by Wine Owners

Posted on 2021-06-08

Why is price transparency important?

Pricing data that is up-to-date, reliable and actionable supports the buying and selling process. By keeping buyers and sellers informed, it breeds confidence in making decisions. In turn, confidence boosts sentiment.

Whilst pricing data would have only been accessed through specialist catalogues or conversations with individual merchants previously, key information such as the provenance of the wine, pricing information and availability can now be accessed in an instant.

Our Wine Passport for example encourages users to record as much information about the wines they own as possible, enabling a more informed and transparent trading decision to be made.

With fast-growing demand from private buyers for sourcing directly from collectors, it has never been more important to rely on a simple, visual and informative interface to ensure competitive pricing.

How do we make sure we provide you with the most up-to-date and reliable data?

We have been in partnership with global wine price discovery website Wine-Searcher for many years, which has enabled us to create and maintain our referential database of over 385,000 wine entries.

Instead of spending hours trawling through data in order to calculate a realistic selling price, our algorithm processes millions of rows of pricing data to ensure you stay as informed as possible about the state of the market. Equipped with this information, you can easily and confidently determine the correct selling price to be competitive and attract buyers' interest.

How does it work?

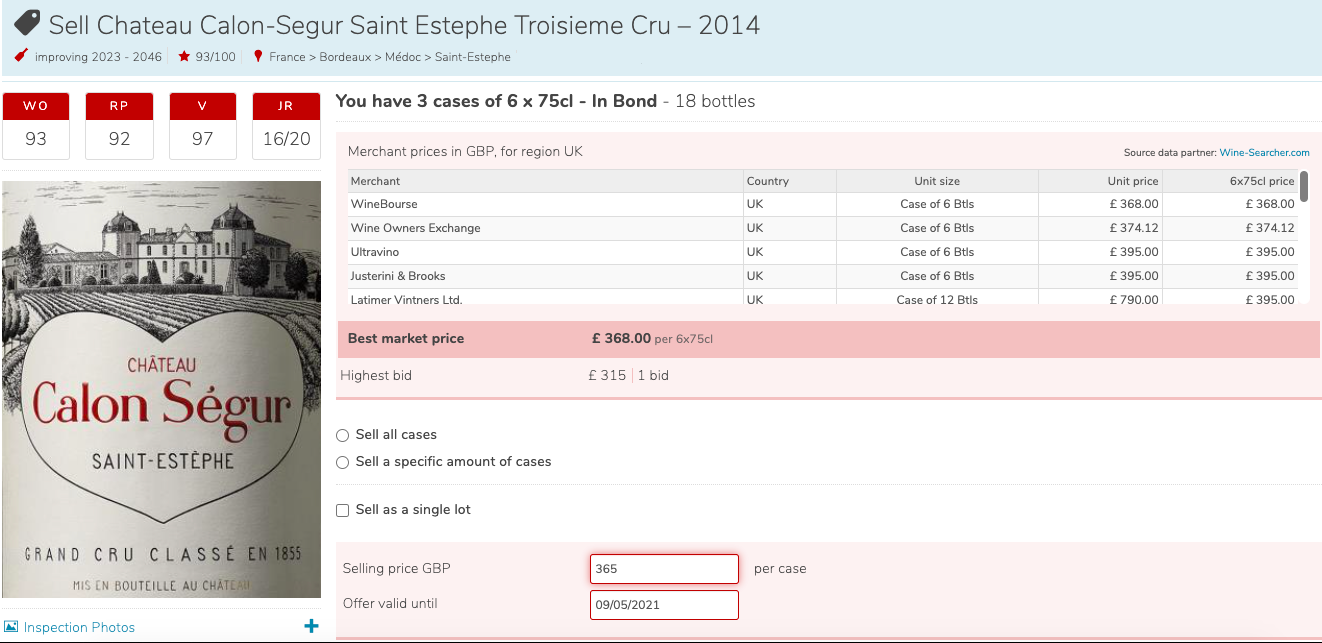

When you offer your wine for sale, you are presented with a live feed of current European marketplace offers for the wine in question, current Wine Owners offers and current Wine Owners bids, as seen below. You will also be able to view the latest bids and offers. If you are unsure or in the case where wines have gone through sharp price changes, it’s worth giving our trading desk experts a call, who will be able to advise you.

