by Wine Owners

Posted on 2020-12-04

Wine Owners is the market-leading collection management platform that provides instant valuations and connects you with a peer to peer trading exchange.

Today, we're very pleased to announce that our collection management platform just got even better - and now includes a fabulous new home cellar management capability.

Imagine knowing exactly where each bottle is stored down to a hole in a rack, and being able to effortlessly move cases from a stack in the corner into bins or racks. Home cellars constantly change and this new release helps make organising them a joy.

Easily catalogue and organise wines at home.

Create new racks, bins and mixed cases

Move or add wines easily to your home cellar.

Save time by copying wines.

And create and update cellar references.

All this while getting the same high quality pricing data from our referential database.

If you want to start managing your home cellar, sign in to your account or create an account if you're not yet a member of Wine Owners.

by Wine Owners

Posted on 2019-03-21

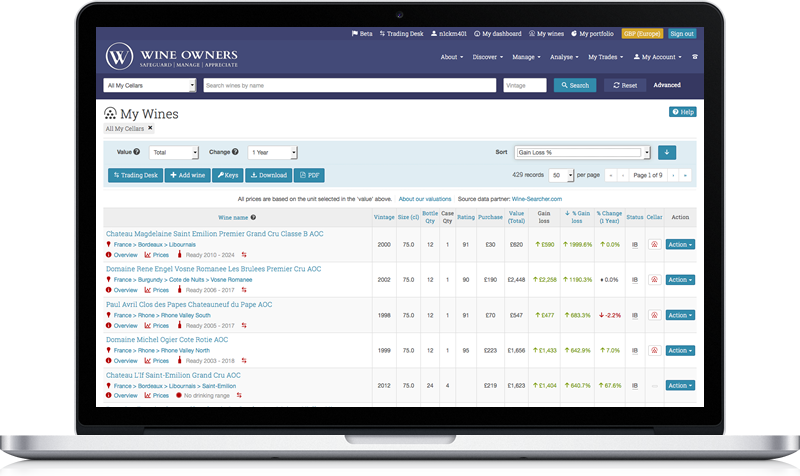

The Wine Owners platform is rich in data and content.

Pricing

Our proprietary algorithms process millions of rows of incoming pricing data to calculate a Market Level - the price at which a wine is likely to find a ready buyer - based on market supply and spread models. The more liquid the wine the more accurate the price will be. Small production wines from older vintages can be virtually impossible to value and although we try our utmost to find a reference point, sometimes it just isn’t possible. This is hardly a new phenomenon for the wine market.

Scores

The Wine Owners average score is the Mean of all scores analysed for a wine that are published by wine writers and critics. For details of the main wine writers' scores that feed into the Wine Owners average mean score, please see the page on wine critics.

The WO average comes in on the conservative side (think Burghound not Parker), so anything above a 95 is a brilliant score.

Research and analysis

If you subscribe to the Collector package (for privates) or the Professional package (for trade) it is possible to research present and historic pricing, produce charts and carry out your own relative value analysis. You will be able to build your own vertical and horizontal analysis using Market Price versus Score and Relative Value Score and/or compare different wines from different vintages on the same chart, some examples here:

