by Wine Owners

Posted on 2017-09-13

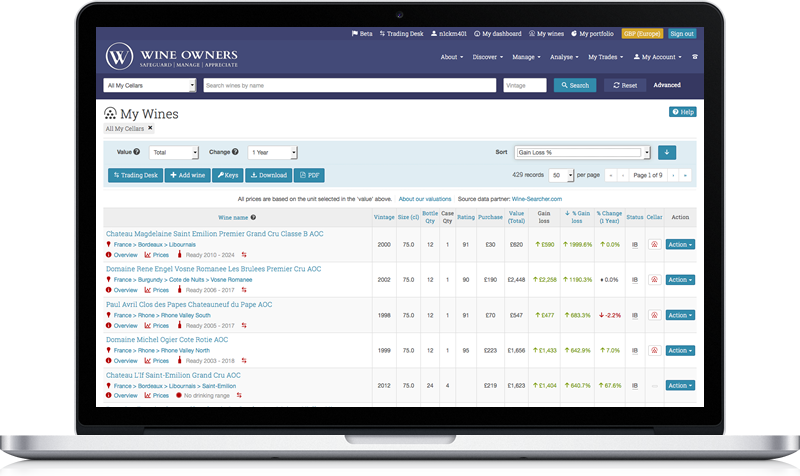

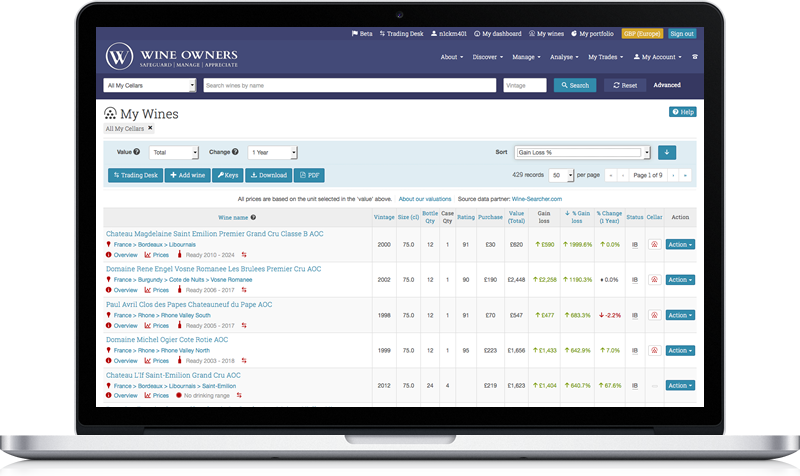

After a busy summer including in August our most productive trading month to date, we thought it would be instructive to run some analysis of trading trends and movements, compared to the same quarter in 2016.

Market share between regions remains relatively stable despite a large increase in trading value overall, with Bordeaux holding first place with a 75.14% share of market compared to 78.15% in the same quarter of 2016. That there is a drop is interesting in its own right, perhaps pointing to greater diversity in wines offered for sale, as well as to diversifying demand in export markets.

Burgundy is the major winner in market share, extending from 11.78% in summer 2016 to 17.10% over the same period in 2017, and we’ve certainly seen an increase in Burgundy purchases from Far East markets, showing a 17% increase on 2016 numbers by value.

Other regions remain very much minority sports, with Rhone up to 2.03% from 1.8% and Italy, surprisingly, down from 4.85% to 2.5%.

Within Bordeaux, the share of the market taken up by First Growths has grown from 28.26% in 2016 to 44.05%, perhaps reflecting heightened interest in the top wines, though the real interest is in how the First Growths compare within their own category.

Haut Brion is the major winner amongst the Firsts, increasing its share of the Bordeaux market to 13.35% from 3.2%. As a proportion of the First Growth market, the share increased from11.31% to 30.3%, putting Haut Brion at the head of the market alongside Lafite.

Lafite moved up to a 13.34% share of the Bordeaux market from 11.62%, but lost ground against the other First Growths, slipping to 30.29% from 41.12%, exchanging a clear lead in the class for an almost dead heat with the progressive Haut Brion.

Mouton showed a similar fall-off in share, dropping from an 8.63% share of Bordeaux to 7%, and a 30.54% share of the First Growth market dropping to a 15.89% share. Market and trading values for Lafite and Mouton remain robust however, so this feels more like a positive story about Haut Brion than a negative for the two Rothschild properties.

