by Wine Owners

Posted on 2015-03-05

You’ve got to laugh. A friend of mine contacted a company called Noble Rock, ostensibly on behalf of his father who had a fine wine collection. My friend’s name is Peter Bevan.

Having requested a valuation from Noble Rock, and offering to sell his wine through them, they called him back offering to sell carbon credits. As interesting a segue as I have ever come across...

Once the conversation was brought back to the question of his father’s wine, he was told that his wine collection had gone up in value substantially. This surprised Peter since he hasn’t yet provided details of the wines to them.

So how could they possibly know what his wines were worth? The Man from the Rock patiently explained to Peter that they knew because every time a wine was bought en primeur the details of the buyer and their wines were entered onto a Register – which they had looked up and that was why they knew about his wines!

Valuations that were subsequently discussed were sky-high, predicated on the well-practised advance fee fraud of paying a sum of money up-front to get the wine to Hong Kong, where it would be sold at auction at a massive premium to market. In this case the advance fee was justified on the basis of it being a VAT payment of 10%. Peter queried, if it was VAT, why it was only 10% of the value and not 20%; the answer being that only half of the VAT due was payable straight away. A novel concept that would interest HMRC I’m sure.

It was all so entertaining and extraordinary. But there is a serious side since people are being taken for a royal ride. Otherwise these people wouldn’t exist would they? The message is clear, do not take calls from people you don’t know selling by phone. And if anyone suggests there’s a way to sell wine at a market premium (check the market level price on www.wineowners.com), they are conning you. It simply doesn’t work that way.

Oh, and what happened to my friend Peter? Well, his name wasn’t really Peter; his real name is Mark. Mark Bevan, of Nexus Wine Collections. He runs one of the UK’s most successful specialist fine wine storage businesses, and had contacted Noble Rock because a number of his clients had been approached by phone spinning their yarns of criminal intent.

by Wine Owners

Posted on 2015-03-01

Today's excellent Matter of Taste event at the Saatchi gallery put on by the Robert Parker organisation highlighted to me that wines from so-called vintages overshadowed by great vintages may give far superior early to medium term pleasure than those more illustrious, fêted siblings.

Thinking back a year or so to previous tastings, Pontet Canet comes to mind. Take your pick from 2002, 2004 or 2006 for wines which today deliver great visceral pleasure (although the latter vintages are youthful) - whether you favour asian-spiced, sweetly grained and plump or delineated and pure fruit the choice (and preference) is yours. The dual powerhouses of 2009 and 2010 are incredibly dense wines, but today seem brutalistic and impregnable. Impressive as hell, they remain ébauches that Time, the master craftsman, is yet to shape.

A wonderful Masterclass led by Neal Martin and Alexandre Thienpont, winemaker and proprietor of Vieux Chateau Certan, further illustrated the point.

The surprise of the tasting was Vieux Chateau Certan 2006, which preceded the 2005.

A composed, peppery and dark-scented nose announced a medium weight, finely-woven, textured wine. Beautifully integrated, showing a firm core coated with a fine, sweet gloss, and a medium-long, insistent finish.

A delight to drink now, whilst giving the warmer, controlled, classically sauvage (iodine/ meaty) character of the 2005 another 5-10 years to achieve its unquestionable potential. In contrast the 2006 has an elegance and purity all of its own, and at a 20% discount to the 2005.

It's worth looking out for 'VCC' 2006 on the back of this showing. It's equally tempting to seek out more 2006s more generally, a vintage that had garnered some good reviews at first release, but which suffered in comparison to the more successful 2005 vintage across the Bordeaux region and due to release prices that were far too close to those of the previous year. Now almost a decade on, the fine, compelling character of the year is clear, and the pricing looks very fair.

