Buzz 500 Index

by demetraWO#11:00:41:817

2014-05-08

The Buzz 500 was always meant to be a bit of fun. Away from the serious business of formulating the fine wine equivalent of the FTSE100, and key region of production tracker indices, we thought it would be interesting to create a ‘popular’ index.

So we took the 100 most searched for wine names on Wine-Searcher, selected 5 vintages per wine that differed according to region, and turned that list into an index. Well, why not?

We wanted answers to the question: are those wines that are most searched for on Wine-Searcher also those that perform the best over the medium term? Will the most searched-for wines tend to be the most demanded? Does most researched translate into purchases, and does that lend support to, or underpin market pricing?

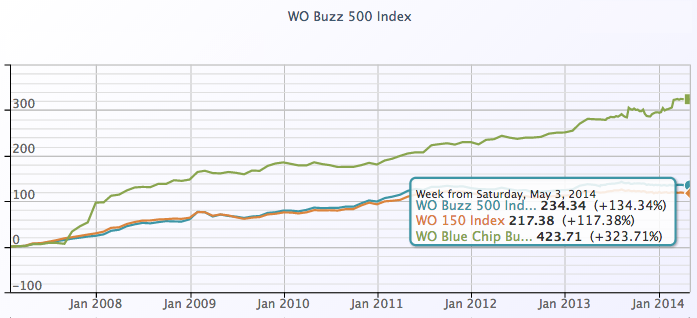

We kicked off the Buzz 500 at the start of 2013, and from that point onwards, it’s outperformed the WO150. That’s not entirely surprising given the strong Bordeaux representation in the latter index. But actually the Buzz 500 has plenty of claret represented too, just different wines. This highlights the first conclusion: there are always outperformers in any segment, and there is a correlation between the most searched for wines in a category and their performance versus other birds of a feather.

You can Review the constituents of each of the indexes here.

But just because hot wines within a category will outperform other wines in the same category, there’s no substitute for market momentum: and nowhere has that been greater than in burgundy these past three years.

So comparing the Buzz 500 to the Blue–chip Burgundy index is – well, rather predictable.

Whilst Burgundy has risen 40% in the last 3 years, the Buzz 500 has managed a paltry 5.5%. That’s still a third better than the poor WO150, weighed down by its First Growth constituents.

If you're a Burgundy officianado that may be good news, or conversely may have put whole classifications of wine out of your drinking reach. And whilst the scarcity of Burgundy is a huge market driver that may point to inexorable upwards momentum, who’s to say it will continue?

The wine market is characterised by myopia – unable or unwilling to see an end to positive trends, and morose in the extreme when sentiment turns . Neither are helpful for collectors.

One behaviour that is consistently predictable is that when wine markets become disconnected with the value in those purses that consume it, the trade and consumers search for better value, Hence the positive kick enjoyed by Northern Italy. More about that in my next index analysis.

Posted in:

Fine wine analysis,

Tags:

Blue Chip Burgundy Index, Buzz 500 Index, FTSE100, wine analysis, wine index, wine market, WO150 Index,