by Wine Owners

Posted on 2016-07-25

It is fair to say that in the recent improvement of fortunes in Bordeaux prices, most focus is given to the classed growths of the Medoc on the Left Bank, and the top wines of Pomerol and St Emilion on the Right Bank. The recovery over the last 12 months has been significant, as seen below, with the Medoc Classed Growth Index (the turquoise line) rising by over 23% and the Libournais Index (purple line) up over 18%. Great news for all those people who have experienced the huge price correction of 2011 to 2014.

But, when looking at Bordeaux as a whole the focus should perhaps swing further south. See what happens when I add the Graves Classed Growth Index (the purple line in the chart, below) into the mix. Over the same time frame the wines of Graves, headlined by Haut Brion and la Mission Haut-Brion, have leapt up by over 30%, outstripping their neighbouring appelations.

Even when you take into account the Brexit effect, which has seen a weak pound in the past month provide a boost from sterling denominated stock as HK and US buyers pile in, this still represents a huge return to form. The lesson here is to realise that the 1855 classification (which ignores Graves, with the notable exception of Haut-Brion) and finest wines north of the Garonne are not the be all and end all. Look south, towards Graves, and you will find a raft of excellent wines that have improved dramatically in the last few years in many instances (think Smith Haut Lafitte, Haut-Bailly, Pape Clement), and which represent both great quality and great value. It is perhaps important that the gravelly, smoky, pencil lead and pencil shaving notes which characterise the best wines of Graves have few, if any, imitations around the world. Bordeaux blends from other continents tend to mimic the Medoc or the Libourne, and so the terroir-specific nature of Graves wines perhaps gives them a uniqueness that collectors ascribe value to in the same way as they do in Burgundy.

Sometimes it pays to take the path less travelled….

by Wine Owners

Posted on 2016-03-10

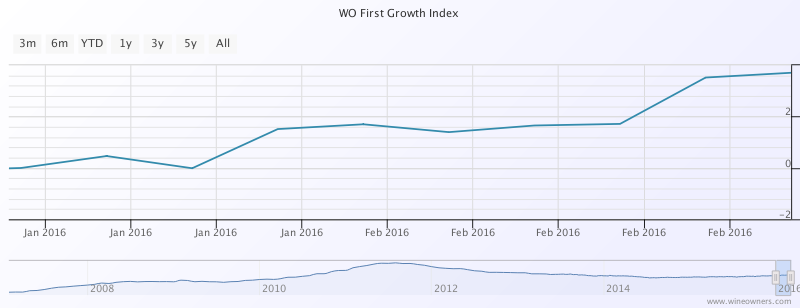

The Wine Owners First Growths Index is up 3.71% Year to date, whilst the Medoc Classed Growth index is up 5.1% for the same period.

The Wine Owners Libournais Index - comprising top Pomerol and St Emilion wines - is also up 4.24% over the last 3 months.

Buyers are coming back into the market in the last few weeks and early signs are very promising: this feels very different to the various short lived rallies since 2013, and is on the back of single digit, consistent quarter on quarter gains over the course of calendar 2015.

The Wine Owners First Growths Index had previously risen 4.6% in 2015. The Medoc Classed Growth index had gained 9% over the course of 2015, with rises dominated by the older back vintages tracked in the vintage range 1996-2006. At this level versus the First Growths it’s noticeable that 2009s are also on the move up.

What does 2016 hold for the collector?

GET YOUR FREE REPORT TODAY

by Wine Owners

Posted on 2015-03-03

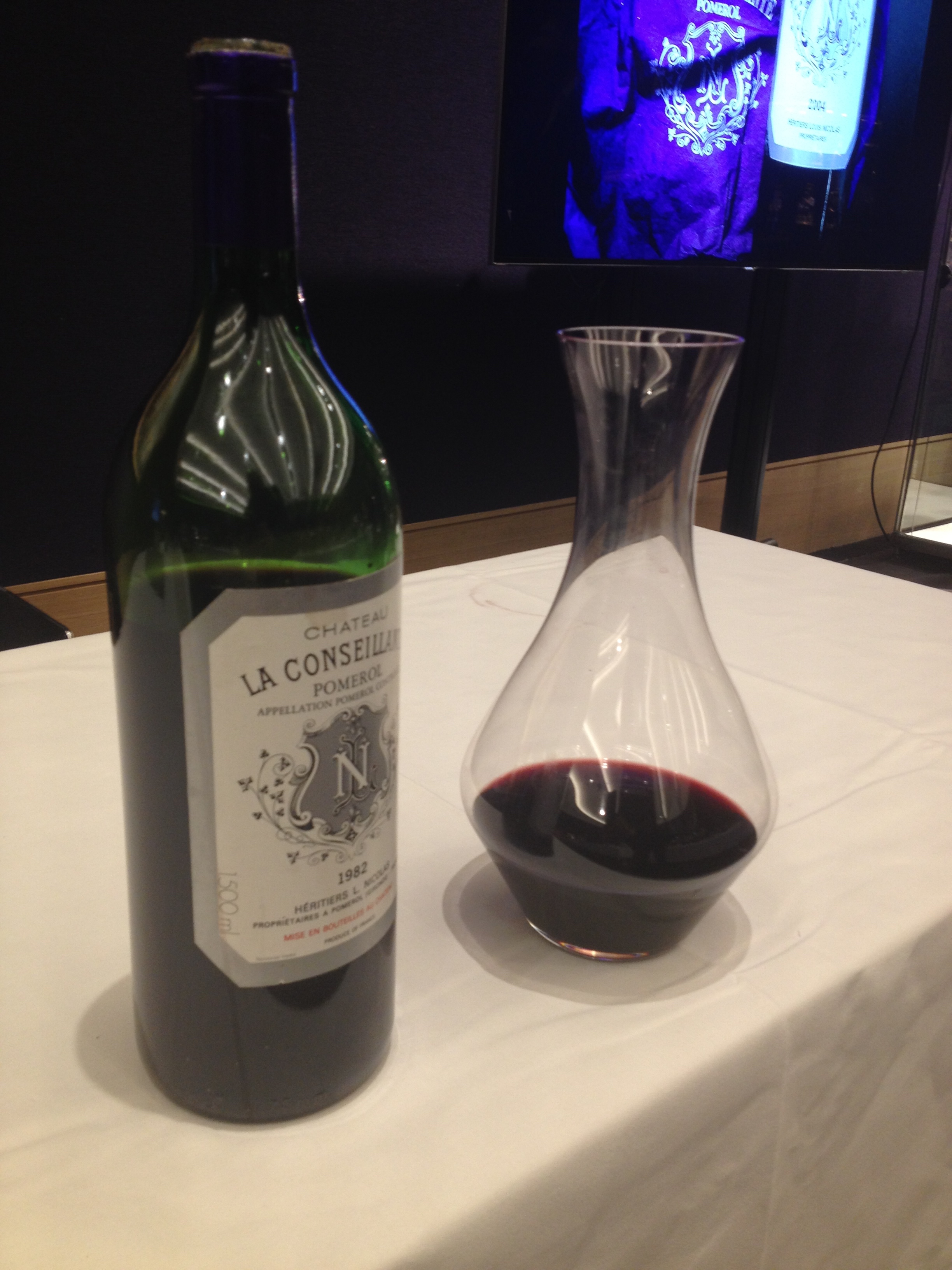

As if to make Jean-Michel Laporte, estate manager of Chateau La Conseillante, feel at home, the walls of auction room G2 at Bonhams on New Bond Street are covered in deep purple fabric. Not only were those walls a perfect match for the violette which so strikingly makes La Conseillante's capsules instantly recognisable, but also recalled Jean-Michel's city of origin, Toulouse, which made it's medieval fortune on the back of the highly prized dye it extracted from violets. Life has a certain symmetry to it, just like the wines of La Conseillante.