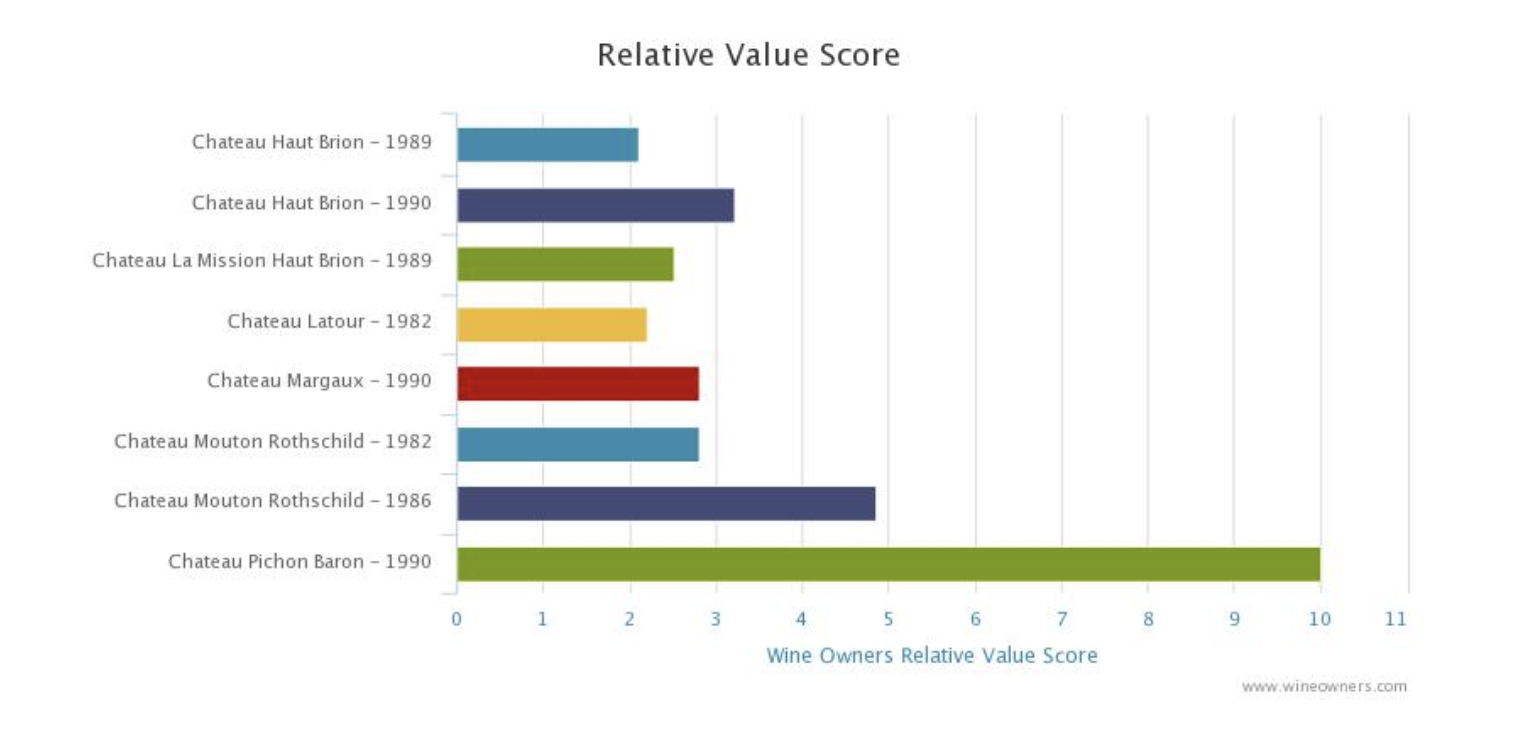

The above chart is self-explanatory, the below less so. The Relative Value Score equation is this:

(WO score - 79) * (WO score - 79) * 10 / price

By using this tool, you soon become used to identifying ‘cheap’ opportunities. Any First Growth that registers a double digit score looks good (but will always need further scrutinization), a highly rated super second from a good vintage scoring 20 looks interesting.