Martin highlighted that Pomerol and St Emilion had enjoyed a particularly successful vintage in 2006. With that in mind, you may wish to check out the fine wine exchange for the following:

Lafleur Petrus

La Conseillante

Hosanna

Ausone

Marzelle

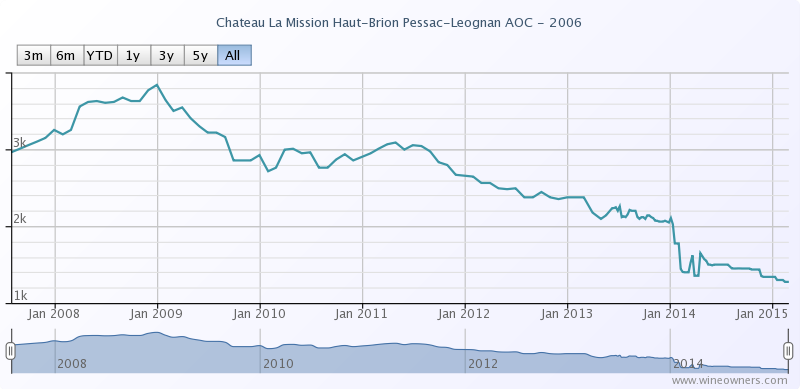

The wine of the 2006 vintage, Robert Parker and Jancis Robinson both proposed (in a rare show of unanimity), was Mission Haut Brion. Surely the price will never be as realistic as it is today, at around £1,250-1,350? (55%+ down from it's idiotic opening price that proved to be damaging to its secondary market performance). At least now this great wine is within reach of more wine lovers.

Mission Haut Brion

A somewhat under-the-radar La Mission, the 2006 was generally overlooked following the brilliance of the 2005. A young, dense purple-hued wine that is developing beautifully, it exhibits notes of Asian plum sauce, charcoal, barbecue smoke, roasted meats, graphite and background oak. Full-bodied with good acidity, moderate tannin and a vigorous, powerful youthfulness, the 2006 will age more quickly than the 2005, but it still requires another 5-8 years of cellaring. Anticipated Maturity: 2014-2035. (RP 2012)

Nick Martin

by Wine Owners

Posted on 2014-06-10

We launched the Exchange a year ago this month, and we thought it would be interesting to have a look back at the very first that went through the platform, and see how it has performed and traded over the last 12 months.

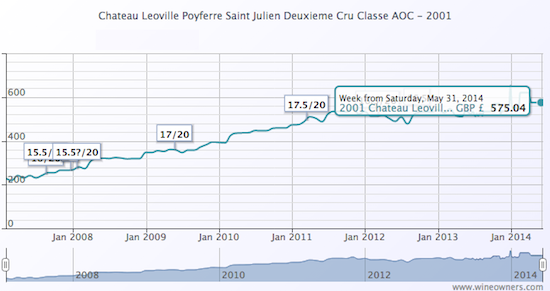

The first trade we put through was a case of 2001 Leoville Poyferre, which was picked up at £570 by a private buyer, from a private seller. The current market level is £575, which with Bordeaux’s relatively undramatic market performance this last year is perhaps unsurprising, though the most recent offers on the Exchange have been slightly north of that figure at £625.

No great fortunes were made on that first case over the last 12 months, then, but trading wine is at least as much about pleasure as profit, and the case was requested for home delivery…

by Wine Owners

Posted on 2014-05-09

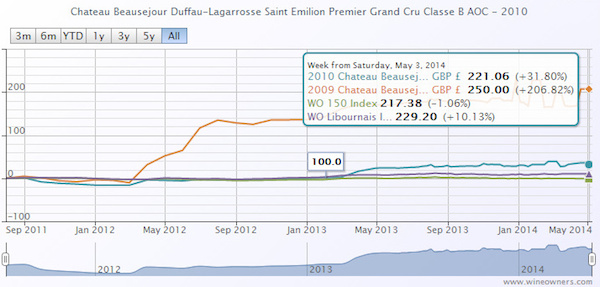

Beausejour Duffau is a great success story of recent years, especially if you are one of the buyers lucky enough to have secured an allocation of the 2009 (in particular) and 2010, both of which received price-boosting perfect ratings from Wine Advocate. The 2009, for example, which has been trading at £2850 has shown nothing but upside since release. The opening EP price here was £800, which is enough to deter the casual buyer, but those who fell in love with the wine from barrel samples have had their faith well rewarded by a market price of £3000, an increase of 270%, which is truly remarkable in an otherwise relatively stale market, and vastly outstrips the performance of pretty much anything else.