Latour has benefited too here, growing a very small share of Bordeaux (1.18%) to 5.07%, and increasing its share of the First Growth market from 4.18% to 11.05%.

Margaux has the least movement to comment on, increasing its share of the Bordeaux market marginally to 5.29% from 3.6%, and falling from 12.84% to 12.01% in its share of the First Growths.

by Wine Owners

Posted on 2016-09-12

The WO First Growth Index showed price appreciation over the last 12 months pushed through the 20% threshold last week.

Haut Brion’s emergence as a wine that can now rivals its peers in the secondary market is clear, with 4 vintages in the top 10 movers, namely 2000, 2003, 2006 and 2008. Will we see Haut Brion close the gap where historically it would have sold at a discount to the other Firsts? The data seems to support the likelihood of this happening.

The top 10 movers have risen 23%-32% in the last year. Furthermore there has been just one faller out of the 75 constituents of the WO First Growth Index, namely Latour 2005.

Top 10 movers over the last 12 months

For the first time in years, we see a wine from the twin peaks of 2009 and 2010 in the top 10 movers, in the shape of the exceptional Margaux 2010. Scores from Robert Parker, Neal Martin and Stephen Tanzer oscillate in the 96-99 range, but the market is indicating it thinks that this could be a perfect wine. It’s now caught up with Haut Brion and Lafite at circa £540 per bottle.

Latour’s withdrawal from the en primeur business looks like paying dividends. Although the 2010’s value is far out in front of the field at £845 a bottle, it’s still not broken through it’s retail en primeur opening offer price of £950. Nevertheless it has performed well through the worst of the Bordeaux market’s 3-4 year slide, losing just 26% of its value by November 2015 before recovering, quite a decent performance compared with Lafite considering their similarly high release prices.

Can the Firsts continue this powerful recovery? Can they recapture the heights of their 2009 and 2010 release prices? If, so which will be the first ‘First’ to do so?

Least likely is Lafite, whose 2010 release price of £983 per bottle reflects a moment in time when Lafite was practically a Chinese barter currency, not to mention the 2009’s vertiginous release of £1,000. In each case there is a loss per per bottle of £440 versus en primeur retail.

Most likely to get back to even terms, in order of proximity of current market price vs opening retail offer price, is:

Latour 2010

Latour 2009

Margaux 2010

Haut Brion 2010

Confidence has returned and momentum is driving the market forward. If and when the current price of the above 4 wines exceeds their opening prices, and buyers of 2009 and 2010 First Growths no longer see a sea of red loss/gain percentages in their portfolios, confidence will be given a further boost.

by Wine Owners

Posted on 2016-04-07

Back from Bordeaux and having tasted widely across all the

major communes, for a good proportion of the wines at least twice, we can

report that 2015 will be a very good to excellent overall vintage.

The wines have nice density accompanied by varying degrees

of power. But it’s best to avoid sweeping generalisations in this vintage, as

this overview explains. Read on...

Those who say the heights were achieved on the right bank

are overlooking a number of exceptional wines from across many other appellations. St. Emilion has been proposed as the top-performing commune

of the vintage, but there are plenty of examples that are too big and powerful.

Those Chateaux really do need to wake up to the changing market that is

thankfully favouring balance once more.

Pomerol has seen some great successes, yet different styles

of vinification between producers have resulted in wines with very different

characters. On the one hand are those that are pure with a brightly illuminated

core of fruit, ripe elegant tannins and a taut finale. On the other are styles

that are evidently riper, with imperceptible tannins and an extremely smooth,

even edgeless, finish. Whilst these are extremely attractive and very easy to drink after just a few months in cask we wonder if they will stay the

long-term course and evolve into compelling wines worthy of their glossy and alluring first

showing.

Many state that the higher up the Medoc peninsular you go,

the less good are the wines due to higher mid-season rainfall than the right

bank, Margaux and Pessac-Leognan. That isn’t necessarily evident, perhaps with

the exception of Haut Médoc and Listrac.

Much-touted Margaux is indeed extremely consistent across

the board, to a degree we’ve not seen for many years. Yet in our view the most

impressive individual wines from the Medoc come from Pauillac and St. Julien,

perhaps with the exception of Chateaux Margaux itself and the broodingly structured Chateau Palmer.

St. Julien is a very consistent appellation once again.

Graves (Pessac Leognan) is excellent, and some historically big styled wines

have reined it in with exceptional results,making for a very impressive showing for the appellation overall.