Graphs

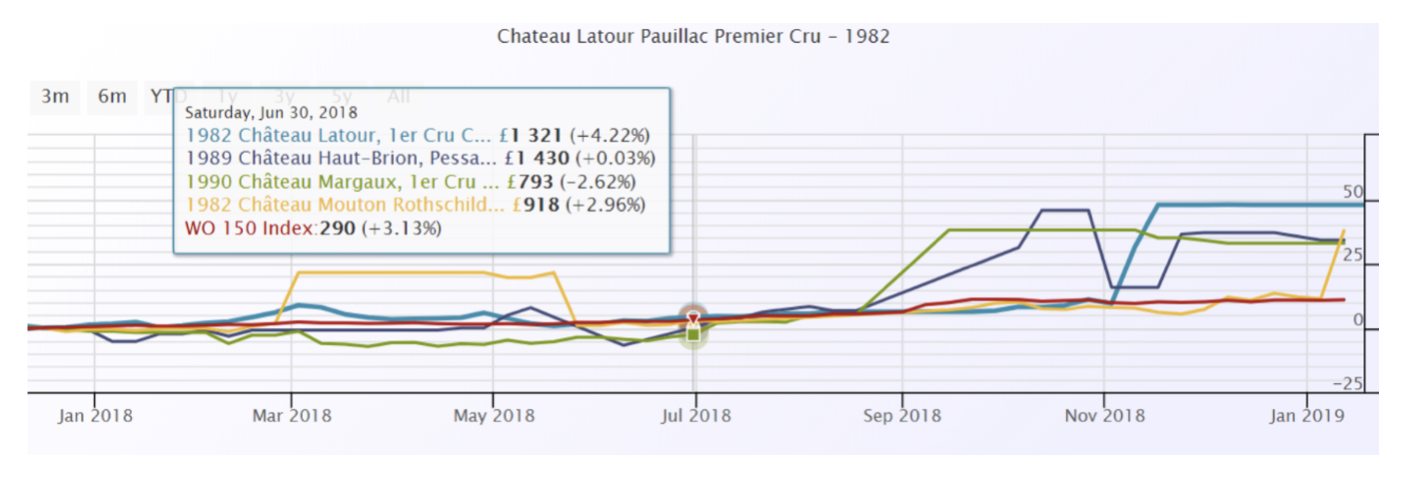

Generate your own fully customised graphs. Compare wine against wine(s), against wine indices and financial indices too!

by Wine Owners

Posted on 2018-03-01

Next Wednesday the annual Knight Frank Wealth Report 2018 will be published. As always, the report's primary focus will be on prime real estate, wealth, investments and luxury lifestyle. The latter pair are of particular interest to Wine Owners users, and the team here at HQ.

We have specific interest in the report's wine investment section, of course. This section rests strongly on data from the Knight Frank Fine Wine Investment Index (KFFWII), a custom-built index created by Wine Owners for Knight Frank in 2015. This index of 200 investment-grade wines has provided Knight Frank with detailed market data for the past three Wealth Reports. Last year, the index really came into its own; the Wealth Report 2017 showed wine clearly out-performing all other passion assets.

Of course, we at Wine Owners HQ have a pretty fair idea of what the upcoming 2018 Wealth Report will say about the wine investment market performance. But if anything, that knowledge piques our interest even further. We are very much looking forward to seeing the report live next Wednesday.

The report can be acquired here, and we will report back here in a couple of weeks' time with the key messages, and an update on the KFFWII.

by Wine Owners

Posted on 2017-11-24

The Don, St Swithins Lane, London, a converted wine warehouse, was the venue for one of Wine Owners tasting evenings offered to its members – Trial and Terroir Dinner based upon the 2011 Bordeaux vintage. The evening was conducted in one of the Don’s private rooms with an earthy dinner by head chef Frederick Forster.

Lionel Dougnac, buying director for De Luze & Fils, one of Bordeaux’s most influential negotiants, helped us navigate the properties surrounding the waters of the Gironde estuary. Lionel has been in the Bordeaux trade for over 20 years, specialising in buying classified growths. He has also worked for the top barrel-maker in France. Oaking became an interesting discussion point half way through the evening.

The focus for the evening was to explore the concept of terroir through the different wines presented during the evening from the 2011 vintage in Bordeaux. A vintage which left many enthusiasts wondering if the so-called ‘harlequin’ year could justify its high prices at primeur. Not surprisingly, there was immediately an exchange over what terroir might mean and during the evening there was plenty of opportunity to plumb the depths of this compelling subject. Lionel was quick to point out that, in his view, terroir was not just about the weather and soils but also included other factors, and even the ambitions of the domain owner.

2011: for those that might have forgotten, it was an unusual year by any standard. The year started with a massive water deficiency in First floors, and an unusually warm and protracted Spring. This meant that the vines were well in advance over the average year. Average temperatures during this period were close to if not in excess of any records previously recorded. It culminated in two extremely hot days in June where the temperature exceed 40°C. Some exposed bunches of grapes, especially on gravel soils, were scorched and losses were considerable, as much as 20% of the crop in some instances. If vignerons were concerned that any continuation of the drought would decimate whatever crop remained they needn’t have worried as damp, cool weather set in for much of July, followed by a very hot August. The heat precipitated some substantial downbursts and overall precipitation was above average for the period. An Indian summer followed which provided optimum conditions for the harvest in September. A series of circumstances which profited the white wines of the region but the red wines were heterogeneous.

