by Wine Owners

Posted on 2019-04-24

Sotheby’s had announced it would auction 75 limited edition Versailles Celebration Cases which house 5 vintages of Chateau Mouton Rothschild to be given towards the restoration of the Palace of Versailles. Each beautifully crafted case honours the rich cultural history of the domain and the Palace of Versailles.

However, as a result of the terrible fire at Notre Dame on 15 April, 2019, yesterday Château Mouton Rothschild and the Palace of Versailles jointly announced that the sale proceeds of the 25 cases sold in London for in excess of £750,000 would be donated to efforts to rebuild Notre-Dame cathedral.

The cases offered in London realised £752,620 / US$983,148 / HK$7.7 million, bringing the combined total for the 50 cases sold in London and Hong Kong to £1.4 million / US$1.9 million / HK$14.8 million.

Proceeds from the final tranche of 25 cases to be offered by Sotheby’s in New York on 4 May will still go towards funding restoration projects at Versailles, as will funds raised from the first tranche of 25 cases sold by Sotheby’s in Hong Kong on 1 April.

Each case presents five Château Mouton Rothschild vintages with labels by outstanding contemporary artists who have also exhibited at the Palace of Versailles:

-

Château Mouton Rothschild 2005 - Giuseppe Penone: Palace of Versailles, 2013

-

Château Mouton Rothschild 2007 - Bernar Venet: Palace of Versailles, 2011

-

Château Mouton Rothschild 2009 - Anish Kapoor : Palace of Versailles, 2015

-

Château Mouton Rothschild 2010 - Jeff Koons: Palace of Versailles, 2008-9

-

Château Mouton Rothschild 2013 - Lee Ufan: Palace of Versailles, 2014

The cases offered across a trio of international auctions at Sotheby’s throughout the Spring 2019, begun in Hong Kong on 1 April, followed by London on 17 April and concluding in New York on 4 May. Successful bidders will also receive an invitation for them and a guest to attend a private visit and tasting at Château Mouton Rothschild and an exclusive event, the Versailles Celebration Gala Dinner, at the Palace of Versailles on 21 September 2019, during which historic ex-cellar vintages will be served including Château Mouton Rothschild 1945 - one of the great vintages of the last century.

For a full list of the artists and labels visit: https://www.chateau-mouton-rothschild.com/label-art/discover- the-artwork

www.chateau-mouton-rothschild.com | Instagram: @moutonnechange

www.chateauversailles.fr | Instagram: @chateauversailles

by Wine Owners

Posted on 2017-05-11

The tasting event in Westminster for the trade in early May provided an opportunity to re-taste a number of 2016 Bordeaux comparatively with their 2015 and 2014 equivalents.

The conclusions reinforce to a large extent the general impressions we formed in Bordeaux at the start of April, but the comparison also showed it’s not one size fits all.

Canon

Starting with the one wine tasted from the right bank, Canon 2016 is showing more aromatics than 2015, very silky, integrated tannins and is thicker-styled, with riper fruit. Canon 2015 showed greater intensity, with a stunningly pure mid-palate of ripe, sticky fruit, and a prolonged finish. Canon 2014 is more classically styled, with a cedar nose and liqueur-like mouth feel, this is lovely now and looks like much earlier drinking.

No doubt there are glorious wines from the Libournais in 2016, but both St Emillion and Pomerol do not conform to a vintage stereotype in these two vintages, and you will have preferences for individual wines from one or other year.

Smith Haut Lafitte

Jumping down to Pessac-Léognan, Smith Haut Lafitte (SML) 2016 is firm and properly dry, with crystalline fruit. Very intense and just on the right side of focus, with a very grippy, licorice finish. SML 2015 has a very energetic attack, sweet, refined tannins, a warm, fruity mid-palate and an aromatically spiced finish. SML 2014 was delicious but not in the same league as the other two vintages.

2015 was a stellar vintage in Pessac and Graves across the board. The same is not true of 2016 but SML showed (along with Haut Bailly, Chevalier and Carmes Haut Brion) that the best 16s are superlative and brilliantly architected for the long-term.