Jean-Michel comes across as proud though modest - "we just make wine" - eschews recent trends for biodynamics in a humid, Atlantic weather system, yet recognises that there are some things that past generations practised which have significance today, such as following the lunar cycles.

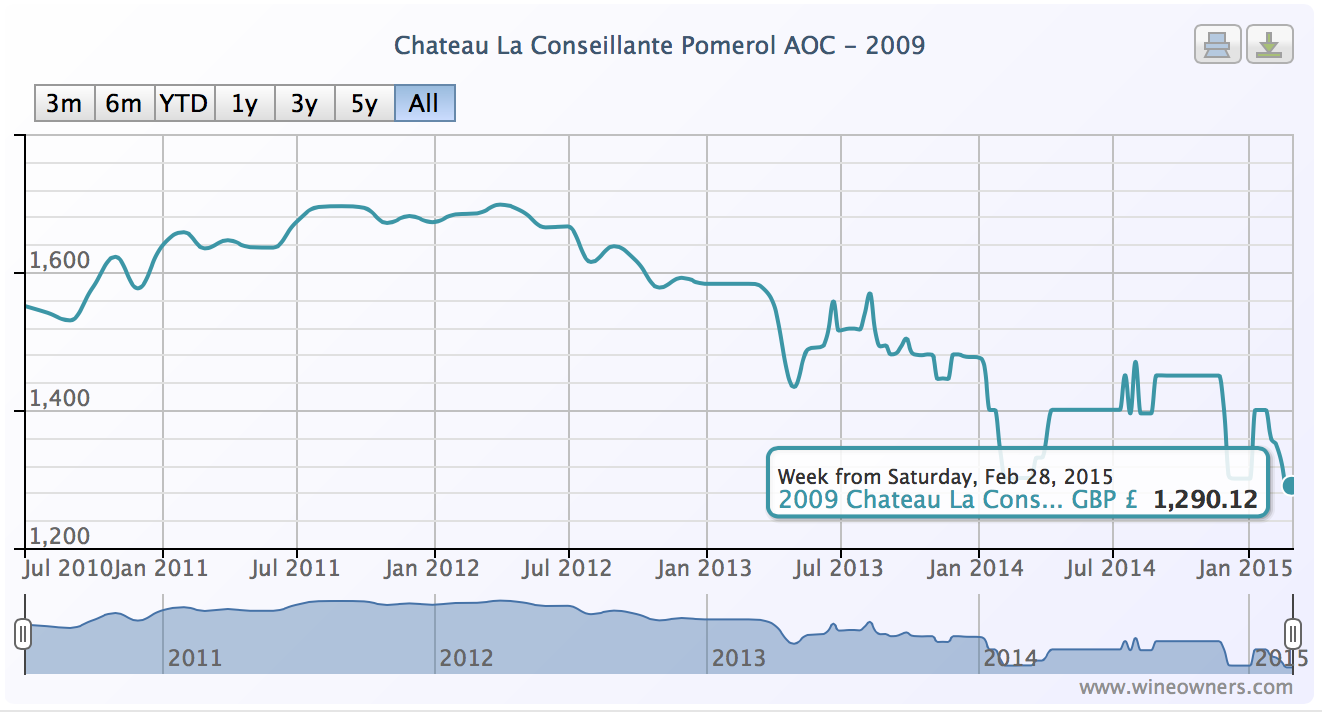

The tasting kicked off with the great duo of 2010 and 2009; the 2011 that was to have been served being misdirected en route to the auction room. Champagne in hand to slate our thirst, this hardly seemed like a great loss, yet by the end of the tasting presumptions of greater and lesser vintages had been challenged. 2010

Licorice and floral notes on the nose, with hints of pepper. Poised fruit, of a vivid, floral character washes over the palate, at once grippy and sweet. Impeccable balance, somehow belying it's 14.5 degrees of alcohol with a remarkable finesse and purity. This really is great wine for the very long term. 2009 Darker fruited nose announcing a warmer style. A deep well of fruit, in the cassis and blackberry spectrum. A powerful entry and confit fruited mid-palate. The heat of the year lends it a modern dimension.

