by Wine Owners

Posted on 2015-08-13

The vision of a sharing economy is a far-reaching and powerful model that is beginning to shape current business practices by leveraging technology and allowing individuals to act as producers, entrepreneurs, collaborators, financiers and a myriad other roles.

“Marketplaces” provide transactions among multiple buyers and multiple sellers. Amazon and eBay are businesses that were created over the last two decades to enable peer-to-peer transactions. There is no doubting the power of creating an environment where thousands of businesses and millions of individuals can trade with one another.

“Workflow” Software as a Service (SaaS)platforms make it easy to manage and track activities that may be focused on short term or very long terms goals, whilst making it very easy for everyone to participate in the marketplace. The integration of workflow and marketplace is what distinguishes them from other marketplaces.

Consider Wine Owners activities’ through the prism of a Workflow Marketplace.

Firstly Wine Owners was conceived as a way of simplifying and simultaneously enriching the ‘wine lives’ of those with a passion for wine through a broad set of structured functionality and market information. This makes research, management and collection tracking substantially easier and less time consuming than before.

Secondly the trading exchange (marketplace) allows anyone to transact with anyone, in the knowledge that everyone has access to the same information, pricing assumptions, settlement and fulfillment processes. This many-to-many transaction pattern is key. Wine Owners is an N-sided marketplace — transactions happen between any participants, individuals and businesses, experienced and inexperienced alike. The pattern of trading counterparties is like a network. That makes Wine Owners both a marketplace and network.

A market network often starts by enhancing a network of professionals or high net worth individuals that exists offline. Many of them have been transacting with each other for years using email, mail, phone calls. By moving these connections and transactions into a SaaS Workflow, a market network makes it significantly easier for deals to be done and clients to get better service.

The Market Network is particularly relevant for complex, high value transactions. In wine, market fragmentation, tax status and specific logistical requirements make a prima facie straightforward commodity rather more complex as a peer-to-peer proposition. A market network is therefore the ideal model to simplify wine management and trading and so increase transaction velocity, satisfaction and build long-term relationships.

The principles that guide us are: the free flow of information; transparency in pricing and valuation; the ability to be in control of one’s own wine-related activities; the potential to sell excess wine; the creation of shared and accepted ‘rules’ about how to undertake and settle trades. All of these are important in contributing to an infrastructure where individuals and trade participants can benefit from the Wine Owners market network with confidence; safe in the knowledge they are operating within a sustainable and fair system.

by Wine Owners

Posted on 2015-03-05

You’ve got to laugh. A friend of mine contacted a company called Noble Rock, ostensibly on behalf of his father who had a fine wine collection. My friend’s name is Peter Bevan.

Having requested a valuation from Noble Rock, and offering to sell his wine through them, they called him back offering to sell carbon credits. As interesting a segue as I have ever come across...

Once the conversation was brought back to the question of his father’s wine, he was told that his wine collection had gone up in value substantially. This surprised Peter since he hasn’t yet provided details of the wines to them.

So how could they possibly know what his wines were worth? The Man from the Rock patiently explained to Peter that they knew because every time a wine was bought en primeur the details of the buyer and their wines were entered onto a Register – which they had looked up and that was why they knew about his wines!

Valuations that were subsequently discussed were sky-high, predicated on the well-practised advance fee fraud of paying a sum of money up-front to get the wine to Hong Kong, where it would be sold at auction at a massive premium to market. In this case the advance fee was justified on the basis of it being a VAT payment of 10%. Peter queried, if it was VAT, why it was only 10% of the value and not 20%; the answer being that only half of the VAT due was payable straight away. A novel concept that would interest HMRC I’m sure.

It was all so entertaining and extraordinary. But there is a serious side since people are being taken for a royal ride. Otherwise these people wouldn’t exist would they? The message is clear, do not take calls from people you don’t know selling by phone. And if anyone suggests there’s a way to sell wine at a market premium (check the market level price on www.wineowners.com), they are conning you. It simply doesn’t work that way.