Keep in mind that the buyer will be paying an additional 2.5% + VAT buyer’s premium. We recommend you offer your wine for sale at around 2.5-3% below the best market price if you want to be shown on Wine Searcher as being the best offer. As around 20% of our new buyers are redirected from Wine Searcher, it is well worth your offer being at the top of their list.

If you’re in doubt, give us a call or email us contact@wineowners.com and we'll be happy to help!

by Wine Owners

Posted on 2019-09-09

August was much like July with summer holidays being the prime concern for most people. The wider market has felt quiet, maybe because the Bordeaux market is still largely flat, but there are definitely pockets of excitement about and the broad-based Wine Owners Index was up 0.9%. Trade was brisk with Piedmont, Tuscany and Champagne dominating turnover at Wine Owners.

The solid, relative value investment case for the wines of Piedmont has created demand which, in turn, has led to us step up our sourcing efforts. Liquidity is tight, obviously one of the plus points in the investment case, but we have managed to unearth some lovely parcels, particularly some legendary Bartolo Mascarello vintages.

Sterling has remained weak due to the Brexit shenanigans, and this has finally translated into some positive moves for various wine indices. As we know, a weaker pound generally leads to increased demand in the sterling denominated secondary fine wine market, especially from U.S.$ based buyers. Little has come out of Asia, however, as continuing rhetoric surrounding the U.S./China trade wars rumble on and Hong Kong is still suffering from the most vocal political protests in its modern history. They (the people of Honk Kong) have even appealed to Mr. Trump to help!

The largest region within the wine market will always be Bordeaux and it is business in the wines of Bordeaux that is suffering the most from these continuing issues. Many of the other top wine regions are less affected by these global events and market conditions as the wines are less traded, and the supply and demand ratio in a different place. Bordeaux has been looking cheap versus its peers for some time now, and there’s a lot of bad news in the price but the stars need to start aligning. This can and will happen, but when is the big question!

by Wine Owners

Posted on 2019-03-14

2007 £1,300 per 6 WO Score 96

2010 £2,100 per 6 WO Score 100

Bartolo Mascarello is one of the true legends of Barolo, think Rousseau or Roumier in Burgundy terms, in case you’re not familiar with the ‘Knights of Nebbiolo’. And if that’s still confusing, think Liverpool (Football Club), but I would say that, wouldn’t I? In fact, to be drawn against Juve tomorrow morning could easily inspire a trip to Piedmont, with a bit more than hazelnuts to look forward to! I digress…

Maria-Teresa Mascarello took over from Bartolo, her father, in 1993, the estate having been founded in 1918. Beautifully simple in its creation, the wine is a blend of four of the top crus, or vineyards and has been consistently and spectacularly successful for decades.

In the charts above and below we have compared various well-regarded vintages of a similar era. These vintages are very good and very scarce, two of the most important factors for investors as they are squirreled away by the canniest collectors and prices have been rising. They are still a fraction of their Burgundian cousins however and we have no issue with recommending a buy, particularly the ’07 and the ’10, the cheapest relative value bets here:

Tasting notes, courtesy of Vinous Media:

2007: Mascarello’s 2007 Barolo shows just how compelling this vintage can be, even now. Sensual, layered and totally voluptuous in the glass, the 2007 shows the more flamboyant side of Barolo. I find the wine’s voluptuous, engaging personality impossible to resist. Sure, 2007 is not a classic vintage, but when a wine is this good, I say: Who cares?

2010: The 2010 Barolo is one of the most striking, hauntingly beautiful wines I have ever tasted here. Mysterious and slow to show its cards, the 2010 impresses for its inner perfume, sweetness and exceptional overall balance. Today the striking fruit and classic, austere elements of the vintage take turns in dominating the wine's balance. The 2010 was always magnificent in barrel. It is equally spectacular from bottle. Readers who can find the 2010 should not hesitate. Ideally I wouldn't dream of touching a bottle until age 15 or so, although I doubt I will personally have the discipline to follow my own advice!