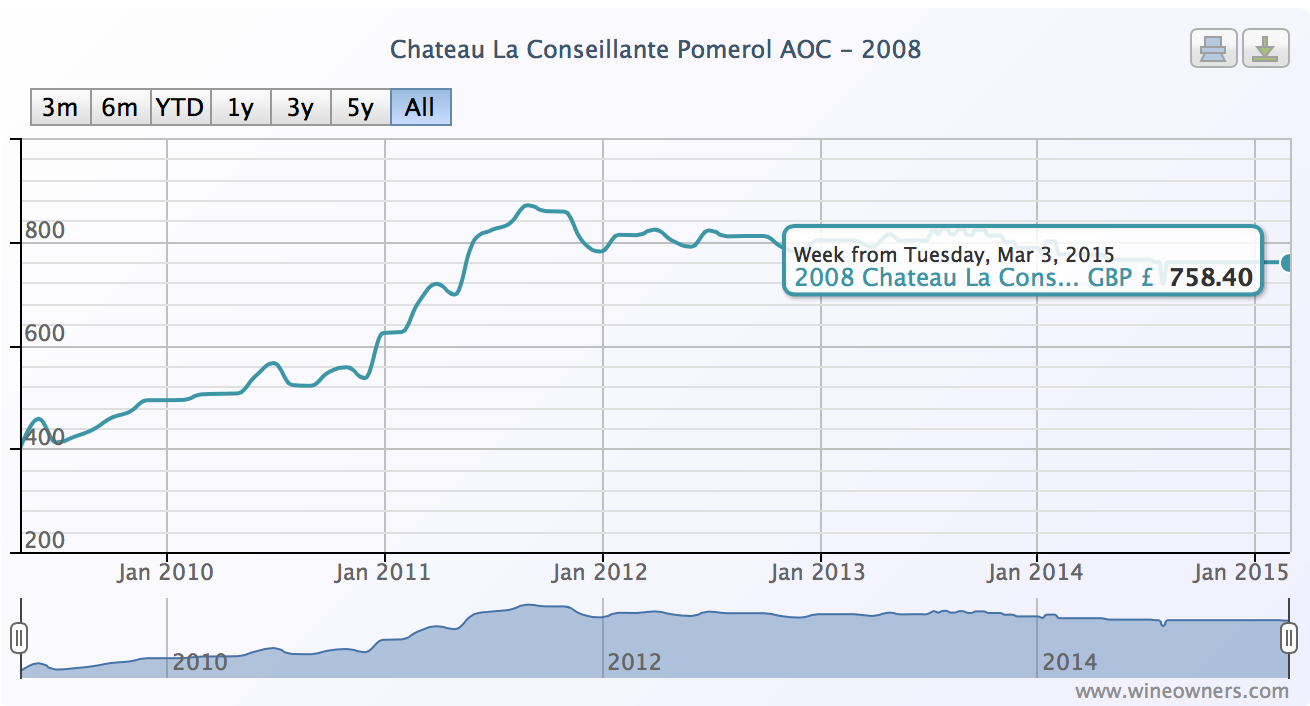

2008 Explosive nose of macerated fruit, aromatic and playful. On the palate, elegant and cool, grippy. Balanced, symmetrical wine with substance to the cleansing fruit, salivant then hints of earthiness on the finish. Classically dry at the end.

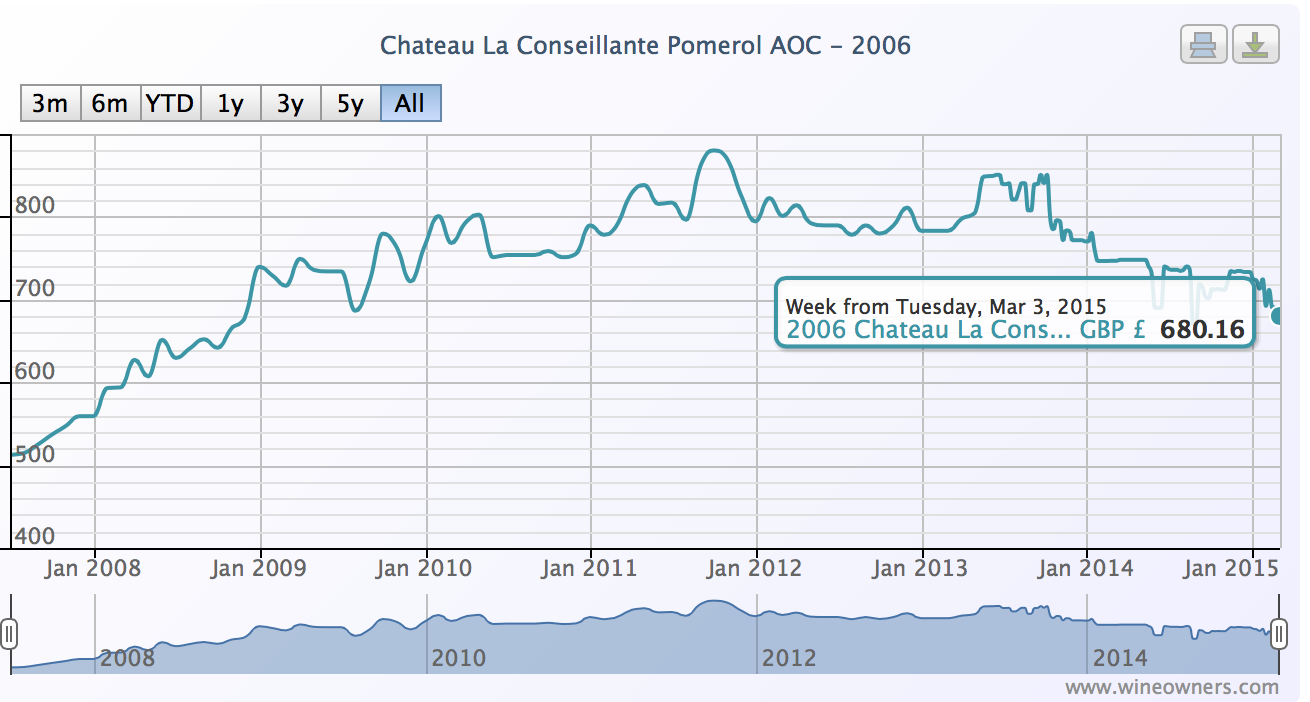

2006 Refined, liquory nose with dusting of pepper. Textural wine, with a meaty, gamey mid palate and iodine notes. 30 minutes later, a revelation, with purer fruit, sappy and intense with great tension and length. Wow. Exciting already, but some way short of early maturity.

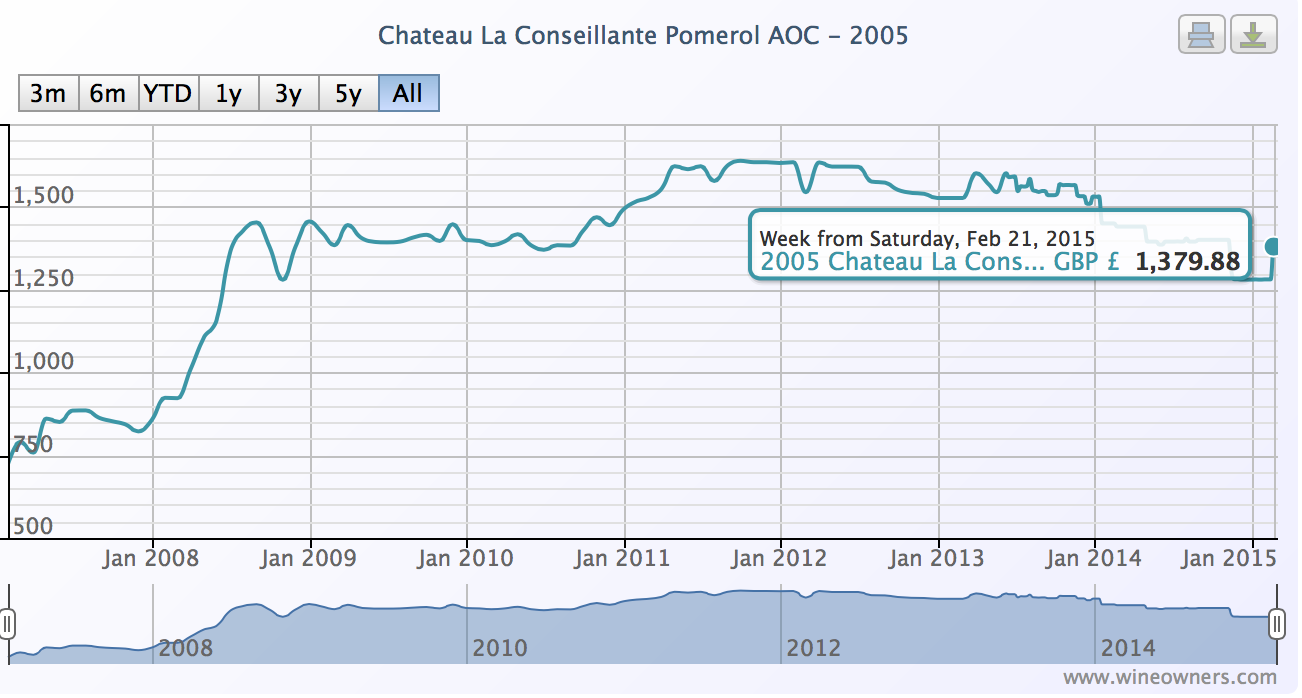

2005 Finely chiselled nose, cool, peppery. The palate shows a velvety smooth entry, aromatic and gamey flavours, with super intensity of grainy fruit. Mouthwatering and lifted mid palate, very progressive, and a very, very long finish.