Buyers of the 2010 show an increase of around 30%, still very much bucking the trend, but slightly less favoured than the 2009, with an equivalent market price of £2652. Given the release price of the 2010, close to £2000 per case, buyers in that vintage were in a sense late to the party, the chateau having had the confidence to price quite aggressively in its second consecutive great vintage. The pricing performance here is probably also coloured by the fact that the 2009 was given a range of 96-98+ in initial tastings by Parker, while the 2010 was offered a marginally more confident 96-100, both being respectively upgraded and confirmed in a 100 point score.

Lucky owners of the 2009 are left in the enviable if awkward position of having to decide whether to take their £2000 per case profit now, or hold in anticipation of future increases (the last perfect score for Beausejour Duffau was 1990 which now trades at £7,500+ per case and has consistently risen since 2006).

There is always the option of laying it down for future drinking in the knowledge that it’s a 100 point wine for which they paid well below the odds on release. Given 2009 is in all likelihood a decade away from entering its maturity plateau, how many savvy buyers will be prepared to drink a case of wine that might be valued at £7,500-£10,000 by then?

by Wine Owners

Posted on 2014-02-06

Average cellar size £60,000

Total cellars under management £40m

|

January |

Overall |

| Bordeaux |

26% of total trades |

39% |

| Tuscany |

23% |

12% |

| Rhone |

21% |

13% |

| Burgundy |

21% |

17% |

Enthusiastic reviews from Antonio Galloni seem to have piqued interest in the 2010 vintage in Tuscany and Piedmont, with back vintages in Tuscany hanging on the coat-tails of the 2010. The tried and tested Supertuscans seem to be the big winners, with trading users offering and bidding around Sassicaia, Ornellaia and Masseto in mid January, with a high correlation of offers to trades across the region.

The inclusion of some excellent new private collections of Rhone and Burgundy in December and January have pushed up the market share of those regions to rival Bordeaux in those months, with a spread of private and trade buyers picking up top wines from producers like Guigal, including a rare parcel of 1989 la Turque trading at £2,900.

Bordeaux, even in a relatively flat market for the region, continued to account for the largest percentage of Exchange trades in January. Interest focusses around classic wines such as 1982 Latour (recent trades at £13,300), top scorers, and ‘off’ vintages, particularly among the first growths. On the right bank in particular, 2005 appears to be attracting new interest where the price is right, so perhaps the prospect of an uninspiring En Primeur season is already encouraging sparks of interest in great vintages with a track record of quality and performance.

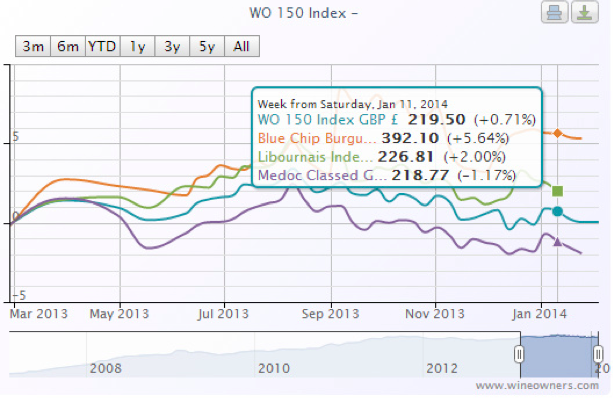

Index comparisons show a relatively flat year’s market, with Medoc Classed Growths slightly underperforming, and top level Burgundy slightly bucking the trend by showing 5.6% growth compared to a base value at Feb 2013.