Rauzan Ségla

Rauzan Ségla 2016 is refined, with a liqueur-like mouth feel, and a hint of prunes. It’s less pure than Rauzan-Ségla 2015, with its fine nose, superbly energetic attack, refined mid palate and liquorice infused, fruit-driven finish. Rauzan-Ségla 2014 is dry, mid-weight, unforced and classic, with appealing grip, and a great, insistent finish.

Margaux was a star appellation of 2015, and this wine confirms how relatively disappointing the commune'’s wines are in 2016. They remain fine claret from a good vintage, but they miss out on the excitement of the ‘15s.

Pontet Canet

Our Pauillac representative of the comparative tasting stood out for its increasingly aromatic character, a factor that Justine Tesseron attributes to the growing influence that biodynamic farming is having on the fruit.

Pontet Canet 2015 was one of the most refined and silky examples of the appellation, yet today it just didn't cut it in the company of the glorious 2014 and deeply serious 2016. Pontet Canet 2016 displayed a fine nose, wonderfully textured fruit, a really firm mid-palate with bitter-edged fruit before sweetening into the long finish. Serious, long-haul stuff – and I suspect might become a legend 50 years hence. Pontet Canet 2014 is extremely aromatic, sweetly imbued with angelica flavouring, and with proper, grainy tannins on the finish.

Montrose

Montrose 2015 is delicious and aromatic: a fine showing for the vintage, yet seemed to lack a bit of structure. St Estephe in particular produced some of the best wines in a generation in 2016, and Montrose shows up that difference as does almost every wine from the appellation. Montrose 2016 is equally as expressive as 2015, but feels like a wine for the longer term, with more serious structure and vital freshness. What impresses here is the focus and elegance, which make this one of the stars of the vintage.

Picture: Wine Owners Ltd.

by Wine Owners

Posted on 2017-03-28

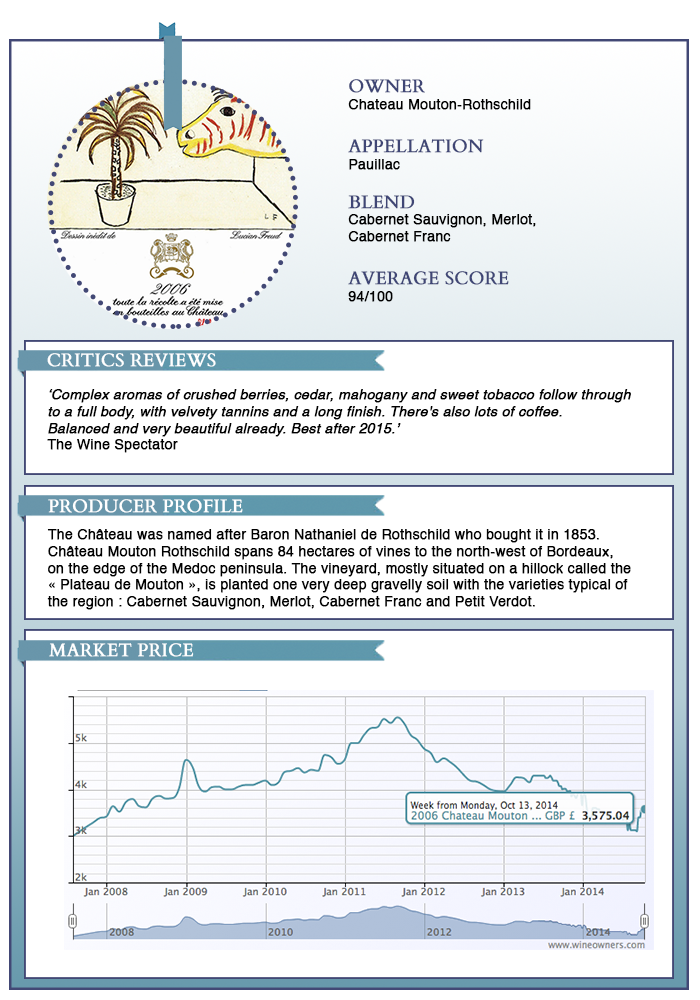

Keen followers of Bordeaux can’t have missed the striking price revivals that have been in progress over roughly the last 12 months, and Mouton Rothschild 2006 makes for in interesting case study.