2001 Earthy nose, aromatic fruit and a touch of pepper. More evolved, with iodine on the mid palate ahead of intense lifted fruit. Firm and decidedly mineral. 2000 Elegant, sweet nose rather like a maturing Barolo or Cote de Nuits Cru. Followed by a red-fruited, warm Burgundian palate. Very pretty, a predictably ripe and satisfying mid-palate, leading to a sappy insistent finish.

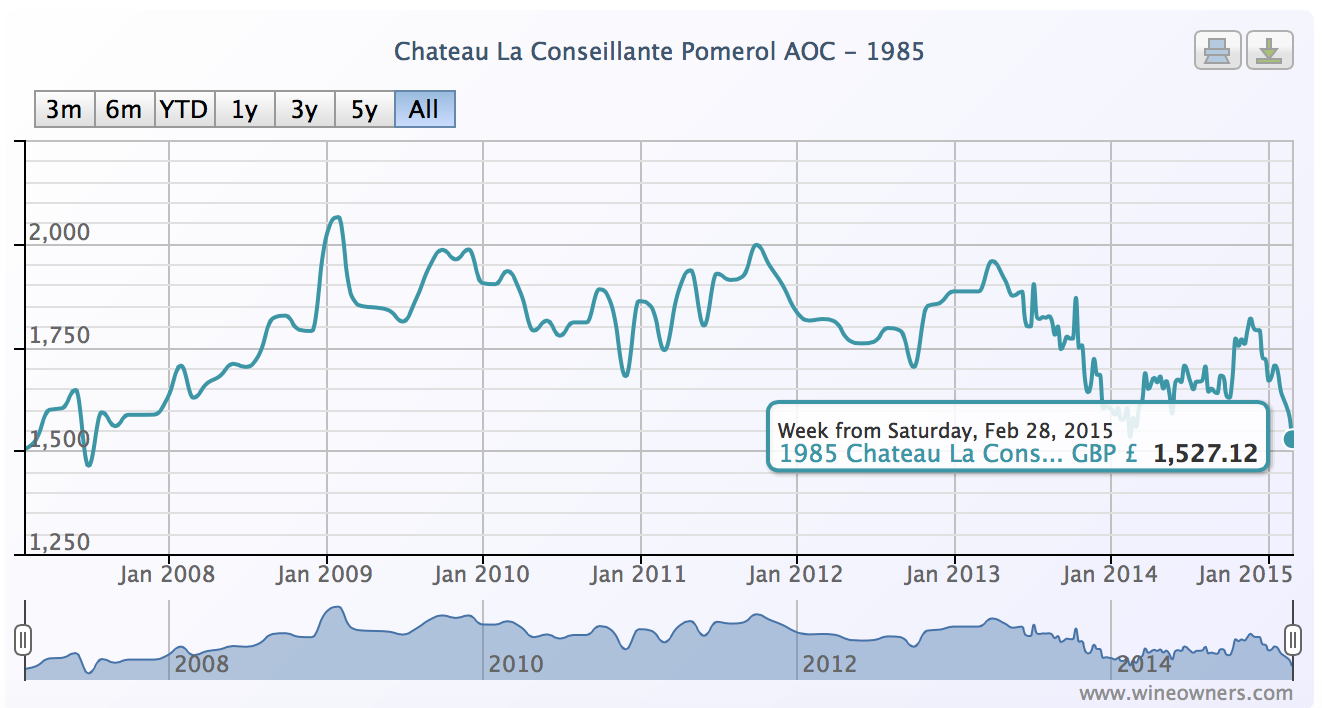

1985 Perfumed nose of sandalwood. Soft-fruited and scented wood notes on the palate, truffled, autumnal and with a subtle smoked character. Utterly alluring and delicious.

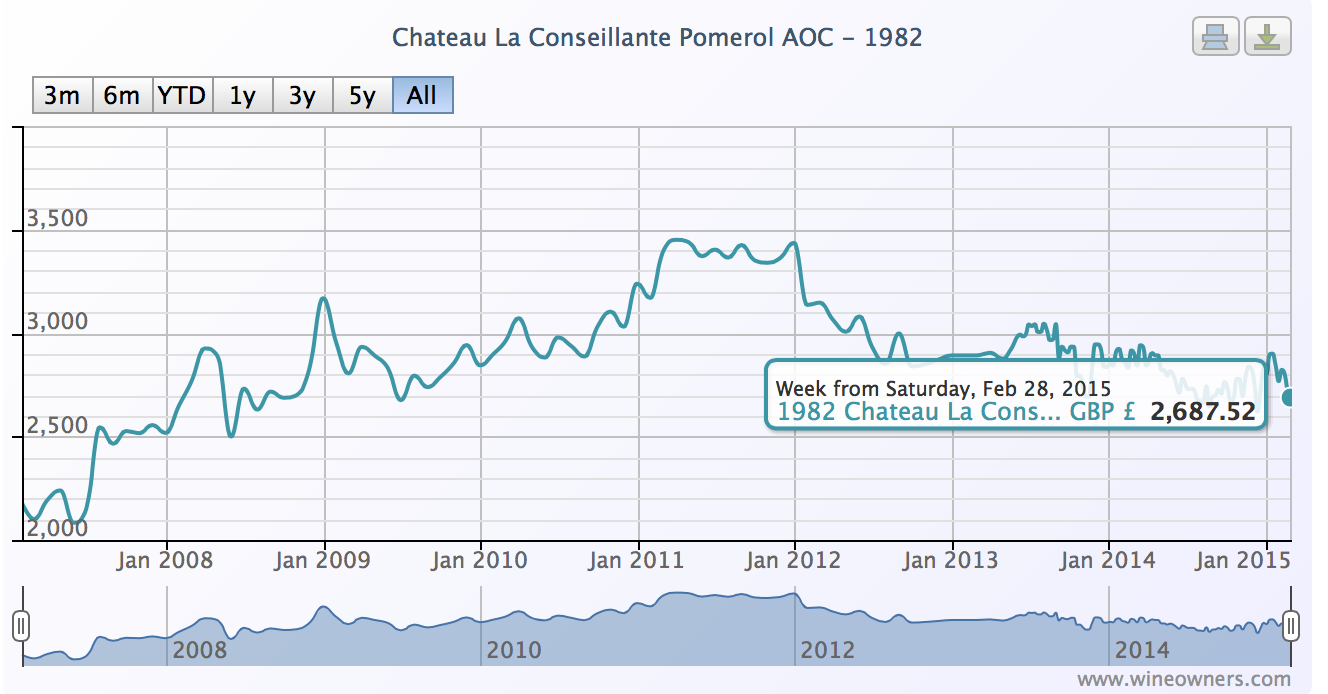

1982 Deeper perfumed nose and camphor. A similarly velvety, coating sensation of fruit like the 2005, then gamey notes, tobacco notes and a more pronounced smokiness. Crystalline finish, again sappy and very, very persistent.

