by Wine Owners

Posted on 2014-10-20

Why is there apparently so little wine in Bordeaux when so little of more recent vintages has been selling through? Why buy young wines at release? Will negociants’ balance sheets cope with more vintages that stick? Why would that happen?

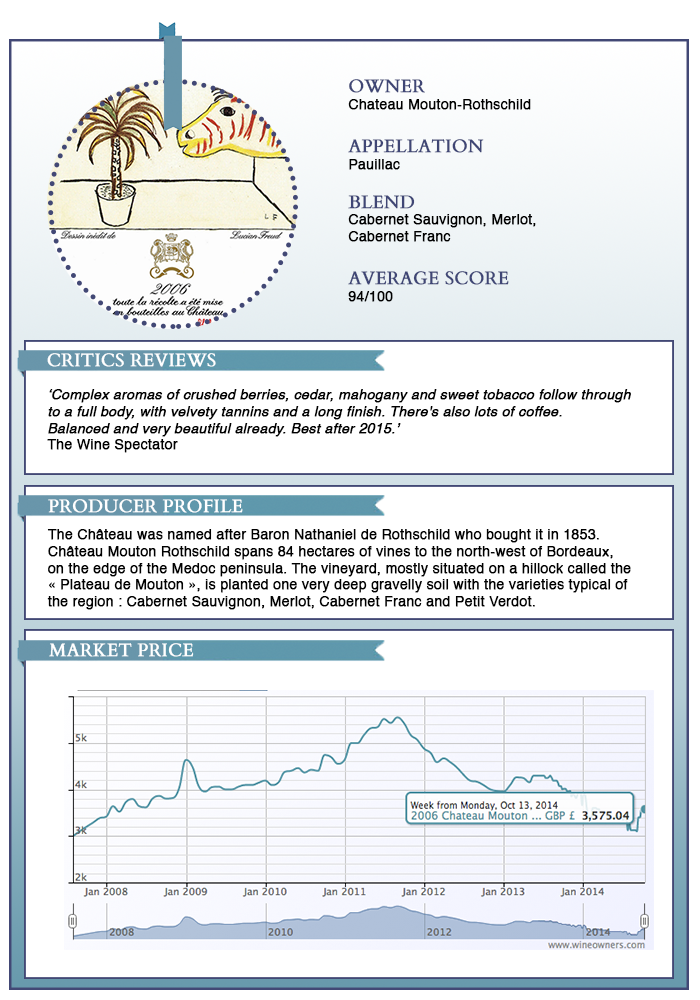

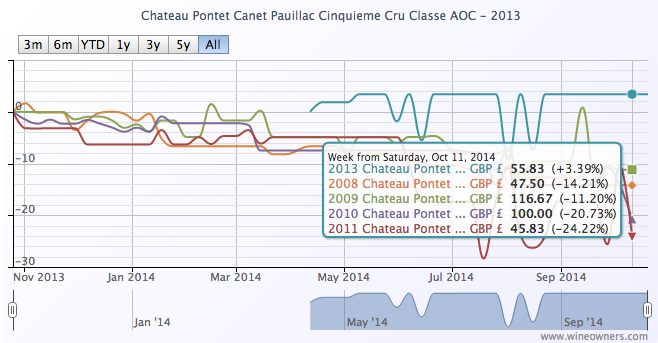

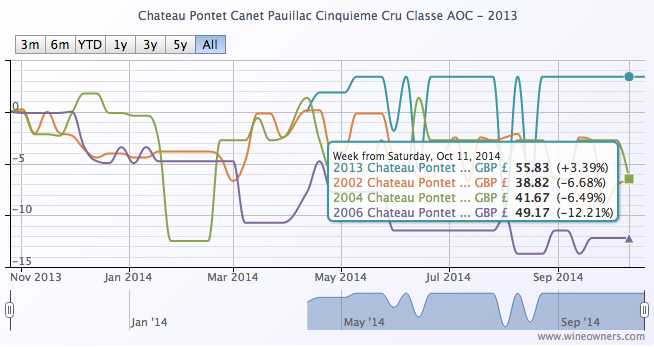

Pontet Canet 2013 famously ‘sold out’ within an hour or two of being offered on the Bordeaux Place. Negociants sucked it up and took their allocations. That’s their historical role after all. Merchants generally weren’t having any of it. More relevantly, nor were their private clients. It was a lousy deal for the consumer: 2002, 2004 and 2006 are all cheaper vintages.

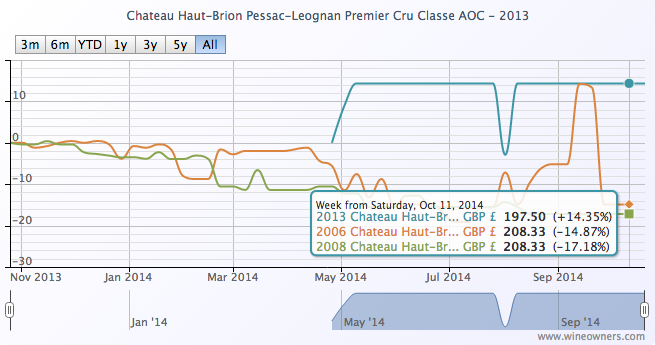

Now we’re on the cusp of a rather good vintage, the first in a small handful of years. Haut Brion 2008 has been trading at £2,400: a fair price for a lovely wine. To be a good buy, what will Haut Brion 2014 need to be offered to consumers for? £2,000? £1,900? £1,800? If instead it’s offered for £2,500, for example, what would be the point of buying it?