Soil composition would appear to have as much to do with

variation between properties as levels of rainfall. It’s possible that this

variable will have been accentuated by a scorching July when drought conditions

had set in, with the vines showing heat stress by starting to drop leaves.

Relief came in early August with some heavy downpours and temperate August weather

accompanied by comparatively high hours of sunshine.

The dry, hot July conditions were compared to 2003. Yet

unlike that vintage when night time temperatures were steamy, 2015 experienced

cooler hours of darkness, and many of the wines do have a pleasant acidity in

the mid palate, whilst the best have a crystalline fruit quality and are salivant - mouth-watering.

Notwithstanding the very high July temperatures, picking

took place from around the middle of September through to October 7th,

with lovely late-season weather giving the fruit plenty of hang time to fully

ripen, and producers were able to pick selectively at their leisure ahead of

the forecasted rains at the start of the second week in October.

It’s been said Merlot is the standout grape of the vintage

and the best since 2010. That’s true of

the right bank overall, but not in the Medoc, where the best wines contain

85%-92% Cabernet Sauvignon.

Also, some of the greatest expressions of the vintage are

wines that contain significant proportions of Cabernet Franc in their blends.

Vieux Chateau Certan, Cheval Blanc, Figeac and Carmes Haut Brion are all gorgeous

benchmarks.

Finally the big question: is 2015 in the same league as

2009/ 2010? Or perhaps 2005, a vintage which in our opinion may well prove the

equal of 2010.It doesn’t look

like it at this stage, and many Negociants

and producers we spoke to didn’t look to equate 2015 with the monumental 2010s.

This is undoubtedly an excellent vintage. We do not think it is a legendary one.

What’s next?

We'll be sharing our tasting notes of the vintage over the

next few days.

You’ll be able to view a number of videos we shot of

producer, Negociant and merchant opinion of the vintage and their favourite

wines.

We’ll review our recommendations and wines we cautioned

against buying early from the 2014 vintage release based on the best wines of

the vintage, which we subjected to a rigorous price per points analysis. You’ll

be able to judge for yourself how well our ‘buys’ and ‘do not buy early’ guidance has performed in the last year - notwithstanding they are still pre-arrivals.

As prices of Bordeaux 2015s release (which we are told will be a long and drawn out affair this year) we shall publish our

price per points analysis, highlighting the buys of the vintage; pinpointing

comparable back vintages that look like good value against a range of other

vintages; and highlighting the wines that are too highly priced at first

release to warrant buying early.

by Wine Owners

Posted on 2016-03-24

Sales of Bordeaux through the

exchange saw a significant increase on the preceding month, rising from a 75%

share of the market to 88%, the highest market share since the launch of the

exchange in 2013. Bids overall in Bordeaux have increased in value by 2

percentage points, perhaps reflecting a slight upturn in confidence in the

market.

The steep rise in Bordeaux’s market

share overshadows other regions, pushing Burgundy right back to 5%, though the

figure reflects less a decline for Burgundy than the strengthening of the

market in Bordeaux. Volume and value traded were in fact similar to the

preceding period. Rhone had a poor showing overall, dropping market share to

1.3%. Again, the figure is skewed by Bordeaux, but in any case volumes were

down, mitigated only by a flurry of interest in Henri Bonneau triggered by the

announcement of his death on Wednesday. The remainder of the market was shared

almost equally between Champagne and Italy, where trading in top level Barolo

oustripped Supertuscans two to one.

As usual, the First Growths accounted

for the lion’s share of the Bordeaux market, 72% of the value of Bordeaux

trades were made up of 1ers crus and their right bank equivalents. Several

large trades in Haut Brion saw that wine take 61% of the value of 1st

growth trades, though Mouton continued to hold its own at 11.7%, down by

percentage on the preceding period, but up in overall value and volume. Lafite

remained strong at 5.8%, with Latour and Margaux lagging behind. Petrus showed

strongly too, picking up a share of 11% among the 1st growths,

though the high value of these wines always has a tendency to distort market

share by value.