We’re looking here at what is effectively an over-performing wine in an under-appreciated vintage. 2006 Mouton has consistently been rated highly by both Robert Parker (last scored at 96 in 2014) and Neal Martin (scored at 97 points in May 2016), and compares very favourably to the other First Growths in 2006. Latour consistently scores around 94-95; Lafite at 95 from Neal Martin, 97 from Parker; Margaux at 94 and Haut Brion at 96.

Not only that, it outscores or equals itself in what ought to be better vintages. The 2005 is likewise rated 97 by both Parker and Martin, and 2006 is only outscored in recent vintages by 2009 and 2010. No doubt then that winemaker Philippe Dhalluin did exceptional work in the vintage, and those buying at the nadir of the market in and around January 2015 were picking up a serious bargain at around £3000, the same price as the far less interesting 2007, and rather cheaper than the less well-rated 2008.

However, having risen in value throughout 2016 from £3200 to £4400, the market price has stagnated since October 2016, and now stands at £4500, with bids standing around £4130, which is still the highest this wine has traded at since 2011, but starts to look like the top of the market. For drinkers, this seems to continue to represent good value, but for those interested in wine as a store of value, quite possibly one to swap out.

Click here to see live trading information on Mouton 2006.

Did you know...? British artist Lucian Freud was commissioned to create the label for the 2006 vintage of Château Mouton-Rothschild. "Far from the tormented portraits and nudes for which he is renowned, [he] chose a joyously exotic transposition of the pleasure of drinking, in which the vinestock is transformed into a springing palm tree and the wine lover into a happily anticipatory zebra." Source: Chateau Mouton Rothschild.

INTERESTED IN BORDEAUX? We will be in the Bordelais covering the en primeur campaign, so don't forget to follow us: - on Twitter - on Instagram - on Facebook |

by Wine Owners

Posted on 2016-02-18

Looking ahead to the forthcoming Bordeaux En Primeur release, it seems like there’ll be plenty to be excited about, at least from a quality perspective, and there’s already a good deal of speculation about release strategies.

It’s fascinating that Chateau Mouton Rothschild has come out with a similar announcement to Chateau Latour’s 2013 En Primeur campaign withdrawal. It amounts to essentially the same thing, nuanced differently.

“Sales of our wines in bottle are growing a lot and we’ve got to the point where we don’t have enough bottles left in our cellar."

“We won’t be buying our wine back but we will be releasing less of it en primeur as we have to rebuild our inventory.”

“We haven’t lost faith in the en primeur system but you have to be reasonable with your pricing as there are so many reference points for consumers now.”

This roughly translates, into words that you and I will understand, as: "in an increasingly transparent world where discerning consumers can analyse and evaluate young wines by their relative value to past vintages, the only way we can get an en primeur campaign away is by pricing at a discount to comparable previous vintages, that recognises the end-user buyer needs a reason to buy early. That doesn’t seem to make a great deal of sense if we wish to capitalise on growing worldwide demand. Going forward, we would rather not give that discount away to more than a tiny number of en primeur buyers who will help us establish (hopefully higher) future secondary market pricing. That will create the preconditions for us to capture a much bigger slice of the downstream value of our wines, satisfying shareholder requirements for income growth and capital (land) appreciation.”

With Latour and Mouton effectively ‘out’, how will the remaining Firsts respond next year?

Last year there were only a small handful of wines worth buying early. That’s not to say there were not plenty of lovely wines made in 2014, but very few were sufficiently well priced to justify tying up cash. Given the overall superior quality of 2015, producers will hike up their prices, possibly quite a bit. Given that, it’s quite likely that savvy wine buyers will do well to continue to focus on relative values from comparable back vintages and revisit 2015 in a few years’ time. Meanwhile the impending campaign is bound to throw a spotlight on 2000, 2005 and even the better values within 2009 and 2010.

by Wine Owners

Posted on 2015-10-29

Quite a lot of members we speak to these days assume that the market prices of Bordeaux are still stagnating or falling. The morosité that had descended on the region's finest wines in by 2012 does not appear to have lifted.

Wine traders will point to volumes that are much reduced since the giddy heyday of 2009-2011, and that is of course true.

