by Wine Owners

Posted on 2014-04-22

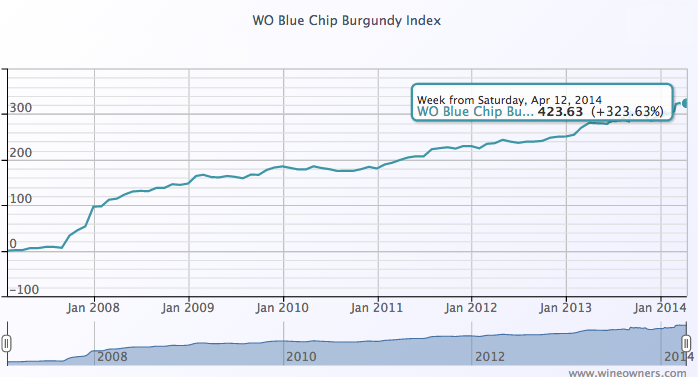

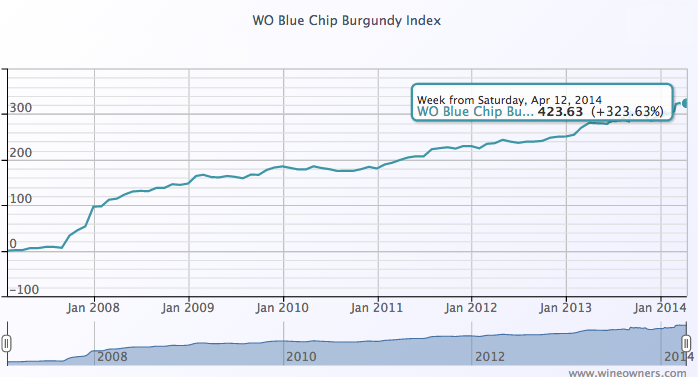

The Blue Chip Burgundy Index is focused on Grand Cru and a small number of top Premier Cru burgundy from the region’s top producers.

These wines are difficult to get allocated at first release in the first calendar quarter two years after harvest, and tend to jump in value as soon

The Blue Chip Burgundy Index is focused on Grand Cru and a small number of top Premier Cru burgundy from the region’s top producers.

These wines are difficult to get allocated at first release in the first calendar quarter two years after harvest, and tend to jump in value as soon as they find their way into the secondary market - such is the competition to own them. So buying in at first release gives the buyer the greatest upside, yet as the graph shows, the upward trend has been irresistible over the last 7+ years.

Once acquired, a significant proportion of these wines never see the light of day again except for when a cork is pulled a decade or so after release. Such is the passion for great burgundy. Does the incredible market performance over the last few years change that we wonder, as more elite producer wines become ultra-expensive - and straying into the lower reaches of DRC, Leroy and Jayer price territory? Nothing has performed as well as fine burgundy in this period, and burgundy’s charted performance (blue) versus the Medoc and Libournais indices (green and orange respectively) looks even more dramatic when compared over the last 3 years.

as they find their way into the secondary market - such is the competition to own them. So buying in at first release gives the buyer the greatest upside, yet as the graph shows, the upward trend has been irresistible over the last 7+ years.

Once acquired, a significant proportion of these wines never see the light of day again except for when a cork is pulled a decade or so after release. Such is the passion for great burgundy. Does the incredible market performance over the last few years change that we wonder, as more elite producer wines become ultra-expensive - and straying into the lower reaches of DRC, Leroy and Jayer price territory? Nothing has performed as well as fine burgundy in this period, and burgundy’s charted performance (blue) versus the Medoc and Libournais indices (green and orange respectively) looks even more dramatic when compared over the last 3 years.

by Wine Owners

Posted on 2014-04-16

Nick Stephens is a respected wine expert with an international reputation as a critic and connoisseur. Nick was awarded the Prud'homme de la Jurade de Saint Emilion in 2007 for his work with the great chateaux and vineyards of that area. A devotee of the wines of Bordeaux, Nick has many years of insider knowledge and an array of chateaux owners, courtiers and negotiants that he does business with. Each year he visits Bordeaux for the En Primeur tastings held for the trade and reports back on the vintage in barrel. Also known as 'Wine Futures,' En Primeur is the opportunity to buy the wine before it is bottled (normally 18 – 24 months in the future) and released onto the market. Always hectic and often full of surprises the tastings are invaluable as they are the first indicator of the quality of the vintage. This year over 5000 wine merchants, brokers, critics, sommeliers and journalists from around 60 countries descended on Bordeaux for the event.

