by Wine Owners

Posted on 2022-10-05

Only a couple of weeks ago the wine market felt like it does quite a lot of the time; a bit of a backwater, no great trends or swings, business as usual. Most things were just floating along calmly on their predicted journey while little pools continued to defy gravity, even though it would appear to make no logical sense; the highly prized Salon 2002 for example, having doubled and tripled in two to three years was in high demand - the joys of rarity are a thing to behold when such demand is in town! (I have sold some of this treasured holding on behalf of clients).

And then along came a newly formed Conservative government who decided they needed to bet the house on the UK economy, cutting taxes in order to promote growth, and wiped 10% off the value of the British pound in the process, and in record quick time. Tax cut reversals have now taken place and sterling has rallied a little although it remains at a much lower level than a year ago:

GBP/USD one year chart

Source: Yahoo Finance

This is unbridled joy for US dollar-based wine traders, which includes the powerful markets of North America, Hong Kong and Singapore, amongst others. Following the latest slide, we have seen some reasonably stale offers of quality stocks suddenly sell and UK traders across the board are reporting increased interest from these areas.

As a result, my personal take on the market has gone from a neutral stance to something more optimistic than that.

I have always held the belief that there is more demand in the US market for the wines of Piedmont and Italy in general given the obvious connections of heritage, and also for Chateauneuf du Pape (or C9P as I saw it written recently!). Mr. Parker had a penchant for handing out incredibly high scores for C9P back in the day which will have helped but it is also felt that America has a higher tolerance for sun kissed, more alcoholic (more than the Europeans are used to at least) juice. Asia does not yet seem to share these particular tastes in these regions but are very happy to continue buying Burgundy and Bordeaux. Everyone continues to buy Champagne, for very good reasons, so that is a large percentage of the market covered already!

I would not be at all surprised to see US wine stocks being exported from the UK back to the USA and feel that back vintages of highly prized Napa wines make strong sense.

Looking ahead, UK buyers in the primary markets for wine will be severely affected by sterling’s weakness in the coming months and their pockets will be stretched, so back vintages of well stored investment grade, quality stocks already in the secondary market also make good sense.

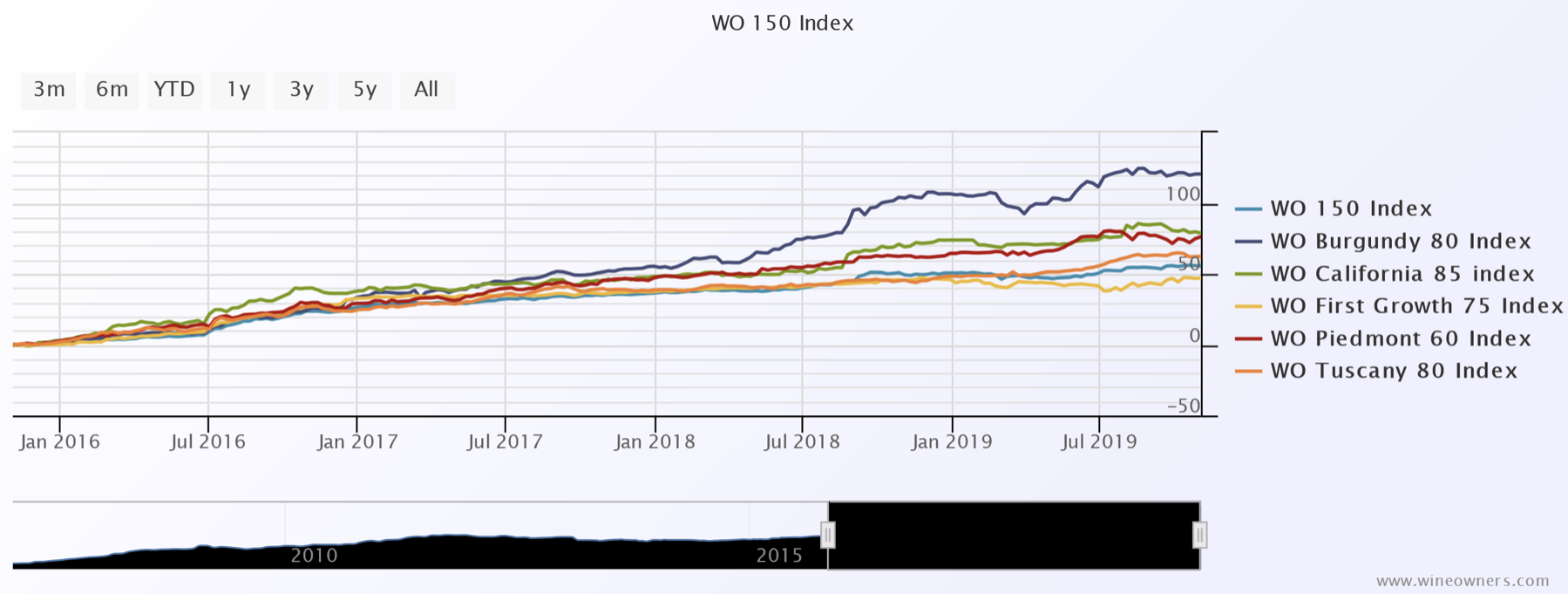

As GBP plummeted and the FTSE faltered, wine investors here in the UK slept well, evidence below. Yet again wine demonstrates its enviable low correlation and low volatility characteristics when all around others were losing their heads. I’ll drink to that!

The WO 150 Index is GBP based, other indices are based in local currency.

Miles Davis, 5th October 2022

by Wine Owners

Posted on 2022-03-09

Like traditional asset classes, the appalling events in Eastern Europe have cast a (tiny) bit of a shadow over the wine market. Unlike traditional asset classes this does not mean prices sharply falling, then rallying, and then yo-yoing up and down, repeating again if necessary, but a much more sedate and sanguine sitting back and taking stock approach. There is no wall of stock flooding the market and buyers have not just suddenly disappeared, they may just be exercising a touch more caution than before the outbreak.

The wine market has been enjoying a really good run for eighteen months or so but the exuberance witnessed in the run up to Christmas has calmed. Indices were still positive in February but trading has slowed a little and the gains are not so pronounced.

