by Wine Owners

Posted on 2019-09-17

WO reveals a brand new trading exchange for fine wine to make it even easier for wine lovers and collectors to buy and sell fine wine online.

It’s now even easier to buy fine wine stored in professional storage by collectors, with a brand new interface to make purchases or bidding more informed and easier than ever.

Collectors who wish to offer wine for sale will benefit from an enhanced price discovery process that makes selecting the best price very straightforward.

There are over 3,000 offers for sale on the Wine Owners trading exchange at any time. Transaction values average £1,400.

Wine Owners’ world-class collection management tools are used to organise, value and track £350,000,000 worth of wine.

Our technology is used by warehouses, retailers, clubs and auction houses to track £1.25bn of wine inventories.

“With the market for self-directed brokerage and wine trading firmly established, we have responded with wholesale changes designed to make selling and buying wine in a marketplace format intuitive and well-informed,” explained Nick Martin, CEO.

“Collectors appreciate being in control of their offers for sale, with tools that enable them to accurately price their wines, and the means to be able to respond to market demand and amend or change the status of their offered wine for sale 24/7.

Buyers appreciate being able to buy professionally-stored wines directly from collectors with transparent provenance, at purchase prices that reflect the low commission rates applied. With fast-growing demand from private buyers for sourcing direct from collectors, we have responded by introducing a simpler, more visual and informative interface to meet the needs of the wine-loving community.”

Wine Owners contacts

Nick Martin is co-founder and CEO of Wine Owners, following a career in information management and technology marketing during which he worked for large brands such as Vodafone, BT, IBM, GEC and Disney to build their customer information databases and data-driven marketing capabilities.

Nick co-founded Wine Owners with ex-Shell technologist Wolter Visscher, who had previously formed his own software house operating in financial services, health services and publishing.

Nick Martin

nick.martin@wineowners.com

Cellphone + (0)7828 170250

Clotilde Muller

Marketing Manager

clotilde.muller@wineowners.com

Landline: + 44 (0)20 7278 4377

by Wine Owners

Posted on 2018-11-01

Wine Owners started business in the global centre of Fine Wine, London, in 2013. The brainchild of Co-Founder and CEO Nick Martin and the result of brilliant software engineering from Co-Founder and CTO Wolter Visscher, the Wine Owners platform was created to organise and track the personal wine collections of sophisticated wine collectors and wine enthusiasts from around the world.

From its inception Nick and Wolter envisioned the platform as being capable of being ‘White Labelled’ by other players in the wine industry and developed it from the get go as a Software as Service ( SaaS) platform to support client relationship management programs and add value to their wine services offerings. Its best-in-class collection management and analytical tools attracted consumers directly to https://www.wineowners.com, while it also has been adopted as a platform by 20 partner brands who have deployed the SaaS platform to enhance their storage, inventorying and collection management propositions, including Corney & Barrow, 67 Pall Mall, Oswalds and Western Carriers. For further information on these companies' use of the platform and to download use cases go to wineowners.biz.

The company reached a major milestone this month - Nick Martin comments - “We are thrilled to announce that the platform has broken through the $1bn barrier of wine organised and tracked directly through our own brand and those of our market partners. Our goal is simply to bring as much value as possible to the lives of consumers with wine collections and those who have been bitten with the bug and are starting out.”

Wine Owners also operates an integrated peer to peer trading exchange, available in key jurisdictions, as a service to members that provides them with direct access to the secondary market at low rates of commission.

Platform users have accumulated collections worth on average $55,000, encompassing those people new to wine with a few dozen bottles up to multi-million dollar collections.

With recent partner additions and subscribers to the Wine Owners site, Wine Owners now has over $1bn of wine being tracked on the platform.

With a pipeline of new SaaS customers for the White Label Platform, and planned US expansion, Wine Owners looks forward to seeing this number grow substantially in the months ahead.