Access the Trading Desk to view recent trades, bids & offers.

by Wine Owners

Posted on 2016-03-22

Undoubtedly, the market potential for wine producers and trading platforms is set to growth, the number of wealthy households in China expected to expand at an annual rate of around 16% for the next 5-7 years. Moreover, there has been high increases in Chinese internet penetration with an increase of 31 million new Internet users in 2015 (reaching a total of 649 million). Such a catalysis, together with general perception of foreign brands being of superior quality (i.e. Burgundy, Bordeaux markets) has hence led to strong import dependence of the Chinese, Japanese and Korean markets, with consumers importing as much as 96-100% of their wines.

However, wine producers must recognise that expansion into Asia, specifically China would face several restrictions with Xi JingPing's government-initiated austerity drive and anti-corruption drive hampering the premium wine market for gifting and banqueting. Hence, firm compliance with central authorities are imperative for the business to thrive. Furthermore, with China's economy growing at a rapid rate of around 6-7% (2016 predictions), China's economy has become multi-dimensional, facing transition challenges as the structure adapts to various economic and market reforms implemented by the central authorities.

by Wine Owners

Posted on 2016-03-10

The Wine Owners First Growths Index is up 3.71% Year to date, whilst the Medoc Classed Growth index is up 5.1% for the same period.

The Wine Owners Libournais Index - comprising top Pomerol and St Emilion wines - is also up 4.24% over the last 3 months.

Buyers are coming back into the market in the last few weeks and early signs are very promising: this feels very different to the various short lived rallies since 2013, and is on the back of single digit, consistent quarter on quarter gains over the course of calendar 2015.

The Wine Owners First Growths Index had previously risen 4.6% in 2015. The Medoc Classed Growth index had gained 9% over the course of 2015, with rises dominated by the older back vintages tracked in the vintage range 1996-2006. At this level versus the First Growths it’s noticeable that 2009s are also on the move up.

What does 2016 hold for the collector?

GET YOUR FREE REPORT TODAY

by Wine Owners

Posted on 2016-03-03

OWNER

Chateau Haut-Brion

APPELLATION

Pessac-Leognan

BLEND

Bordeaux Red Blend

AVERAGE SCORE

98/100

Haut-Brion 2005 initially enjoyed strong growth, peaking at £7,300 on the 30th September, 2008, ever since then however, the market value has dropped, reaching a trough of £4,561 in Jan 31, 2013. The price has plateaued to around its current value with little room for potential growth.

REVIEW

Another profound effort from Haut-Brion, the 2005 (a 9,000-case blend of 56% Cabernet Sauvignon, 39% Merlot, and the rest Cabernet Franc) has bulked up to the point that it is fair to compare it to the great successes of 1989, 1990, 1995, 1996, 1998, and 2000. A dark ruby/purple color is followed by a nuanced, noble bouquet of blue and red fruits interwoven with wet stones, unsmoked cigar tobacco, scorched earth, and spring flowers. The wine is full-bodied, pure, and complex as well as exceptionally elegant with laser-like precision. (Robert Parker, April 2008)

by Wine Owners

Posted on 2016-02-15

As expected, Bordeaux continues to dominate trading on the exchange both by value and volume. Reported figures much the same as the previous quarter, with Bordeaux accounting for 75% of trades, and 75% of trading value. The latter is a 5% fall from the previous quarter, which reflects an increased number of trades overall, and in increase in bulk trades of slightly lower value wines in the runup to Chinese New Year.

Burgundy has increased market share on last quarter, now accounting for 15.75% of trade by value, and 11.55% by volume. Both figures are big steps up from the previous quarter, and serve to demonstrate that the marketplace is still small enough to be affected by parcels from individual collectors providing a sudden elevation in liquidity, especially outside Bordeaux.

The First Growths accounted for the largest shares of the market in terms of value trades, and within that number Mouton Rothschild had the best of it, with a 31.8% share of the First growth market by value. Lafite trailed slightly at 26.1%. Haut Brion showed higher than expected at 16.67% and Margaux held its ground at 11.9%.

The surprise in this quarter has been Latour, which has trailed at 7.14%. Hard to determine whether that’s just slightly lower availability of Latour in the market over that period, but either way it seems like the two Rothschild properties are on top at the moment.

The increased focus on Burgundy came at the expense of Italy, which seems to be slightly off the boil compared to the previous quarter’s promising outlook. In fact, Italy was clearly overtaken on volume by the Rhone, which ran at 5.89% of volume traded v Italy’s 1.54, although on value traded the figures are rather closer.

