by Wine Owners

Posted on 2014-11-04

Coming up soon, Nick Martin will present Wine Owners’ Wine Management Platform (WMP) for wealth managers.

November 13 at 7pm at the Masi wine bar in Zurich

Courtesy of finteCH+innovation meetup hosted by Credit Suisse’s John Hucker.

With the massive growth in alternative tangibles held by High Net worth Individuals, wealth managers have begun to appreciate the need to offer services to help their clients track and manage their treasure assets in addition to the traditional service offerings.

Wine Owners (WO) has developed a wine trading platform that makes it easy to manage, track and self-direct. Since launching 15 months ago, WO now manages over £500M in wine with the Wine Management Platform (WMP) as a branded (white label) solution used by companies such as Corney & Barrow and The Wall Street Journal.

The company was recently featured in the Financial Times How to Spend It magazine.

The presentation will show how Wine Owners is addressing the challenges of trading tangible assets using a version of WMP developed for wealth and relationship managers, and the strategies open to them to justify integrating the WO WMP with their client-facing proposition.

For more information, click here.

To see the great companies that Wine Owners works with, click here.

WO recently deployed a platform in partnership with the Wall Street Journal.

WO has developed a version of WMP for wealth/ relationship managers that allows them to offer own-branded functionality for High Net Worth Clients.

If you are interested in attending this event on November 13th please click here to sign up. See you there!

by Wine Owners

Posted on 2014-06-13

by Wine Owners

Posted on 2014-06-03

Nobles Crus, once thought to have been the world's largest wine fund, has allowed certain shareholders in the collective investment vehicle to exit their positions, notwithstanding Luxembourg's financial watchdog order last year to suspend all redemptions and subscriptions.

Investor Protection Europe, a consumer protection organisation, cites this sweetheart deal as an example of lax regulation and called it 'a clear violation of the rights of minority shareholders'.

Notwithstanding, the arrangement may come as a relief to key players in fine wine producing regions such as Bordeaux, whose wholesale distributors had been concerned about the risk of such a large volume of fine wine hitting an already uncertain market. If other shareholders were to follow suit and take a partial reimbursement in settlement, the risks of a large volume of fine wine hitting the market could be partially mitigated.

Private investors choosing to put money into Collective wine funds should know that Wine Owners provides a rigorous solution for fund management, fund valuation and provides a comprehensive audit trail of price calculations to wine funds including those regulated by the Financial Conduct Authority (FCA).

Wine Owners valuations reflect the realistic price that wines are likely to fetch in the global secondary fine wine market, and therefore the solution represents the single most credible analysis and oversight tool for those funds whose holdings are diversified across different fine wine regions of production.

For further information contact us on + 44 (0)207 278 4377.

by Wine Owners

Posted on 2013-10-30

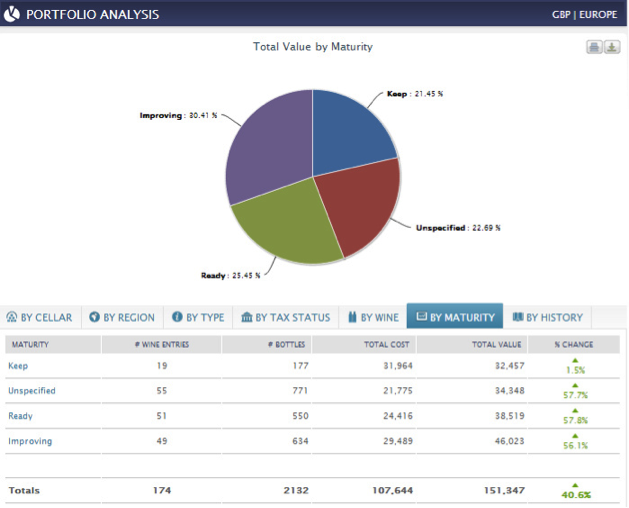

One of the pitfalls of collecting is knowing when to pull a case out of storage, and making sure that older stocks don’t linger unappreciated until past their prime. Your Wine Owners Portfolio allows you to sort wines by maturity, so you can decide what to bring out of storage for drinking, what to keep, and what you might wish to sell on. The drinking dates are backed up by over 100,000 reviews, so you can keep up to date with professional appraisals of your wines.

Bordeaux

In younger vintages, it’s about possible to start drinking 2001, 2002, & 2004. 2001 and 2004 have a reasonable amount in common, being both classically styled wines without the opulence or longevity of 2000 and 2005. Useful in this case to refer back to Jancis Robonson’s FT article (2 Apr 2011), which sets out the case for 2001 as a useful ‘forgotten’ vintage. 2001 Chateau Grand Puy Lacoste Pauillac 5eme Cru Classe AOC, rated highly in that article and with a market price of £423 seems like a particular steal, perhaps because Robert Parker’s rating, so often a market driver for Bordeaux prices, is quite low. The vast majority of the 2005s on the left bank are still developing, certainly so at First and Second Growth level.

Vintages from the mid-nineties are subject to growing demand, as these wines enter their prime drinking window. 95s and 96s in particular are beginning to turn serious – try Chateau Calon-Segur St Estephe 3eme Cru Classe AOC 1995 for a well priced example.

For those who don’t have a taste for the very tertiary, Bordeaux from the good mid-eighties vintages should be starting to get finished up now. Most 85’s, and certainly 86’s and 88’s, except at the very top level are getting close to the beginning of decline, and are better off on the table now than spending another few years in the cellar.

Burgundy

Aged Burgundy is notoriously difficult to source, but for those who already have it in their cellars, drinking dates are heavily vintage dependent. Collectors with 2007s in the the cellar, below Grand Cru level, can start to look at those wines now, with many showing an extremely fresh and vibrant character now, perfect for those who like an early drinking, energetic style.

Domaine Comte Georges de Vogue Chambolle Musigny Premier Cru AOC 2007

Older vintages, if you can find them, that are beginning to show well include 2002, and 1999: try Hospices de Beaune Corton Cuvee Charlotte Dumay Grand Cru AOC 1999 as an example of a Corton that should be drinking superbly now.

Champagne

Plenty of merchants and supermarkets will be gearing up for Christmas offers around Champagne in the next month, but the best way to be prepared is to start a year in advance. Most NV bottlings will seriously benefit from a further year in the cellar, so if you have the space to keep roughly 12 months stock of champagne and top up as you go, that’s the best way to make sure you’re drinking the wine at its peak.

At vintage and prestige cuvee level, 1996 and 1999 wines are both beginning to come into their own, with Moet & Chandon Dom Perignon Champagne 1999 showing particularly well recently.

With over 100,000 reviews available for more than 145,000 fine wines, we think Wine Owners offers a great solution to keeping track of your wines with over £37,000,000 of stock under management.

by Wine Owners

Posted on 2013-03-25

Thank you everyone who's been using our fine wine asset management and trading exchange since November 2012 when it first released.

As a result of all our fantastic feedback, we've just released a brilliant new version, providing quick answers to questions such as:

- how much have I spent to date;

- what’s a wine honestly worth if I wanted to sell it tomorrow; how have my wines performed;

- what should I drink now or drink up;

- what do I have too much of and what should I think of selling next to make room for what I’d like to buy next?

With this new release, Wine Owners provides answers to all those fundamental questions and a lot more besides, and is available now via complimentary subscription here.