L’Evangile vs Vieux Château Certan: the expression of the two first wines on offer provided an interesting contrast. The owners at VCC, the Thienpont family since 1924, have always worn their heart on their sleeve combined with an increasingly obsessive focus on managing First floor at a micro level of geography – and an ambition to let the terroir speak for itself using minimum intervention in the wine making. L’Evangile, now wholly owned by Domaines Barons de Rothschild since 1999 (they had earlier acquired a majority a shareholding) is a neighbour from ‘Haut-Pomerol’ with an ambition to become one of the top Pomerol estates. The latter’s substantially higher Merlot in the blend offered a very round and pleasing profile – a whopping 94%, leaving little room for their Cabernet Franc. It was very elegant and restrained which contrasted with the beautifully defined structure of VCC. There were pleasing elements in both wines. Interestingly, guests were not to be tempted by the more voluptuous offer and unanimously preferred the ‘aesthetic values’ expressed in Vieux Château Certan 2011.

In Pessac, the contrast was even more stark. Haut-Bailly, as always, attractive and feminine, seduced much of the company with its approachable elegance based on a more merlotised style than usual - a statistical recognition, if nothing else, that its Cabernet Sauvignon suffered that year. The Cabernet Franc, already on the way out at the domain, hardly got more than a top-up role. Haut-Bailly have always acknowledged that their terroir has issues under dry conditions such as those experienced in 2011. La Mission Haut-Brion was altogether more muscular and intense. It possessed a complex tension which will be years in its evolution. Lionel had obviously selected the wines he felt would give us more to ponder. We digressed into a conversation about how artists’ materials are perhaps the elements of physical terroir; that artistic genius is the inspiration, imagination and ambition of an estate’s terroir interpreted by the owner. Whatever the canvas that year, Wine Owners terroirists’ marginally preferred the more ‘traditional’ yet polished properties expressed in the intense muscularity of La Mission Haut-Brion 2011.

The grand estates of Pauillac were represented by Pontet-Canet and Château Pichon-Longueville Baron. This gave us an opportunity to discuss the influence of biodynamic viticulture in the region and its impact on the wines of Pontet-Canet. Clearly something had separated the processes of these two estates which are largely comparable in terms of size and varieties. When it came down to it, Pichon Baron managed 82% Cabernet Sauvignon in their blend, whilst Pontet-Canet a mere 60%. Yields were disparate too – 39% in the case of Pichon Baron whilst at Pontet-Canet it was 32%. It’s worth just quoting from the specification sheet of Pichon-Baron 2011 to understand properly the enormous lengths châteaux had to go to preserve the quality in the bottle:

“Bespoke grape picking: the grapes were picked and brought in the vat-house plot by plot, in order of maturity, with particular attention to selection on the plots. Sorting in the vat-house was highly meticulous [their bold] keeping only the very best grapes. The grapes were sorted twice, both before and after de-stemming. Once de-stemmed, the selection of the grapes was fine tuned on two sorting lines, one manual and one using optic systems.”

This extensive and costly work appears to have been justified as the assembled company substantially preferred this wine. Perhaps the more laissez-faire practices of biodynamics don’t favour complicated years albeit it may be a more ‘authentic’ product.

