by Wine Owners

Posted on 2018-04-11

Reflecting on day two, with the heady aromas of Pavie and co still flickering around our mouths, and a hard day's tasting behind us, we searched for patterns and rules. But, on reflection, there really is no rule that we can suggest.

©Jonathan Reeve / Wine Owners

An Unexpected Guest

Cabernet Sauvignon made an larger-than-usual appearance in several top wines we tried today, most noticeably Vieux Chateau Certan and Cheval Blanc. Typically, VCC contains just 1% Cabernet Sauvignon, but in 2017 that was increased to 5%. Although there was no overt Cabernet Sauvignon aroma profile in the wine, its freshness and focus almost certainly added to the completeness of the mouthfeel. Cheval Blanc is a quite different story; 2017 is the first vintage in many years that the wine will contain Cabernet Sauvignon.

©Jonathan Reeve / Wine Owners

Shining Examples of Franc

Cabernet Franc is absolutely not in the dog house in 2017, despite the general impression that it had a tough vintage. Three stand-out wines from today's line-up contained substantial levels of Cabernet Franc; Chateau Troplong- Mondot, Chateau Canon and Cheval Blanc's Petit Cheval. The former pair included around 25% Cab Franc, and Le Petit Cheval put on a blinding performance with a relatively massive 48%. So, while the variety may have had a very tough vintage in some parts of the right bank, it is showing admirably in others.

Frost Patterns

There is a lot of emphasis this week on The Frost (27th and 28th April 2017), and rightly so; it was absolutely devastating from some producers, and has had clear repercussions in their 2017 wines. But not all vineyards were affected, and some seem to have escaped entirely unscathed. Chateau Canon, for example, was almost completely untouched by frost. The wines are suitably excellent - refined, bright, tight and focused. Vieux Chateau Certan - our second tasting of the day - is another example of a winery seemingly undaunted by the frost. It tasted magnificent, silky and balanced this morning, all those tannins ago. But many of those right bank producers who did experience frost have found ways to produce good, and even excellent wines. Some adjusted the blend of grapes they use. Soutard is a fantastic and successful example of this; their 2017 is very good, and will be a great value buy when released. Their 2017 blend was 90% Merlot (significantly higher than the 65% normally used), with Cabernet Franc, Cab Sauvignon and Malbec making up the remaining 10%.

Chateau Gazin was untouched by frost, but the team there nonetheless felt that their Cab Franc wasn't quite up to scratch. They took the decision to boost their blend up to a fat 95% Merlot, resulting in a 2017 grand vin with a silky mouthfeel, great balance, and an enticing touch of kirsch dancing around on the nose.

On the left bank yesterday, the story was quite different. The frost was relatively indiscriminate there, affecting most vineyards to some extent. But here in the right bank, the hillier landscape allowed the freezing air to drain away from some places...and to gather catastrophically in others. Thus the distribution of frost damage was much more patchy here. Clay-based areas and lower-lying sites were obviously hit very hard by the frost. We do feel for those producers hit hardest - it was clearly not an easy vintage for them, and they face challenges ahead when the wines are released to market.

©Jonathan Reeve / Wine Owners

So the rule really is that there is no rule here. Which makes exhaustive primeurs tasting all the more valuable. Tomorrow (Wednesday) we head to Graves and Pessac-Leognon in the morning, to taste the Haut-Brion wines, and then on to Pape Clement and Malartic Lagraviere. We shall see if, and to what extent, the gravel soils helped mitigate the frost impact here...

by Wine Owners

Posted on 2015-10-29

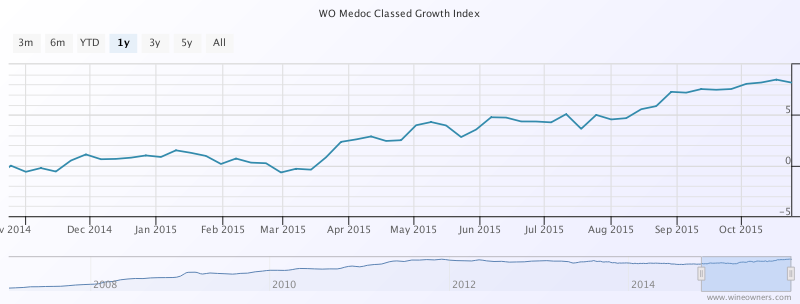

Quite a lot of members we speak to these days assume that the market prices of Bordeaux are still stagnating or falling. The morosité that had descended on the region's finest wines in by 2012 does not appear to have lifted.

Wine traders will point to volumes that are much reduced since the giddy heyday of 2009-2011, and that is of course true.

However, it does not mean that in aggregate, prices of Bordeaux have begun an upward trend. In the last year, the Wine Owners Medoc Classed Growth Index is up 8.2%.

Whereas the Wine Owners First Growth Index has only managed half of that in the last year, up 4.1%.

