by Wine Owners

Posted on 2016-03-24

Sales of Bordeaux through the

exchange saw a significant increase on the preceding month, rising from a 75%

share of the market to 88%, the highest market share since the launch of the

exchange in 2013. Bids overall in Bordeaux have increased in value by 2

percentage points, perhaps reflecting a slight upturn in confidence in the

market.

The steep rise in Bordeaux’s market

share overshadows other regions, pushing Burgundy right back to 5%, though the

figure reflects less a decline for Burgundy than the strengthening of the

market in Bordeaux. Volume and value traded were in fact similar to the

preceding period. Rhone had a poor showing overall, dropping market share to

1.3%. Again, the figure is skewed by Bordeaux, but in any case volumes were

down, mitigated only by a flurry of interest in Henri Bonneau triggered by the

announcement of his death on Wednesday. The remainder of the market was shared

almost equally between Champagne and Italy, where trading in top level Barolo

oustripped Supertuscans two to one.

As usual, the First Growths accounted

for the lion’s share of the Bordeaux market, 72% of the value of Bordeaux

trades were made up of 1ers crus and their right bank equivalents. Several

large trades in Haut Brion saw that wine take 61% of the value of 1st

growth trades, though Mouton continued to hold its own at 11.7%, down by

percentage on the preceding period, but up in overall value and volume. Lafite

remained strong at 5.8%, with Latour and Margaux lagging behind. Petrus showed

strongly too, picking up a share of 11% among the 1st growths,

though the high value of these wines always has a tendency to distort market

share by value.

Access the Trading Desk to view recent trades, bids & offers.

by Wine Owners

Posted on 2016-02-15

As expected, Bordeaux continues to dominate trading on the exchange both by value and volume. Reported figures much the same as the previous quarter, with Bordeaux accounting for 75% of trades, and 75% of trading value. The latter is a 5% fall from the previous quarter, which reflects an increased number of trades overall, and in increase in bulk trades of slightly lower value wines in the runup to Chinese New Year.

Burgundy has increased market share on last quarter, now accounting for 15.75% of trade by value, and 11.55% by volume. Both figures are big steps up from the previous quarter, and serve to demonstrate that the marketplace is still small enough to be affected by parcels from individual collectors providing a sudden elevation in liquidity, especially outside Bordeaux.

The First Growths accounted for the largest shares of the market in terms of value trades, and within that number Mouton Rothschild had the best of it, with a 31.8% share of the First growth market by value. Lafite trailed slightly at 26.1%. Haut Brion showed higher than expected at 16.67% and Margaux held its ground at 11.9%.

The surprise in this quarter has been Latour, which has trailed at 7.14%. Hard to determine whether that’s just slightly lower availability of Latour in the market over that period, but either way it seems like the two Rothschild properties are on top at the moment.

The increased focus on Burgundy came at the expense of Italy, which seems to be slightly off the boil compared to the previous quarter’s promising outlook. In fact, Italy was clearly overtaken on volume by the Rhone, which ran at 5.89% of volume traded v Italy’s 1.54, although on value traded the figures are rather closer.

Access the Trading Desk to view recent trades, bids & offers.

by Wine Owners

Posted on 2014-07-02

You might also like our first infographic: The 9 Commandments to Wine Collecting

by Wine Owners

Posted on 2014-02-06

Average cellar size £60,000

Total cellars under management £40m

|

January |

Overall |

| Bordeaux |

26% of total trades |

39% |

| Tuscany |

23% |

12% |

| Rhone |

21% |

13% |

| Burgundy |

21% |

17% |

Enthusiastic reviews from Antonio Galloni seem to have piqued interest in the 2010 vintage in Tuscany and Piedmont, with back vintages in Tuscany hanging on the coat-tails of the 2010. The tried and tested Supertuscans seem to be the big winners, with trading users offering and bidding around Sassicaia, Ornellaia and Masseto in mid January, with a high correlation of offers to trades across the region.

The inclusion of some excellent new private collections of Rhone and Burgundy in December and January have pushed up the market share of those regions to rival Bordeaux in those months, with a spread of private and trade buyers picking up top wines from producers like Guigal, including a rare parcel of 1989 la Turque trading at £2,900.

Bordeaux, even in a relatively flat market for the region, continued to account for the largest percentage of Exchange trades in January. Interest focusses around classic wines such as 1982 Latour (recent trades at £13,300), top scorers, and ‘off’ vintages, particularly among the first growths. On the right bank in particular, 2005 appears to be attracting new interest where the price is right, so perhaps the prospect of an uninspiring En Primeur season is already encouraging sparks of interest in great vintages with a track record of quality and performance.