For further information:

Wine Owners contacts

Nick Martin is cofounder and CEO of Wine Owners. He’s been collecting wine for 30 years, and following a career in information management and technology marketing during which he worked with large brands such as Vodafone, BT, IBM, GEC and Disney to build their customer information databases.

Nick co-founded Wine Owners with ex-Shell technologist Wolter Visscher, who had previously created his own Software House operating in financial services, health services and publishing.

Contact details:

Nick Martin

nick.martin@wineowners.com

Cellphone + (0)7828 170250

Clotilde Muller, Head of Sales and Marketing

clotilde.muller@wineowners.com

Landline: + 44 (0)20 7278 4377

by Wine Owners

Posted on 2018-09-24

Vinous, a leading wine publication founded by critic Antonio Galloni, and Wine Owners, a best-of-breed collection management platform, today announced a partnership that allows Vinous subscribers to access reviews for wines within their Wine Owners account.

Vinous’ wine reviews are widely considered to be the most respected in the world, a result of their all-star team of wine critics spending months of the year traveling to the regions they cover. Wine Owners enables 15,000 collectors and wine lovers to organise, track, value and inform their wine collecting and appreciation. These users will now be able to benefit from Vinous’ leading insight into the fine wines of the world seamlessly integrated into the collection management platform.

“We are thrilled to be partnering with Wine Owners in creating a program that gives Vinous subscribers the ability to see Vinous reviews directly within their Wine Owners account,” said Vinous CEO Antonio Galloni. “Wine Owners’ commitment to providing a modern solution for the logistical challenges consumers face with inventory management is impressive.”

“We are thrilled to be able to offer our members who are subscribed to Vinous all the reviews, scores and drinking dates from their gifted team of tasters that includes Antonio Galloni, Neal Martin, Stephen Tanzer, Josh Raynolds, Ian D’Agata and David Schildknecht” commented Nick Martin, Wine Owners CEO. He continues, “Vinous content will substantially help our members to understand and appreciate their wines. We are proud to be associated with the whole Vinous team.”

Wine Owners members can create a Vinous subscription at Vinous.com, at the Classic level or higher, to see Vinous reviews within their pre-existing collection management account.

Vinous Classic and higher subscribers can create an account at wineowners.com and simply connect their Wine Owners account to their Vinous subscription to see Vinous reviews within their account.

= = = = =

About Vinous

Vinous is one of the world’s most influential wine publications. Founded in 2013 by Antonio

Galloni, Vinous grew in 2014 through the addition of Stephen Tanzer’s International Wine Cellar

and its team of noted critics. Vinous expanded its digital platform in 2016 through the

acquisition of Delectable. Today, Vinous has readers in over 90 countries around the world and

provides comprehensive reviews of new releases, hosts vertical tastings and retrospectives, and

creates in-depth video content on location from the world’s most celebrated wine regions,

among many features.

About Wine Owners

Wine Owners is an online wine collection management platform and trading community for people who love and collect fine wine. It brings together everything to organise, value and track a fine wine collection: a vast database of fine wine with a wealth of information; pricing for current market valuations and 10-year price history; and direct market access via a dynamic fine wine marketplace that makes it simple and cost-effective to sell your wine yourself, or to buy from other wine collectors. To date, Wine Owners enables 15,000 wine collectors to track a total of over $900,000,000 of wine.

For further information:

Nick Martin

nick.martin@wineowners.com

Landline: + 44 (0)20 7278 4377

Cellphone + (0)7828 170250

Clotilde Muller, Marketing Manager

clotilde.muller@wineowners.com

by Wine Owners

Posted on 2017-11-23

Wine Owners, the global fine wine collection management platform and peer-to-peer trading exchange, has released its market performance data for the last year and predictions for 2018.

Wine Owners is also the fine wine market data provider to Knight Frank, having developed the Knight Frank Fine Wine Icons index (KFFWI), included within the influential Wealth Report.