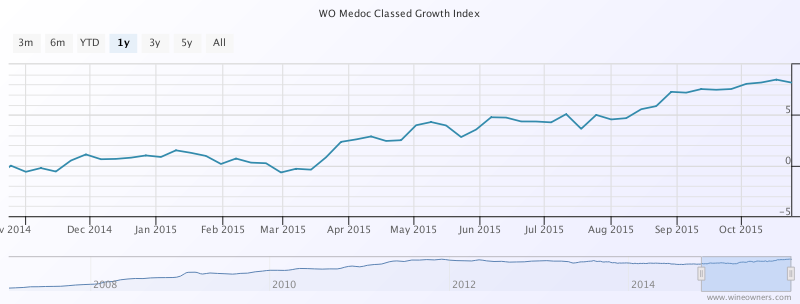

However, it does not mean that in aggregate, prices of Bordeaux have begun an upward trend. In the last year, the Wine Owners Medoc Classed Growth Index is up 8.2%.

Whereas the Wine Owners First Growth Index has only managed half of that in the last year, up 4.1%.

That's still better than the performance of the FTSE100, which is fractionally underwater over the last year, and exactly where the S&P500 has clawed it's way back to after the summer's wobbles.

Wine Owners 150 = Turquoise

FTSE100 = Navy

S&P500 - Green

However, when looking at First Growth performance over the last 12 months, it is far from broad-based. 'The further they rise, the longer they fall' seems to hold true, with Lafite 1986 and 1989 performing the worst at -8% and -9% respectively.

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1999 | -5.45% | £ 216.68 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2006 | -5.75% | £ 286.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2009 | -5.82% | £ 441.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1982 | -5.92% | £ 436.68 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1982 | -6.29% | £ 1,810.14 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1998 | -7.15% | £ 270.83 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2006 | -7.26% | £ 212.50 |

| Chateau Margaux Premier Cru Classe AOP | 1989 | -7.59% | £ 250.10 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1986 | -8.13% | £ 651.48 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1989 | -9.11% | £ 395.92 |

Among the vintages populating negative territory, 1986 has suffered with the exception of the very great Mouton. The exceptional 1989s and 1990s have fallen, along with with the dull 1999s.

The risers are headed by Mouton, Haut Brion and Latour. The top 10 performers registering double digit growth are entirely accounted for by these three Châteaux.

| Wine | Vintage | Change 1 year | Price |

|---|

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2005 | 22.39% | £ 366.67 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2008 | 21.13% | £ 262.54 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2005 | 20.95% | £ 437.50 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 1996 | 16.87% | £ 282.74 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1990 | 14.30% | £ 429.12 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2005 | 13.36% | £ 566.79 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2000 | 13.32% | £ 1,038.81 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2008 | 11.00% | £ 226.64 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1989 | 9.08% | £ 1,000.03 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1995 | 8.49% | £ 316.67 |

Crossing over to the right bank, predominant top performers over the last 12 months are St EmillMedoc Classed Growth Indexon 2005s and the 2001 Class A relative newcomers. Since March 2015 The Wine Owners Libournais Index is up 7%, coming off it's 3 year lows at that point.

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 53.85% | £ 300.00 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 48.07% | £ 176.57 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 45.67% | £ 183.46 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2000 | 37.16% | £ 301.79 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 1998 | 34.59% | £ 161.84 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOP | 2005 | 27.82% | £ 110.96 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 26.84% | £ 232.57 |

| Chateau La Violette Pomerol AOP | 2009 | 26.67% | £ 208.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOP | 2005 | 24.71% | £ 433.34 |

What can we conclude from this? Some commentators are suggesting that value is returning to older back vintages on the back of 4 year declines. Relative value vs quality is likely to be a key driver of future value, for which we recommend you check out the new price per points builder on Wine Owners to which you'll need to subscribe.

