by Wine Owners

Posted on 2020-06-02

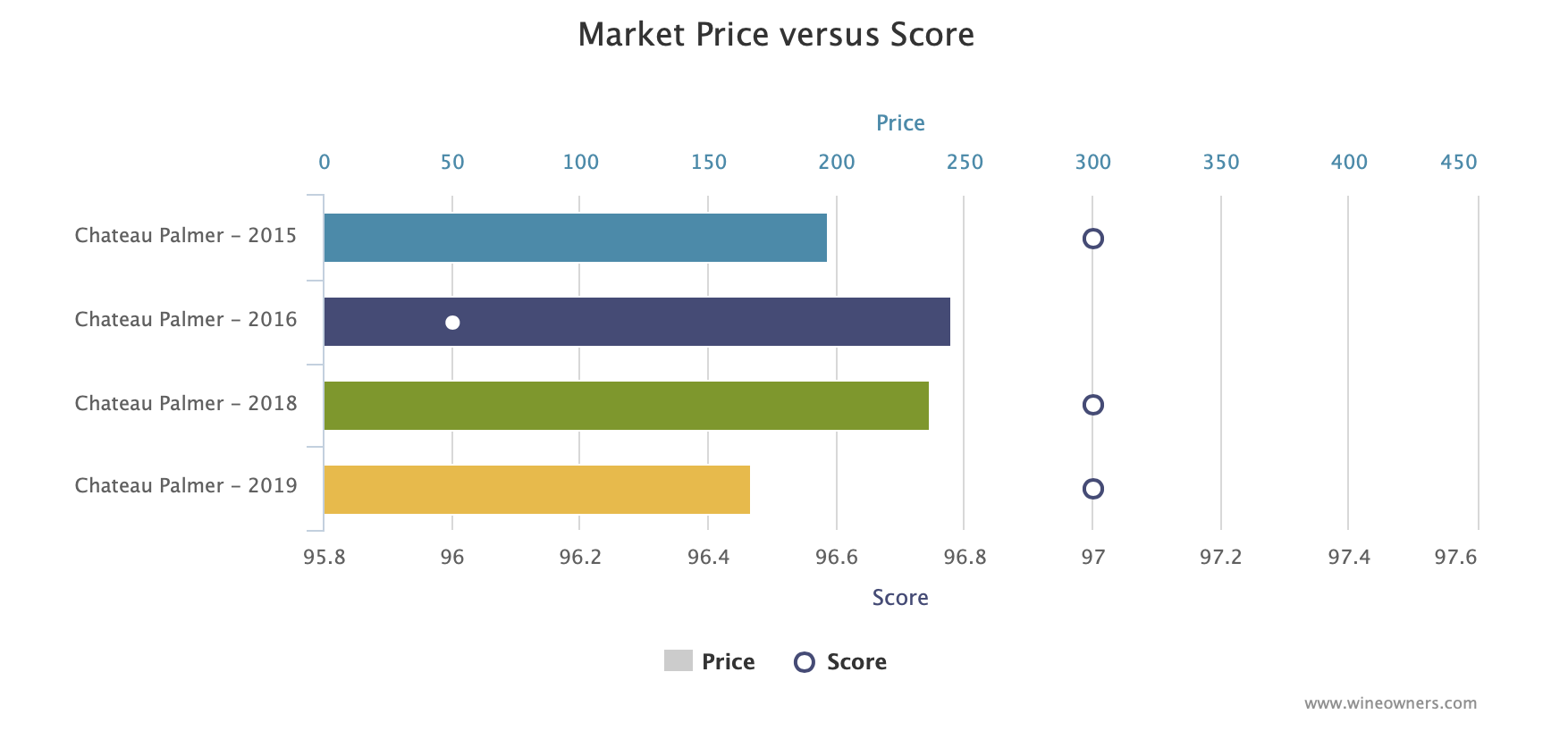

Palmer was released this morning at £999 per 6, a 31% reduction from the (pumped-up) pricing levels of 2016 and 2018. We are back into rational release pricing territory.

