by Wine Owners

Posted on 2020-05-27

So Latour 2012 is out today at £350 a bottle. What’s that got to do with 2019 EP I hear you ask? Well coming as it does just before the releases of the 2019 big boys, and because it’s the first release from Latour that wasn’t previously released EP, it’s seen as a test of the market and what the consumer’s appetite is for laying out hard earned spondoolies in The Time of Covid.

I’ve seen emails from merchants this morning gushing that this is the cheapest Latour in the market today, and how they’ve got the pricing right.

The retail channel needs to see the 2019 releases come out minus 30% v 2018. That would put Lafite et al at around £2,000/ 6 and at that price it would sell. Plus it might just re-energise the Bordeaux secondary market with a dollop of positive sentiment.

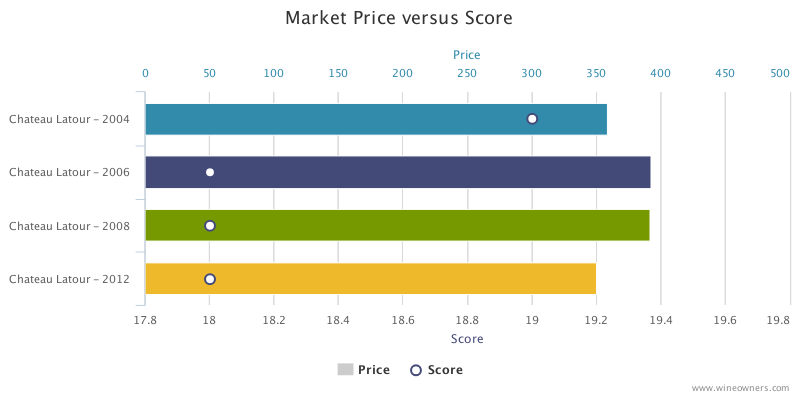

However If we compare 2012 Latour to other comparable vintages of Latour, so say 2008, 2006 and 2004, which I think is rather realistic, we see a very different picture.

Here’s the market price and JR points plotted for 2012 and those benchmark vintages selected:

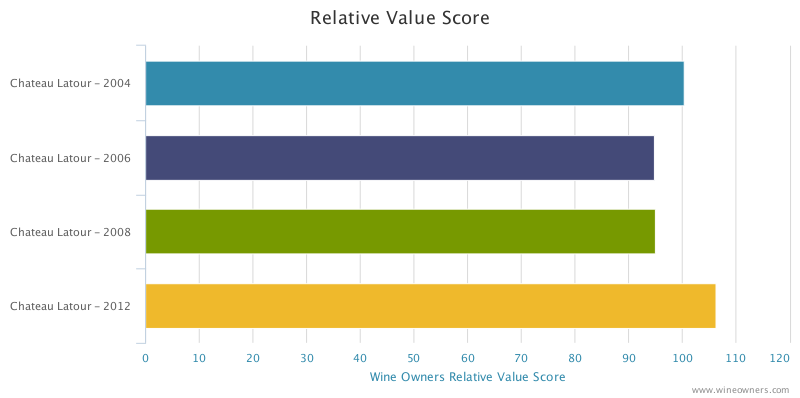

And here’s the weighted effect of that taking into account scores:

The longer the bar the better the value, the bigger the gap between the longest and the next, the more compelling the buy. Not much in it is there? Which says that Ch. Latour, far from doing their 2019 EP peers a massive favour, have given absolutely nothing away. There’s no Covid discount baked into this price. The best you can say is that there’s no guff about ex Chateau premium.

So, as a curtain raiser, it's a damp squib. But that’s their release model now and who’s to say they are wrong? At least we know what we’re drinking. The reply to this question, answerable only by Lafite et al, will come soon enough.

by Wine Owners

Posted on 2019-01-21

Latour ’82, Mouton Rothschild ’82, Mouton Rothschild ’82, ’86, Haut Brion ’89, La Mission Haut Brion ’89, Margaux ’90, Cheval Blanc ’90 and Pichon Baron ‘90

When managing two wine investment funds (2006-2016) we referred to this subsection of the portfolio as ‘the legends‘. They all received cast iron reviews from all the major critics and rock solid and multiple 100s from Big Bob. Cheval Blanc ’90 “unequivocally a brilliant wine” (Neal Martin) has slipped a little to a 98+, but otherwise these wines are confirmed as truly great – legendary in fact! As such, they don’t come cheap (prices in GBP per bottle in graphic below).