by Wine Owners

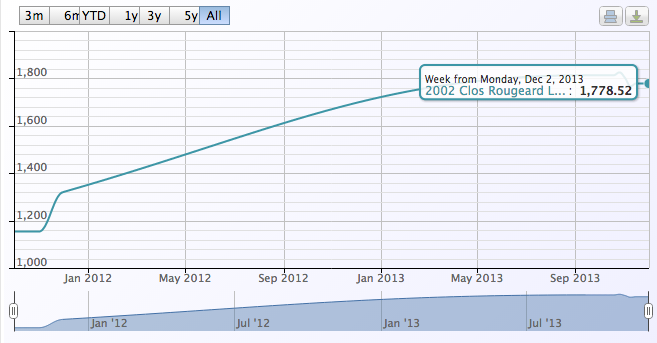

Posted on 2013-12-03

Clos Rougeard is a one-off compared with other Cabernet Franc wines produced in the Loire Valley. It is an estate that has been owned by the Foucault family for several generations. The current generation, brothers Charly and Nady, are strong advocates of organical farming. Slowly vinified in oak barrels, unfined and unfiltered, their wine challenge the traditionally held view of Saumur-Champigny being sappy, fruity luncheon wines.

The 2002 vintage of Le Bourg was traded this week at a price of £995 per 12, 44% below the current market price of £1778.52. Wild price variations are not unknown with the pricing of scarce for which demand is narrow. Bear in mind too it was long ago that the wine was selling for £30/bottle.

Saumur-Champigny is often regarded as being under-rated and ‘good-value’. With recent qualitative improvements, and an established qualitative benchmark in Clos Rougeard, might we see growing international interest in Saumur’s Cabernet Franc wines ?

'The Foucaults' 2002 Saumur-Champigny Le Bourg displays a complex aromatic melange of machine, blackberry, smoked meat, resinous herbs, toasted nuts, sauteed mushrooms, flowers, and sweat. Sleek in texture, enormously rich and expansive in the mouth, yet retaining an invigorating core of acidity, it spreads salt and wet stone mineral traces, bitter black fruits and pungent herbs in the wake of its long, penetrating, juicy finish. I imagine this evolving into something like the glorious 1988 I was served on my recent visit. '

92 points, Robert Parker, August 2007

by Wine Owners

Posted on 2013-11-21

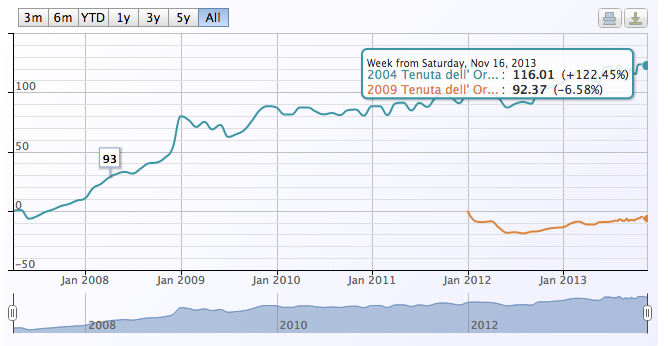

Among all wines that were bought and sold this week on the Exchange, let's take a look at Tenuta dell' Ornellaia Ornellaia Bolgheri 2004.

Bolgheri is one of Italy’s most prestigious vineyard areas, with a reputation based around terroir-driven Bordeaux style blends from iconic estates such as Sassicaia and Ornellaia. The main focus of the Bolgheri DOC is the importance of terroir and for this reason, the Bolgheri Rosso and Bolgheri Superiore wines are labeled without the mention of grapes, as terroir is considered more significant than grape varieties. It is also why Bolgheri wines are reputed for their true expressions of terroir.

Tenuta dell' Ornellaia Ornellaia Bolgheri 2004 reached a market price peak of £1403.76 at the beginning of November and is now hovering around £1,380, with the most recent trade on the Exchange at a level of £1244.