Our final flight of the evening ended with a cheese plate and perhaps two of the most interesting wines of the evening – Chateaux Montrose and Calon-Ségur. Both estates in their own ways have seen major upheavals over the last 5-10 years. One could even be forgiven for thinking that terroir might the servant of the ambition of the two new owners. Certainly, the Bouygues have invested colossal sums in an estate which they were always destined to own. The recent vintages have all demonstrated that their terroir has justified the trust of its billionaire owners producing wonderful wines in supposedly less good vintages. 2011 was no exception. Montrose’s enhanced ‘environmental responsibility’ which the Bouygues have brought to the estate extends the work of one of its founders, Mathieu Dollfus, who established a programme of social care for his workers building them free housing in the ‘Montrose village’, included them in profit sharing and even offered free health care – making ‘unique contributions to the community’ of Saint-Estèphe. The windmill which stands on the property is a ‘symbol’ of his tenure and his fight against phylloxera – the windmill drew up water which flooded First floors – a practice which had some success in reducing the disease at the time. At Calon-Ségur, despite the death of its owner at harvest time, pulled off a stunning wine - contradicting received wisdom about yields (the estate had one of the largest yields of all the wines tasted) and demonstrated that even in turbulent times estates can pull something out of a hat. Triumph in adversity is part of the story of Bordeaux. Opinion was equally divided on their relative merits.

Lionel’s deft commentary on the wines permitted discussions on all other matters of interest to the guests. This wasn’t just a working evening – although there was much to delve into.

The evening conversation turned to a brief but informative discussion about the commercial prospects of ‘La Place’, advantages or otherwise of buying en primeur and discussions on some practices of specific châteaux to release wines as ‘library’ wines after primeur campaigns - subjects which Lionel was uniquely qualified to explain.

For those still with the will to carry on tasting there was ample opportunity with additional samples as backup. Overall, the unscientific assessment was that there were 3 stand-out wines – La Mission Haut-Brion 2011, Montrose 2011 and Vieux Château Certan 2011.

Broader definitions of terroir escape the confines of the tightly worded official description. The Australian economist David Throsby outlined the concept of a ‘cultural good’ (in his seminal book Economics and Culture, 2001) which might fit better to the breadth of considerations Lionel managed to convey during the evening. Throsby’s thesis is that a person’s preference for something would be based upon the characteristics of the good which contribute to its cultural value. Some of these are highlighted above in quotes but, in summary, they include aesthetic properties eg elegance and balance; spiritual value – emotional and inspirational attachment; environmental which includes PDO (L’Appellation d’origine protégée) and environmental responsibility; historical – evolution and tradition; symbolic, such as the name of ‘Bordeaux’ itself and what it inspires and among others one might conjure; and authenticity which is embodied in the unique character of a wine drawn from the local area where it is produced.

The WineOwners Trial and Terroir Dinner managed to elucidate these concepts and more.

by Wine Owners

Posted on 2017-10-26

What a treat to welcome Matthieu Bordes to a Lagrange dinner in London, with a full house of Wine Owners’ enthusiasts around the table.

Matthieu was subsequently described by one member in attendance as ‘informative, congenial and charming’. His passion for Lagrange shone through. Matthieu is both boss (Directeur Générale) and the wine maker since 2013, the year that extensive modernisations were also made to their wine-making facilities.

Chateau Lagrange is an unmorcelated parcel to the west of the commune of St Julien, classified as a 3rd Growth in 1855. Owned by Japanese beverage giant Suntory, it’s very much run with a free hand by the local management team.

Arums de Lagrange 2016

The tasting kicked off with the estate’s white wine, Les Arums de Lagrange 2016, comprising sauvignon blanc, semillon and a dollop of muscadelle. Arum is a form of hardy lily, and the name is aptly chosen. Les Arums is delightful with a delicate nose and very attractive purity. There’s no trace no heaviness, nor any overt cépage character, due to the gentle handling of the fruit and a balance between barrel fermentation and a period of élevage in steel. It’s drinking beautifully already: there’s clarity to the fruit underpinned by appealing freshness. No need for a Coravin with this one; it’s too tempting to drink the whole bottle!

Chateau Lagrange 2015

A fitting guard of honour for the 2016 vintage that followed. There’s a benchmark cedar nose, with warm and inviting fruit. The initial impression on the nose is of a lush wine, yet the attack is firm, and the fruit is beautifully pure – crystalline. There’s impressive intensity, but at present without the sense of coiled energy of the greatest vintages. Nevertheless this will drink well moderately young, with its warm and inviting nature unlikely to turn taciturn. Very impressive given it had only recently been bottled, a time when wines can pass through an unsociable teenage phase. We wouldn’t be surprised if this gained much more length with time.