by Wine Owners

Posted on 2015-02-16

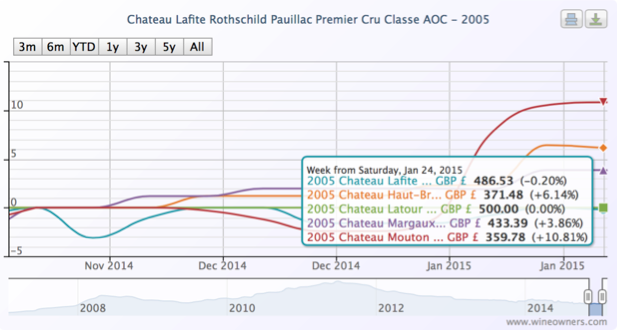

The turning point for fine Bordeaux was August of last year. By early October it was unclear whether the tick-up was yet another of those blips we’d seen several of during the previous 24 months.

Today it is clearer: the trend is up, most wines are well off their lows, and the Bordeaux Index overall is 2.17% up on 6 months ago.

The exception is the Libournais index covering Pomerol and St Emilion, which has slipped 0.48%, a reversing the gains of 1.24% between early October and the end of November last year.

The Medoc Classed Growths are collectively up 2.77% form their August 9th 2014 lows.

Whereas the First Growths only managed 1.51% during the same period. Not entirely surprising since top vintages are still highly priced, they have had further to fall, making it hard to call bottom, and started picking up momentum in January 2015. What is clearer is that wines such as Haut Brion 2008 appear to be interesting propositions.

Elsewhere the Blue Chip Burgundy Index continues to power ahead, though within that there are notable, and expensive, fallers (last 12 months):

| Domaine de la Romanee-Conti Le Montrachet Grand Cru AOC |

2010 |

-7.16 |

| Domaine Ponsot Charmes Chambertin Cuvee des Merles Grand Cru AOP |

2010 |

-7.69 |

| Domaine Armand Rousseau Mazis-Chambertin Grand Cru AOC |

2010 |

-7.89 |

| Domaine Jean Grivot Richebourg Grand Cru AOC |

2007 |

-9.43 |

| Domaine de la Romanee-Conti Romanee Saint Vivant Grand Cru AOC |

2010 |

-10.71 |

| Domaine Jean Grivot Echezeaux Grand Cru AOC |

2002 |

-11.2 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2006 |

-13.15 |

| Sylvain Cathiard Vosne Romanee En Orveaux Premier Cru AOC |

2010 |

-13.69 |

| Domaine Comte Georges de Vogue Chambolle Musigny Les Amoureuses Premier Cru AOC |

2002 |

-13.7 |

| Domaine de la Romanee-Conti La Tache Monopole Grand Cru AOC |

2010 |

-15.38 |

| Domaine Armand Rousseau Clos de la Roche Grand Cru AOC |

2010 |

-16.08 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2005 |

-16.18 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2006 |

-16.35 |

| Domaine Leflaive Chevalier-Montrachet Grand Cru AOC |

2005 |

-16.67 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2008 |

-20 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2006 |

-20.16 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2005 |

-21.94 |

Northern Italy is up 1.42%, with Giacomo Conterno one again heading the leaderboard

Champagne has defied our predictions in gaining a whopping 7.42% over the last 6 months, the top risers comprising exclusively older vintages in the range 1996-2002. This makes a lot of sense. Millions of bottles of top cuvees such as Dom Perignon (up to 8M bottles per annum) means that values kick up only when supply and demand becomes more balanced.

We also thought Californian wines would moderate their growth this year. Comparative to Bordeaux prices, they seem expensive. Since January they have indeed dipped -0.65%, off the back of six month growth of 6.65% up until that point. It’s too early to say whether they are simply pausing for breath, or have reached a natural plateau. The trend line favours the first scenario.

by Wine Owners

Posted on 2014-10-17

Treasure assets are uncorrelated. That’s part of the attraction to high net worth individuals (HNWIs) looking for suitable stores of value.

I use the phrase store of value purposefully. Wealth preservation and enjoyment of the fruits of success are arguably far more important to HNWIs than specific targeted annual returns.

Wine has appeared deeply uncorrelated since the financial crisis of 2008. The facts bear that out. Yet we mustn’t forget the power of externalities to distort underlying tendencies; such as insatiable demand from China up until mid-2011, or the flight from traditional financial instruments during periods of extreme market stress into all things tangible. It’s easy to forget that the wine market did suffer during previous economic recessions or shocks, whether the recession of the early 1990s or the Asian financial crisis of 1997.

Yes, of course we’re talking principally about Bordeaux, that behemoth of a region that produces unrivalled oodles of fine red wine. Paradoxically other regions of production may indeed be uncorrelated with Classed Growth Bordeaux as hot wine money searches for relative value, or where scarcity creates a rather different drumbeat.

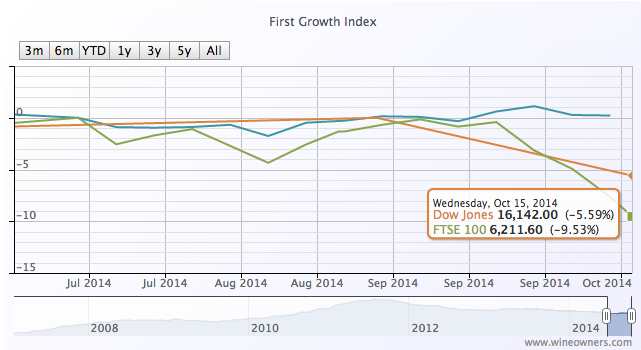

With the current financial market turmoil; the sudden reawakening to the woes of Europe; the economic and political uncertainty of its recession-hit member states - what better moment to analyse the question of market correlation?

The wine market became quite excited by a small upturn that started in late July, continued during August and through much of September. A month on, and things aren’t quite so clear-cut, but in spite of plummeting stock markets, wine prices are not following suit.