Major indices over a one year period:

My feeling is that the wine market has developed so much breadth in the last decade or so that it is less affected by global events than previously. Merchants and market makers are slower to mark down prices than before; they have survived Asian currency crises, the bursting of dot com bubbles and global financial disasters etcetera, etcetera and are better capitalised and have a wider audience. The volume and the diversity of the client base continues to grow which at this point in the wine market’s history is bringing more stability to underlying prices. As an asset class it offers probably better diversification than ever before and may even start to challenge Gold as a safe haven trade. The Kremlin’s gold reserves are well documented, and may be up for sale soon - luckily the same cannot be said about their fine wine holdings!

Factor that in with some supply issues (thinking drought affected Burgundy), supply chain issues (thinking Brexit amongst others), and rising inflation and I think wine is still a good place to be. We would definitely recommend looking out for cut priced opportunities if they arise and there’s certainly no reason to panic. Not yet at least!

And here's a look at the major indices over the last fifteen years:

by Wine Owners

Posted on 2022-02-03

As eagerly anticipated as the Sue Gray report, here it is, the annual WO round up and look ahead.

So, what happened?

2021 turned out to be a very good year for the wine market, the owners of wine and therefore for Wine Owners Ltd. also. Turnover on the exchange ramped up by 77% in 2021, producing more buying and selling opportunities than ever before! Our tenth year of trading is set to be an exciting one and has started well.

The broad based WO150 Index returned +15% with the stars of the show being Champagne and Burgundy, posting respectively +30% and +27%. Bordeaux returned a more modest 10% while Italy, having led the charge in 2020 came in with more modest numbers, yielding 6.5%. Tuscany performed better than Piedmont which was flat on the year. The Rhone did well, notching low double figures and the Rest of the World was twice as good as that, all thanks to California.

The reasons for the strength in the market were various; probably the biggest two were continued liquidity being pumped into the system in a low interest environment pushing more buyers into real assets, and the very real fear of inflation. Savings derived from staying at home more seems to have pushed up the spend on what people have been consuming at home – a quality driven drowning of sorrows in yet another lockdown!? The lifting of U.S. tariffs on some European wines brought a weight of new buying activity from across the pond, as did a lot of ‘new wave’ investment dollars - this should not be underestimated.

The market pre Covid had been largely stifled by various different factors but once demand started to outstrip supply, the market started to motor. Hong Kong and China were not responsible (for once) and collectively have been less of a force in recent times. Stringent lockdowns and border controls have meant very few visitors, especially of Mainland Chinese to Hong Kong, and an exodus of wealthy residents seeking a more liberated culture – some of the demand is moving elsewhere. Current thinking is that will last for some time (not just until after the Winter Olympics!), so be warned. I would expect Singapore to take up some of the slack and become a more prominent player.

Champagne

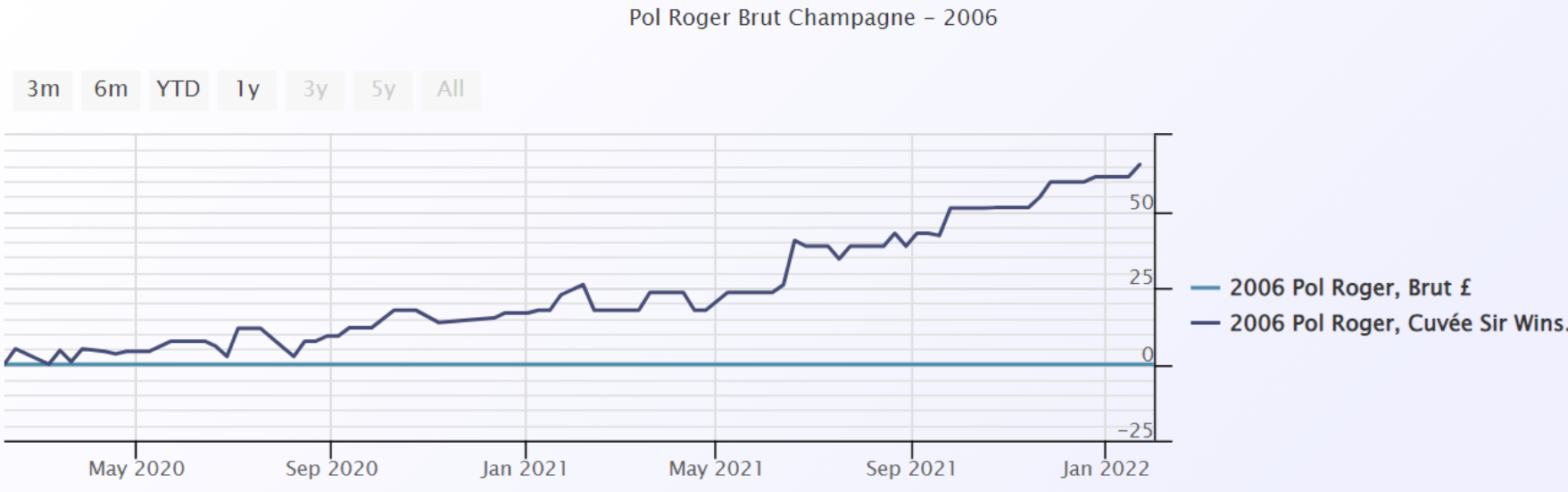

I cannot remember Champagne ever being the star turn in the wine market before but given the cyclical nature of the market and the fact that the different regions are much more equal than they used to be, it is not surprising. It has also consistently delivered steady returns, see my report from last July, just before the market really accelerated. Reports of supply shortages coming out of the region and a slew of really good quality releases added further weight to the concept of Champagne as an investment proposition which led to some voracious buying activity. The Champagne Index is dominated by the biggest names and/or the tête de cuvée of noble producers. As ever, fine wine collectors and investors focus in on the most prized assets driving the gap between the seriously good and the seriously a little bit better than that ever wider. Here’s a good example, vintage Pol Roger ’06 versus the Sir Winston Churchill cuvée from the same year:

The ‘simple’ vintage Champagnes from good producers offer extremely good value to drinkers and is a segment of the market that has been left behind.

Where Champagne goes from here is one of the big questions as some of the recent returns have been enormous. Various vintages of Krug, Dom Perignon, Taittinger’s Comtes de Champagne, Pol Roger’s Winston Churchill have added more 50-100% in the last year and rosé Champagne has been bought in a way not seen before. I am tempted to take some profit from some of the biggest risers and look for some laggards.