Chateau Lagrange 2016

Unsurprisingly with a barrel sample, the nose is on the 2016 is un-evolved, with primary, juicy fruit to the fore. The initial impression at first sip is that the wine is elegant and of medium weight, with a mild savoury streak adding interest. This is an insinuating wine though, whose accomplishments and embellishments become apparent progressively with time in the glass. The tannins are so ripe and silky that their velvety texture cloaks a very considerable underlying structure to the fruit. IPT levels were rather high within the best sectors in 2016, essentially a measure of tannin and colorant from skins, pips and vegetal matter. That substance is very much in evidence chez Lagrange, with a delightful balance that suggests great class. Magnificent.

Chateau Lagrange 2005

We’ve always been fans of those 2005s where the wine making wasn’t unduly extracted, and this Lagrange ticks that box. There’s a dusting of white pepper on the nose, with a blast of kirsch and liquorice. The attack is sweetly fruited, with black ripe cherry dominating the mid palate, and a liqueur-like texture. The finish is heady and visceral. A soulful wine, and very well balanced too. Destined to drink sooner than some other 2005s but with the wherewithal to sustain a long drinking window.

Chateau Lagrange 2009

The nose is extremely fruity yet somehow delivers an impression of being very well integrated. There is enormous intensity to the 2009, with cloves, liquorice, chocolate and blackcurrants, wrapped up in a beautiful texture. The ripeness of the tannins is defining, providing a structure and focus to a bold wine. 27% Merlot, 63% Cabernet Sauvignon. This will need a number of years to properly resolve, by which time the evidently exotic bouquet and textured palate should ensure it develops into a wine reminiscent of 1982 St Juliens.

Chateau Lagrange 1996

Shifting away from young wines with a long life ahead, the 1996 surprised with its maturity. The nose is gamey, with leather notes, and savoury aromatics of smoked meat and sweet wood scents. On the palate there’s a satisfying depth to the wine, in common with other successful 1996s, yet with less noticeable acidity at this stage of evolution than many other top crus classés. Cloves, liquorice and blond tobacco dominate the mid palate before an attractive finish. The freshness of the vintage is seamlessly resolved into the whole. There’s a significant 7% of Petit Verdot in the blend that salt and peppers the 57% Cabernet Sauvignon and 27% Merlot. This is a success offering good value drinking now. If you haven’t already decided on the wine to serve with the Turkey, duck or goose this Christmas, look no further.

by Wine Owners

Posted on 2016-10-17

Guests gathered for a rather special evening of rare, older Rioja vintages at the Portland restaurant, a one-star Michelin restaurant serving food in an informal style of family-service.

The plates were delicious, and although a couple of the starters - buttermilk and smoked cod’s roe - worried the table in light of the venerable bottles, there was no arguing with the deliciousness of every plate served. The main course of beef was simply outstanding, served with melt-in-the-mouth heritage carrots and brown buttered cauliflower.

The wines were opened 90 minutes in advance, and with so many crumbling corks, insecurity got the better of us and we held off decanting until the last minute in most cases.

Starter course 1

Ygay Etiqueta Blanca 1970

2 bottles were served, one of which opened with a musty nose, the other was much more energetic with purer character.

It’s always worth leaving old bones some time in the glass to recover from the shock of opening, and sure enough, the musty character blew off, but without the zest and purity of the second bottle.

Marques de Murrieta Castillo Ygay Rioja Gran Reserva Especial 1970

By comparison the Castillo Ygay, bottled we think in the late 1990s or 2000s, and with a fresh cork to prove it, seemed rather clunky and thick. It was as if the extended barrel ageing has rubbed out its finer lines, leaving it smudged.

There was no arguing with the richer fruit, but where was the definition or class?

Starter course 2

Berberana Rioja Gran Reserva 1950

From a private cellar in Richmond, this wine was served from a decanter, having been filtered through muslin to strain a few pieces of crumbly cork that the operator of the Westmark cork puller had failed to pull out cleanly.

Arguably the star of the show, this ethereal wine showed intensity allied to a sense of weightlessness. It improved in the decanter over 2 hours and wowed the entire table.

Rioja GR Honorable Gomez Cruzado 1964

Similarly to the Ygay Etiqueta Blanca, a dustiness blew off with time in the glass to reveal pear drops and an earthy, more savoury character.