Liv-ex have recently seen a predominance of trades of the 2010 vintage, and whilst there seems to be value returning selectively to the Classed Growths, one wonders if it's a little early yet the First Growths, whose starting release prices were in nose-bleed territory. Since 'the further they rise, the longer they fall' it may yet be a bit early to call.

by Wine Owners

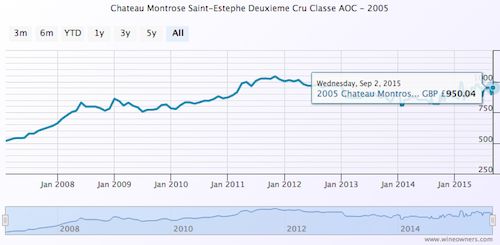

Posted on 2015-10-29

OWNER

Chateau Montrose

APPELLATION

Saint-Estephe

BLEND

Bordeaux Red Blend

AVERAGE SCORE

95/100

CRITICS REVIEW

'This is considered to be among the greatest vintages ever made in Montrose, right up with the 1929, 1945, 1947, 1959, 1961, 1989, 1990 and 2009. Harvest was October 15 to 17. The wine has really come on since I last tasted it, and it needs at least another 10 years of cellaring. The blend was 53% Cabernet Sauvignon, 37% Merlot, 9% Cabernet Franc and 1% Petit Verdot. The wine is opaque black/blue, with an incredible nose of blueberry and blackberry liqueur, with hints of incense, licorice, and acacia flowers. Tannins are incredibly sweet and very present. The wine is full-bodied, even massive, with great purity, depth and a finish that goes on close to a minute. This is a 50- to 75-year-old wine that will repay handsomely those with good aging genes.'

100 points - Robert Parker

View all scores & reviews

PRODUCER PROFILE

Area under vines 95 hectares

Soils deep, large size gravel with sand and a small amount of clay

Average age of the vines 40 years

Production 400 000 bottles a year

Planting density 9000 vines/ha

Ageing in 60% new oak barrels for 16 to 18 months

View full profile

MARKET PRICE

by Wine Owners

Posted on 2015-09-02

Chateau Pontet Canet - 2009

Region: Bordeaux (Medoc)

Appellation: Pauillac

Classification: Cinquieme Cru Classe

'An amazing wine in every sense, this classic, full-bodied Pauillac is the quintessential Pontet Canet from proprietor Alfred Tesseron, who continues to reduce yields and farms his vineyards biodynamically - a rarity in Bordeaux. Black as a moonless night, the 2009 Pontet Canet offers up notes of incense, graphite, smoke, licorice, creme de cassis and blackberries. A wine of irrefutable purity, laser-like precision, colossal weight and richness, and sensational freshness, this is a tour de force in winemaking that is capable of lasting 50 or more years. The tannins are elevated, but they are sweet and beautifully integrated as are the acidity, wood and alcohol (which must be in excess of 14%). This vineyard, which is situated on the high plateau of Pauillac adjacent to Mouton Rothschild, appears to have done everything perfectly in 2009. This cuvee should shut down in the cellar and re-open in a decade or more. Anticipated maturity: 2025-2075.' - 100 points RP

Chateau Cos d'Estournel - 2009

Region: Bordeaux (Medoc)

Appellation: Saint-Estephe

Classification: Deuxieme Cru Classe

'One of the greatest young wines I have ever tasted, the monumental 2009 Cos d'Estournel has lived up to its pre-bottling potential. A remarkable effort from winemaking guru Jean-Guillaume Prats and owner Michel Reybier, this blend of 65% Cabernet Sauvignon and the rest Merlot (33%) and a touch of Cabernet Franc (2%) was cropped at 33 hectoliters per hectare. It boasts an inky/black/purple color along with an extraordinary bouquet of white flowers interwoven with blackberry and blueberry liqueur, incense, charcoal and graphite. The wine hits the palate with extraordinary purity, balance and intensity as well as perfect equilibrium, and a seamless integration of tannin, acidity, wood and alcohol. An iconic wine as well as a remarkable achievement, it is the greatest Cos d'Estournel ever produced. It is approachable enough at present that one could appreciate it with several hours of decanting, but it will not hit its prime for a decade, and should age effortlessly for a half century.' - 100 points RP

Chateau Montrose - 2005

Region: Bordeaux (Medoc)