Does it work? Absolutely. Note we have put in a placeholder of 18 points but it works at 17 points too.

At this rate, if the whole of Bordeaux rallies around the reduction level of -30% to -35% set by Pontet Canet and now Palmer (and rumoured to be the level of reduction that Lafite will apply), this’ll be the first en primeur campaign since 2014 where it would make sense to buy more broadly than the very specific, narrow range that we’ve suggested makes any sense at all in the last 3 campaigns.

Here’s the analysis of Palmer.

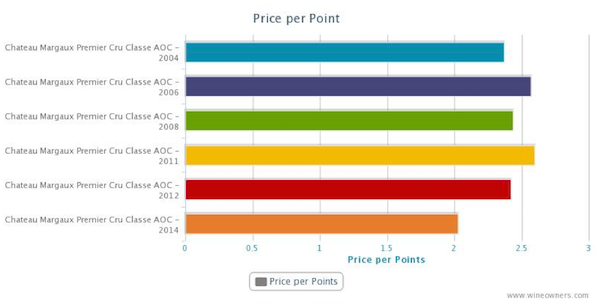

First pricing and scores:

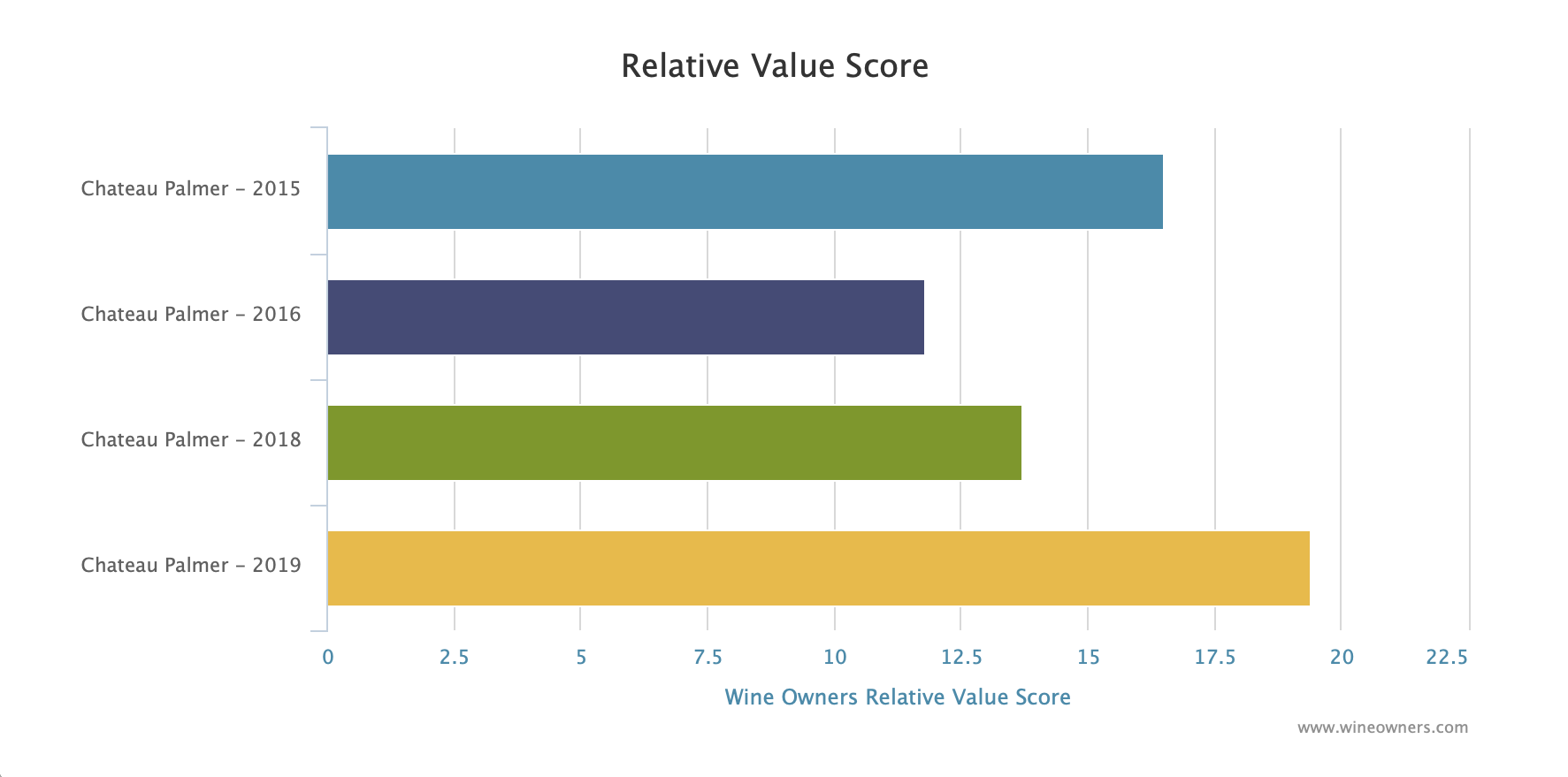

And the relative value calculation. Note how much longer, and therefore better value, the 2019 bar is than any of the comparative vintages used for the analysis:

Banner Image: www.chateau-palmer.com

by Wine Owners

Posted on 2016-05-09

Before we jump into the 2015 En Primeur campaign with analysis and our recommendations of those Crus worth buying, let’s have a look at how last year’s 2014 En Primeur ‘picks’ have performed?

BACK VINTAGES THAT NEW RELEASES HIGHLIGHTED AS BUYS

Before we look at the performance of our 2014 top tips, it’s worth remembering that new releases nearly always shine a spotlight on comparable back vintages and help the market see where there’s value. Last year we focused on some Châteaux from back vintages that we felt were undervalued. Let’s see how they performed:

Chateau Haut Brion 2008

Last year we tipped Château Haut-Brion Premier Grand Cru Classé Pessac-Léognan 2008, priced at £ 2,400 per 12x75cl.