'This year Bordeaux En Primeur has attracted more comment and attention than expected, being even more agonised over than the boom years of 2010 and 2009. The 2013 vintage has been a trial for the Bordelais producers who have had to face severe weather conditions, reduced yields and rising production costs. If they had these difficulties twenty years ago most chateaux would not have been able to make a wine in such conditions. Thanks to advances in technology and increased expertise in vineyard management and in the chai wine was produced in 2013. The dry whites and sweet wines of Sauternes and Barsac are excellent but it is a different story for the reds. Overall they lack colour, complexity and depth. They will drink earlier than normal and 2013 is definitely not a speculators vintage.

Given that 2013 is a poor vintage for the Bordeaux red wines it is astonishing how much scrutiny they are commanding. Bordeaux has obviously not lost its appeal or its following.

But a spate of high priced years coupled with a run of mediocre vintages (2011, 2012 and 2013) means that wine enthusiasts and collectors need to look further afield. The best place to look for high quality Bordeaux reds is now in the past, in the back vintages of previous years and in particular 2008. In my opinion the 2008 wines are far superior in quality to more recent vintages and are more reasonably priced.

Over the past decade Bordeaux pricing hit two major price hikes and one minor. These occurred when good years were declared 'the vintage of the century'. The first was the 2005 vintage, the second with the 2009 and the third minor hike occurred with the 2010. The table below shows the release prices ex-negoce (to the trade) from a cross section of popular wines. At the time of writing the 2013 prices have only just started to be released. Pontet Canet, in an unprecedented move, released before the tastings had even begun.

|

Year

|

Margaux |

Parker Score |

Leoville Las Cases |

Parker Score |

Montrose |

Parker Score |

Pontet Canet |

Parker Score |

|

2004

|

96.00 |

93 |

50.00 |

93 |

31.80 |

91 |

24.50 |

90+

|

|

2005

|

460.00 |

98+ |

180.00 |

98 |

66.00 |

95 |

47.00 |

96+

|

|

2006

|

340.00 |

94+ |

125.00 |

95 |

51.00 |

94+ |

43.00 |

95+ |

|

2007

|

240.00 |

92 |

85.00 |

91+ |

45.00 |

91 |

43.00 |

91 - 94 |

| 2008 |

130.00 |

94 |

79.00 |

93 |

42.00 |

95 |

43.00 |

96

|

|

2009

|

550.00 |

99 |

216.00 |

98+ |

108.00 |

100 |

72.00 |

100 |

|

2010

|

600.00 |

99 |

192.00 |

96+ |

132.00 |

99 |

100.00 |

100

|

| 2011 |

360.00

|

94 - 96+ |

110.00 |

93 - 95+ |

72.00 |

91 - 93 |

66.00 |

93 - 95

|

| 2012 |

240.00 |

92 - 94 |

85.00 |

93 - 95+ |

57.60 |

92 - 94 |

60.00 |

91 - 94

|

| 2013 |

- |

- |

- |

- |

57.60 |

- |

60.00 |

-

|

As you can see from the table the 2008s hold their own in terms of quality with Parker scores being the equal or in some cases being higher, than those of 2007, 2011 and 2012 vintages. Scores for 2013 will not be released until Parker tastes the wines in June. A recent trade survey revealed that the industry itself believes the worst vintages in terms of quality regarding the First Growths are 2007 and 2013 whereas 2008 is considered the best. This is not surprising as the 2008 vintage represents good wine at a good price, despite the rise in value of some of the wines since their release. The wines are elegant, not over powering but with loads of fruit and well balanced tannins resulting in classic wines that can be drunk, savoured and enjoyed now or over the next three decades.

What happens to the En Primeur system itself if prices fail to drop for 2013 remains to be seen but savvy buyers can certainly find some lovely wines at good prices if they turn to overlooked vintages from decent years in the past.'