Latour and Mouton ’82, +46% and 38% in 2018 respectively, Haut Brion and La Mission ’89 +35% and +52% respectively and Margaux ’90 +35% have all broken out and have massively outperformed the index in the last few months. I believe they can continue to yield positive returns.

Scarcity has been the big driver of price rises in the last couple of years as demonstrated most ably by Burgundy (WO Burgundy Index +33% for 2018, +16% in 2017). This is a prime example of how the principle of good demand versus limited supply in the wine market can work. As a region Burgundy has thrashed others as production is so much smaller, especially with Bordeaux in comparison. Where Bordeaux has been able to compete is in these older vintages of legendary wines, where consumption has driven a scarcity of supply. Each case that is now opened will have a direct impact on that side of the equation.

Cheval ’90 has been volatile but is generally on the up and is well worth considering. I have included Pichon Baron ’90, only a 98+ according to Neal Martin but a Steven Spurrier legend, as it is so relatively cheap and has not broken out at all, so watch this space. The really obvious choice, however, is Mouton ’86. This wine at 32+ years is still a baby in terms of maturity but has an exciting life ahead. Its backwardness has had an impact on the wine’s supply but that will change. As ever good provenance is extremely important and as this is a wine that has been traded more than most so beware - we have seen many examples of poor condition. If this can be found in good nick, do not hesitate in acquiring it - it’s a legend!

Recommendation

Buy: Mouton ’86, Cheval Blanc ’90, Pichon Baron ‘90

Hold: if it’s a legend, continue to hold, for now at least…

N.B. Petrus ’89 and ’90 fall into the ‘legend’ definition but they are so expensive (c.£45,000 per 12) and rare, they have been excluded here.

Miles Davis - professional wine consultant working in the fine wine market. He has been a wine collector for thirty years and managed wine investment funds between 2006-17 for Wine Asset Managers LLP.

by Wine Owners

Posted on 2016-09-12

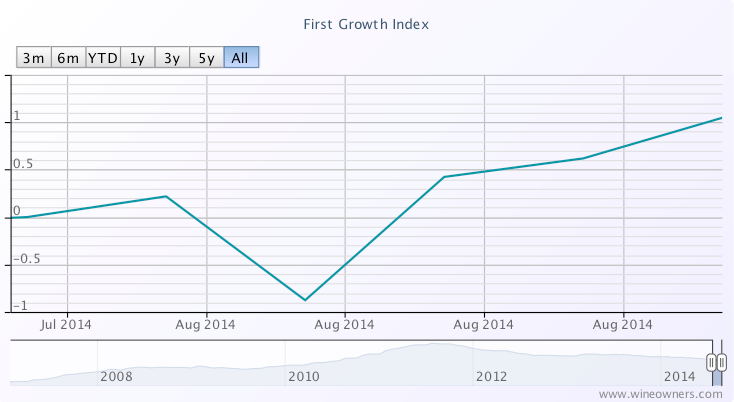

The WO First Growth Index showed price appreciation over the last 12 months pushed through the 20% threshold last week.

Haut Brion’s emergence as a wine that can now rivals its peers in the secondary market is clear, with 4 vintages in the top 10 movers, namely 2000, 2003, 2006 and 2008. Will we see Haut Brion close the gap where historically it would have sold at a discount to the other Firsts? The data seems to support the likelihood of this happening.

The top 10 movers have risen 23%-32% in the last year. Furthermore there has been just one faller out of the 75 constituents of the WO First Growth Index, namely Latour 2005.

Top 10 movers over the last 12 months

For the first time in years, we see a wine from the twin peaks of 2009 and 2010 in the top 10 movers, in the shape of the exceptional Margaux 2010. Scores from Robert Parker, Neal Martin and Stephen Tanzer oscillate in the 96-99 range, but the market is indicating it thinks that this could be a perfect wine. It’s now caught up with Haut Brion and Lafite at circa £540 per bottle.

Latour’s withdrawal from the en primeur business looks like paying dividends. Although the 2010’s value is far out in front of the field at £845 a bottle, it’s still not broken through it’s retail en primeur opening offer price of £950. Nevertheless it has performed well through the worst of the Bordeaux market’s 3-4 year slide, losing just 26% of its value by November 2015 before recovering, quite a decent performance compared with Lafite considering their similarly high release prices.