Oh, and what happened to my friend Peter? Well, his name wasn’t really Peter; his real name is Mark. Mark Bevan, of Nexus Wine Collections. He runs one of the UK’s most successful specialist fine wine storage businesses, and had contacted Noble Rock because a number of his clients had been approached by phone spinning their yarns of criminal intent.

by Wine Owners

Posted on 2014-06-24

LONDON (June 24, 2014)

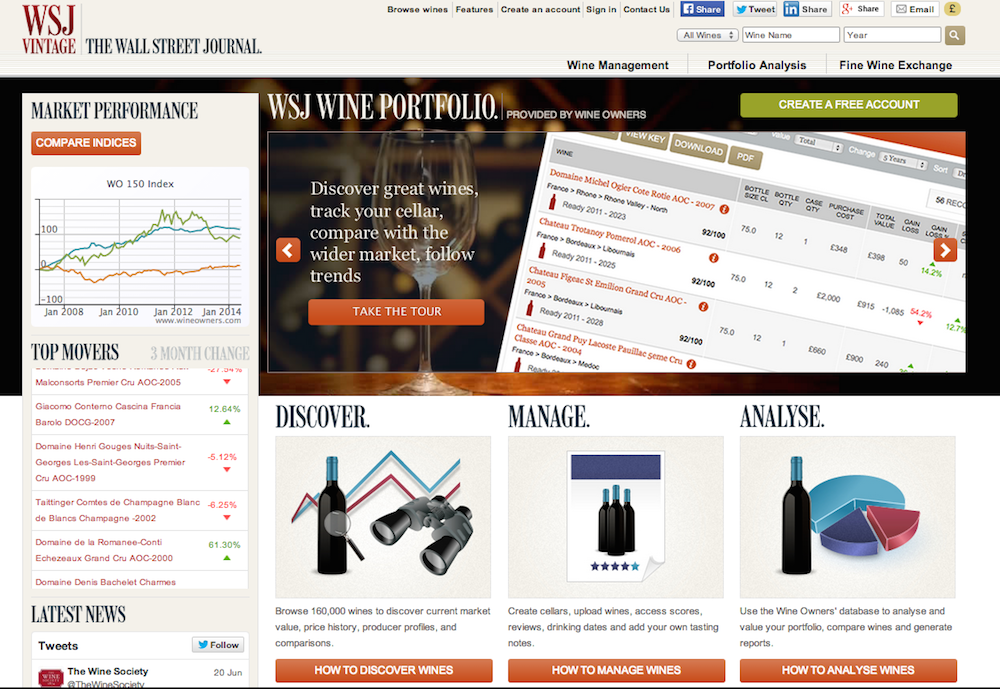

Wine Owners is now powering a newly-launched wine management and appreciation tool for The Wall Street Journal, WSJ Wine Portfolio.

The tool now allows users to discover wines, track individual prices over time, compare wines to indexes and other assets, and build an online portfolio to manage a cellar and track its value. With data provided by Wine Owners, the portfolio tool is available on The Wall Street Journal’s newly launched WSJ. Vintage which features columns, news and top picks by The Wall Street Journal’s award-winning columnists in Europe and the U.S., along with “one-minute wine” videos and an archive of articles on how to enjoy wine.

Key features of WSJ Wine Portfolio include:

• Discover – Readers can browse from the Wine Owners’ database of 160,000 wines to discover current market value, price history, producer profiles, and comparisons.

• Manage – Readers can organise and track the value of their fine wine collections.

• Analyse – Readers can value their wines and research wine prices over time. Those can be charted against other wines, indexes, and other asset classes.

Nick Martin, founder of Wine Owners, said, “We are delighted to be partnering with such respected global media brand as The Wall Street Journal. The platform will help readers manage their portfolios more proactively, and provide unparalleled visibility of their wine collections.”

“We see this as a natural extension to the rich wine coverage delivered by our award-winning columnists Will Lyons and Lettie Teague,” added Thorold Barker, Editor, Europe Middle East and Africa, The Wall Street Journal. “It allows our readers to engage with wine both for pleasure and as an investment.”

by Wine Owners

Posted on 2014-06-10

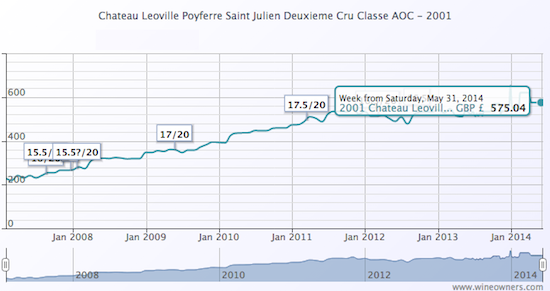

We launched the Exchange a year ago this month, and we thought it would be interesting to have a look back at the very first that went through the platform, and see how it has performed and traded over the last 12 months.

The first trade we put through was a case of 2001 Leoville Poyferre, which was picked up at £570 by a private buyer, from a private seller. The current market level is £575, which with Bordeaux’s relatively undramatic market performance this last year is perhaps unsurprising, though the most recent offers on the Exchange have been slightly north of that figure at £625.

No great fortunes were made on that first case over the last 12 months, then, but trading wine is at least as much about pleasure as profit, and the case was requested for home delivery…

by Wine Owners

Posted on 2013-05-03

Wine is a classic collectible asset.