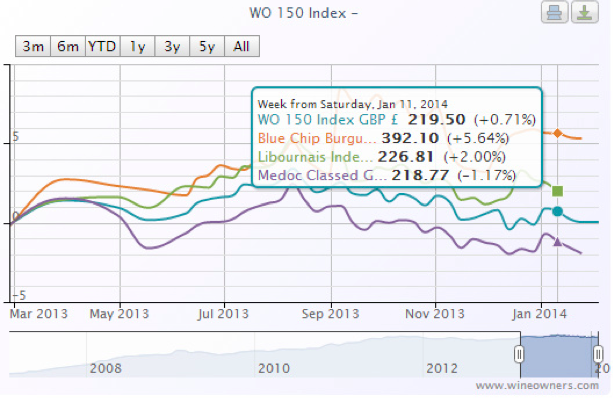

Index comparisons show a relatively flat year’s market, with Medoc Classed Growths slightly underperforming, and top level Burgundy slightly bucking the trend by showing 5.6% growth compared to a base value at Feb 2013.

by Wine Owners

Posted on 2013-11-21

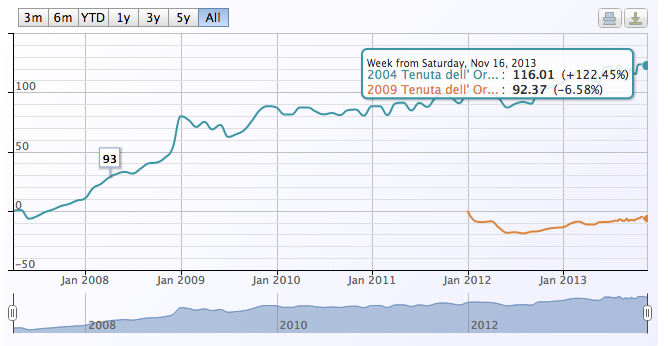

Among all wines that were bought and sold this week on the Exchange, let's take a look at Tenuta dell' Ornellaia Ornellaia Bolgheri 2004.

Bolgheri is one of Italy’s most prestigious vineyard areas, with a reputation based around terroir-driven Bordeaux style blends from iconic estates such as Sassicaia and Ornellaia. The main focus of the Bolgheri DOC is the importance of terroir and for this reason, the Bolgheri Rosso and Bolgheri Superiore wines are labeled without the mention of grapes, as terroir is considered more significant than grape varieties. It is also why Bolgheri wines are reputed for their true expressions of terroir.

Tenuta dell' Ornellaia Ornellaia Bolgheri 2004 reached a market price peak of £1403.76 at the beginning of November and is now hovering around £1,380, with the most recent trade on the Exchange at a level of £1244.

'The 2004 Ornellaia (magnum) has always been a beautiful wine, but stylistically it stands out quite a bit from other vintages of this era, something that is particularly evident in this tasting. The 2004 is perhaps the most delicate, feminine Ornellaia ever made. Silky tannins frame a perfumed core of ripe fruit all the way through to the sublime finish. The wine's inner fragrance, sweetness and balance are all impeccable. The 2004 remains one of my all-time favorite Ornellaias, and it is firing on all cylinders on this night. In 2004 the growing season was long and even, with a cool early summer and warmer late summer. Yields were on the high side, as the vines released the stored energy they had held in reserve from the previous year, which required the estate to aggressively green harvest in order to keep the plants in balance. The 2004 Ornellaia is 60% Cabernet Sauvignon, 25% Merlot, 12% Cabernet Franc and 3% Petit Verdot. The relatively high percentage of Cabernet Franc may explain the 2004's gorgeous, vivid bouquet. The wine spent a total of 18 months in oak (70% new) prior to being bottled. Anticipated maturity: 2012-2024.' 95 points, Antonio Galloni

Interestingly, the younger 2009 vintage, rated 97 points by Robert Parker, gravitates around a market price of £1,108. It slightly dropped from its release price of £1186. This raises two questions. First, can the 2004 stand as a benchmark against which younger vintages are compared? In which case will the 2009 follow the same trajectory over the next few years?

by Wine Owners

Posted on 2013-03-25

Wine Owners provides drinking advice across a large part of its growing database of 82,000 fine wines, based on 75cl bottles.

These drinking ranges are likely to be rather accurate, since we painstakingly average start and end dates from fine wine reviewers to arrive at the estimates.

It goes without saying that prime drinking will depend on many factors, such as long-term storage conditions, time of year shipped and periods when palettes may have been subjected to intense heat, for example dockside between reefer and cooled ship's container.