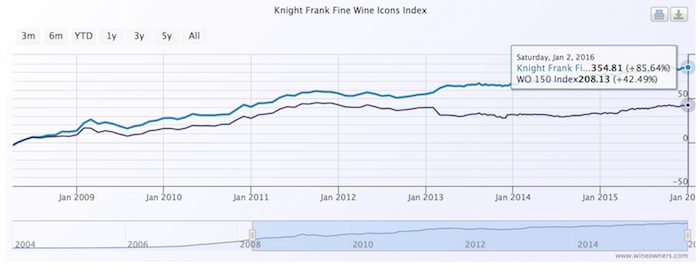

The Knight Frank Wealth Report 2017 called out fine wine as the best performing passion asset of 2016 – with their Knight Frank Fine Wine Icons Index (KFFWI) up 24%. The KFFWI includes some scarcity-driven markets in its composition – reflecting high net worth interest in hard to find iconic wines.

Over the previous decade the KFFWI index rose 267%, second only to the classic car market that until last year had, literally, raced ahead.

By way of comparison, The Wine Owners 150 (WO 150) Index – that reflects a balanced portfolio of collectible blue chip fine wines (and therefore heavily weighted to include blue chip Bordeaux) – rose by a rather more moderate 137% over the same period, yet also gained 25% in 2016 as the Bordeaux market shifted from recovery to catch-up mode.

2017 has seen consolidation of those gains and high single digit growth with the Wine Owners 150 Index rising 7.25% to date.

The Wine Owners’ Fine Wine Predictions report analyses performance by each of the major wine producing regions, including Bordeaux, Burgundy, Champagne, Rhone, Italy, Spain and the USA, identifies where there’s value, reviews buying strategies, and highlights opportunities for growth.

You can download the report free here

= = = = =

About Wine Owners

Wine Owners is a market leader in fine wine collection management and global peer-to peer trading.

Launched in 2013 Wine Owners has built a community of wine lovers, collectors and wine-related businesses comprising:

- £650,000,000 of fine wine catalogued, tracked and valued

- 300,000 referential wine entries

- 100 million price points processed annually

Authoritative market pricing is produced using very large amounts of data from Wine Searcher the world’s comparative pricing wine search engine, applying proprietary pricing algorithms developed by our experts.

Wine Owners additionally implements white-labelled technology to wine trading companies, warehouses, private members’ clubs and family offices who operate the platform under their own brands.

- ends -

For further information:

Nick Martin

nick.martin@wineowners.com

Landline: + 44 (0)20 7278 4377

Cellphone + (0)7828 170250

Clotilde Muller, Marketing Manager

clotilde.muller@wineowners.com

by Wine Owners

Posted on 2016-07-21

Members of Wine Owners, who use the ground-breaking 3 year old collection management platform and integrated wine trading exchange to manage and track their wines and buy and sell with their peers, can now gain access to Robert Parker reviews and content as part of their Wine Owners premium membership plans.

Their fully inclusive 12-month subscription to eRobertParker.com gives:

- Access to more than 300,000 professional tasting notes, Wine Journal, Hedonist's Gazette restaurant reviews, and direct chat with Reviewers via Bulletin Board.

- Global series of Matter of Taste events at members' price

- Access RP Global Benefits Program to enjoy members' privileges.

- Robert Parker mobile app.

Wine Owners Founder, Nick Martin, said “We are delighted to have reached agreement with the Robert Parker Wine Advocate team to provide an annual subscription and access to their service for our premium members. We are honoured to be partnering with them and including this must-have content within our membership plans.”

“Our goal at Wine Owners is to make each person’s journey into wine appreciation more transparent and informed; to empower them through providing the tools, information and low-cost direct market access that we all want”.

“As a wine enthusiast since the mid 1980s, Robert Parker’s insights were an essential information resource for me as my interest in wine grew. We are thrilled to share that experience with collectors who today rely on the Wine Owners platform, and with the new generation discovering wine.”