Can the Firsts continue this powerful recovery? Can they recapture the heights of their 2009 and 2010 release prices? If, so which will be the first ‘First’ to do so?

Least likely is Lafite, whose 2010 release price of £983 per bottle reflects a moment in time when Lafite was practically a Chinese barter currency, not to mention the 2009’s vertiginous release of £1,000. In each case there is a loss per per bottle of £440 versus en primeur retail.

Most likely to get back to even terms, in order of proximity of current market price vs opening retail offer price, is:

Latour 2010

Latour 2009

Margaux 2010

Haut Brion 2010

Confidence has returned and momentum is driving the market forward. If and when the current price of the above 4 wines exceeds their opening prices, and buyers of 2009 and 2010 First Growths no longer see a sea of red loss/gain percentages in their portfolios, confidence will be given a further boost.

by Wine Owners

Posted on 2016-02-18

Looking ahead to the forthcoming Bordeaux En Primeur release, it seems like there’ll be plenty to be excited about, at least from a quality perspective, and there’s already a good deal of speculation about release strategies.

It’s fascinating that Chateau Mouton Rothschild has come out with a similar announcement to Chateau Latour’s 2013 En Primeur campaign withdrawal. It amounts to essentially the same thing, nuanced differently.

“Sales of our wines in bottle are growing a lot and we’ve got to the point where we don’t have enough bottles left in our cellar."

“We won’t be buying our wine back but we will be releasing less of it en primeur as we have to rebuild our inventory.”

“We haven’t lost faith in the en primeur system but you have to be reasonable with your pricing as there are so many reference points for consumers now.”

This roughly translates, into words that you and I will understand, as: "in an increasingly transparent world where discerning consumers can analyse and evaluate young wines by their relative value to past vintages, the only way we can get an en primeur campaign away is by pricing at a discount to comparable previous vintages, that recognises the end-user buyer needs a reason to buy early. That doesn’t seem to make a great deal of sense if we wish to capitalise on growing worldwide demand. Going forward, we would rather not give that discount away to more than a tiny number of en primeur buyers who will help us establish (hopefully higher) future secondary market pricing. That will create the preconditions for us to capture a much bigger slice of the downstream value of our wines, satisfying shareholder requirements for income growth and capital (land) appreciation.”

With Latour and Mouton effectively ‘out’, how will the remaining Firsts respond next year?

Last year there were only a small handful of wines worth buying early. That’s not to say there were not plenty of lovely wines made in 2014, but very few were sufficiently well priced to justify tying up cash. Given the overall superior quality of 2015, producers will hike up their prices, possibly quite a bit. Given that, it’s quite likely that savvy wine buyers will do well to continue to focus on relative values from comparable back vintages and revisit 2015 in a few years’ time. Meanwhile the impending campaign is bound to throw a spotlight on 2000, 2005 and even the better values within 2009 and 2010.

by Wine Owners

Posted on 2015-10-29

Quite a lot of members we speak to these days assume that the market prices of Bordeaux are still stagnating or falling. The morosité that had descended on the region's finest wines in by 2012 does not appear to have lifted.

Wine traders will point to volumes that are much reduced since the giddy heyday of 2009-2011, and that is of course true.

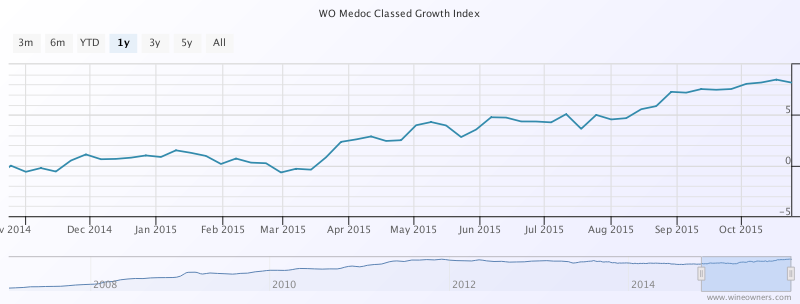

However, it does not mean that in aggregate, prices of Bordeaux have begun an upward trend. In the last year, the Wine Owners Medoc Classed Growth Index is up 8.2%.

Whereas the Wine Owners First Growth Index has only managed half of that in the last year, up 4.1%.

That's still better than the performance of the FTSE100, which is fractionally underwater over the last year, and exactly where the S&P500 has clawed it's way back to after the summer's wobbles.