Fine wine differs from stocks and shares in that it does not produce an income and it is not fungible. In this it shares common characteristics with other collectible classes such as art, stamps, coins, cigars and classic cars.

Fungible is another way of saying ‘interchangeable’. Cash is fungible; one £20 note having equivalence with any other note of the same value. Pure gold is also fungible, a gram being interchangeable with any other gram.

In contrast, diamonds are not perfectly fungible because varying cuts, colors, grades, and sizes make it difficult to find many diamonds that are exactly alike. Diamonds illustrate the point that fungibility is not the same as liquidity or scarcity. A global market can nonetheless exist and thrive irrespective of whether an asset class is perfectly fungible or not.

Neither is fine wine perfectly fungible, notwithstanding the contrary views of Joe Roseman, the investment economist who coined the phrase SWAG for Silver, Wine, Art and Gold.

Similarly, typically over time, one case of a particular wine of the same vintage loses its ability to be treated as interchangeable with another, due to variables such as storage location (and implied quality of condition), tax status (held under bond or duty paid), back or strip labels (denoting its original export destination e.g. China) and packaging (e.g. original wooden case or a repack).

Non-fungibility creates market pricing variability. To illustrate the point from another collectible segment, cigars stored at Dunhill in Mayfair are thought to carry a premium at auction houses; such is the excellent reputation of their humidor.

The growing globalisation of the fine wine market over the last decade, with the opening up of the Far East and Russian markets, and the future potential influence of Brazil, India and other emerging regions, has shone a spotlight on the importance of wine provenance – being the term used to describe history and current condition.

The question of how good is a wine’s provenance arises directly from the fact that wine is not fungible. The top estates (typified by the Bordeaux First Growths) are gradually adopting technological innovations that could help in future. Everyone agrees that provenance can only become increasingly important.

Where the wine is stored, how long it’s been kept there undisturbed, where it’s been and the distance it’s had to travel; are all more pertinent questions than ever before.

A new system of building and tracking provenance is surely needed, where older stocks can be traced back, through transfer of title, movements, location changes and inspections.

Traceability and reliability of source will increasingly justify higher prices for the best stock, and lead to a disparity of value or market liquidity between two bottles or cases of the same wine.

There is already a widening gap between older wines sourced direct from the producer compared with secondary market stocks in those cases where history cannot be proved.

It is well worth the investment in time to seek out secondary market stock with good provenance, in order to assure your fine wine purchases can serve as an effective store of value. Greater market transparency is surely the key to giving private buyers the confidence and information they need.

by Wine Owners

Posted on 2013-04-05

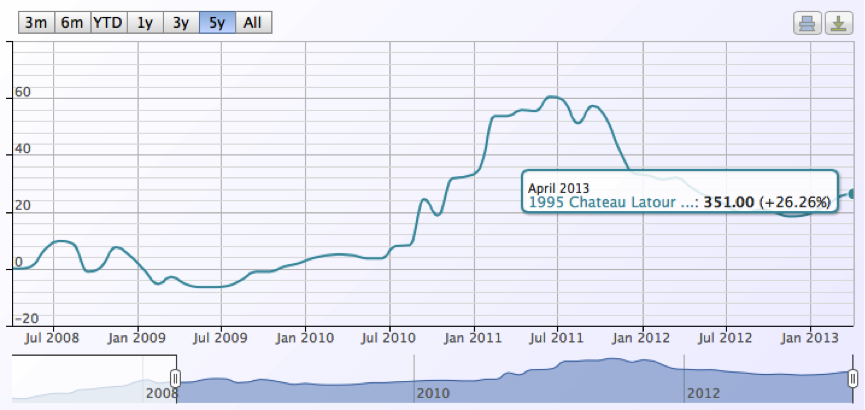

With updated prices released on Wine Owners' - the world's first full service, independent asset management and trading exchange - it's an opportune time to check on the market price of Chateau Latour 1995.

Why? Because having withdrawn from the en primeur release system in April 2012, Latour director Frederic Engerer had announced that each year a vintage of Chateau Latour and the second wine, Les Forts de Latour, would be released at the start of their perfect drinking window.On March 19th 2013 the first of the 'library' releases, 1995, was offered at a UK retail price of (GBP) £4,950.Each bottle comes with a prooftag (a security product guaranteeing traceability and authenticity) and sports a back label stating the date of shipment from the chateau.1995 was a great vintage for Latour, as evidenced by the following wine critic reviews:

Robert Parker 96 points (June 2000)

A beauty, the opaque dense purple-coloured 1995 exhibits jammy cassis, vanillin, and minerals in its fragrant but still youthful aromatics. Medium to full-bodied, with exceptional purity, superb concentration, and a long, intense, ripe, 40-second finish, this is a magnificent example of Latour. As the wine sat in the glass, scents of roasted espresso and toasty new oak emerged. This classic will require considerable cellaring. Anticipated maturity: to 2050.