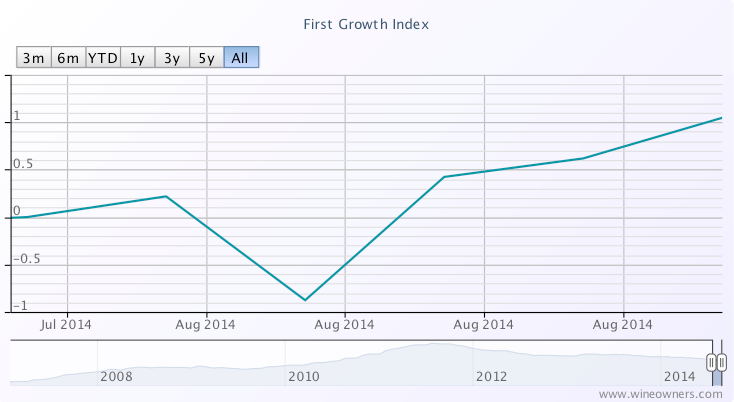

The First Growth Index is up by 1.2% over the last 3 months whilst the FTSE has dived almost 8% - that’s roughly the same amount of value destruction as the First Growths experienced over the previous 12 months. The Bordeaux Index has followed the same positive (if tentative) trajectory (comprising Medoc and Graves Classed Growths and the top Libournais benchmarks). So has Northern Italy, only a whisker off its all-time highs, along with blue chip Burgundy and the effervescent Champagne market.

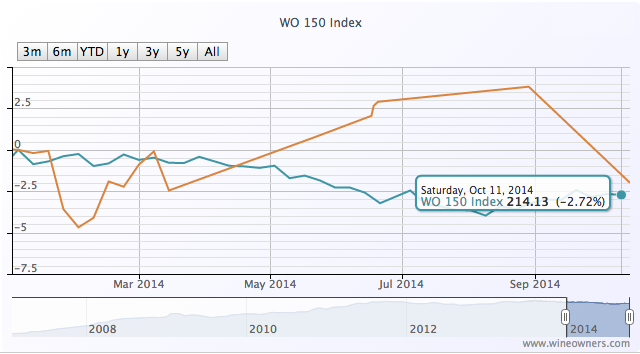

After a disappointing year so far for the wine market overall (represented by the WO 150 Index), the previously run-away Dow is within single-digit, fingertip distance of fine wine’s -2.7% fall.

by Wine Owners

Posted on 2014-09-12

With market sentiment for fine red Bordeaux brightening, we ask, what do the latest market numbers actually suggest?

Let's start with the market as a whole.

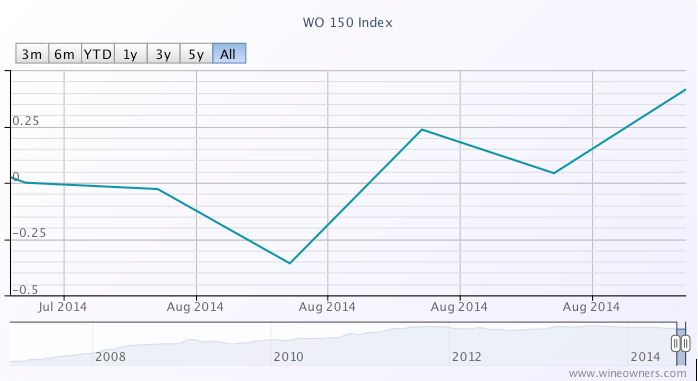

The Wine Owners 150 (WO 150) comprises investment grade wines across the top 40 performers of the last 20 years from all key regions of production. This index rose 0.4% in the last month compared with a fall of -4.45% over the course of the last 12 months. Of the most recent bottom 40 fallers, all were red Bordeaux. More positively there were 22 Bordeaux in the top 40 gainers.

1 month

1 year

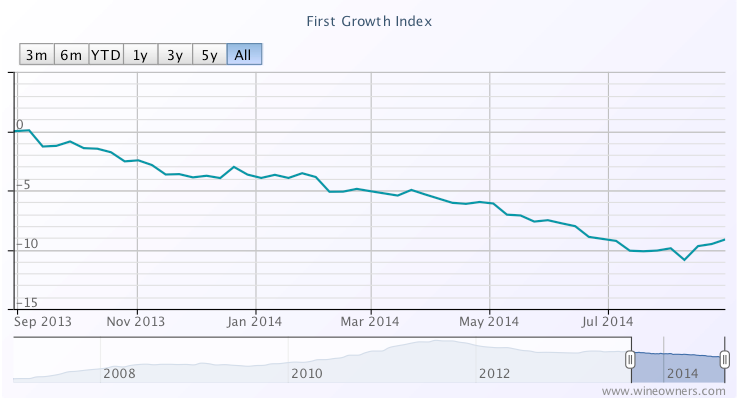

The First Growths Index rose 0.98% over the last month, and is now down -9.14% over the last 12 months, off its early August lows of -10.87%

Haut Brion appears to be leading the charge, 1989 and 2006 showing strong double digit growth, with Mouton (1986, 1989, 1996, 1998 and 2010) showing 5%-8.5% growth along with Haut Brion 2003, Margaux 1986 and Lafite 1990. The predominance of older, scarcer vintages among the top movers is notable. Older vintages can show some of the sharpest short-term moves given there is much less of them in the market, so market movements in 25 year old vintages are not convincing bellwethers.

1 month

1 year

The Medoc classed growth index rose 0.23% over the month and was up 0.72% from its August lows, and is now down -4.8% over the last 12 months.

Palmer saw double digit growth in respect of vintages 2009 and 1998, along with Pontet Canet 1996, Leoville Barton 2006 and Gruaud Larose 2005. Risers however were largely offset by fallers across a broad range of vintages including 1996, 2000, 2005, 2006 and 2009. Although there is increasingly positive support for hard-hit wines from vintages such as 2005, the data does not yet substantiate an upturn.

1 month

1 year

The right bank also saw a rise comparable with the First Growths, with the Libournais Index up 1.09% over the last month, and up 2.5% from its August lows. It is now down just -0.98% over the course of the last year.

Top movers include Petrus 2010, Beausejour Duffau (1998 and 2010), VCC (2001 and 2010), Tertre Roteboeuf (2005, 2009, 2010), Belair [Monange] (2000, 2010), Latour a Pomerol 2005 and Pavie Macquin 2005.

1 Month

1 year

Green shoots?

It’s noticeable that merchants have been talking about restocking since July which can only be positive, but there are opposing views on where the latest data may lead the market.

With the exception of a 0.94 rise in the First Growths Index in December 2013, price declines have been inexorable since then – until now. The trade is split however on how much further First Growths have to fall, especially amongst the previously most inflated wines. With the First Growths down -27% since the peak in July 2011, a small rise of 0.98% may be positive but the inevitable continuing focus on value on the part of buyers favours the possibility of as many - or more - fallers vs risers over the remainder of 2014.