Wine Owners 150 = Turquoise

FTSE100 = Navy

S&P500 - Green

However, when looking at First Growth performance over the last 12 months, it is far from broad-based. 'The further they rise, the longer they fall' seems to hold true, with Lafite 1986 and 1989 performing the worst at -8% and -9% respectively.

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1999 | -5.45% | £ 216.68 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2006 | -5.75% | £ 286.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2009 | -5.82% | £ 441.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1982 | -5.92% | £ 436.68 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1982 | -6.29% | £ 1,810.14 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1998 | -7.15% | £ 270.83 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2006 | -7.26% | £ 212.50 |

| Chateau Margaux Premier Cru Classe AOP | 1989 | -7.59% | £ 250.10 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1986 | -8.13% | £ 651.48 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1989 | -9.11% | £ 395.92 |

Among the vintages populating negative territory, 1986 has suffered with the exception of the very great Mouton. The exceptional 1989s and 1990s have fallen, along with with the dull 1999s.

The risers are headed by Mouton, Haut Brion and Latour. The top 10 performers registering double digit growth are entirely accounted for by these three Châteaux.

| Wine | Vintage | Change 1 year | Price |

|---|

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2005 | 22.39% | £ 366.67 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2008 | 21.13% | £ 262.54 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2005 | 20.95% | £ 437.50 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 1996 | 16.87% | £ 282.74 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1990 | 14.30% | £ 429.12 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2005 | 13.36% | £ 566.79 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2000 | 13.32% | £ 1,038.81 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2008 | 11.00% | £ 226.64 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1989 | 9.08% | £ 1,000.03 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1995 | 8.49% | £ 316.67 |

Crossing over to the right bank, predominant top performers over the last 12 months are St EmillMedoc Classed Growth Indexon 2005s and the 2001 Class A relative newcomers. Since March 2015 The Wine Owners Libournais Index is up 7%, coming off it's 3 year lows at that point.

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 53.85% | £ 300.00 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 48.07% | £ 176.57 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 45.67% | £ 183.46 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2000 | 37.16% | £ 301.79 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 1998 | 34.59% | £ 161.84 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOP | 2005 | 27.82% | £ 110.96 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 26.84% | £ 232.57 |

| Chateau La Violette Pomerol AOP | 2009 | 26.67% | £ 208.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOP | 2005 | 24.71% | £ 433.34 |

What can we conclude from this? Some commentators are suggesting that value is returning to older back vintages on the back of 4 year declines. Relative value vs quality is likely to be a key driver of future value, for which we recommend you check out the new price per points builder on Wine Owners to which you'll need to subscribe.

Liv-ex have recently seen a predominance of trades of the 2010 vintage, and whilst there seems to be value returning selectively to the Classed Growths, one wonders if it's a little early yet the First Growths, whose starting release prices were in nose-bleed territory. Since 'the further they rise, the longer they fall' it may yet be a bit early to call.

by Wine Owners

Posted on 2014-09-12

With market sentiment for fine red Bordeaux brightening, we ask, what do the latest market numbers actually suggest?

Let's start with the market as a whole.

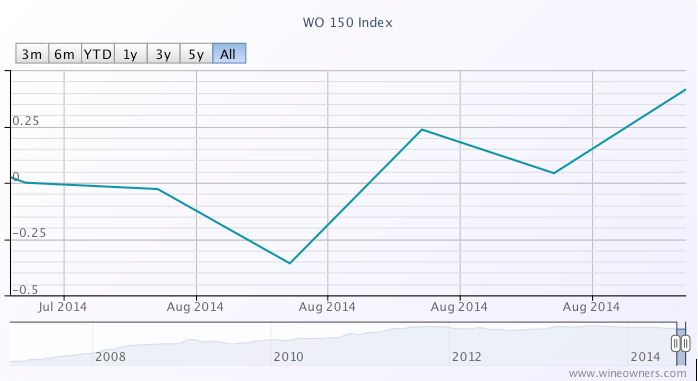

The Wine Owners 150 (WO 150) comprises investment grade wines across the top 40 performers of the last 20 years from all key regions of production. This index rose 0.4% in the last month compared with a fall of -4.45% over the course of the last 12 months. Of the most recent bottom 40 fallers, all were red Bordeaux. More positively there were 22 Bordeaux in the top 40 gainers.