Burgundy

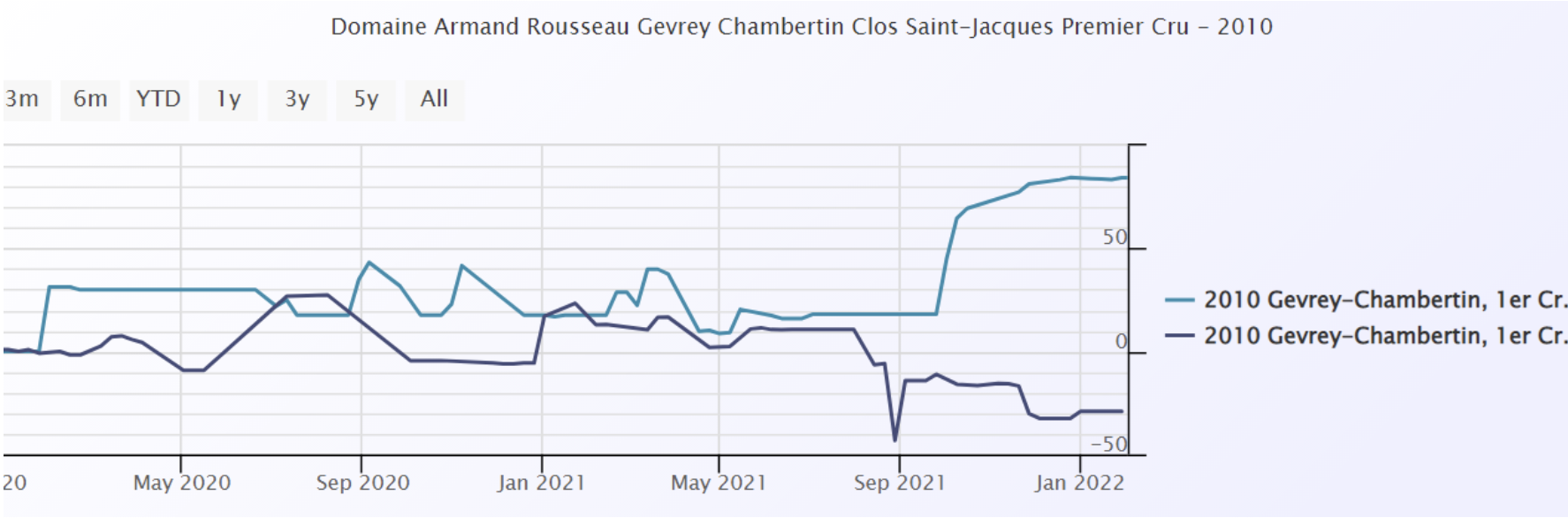

The polarisation of the wine market and the premiums attached to the most desirable names have continued to grow and probably make less sense than ever before. Names such as Leroy, DRC and Rousseau in Burgundy have outperformed their neighbours and as highlighted in some of our recent offers, often trade at multiples of equally high scoring wines from the same vineyards but from less famous producers. Obviously, this creates opportunity and I feel more comfortable making bets at the prices that are a fraction of the big guys. Here is a comparison between Armand Rousseau’s Clos St. Jacques (light blue) versus Bruno Clair’s. This sort of chart can be repeated numerous times - premiums have become too large for my liking, but if Rousseau is your man and you have the cash….

The current shortage of 2020 red Burgundy and the general short supply frost hit ’21 vintage, see report from last November, will push prices and demand ever higher and whilst some price performances seem overly vertiginous, I anticipate they will continue their path – for now at least. High rollers love spending big on Burgundy and the small production levels really adds the glitter dust to this famous region. And there are always the producers that are beginning to make a name for themselves.

Bordeaux

Bordeaux had a decent year, posting +10%. Apart from a brief flirtation with the 2019 en primeur release, Bordeaux has not been sexy for a very long time now. Market share continues to fall as other regions eat into the Bordelais’ gateau. It is still, and always will be, the largest slice of the market and those who buy into the general wine argument and need liquidity are best allocating here. It has become the steady Eddie. As a massive generalisation you know what you’re getting in your glass with a Bordeaux; a lot of that infuriating yet bewitching and beguiling wonder of what to expect from your wine just doesn’t exist in the same way that it does with Burgundian Pinot or Piedmont’s Nebbiolo and passionate collectors are just not quite so aroused by its charms (as I said, a generalisation!). I expect it to remain firm however.

Italy

Italy has had a mixed year. Super Tuscany has done well, the massive names of Sassicaia, Tignanello and Masseto have continued to shine posting average gains in the region of 25%, 35% and 25% respectively, and Solaia and Ornellaia also, but not so brightly. Lots of smaller Brunelli have fared quite well and this sector continues to build – hardly surprising given the price to quality ratio. Piedmont has had a mixed time, Monfortino in general is up a little in most vintages but lots of big names across the region have remained unchanged. I would not be surprised to see interest return to this area once Burgundy’s current run has blown through. There are still numerous 2016s looking very interesting for the longer term.

The Rhone

The Rhone valley is more appreciated than ever before. There are numerous cult producers all over Cote Rotie, Hermitage, Cornas with St. Joseph coming to the party nowadays. Prices of Rayas product from down south have travelled to the far north as collectors chase these rare treasures. White Rhone is still very much a speciality interest but one to keep an eye on. I have bought a lot of red Rhone for drinking from the WO platform in the last year or so as the combination of maturity, quality and price is virtually impossible to beat. There are plenty of names delivering superior returns too.

The Rest of the World

California has dominated the remaining regions with some ease, posting over 20%. Screaming Eagle has led the pack, followed by Ridge and Dominus. Australia has suffered at the hands of China’s tariffs.

Conclusion

I am confident the market will continue to perform well this year. Sentiment is strong, and supply in some key areas is shorter than usual, especially Burgundy. The inflation fear mentioned earlier is real and wine has been seen as a good hedge against this for a long time now. Interest rates are likely to rise but remain historically low and the real asset argument holds sway but will lessen as QE reverses – something to keep an eye on. Access to the fine wine market is greater than ever before, particularly in the U.S., and continues to grow.

As ever, I would be delighted to hear from you to discuss any of this, or anything else wine related. I am happy to help and advise on your portfolio or cellar, for investment or drinking purposes. And now we can go out again I would be delighted to share a bottle!