The Medoc classed growths saw a 0.7% uptick in March 2014 in addition to a rise last December in line with the First Growths. Taking all the data into account, it’s hard on that basis to read anything into the recent comparable bounce back from August lows.

The Libournais Index has performed the strongest over the last year with a 2.3% rise between mid January and mid February 2014, comparable with the performance over the last month after a summer of declines. Relative scarcity and a positive 3-year performance (+8%) suggest that the conditions for a broader based recovery are more firmly established for right bank fine wines.

Perhaps of significance, the 22 Bordeaux constituents showing price growth in the WO 150 index since the end of July compares with just 10 Bordeaux wines that have traded in positive territory on a 12 month view.

by Wine Owners

Posted on 2014-08-14

Unsurprisingly, given the continuing market morosité over classed growth Bordeaux, the index plumbed fresh 2014 lows last week, down -3.83% since January, and -6.8% from this time a year ago. The right bank fared marginally better with the Libournais Index year to date (-2.68%) whilst year to date it was down -4.61%.

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOC |

2000 |

-16.15% |

£475.00 |

| Chateau Beausejour Becot Saint Emilion Premier Grand Cru Classe B AOC |

2000 |

-16.19% |

£41.31 |

| Chateau Belair-Monange Saint Emilion Premier Grand Cru Classe B AOC |

2010 |

-16.55% |

£81.66 |

| Chateau La Fleur Petrus Pomerol AOC |

2001 |

-16.78% |

£93.70 |

| Chateau Latour a Pomerol Pomerol AOC |

2005 |

-17.02% |

£48.71 |

| Chateau Le Tertre Roteboeuf Saint Emilion Grand Cru AOC |

2001 |

-17.63% |

£100.72 |

| Chateau Beausejour Duffau-Lagarrosse Saint Emilion Premier Grand Cru Classe B AOC |

2005 |

-17.90% |

£48.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOC |

2005 |

-18.70% |

£325.00 |

| Chateau Figeac Saint Emilion Grand Cru AOC |

2009 |

-18.99% |

£120.83 |

| Chateau Clos L'Eglise Pomerol AOC |

2001 |

-19.55% |

£71.46 |

| Chateau Beausejour Becot Saint Emilion Premier Grand Cru Classe B AOC |

1998 |

-19.82% |

£32.89 |

| Chateau Latour a Pomerol Pomerol AOC |

2001 |

-20.04% |

£32.36 |

| Chateau Ausone Saint Emilion Premier Grand Cru Classe A AOC |

2005 |

-21.21% |

£802.05 |

| Chateau Moulin Saint-Georges Saint Emilion Grand Cru AOC |

2000 |

-21.74% |

£34.45 |

| Chateau Hosanna Pomerol AOC |

2000 |

-21.79% |

£111.60 |

| Chateau Clos L'Eglise Pomerol AOC |

2009 |

-24.12% |

£98.24 |

| Chateau Ausone Saint Emilion Premier Grand Cru Classe A AOC |

2000 |

-25.02% |

£750.00 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOC |

2000 |

-26.15% |

£26.77 |

| Le Dome Saint Emilion Grand Cru AOC |

2000 |

-40.75% |

£76.41 |

The First Growth Index is down -10% year to date and -27.9% since summer 2011 highs. However, there are some surprisingly low prices on back vintages being seen on the fine wine exchange. How about Latour 2004 at £3,050 IB per 12x75cl excluding buyer’s commission? Or Margaux 1996 at £3,500 IB per 12x75cl - one of their great vintages, drinking beautifully now. Frankly, with pretty good to excellent back vintages fetching these kind of prices, no wonder there are no takers for the recent string of Bordeaux off-vintages. The risk to discount ratio is simply not compelling enough. No doubt the market will sort that out over the next couple of years. Contrarily, good to great vintages with 6-10+ years under their belts are starting to look very attractive in places, at least in our eyes, and there’s a trend towards restocking within the fine wine trade - a positive sign.

Looking at constituents of the Wine Owners 150 (which comprises 150 Investment Grade Wines across the top 40 performers of the last 10 years), the leaderboard is topped by Monfortino 2002, up 39% in the last 12 months. This is a romantic, if not heroic performance, from one of the greatest wines in the world defying the miserable conditions of the vintage with its superlative microclimate and the producer’s belief in the intrinsic quality of the wine.

Year on year top performers (Wine Owners 150):

| Giacomo Conterno Monfortino Barolo Riserva DOCG |

2002 |

39.06% |

£338.62 |

| Screaming Eagle Winery Cabernet Sauvignon Napa Valley AVA |

1995 |

28.99% |

£3,135.00 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2005 |

28.50% |

£2,015.74 |

| Tenuta dell' Ornellaia Masseto Toscana IGT |

1998 |

20.66% |

£454.00 |

| Petrus Pomerol AOC |

2001 |

18.28% |

£1,400.00 |

| Tenuta dell' Ornellaia Ornellaia Bolgheri DOC |

2004 |

16.53% |

£133.33 |

| Tenuta dell' Ornellaia Masseto Toscana IGT |

1997 |

15.94% |

£516.67 |

| Chateau Le Pin Pomerol AOC |

2009 |

14.92% |

£2,291.67 |

| Domaine de la Romanee-Conti Richebourg Grand Cru AOC |

2002 |

12.08% |

£1,130.35 |

| Dominus Estate Bordeaux Red Blend Napa Valley AVA |

1997 |

10.66% |

£107.27 |

| Domaine de la Romanee-Conti Romanee Conti Monopole Grand Cru AOC |

2001 |

9.62% |

£7,353.97 |

| Tenuta San Guido Sassicaia Bolgheri DOC |

2006 |

9.36% |

£137.50 |

| Joseph Phelps Winery Insignia |

1997 |

9.19% |

£163.90 |

By the way, not one Medoc classed growth made it into the top 20 of the Wine Owners 150, with the best performing representative of the region being Pichon Baron 2000.

| Chateau Pichon Baron Pauillac Deuxieme Cru Classe AOC |

2000 |

2.47% |

£125.00 |

by Wine Owners

Posted on 2014-05-09

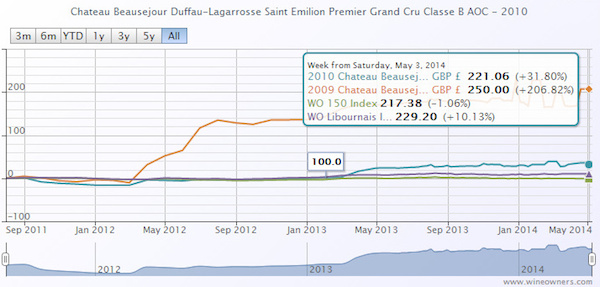

Beausejour Duffau is a great success story of recent years, especially if you are one of the buyers lucky enough to have secured an allocation of the 2009 (in particular) and 2010, both of which received price-boosting perfect ratings from Wine Advocate. The 2009, for example, which has been trading at £2850 has shown nothing but upside since release. The opening EP price here was £800, which is enough to deter the casual buyer, but those who fell in love with the wine from barrel samples have had their faith well rewarded by a market price of £3000, an increase of 270%, which is truly remarkable in an otherwise relatively stale market, and vastly outstrips the performance of pretty much anything else.