'The 2004 Ornellaia (magnum) has always been a beautiful wine, but stylistically it stands out quite a bit from other vintages of this era, something that is particularly evident in this tasting. The 2004 is perhaps the most delicate, feminine Ornellaia ever made. Silky tannins frame a perfumed core of ripe fruit all the way through to the sublime finish. The wine's inner fragrance, sweetness and balance are all impeccable. The 2004 remains one of my all-time favorite Ornellaias, and it is firing on all cylinders on this night. In 2004 the growing season was long and even, with a cool early summer and warmer late summer. Yields were on the high side, as the vines released the stored energy they had held in reserve from the previous year, which required the estate to aggressively green harvest in order to keep the plants in balance. The 2004 Ornellaia is 60% Cabernet Sauvignon, 25% Merlot, 12% Cabernet Franc and 3% Petit Verdot. The relatively high percentage of Cabernet Franc may explain the 2004's gorgeous, vivid bouquet. The wine spent a total of 18 months in oak (70% new) prior to being bottled. Anticipated maturity: 2012-2024.' 95 points, Antonio Galloni

Interestingly, the younger 2009 vintage, rated 97 points by Robert Parker, gravitates around a market price of £1,108. It slightly dropped from its release price of £1186. This raises two questions. First, can the 2004 stand as a benchmark against which younger vintages are compared? In which case will the 2009 follow the same trajectory over the next few years?

by Wine Owners

Posted on 2013-06-11

The Wine Owners team had a BYO dinner at Cafe Anglais last month where we tasted some great wines. Here's the order of fare:

Les Plantiers de Haut-Brion Blanc Pessac Leognan 2007

Les Plantiers is a very limited production white from the young vines of Haut Brion and La Mission Haut Brion. It offers more than a hint of the style and quality of the Grand Vin, with a zesty and lively fruit appeal supported by good depth and minerality. Pure and balanced, long in the mouth, it will drink well on arrival but could also take five year's cellaring.

(90 points RP)

WO team view: White wine of the night. Taut, really long and pure, with at least a decade of life ahead.

Domaine Remi Jobard Meursault Charmes Premier Cru 2001

The superb, white flower-scented 2001 Meursault-Charmes splendidly combines breadth, depth, density, and concentration with focus, balance, and elegance. This intensely flavored wine is crammed with creamed minerals, limestone, chalk, and juicy spiced pears whose flavors can be experienced throughout its magisterial finish. (93-95 points WA)

WO team view: Showing why 2001 is such an extraordinary white burgundy vintage. The WA note reflects current reality perfectly.

Domaine Georges Roumier Morey-Saint-Denis Clos de la Bussiere Premier Cru 1997

Bright and scintillating if a little more backward than Roumier Chambolles. Gripping dark cherry and cherry stone fruit with touches of bramble and cassis wrapped in firm, defining fruit tannins. There is also a savoury mineral, stone and herb dimension, making this a very complex, complete Morey.

WO team view: Top of its game, and would have been a candidate for wine of the night were it not for..

Domaine Ghislaine Barthod Chambolle-Musigny Les Charmes Premier Cru 1999

The stunning 1999 Chambolle-Musigny Les Charmes is medium to dark ruby-colored and has an explosive blackberry, raspberry, and super-ripe cherry-scented nose. Medium to full-bodied, broad, and satin-textured, this is a superb wine that coats the palate with loads of cherries, violets, and candied black raspberries. Its perfumed, harmonious personality is feminine, expansive, and concentrated. Additionally, it reveals an exceptionally long, juicy, and delineated finish. It is the finest wine I have ever tasted from Mme. Barthod. Projected maturity: 2005-2014. (93-95 points WA)

WO team view: Not quite as boisterous as the deep, intense Morey. More to come in the coming few years.

Domaine du Pegau Cuvee Reservee Chateauneuf du Pape 1995

The 1995 Cuvee Reservee exhibits an opaque black/purple color, and extraordinary rich, intense aromas of smoke, black raspberries, kirsch, and spice. Exceptionally full-bodied, with an unctuous texture, and a thick, rich, expansive mid-palate, this superbly concentrated wine appears to be a worthy rival to this estate's phenomenal 1989 and 1990. This is a blockbuster Chateauneuf du Pape. Anticipated maturity: 2001-2020. (94 points Robert Parker)

WO team view: Perfectly mature, gamey and uniquely complex. Rich, sappy, utterly beguiling and moorish.