Miles Davis 02/02/2022

by Wine Owners

Posted on 2021-06-17

Luke MacWilliam, June 2021

It is well documented that Piedmont is attracting more attention than ever before and activity in the secondary market has become increasingly frequent.

Comparisons can be drawn between Burgundy and Piedmont in terms of quality and scale (no politically motivated 1855 classification here). Your regional Nebbiolo or Barbera (Langhe, d’Alba etc) equate to a Bourgogne rouge, your straight Barolo to a village cru and then your single vineyards to Premier Cru Burgundy. The most lauded single vineyards from the best producers can mix it with the Grand Cru big boys! Pay particular attention to Cannubi, Bussia, Brunate and Rocche dell’Annunziata and Monvigliero.

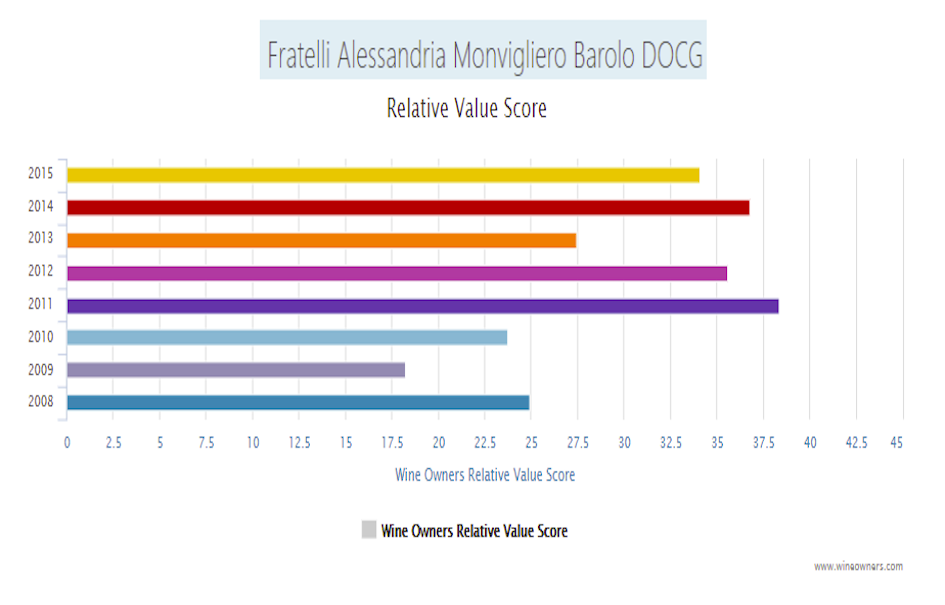

One producer I’d like to place under our spotlight is Fratelli Alessandria. A 150 year old estate, Fratellis Alessandria has 30 acres to its name, and produce a portfolio of wines from “simple” Langhe Nebbiolo right up the Premier and Grand cru equivalents in San Lorenzo, Gramolere and Monvigliero.

Last January - following a trip to Piedmont our very own Miles Davis noted the following:

The same week, I attended a Monvigliero focused Barolo tasting at 67 Pall Mall and was blown away by the ethereal elegance, approachability and precision of Fratelli Alessandra’s wines (Diego Morra, Roset and Sordi also shone, but I’ll leave those for another day). Don't mistake “youthful approachability” as “lack of ageability” - it’s still Nebbiolo we are talking about - the structure is there to go 20-30 years. The killer combination of approachability, ageability and affordability is exactly why any self-respecting wine lover should buy into them, you can enjoy the evolution for years to come without getting involved in bonkers Burgundy money (yet).

The same week, I attended a Monvigliero focused Barolo tasting at 67 Pall Mall and was blown away by the ethereal elegance, approachability and precision of Fratelli Alessandra’s wines (Diego Morra, Roset and Sordi also shone, but I’ll leave those for another day). Don't mistake “youthful approachability” as “lack of ageability” - it’s still Nebbiolo we are talking about - the structure is there to go 20-30 years. The killer combination of approachability, ageability and affordability is exactly why any self-respecting wine lover should buy into them, you can enjoy the evolution for years to come without getting involved in bonkers Burgundy money (yet).

Fratelli Alessandria are moving forwards, and as demand increases for quality Barolo so are prices of the top crus and top vintages (investment anyone?) but on relative value terms they are still an absolute steal.

Take their regular Barolo 2016. £175 + comms IB per 6 and earning a whopping 96pts from Monica Larner. Could you imagine such a write up for a village burgundy?

'The 2016 Barolo opens to tight elegance and a nervous quality that pits red fruit energy over lean fruit weight. The results are graceful, lithe, fragile and lasting. The wine's aromas unfolded slowly and seductively, revealing wild berry, cassis, bitter cherry, toasted almond and blue flower. This is a dreamy wine that promises more beauty as it continues its bottle evolution. An ample 20,000 bottles were produced. This is one of the very best values found anywhere in Barolo.' 96pts, Monica Larner, Wine Advocate

It doesn’t stop there, moving up to Gramolere 2013 (premier cru equivalent) at £215 + comms IB per 6.

'This is a wine of beauty and intensity. The Gramolere cru in Monforte d'Alba is distinguished by the focused and sharp nature of its aromas. The 2013 Barolo Gramolere is a textbook expression of the cru, with deeply delineated aromas of wild berry, rose hip, rosemary sprig and licorice. The mouthfeel is silky and smooth with good structure and firmness to add to that sense of purity and sharpness. The wine's profound depth is what stands out most.' 94pts, Monica Larner, Wine Advocate.

And finally to Monvigliero:

'The 2010 Barolo Monvigliero shows a pretty degree of color salutation with brilliant garnet and ruby highlights. The bouquet is broad and wide-sweeping with a healthy succession of red berry, sweet almond, stone fruit, medicinal herb and crushed mineral. Fruit thrives from 220 to 280 meters above sea level with full southern exposures facing La Morra. They own 1.5 hectares of the 20-hectare single vineyard. Fratelli Alessandria keeps its Barolo in oak casks for three years, instead of two. The wine shows light spice notes with distant touches of dark fruit. The tannins are silky and long. The wine is amazingly expressive now, but promises great aging potential. Drink: 2017-2033.' 95pts, Monica Larner, Wine Advocate.