Appellation: Saint-Estephe

Classification: Deuxieme Cru Classe

'In 2005, a very serious drought year stressed most vineyards in Bordeaux, which are all dry-farmed. The volume of rainfall was less than half the average of the previous 30 years. The clay subsoils at Montrose have always played a major role in not only dry years, but also in extremely hot ones, such as 2003, as they retain more moisture. The grapes were harvested between September 23 and October 9. This is a very powerful, full-bodied wine that is quite tannic, but the tannins are relatively velvety. The wine is rich, complex, majestic, multi-dimensional and also avoids any of the austerity that some 2005s possess. It has done quite well in its bottle evolution and should turn out to be a great Montrose, capable of lasting 30 to 50 years.' - 95 points RP

by Wine Owners

Posted on 2015-08-28

1/ Grand Puy Lacoste 2010 is a great wine. 4 years after release, the price is £100 off its opening price. GPL 2010 is surely now one of the buys of that wonderful vintage. Rated 95 points by Robert Parker this will be a magnificent drink in years to come. We would not be surprised to see this rerated 97 points in due course.

'An absolutely magnificent wine from this very popular estate, which sits well off the Route du Vin, just to the southwest of the town of Pauillac, its classic creme de cassis and floral notes are well-displayed. The wine possesses supple tannin, a full body, voluptuous character and a layered, impressively textured mouthfeel. This is a brilliant effort from Grand Puy Lacoste that can be drunk in 4-5 years or cellared for three decades or more.' RP 95.

- - -

2/ Montrose 2010 is another beauty, a perfect wine and less expensive than 2009, yet a seamless monument that is the equal of any of the First Growths. It’s hardly surprising this is a hot market: surely it’s only going to go one way from here?

'This is considered to be among the greatest vintages ever made in Montrose, right up with the 1929, 1945, 1947, 1959, 1961, 1989, 1990 and 2009. Harvest was October 15 to 17. The wine has really come on since I last tasted it, and it needs at least another 10 years of cellaring.' RP 100.

- - -

3/ Ducru Beaucaillou 2011 is interesting. It wasn’t so long ago that top new vintages of this super-second were releasing at well into 4 figures. The unfashionable 2011 vintage provides the opportunity to buy in for just £660 per case of 12.

Exchange activity is suggesting this is a buy as top-drawer drinking claret. The latest Parker score surely reflects the a period during which the wine has shut down. Once this wine starts to open up again, could there be the potential for it to be rerated in the 93-95 range in line with the en original primeur rating? Neal Martin’s rating is 92-94.

'The 2011 Ducru Beaucaillou (which normally represents 1/3 to ½ of the entire crop) possesses a dense ruby/purple color along with a beautiful nose of sweet creme de cassis, crushed rock and spring flower aromas. This rich, medium to full-bodied St.-Julien is among the most concentrated wines of the Medoc. Moderate tannin is sweet and well-integrated. This beauty will benefit from 3-5 years of cellaring and keep for two decades.' RP 92+.

by Wine Owners

Posted on 2015-06-10

Jane Anson’s insight into what courtiers and négoces think about the en primeur system makes for very interesting reading.

Perhaps what many Chateaux are unwilling to go on record with is the question of estate value.

Land values are at least partially driven by the cost per bottle that can be achieved by the Chateaux at the point of release. The higher the release price (whenever that is) the higher the cost of land per hectare.

If you've just blown €200M on a slice of prime classed growth real estate, you want to support the underlying assumptions upon which that price was predicated. The balance sheet value of that asset and its ability to appreciate over time (and not see shareholder value diminished) becomes pretty crucial.

Is this one of the reasons why Calon released so little and massively cut back on the number of Négoces they allowed allocations, narrowing channels to market?

We totally agree with Jane Anson that a number of the First Growths got their pricing right. For me Lafite at first tranche and Mouton (Grand and Petit) got it most right vs market pricing of back vintages. There is future value in those purchases.

The sooner the 'funding' model of EP is clarified, the sooner the negativity surrounding the EP release period will evaporate. I think consumers dislike conflicting messaging and behaviour as much as channels of distribution do.

Let's say it; the top Chateaux (the only part of the EP market that appears to be worth bothering with) don't need us to fund the next vintage. Nor therefore do they have a need to leave enough on the table to convince us of the opportunity-cost of stockholding for them. That illusion is about to be shattered.

by Wine Owners

Posted on 2014-10-13