1 month

1 year

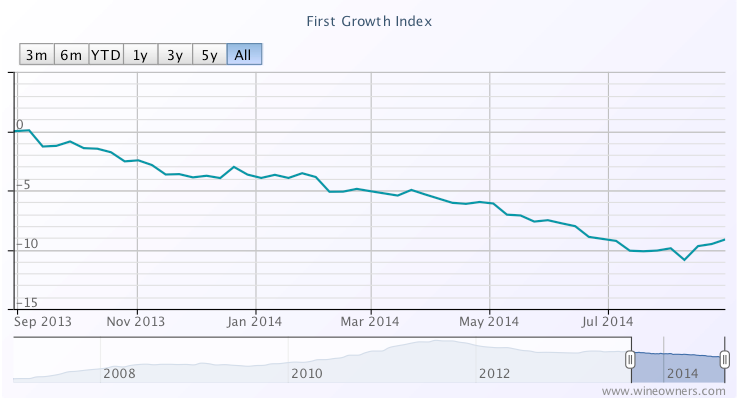

The First Growths Index rose 0.98% over the last month, and is now down -9.14% over the last 12 months, off its early August lows of -10.87%

Haut Brion appears to be leading the charge, 1989 and 2006 showing strong double digit growth, with Mouton (1986, 1989, 1996, 1998 and 2010) showing 5%-8.5% growth along with Haut Brion 2003, Margaux 1986 and Lafite 1990. The predominance of older, scarcer vintages among the top movers is notable. Older vintages can show some of the sharpest short-term moves given there is much less of them in the market, so market movements in 25 year old vintages are not convincing bellwethers.

1 month

1 year

The Medoc classed growth index rose 0.23% over the month and was up 0.72% from its August lows, and is now down -4.8% over the last 12 months.

Palmer saw double digit growth in respect of vintages 2009 and 1998, along with Pontet Canet 1996, Leoville Barton 2006 and Gruaud Larose 2005. Risers however were largely offset by fallers across a broad range of vintages including 1996, 2000, 2005, 2006 and 2009. Although there is increasingly positive support for hard-hit wines from vintages such as 2005, the data does not yet substantiate an upturn.

1 month

1 year

The right bank also saw a rise comparable with the First Growths, with the Libournais Index up 1.09% over the last month, and up 2.5% from its August lows. It is now down just -0.98% over the course of the last year.

Top movers include Petrus 2010, Beausejour Duffau (1998 and 2010), VCC (2001 and 2010), Tertre Roteboeuf (2005, 2009, 2010), Belair [Monange] (2000, 2010), Latour a Pomerol 2005 and Pavie Macquin 2005.

1 Month

1 year

Green shoots?

It’s noticeable that merchants have been talking about restocking since July which can only be positive, but there are opposing views on where the latest data may lead the market.

With the exception of a 0.94 rise in the First Growths Index in December 2013, price declines have been inexorable since then – until now. The trade is split however on how much further First Growths have to fall, especially amongst the previously most inflated wines. With the First Growths down -27% since the peak in July 2011, a small rise of 0.98% may be positive but the inevitable continuing focus on value on the part of buyers favours the possibility of as many - or more - fallers vs risers over the remainder of 2014.

The Medoc classed growths saw a 0.7% uptick in March 2014 in addition to a rise last December in line with the First Growths. Taking all the data into account, it’s hard on that basis to read anything into the recent comparable bounce back from August lows.

The Libournais Index has performed the strongest over the last year with a 2.3% rise between mid January and mid February 2014, comparable with the performance over the last month after a summer of declines. Relative scarcity and a positive 3-year performance (+8%) suggest that the conditions for a broader based recovery are more firmly established for right bank fine wines.

Perhaps of significance, the 22 Bordeaux constituents showing price growth in the WO 150 index since the end of July compares with just 10 Bordeaux wines that have traded in positive territory on a 12 month view.

by Wine Owners

Posted on 2013-11-15

The 2009 Annual Bordeaux Tasting organised by The Institute of the Masters of Wine recently highlighted the high standard and homogeneity of Bordeaux 2009.

The best Medocs were beautifully perfumed, notably throughout the Graves, Margaux, and St. Julien. Where freshness was retained, the very ripe fruit lifted by fresh acidity, the wines were both easy to taste and delineated.

Examples that stood out were:

Pontet Canet with a refined, liqueur texture, fabulous confit yet crystalline, vivid fruit, and a velvety finish.

Leoville Barton was extremely pretty for a property that typically makes very structured long-term wines, exciting and fresh with wonderful aromatics.