Today a Haut-Brion can be found at £ 2,800, an increase of 16.7% ( April 2016 ). We'd rate it a hold.

TASTING NOTES

"08 Château Haut Brion shows a good depth of color with dark ruby and purple hues. Fresh black raspberry, oak, tar, and spice are in abundance on the nose. The wine has a rich, opulent character. Multi-layered pure, ripe fruit and elegant tannins fill your mouth as you taste. The polished, balanced wine ends with an elegant, long, rich finish expressing purity in the fruit."

Robert Parker Score : 96/100

Chateau Palmer 2004

Last year Château Palmer 2004 cost was around £ 1,140 per 12x75cl.

Since last year, Château Palmer 2004 has risen to £ 1,390, an increase of 15.8%.

Robert Parker Score: 94

by Wine Owners

Posted on 2016-03-10

OWNER

OWNER Chateau Palmer

APPELLATION

Margaux

BLEND

Bordeaux Red Blend

AVERAGE SCORE

92/100

REVIEW

The deep ruby purple 2010 Alter Ego de Palmer has a lovely perfume of bright fruits with blackberries, blueberries, cedar and violets, and is rich and seductive on the palate, supported by fairly high (14.4%) alcohol. A blend of 51% Cabernet and 49% Merlot, this is one of the most concentrated Alter Egos ever.

(Jeannie Cho Lee, 2011)

by Wine Owners

Posted on 2015-05-27

So goes the good luck saying, advising what a bride might wear at her wedding to bring good fortune.

In reviewing Bordeaux 2014 releases to date what could be more appropriate? After all, this has been a campaign where a few enlightened producers got their winemaking and pricing aligned, whilst others (the majority?) have simply ignored the current compelling pricing of many of their back vintages of comparable quality.

