by Wine Owners

Posted on 2016-02-18

Looking ahead to the forthcoming Bordeaux En Primeur release, it seems like there’ll be plenty to be excited about, at least from a quality perspective, and there’s already a good deal of speculation about release strategies.

It’s fascinating that Chateau Mouton Rothschild has come out with a similar announcement to Chateau Latour’s 2013 En Primeur campaign withdrawal. It amounts to essentially the same thing, nuanced differently.

“Sales of our wines in bottle are growing a lot and we’ve got to the point where we don’t have enough bottles left in our cellar."

“We won’t be buying our wine back but we will be releasing less of it en primeur as we have to rebuild our inventory.”

“We haven’t lost faith in the en primeur system but you have to be reasonable with your pricing as there are so many reference points for consumers now.”

This roughly translates, into words that you and I will understand, as: "in an increasingly transparent world where discerning consumers can analyse and evaluate young wines by their relative value to past vintages, the only way we can get an en primeur campaign away is by pricing at a discount to comparable previous vintages, that recognises the end-user buyer needs a reason to buy early. That doesn’t seem to make a great deal of sense if we wish to capitalise on growing worldwide demand. Going forward, we would rather not give that discount away to more than a tiny number of en primeur buyers who will help us establish (hopefully higher) future secondary market pricing. That will create the preconditions for us to capture a much bigger slice of the downstream value of our wines, satisfying shareholder requirements for income growth and capital (land) appreciation.”

With Latour and Mouton effectively ‘out’, how will the remaining Firsts respond next year?

Last year there were only a small handful of wines worth buying early. That’s not to say there were not plenty of lovely wines made in 2014, but very few were sufficiently well priced to justify tying up cash. Given the overall superior quality of 2015, producers will hike up their prices, possibly quite a bit. Given that, it’s quite likely that savvy wine buyers will do well to continue to focus on relative values from comparable back vintages and revisit 2015 in a few years’ time. Meanwhile the impending campaign is bound to throw a spotlight on 2000, 2005 and even the better values within 2009 and 2010.

by Wine Owners

Posted on 2016-02-15

As expected, Bordeaux continues to dominate trading on the exchange both by value and volume. Reported figures much the same as the previous quarter, with Bordeaux accounting for 75% of trades, and 75% of trading value. The latter is a 5% fall from the previous quarter, which reflects an increased number of trades overall, and in increase in bulk trades of slightly lower value wines in the runup to Chinese New Year.

Burgundy has increased market share on last quarter, now accounting for 15.75% of trade by value, and 11.55% by volume. Both figures are big steps up from the previous quarter, and serve to demonstrate that the marketplace is still small enough to be affected by parcels from individual collectors providing a sudden elevation in liquidity, especially outside Bordeaux.

The First Growths accounted for the largest shares of the market in terms of value trades, and within that number Mouton Rothschild had the best of it, with a 31.8% share of the First growth market by value. Lafite trailed slightly at 26.1%. Haut Brion showed higher than expected at 16.67% and Margaux held its ground at 11.9%.

The surprise in this quarter has been Latour, which has trailed at 7.14%. Hard to determine whether that’s just slightly lower availability of Latour in the market over that period, but either way it seems like the two Rothschild properties are on top at the moment.

The increased focus on Burgundy came at the expense of Italy, which seems to be slightly off the boil compared to the previous quarter’s promising outlook. In fact, Italy was clearly overtaken on volume by the Rhone, which ran at 5.89% of volume traded v Italy’s 1.54, although on value traded the figures are rather closer.

Access the Trading Desk to view recent trades, bids & offers.

by Wine Owners

Posted on 2016-02-02

No, we’re not referring to an ancient Microsoft operating system release, but to a potential purchasing window for Bordeaux 2000.

Word on the street is that there could be a bumper set of new reviews released this year of 2000 claret on erobertparker.com – 15 years on.

And why not, it’s one of the 4 greatest last vintages, alongside or after 2005, 2009 and 2010.

The wines show effortless balance, are precise and richly fruited, and in the case of top classified crus, are still at a very early stage of their evolution, with their peak years still ahead of them.

