Introducing the Knight Frank Fine Wine Icons Index.

by cescriva

2014-11-10

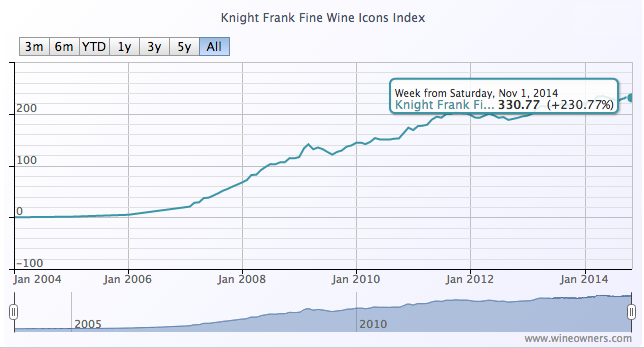

Created by Wine Owners* exclusively for Knight Frank, The Knight Frank Fine Wine Icons Index (KFFWI Index) reflects a representative basket of the world’s 40 most iconic wines, drawn from key regions of production. Up to 5 vintages of each wine are included.

The KFFWI has delivered growth of 230% over the last 10 years. Looking at the last 7 years growth has been 115%, 43% over 5 years and 8.5% over the last 3 years.

Given its role as the world’s largest fine wine region of production, Bordeaux is strongly represented with 14 wines, encompassing all of the First Growths. The performance of any fine wine index since Bordeaux’s peak in June/ July 2011 will reflect – and be depressed by - the very significant falls experienced since then.

Those highs were driven by unprecedented demand from China in the years leading up to 2011. Speculation overtook the interests of an orderly market, with brokers betting on which wines would become the next recognised brands in the Chinese market, creating an investment bubble.

Since the bubble burst, First Growth declines have averaged -28%, with certain wines halving in value, for example Lafite 2005 has fallen by -48.6%.

Volatility creates buying opportunities in any market, and wine is no different. When sentiment is negative, markets will tend to overshoot as they readjust. Whether we'll see a recovery this year or next remains to be seen. At some point in that timeframe sentiment towards Bordeaux will improve as prices bottom.

It may take the remainder of 2014 for market positions to unwind. Prices will start to firm up as and when channel inventories start to deplete. Calling the bottom of a market is notoriously problematic, but back vintages are looking more interesting than at any time in the last 4-5 years.

Other fine wine regions have performed exceptionally well over the last few years, notably Burgundy. Top burgundy has averaged 63.5% growth over the last 5 years, and 34% over the last 3 years. Scarcity of supply of demanded wines is a key driver of future value, and Burgundy has suffered a string of short vintages since 2010, a factor that is likely to lend support to current pricing levels of new releases.

The top 20 performers over the last 12 months reflect the increasing the growing interest in northern Italy.

Bigger production volumes offer better market liquidity, to the benefit of Super Tuscan brands, and which Solaia and Masseto enhanced by distributing through the Place de Bordeaux.

Barolos and Barbarescos from 2010 - considered to be a great Piedmont vintage, have ignited interest in the region - and its similarities with Burgundy - small estates, fragmented ownership, mono-cepage (single noble grape variety) and scarcity - suggest there is future value to be achieved if same degree of general qualitative improvement seen in Burgundy over the last decade can be demonstrated.

The bottom 20 performers over the last year simply reinforce the decline of Bordeaux prices.

Posted in:

Press release,

Tags:

Bordeaux wines, Burgundy, fine wine, fine wine index, First Growths, KFFWI, Knight Frank, Knight Frank Fine Wine Icons Index, Knight Frank's Luxury Investment Index, Northern Italy, Wine, Wine Owners,