From a relative value perspective, scores are high across the board. 2010 and 13 are the vintages that have begun to move upwards in price, 2016 has rocketed too. Value can be found in 11, 12, 14 and 15 where quality remains consistent.

P.S For the adventurous out there - seek out their Pelaverga Speziale for something utterly different. Pelaverga is a local variety made almost exclusively around Verduno. My notes start with “Wow. Weird. So floral….not like anything I’ve tasted before” and my attention was grabbed immediately.

P.S For the adventurous out there - seek out their Pelaverga Speziale for something utterly different. Pelaverga is a local variety made almost exclusively around Verduno. My notes start with “Wow. Weird. So floral….not like anything I’ve tasted before” and my attention was grabbed immediately.

A historic producer who embraces tradition and local identity, but also strives to improve and improve in a changing world ticks all the boxes for me.

by Wine Owners

Posted on 2021-06-10

Miles Davis, 10th June 2021

Whilst writing the offer for Bollinger Grand Année Rosé 2012 (still some available here!) this week, I started thinking about pink fizz in a different context. Before now, I had never stopped to think about it seriously, it had always been something for immediate, and possibly immature, pleasure. I have never taken it seriously or given it the respect it deserves – more fool me!

Harking back, my first introduction as a rather inexperienced taster (at circa 15 years of age) was when an older sibling brought back a couple of bottles of Laurent Perrier NV Rosé from France for a Christmas treat. I remember, very clearly, being absolutely blown away, and that was just the concept of it – champagne that is pink, surely not!? Suffice to say it was heartily enjoyed but then a few Christmases later, rather easily surpassed, by another Champagne, a white this time but by the name of Dom Perignon. Obviously comparisons between the two are not fair but in many ways the damage was done. I was aware there was a Dom Perignon Rosé but that was another chunk up on an already expensive price tag, which was a step too far. Instead of considering rosés, I became used to buying special cuvées and vintage white champagne for the big occasion, and the odd Sunday lunch! Ironically I believe I was thinking that rosés were just not as serious or interesting as their white counterparts, yet when you start looking at the various critics and ratings between the different offerings from the same stables it is clear that this is not the case at all.

Vintage rosés are not produced as often as whites and are often more ‘vinous’ or ‘gastronomique’. They are made either by either skin contact through maceration from the Pinot Noir and Pinot Meunier grape varieties or by blending typically 5-20% of red wine with the still white wine and before the 2nd fermentation in bottle. Bollinger’s Grand Année Rosé, for example, is made using 5% of red wine derived from their La Cote Aux Enfants vineyard.

When I was managing wine investment funds, a few vintages of white Krug and Dom Perignon found their way into the portfolio but we did not even consider rosés at the time. Now the wider wine market is growing ever broader and more tradeable, it would be foolish to ignore them. Some of the smarter money is already in and demand is growing. The best wines can age gracefully for a long, long time and the prices for top Champagnes (of both colours) from top producers and vintages only travel in one direction.

Some of the producers who produce top quality rosé Champagnes:

Krug

Dom Perignon

Bollinger

Billecart-Salmon

Philipponat (Clos des Goisses)

Taittinger (Comtes de Champagne)

Ruinart

by Wine Owners

Posted on 2021-03-24

Luke MacWilliam, March 2021

When buying wine with half (or even a full) eye on investment, there is a sea of information and misinformation out there. Often authors have an agenda or a producer to push, they want you to buy the wine they are selling. I recently had a call from an importer who was telling me how “Producer X” (that they imported) is going to be a great investment wine and would we want to promote that “fact” to our members. The lines between marketing, and genuine insight and opinion can become blurred.

I politely declined, explaining that Wine Owners is here to facilitate trading between collectors and that when we do publish opinions regarding the investment market, it is based on a combination of data, observations and personal experience.

How you then choose to use this information is up to you; my number one piece of advice is to read broadly. Do not exclusively read what we put out or content from other trade members and don't solely listen to your account manager who has a target to hit. Combine all three and when you see things repeated by people with different agendas (or no agenda) there may just be something to it.

For example, back in January, Wine Owners’ very own Miles Davis wrote the following unassuming paragraph in his annual investment report.

“The Rhone is solid but unexciting yet provides immense drinking pleasure at a relatively cheap price point. Back on solid form, I think (Jaboulet) Hermitage La Chapelle ’09 and ’10s are under-priced (the ’78 remains the best wine I have ever drunk).” Miles Davis/Wine Owners 2020 Wine Investment Report and a look ahead at 2021

Totally independently, Bordeaux Index released their own report with a similarly passive but very honest insight on Rhone:

“Rhone: If Piedmont can be frustrating from the stop-start nature of investment potential delivering results, Rhone is perhaps tougher still. Rising En Primeur prices have not helped as they tend to snuff out broader interest in the region rather than fan the flames. We see the potential this year as being in the Northern Rhone primarily and focused more on the classical names: Guigal, Chave, Jaboulet.” Bordeaux Index’s 2020 Market Review & 2021 Outlook

Two unassuming and easily overlooked comments resonated with me. I read both within a few days and I love the wines of Northern Rhone as a consumer. I checked out the trading platform, there was an offer for Jaboulet Hermitage 2010, and a bid, that's another tick in the box, the wine is liquid, others want it too.

Then, as I was cleaning up my inbox I spotted the offer. A regular offer from a trade client that I often overlook, but there it was, jumping out at me like a jack-in-a-box. Jaboulet Hermitage 2010 at 10% discount to market.

That was it, I was not missing out on this, and I didn’t (Miles might have, despite me telling him immediately…sorry Miles!).