In the light of that, what mixture of old and new vintages might the wine lover or collector consider?

SOMETHING OLD

Something old is symbolic of continuity.

When comparing the 2014s to broadly comparable back vintages, it reaffirms the value there is in wines around the 7-12 year old mark. In the majority of cases these are wines just hitting their stride, and in some cases with enormous drinking windows ahead of them.

Here are some examples but today Bordeaux unquestionably is generally favouring back vintages over new releases.

L’Eglise Clinet 2006

I just love L’Eglise Clinet, so I’m delighted to give it my first mention. Only, why buy 2014 when 2004, 2006 and 2008 are all cheaper? Personally I’d probably pay the market premium for the 2006, simply because that vintage is proving to be such a fine year in Pomerol. There is so much definition to the fruit, and such balance to the best wines. L’Eglise Clinet is an obvious choice due to winemaking of the highest order over the last decade.

Haut Brion 2008

At around £2,400 per case, the 2008 makes a profoundly compelling case for itself, as does the 2012 in the light of its recent Parker rerating, reinforced by other reviewers such as Jeff Leve. Throw 2006 into the mix as a wine of exceptional purity, and there’s an embarasse de richesses for grown up lovers of Graves.

Palmer 2004

Leaving aside the fact that the beautiful 2014 is Palmer’s first vintage made entirely biodynamically, 2004 still stands out as a wine value that warrants the wine lover’s attention. According to Parker it’s a modern day version of Palmer’s brilliant 1966, majoring on elegance and precision, freshness and depth of flavor.

SOMETHING NEW

Represents good luck, success and hopes for a bright future.

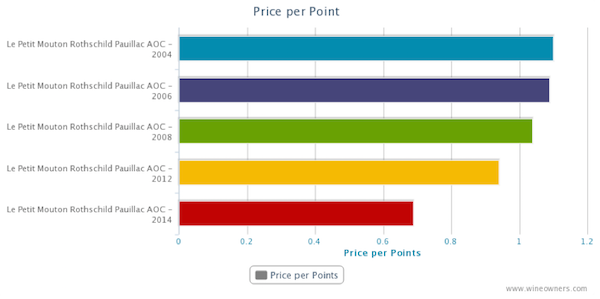

Let’s start with a handful of winners. Using the soon to be released price per points analysis feature on Wine Owners highlights value in the context of broadly comparable quality. The teetering Euro helped, creating a rare opportunity for Châteaux to please the market and satisfy their accountants. A handful grasped the opportunity.

Le Petit Mouton 2014

Growing positive sentiment in respect of the quality of the last decade’s vintages has given those years a recent helping hand. This is the cheapest vintage in the market at £375, and a 40% discount to its possible qualitative equal – 2006. Different too. The success of Merlot on gravel relegated a big slug of Cabernet to the second wine, so atypically cabernet-dominated and correspondingly serious.

Mouton Rothschild 2014

Outstanding in a vintage in which Pauillac starred. There’s a breezy balance whilst its Merlot genes and dash of Cabernet Franc complete a raspberry-driven, fresh, complex palate with plenty of fine-grained tannins. They got the price right as the charts show.

Lynch Bages 2014

Poised, with classic Pauillac character; loaded with griottes fruit and flowing Saville Row lines. It was priced to within a hairs-breadth of 2011 and 2012 current market value but the value difference over 2008 and 2006 must have convinced loyal buyers to part with their money early as merchants reported healthy demand.

Lafite 2014

We didn’t think Lafite was the most immediately impressive First Growth in 2014. In fact it seemed to be the most obdurate. Yet the critics lapped it up, and we’re more than happy to defer to their better judgement. In the meantime one thing is very, very obvious looking at the price per points analysis. It’s priced as a come-on to consumers to open their pocket books and buy early.

SOMETHING BORROWED

Anything can be borrowed but it must be returned afterwards.