#####

NOTES TO EDITORS

About Wine Owners

Wine Owners is a UK headquartered wine collection management and peer to peer trading exchange platform that launched in June 2013, specifically developed to meet the needs of wine lovers and collectors around the world.

Wine Owners brings together the collector passion, fine wine knowledge, technical and data know-how to create a comprehensive and effective platform for fine wine appreciation and trading.

Today the platform is used by 15,000 members in 19 countries who manage £500,000,000 of wine. It is an authority on wine valuation and provides information and market transparency to its thousands of members.

About Robert Parker

Robert Parker is a leading U.S. wine critic with international influence. Credited for popularizing the 100-point wine rating scale, he has built a talented team of global wine experts to expand the scope of reviews produced.

Robert Parker Wine Advocate is the most influential global guide to fine wine buying and is a major factor in setting prices for newly released vintages around the world, particularly in Bordeaux.

In 2001, Wine Advocate team launched online website RobertParker.com – The Independent Consumer’s Guide to Fine Wine.

About RobertParker.com

From its beginning in 1978 as a detailed consumer’s guide that is 100% subscriber funded and supported, Robert Parker Wine Advocate quickly established itself as unbiased, in-depth and highly influential globally. Both wine trade professionals and collectors/connoisseurs read through over 30,000 reviews annually.

Today, RobertParker.com is one of the most viewed wine sites in the world with an average of 1 million visits per month, and includes a dynamic Bulletin Board where members can trade experiences about wine, food, travel and luxury lifestyle choices.

Robert Parker Wine Advocate also hosts Matter of Taste, a series of global events bringing the iconic wines of the world to all Robert Parker members – held in 9 cities in 2014-2015.

by Wine Owners

Posted on 2016-03-03

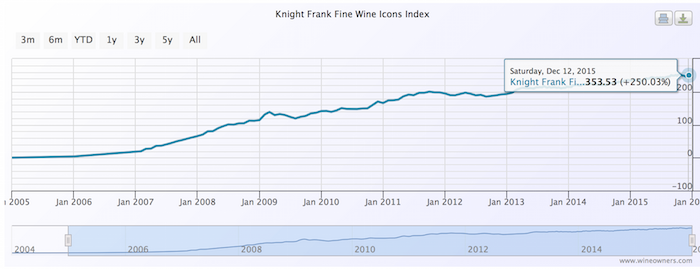

Two years ago, we introduced the Knight Frank Fine Wine Icons Index (KFFWI Index), created exclusively for Knight Frank. The KFFWI Index reflects a representative basket of the world’s 40 most iconic wines, drawn from key regions of production.

The Knight Frank Fine Wine Icons Index (KFFWII) - made up of many of the world’s most sought-after and trophy wines - is up 85% in the last 5 years, outperforming the Wine Owners 150 (market tracker) index by 50%.

Over a 10 year period, the index has grown by 250%.

Bordeaux on the rise

With new collectors coming into the market in greater numbers, and a year of solid if unspectacular gains under Bordeaux’s metaphorical belt, the market appears set for another year of single digit rises. As Bordeaux is the world’s single largest region of quality wine production, we expect to rebalance the Knight Frank Fine Wine Icons Index back towards top Bordeaux, principally from great, older vintages .

With this in mind, it’s not surprising that of the 25 top-performing First Growths in 2015, only two were from 2009 or 2010. Those vintages that performed best were 1989, 1990, 1996, 2000, and 2005.

We continue to see opportunities in Bordeaux in 2016 as the market continues its recovery.

2005 Classed Growth Medocs were up 9% in 2015, yet we are likely to see further upward momentum during 2016. It is a great vintage currently going through a backward, tannic phase, yet when it emerges from this part of its cycle it is likely to be seen as being on par with the great 2010 vintage.

Italy, Burgundy, California

Looking more widely, Overall, the Wine Owners Northern Italian Index is up 7.5% over the last 12 months, and will surely gather further momentum in 2016 with the continued interest in Barolo and Barbaresco.