The 2007 is the cheaper option from a classic vintage and the 2010 is the turbo charge version from the all-conquering 2010 vintage. Both are recommended.

by Wine Owners

Posted on 2019-03-07

In terms of reputation Screaming Eagle is the ne plus ultra of American wines, the equivalent of Petrus on the Right Bank, Romanee-Conti on the Cote de Nuits and Conterno Monfortino in Piedmont.

The prices of the wine varies from £2240 per bottles up to £2600 per bottle for the vintages of 2009, 2011, 2012, 2013 and 2014, but over the last two years it has been the 2009 and 2011 that have made the greatest gains, with 37.9% and 42.7% respectively. Double digt growth seems to be the norm on a CAGR basis.

The 100 point vintages of 2010 and 2007 are roughly £3600 per bottle, and have gown at a slower rate in the last two years, suggesting again that there is better vakue to be had in the 97 to 99 point bracket currently.

Current market levels puts the 97 point ’09 at £2602 a bottle and the 94 point ‘11 at £2461 per bottle. These prices are at a premium of £350 and £200 respectively to the 97 point 2013 and 98 point 2014, which would seem a little illogical. Hard to see a justification for a discount for equivalently scored wines. As the chart below shows, the 2011 in particular seems over-priced and the more recent vintages would seem to offer greater upside potential.

Trying to compare Screaming Eagles with other US wines is a rather thankless task as it operates on a different pricing level entirely to every other wine in California. There are several things you can say about it in isolation, however:

- There is no vintage values at less than £2000 a bottle, and many tip the scales at over £3500 per bottle

- Three pack OWCs are the norm – almost all stock available comes in this format

- It has the highest average Parker score over the last twenty years of any wine in the world except Conterno Monfortino

- No more than 700 cases (12 pack equivalent) are made in any vintage.

It would seem logical to suggest for the medium to long term that younger, higher point scoring vintages offer the greatest potential for capital growth. Not for the faint hearted, of course, but the fundamentals of extremely small production, a style that will see each vintage improve for a minimum of 25 years form bottling and a brand that has cemented itself as the epitome of great modern Californian wine making make this a wine that needs to be considered very seriously as an unavoidable component in any top drawer cellar…

by Wine Owners

Posted on 2019-02-11

Sassicaia 2006, 94 points £2,050 per 12

Sassicaia 2009, 96 points £1,590 per 12

Sassicaia 2010, 94 WO points £1,430 per 12

Sassicaia 2015, 97 points £1,750 per 12

Sassicaia 2016, 100 points (WA) £2,700 now, released yesterday at £1,270!

I am now editing this blog originally written on the 25th January as yesterday saw the release of

Sassicaia ’16. Monica Larner of the

Wine Advocate heaped the magical three digit score and a boat load of praise meaning it sold out in seconds (she does hold sway!). I would have enjoyed being a fly on the wall of Armit’s office yesterday as the phones must have been red (pun intended) hot! If, like she says it will, the ’16 turns out to be just as good and valuable as the ’85 vintage, 31 years from now, that would yield a most respectable 8%

CAGR (compound average growth rate). One should take note, however, that the price of the ’85 more than doubled in the last three years so buyer’s beware! I repeat my recommendations from before.

Original post:

When we began researching Sassicaia for this post we began by thinking it would turn out be a good and solid egg. We were right. Other than the stratospheric and legendary 100 point ’85, now c.£30,000 per 12, up from £12,000 three long years ago, Sassicaia is a really steady holding. It’s a wine that gets drunk readily, is approachable at a younger age than most investment grade wines and doesn’t tend to get dumped in a downturn.

