by Wine Owners

Posted on 2016-03-24

Sales of Bordeaux through the

exchange saw a significant increase on the preceding month, rising from a 75%

share of the market to 88%, the highest market share since the launch of the

exchange in 2013. Bids overall in Bordeaux have increased in value by 2

percentage points, perhaps reflecting a slight upturn in confidence in the

market.

The steep rise in Bordeaux’s market

share overshadows other regions, pushing Burgundy right back to 5%, though the

figure reflects less a decline for Burgundy than the strengthening of the

market in Bordeaux. Volume and value traded were in fact similar to the

preceding period. Rhone had a poor showing overall, dropping market share to

1.3%. Again, the figure is skewed by Bordeaux, but in any case volumes were

down, mitigated only by a flurry of interest in Henri Bonneau triggered by the

announcement of his death on Wednesday. The remainder of the market was shared

almost equally between Champagne and Italy, where trading in top level Barolo

oustripped Supertuscans two to one.

As usual, the First Growths accounted

for the lion’s share of the Bordeaux market, 72% of the value of Bordeaux

trades were made up of 1ers crus and their right bank equivalents. Several

large trades in Haut Brion saw that wine take 61% of the value of 1st

growth trades, though Mouton continued to hold its own at 11.7%, down by

percentage on the preceding period, but up in overall value and volume. Lafite

remained strong at 5.8%, with Latour and Margaux lagging behind. Petrus showed

strongly too, picking up a share of 11% among the 1st growths,

though the high value of these wines always has a tendency to distort market

share by value.

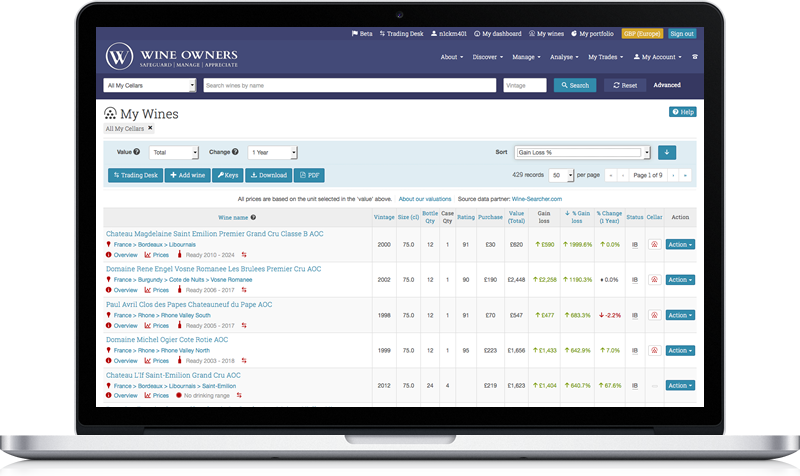

Access the Trading Desk to view recent trades, bids & offers.

by Wine Owners

Posted on 2016-02-15

As expected, Bordeaux continues to dominate trading on the exchange both by value and volume. Reported figures much the same as the previous quarter, with Bordeaux accounting for 75% of trades, and 75% of trading value. The latter is a 5% fall from the previous quarter, which reflects an increased number of trades overall, and in increase in bulk trades of slightly lower value wines in the runup to Chinese New Year.

Burgundy has increased market share on last quarter, now accounting for 15.75% of trade by value, and 11.55% by volume. Both figures are big steps up from the previous quarter, and serve to demonstrate that the marketplace is still small enough to be affected by parcels from individual collectors providing a sudden elevation in liquidity, especially outside Bordeaux.

The First Growths accounted for the largest shares of the market in terms of value trades, and within that number Mouton Rothschild had the best of it, with a 31.8% share of the First growth market by value. Lafite trailed slightly at 26.1%. Haut Brion showed higher than expected at 16.67% and Margaux held its ground at 11.9%.

The surprise in this quarter has been Latour, which has trailed at 7.14%. Hard to determine whether that’s just slightly lower availability of Latour in the market over that period, but either way it seems like the two Rothschild properties are on top at the moment.

The increased focus on Burgundy came at the expense of Italy, which seems to be slightly off the boil compared to the previous quarter’s promising outlook. In fact, Italy was clearly overtaken on volume by the Rhone, which ran at 5.89% of volume traded v Italy’s 1.54, although on value traded the figures are rather closer.

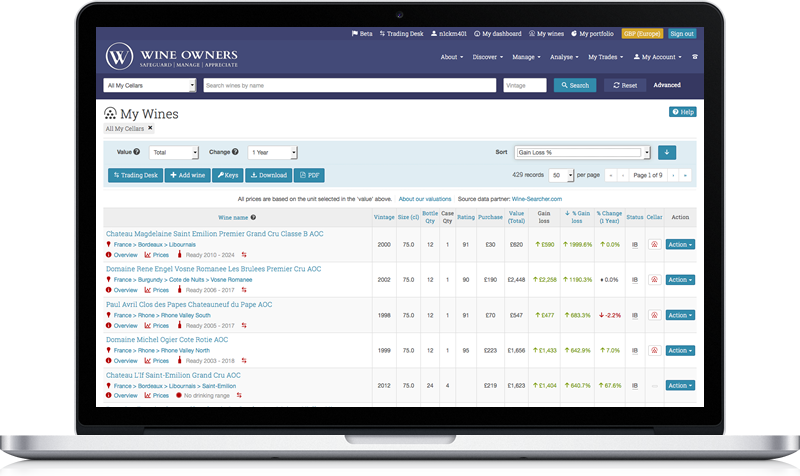

Access the Trading Desk to view recent trades, bids & offers.