Buyers of the 2010 show an increase of around 30%, still very much bucking the trend, but slightly less favoured than the 2009, with an equivalent market price of £2652. Given the release price of the 2010, close to £2000 per case, buyers in that vintage were in a sense late to the party, the chateau having had the confidence to price quite aggressively in its second consecutive great vintage. The pricing performance here is probably also coloured by the fact that the 2009 was given a range of 96-98+ in initial tastings by Parker, while the 2010 was offered a marginally more confident 96-100, both being respectively upgraded and confirmed in a 100 point score.

Lucky owners of the 2009 are left in the enviable if awkward position of having to decide whether to take their £2000 per case profit now, or hold in anticipation of future increases (the last perfect score for Beausejour Duffau was 1990 which now trades at £7,500+ per case and has consistently risen since 2006).

There is always the option of laying it down for future drinking in the knowledge that it’s a 100 point wine for which they paid well below the odds on release. Given 2009 is in all likelihood a decade away from entering its maturity plateau, how many savvy buyers will be prepared to drink a case of wine that might be valued at £7,500-£10,000 by then?

by Wine Owners

Posted on 2014-04-22

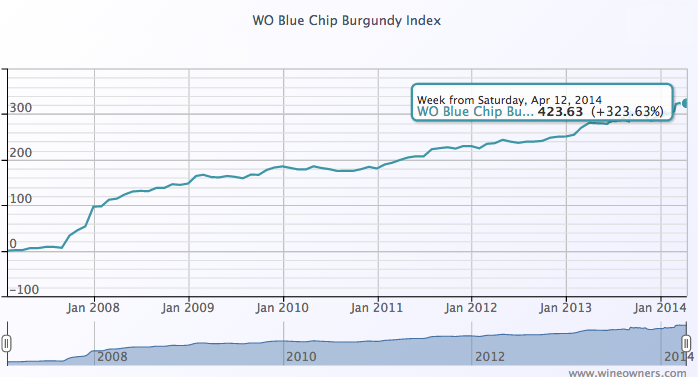

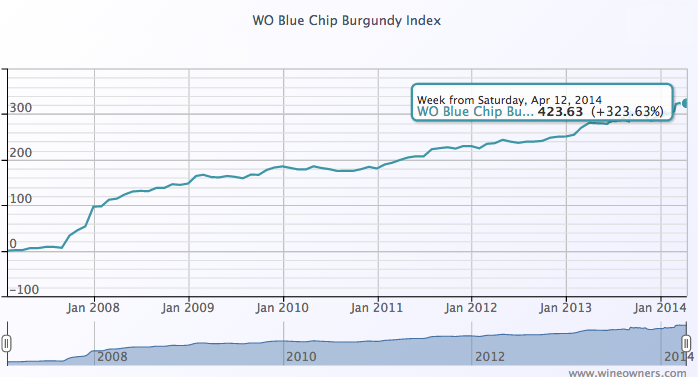

The Blue Chip Burgundy Index is focused on Grand Cru and a small number of top Premier Cru burgundy from the region’s top producers.

These wines are difficult to get allocated at first release in the first calendar quarter two years after harvest, and tend to jump in value as soon

The Blue Chip Burgundy Index is focused on Grand Cru and a small number of top Premier Cru burgundy from the region’s top producers.

These wines are difficult to get allocated at first release in the first calendar quarter two years after harvest, and tend to jump in value as soon as they find their way into the secondary market - such is the competition to own them. So buying in at first release gives the buyer the greatest upside, yet as the graph shows, the upward trend has been irresistible over the last 7+ years.

Once acquired, a significant proportion of these wines never see the light of day again except for when a cork is pulled a decade or so after release. Such is the passion for great burgundy. Does the incredible market performance over the last few years change that we wonder, as more elite producer wines become ultra-expensive - and straying into the lower reaches of DRC, Leroy and Jayer price territory? Nothing has performed as well as fine burgundy in this period, and burgundy’s charted performance (blue) versus the Medoc and Libournais indices (green and orange respectively) looks even more dramatic when compared over the last 3 years.

as they find their way into the secondary market - such is the competition to own them. So buying in at first release gives the buyer the greatest upside, yet as the graph shows, the upward trend has been irresistible over the last 7+ years.

Once acquired, a significant proportion of these wines never see the light of day again except for when a cork is pulled a decade or so after release. Such is the passion for great burgundy. Does the incredible market performance over the last few years change that we wonder, as more elite producer wines become ultra-expensive - and straying into the lower reaches of DRC, Leroy and Jayer price territory? Nothing has performed as well as fine burgundy in this period, and burgundy’s charted performance (blue) versus the Medoc and Libournais indices (green and orange respectively) looks even more dramatic when compared over the last 3 years.

by Wine Owners

Posted on 2014-03-25

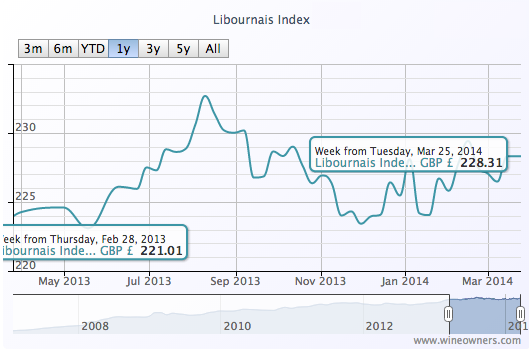

With a level of 221 at the end of February 2013 (baseline January 31st 2007), the Libournais Index shows a relatively flat performance, with a change of only 1.8% over a 1-year period to 228.31.

While the top movers of the Medoc Classed Growth Index were relatively affordable vintages, the Libournais Index top gainers feature higher value wines, as do the biggest fallers, perhaps indicating a rather higher level of market interest than on the left bank.

Individual high-scoring wines, however, buck the trend, with the 100 pointers La Violette 2010 and Petrus 2009 showing that a perfect Parker score can still be a market driver and suggesting that scarcity may increasingly be a market driver within the Bordeaux market, either due to tiny production or due to age.

It's arguably even more interesting to see the price of Vieux Chateau Certan 2010 fall quite significantly since the turn of the year (possibly as stockholders finally throw their hands up and start to write-down the value of their holdings?). Will Vieux Chateau Certan 2010 fall further carried by the momentum of price gravity? At some point this could be extremely tempting, for an utterly sublime wine that was considered by many (including us) to be perfect.

TOP GAINERS

BIGGEST FALLERS

Create an account on www.wineowners.com to receive our analyses by email.