by Wine Owners

Posted on 2015-10-30

It's a trend that's more and more talked about.

Every Investor summed it up as follows 'Investors need to reset their investment return expectations from UK equities' quoting a portfolio manager of Franklin UK Managers’ Focus Fund.

Financial News reported that 'anxious investors are pouring money into multi-asset funds in the hope that these will offer then greater protection in a downturn'.

Privately, Swiss wealth managers worry that the current investment model is "broken".

Returns are not what they were, volatility has significantly increased, whilst this year's top quartile heroes are as likely to find themselves in next year's 2nd or third quartile. In the good years private wealth managers are not shy in extolling their own virtues, whilst in the bad years they point to outperformance of the general tracking indices.

High net worth individuals want their investment managers to preserve their wealth. When that becomes a marginal activity is it any wonder that they start to look elsewhere?

One place they look is collectibles. It's a natural thing to do; collectors are often experts in their own right. They might be left cold by financial market and instrument relationships, but the things they love are the things they know most about.

Let's be clear, the things you love are never going to be a central plank of most people's investment strategy. But for many, that historically skinny fringe around the perimeter of total net worth is growing thicker and thicker. If you can't make money on deposit, and your core investment strategy looks riskier than before, why wouldn't you put a little bit more into the things you understand?

Then there's the question of utility. Financial instruments that form the core of what you invest in have a single purpose: to make you money and preserve wealth.

The things you love have utility beyond this simple purpose. At a basic level they satisfy a human urge to learn, collect and own, then to socialise that interest.

For wine, there's further utility in its enjoyment, its sharing and the generosity of spirit that accompanies opening grand bottles with friends or fellow enthusiasts and collectors. There's pleasure in opening a bottle of wine that has increased in value and knowing you paid rather less for it. There's even rationality in drinking a wine that cost as much or less than when you were persuaded to buy it years before. Some collectors think of this as a form of dividend-taking. A dividend in the form of enjoying some of the fruits of a collection, lovingly built up over time.

Like with anything that becomes used as a store of value, diversity is a key to success. So is independence of thought and action. Access to information and trend data is of course important. A buying perspective needs cross-referencing to verifiable facts and figures.

by Wine Owners

Posted on 2015-10-29

Our goal? Simply to be the best platform in the world where wine lovers and collectors can do absolutely everything they want to do. We are the go-to address for your personal wine management. Whatever you need to help you do that we'll build!

New www.wineowners.com is a responsive website, which means it automatically adjusts according to the screen size and resolution of the device you are using.

More and more we use multiple devices that come in diverse shapes and sizes. The new Wine Owners mobile website allows you to access Wine Owners from almost any device, wherever you are. The screen including the menus adapt to the screen size you are using. On a smart phone for example, the top navigation looks like and behaves similarly to an App.

Also available on mobiles and tablets is Label recognition, allowing you to take a picture of label with your device's inbuilt camera, and choose whether to research, add or consume wine using this cutting edge method.

The advantages of a responsive website over a downloadable App are that you have access to all the functionality of the entire site without compromising any features or activities; there’s no need to download periodic updates, and your site preferences persist across any devices you may use to access our website.

There's a raft of new functions and improvements which we've included, answering many of your requests for more...

New functionality

As well as the new interface designed for mobile use, we have also added a number of new functions in this release:

Portfolio Management

Trading exchange

My Market Position panel, showing all your offers, bids, pending trades and order history with links to the detail lists

User experience

by Wine Owners

Posted on 2015-10-29

There was one thing we were really clear about when first launching Wine Owners. This was a platform created by and for wine lovers and collectors.

Fast forward 2 and a bit years, and there are an amazing 12,000 of you using the platform to access, organise, track and explore your wine collection in one way or another.

We've had such great feedback from so many of you who love what we've created, that we thought it would be great fun to throw the spotlight on you, and give you the stage for talking about the bit of your life to do with wine. Those of us who are into wine (some might say slightly obsessed by it) really enjoy reading other collector stories, so if you're happy to share, we'd love to hear from you.

Just contact me on nick.martin@wineowners.com with your thoughts and a photo!

To make it a bit more fun, we're offering each member whose story we publish a smart dinner in London, not to mention some brilliant wines from our private collections (which should keep all our lovely shareholders happy).

So what should you talk about? Anything you like really, but here are some pointers...

How did you get into wine in the first place?

What was the first ever wine you tasted that gave you goosebumps?

When did you start collecting?

What's your favourite region and style of wine?

Who's your favourite producer?

Best ever wine decision and worst ever wine decision?!

Most amazing wine and food combination?

The greatest bottle you've ever had and why you liked it so much?

Your favourite wine critic?

Your desert island wine.

Closing date for the invitation to share your wine life with us and be invited to a beautiful wine dinner is 31st November 2015.

Once again, contact us to say yes via email on nick.martin@wineowners.com or call us on + 44 (0)20 7278 4377.

by Wine Owners

Posted on 2015-10-29

Quite a lot of members we speak to these days assume that the market prices of Bordeaux are still stagnating or falling. The morosité that had descended on the region's finest wines in by 2012 does not appear to have lifted.

Wine traders will point to volumes that are much reduced since the giddy heyday of 2009-2011, and that is of course true.