Montrose was immense, and so confidently poised within its powerful structure.

Mission Haut Brion was truly fine; beautifully perfumed, noble fruit, dusty tannins in no way inhibiting a very long finish.

Sister property Haut Brion showed in a more structured vein, bright fruits, yeast and cedar on the nose, uplifting with a real sense of energy underlying the progression of flavours. Haut Brion was a beacon of how great 2009 can be when ripe fruit, acidity, structure and energy come together to create a unique, visceral experience. It also served to highlight how unctuous and relatively soft so many of the other wines in 2009 really are. And this isn't necessarily a good thing for the long term.

At a recent dinner tutored by Edouard Moueix where he showed La Fleur Petrus 2009 and 2010 side by side, the 2009 was unctuous and richly textured. The 2010 had more clearly delineated elements, showed as being far more complex, with wave after wave of nuanced flavours through an almost interminable finish.

Back in 2011, in the heat-wave of that Bordeaux spring, 2010 also showed brilliantly. Where wines were compared side by side, the 2010 vintage got my vote almost every time, including beauties from:

Calon Segur

Cheval Blanc

Haut Brion

Haut-Bailly

La Conseillante

L’Eglise-Clinet

La Mission Haut-Brion

Latour

Le Pin

Margaux

Montrose

Pichon Longueville Comtesse de Lalande

Rauzan Segla

Vieux Chateau Certan

So for me whilst the two vintages are both extraordinary; I prefer the definition, balance, complexity and enduring length of flavour so commonly found in the best 2010 red Bordeaux, which gets my vintage vote bar a few exceptions like Leoville Barton.

by Wine Owners

Posted on 2013-04-05

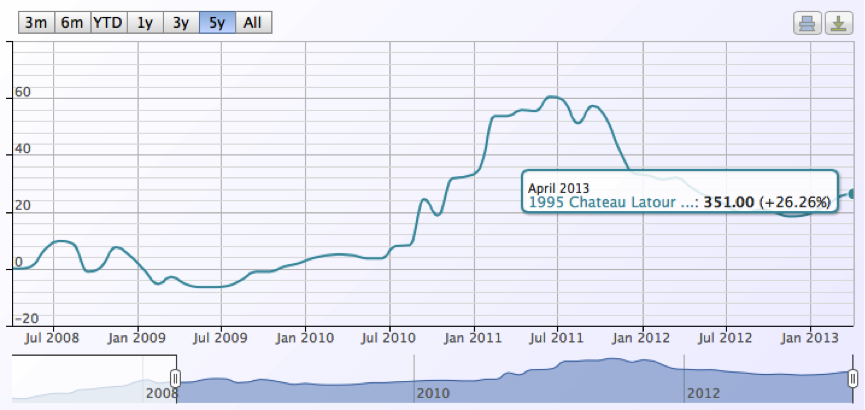

With updated prices released on Wine Owners' - the world's first full service, independent asset management and trading exchange - it's an opportune time to check on the market price of Chateau Latour 1995.

Why? Because having withdrawn from the en primeur release system in April 2012, Latour director Frederic Engerer had announced that each year a vintage of Chateau Latour and the second wine, Les Forts de Latour, would be released at the start of their perfect drinking window.On March 19th 2013 the first of the 'library' releases, 1995, was offered at a UK retail price of (GBP) £4,950.Each bottle comes with a prooftag (a security product guaranteeing traceability and authenticity) and sports a back label stating the date of shipment from the chateau.1995 was a great vintage for Latour, as evidenced by the following wine critic reviews:

Robert Parker 96 points (June 2000)

A beauty, the opaque dense purple-coloured 1995 exhibits jammy cassis, vanillin, and minerals in its fragrant but still youthful aromatics. Medium to full-bodied, with exceptional purity, superb concentration, and a long, intense, ripe, 40-second finish, this is a magnificent example of Latour. As the wine sat in the glass, scents of roasted espresso and toasty new oak emerged. This classic will require considerable cellaring. Anticipated maturity: to 2050.

Jancis Robinson 18.5 points (2011)

Lustrous deep crimson almost right out to the rim still. Hint of mint on the nose – quite aromatic. Pretty. Charming for a Latour grand vin! Though there is a strong undertow of graphite. More intense than 1996. Drink to 2035

Lisa Perrotti-Brown 96 points (Nov 2012)

Deep garnet-brick in colour, the nose is well developed, displaying dried berry, leather, vanilla pod and anise notes with a faint whiff of potpourri. The palate is wonderfully fleshy and opulent with velvety, approachable tannins and a long finish.