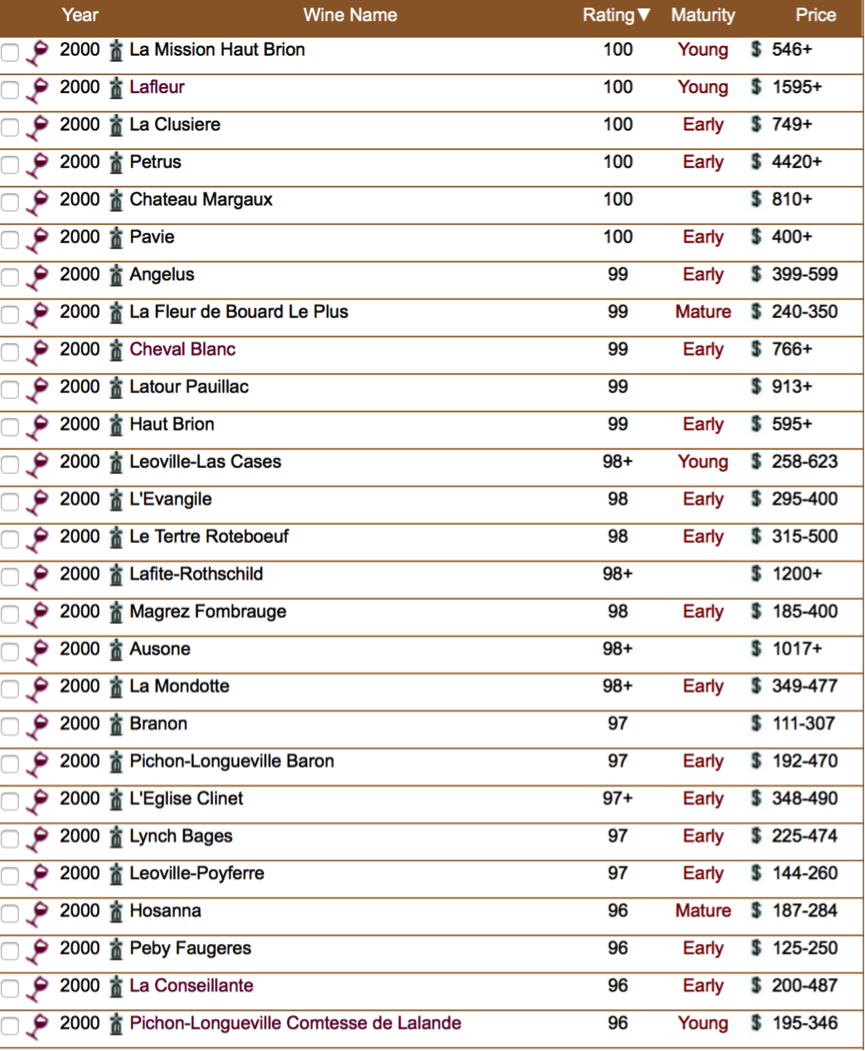

Those wines that are re-rated positively this year will increase in value, in a vintage where there are still plenty of values to be had. With so many wines within a few points of perfect 100 scores, there’s plenty to speculate about which could be worthy of a rerating.

Take relative values, for example a number of wines that were last rated at 98(+) points. This is a helpful starting point for seeing where short-term opportunities may exist.

We’re inclined to rule out big and bouncy productions such as Magrez Fombrauge as the world swings away from extracted winemaking in favour of definition and a degree of finesse. We can all have our biases after all, market commentators and critics alike!

Once value relative to peers is established, it’s then worth cross checking value of a selected with other comparable vintages.

Now let’s take L’Évangile as a case in point:

Based on this analysis would you buy into 2000 or 2010? We’ve ruled out 2009 on the basis that a) it’s already 100 points and b) it’s an über-fruity 15° number.

The following table shows the scores, predominantly from the 20 years-on retrospective published in 2010.

Source: erobertparker.com

by Wine Owners

Posted on 2016-02-01

Do collectors ever drink affordable, everyday drinkers? Of course we do!

Don’t forget that in the heyday of Bordeaux, ‘luncheon’ wines were required purchasing behaviour to ‘balance’ some of the more sought after wines whose supply was carefully managed through judicious releasing strategies by the Châteaux.

At time of purchase, these low cost, often delicious (sometimes extremely dull) drinkers seemed cheap, their modest cost leading on the eager buyer. I remember being promised by one merchant that I shouldn’t hold back from balancing with cheaper wines: “you’ll always be able to sell them for what you paid”.

10-20 years on, the true cost of these wines becomes apparent. Annual storage fees of £10-14 adds up over time. If you thought you might never drink them, it will have proved to be a rather expensive balancing exercise to get allocations of the wines you really wanted.

Continuing to store them is only recommended if you have an idea of when you are going to drink them (a daughter’s wedding perhaps?). Alternatively pull them out of storage and keep them at home where they’re more likely to be broached.

Otherwise, it’s time to move these wines on, get what you can for them, and reduce your annual storage bill. There are plenty of restaurants and wine lovers starting out who are attracted by bottles that are fully mature at bargain prices.