Bodegas Bilbainas 1964

Fruity and balanced with an alluring freshness and utterly delicious. A surprise since no one had encountered the producer. One to seek out and is very good value.

Main course

Vina Real CVNE 1964

This was the other wine that vied for wine of the night along with the Berberana.

Energetic, deep and pure. Burgundian texture with a brilliant complexity of fruit that carried though into a long and deeply satisfying finish.

CVNE Imperial Gran Reserva 1964

An absolute dog of a bottle, sadly. Devil’s juice.

Rioja Alta 904 Reserva 1964

A comparatively rich fruit profile on this wine compared to the other wines of the flight, but perhaps somewhat lacking in definition if we were to be critical. This less developed – perhaps worth revisiting in the future?

Cheeseboard

Corral Reserva 1987

Perhaps a touch of rusticity here, but with plenty to like, with a pungent, rose petal quality to the nose.

Corral Reserva 1991

Richer and less evolved than the 1987, this made an interesting comparison. Tasted on its own this would no doubt have seemed excellent, but slightly overshadowed by the context here I fear.

Plus a mystery wine served blind – 1988 Valbuena 5

Elegant and pleasantly evolved with remarkable balance between richness of the Douro fruit and a dry, firm structure reminiscent of cool climate claret, even down to a persistent saline note on the palate lending freshness. Certainly supports the reputation of the producer.

What we learned

1. The dinner challenged the blanket reputation of 1964 as immortal - it isn’t. Delicious though several were, they are not destined to remain so.

2. A common understanding is that Gran Reserva is better than Reserva, that is better than Consecha. Price follows the length of description it seems. Based on this tasting, the length of time aged in wooden vats does not necessarily improve the quality of the wine. The Etiqueta Blanco vs Gran Reserva Especial, both 1970, certainly supports this thinking. Th Etiqueta Blanco was the finer wine, by far.

It doesn’t help that definitions seems to have changed over the years. Our 904 1964 was a Reserva, and possibly all the better for it, whilst other bottlings of the same year are described (in a Bid for Wine auction a year ago) as Gran Reserva. More recent vintages of 904 are described as Gran Reserva.

3. You don’t need to just follow the wines of the biggest Rioja operations, such as Rioja Alta, Marques de Murrieta and CVNE. The least well known producers on this showing delivered very good value for such old wines.

by Wine Owners

Posted on 2016-03-24

Sales of Bordeaux through the

exchange saw a significant increase on the preceding month, rising from a 75%

share of the market to 88%, the highest market share since the launch of the

exchange in 2013. Bids overall in Bordeaux have increased in value by 2

percentage points, perhaps reflecting a slight upturn in confidence in the

market.

The steep rise in Bordeaux’s market

share overshadows other regions, pushing Burgundy right back to 5%, though the

figure reflects less a decline for Burgundy than the strengthening of the

market in Bordeaux. Volume and value traded were in fact similar to the

preceding period. Rhone had a poor showing overall, dropping market share to

1.3%. Again, the figure is skewed by Bordeaux, but in any case volumes were

down, mitigated only by a flurry of interest in Henri Bonneau triggered by the

announcement of his death on Wednesday. The remainder of the market was shared

almost equally between Champagne and Italy, where trading in top level Barolo

oustripped Supertuscans two to one.

As usual, the First Growths accounted

for the lion’s share of the Bordeaux market, 72% of the value of Bordeaux

trades were made up of 1ers crus and their right bank equivalents. Several

large trades in Haut Brion saw that wine take 61% of the value of 1st

growth trades, though Mouton continued to hold its own at 11.7%, down by

percentage on the preceding period, but up in overall value and volume. Lafite

remained strong at 5.8%, with Latour and Margaux lagging behind. Petrus showed

strongly too, picking up a share of 11% among the 1st growths,

though the high value of these wines always has a tendency to distort market

share by value.