The 2015 is another exception to this generalisation, not least because last November it claimed the coveted Wine Spectator’s ‘Wine of the Year’ 2018, causing the price to do this:

It is interesting to note that the Wine Advocate’s upgrade from 91-93 to 97 points in February 2018 had no lasting impact on price – do they not influence this corner of the market, we wonder?

In an efficient market, there’s a great short to mid-term switch play here, selling '15 and buying the cheaper and older ’09 or ’10 vintage where supply is shrinking faster. This is the wine market though, and trades like these not always play out. Judging from the price of the ’06, there is sufficient upside to these two vintages to suggest a purchase, especially if conservative is your thing!

The younger 2013 also looks cheap (but much more plentiful):

Buy: 2009, 2010, 2013

Trading sell: 2015

by Wine Owners

Posted on 2019-02-07

The broad-based WO 150 Index was flat for the month, as were nearly all the indices. The only real note of interest was the Burgundy Index, dropping by 0.7%. As you can see from the graph below it has been the stellar performer amongst the great wine producing regions of the world. It’s far too early to start calling a general cooling off period but as I have been arguing here it feels right to top slice some of the better performing names and start looking for some laggards.

The numbers in the box below are performance numbers over a five-year period, so all very respectable but nothing comes close to Burgundy. The consistency and lack of volatility must surely be a thing of beauty to the investor and connoisseur alike?

January is a busy month in the wine world when the latest Burgundy vintage is sold ‘en primeur’. 2017 was a decent vintage (See WO Blog) and has sold through pretty well given another year of testing prices.

The ‘Southwold group’ met in January to review the now in bottle Bordeaux 2015 vintage and there are two excellent reports on the three day session to be found on Vinolent.net and FarrVintners.com. In brief summary, ’15 is maybe not quite the excellent vintage that was first pronounced, certainly when judged by ‘English’ palates but still pretty damn good with some show stoppers therein. At the end of the Farr report there is an interesting table of recent vintages in order of perceived quality.

Here at Wine Owners we are betting more heavily on the ’16 vintage (not yet included in the Farr report) which we believe will move very close to the top of the leader board. Messrs Martin and Galloni of Vinous Media have recently reviewed the 16s in bottle and are waxing lyrical. Our very own meteorology and Bordeaux expert called the ’16 vintage some time back - pre the en primeur tastings even! All subsequent tastings and encounters of the vintage have confirmed our views and we are confident enough to shout BUY. What and when is a much more interesting question - so please get in touch to hear our thoughts.

by Wine Owners

Posted on 2019-01-31

Domaine Bruno Clair, Chambertin, Clos de Beze 2010

WO Score: 94

Price: £3,120 per 12

Note from Burghound (93-96 points):

A spicy, pure and admirably refined nose offers up notes of cool, layered and an impressively broad mix of wild red berries, stone and underbrush hints. The textured and almost painfully intense broad-shouldered flavors possess deep reserves of tannin-buffering dry extract as well as the same extraordinary finishing depth that the nose hints at. A knock-out but this is expressly built to age and the flavors and tannic spine are so tightly wound that it's pointless to buy this if you do not intend to age it for at least 10 to 12 years first.

Domaine Drouhin-Laroze, Chambertin, Clos de Beze 2010

WO Score 96

Price: £1,410 per 12

Note from Burghound (93-95):

A spicy, ripe, elegant and admirably pure nose offers up notes of anise, sandalwood and clove that add breadth to the floral, earth and stone-suffused aromas. There is the same superb breadth to the rich, intense and tension-filled full-bodied flavors that possess excellent power and drive on the seductively textured, muscular and classy finish.

Both the Drouhin-Laroze and the Bruno Clair expressions of Clos de Beze from the blockbuster 2010 look attractive at current levels with the less fashionable Drouhin-Laroze really standing out - there are a few cases in the market too. Both get great scores across the board from the critics and have not kept pace with the sizzling Burgundy index (Drouhin-Laroze in light blue) over the last three years:

Whilst seeking high quality wines that have lagged the Burgundy market, these two have popped up as good candidates. More and more market watchers will be searching for this type of opportunity, so some catch up is expected. Neither have hit their drinking stride yet but when the scarcity kicks in, will it be possible to source them when they do? I doubt it.