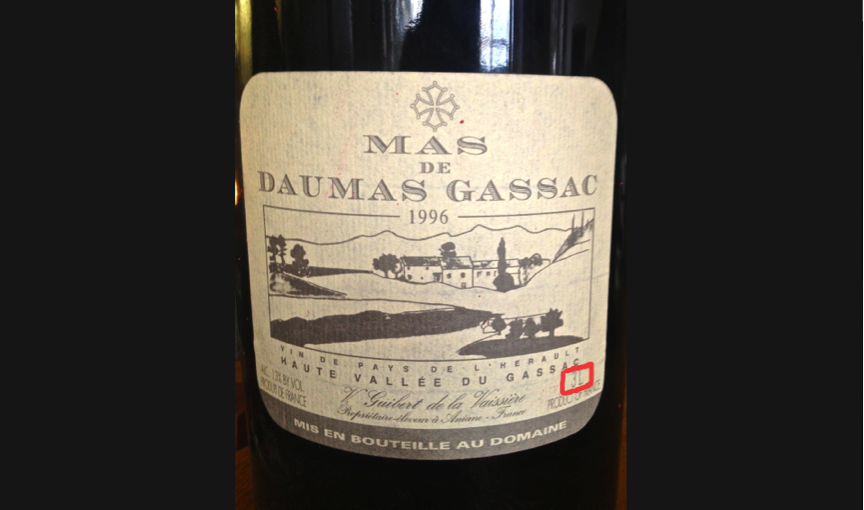

Those drinking dates can be largely disregarded when it comes to large formats. This Easter reminded me how dramatic the differences can be, when I judged a family dinner at my brother's new house to be the perfect occasion to open a double magnum of Mas de Daumas Gassac 1996.

Bought just a year ago on the secondary market, this 3 litre double magnum was apparently well kept, coming out of good storage in its original wooden box and with a high fill level. I acquired it on a whim for GBP 80, knowing full well that the standard bottle size of this vintage could well be fading fast, following Cellartracker! notes and Chris Kissack from The Wine Doctor.

In the event, once the wax seal was broken and a delicate cork extracted, the wine was delightful; darkly coloured with a rusty-bricked rim. Sweet cedar and savoury scents gave way to a palate of earthy blackberry, lifted with bright notes of fresh currents providing the requisite balance and energy on the way to a soft delicate finish. Hard to resist before the meal, but showing enough power and substance to complement the roast duck.

The moral of this story: take drinking advice for large formats with a large pinch of salt.

Buying bigger bottles on the secondary from other collectors can be a rewarding experience full of nice surprises. Sure there are disappointments along the path of discovery and fine wine appreciation, and you can't exactly ask for your money back from another collector. But that misses the point; buy what you can afford and savour the victories!

by Wine Owners

Posted on 2013-03-25

Thank you everyone who's been using our fine wine asset management and trading exchange since November 2012 when it first released.

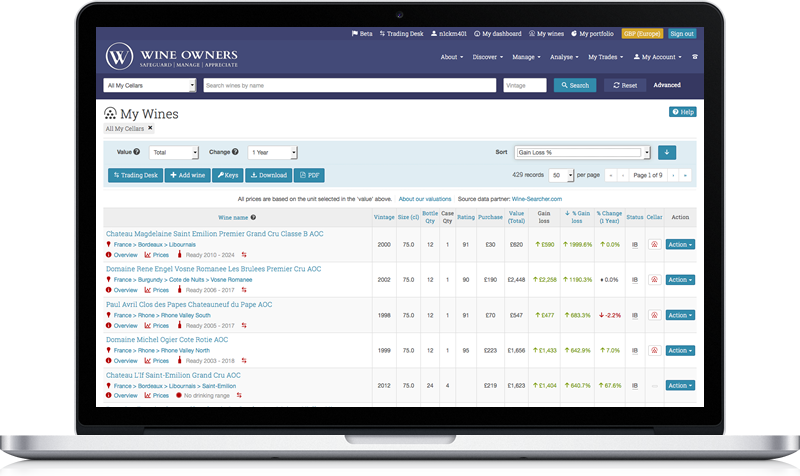

As a result of all our fantastic feedback, we've just released a brilliant new version, providing quick answers to questions such as:

- how much have I spent to date;

- what’s a wine honestly worth if I wanted to sell it tomorrow; how have my wines performed;

- what should I drink now or drink up;

- what do I have too much of and what should I think of selling next to make room for what I’d like to buy next?

With this new release, Wine Owners provides answers to all those fundamental questions and a lot more besides, and is available now via complimentary subscription here.