Burgundy remains hot, with the Wine Owners Blue Chip Burgundy index up 15% in the last 12 months, and 26% over the last 3 years. California fine wine performance has been similarly strong.

Buying strategy

More than ever, ‘wine picks’ within a framework of quality, wine style, and relative value, is key.

Quality

For primary market releases the old saying ‘follow the producer, not the vintage’ still holds true, but these days that loyalty must be subject to the sense check of the ‘relative value’ analysis explained below.

The risk involved in buying within the secondary market is significantly mitigated by the body of tasting notes that accumulates as wine ages, allowing a proper evaluation through consensus, and a better sense of style.

Wine Style

The fashion for big, extracted wines is on the wane. The trend is firmly back towards wines of balance and finesse, and this is especially true of the most expensive wines. Modern styled producers tend not to see value appreciation to the same extent as their more timeless counterparts.

Relative value

High value wines bought to be kept for a number of years are commonly selected on relative value. Selecting specific critic scores and generating a price per point allows the collector to see which wines have, on balance, an upside.

Typically, price per points analysis is conducted on a vertical of a single wine’s vintages or comparatively between other producers’ wines from the same vintage within the same category or group of wines.

This week, Knight Frank launched the 10th Edition of the Knight Frank Wealth Report, which offers a unique glimpse into the attitudes, investments and choices of ultra-high-net-worth individuals (UHNWIs) from around the world. You can download the report here.

by Wine Owners

Posted on 2014-11-10

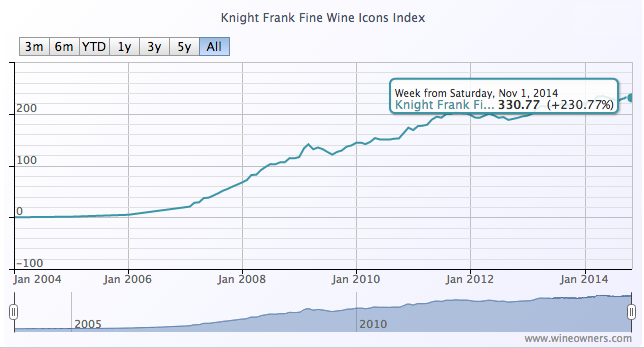

Created by Wine Owners* exclusively for Knight Frank, The Knight Frank Fine Wine Icons Index (KFFWI Index) reflects a representative basket of the world’s 40 most iconic wines, drawn from key regions of production. Up to 5 vintages of each wine are included.

The KFFWI has delivered growth of 230% over the last 10 years. Looking at the last 7 years growth has been 115%, 43% over 5 years and 8.5% over the last 3 years.

Given its role as the world’s largest fine wine region of production, Bordeaux is strongly represented with 14 wines, encompassing all of the First Growths. The performance of any fine wine index since Bordeaux’s peak in June/ July 2011 will reflect – and be depressed by - the very significant falls experienced since then.

Those highs were driven by unprecedented demand from China in the years leading up to 2011. Speculation overtook the interests of an orderly market, with brokers betting on which wines would become the next recognised brands in the Chinese market, creating an investment bubble.

Since the bubble burst, First Growth declines have averaged -28%, with certain wines halving in value, for example Lafite 2005 has fallen by -48.6%.

Volatility creates buying opportunities in any market, and wine is no different. When sentiment is negative, markets will tend to overshoot as they readjust. Whether we'll see a recovery this year or next remains to be seen. At some point in that timeframe sentiment towards Bordeaux will improve as prices bottom.

It may take the remainder of 2014 for market positions to unwind. Prices will start to firm up as and when channel inventories start to deplete. Calling the bottom of a market is notoriously problematic, but back vintages are looking more interesting than at any time in the last 4-5 years.