That's still better than the performance of the FTSE100, which is fractionally underwater over the last year, and exactly where the S&P500 has clawed it's way back to after the summer's wobbles.

Wine Owners 150 = Turquoise

FTSE100 = Navy

S&P500 - Green

However, when looking at First Growth performance over the last 12 months, it is far from broad-based. 'The further they rise, the longer they fall' seems to hold true, with Lafite 1986 and 1989 performing the worst at -8% and -9% respectively.

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1999 | -5.45% | £ 216.68 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2006 | -5.75% | £ 286.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2009 | -5.82% | £ 441.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1982 | -5.92% | £ 436.68 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1982 | -6.29% | £ 1,810.14 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1998 | -7.15% | £ 270.83 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2006 | -7.26% | £ 212.50 |

| Chateau Margaux Premier Cru Classe AOP | 1989 | -7.59% | £ 250.10 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1986 | -8.13% | £ 651.48 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1989 | -9.11% | £ 395.92 |

Among the vintages populating negative territory, 1986 has suffered with the exception of the very great Mouton. The exceptional 1989s and 1990s have fallen, along with with the dull 1999s.

The risers are headed by Mouton, Haut Brion and Latour. The top 10 performers registering double digit growth are entirely accounted for by these three Châteaux.

| Wine | Vintage | Change 1 year | Price |

|---|

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2005 | 22.39% | £ 366.67 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2008 | 21.13% | £ 262.54 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2005 | 20.95% | £ 437.50 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 1996 | 16.87% | £ 282.74 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1990 | 14.30% | £ 429.12 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2005 | 13.36% | £ 566.79 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2000 | 13.32% | £ 1,038.81 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2008 | 11.00% | £ 226.64 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1989 | 9.08% | £ 1,000.03 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1995 | 8.49% | £ 316.67 |

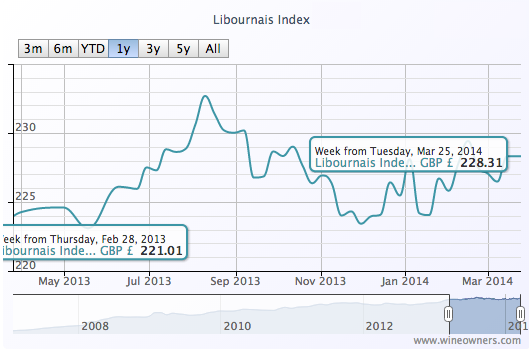

Crossing over to the right bank, predominant top performers over the last 12 months are St EmillMedoc Classed Growth Indexon 2005s and the 2001 Class A relative newcomers. Since March 2015 The Wine Owners Libournais Index is up 7%, coming off it's 3 year lows at that point.

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 53.85% | £ 300.00 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 48.07% | £ 176.57 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 45.67% | £ 183.46 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2000 | 37.16% | £ 301.79 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 1998 | 34.59% | £ 161.84 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOP | 2005 | 27.82% | £ 110.96 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 26.84% | £ 232.57 |

| Chateau La Violette Pomerol AOP | 2009 | 26.67% | £ 208.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOP | 2005 | 24.71% | £ 433.34 |

What can we conclude from this? Some commentators are suggesting that value is returning to older back vintages on the back of 4 year declines. Relative value vs quality is likely to be a key driver of future value, for which we recommend you check out the new price per points builder on Wine Owners to which you'll need to subscribe.

Liv-ex have recently seen a predominance of trades of the 2010 vintage, and whilst there seems to be value returning selectively to the Classed Growths, one wonders if it's a little early yet the First Growths, whose starting release prices were in nose-bleed territory. Since 'the further they rise, the longer they fall' it may yet be a bit early to call.

by Wine Owners

Posted on 2014-03-25

With a level of 221 at the end of February 2013 (baseline January 31st 2007), the Libournais Index shows a relatively flat performance, with a change of only 1.8% over a 1-year period to 228.31.

While the top movers of the Medoc Classed Growth Index were relatively affordable vintages, the Libournais Index top gainers feature higher value wines, as do the biggest fallers, perhaps indicating a rather higher level of market interest than on the left bank.

Individual high-scoring wines, however, buck the trend, with the 100 pointers La Violette 2010 and Petrus 2009 showing that a perfect Parker score can still be a market driver and suggesting that scarcity may increasingly be a market driver within the Bordeaux market, either due to tiny production or due to age.

It's arguably even more interesting to see the price of Vieux Chateau Certan 2010 fall quite significantly since the turn of the year (possibly as stockholders finally throw their hands up and start to write-down the value of their holdings?). Will Vieux Chateau Certan 2010 fall further carried by the momentum of price gravity? At some point this could be extremely tempting, for an utterly sublime wine that was considered by many (including us) to be perfect.

TOP GAINERS

BIGGEST FALLERS

Create an account on www.wineowners.com to receive our analyses by email.