A couple of worrying features of the 2014 campaign have emerged.

The first is linkage. Back in 2010 Bordeaux chose to tie certain wines with others. The most interesting example was a pack of Rieussec linked to a pack of Carruades. Interesting because of the distorting factor it had on the market for Rieussec. Back then, merchants simply added a couple of hundred pounds to the price of their Carruades allocation before dumping Rieussec onto Livex and selling through at £210-£220 per 12; roughly half the retail release price offered to consumers. To this day those Livex members who jumped in and hoovered up stock are sitting on the best returns that the 2010 vintage had to offer. Not great for the consumer who bought Carruades but a creative market response to price manipulation.

Linkage is seemingly back, with Rieussec once again tied to Carruades, according to one or two merchants we talked to. Who’s doing the tying is a question to which I have no answer, and this time the merchants can’t just transfer pricing from one wine (relatively difficult to sell at first release) to another (for which there was unquenchable demand back in 2010).

The second feature is limited quantities released by some Châteaux. Who’d have thought the Bordelais would have de facto discouraged early purchases in 2014 – maybe they don’t believe in the en primeur system after all? Like a boyfriend who isn’t in love anymore, but is too insecure to let his partner go.

Calon-Ségur is a wine I thought showed delightfully in 2014. The vibe among négociants in Bordeaux was positive, lending emotional support to the wine even before release.

Recently acquired by Suravenir Assurance, an insurance company for whom no doubt a higher average release price per bottle will help to sûr-value their estate on a forward-looking basis, chose to release up but at a realistic price point for the fine quality. But then the real game plan became apparent. There was no wine: merchants who had assumed they were in line for a reasonable allocation (and had promised private clients allocations on that basis) found that they were empty handed. Merchants were left scurrying around for whatever they could pick up. Consumers were left feeling that however big Calon’s heart, maybe it was losing its soul.

This is the sort of attempt at market influence that Bordeaux EP does not need. Frankly, if Châteaux would prefer to achieve a higher price than the market can bear, then why not exit EP as Latour did, and release when the wine is considered ready? It’s dishonest to play it both ways and the market will not necessarily reward throttled supply with higher prices: demand is often chocked off too in the process.

SOMETHING BLUE

The symbol of faithfulness, purity and loyalty.

There are so many Châteaux that we could have used to exemplify the question of whether we would have chosen to buy early, or wait a few years until the young wines are fully formed, or go back to earlier vintages where there’s so much value to be had. In most (but by no means all) cases we’d go back to earlier vintages and wait to buy the new releases in bottle. But buying young wine isn’t an entirely rational decision as we all know.

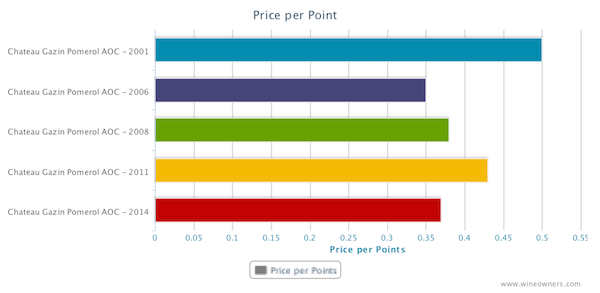

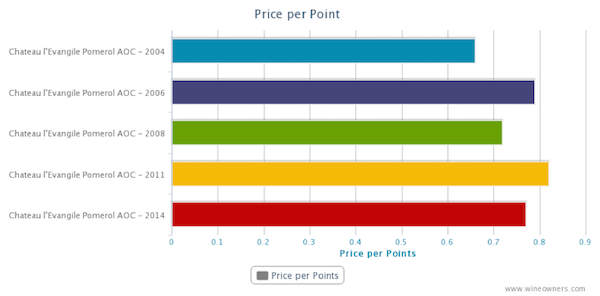

Which vintages would you buy on the basis of the following charts? You decide!