Chateau Grand Puy Lacoste Pauillac 5eme Cru Classe 1989

I absolutely love the nose on this wine, with amazing aromas of currant, tar, spices and berries that jump out of the glass. Loads of flowers, too. So complex. Delivers a full-bodied palate, with racy tannins and lots of flavor, from tar to spices to leather. A little tight, and so enjoyable now, but better in a few years still.’ (2010) (95 points, James Suckling)

WO team view: Wine of the night. Extraordinarily complex; it kept evolving in the decanter throughout dinner. GPL simply stomped all over Hosanna. No context, embarrassing really...

Chateau Hosanna Pomerol 2000

Dense ruby/purple, with a glorious nose of blackberries, cassis, white flowers, licorice, and a hint of sweet oak, this seamless wine is a classic example of purity and symmetry. A singular style reminiscent of a hypothetical blend of Cheval Blanc and L'Evangile.

(96 points, Robert Parker)

WO team view: Yeah it's good. Rich, deep, quite lingering, but made to look very ordinary by GPL 1989.

Domaine Huet Cuvee Constance Moelleux Vouvray 1993

The 1993 Cuvée Constance has a remarkably rich colour for any wine from Vouvray, belying the intensity of this nectar. The nose is remarkable, marked by aromas of rich golden syrup, with a whispering seam of botrytis which has a curiously dry suggestion, as does the nutty, caramel nuances that follow on. This is deep, complex and multi-faceted. Chris Kissack

WO team view: Lovely end to an amazing dinner, and not a single duff bottle. A sign of good fortune with which to toast the success of Wine Owners perhaps?

By the way, did you want to know the food that accompanied the wines? Thought not...

by Wine Owners

Posted on 2013-05-03

Wine is a classic collectible asset.

Fine wine differs from stocks and shares in that it does not produce an income and it is not fungible. In this it shares common characteristics with other collectible classes such as art, stamps, coins, cigars and classic cars.

Fungible is another way of saying ‘interchangeable’. Cash is fungible; one £20 note having equivalence with any other note of the same value. Pure gold is also fungible, a gram being interchangeable with any other gram.

In contrast, diamonds are not perfectly fungible because varying cuts, colors, grades, and sizes make it difficult to find many diamonds that are exactly alike. Diamonds illustrate the point that fungibility is not the same as liquidity or scarcity. A global market can nonetheless exist and thrive irrespective of whether an asset class is perfectly fungible or not.

Neither is fine wine perfectly fungible, notwithstanding the contrary views of Joe Roseman, the investment economist who coined the phrase SWAG for Silver, Wine, Art and Gold.

Similarly, typically over time, one case of a particular wine of the same vintage loses its ability to be treated as interchangeable with another, due to variables such as storage location (and implied quality of condition), tax status (held under bond or duty paid), back or strip labels (denoting its original export destination e.g. China) and packaging (e.g. original wooden case or a repack).

Non-fungibility creates market pricing variability. To illustrate the point from another collectible segment, cigars stored at Dunhill in Mayfair are thought to carry a premium at auction houses; such is the excellent reputation of their humidor.

The growing globalisation of the fine wine market over the last decade, with the opening up of the Far East and Russian markets, and the future potential influence of Brazil, India and other emerging regions, has shone a spotlight on the importance of wine provenance – being the term used to describe history and current condition.

The question of how good is a wine’s provenance arises directly from the fact that wine is not fungible. The top estates (typified by the Bordeaux First Growths) are gradually adopting technological innovations that could help in future. Everyone agrees that provenance can only become increasingly important.

Where the wine is stored, how long it’s been kept there undisturbed, where it’s been and the distance it’s had to travel; are all more pertinent questions than ever before.