Although it is not comparing like with like, Rousseau’s take on this famous piece of dirt, (rated at 94-97) at £40,000 per 12, is probably fully valued and I for one would be making a switch! Putting it another way you can buy 28.5 bottles of the Drouhin-Laroze product for one of dear Monsieur Rousseau’s! The Clair to Rousseau ratio a more modest 1:13, but still!?

by Wine Owners

Posted on 2018-05-17

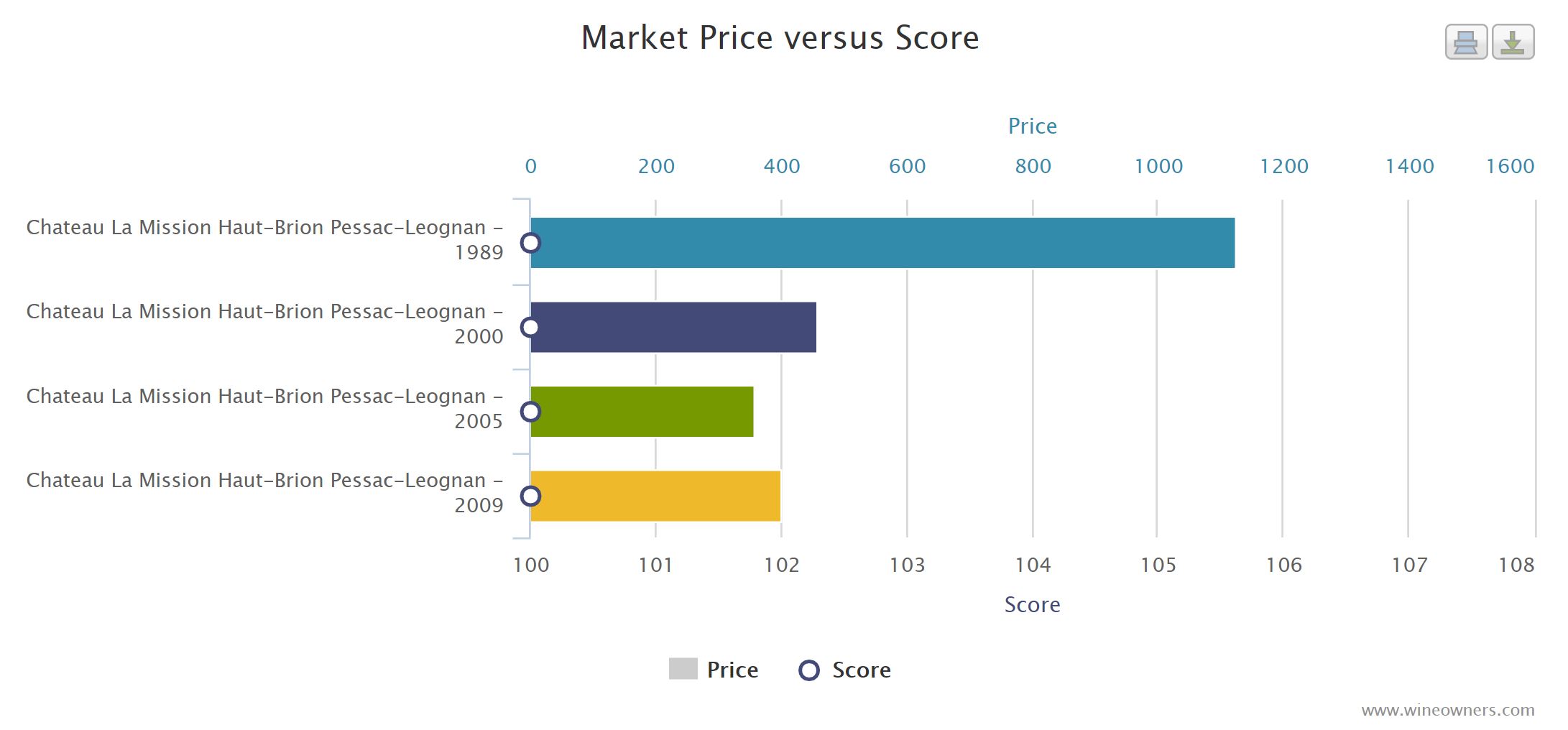

An overlooked example of value for money here from the 100 point La Mission 2005. Compared to Domaine Clarence Dillon stablemate Haut-Brion, and the rest of the 2005 First Growths, 2005 La Mission is a clear winner in terms of value as is eminently clear from relative value analysis. The only other 100 point wine on the whole left bank is Haut-Brion, which trades at around £6,500. The other Mouton will cost £5,250, Latour £6,600, and Margaux £6,100, all on 98 points, while Lafite lags behind them all in relative terms, commanding £7,700 for 96 points.

Compared to other 100 point La Missions over the year, the 2005 wins out on relative value as well. Whether any of the 2009, 2005 and 2000 will hit the price highs of the legendary 1989 is a subject on which the verdict is very much out, and will depend on how reputation of the vintages develops. Nevertheless, all three look like relatively sound buys, and the 2005 at the offer price just beats the rest (assuming they can be bought at market level).

“The 2005 La Mission Haut-Brion is pure perfection. It has an absolutely extraordinary nose of sweet blackberries, cassis and spring flowers with some underlying minerality, a full-bodied mouthfeel, gorgeously velvety tannins (which is unusual in this vintage) and a long, textured, multi-layered finish that must last 50+ seconds. This is a fabulous wine and a great effort from this hallowed terroir. Drink this modern-day legend over the next 30+ years. Only 5,500 cases were produced of this blend of 69% Merlot, 30% Cabernet Sauvignon and 1% Cabernet Franc.”

100 points, Robert Parker

La Mission Haut-Brion 2005 is offered £4,300 on the Wine Owners Exchange (£4,435 including fees)

by Wine Owners

Posted on 2017-04-05

by Wine Owners

Posted on 2017-03-28