It’s unlikely that I would have bought this as a modest investment punt based on just a single one of those events. I might have bought some to drink based on Miles’ comment about the ‘78 and other reviews, but all 3 events together added up and it made sense. I have no regrets (except maybe I should have bought more!). Previously trading at just over £600 per 6 the last trade on Wine Owners was £715, and that still feels like a good buy... I’ll be holding mine for a little while longer (unless Miles bids me for one!).

by Wine Owners

Posted on 2021-03-17

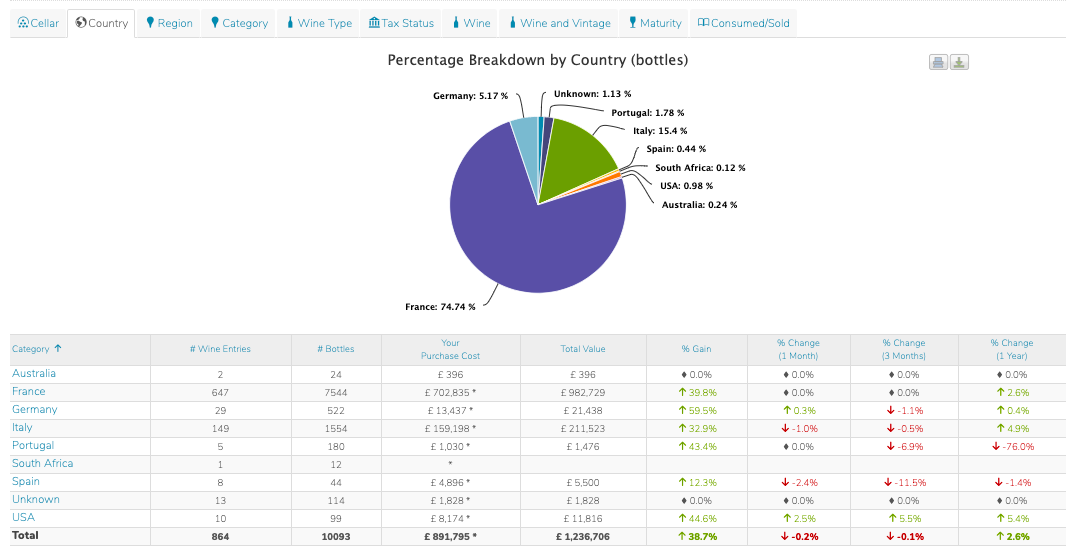

For just a moment, imagine no longer having to depend on a tedious cellar spreadsheet and instead being able to view your entire wine collection all in one place in an interactive way, bringing your portfolio to life?

Spreadsheets can be dull and relentless at the best of times. By consolidating piles of paper, spreadsheets, emails and invoices all into a well organised online portfolio, you can pull other valuable pieces of information together that lend a new dimension of enjoyment to organising your collection. Contrary to what you may think, managing your collection end to end, ensuring that all your wine acquisitions are accounted for, can be a fun process!

Cellar management software enables you to achieve this in 3 steps:

Step 1) Getting your collection organised.

Figuring out what wine you have may sound simple but it often isn’t. Wines are sourced from multiple merchants and stored in numerous locations. Although the majority of merchants are organised, not all can be relied on to remind you of your purchases.

An online cellar management platform enables you to track your entire wine collection in one place, both your professionally stored wines and those at home. Wine Owners’ home cellar functionality enables you to track the exact location of each bottle down to hole in a bottle rack, so that no bottle will be forgotten and ensures wines will be consumed within their drinking window (a window that you can edit according to taste).

Having been built by a fellow wine enthusiast, all functionality has been developed taking every part of the wine journey into consideration. All important information can be recorded: the wine name, vintage, format, where it was bought, purchase price, condition, quantity or a shipment date if it is incoming stock.

When you join, you have instant access to a pool of valuable information including drinking dates, critic stores, producer profiles and up to date pricing information and more, enough to keep any wine collector happy. Optimised for mobile and tablet access, you can access your collection wherever you are, whether on public transport, at work or abroad.

2) Rediscovering your collection.

Now that you have catalogued your portfolio and you know what you have and where it is, Wine Owners can help you make well-informed decisions around a) which wines to drink next and b) what you have too much of thanks to overzealous purchasing or a very good relationship with your account manager!

Lots of fun is to be had exploring the integrated analytical tools which include sophisticated pricing graphs and relative value score analysis. You can also review your portfolio by a range of filters, view values per category, total value and category performance over different periods of time.

Latest perspectives of the critics are also helpful to appreciate the quality of the wines you have bought, and you can add your own tasting notes as well.

3) Shaping your collection.

Once you’re clear on your inventory, it’s time to take key decisions around your collection.

You may wish to sell surplus stock back to the merchant who initially sold you the wine or, if they refuse, you’re only a few clicks from being able to offer your wine for sale in a vibrant secondary market, with trading desk experts available to help.

An easy to navigate, comprehensive digital overview makes it a lot easier to make decisions around which wines in your collection you’ll want to keep and the ones that are ballast. You’ll also be less likely to miss a drinking window. As a wine collector, the satisfaction of enjoying that glass of wine that has appreciated 10-fold since the date of purchase cannot be understated!

For those members who want to buy and sell, it’s super simple.

As it is integrated with a peer-to-peer trading exchange, you are joining a vibrant ecosystem of like-minded collectors as soon as you upload your collection.

In addition, by making purchases through the platform, every part of the settlement process is looked after by our logistics team.

If you are ready to upgrade your cellar management experience, we’re here to help. You can start by creating a free account HERE to organise, value and monitor price changes on up to 30 wines. If you have over 30 wines, our premium plans offer all the tools you will ever need to easily and successfully manage your collection.

by Wine Owners

Posted on 2021-03-04

Miles Davis, March 2021

In early December I wrote the following:

‘Traditional assets continue to bounce around, no doubt causing palpitations and stress. More than ever, this year has been about timing in the capital markets, and if you got that wrong, the chances are you got it expensively wrong. Not so for vino! Unlike after the global financial crisis, the wine market has held its nerve, merchants did not mark down prices and the market has been stable. Investors are about, and even Bordeaux prices feel like they are firming up. Collectible assets are in vogue and it is easy to see why given these circumstances.’

Not too much has changed since then although there has been plenty more talk about inflation, with the UK’s November numbers coming through much higher than anticipated. This can be viewed as a positive. There has also been the small matter of a new American President. This, in itself, should not have a direct influence on the wine market (!?) but a $1.9 trillion stimulus package and a clear signal that money is going to keep being pumped into the system might be!

So, the macro factors are looking stable and the index performances from last year are also looking sensible. There is no massive ‘feel good factor’ about, which often brings about a more boom-and-bust style dynamic, so this is beginning to feel like an old-fashioned wine market, steady as she goes, nice little earner, thanks very much.