Loyalty? Surely not. Would consumers really want to play the stockholder for Chateaux that made extravagant profits out of 2005, 2006, 2009 and 2010 vintages? Some of who pillaged the European Union’s agricultural support fund during the bloody aftermath of Lehmann to construct a new chai or two? Buy into wines that might not drink for 15-20 years and might not be materially more expensive in 2 or 3 or more years’ time? Wines that are made in such benevolent quantities that finding them won't take more than a couple of minutes online? When there are so many back vintages that are coming back down to earth and are challenging our perceptions of value over the last few years?

So let’s imagine that the 2014 vintage proves a tricky sell. Not as thankless a job as the unloved 2013 vintage of course. The really big merchants who have an economic interest in en primeur to succeed and will sell the vintage: the weather, the brilliant Indian summer, the inevitable comparisons with the weather of 1996. Those cool nights, dewy mornings and balmy days under clear skies. But imagine it’s not what you might call a ‘successful’ campaign…

What happens then? How many of the negociants will be able to stomach another huge influx of stock without a corresponding outflux? With credit harder or impossible to come by; stalling European growth; a currency still fairly strong but with a significant downside, undermined by Europe’s recession-states, impatient creditors and a faltering Germany? With banks increasingly wary of lending support?

Of course some negociants will seize the moment to consolidate their position, increasing their market share as they gobble up distressed owners and their stocks. But others?

No one is yet disputing the efficiency of the negociant distribution system via the Bordeaux Place. After all, the huge Tuscan estates were sufficiently impressed by the system to want in. (And if you want your Libournais estate to be Classé, woe betide you if you try to circumnavigate the system.)

But it doesn't automatically follow that you have to believe in en primeur as long as it undervalues the consumer’s stockholding role to adhere to the established Bordeaux distribution model.

Passion-driven many of us may be, but perennially stupid we are not.

by Wine Owners

Posted on 2014-10-17

Treasure assets are uncorrelated. That’s part of the attraction to high net worth individuals (HNWIs) looking for suitable stores of value.

I use the phrase store of value purposefully. Wealth preservation and enjoyment of the fruits of success are arguably far more important to HNWIs than specific targeted annual returns.

Wine has appeared deeply uncorrelated since the financial crisis of 2008. The facts bear that out. Yet we mustn’t forget the power of externalities to distort underlying tendencies; such as insatiable demand from China up until mid-2011, or the flight from traditional financial instruments during periods of extreme market stress into all things tangible. It’s easy to forget that the wine market did suffer during previous economic recessions or shocks, whether the recession of the early 1990s or the Asian financial crisis of 1997.

Yes, of course we’re talking principally about Bordeaux, that behemoth of a region that produces unrivalled oodles of fine red wine. Paradoxically other regions of production may indeed be uncorrelated with Classed Growth Bordeaux as hot wine money searches for relative value, or where scarcity creates a rather different drumbeat.

With the current financial market turmoil; the sudden reawakening to the woes of Europe; the economic and political uncertainty of its recession-hit member states - what better moment to analyse the question of market correlation?

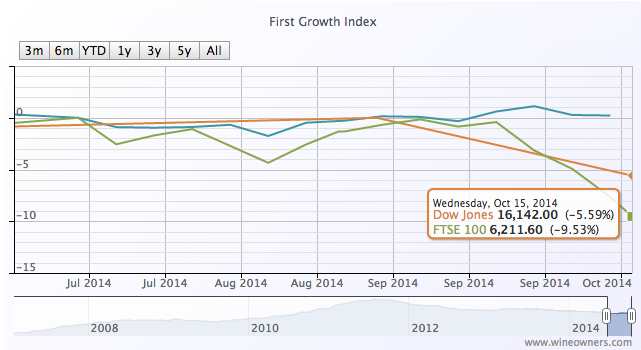

The wine market became quite excited by a small upturn that started in late July, continued during August and through much of September. A month on, and things aren’t quite so clear-cut, but in spite of plummeting stock markets, wine prices are not following suit.

The First Growth Index is up by 1.2% over the last 3 months whilst the FTSE has dived almost 8% - that’s roughly the same amount of value destruction as the First Growths experienced over the previous 12 months. The Bordeaux Index has followed the same positive (if tentative) trajectory (comprising Medoc and Graves Classed Growths and the top Libournais benchmarks). So has Northern Italy, only a whisker off its all-time highs, along with blue chip Burgundy and the effervescent Champagne market.

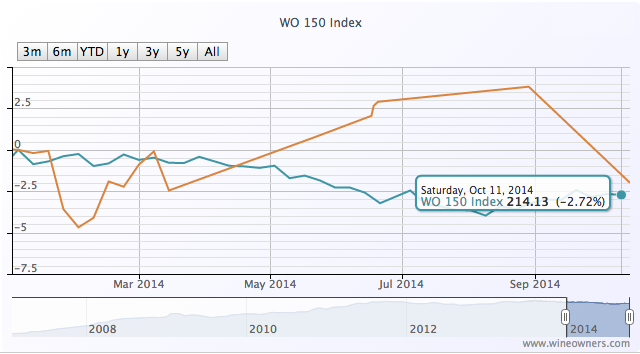

After a disappointing year so far for the wine market overall (represented by the WO 150 Index), the previously run-away Dow is within single-digit, fingertip distance of fine wine’s -2.7% fall.

by Wine Owners

Posted on 2014-10-13