Other fine wine regions have performed exceptionally well over the last few years, notably Burgundy. Top burgundy has averaged 63.5% growth over the last 5 years, and 34% over the last 3 years. Scarcity of supply of demanded wines is a key driver of future value, and Burgundy has suffered a string of short vintages since 2010, a factor that is likely to lend support to current pricing levels of new releases.

The top 20 performers over the last 12 months reflect the increasing the growing interest in northern Italy.

Bigger production volumes offer better market liquidity, to the benefit of Super Tuscan brands, and which Solaia and Masseto enhanced by distributing through the Place de Bordeaux.

Barolos and Barbarescos from 2010 - considered to be a great Piedmont vintage, have ignited interest in the region - and its similarities with Burgundy - small estates, fragmented ownership, mono-cepage (single noble grape variety) and scarcity - suggest there is future value to be achieved if same degree of general qualitative improvement seen in Burgundy over the last decade can be demonstrated.

The bottom 20 performers over the last year simply reinforce the decline of Bordeaux prices.

by Wine Owners

Posted on 2013-04-04

Wine Owners – https://www.wineowners.com - the world’s first full service, independent fine wine asset management and trading exchange created by collectors for collectors, has just became finer still with the release of a new version inspired by user suggestions received over the last five months since the first release.

The Wine Owners platform is unique and is the first complete fine wine management solution for the whole spectrum of wine owners from enthusiasts to investors. It provides a wide range of integrated complimentary services and powerful tools for portfolio management - understanding, updating, analysing, comparing - and trading fine wine collections; inspired by the experiences of its founder, Nick Martin.

A veteran business leader from the world of information management and marketing, and with little spare time to devote to managing his beloved collection, he found it painfully time-consuming to trawl the Internet researching potential purchases and reviewing his wines.

Martin says: “There are some very basic questions I want quick answers to: how much have I spent to date?; what’s a wine honestly worth if I wanted to sell it tomorrow?; how have my wines performed?; what should I drink now or drink up?; what do I have too much of, and what should I think of selling to make room for what I’d like to buy next? The answers were out there but it was really time-consuming work piecing together the disparate sources.

“With this new release, Wine Owners provides answers to all those fundamental questions and a lot more besides, and is freely available thanks to a complimentary subscription.

“Determining what a wine is really worth demands a reliable pricing database. The process of price discovery is, after all, an essential precondition to any good trading environment. Buyers and sellers alike need the certainty of knowing at what price a wine is likely to find a market. Transparency and easy access to information empowers private clients to take decisions, just as many already do for their traditional investments.”

Wine Owners teamed up with Wine Searcher which sources pricing data from 25,000 merchants worldwide representing millions of real retail price points. Using proprietary algorithms, Wine Owners calculates a Market Level for each one of 85,000 wines in its referential database, based on the supply characteristics and spread of actual market prices for each one.

Martin believes that Market Level pricing is a significant step forward in bringing greater transparency to a highly fragmented market. “Private clients have the right to know at what level their wine is likely to sell, and therefore its true worth. Buyers have a right to know what is fair value,” he says.

“With the price escalation in fine wine witnessed over the last decade, the challenge of valuations in a burgeoning wine fund scene, and the opening up of large new markets such as China, reliable price discovery is more important and challenging than ever before. It’s one that Wine Owners simplifies for subscribers who can value individual wines or their entire collection freely.”

Martin’s desire to solve his fine wine needs also extended to secondary market trading; he yearned for more control over how his wines were sold.

“Selling via the secondary fine wine market can take time, from the moment a private client gets quotes to the receipt of funds following settlement, commonly months later,” he says. “Many wines can sell well through traditional channels, others don’t. There had to be a simple alternative that would give me the transparency, control and choice I craved.”

Martin says that none of the existing cellar management products and online sales options solved these problems. “Wine enthusiasts and collectors are crying out for the whole cycle of collecting to be made easier for them, and that can only happen when a single platform integrates physical storage with portfolio management, price discovery and safe, assured trading,” he says. “That’s what we mean by full service and is exactly what Wine Owners delivers.”