Bordeaux First Growths continue to be the fly in the ointment, underperforming all the other regions with +2.8%, save California with -2%, and generally Bordeaux’s market share continues to slide and is now less than 40% (95% ten years ago!). Pricing from a few of the Chateaux meant the 2019 en primeur campaign awoke the old beast for a moment but otherwise, the top end wine market of Bordeaux continues to struggle. Interestingly, the much broader Bordeaux 750 fared far better with a nearly 10% rise.

Italy was the star of the wine market show in 2020, with Tuscany posting nearly 20% gains and Piedmont 6.4%, followed by Champagne with 12.7%. It is more than coincidence that these markets have been exempt from US tariffs in recent times. Italy has long lived in the shadows of France in terms of reputation and price in the fine wine world, but the gap is still vast, certainly pricewise. The super recognizable names of the Super Tuscans, which have recently benefited from the mega vintages of ’15 and ’16, consistently receive incredibly high scores.

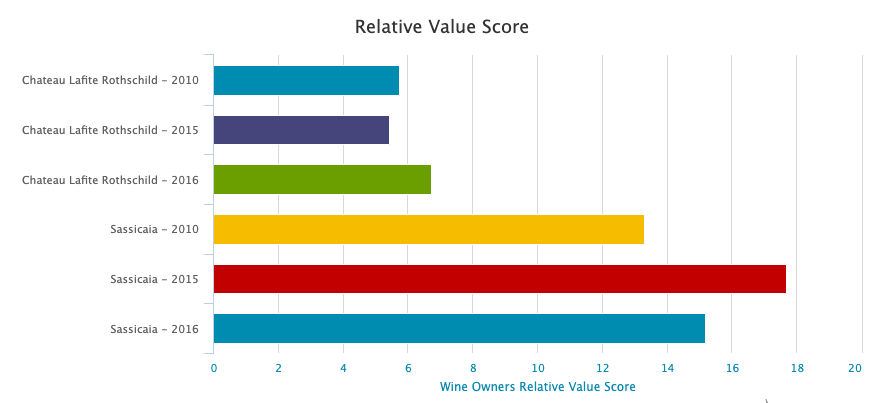

The 2016 Sassicaia (100 points WA, 97 VM), one of the most expensive Sassicaias of all time, is £230 a bottle, Lafite Rothschild 2016 (99 WA, 97 VM) is £530 a bottle, and production levels are roughly twice as much at Lafite. Maybe this is not a fair comparison but given the price differential and the tariffs in place, I know which one I would be backing:

This is a short excerpt from Miles Davis' 'Wine Owners 2020 Wine Investment Report and a look ahead at 2021'. CLICK HERE to read the full report.

by Wine Owners

Posted on 2020-12-16

Luke Macwilliam, December 2020

At the beginning of December, Mouton Rothschild announced that Chinese artist Xu Bing had been chosen to design the latest installment in their famous long running series. The label itself features the words Mouton Rothschild styled to resemble Chinese characters. Visually it’s attractive enough, it’s certainly quite clever and effective in the way you are compelled to look beyond the characters and see the recognisable letters hidden in the design.

Predictably the price jumped around 12% after the announcement, Mouton Rothschild, Chinese artist, good vintage, it's a banker! Isn’t it?

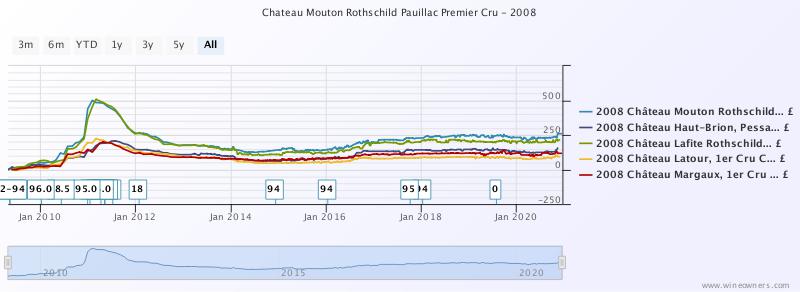

The last time Mouton entrusted the honour of designing their label to a Chinese artist was a decade ago in 2010, on the release of the 2008 Vintage. Now the market was very different back then, and the Chinese market was the main driver of the wine market as it grew and grew despite the financial crisis of 2008. Upon announcing the label design, prices skyrocketed.

The excitement was short lived, however. The Chinese bubble burst in the summer of 2011 and prices came tumbling down.

If we compare the big five from 2008 (nb. Lafite also included a Chinese Symbol on their 2008 label), you can clearly see the over inflation the hype caused compared to the other 1st growths. Those who bought Mouton and Lafite 2008 between Nov 2010 and June 2012 will have been licking their wounds for some time, destined to never recoup their losses.

If you bought in 2014 however, you will have seen Mouton 2008 perform in a much more sensible manner.

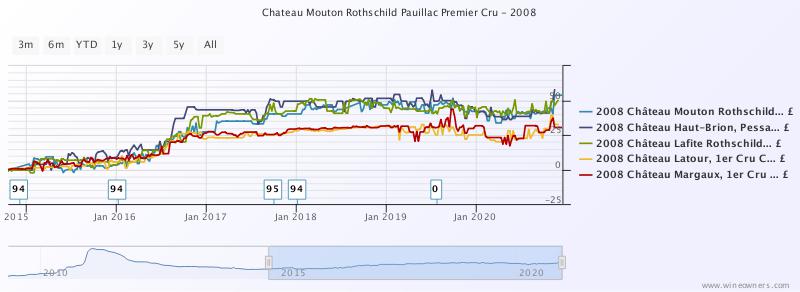

The last 5 years performance is a much healthier representation of the Bordeaux market in general, steady growth between 2015-2018, a flat 2018-19 (read THIS market report from Sept 2019 for the explanation) and finally strong resilience in a really difficult 2020 for markets of any kind. Has Mouton 2008 performed in this way because of it’s label or because it’s a top wine?

All of the 1st growths have tracked steadily, but more recently, Mouton and Lafite 2008 have begun to diverge in price once more showing that continued demand for these special labels does still exist.

In 20 years time when supplies of these vintages become more scarce, will Chinese demand for a label outrun the global demand for the greatest vintages (2010, 2016 etc)? That is the million dollar question.

