine was more elemental with a sense of breadth, and a tongue-numbing licorice intensity ahead of a firm finish.

La Tache was a corresponding step up from the Richebourg. A perfumed nose set it apart from the preceding wines, at once ethereal and creamy. Very powerful entry, great intensity, a touch of iodine and iron framing a firm finish.

Romanée-Conti was equally perfumed but more focused. A palate of enormous, uncontainable volume. Such depth, whilst citrus notes and a lifted finish provided the perfect counterweight to a profound wine.

by Wine Owners

Posted on 2015-02-06

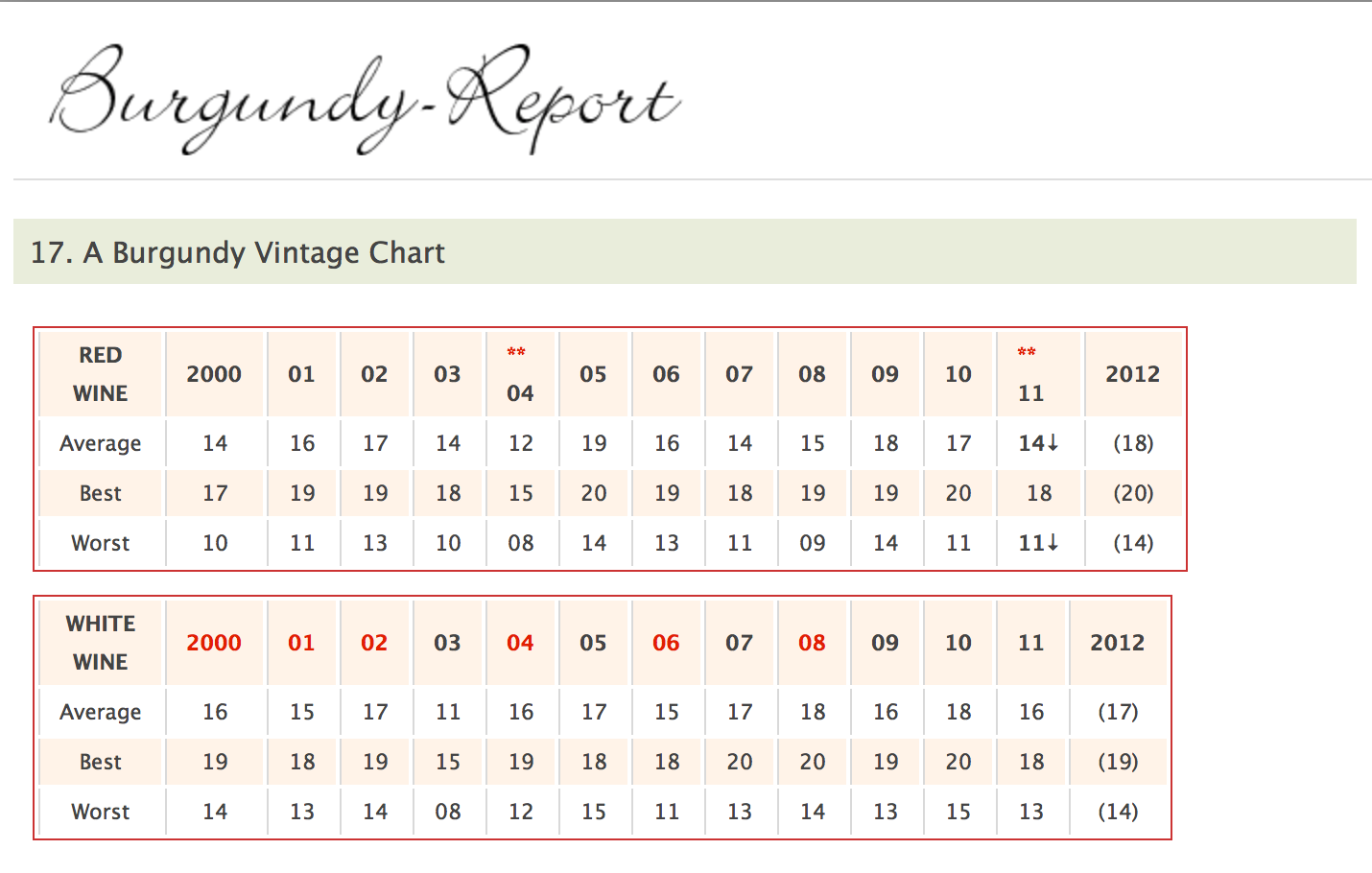

Hats off to Bill Nanson for creating an all-encapsulating system for showing the quality of a vintage with an emphasis on its range and its highs and lows.

This pure genius and is a great model for other regions where fragmentation and micro-climate variability exerts a key influence.