A new system of building and tracking provenance is surely needed, where older stocks can be traced back, through transfer of title, movements, location changes and inspections.

Traceability and reliability of source will increasingly justify higher prices for the best stock, and lead to a disparity of value or market liquidity between two bottles or cases of the same wine.

There is already a widening gap between older wines sourced direct from the producer compared with secondary market stocks in those cases where history cannot be proved.

It is well worth the investment in time to seek out secondary market stock with good provenance, in order to assure your fine wine purchases can serve as an effective store of value. Greater market transparency is surely the key to giving private buyers the confidence and information they need.

by Wine Owners

Posted on 2013-04-04

Fine wine is a multi-million dollar industry and is fraught with peril. From fake bottles to fraudulent contents, from mislabelled wine to misled consumers, wine has been faked, forged, and used for fraud for as long as it has been consumed.

This eBook provides a brief history of forgery and fraud in the fine wine world, including case studies on Rudy Kurniawan and Hardy Rodenstock, and is available from Amazon for just £1.53, or free to borrow and read on the Kindle for 'Prime' users.

The Wine Forger’s Handbook also functions as a guide, both on how fraudsters have been found out, and tips on how to avoid being fooled in your own wine purchases.

Written by a pair of award-winning writers, wine expert Stuart George and best-selling art crime expert Dr. Noah Charney, The Wine Forger’s Handbook is a fun, informative, engaging read, and one which could potentially save you from making costly purchases of fake wine.

The Wine Forger’s Handbook is ideal for anyone from wine collectors to casual drinkers, or those who enjoy true crime stories of forgery, deception, and detection set against the vivid backdrop of the world of wine.

ABOUT THE AUTHORS

Noah Charney

Noah Charney is a professor of art history specialising in art crime and a best-selling author of fiction and non-fiction.

His books include the international best-seller novel The Art Thief; the best-selling Stealing the Mystic Lamb: The True Story of the World’s Most Coveted Masterpiece; The Thefts of the Mona Lisa: On Stealing the World’s Most Famous Painting; and the guidebook series Museum Time. He is editor of Art & Crime: Exploring the Dark Side of the Art World and editor-in-chief of The Journal of Art Crime, the first peer-reviewed academic journal in its field.

He is the founder of ARCA, the Association for Research into Crimes against Art, an international non-profit research group on art crime and cultural heritage protection (http://www.artcrimeresearch.org/). He teaches art history and art crime on the ARCA Postgraduate Certificate Program in Art Crime and Cultural Heritage Protection at American University of Rome and for Brown University.

He is a popular speaker and recently gave a TED talk on art crime, which can be viewed at http://www.youtube.com/watch?v=T897Foh5s0g. He is an award-winning columnist for numerous magazines, with regular columns in The Daily Beast (http://www.thedailybeast.com/features/how-i-write.html), Tendencias del Mercado del Arte, and ArtInfo (http://blogs.artinfo.com/secrethistoryofart/).

He encourages readers to join him on Facebook (https://www.facebook.com/NoahCharney) or through his website http://www.noahcharney.com/.

Stuart George

Stuart George is an independent wine consultant in London.

In 2003 he was awarded the UK Young Wine Writer of the Year. Stuart was co-author of The Wine Box (2005), picture editor and leading contributor to 1001 Wines You Must Try Before You Die (2008), and editor of the award-winning The Finest Wines of Tuscany and Central Italy(2009) and The Finest Wines of Champagne (2009).

Stuart has contributed to publications on five continents, including The Daily Telegraph, Fine Wine International, Fine Wine & Liquor, Meininger’s Wine Business Monthly, Sommelier Journal, The Tasting Panel Magazine and the Times Literary Supplement.

He is a sought-after show judge and has been a jury member at wine competitions in Austria, Brazil, Chile, China, France, Luxembourg, Portugal and Spain. He has worked harvests in France, Italy and Australia.

His website and blog is at http://www.StuartGeorge.net/. He can be followed on Twitter at @sdgeorge1974.