Jancis Robinson 18.5 points (2011)

Lustrous deep crimson almost right out to the rim still. Hint of mint on the nose – quite aromatic. Pretty. Charming for a Latour grand vin! Though there is a strong undertow of graphite. More intense than 1996. Drink to 2035

Lisa Perrotti-Brown 96 points (Nov 2012)

Deep garnet-brick in colour, the nose is well developed, displaying dried berry, leather, vanilla pod and anise notes with a faint whiff of potpourri. The palate is wonderfully fleshy and opulent with velvety, approachable tannins and a long finish.

Latour took criticism for their release price from some quarters arguing that that it was too high compared to market prices for previously released-en-primeur bottles of 1995.

Our analysis (Wine Owners Market Level calculation: base data sourced from Wine Searcher) shows the current market price per bottle is £351, or the rounded equivalent of £4,200 for a 12x75cl case.

As the chart shows this is down from £433 per bottle in April 2012, or the rounded equivalent of £5,200 for a 12x75cl case, showing the prolonged tough time first growths have endured since hitting their giddy heights in the summer of 2011.

So is a £700 case market premium for an ex chateau release with perfect provenance and a prooftag worth it?

Yes, according to Lisa Perrotti-Brown MW who believes a 15% premium is worth paying to source that perfectly stored and shipped wine.

And that, funnily enough, is precisely the premium that Latour decided to place on the 1995 library release.

by Wine Owners

Posted on 2013-03-25

Thank you everyone who's been using our fine wine asset management and trading exchange since November 2012 when it first released.

As a result of all our fantastic feedback, we've just released a brilliant new version, providing quick answers to questions such as:

- how much have I spent to date;

- what’s a wine honestly worth if I wanted to sell it tomorrow; how have my wines performed;

- what should I drink now or drink up;

- what do I have too much of and what should I think of selling next to make room for what I’d like to buy next?

With this new release, Wine Owners provides answers to all those fundamental questions and a lot more besides, and is available now via complimentary subscription here.

by Wine Owners

Posted on 2013-02-17

We're being asked increasingly how Wine Owners arrives at its Market Level pricing, helping to provide a benchmark for real-world valuation of wine collections for its private client users.

So here's how we process millions of data points to give our users pricing insight on their fine wine collections that they can translate into estimates of realisable current market value, less sales commissions.

The source of data comes from WineSearcher, the world's pre-eminent search engine for fine wine, helping wine enthusiasts everywhere to source wines they wish to buy from retailers.

Retail pricing is collected from over 34,000 wine merchants and traders around the world, and this data can be analysed by country and region.

WineSearcher's scope of work is huge, processing millions of data points on wines that are for sale or just sold every day.

How does Wine Owners work with this primary data source?

Our proprietary algorithms process this data to eliminate the inevitable anomalies that such large data sets present. We focus on pricing for the world's top 250,000 fine wines.

For our private client members who appreciate, collect and invest in the fine wine top end of the market, our focus on a specific strata of fine wine pricing enables us to structure, standardise, format, analyse and process these wines in great depth.

How does Wine Owners calculate the Market Level?

We first exclude possible outliers from the source data.

Next we recognise the different liquidity characteristics of the fine wine market and assign a liquisity score to each wine in our database.

Rare wines, old vintages and other wines with limited liquidity are treated differently to incoming streams for top Bordeaux where there is substantial relative market availability and demand.

We then analyse the spread between market low and mid point for each wine and calculate the point between the two, depending on liquidity scores, that constitutes the Market Level.

Our proprietary algorithms are designed to give you the most consistent approach to pricing a market in wine.

Of course, wine is a collectable asset very unlike stocks and shares or gold, and therefore market prices reflect differences in geographical availability and tax status, not to mention condition and history (the essential elements of 'provenance'. What that means is that pricing fine wine is not a wholly scientific process, and a consistent approach such as ours will not capture every market discontinuity. Nevertheless Wine Owners offers users a rigorous approach to calculating Market Level pricing, being a likely pricing level at which your wines can sell without undue delay.

The following price graph, a new version of the existing functionality on https://www.wineowners.com , illustrates the pricing information and interactive site tools you can use to manage your wine collection.

We value based on the market retail value, and therefore you can expect to deduct selling commissions from this price.