Access the Trading Desk to view recent trades, bids & offers.

by Wine Owners

Posted on 2016-02-15

As expected, Bordeaux continues to dominate trading on the exchange both by value and volume. Reported figures much the same as the previous quarter, with Bordeaux accounting for 75% of trades, and 75% of trading value. The latter is a 5% fall from the previous quarter, which reflects an increased number of trades overall, and in increase in bulk trades of slightly lower value wines in the runup to Chinese New Year.

Burgundy has increased market share on last quarter, now accounting for 15.75% of trade by value, and 11.55% by volume. Both figures are big steps up from the previous quarter, and serve to demonstrate that the marketplace is still small enough to be affected by parcels from individual collectors providing a sudden elevation in liquidity, especially outside Bordeaux.

The First Growths accounted for the largest shares of the market in terms of value trades, and within that number Mouton Rothschild had the best of it, with a 31.8% share of the First growth market by value. Lafite trailed slightly at 26.1%. Haut Brion showed higher than expected at 16.67% and Margaux held its ground at 11.9%.

The surprise in this quarter has been Latour, which has trailed at 7.14%. Hard to determine whether that’s just slightly lower availability of Latour in the market over that period, but either way it seems like the two Rothschild properties are on top at the moment.

The increased focus on Burgundy came at the expense of Italy, which seems to be slightly off the boil compared to the previous quarter’s promising outlook. In fact, Italy was clearly overtaken on volume by the Rhone, which ran at 5.89% of volume traded v Italy’s 1.54, although on value traded the figures are rather closer.

Access the Trading Desk to view recent trades, bids & offers.

by Wine Owners

Posted on 2015-10-29

Our goal? Simply to be the best platform in the world where wine lovers and collectors can do absolutely everything they want to do. We are the go-to address for your personal wine management. Whatever you need to help you do that we'll build!

New www.wineowners.com is a responsive website, which means it automatically adjusts according to the screen size and resolution of the device you are using.

More and more we use multiple devices that come in diverse shapes and sizes. The new Wine Owners mobile website allows you to access Wine Owners from almost any device, wherever you are. The screen including the menus adapt to the screen size you are using. On a smart phone for example, the top navigation looks like and behaves similarly to an App.

Also available on mobiles and tablets is Label recognition, allowing you to take a picture of label with your device's inbuilt camera, and choose whether to research, add or consume wine using this cutting edge method.

The advantages of a responsive website over a downloadable App are that you have access to all the functionality of the entire site without compromising any features or activities; there’s no need to download periodic updates, and your site preferences persist across any devices you may use to access our website.

There's a raft of new functions and improvements which we've included, answering many of your requests for more...

New functionality

As well as the new interface designed for mobile use, we have also added a number of new functions in this release:

Portfolio Management

Trading exchange

My Market Position panel, showing all your offers, bids, pending trades and order history with links to the detail lists

User experience

by Wine Owners

Posted on 2015-10-29

There was one thing we were really clear about when first launching Wine Owners. This was a platform created by and for wine lovers and collectors.

Fast forward 2 and a bit years, and there are an amazing 12,000 of you using the platform to access, organise, track and explore your wine collection in one way or another.

We've had such great feedback from so many of you who love what we've created, that we thought it would be great fun to throw the spotlight on you, and give you the stage for talking about the bit of your life to do with wine. Those of us who are into wine (some might say slightly obsessed by it) really enjoy reading other collector stories, so if you're happy to share, we'd love to hear from you.

Just contact me on nick.martin@wineowners.com with your thoughts and a photo!

To make it a bit more fun, we're offering each member whose story we publish a smart dinner in London, not to mention some brilliant wines from our private collections (which should keep all our lovely shareholders happy).

So what should you talk about? Anything you like really, but here are some pointers...

How did you get into wine in the first place?

What was the first ever wine you tasted that gave you goosebumps?

When did you start collecting?

What's your favourite region and style of wine?

Who's your favourite producer?

Best ever wine decision and worst ever wine decision?!

Most amazing wine and food combination?

The greatest bottle you've ever had and why you liked it so much?

Your favourite wine critic?

Your desert island wine.

Closing date for the invitation to share your wine life with us and be invited to a beautiful wine dinner is 31st November 2015.

Once again, contact us to say yes via email on nick.martin@wineowners.com or call us on + 44 (0)20 7278 4377.