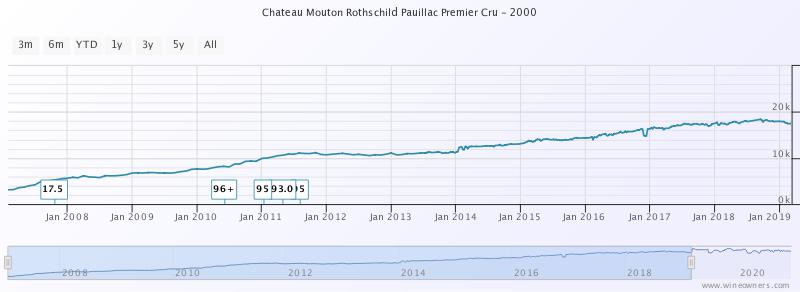

Let’s look at the example of Mouton 2000, we have a golden combination of a special wine from a special vintage in a special bottle (not just for the Chinese Market, but for the world). The result? Steady increase in value over time as demand remains high and stocks steadily run down. The troubles of 2011 did not affect Mouton 2000 in the way they did affect Lafite and Mouton 2008.

If you buy into a Chinese label, you are buying into the notion that China is, and will continue to be the main driver of the top end of the fine wine market. If you buy into a wine, then the whole world will potentially be after what you have.

Wine is a long game, and snap reactionary decisions based on hype come with great risk. If you are looking to make a quick buck then you are likely to come unstuck. Call me boring, but I find trends more compelling than one-off anomalies. There is a place for special editions in your portfolio, they do tend perform well over time, so long as the wine is up to the task as well.

Oh, and if you fancy picking up a case of Mouton 2008 BID or BUY here.

Luke MacWilliam, December 2020

Banner Image: http://www.domainedechevalier.com

by Wine Owners

Posted on 2019-11-15

This article is a republished version of one that appeared earlier in the year. Why? Because there’s another reason to sing about the virtues of Italian wines; the Trump administration have recently introduced a 25% tariff on all wines from France, Germany and Spain below a 14.1% alcohol level (Champagne is exempt). This has caused a loss in confidence in the French heavyweights and Bordeaux and Burgundy prices are on the slide. Italy’s cheese industry was the one selected to take the hit in this particular trade war, leaving their wine sector sitting pretty. We’ve been bullish on Italy all year, this adds further grist to the mill.

The Italians are not only the largest wine producing country in the world, they have been making wine for over four thousand years and cultivate over two thousand grape varieties on a multitude of different soils in twenty different regions! They are not bad at food either. Their climate seems to suit most of the finer things in life.

Italian wine being recommended is nothing new, but having it recommended as a collectable asset bearing an investment case is another matter. Ten years or so ago, a few canny collectors realised some of the ‘Super Tuscans’ (red wines typically made of a Bordeaux blend in Tuscany) such as Masseto, Ornellaia, Sassicaia (recent blog) and Solaia were ripe for decent returns. Traditionalists were a bit put out by these glossy new pretenders turning up on the Italian wine scene with their fancy French grape varieties and lots of marketing but it is fair to say they have helped the overall attention given to Italy and, as a result, the ‘Bs’ are blossoming – namely, Barolo, Barbaresco and, to a lesser extent, Brunello.

Wines from the best producers of Italy’s most venerable regions have been collected by the cognoscenti for years but now their appeal is becoming more widespread. The problems of Bordeaux, following an explosive China-driven period, have been well documented in the last decade and in its place, the smaller top-quality regions have been profiting. The indices for the last five years show Burgundy +120%, California +79%, Piedmont +76%, Tuscany +62% and First Growth Bordeaux +47%, the broad base WO 150 is +55% (all nice numbers!).

The reason for Burgundy’s performance is that old tried and tested wine world fundamental of genuine demand outstripping supply - who knew!? I think it is fair to say prices in Burgundy have been coming off the top for nearly a year now. Californian prices were a little more ‘forced’ and are in retreat now, but both these regions produce tiny quantities in comparison to the number of people looking to access these markets and gain exposure. Very widely held Bordeaux has been steady but is beginning to slide in this difficult environment. Piedmont and Tuscany are holding firm to gently positive.

The complex nature of Burgundy, California and Piedmont with their tiny (compared to Bordeaux) vineyards is attractive. This adds to the aesthetics, spurring on both the well-seasoned and newcomers alike, keen to learn more and invest time and money accordingly. More of the written word is more easily accessible to interested folk, and with platforms such as Wine Owners to trade on, the visibility of the product and the liquidity of the commodity has increased.

Grand Nebbiolo from Piedmont is yet to hit the big time, apart from a special few producers, but the word is spreading and there are ‘new’ names coming through; dedicated collectors and the inquisitive are homing in. It is a Burgundian-like network of vineyards, producers, families and reputations and you need to know what you are doing. Famous names like Conterno, for example, have six listings in my favourite reference book: Aldo, Diego, Fantino, Franco, Giacomo (the big one) and Paolo.

Some of the bigger names like Giacomo Conterno famed for his Montfortino vineyard, Giuseppe Rinaldi, Bartolo Mascarello, Bruno Giacosa and Gaja are already highly sought after superstars, with prices to match, but there are a host of others with reputations and demand beginning to swell; Brovia, Cappellano, Fratelli Alessandria, Sandrone, Voerzio and Vietti to name a few.

The ‘Super Tuscans’ of Bolgheri are much simpler to understand, like Bordeaux versus Burgundy, and are produced in larger numbers. The names mentioned earlier are virtually household names (in wine terms!), are less exciting right now overall but tend to deliver very steady returns.

Brunello di Montalcino, made from Sangiovese, is also comparatively easy to piece together in relation to Piedmont. Biondi Santi, Poggio di Sotto, Salvioni and Soldera are the big names with the fancy price tags. The secondary market for Brunello has not yet developed so, for now at least, it is a case of keeping a watchful eye although Soldera has been added to several portfolios already. There are many other less well-known names that have been attracting huge plaudits from the top critics that remain under the radar. This group haven’t matured into the darlings of the market, so far, and back vintages are cheap and well worth consideration.

There have been some excellent vintages in Italy in the last decade or so, attracting fantastic media coverage and now the battle-weary Bordeaux buyers and profit takers of Burgundy are moving in. Another reason for favouring Italian wines in the current climate is that the U.S. and Germany are the biggest export markets, so the market unlikely to be affected by any potential fallout from Brexit.

Most of all, however, these wines are barely scratching the Asian surface as yet and we all know what happens when that changes!

Miles Davis 15th November 2019