Nick Stephens

Prud'homme de la Jurade de Saint Emilion

Owner of www.bordeaux-undiscovered.co.uk and Fine Wine Merchants www.interestinwine.co.uk

by Wine Owners

Posted on 2014-04-02

Tucked away inside the Royal Opera Arcade off Piccadilly is a small, authentic bar à vin, the Pall Mall. This was the venue for the first ever Wine Owners event in association with our friends at Asset Wines, who are headquartered upstairs above the bar.

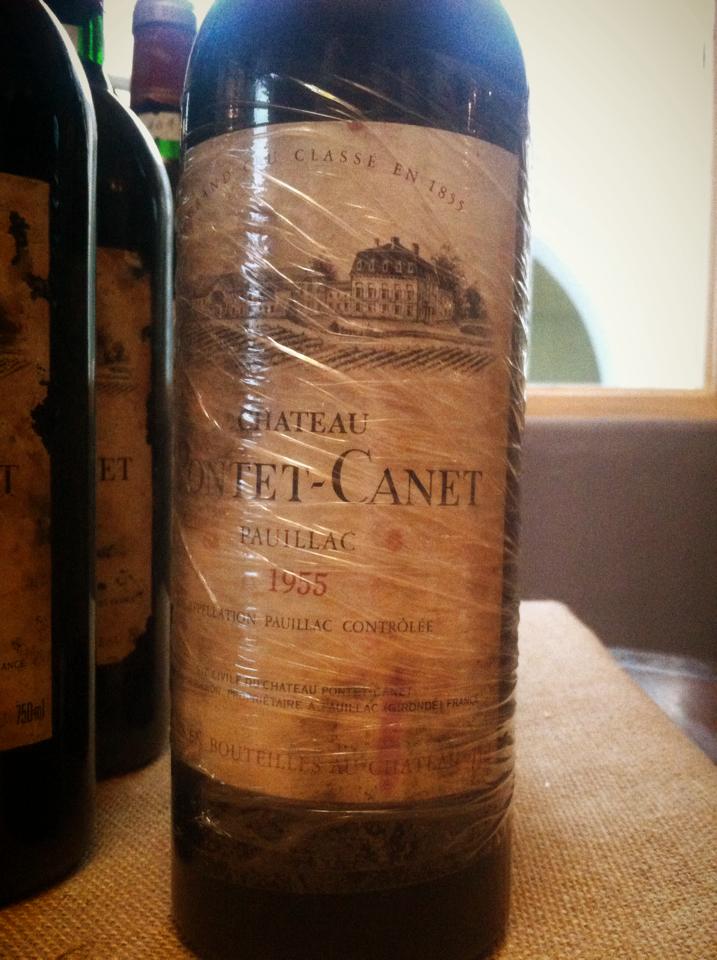

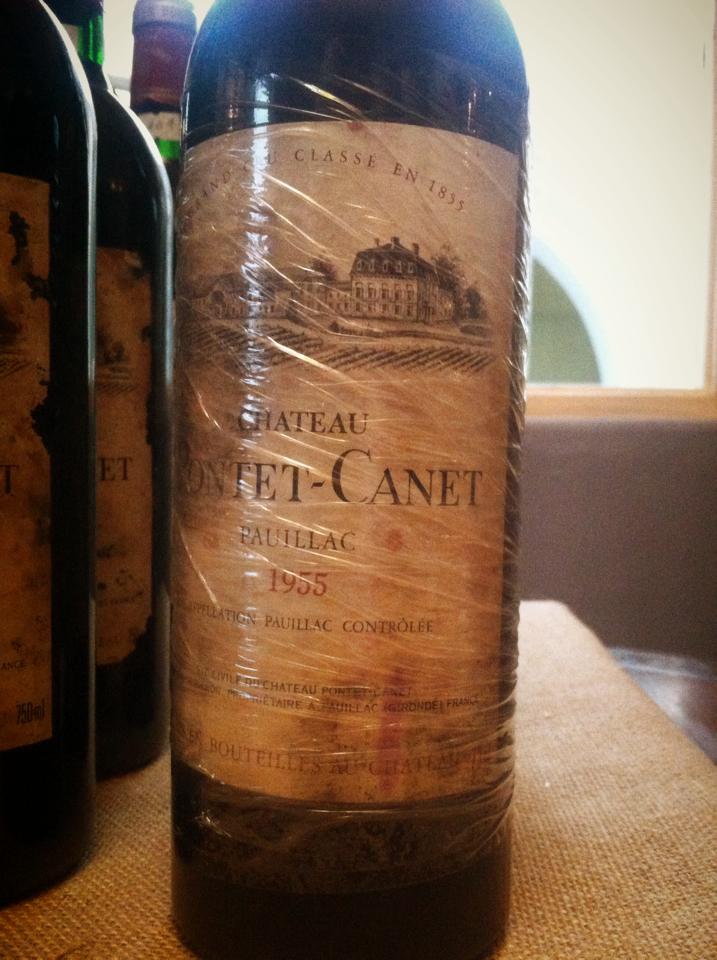

We are very proud to have co-hosted a vertical of Pontet Canet, among the very largest medocaine cru classé estates and the largest of Pauillac, yet arguably the most progressive - having risen far above their classified status whilst demonstrating leadership and foresight in investing heavily in uncompromising viticultural practises in the pursuit of excellence. Many of us have bought regularly upon release over the last 20 years, so it was an exciting prospect to be tasting across 4 decades of wine making evolution.

Thanks to Loric Gouban, Wine Owners’ popular new intern, we also had the pleasure of welcoming Justine Tesseron the daughter of co-owner Alfred, who introduced the Chateau and shared its history with the 30 wine enthusiasts assembled. Everyone was delighted she was able to join us and thoroughly enjoyed her company.

The first wine to be poured was 1985. At first blush it showed a fine cedar and bramble nose, and was a satisfactorily savoury wine. Frankly, it was served in the correct order of interest.

1996 had an immediately deeper nose, beautifully long to taste with fine powdery tannins, elegant but still taut and with the promise of more to come in another few years. The wine split the attendees, some of whom deeply admired its sinuous complexity, latent power and impressive length; whilst others were left wanted more fat. For a significant minority this was the most admired wine, although this may need some time to find its finest voice.

2004 was a very different expression. Ripe, intensely juicy and with sweet, tangible tannins delivering an impressive package of power, energy and seduction.

2006 proved to be an unexpected delight. Parker had advised his readers to ‘fill their boots’ and how right he was! Such poise and elegant fruit, this was really svelte with a pure finish. It perfectly intersected the youthful classicism of the 1996, and the juicy attention-grabbing fruit, sweetly tannic, crowd-pleasing 2004. At this point in the tasting this was for many the wine of the night. It has to be said, today this vintage sells for a great price (£600-£640) considering the very fine quality.