Latour took criticism for their release price from some quarters arguing that that it was too high compared to market prices for previously released-en-primeur bottles of 1995.

Our analysis (Wine Owners Market Level calculation: base data sourced from Wine Searcher) shows the current market price per bottle is £351, or the rounded equivalent of £4,200 for a 12x75cl case.

As the chart shows this is down from £433 per bottle in April 2012, or the rounded equivalent of £5,200 for a 12x75cl case, showing the prolonged tough time first growths have endured since hitting their giddy heights in the summer of 2011.

So is a £700 case market premium for an ex chateau release with perfect provenance and a prooftag worth it?

Yes, according to Lisa Perrotti-Brown MW who believes a 15% premium is worth paying to source that perfectly stored and shipped wine.

And that, funnily enough, is precisely the premium that Latour decided to place on the 1995 library release.

by Wine Owners

Posted on 2012-03-04

Around 9am on Friday 2nd March 2012 my inbox lit up with wave after wave of 2009 Bordeaux offers from wine merchants. (Congratulations to Flint Wines for refreshingly focusing on an up-and-coming Burgundian grower.) In the weeks leading up to last Friday, merchants had taken the opportunity to inform private customers that RP's new scores were imminent, and that now was a good time to pick over market prices, many of which had fallen from their release price and 2011 highs.

I'd already done all my 2009 'business' during 2010/11 so stood by and watched. Parker duly came out with his new 2009 scores and a glowing recommendation - like 1982 (on which he made his reputation) but better thanks to advances in wine making, a return to traditional vineyard husbandry, and greater de-classification of parcels into second and third wines (in fairness common arguments trotted out regularly by the regisseurs and chateau owners in Bordeaux). What surprised everyone was how many high points he awarded his favourite wines - 18 wines getting 100 points; in comparison to just 6 wines in each of the two great vintages of 2000 and 1982.

Here are the final 100 pointers thanks to Ditton Wine Traders

| wine |

bottle |

barrel |

| Beausejour Duffau Lagarosse |

100 |

96-98 |

| Bellevue Mondot |

100 |

95-100 |

| Clinet |

100 |

97-100 |

| Clos Fourtet |

100 |

95-98 |

| Cos d'Estournel |

100 |

98-100 |

| Ducru Beaucaillou |

100 |

96-98 |

| L'Evangile |

100 |

96-100 |

| Haut Brion |

100 |

96-100 |

| La Mission Haut Brion |

100 |

98-100 |

| La Mondotte |

100 |

95-98 |

| Latour |

100 |

98-100 |

| Le Pin |

100 |

95-98 |

| Leoville Poyferre |

100 |

97-100 |

| Montrose |

100 |

96-100 |

| Pavie |

100 |

96-100 |

| Petrus |

100 |

96-100 |

| Pontet Canet |

100 |

97-100 |

| Smith Haut Lafitte |

100 |

96-98 |

And Friday's price increases vs the previous day's prices ranked from high to low

| Wine |

prior |

after |

% change |

| Beausejour Duffau Lagarosse |

£1,000 |

£2,400 |

140% |

| Clos Fourtet |

£750 |

£1,800 |

140% |

| Smith Haut Lafitte |

£680 |

£1,600 |

135% |

| Clinet |

£1,500 |

£2,200 |

47% |

| Le Pin |

£18,000 |

£25,000 |

39% |

| Montrose |

£1,900 |

£2,550 |

34% |

| Leoville Poyferre |

£1,350 |

£1,800 |

33% |

| Pontet Canet |

£1,350 |

£1,800 |

33% |

| L'Evangile |

£2,300 |

£2,750 |

20% |

| La Mondotte |

£2,550 |

£3,000 |

18% |

| Petrus |

£25,000 |

£29,000 |

16% |

| Cos d'Estournel |

£2,800 |

£3,200 |

14% |

| Pavie |

£2,200 |

£2,500 |

14% |

| Ducru Beaucaillou |

£2,000 |

£2,200 |

10% |

| Haut Brion |

£7,400 |

£8,000 |

8% |

| Bellevue Mondotte |

£2,550 |

£2,750 |

8% |

| La Mission Haut Brion |

£5,600 |

£6,000 |

7% |

| Latour |

£11,700 |

£11,800 |

1% |