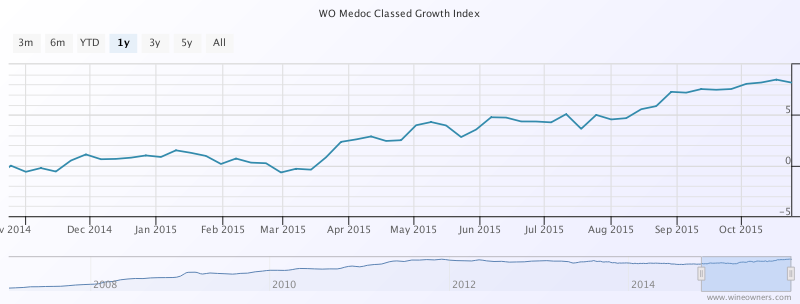

However, it does not mean that in aggregate, prices of Bordeaux have begun an upward trend. In the last year, the Wine Owners Medoc Classed Growth Index is up 8.2%.

Whereas the Wine Owners First Growth Index has only managed half of that in the last year, up 4.1%.

That's still better than the performance of the FTSE100, which is fractionally underwater over the last year, and exactly where the S&P500 has clawed it's way back to after the summer's wobbles.

Wine Owners 150 = Turquoise

FTSE100 = Navy

S&P500 - Green

However, when looking at First Growth performance over the last 12 months, it is far from broad-based. 'The further they rise, the longer they fall' seems to hold true, with Lafite 1986 and 1989 performing the worst at -8% and -9% respectively.

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1999 | -5.45% | £ 216.68 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2006 | -5.75% | £ 286.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2009 | -5.82% | £ 441.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1982 | -5.92% | £ 436.68 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1982 | -6.29% | £ 1,810.14 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1998 | -7.15% | £ 270.83 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2006 | -7.26% | £ 212.50 |

| Chateau Margaux Premier Cru Classe AOP | 1989 | -7.59% | £ 250.10 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1986 | -8.13% | £ 651.48 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1989 | -9.11% | £ 395.92 |

Among the vintages populating negative territory, 1986 has suffered with the exception of the very great Mouton. The exceptional 1989s and 1990s have fallen, along with with the dull 1999s.

The risers are headed by Mouton, Haut Brion and Latour. The top 10 performers registering double digit growth are entirely accounted for by these three Châteaux.

| Wine | Vintage | Change 1 year | Price |

|---|

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2005 | 22.39% | £ 366.67 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2008 | 21.13% | £ 262.54 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2005 | 20.95% | £ 437.50 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 1996 | 16.87% | £ 282.74 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1990 | 14.30% | £ 429.12 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2005 | 13.36% | £ 566.79 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2000 | 13.32% | £ 1,038.81 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2008 | 11.00% | £ 226.64 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1989 | 9.08% | £ 1,000.03 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1995 | 8.49% | £ 316.67 |

Crossing over to the right bank, predominant top performers over the last 12 months are St EmillMedoc Classed Growth Indexon 2005s and the 2001 Class A relative newcomers. Since March 2015 The Wine Owners Libournais Index is up 7%, coming off it's 3 year lows at that point.

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 53.85% | £ 300.00 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 48.07% | £ 176.57 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 45.67% | £ 183.46 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2000 | 37.16% | £ 301.79 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 1998 | 34.59% | £ 161.84 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOP | 2005 | 27.82% | £ 110.96 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 26.84% | £ 232.57 |

| Chateau La Violette Pomerol AOP | 2009 | 26.67% | £ 208.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOP | 2005 | 24.71% | £ 433.34 |

What can we conclude from this? Some commentators are suggesting that value is returning to older back vintages on the back of 4 year declines. Relative value vs quality is likely to be a key driver of future value, for which we recommend you check out the new price per points builder on Wine Owners to which you'll need to subscribe.

Liv-ex have recently seen a predominance of trades of the 2010 vintage, and whilst there seems to be value returning selectively to the Classed Growths, one wonders if it's a little early yet the First Growths, whose starting release prices were in nose-bleed territory. Since 'the further they rise, the longer they fall' it may yet be a bit early to call.

by Wine Owners

Posted on 2015-10-29

OWNER

Chateau Montrose

APPELLATION

Saint-Estephe

BLEND

Bordeaux Red Blend

AVERAGE SCORE

95/100

CRITICS REVIEW

'This is considered to be among the greatest vintages ever made in Montrose, right up with the 1929, 1945, 1947, 1959, 1961, 1989, 1990 and 2009. Harvest was October 15 to 17. The wine has really come on since I last tasted it, and it needs at least another 10 years of cellaring. The blend was 53% Cabernet Sauvignon, 37% Merlot, 9% Cabernet Franc and 1% Petit Verdot. The wine is opaque black/blue, with an incredible nose of blueberry and blackberry liqueur, with hints of incense, licorice, and acacia flowers. Tannins are incredibly sweet and very present. The wine is full-bodied, even massive, with great purity, depth and a finish that goes on close to a minute. This is a 50- to 75-year-old wine that will repay handsomely those with good aging genes.'

100 points - Robert Parker

View all scores & reviews

PRODUCER PROFILE

Area under vines 95 hectares

Soils deep, large size gravel with sand and a small amount of clay

Average age of the vines 40 years

Production 400 000 bottles a year

Planting density 9000 vines/ha

Ageing in 60% new oak barrels for 16 to 18 months

View full profile

MARKET PRICE