Access the Trading Desk to view recent trades, bids & offers.

by Wine Owners

Posted on 2016-02-02

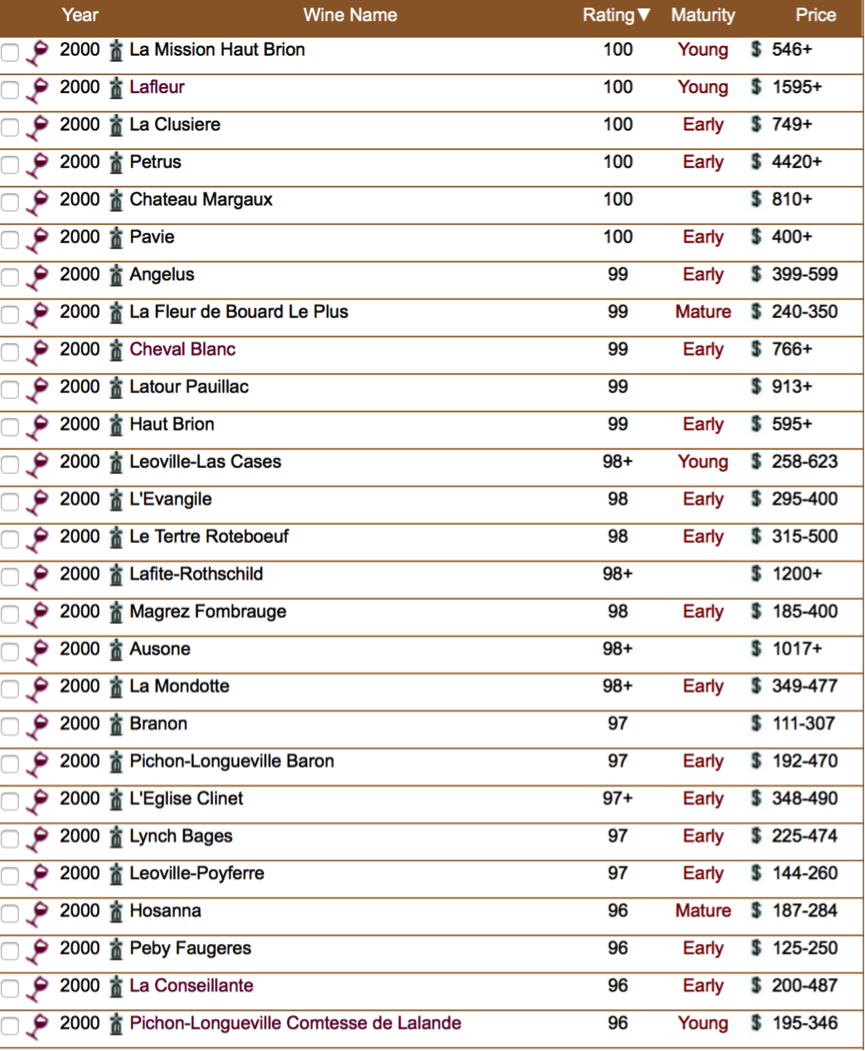

No, we’re not referring to an ancient Microsoft operating system release, but to a potential purchasing window for Bordeaux 2000.

Word on the street is that there could be a bumper set of new reviews released this year of 2000 claret on erobertparker.com – 15 years on.

And why not, it’s one of the 4 greatest last vintages, alongside or after 2005, 2009 and 2010.

The wines show effortless balance, are precise and richly fruited, and in the case of top classified crus, are still at a very early stage of their evolution, with their peak years still ahead of them.

Those wines that are re-rated positively this year will increase in value, in a vintage where there are still plenty of values to be had. With so many wines within a few points of perfect 100 scores, there’s plenty to speculate about which could be worthy of a rerating.

Take relative values, for example a number of wines that were last rated at 98(+) points. This is a helpful starting point for seeing where short-term opportunities may exist.

We’re inclined to rule out big and bouncy productions such as Magrez Fombrauge as the world swings away from extracted winemaking in favour of definition and a degree of finesse. We can all have our biases after all, market commentators and critics alike!

Once value relative to peers is established, it’s then worth cross checking value of a selected with other comparable vintages.

Now let’s take L’Évangile as a case in point:

Based on this analysis would you buy into 2000 or 2010? We’ve ruled out 2009 on the basis that a) it’s already 100 points and b) it’s an über-fruity 15° number.

The following table shows the scores, predominantly from the 20 years-on retrospective published in 2010.

Source: erobertparker.com