Then came the 1955, riskily presented as the last of the flight in the hope - rather than the expectation - of a bouquet finale. Never mind, we all said, it’ll be interesting at the very least and a privilege to taste. The bottles opened had both been re-corked at the property in 1989, and their labels were of the modern design in place of the original ‘Cruse’ versions. The understanding was that this ancient wine had spend its first 34 years in the cellars at Pontet Canet, before being reconditioned and sold. The wine turned out to be a monument. A soft, alluring nose was followed by the most mouthwatering palate, showing the complexity of age yet the freshness of something altogether younger, cupped in perfect balance with the most persistent of lifted fruit. In the glass the wine evolved over a 30 minute period, taking on more roundness with air and continuing to develop attractively to the last sip. Burgundian in texture and weight, what a way this was to finish such a convivial evening!

by Wine Owners

Posted on 2014-04-01

The Wine Owners 150 (WO 150) comprises Investment Grade Wines across the top 40 performers of the last 10 years. The goal of the WO 150 is to provide a stable and reliable index for comparison periods over extended periods of time. Because the wine performance is made up of many sub-markets, some of which have risen strongly whilst Bordeaux continues to fall acting as a significant counterweight given its significant representation. The WO 150 reflects a classic portfolio of blue chip wines.

Within the WO 150 index, top performers over the last 3 months seem to reflect a very broad-based group of wines:

Worst performers

Unsurprisingly Bordeaux dominates at the bottom end of performance, where the first quarter of 2014 has seen some quite sharp falls. Interestingly Monfortino 2002 finds its way into this company, in sharp contrast with Northern Italy generally and other vintages from this top micro-cuveé Barolo. Seemingly the market will price in the perceived quality of a vintage, irrespective of how dramatically a specific wine outperforms.

Go to the indices page to see a range of other more specific markets. Want to see an index we don’t yet have? Ask us and we’ll set one up for you if we think it’s of general interest!