Keen followers of Bordeaux can’t have missed the striking price revivals that have been in progress over roughly the last 12 months, and Mouton Rothschild 2006 makes for in interesting case study.

We’re looking here at what is effectively an over-performing wine in an under-appreciated vintage. 2006 Mouton has consistently been rated highly by both Robert Parker (last scored at 96 in 2014) and Neal Martin (scored at 97 points in May 2016), and compares very favourably to the other First Growths in 2006. Latour consistently scores around 94-95; Lafite at 95 from Neal Martin, 97 from Parker; Margaux at 94 and Haut Brion at 96.

Not only that, it outscores or equals itself in what ought to be better vintages. The 2005 is likewise rated 97 by both Parker and Martin, and 2006 is only outscored in recent vintages by 2009 and 2010. No doubt then that winemaker Philippe Dhalluin did exceptional work in the vintage, and those buying at the nadir of the market in and around January 2015 were picking up a serious bargain at around £3000, the same price as the far less interesting 2007, and rather cheaper than the less well-rated 2008.

However, having risen in value throughout 2016 from £3200 to £4400, the market price has stagnated since October 2016, and now stands at £4500, with bids standing around £4130, which is still the highest this wine has traded at since 2011, but starts to look like the top of the market. For drinkers, this seems to continue to represent good value, but for those interested in wine as a store of value, quite possibly one to swap out.

Click here to see live trading information on Mouton 2006.

Did you know...? British artist Lucian Freud was commissioned to create the label for the 2006 vintage of Château Mouton-Rothschild. "Far from the tormented portraits and nudes for which he is renowned, [he] chose a joyously exotic transposition of the pleasure of drinking, in which the vinestock is transformed into a springing palm tree and the wine lover into a happily anticipatory zebra." Source: Chateau Mouton Rothschild.

INTERESTED IN BORDEAUX? We will be in the Bordelais covering the en primeur campaign, so don't forget to follow us: - on Twitter - on Instagram - on Facebook |